Instant NJ Flood Insurance at Great Rates. Fast Coverage.

Guaranteed.

Save big with our reliable New Jersey flood insurance plans—fast quotes, faster coverage.

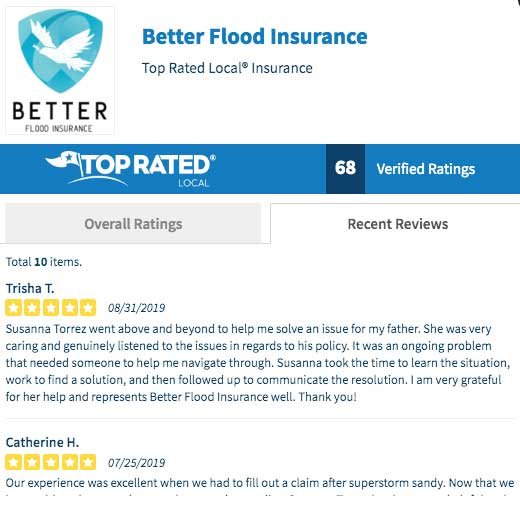

$2.3M+

Annual Premium Savings

4.9★

Average Ratings

445+

Reviews

5,497+

Happy Clients

Quick Flood Insurance quote NJ

We Get It,

Buying Flood Insurance in NJ Is Confusing…

You might be asking:

• What coverage do I need?

• How much is flood insurance in New Jersey going to cost me?

• How much can I save?

It’s okay, your search for cost-effective NJ flood insurance that doesn’t compromise on coverage ends here.

Meet The Flood Nerd™

Your NJ Flood Expert, Friend, and Guardian

In 2015, Robert Murphy, inspired to help homeowners and businessowners alike, entered the insurance brokerage market with one goal in mind: To help uncertain NJ homeowners find affordable, high quality flood insurance that doesn’t compromise on coverage.

We Find You Great Coverage

While Saving You Up To $1,457+ A Year!

What you seek is:

Enhanced security for your New Jersey Property.

Significant savings.

Absolute freedom.

Unwavering certainty.

Memorable moments.

Quality family time.

Peaceful travels.

It's As Easy As 1, 2, 3!

1

Fill Out Our Online Form

Complete our easy quote form so we can understand your needs & personalize your rates.

2

Get An Instant Quote

Our team scours insurance companies nationwide to instantly present the best coverage & rate options for your needs.

3

Get Coverage

If you’re happy with the coverage options, you can sign up easily directly from our online portal.

Welcome to the Flood Insurance Enlightenment, Jersey Style!

Hey there!

So, you’ve wandered into the marshy world of NJ flood insurance, huh?

Pull up a chair.

Let’s unravel this soggy sweater together.

You’re in New Jersey, the land of diners, the Shore, and, yes,

the occasional uninvited guest named Flooding.

Now, you might be sitting cozy in your home thinking,

“My homeowner’s insurance has got me covered, right?”

Oh, if it were only that simple!

Unveil Your Home’s Ultimate Protector: Stand-Alone Flood Insurance

You see, your homeowner’s insurance,

whether it’s from the big guys like Farmers or Allstate,

or even that charming local outfit,

it’s like that friend who says they’ll help you move and then bails because they “forgot.”

When it comes to flooding, they’re out, leaving you holding the wet box of your belongings.

Yep, flooding is the VIP at the exclusion party on your standard homeowner’s policy.

Mother Nature’s Challenge: Outsmarting NJ’s Unpredictable Waters

So, what gives?

You pay your premiums, decorate your home,

and then Mother Nature decides to remodel your basement with an indoor pool you never asked for.

And your insurance?

“Flood? Oh, we don’t cover that.” Great, right?

It’s like discovering your unlimited data plan doesn’t include those hours you spend watching cat videos.

A bit of a letdown.

The truth bomb here is:

if you want your home to strut down the flood runway and come out dry on the other side,

you need something with a bit more oomph. Enter stage left: stand-alone flood insurance.

Embrace Security: Your Essential Guide to Waterproofing Your NJ Haven

Let’s chat about why your adorable abode in New Jersey might just need its own stylish raincoat in the form of a flood insurance policy.

Because, let’s face it, relying on your standard homeowner’s policy to keep you dry during a New Jersey nor’easter is like expecting a paper umbrella to keep you dry in a hurricane. Cute, but not very practical.

Stick around as we dive deeper into the world of NJ flood insurance, minus the actual diving because, well, we’re trying to avoid the whole flooding thing, remember?

Do I need flood insurance in New Jersey?

