Instant AE Flood Zone Flood Insurance At Great Rates

Find out how much you can save on high quality, high coverage flood insurance plans in 10 minutes or less!

$2.3M+

Annual Premium Savings

4.9★

Average Ratings

445+

Reviews

5,497+

Happy Clients

Is Flood Zone AE Bad?

Understanding the Risks and Opportunities

One common concern among homebuyers is the question, ‘Is Flood Zone AE bad?’ The answer requires a nuanced understanding. Flood Zone AE is classified by FEMA for areas that have a 1% annual chance of flooding and where the wave heights are typically less than 3 feet. Although properties in Flood Zone AE are categorized as high-risk due to this higher probability of flooding, it’s important to remember that this does not guarantee that flooding will occur. These areas may face increased risks, but with proper precautions and community efforts in flood mitigation, the actual incidence of flooding can vary significantly. Moreover, living in such a zone requires homeowners to carry mandatory flood insurance, which is a critical factor to consider in terms of preparedness and financial implications.

Alongside these considerations are the undeniable benefits: often beautiful waterfront settings, a strong sense of community, and, in some cases, more affordable real estate prices. Making an informed decision about living in Flood Zone AE means balancing these potential risks with the unique opportunities these areas offer. Understanding the specifics of the flood risk and the requirements set forth by FEMA can help potential residents make a more informed choice about their future home.

Flood Zones: What You Need to Know Before Buying a Home.

When it comes to buying a new home, the location is one of the most important factors. It’s not just about finding a neighborhood you want to live in—it’s also about making sure that your home is located in an area safe from crime, with clean and safe local schools, and an awareness of natural disasters such as floods or wildfires.

If you’ve been house hunting recently, you might have come across the term “Flood Zone AE.” But what does that mean? Let’s look at Flood Zone AE and why it matters when buying a new home.

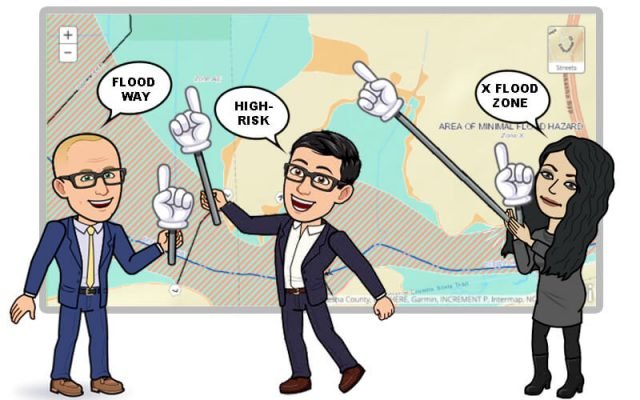

What Does Flood Zone AE Mean?

Flood Zone AE, identified by the Federal Emergency Management Agency (FEMA), stands for “Area of Special Flood Hazard.” This designation indicates that a property is in a higher-risk flood zone, meaning there’s an increased chance of flooding due to its proximity to bodies of water or being in low-lying areas. FEMA provides detailed maps online for these areas

Should I Avoid Buying a Home in Flood Zone AE?

While it’s true that Flood Zone AE is considered a high-risk area, with a 1% annual chance of flooding and a 26% chance over a 30-year mortgage, it’s not necessarily a deal-breaker. Here’s why:

Awareness and Preparedness: Properties in higher risk flood zones like AE are often more prepared. Flood insurance is typically required by lenders, which means homeowners are more likely to be covered in the event of a flood.

Community Efforts: Communities in these zones are required to undertake flood mitigation efforts, which can effectively reduce the risk of flooding.

The Real Picture of Risk: Flood maps in many areas are outdated. Homes in supposed lower risk zones might not be aware of their true risk, whereas homes in AE zones are well-informed.

Balancing the Pros and Cons

While living in Flood Zone AE has its challenges, like the potential of flooding, for some properties expensive flood insurance, and strict building regulations, it also offers unique benefits:

Beautiful Scenery: Many AE flood zones are near scenic water bodies, offering beautiful views and recreational opportunities.

Strong Communities: There’s often a strong sense of community in these areas, with neighbors looking out for each other.

Affordable Housing Options: The risk factor can lead to lower housing costs, making it a viable option for those on a budget.

It’s important to consider the specific location within the flood zone, as not all AE zones are the same. Researching the past flood history and understanding potential mitigation strategies like elevating buildings or installing flood barriers is crucial.

The Flood Nerds would like to convince you that Flood zone AE isn’t bad as you would think.

Understanding the Unpredictability and Precautions in Flood Zone AE

One fundamental truth about flooding is that its occurrence is largely unpredictable. Mother Nature has her own plans, and even the most advanced models can’t guarantee when or if a specific area will flood. However, in response to this unpredictability, communities in Flood Zone AE are required to implement comprehensive flood mitigation projects. These projects aim to significantly reduce the potential for loss in these higher-risk areas. Historical data shows that, for the most part, these efforts are effective in minimizing flood damage.

For homeowners with a mortgage in Flood Zone AE, purchasing flood insurance is typically a requirement. This isn’t just a formality—it’s a crucial step in covering a significant gap that standard homeowner policies don’t address. Should the unexpected happen, and your property experiences flooding, this insurance can be the key to avoiding financial ruin. It’s a safety net, ensuring that you’re not left in a precarious position if disaster strikes.

This caution is underscored by recent events. For instance, since Hurricane Harvey in 2017, numerous flooding incidents have occurred in areas previously deemed lower risk. Many homeowners in these areas lacked adequate flood coverage and faced tough choices in the aftermath—foreclosure, property abandonment, or taking out high-interest loans for repairs. These scenarios highlight the importance of being prepared, even in seemingly lower-risk zones.

Incorporating Awareness and Insurance into Your Decision

When considering a home in Flood Zone AE, it’s crucial to balance awareness of the area’s flood history with the necessary precautions. Flood insurance isn’t just a lender’s requirement; it’s a wise investment in your property’s and family’s future security. By understanding both the risks and the proactive measures taken by communities in Flood Zone AE, you can make a more informed decision about purchasing a home in these areas.

How Can I Protect Myself From Flooding?

Apart from purchasing flood insurance, being informed about local regulations and development near waterways is vital. Even if you’re outside an official FEMA-designated Flood Zone AE area, awareness and preventive measures are key.

It's As Easy As 1, 2, 3!

1

Fill Out Our Online Form

Complete our easy quote form so we can understand your needs & personalize your rates.

2

Get An Instant Quote

Our team scours insurance companies nationwide to instantly present the best coverage & rate options for your needs.

3

Get Coverage

If you’re happy with the coverage options, you can sign up easily directly from our online portal.

How Much Does Flood Insurance Cost in Flood Zone AE?

For homes located in Flood Zone AE, the annual cost of flood insurance typically averages around $424. This is in contrast to the average annual premium of $1,025 noted for policies issued through the National Flood Insurance Program. The specific cost of your flood insurance may vary based on chosen coverage limits and the particular flood risk history of your home. To obtain an accurate estimate tailored to your situation, it is recommended to request a personalized quote, which can usually be done at no cost.

Conclusion

Understanding what Flood Zone AE means is crucial in your home-buying decision process. With the right information and preparation, purchasing a home in Flood Zone AE doesn’t have to be intimidating or overly risky. It’s about balancing the risks and benefits and making an informed decision that serves your interests and safety. Remember, the Flood Nerds believe that living in a Flood Zone AE isn’t as bad as you might think, provided you are well-informed and prepared.