It is important to have flood insurance coverage in New Jersey because our beloved state has seen a fair share of flooding, and there is likely more coming.

We believe most homeowners think about Flood insurance in New Jersey at some point, maybe before buying a home or during the closing process. However, many of us only think about it when a big storm looms, or we have heard on the news that there is flooding forecasted or happening too close to our home.

If your home or business is in a flood zone, that is considered a flood-risk area. Sadly, many homeowners decide to forgo purchasing coverage because they believe they are safe from flooding. Some real estate and insurance agents may even say you don’t need it.

I ask you to consider the facts: 20 percent of all flooding events across our nation come in areas that are considered low risk. After our last few major storms (Hurricane Harvey), we saw flooding in these low-risk areas. Eighty percent of these individuals had water in their homes or building and didn’t have flood insurance coverage.

In Harris county, nearly 135,000 homes were damaged. Three-fourths of these properties were considered low to moderate risk.

We often hear that people believe the government will help, which is true. However, a few things must align for you to get government assistance.

What are the common misconceptions about flood insurance in New Jersey?

Your page provides a comprehensive guide on how to get flood insurance quotes online in New Jersey, tailored to give you the best options swiftly and efficiently:

1. Fill Out Our Online Form: Complete our easy quote form so we can understand your needs & personalize your rates. Enter your address and confirm the details to ensure accuracy and relevance to your specific location in New Jersey.

2. Get An Instant Quote: Our team scours insurance companies nationwide to instantly present the best coverage & rate options for your needs. We provide you with 10 free quotes from top-rated insurance companies, allowing you to compare and choose the best one for your home.

3. Get Coverage: If you’re happy with the coverage options, you can sign up easily directly from our online portal. Enjoy peace of mind knowing you are choosing from the best, as all our recommended options are rated A+ by AM Best, ensuring quality and reliability.

By following these steps, you can quickly compare prices and start saving today. Our service is built to save YOU money and get competitive quotes that are customized for your New Jersey home. Just reach out to learn more and explore the options tailored just for you.

What are the common misconceptions about flood insurance in New Jersey?

Common misunderstandings about flood insurance in New Jersey often involve two key misconceptions. Firstly, many believe that their standard homeowners’ insurance policy includes protection against flood damage, which it usually does not. Secondly, residents sometimes assume that living in areas deemed low-risk for floods eliminates the need for such insurance, disregarding the potential for unexpected flooding events and the advisable nature of having coverage regardless of perceived risk.

Additionally, the Flood Nerds can play a critical role in navigating these misunderstandings and securing appropriate flood insurance coverage for residents in New Jersey. By leveraging their expertise and extensive network, Flood Nerds thoroughly evaluate multiple insurance options to find the best fit based on individual needs and property locations. They ensure that clients understand the distinct separation between standard homeowners’ insurance and flood insurance, and highlight the importance of coverage even in areas not traditionally recognized as high risk. This tailored approach helps residents not only meet legal or lender requirements but also provides peace of mind by safeguarding their homes and possessions against unforeseen flood damage.

Flood Risk Awareness and Preparedness in New Jersey

While certain regions like coastal areas and cities along major rivers are well-known for their higher flood risks, the truth is that no part of New Jersey is immune to the threat of flooding. Even areas considered low-risk according to flood maps can still experience devastating flood events, as seen in the aftermath of hurricanes like Sandy and other major storms that have impacted the state.

Staying informed about your property’s specific flood risk is crucial for New Jersey residents. By consulting the latest “flood zone map nj” data and understanding your area’s flood history, you can take proactive steps to mitigate potential damage:

- Invest in “flood insurance in nj”: Flood damage is typically not covered by standard homeowner’s insurance policies. Securing adequate “new jersey flood insurance” is essential for protecting your home and belongings.

- Implement flood-proofing measures: Simple steps like elevating utilities, installing backflow valves, and using flood-resistant materials can significantly reduce the impact of floodwaters on your property.

- Develop an emergency plan: Have an evacuation plan in place and keep emergency supplies on hand. Know the designated evacuation routes and shelters in your area.

- Stay vigilant: Monitor weather reports and heed all evacuation orders or flood warnings issued by local authorities, especially during hurricane season or periods of heavy rainfall.

By taking a proactive approach to flood preparedness and understanding the risks highlighted by resources like the “nj flood map” and historical “flooding in nj” events, New Jersey residents can minimize the potential damage and disruption caused by these devastating natural disasters.

NJ flooding: Recent Flood Events in New Jersey (2012-2024)

April 2023 Spring Storms: A series of severe storms in early 2023 led to flooding across several counties, including urban areas where drainage systems were overwhelmed. The response highlighted improvements in flood management and emergency services since Hurricane Sandy.

2021 Nor’easter: This powerful storm brought intense rainfall over several days, resulting in riverine flooding and affecting many communities. The event underscored the vulnerability of urban drainage systems to prolonged heavy rain.

Tropical Storm Isaias (2020): Isaias caused significant damage in New Jersey, particularly from wind and flooding. Numerous rivers overflowed, and storm surges impacted coastal areas, leading to widespread power outages and infrastructural damage.

September 2018 Floods: A series of strong storms triggered serious flooding, especially in parts of Bergen, Essex, and Monmouth counties. The event caused substantial property damage and disrupted transportation.

July 2016 Flash Flooding: Intense rainfall led to flash flooding across parts of central and northern New Jersey. Roads were submerged, and many vehicles were stranded in floodwaters, highlighting the sudden nature of such events.

Hurricane Joaquin (2015): While Hurricane Joaquin ultimately veered away from a direct hit on New Jersey, the anticipation of the storm caused significant concern, leading to extensive preparations. The coastal areas experienced heavy rain and some flooding due to the storm’s wide-reaching effects.

Historical Flood Events in New Jersey

Hurricane Sandy (2012): Perhaps the most infamous flood event in recent history, Hurricane Sandy caused unprecedented devastation across New Jersey. The storm led to massive flooding, especially in coastal and low-lying areas, highlighting the vulnerability of these regions to storm surges and high tides.

Tropical Storm Irene (2011): Before Sandy, Tropical Storm Irene swept through New Jersey, causing significant river and inland flooding. This storm emphasized the need for flood awareness even away from the immediate coast.

Passaic River Floods: The Passaic River basin has a long history of flooding, with notable events occurring as far back as 1903, and more recently in 2007 and 2010. These floods have repeatedly affected communities along the river, causing extensive damage and displacing residents.

Nor’easters: These powerful storms are not uncommon in New Jersey and can lead to severe coastal and inland flooding. The nor’easter of 1992, for example, caused significant flooding along the Jersey Shore and inland rivers, demonstrating the wide-reaching effects of these weather events.

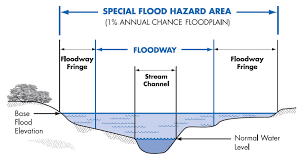

How does the flood zone of my property affect my flood insurance in New Jersey?

In New Jersey, the flood zone designation of your property is a crucial factor in determining your flood insurance premiums. Properties located in areas designated as high-risk for flooding are subject to higher insurance costs due to the increased likelihood of flood damage. Conversely, properties in moderate to low-risk flood zones typically experience lower insurance rates. However, even for these properties, factors such as the specific elevation of the property and its distance from nearby bodies of water can also influence the insurance costs. Thus, understanding the flood zone classification of your property can provide important insights into your potential flood insurance expenses.

NJ flooding - How does flood insurance in New Jersey work in the event of a disaster?

In the event of a flood disaster in New Jersey, if you have flood insurance, here’s what you need to do: First, report the damage immediately to your insurance provider. An insurance adjuster will then come to assess the damage and determine what is covered under your policy. Following the inspection, your insurance provider will process your claim according to the terms of your policy. This structured process ensures that you receive the financial support needed to recover from the disaster.

Now, let’s consider the situation where you don’t have flood insurance. The president of the United States must declare the flooding event a state of emergency. If this doesn’t happen, then there won’t be assistance. The average amount of assistance that homeowners get—Homeowners’ average amount of assistance after a flood when they do not have flood coverage is $5,000. The average cost of damage to one’s property after a flood is $38,000+. That $5K you get from the government? It comes as a loan, and you will need to pay it back. Are you willing to gamble away your financial future by forgoing flood insurance coverage?

Clearly, having flood insurance in place is crucial. It not only provides a clear process for damage assessment and claim handling but also secures financial aid without the uncertainties and limitations associated with relying solely on government disaster declarations and assistance.

New flood insurance rates NJ

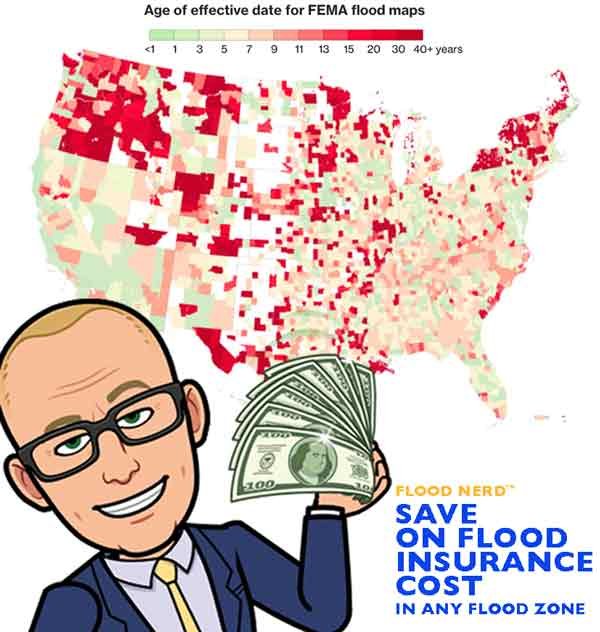

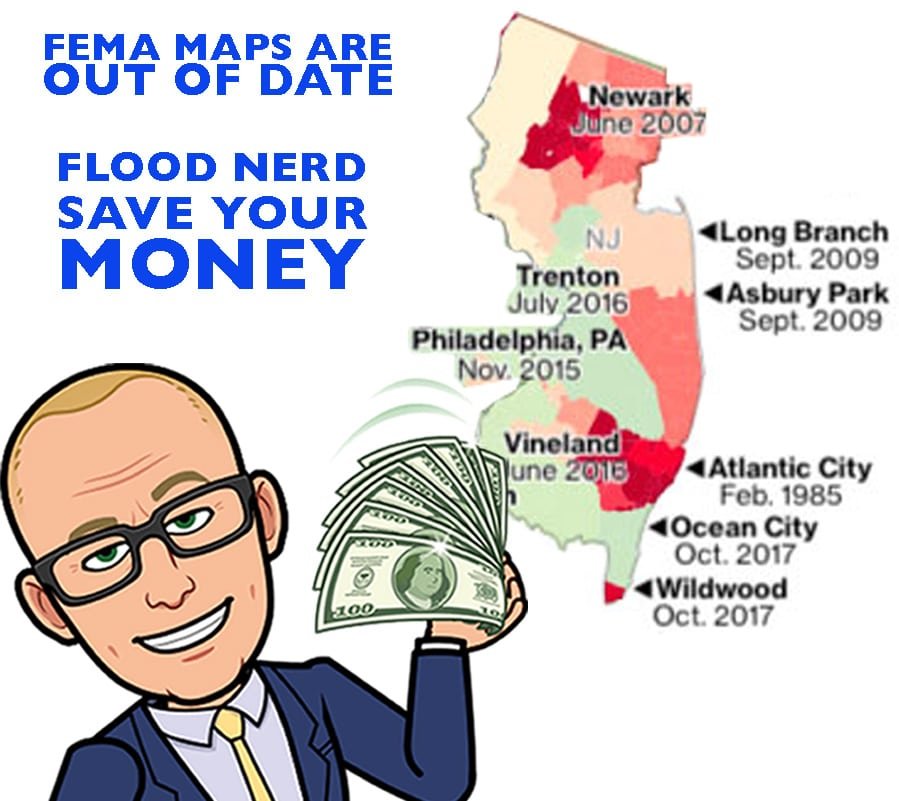

Because of all these factors, it is difficult for property owners to know their true risk of flooding. FEMA admits that their flood maps only give an idea of part of the risk. Our recent storms are facts that it can rain anywhere within New Jersey, and you should consider getting flood coverage so you are not uninsured when you need it most.

FEMA flood zone maps often take years to go into effect after the terrain was studied; this gives the impression that the area is “more up to date” than it is.

NJ flood zone map

The average cost for New Jersey flood insurance in these Low-risk areas is $595 per year.

FEMA’s National Flood Insurance Program (NFIP) and all federally backed lenders rely on these New Jersey flood insurance maps to assess risk, set premiums and determine who is required to purchase flood insurance. Bad information about an area’s flood risk can leave property owners under, or an area’s flood risk can leave property owners uninsured.

How much is flood insurance in New Jersey?

The cost of flood insurance in New Jersey typically ranges between $1,000 and $1,200 annually if you are enrolled in a plan through the National Flood Insurance Program (NFIP). However, this figure is an approximate average and your actual cost could vary significantly. This variation depends on multiple factors such as your home’s specific location, its flood risk level, the desired coverage limits, and certain characteristics of your property.

Additionally, if you consider obtaining flood insurance from private insurers, you might find that the costs can differ quite a bit. Private insurers usually have different methods for assessing risks and setting prices, and they often provide more customization options for their policies, which could influence the overall cost.

To find the most accurate and applicable rates for your situation, consider consulting with an insurance provider like us flood nerd or using an online platform that offers personalized quotes. By entering details about your property and location, you can receive a range of quotes that cater specifically to your needs in New Jersey.

Is there a waiting period for flood insurance in New Jersey?

In New Jersey, flood insurance policies purchased through the National Flood Insurance Program (NFIP) are subject to a 30-day waiting period before the coverage becomes active. This can pose a risk in areas vulnerable to flooding where a month’s wait may be too long. However, some private insurance providers offer policies with shorter waiting periods, providing quicker protection for your home. For those living in lower-risk zones, the standard 30-day waiting period may be less of an issue. Alternatively, homeowners have the option to seek coverage from private insurers who might provide faster activation of the policy. Consulting with flood insurance experts like those at Better Flood Insurance can help you explore these faster alternatives and secure coverage that meets your needs promptly.

What does flood insurance cover in New Jersey?

Flood insurance in New Jersey serves as an important complement to standard homeowners’ insurance by addressing specific types of water-related damages that are typically excluded from general policies. While typical homeowners’ policies can cover water damage resulting from issues like pipe bursts or appliance malfunctions, they fall short of providing coverage for damages caused by overland floods.

A stand-alone flood insurance policy typically covers the physical structure of your home and its contents against damages resulting from overland flooding, which refers to the inundation of property by overflowing bodies of water. It is essential for homeowners to carefully review their flood insurance options because policies can vary, especially under the National Flood Insurance Program (NFIP). These policies may have limitations, especially when dealing with high-value properties or significant personal valuables.

For homeowners with extensive coverage needs let your flood nerd know so we can shop the private flood markets, and we will be considering additional excess flood insurance or policies offered by private insurers that can provide more extensive protection. Consulting with a professional, such as those at Better flood insruance, can be invaluable in navigating the nuances of flood insurance to secure optimal coverage for your home in New Jersey.

Who needs flood insurance in New Jersey?

In New Jersey, flood insurance is crucial for various reasons and for different groups of homeowners. Primarily, homeowners residing in areas designated as high-risk flood zones are typically required by their mortgage lenders to secure flood insurance coverage. This is to protect the financial investment of both the lender and the homeowner in case of flood damage.

Beyond this immediate requirement, flood insurance is strongly recommended for all homeowners, not just those in high-risk zones. New Jersey’s geographical features, including its expansive 130-mile coastline, bays, marshlands, the Atlantic Ocean, Hudson River, Delaware Bay, and Delaware River, contribute to its vulnerability to flooding from different sources, such as storm surges and rising river waters.

Additionally, the broad entry of insurers into the flood insurance market has made it easier and often more affordable to obtain coverage. This accessibility allows homeowners in lower-risk areas to consider flood insurance as a financially feasible protection measure. Given that standard homeowners insurance policies exclude flood-related damages, securing flood insurance separately protects your significant investment in your home from unforeseen natural water-related disasters.

In summary, anyone owning a home in New Jersey, regardless of their area’s immediate risk level for flooding, should consider getting flood insurance to safeguard their property against the unpredictable nature of floodwaters. This is not only a mandatory requirement for those in high-risk zones but a prudent decision for all homeowners in the state.

What are the options for flood insurance coverage in New Jersey?

In New Jersey, homeowners looking to insure their properties against flooding have multiple options to consider.

Originally, the National Flood Insurance Program (NFIP) was the sole provider of flood insurance in the state. However, in recent years, several private insurance companies have entered the market, offering strong alternatives. These private policies often provide more affordable rates and broader coverage options compared to the NFIP.

Homeowners can seek assistance from flood insurance experts, such as those at Better Flood Insurance, who are equipped to help navigate the various choices available. They can aid in understanding the nuances of each policy and how it caters to the specific needs based on the location of a home, from areas along the scenic shores of Cape May County to the historical regions overlooking the Hudson.

They also specialize in crafting customized insurance solutions, particularly for high-value homes, ensuring strong protection against flooding.

Why is flood insurance important in New Jersey?

Flood insurance is crucial in New Jersey because it provides financial protection against damage that regular homeowners’ insurance does not cover. In regions like New Jersey, where occasional flooding can occur, having flood insurance ensures that your substantial investment in your home is safeguarded. Furthermore, for homes located in areas with less frequent flooding, premiums for flood insurance tend to be more affordable. This makes flood insurance in New Jersey an important and economical precaution that can save homeowners from potentially large, unexpected repair costs after flood events.

New Jersey NFIP flood insurance.

The National Flood Insurance Program (NFIP), also known as FEMA, is the government option for flood insurance. The NFIP has enjoyed a 50-state monopoly on the flood insurance market.

What are the FEMA Flood Insurance Changes in 2022?

The modifications to FEMA’s flood insurance policies in 2022 involve comprehensive updates to how premiums are calculated under the National Flood Insurance Program (NFIP). This revamped approach, known as Risk Rating 2.0, aims to offer a more accurate reflection of flood risk on a property-by-property basis, considering factors such as distance to water bodies, type of flooding, and cost to rebuild a home. These changes aspire to make flood insurance rates more fair and equitable, moving away from the older model that primarily relied on flood zone maps without fully accounting for individual risk factors.

Not “private flood insurance” but NFIP Resellers

Suppose you have Nationwide Flood Insurance, State Farm Flood Insurance, Progressive Flood Insurance, or any of the logos below. In that case, you are buying the NFIP flood policy that is just being resold through a government program. These companies are private companies, but their flood insurance is not. Here is a list of the 70 companies that resell the NFIP policy.

What is covered under a standard flood insurance policy in New Jersey?

A standard flood insurance policy in New Jersey typically provides coverage for two main areas: the physical structure of the home and the contents within it. This includes any structural damage to the home’s foundation, walls, and integral systems, as well as coverage for personal items housed within the home such as furniture, appliances, and clothing.

How does New Jersey's flood risk affect insurance rates?

In New Jersey, the risk of flooding significantly affects insurance premiums. Properties that are located in areas deemed to be high-risk for flood events, as determined by FEMA’s flood zone maps, are more susceptible to flooding. This increased likelihood of flooding leads to higher insurance costs for these properties. The specific flood zone designation a property receives determines its assessed risk level, which in turn influences the rate of insurance that homeowners must pay.

Can I get flood insurance in New Jersey if my property is not in a designated flood zone?

Many homeowners wonder if they can get flood insurance in New Jersey if their property is not located within a designated flood zone. The answer is yes, you can indeed secure flood insurance regardless of your property’s flood zone designation.

Flooding can happen anywhere, not just within known flood zones, so it is advisable to consider your property’s specific risks and needs. Once you decide to purchase flood insurance, many factors go into determining the cost for properties in New Jersey.

If your home is considered a low-to-moderate risk, which is not in a lender-required flood zone, often designated as Flood Zone X, you can benefit from a heavily subsidized policy through the government. This is usually identified as an X-flood zone.

Does New Jersey have flood insurance options available?

Yes, New Jersey offers flood insurance options for residents, primarily through the National Flood Insurance Program (NFIP) managed by the Federal Emergency Management Agency (FEMA). In communities participating in the NFIP, homeowners, renters, and business owners can buy flood insurance to safeguard their properties and belongings from flood-related damages. This insurance is necessary as it is not included in standard homeowner insurance policies and must be procured separately.

New Jersey private flood insurance market

There are alternatives to the NFIP or government insurance. It is called Private flood insurance, most notably Lloyd’s of London Flood insurance. However, there are other options available in New Jersey. We shop all the options for your property in your region to ensure you are getting the best premium. Please click here if you are ready to have us do the work for you.

Our shopping does include the NFIP because sometimes we find that with government subsidies, you can get a much better premium, including the NFIP. After all, sometimes, you can get a much better premium with government subsidies.

Get a quote

What are the benefits of private flood insurance over NFIP in New Jersey?

Since we are who we are and experts in Flood Insurance, we will look at every property in every way possible to ensure that we are getting the best premium for our clients, and WE often Do. We tried this same property on our Private flood options and were able to get the premium to under $2,500, and we have, in some cases with similar properties, get the annual premium to $600. This was a feather in our cap and made our clients very happy. Again all properties are unique in these VE flood zones, but if we can find a private flood policy for you, we guarantee it will be better than the NFIP option or if not then we will provide you the NFIP option.

Not only can the premiums be more competitive, but private flood insurance also offers superior benefits. Private insurers provide tailored coverage options to match your specific needs. This means we can customize your policy to include protections that are most relevant to your property and lifestyle, something the NFIP’s one-size-fits-all approach often lacks. Moreover, private policies may offer coverage for items not covered by the NFIP, such as basements and contents. This additional coverage can be crucial for many homeowners, providing peace of mind that their investments have higher protection. With these advantages, choosing private flood insurance can be a smarter choice for many New Jersey residents looking for comprehensive flood protection.

Lloyd’s of London Flood Insurance New Jersey Marke

New Jersey is fortunate to have many Lloyd’s of London flood insurance options. Although many Lloyd’s flood insurance companies will have you assume that there is only one option, nothing could be further from the truth.

Lloyds’ of London has a rich history attributed to having invented the first modern insurance model. Unlike most of its competition, Lloyd’s of London is not a company but a corporate body. This structure works well since it has been around for over 330 years. Lloyd’s operates under multiple financial backers pooling their capital to spread the risk.

I have two blog posts that deep dive into Lloyd’s of London and what they mean to New Jersey’s flood insurance market. If you are interested, the links are below.

Lloyd’s of London Flood Insurance

FEMA vs. Private Flood Insurance

Lloyd’s also ensures the world with flood insurance, which covers flooding events in India, Australia, and much of Europe. The “game” of insurance is to spread your risk since Lloyd’s is worldwide.

My joke here is that Lloyd’s is banking on GodsGod’s promise that he won’t flood the entire world again, …..so they won’t have to pay out the whole world’s flood claim.

How much does flood insurance cost in New Jersey?

Many factors go into getting the cost of flood insurance for New Jersey. If your home is considered a low-to-moderate risk, you can get a heavily subsidized policy through the government.

New Jersey flood insurance low-to Moderate Risk rate and cost.

This is Flood Zone X, which is not lender required flood zone.

This is usually identified as an X-flood zone. Then we would suggest the government Preferred Risk Policy (PRP) which is a subsidized policy and has set flood insurance coverage limits (see the grid below):

How much is flood insurance in NJ

The average cost for flood insurance in New Jersey with the maximum set limits in these Low-risk flood zone areas is $405 – $700 per year.

If your property is in a higher-risk flood zone, it is usually identified with a Flood Zone AE. Your lender will require you to have flood insurance. The cost of flood insurance in New Jersey depends on many factors that are unique to the structure. We will try to give you an idea of the most common homes we see in New Jersey with a basement foundation.

We will look at the New Jersey cost of flood insurance for the NFIP maximum of $250,000 for the (building only) with NO CONTENTS and our recommended deductible of $5,000.

We will be rating this example on the NFIP and a few of our private flood insurance policies, specifically Lloyds flood insurance options in New Jersey.

How can I lower my flood insurance premiums in New Jersey?

As experts in Flood Insurance, we understand the importance of reducing your premiums while ensuring optimal coverage. To achieve this, we evaluate each property. One effective strategy is to raise your deductibles. By opting for a higher deductible, you can significantly reduce your premium costs. Additionally, implementing flood mitigation measures such as elevating your property or installing flood vents can not only safeguard your home but also lead to lower insurance rates.

We often find that with Private flood options, we can significantly lower the premium compared to the NFIP option. In some cases, we have been able to reduce annual premiums to as low as $600. All properties are unique in these VE flood zones, but if we can find a private flood policy for you, we guarantee it will be better than the NFIP option.

Moreover, the competitive pricing of private insurers is another avenue worth exploring. The insurance market offers a variety of options that cater to different needs and budgets, and our team specializes in finding the best deals that provide both strong coverage and value for money.

Let us help you save money today by exploring all these options to tailor the perfect flood insurance plan that meets your specific needs and budget.

Who provides flood insurance in New Jersey, and what are the sources?

In New Jersey, flood insurance is available from two main sources: the federally administered National Flood Insurance Program (NFIP) and various private insurance companies. The NFIP, managed by the Federal Emergency Management Agency (FEMA), offers flood insurance to homeowners, renters, and business owners in communities that participate in the program throughout the United States, including those in New Jersey. Alternatively, private insurers in New Jersey offer flood insurance policies, which might include more customizable options and flexibility than those provided by the NFIP. Homeowners and property owners in New Jersey can choose between these federal and private options to secure coverage that best suits their needs. Your Flood Nerd is one service that aids in comparing offerings from multiple private flood insurance providers, helping clients identify the most fitting coverage and pricing.

What are the different options available for premium payment in New Jersey?

We offer several payment methods for your convenience:

- Secure ACH (e-check) transfer: Direct and secure, ideal for quick processing.

- Credit/Debit card: Please note, a 3% processing fee is added to card payments.

- Mail-in paper check: Ensure it arrives before your policy begins. Keep in mind that mailed checks are processed as ACH transactions, making e-checks a quicker and safer option.

What are the requirements for flood insurance in New Jersey?

In New Jersey, while it’s not mandated by state law for all homeowners to carry flood insurance, specific circumstances necessitate its purchase. If you own a property situated within an area designated as high-risk for floods, and your mortgage is financed through a lender that is federally regulated or insured, then you are generally obligated to secure flood insurance.

Cost of Flood Insurance in NEW JERSEY in high-risk flood zone AE

Our example is Ocean City, but the premiums will be the same if in Atlantic City, Brigantine, Avalon, North Wildwood, Wildwood Crest, Hoboken, and many other New Jersey flood ones.

AE flood zone insurance NJ

In our example, the Base Flood Elevation (BFE is 10) and is a home that is built before 1973

NFIP option in New Jersey Flood Zone AE

NFIP – Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

NFIP Annual premium in High-Risk flood zone is $3,824.00

This option is what we see if the property has had a flood loss before and either doesn’t have an Elevation Certificate applied, or the Elevation certificate shows that the lowest floor is 4 feet under the BFE for the area. You can use 10% of your coverage to cover other structures on your property.

New Jersey Private flood insurance – Lloyd’s of London Flood Insurance (option 1)

Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

Lloyd’s of London (option 1) Annual premium in High-Risk flood zone is $ 868.75

This option is great, and we are very happy when we can get this option. They can be a bit choosey about what risk they will accept and will not take anything that has had a flood loss. They offer basements coverage, about $2,000 for loss of use, about $2,000 for loss of use, and $2,000 for other structures, but they can’t increase this coverage. They do not require an Elevation Certificate to rate.

New Jersey Private flood insurance – Lloyd’s of London Flood Insurance (option 2)

Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

Lloyd’s of London (option 2) Annual premium in High-Risk flood zone is $ 911.25

This option is great, and we are very happy when we can get this option for our clients. They seem to be writing almost all risks; however, they do not write any property in a designated floodway or have a depth of -4 under the BFE. In our example, with our BFE being 10, they will not accept this risk if the lowest floor is 6. They will not take anything that has had a flood loss. They offer limited coverage for basements and do not require an Elevation Certificate to rate as a percentage of coverage for loss of use. If you want coverage for other structures, that will need to be added.

Private Flood insurance option (option 3), Not Lloyd’s

Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

Annual, The annual premium in High-Risk flood zone, is $2,459.75

This option will take properties with one flood loss for more than five years, and the payout was under $100,000 on the claim. Their coverage matches the NFIP. They will write practically all risks, don’t need an elevation certificate to rate, and are a bit lower in premium than the NFIP.

Private Flood Insurance – Lloyd’s of London (option 4)

This option must be written on the building’s Replacement Cost Value (RCV). Otherwise, there is a co-insurance penalty that kicks in. So, $250,000 might be a bit low in New Jersey, but to keep this going, let’s use that for this option

Coverage of $250,000 (RCV) building coverage, No Contents, and a $5,000 deductible

The annual premium in a High-Risk flood zone is $718.20 (great price).

This options rating system is all over the board. Sometimes we get a crazy great price, but other times the premium is way higher than the NFIP will consider taking a property that has had one flood loss before as long as it has been more than ten years and the payout was under $50,000 on the claim. Their preferred coverage is at replacement cost, slightly different from some of our other Lloyd’s flood options. We usually reserve this one if the property doesn’t fit the above options. We can adjust coverages to control premiums. As mentioned before, these underwriters’ rates are all over the board. It is worth shopping through to ensure we are getting you the best premium possible. They don’t need an elevation certificate to rate.

Private Flood Insurance – Lloyd’s of London (option 5)

Coverage of $250,000 (RCV) building coverage, No Contents, and a $5,000 deductible.

The annual premium in a High-Risk flood zone is $1,231.25

This option came from the company that used to run the NFIP program, so the coverage matches the NFIP coverage with two differences. They offer living expenses which will cover your cost when you are displaced from your home during repairs (most Lloyds flood policies offer this). They also offer swimming pool clean out, which is unique, so if you have a pool, ask for this coverage.

Private Flood Insurance – Lloyd’s of London (option 6)

Coverage of $250,000 (RCV) building coverage. No Contents and a $5,000 deductible.

The annual premium in a High-Risk flood zone is $516.04

This options rating system is also all over the board. Sometimes we get a crazy low price; other times, the premium is way higher than the NFIP. They will consider taking a property that has had one flood loss before as long as it has been more than ten years and the payout was under $25,000 on the claim. They have been rumored to give a low price the first year and then non renew following years, or sometimes they jack the price way up so that we will watch them. They have a slick system, and their underwriting is managed by a 3rd party, which also sometimes seems to be a glitch.

More options are coming online every day, and we are working to be looking into every viable option.

Currently, New Jersey has 224,541 NFIP policies in force to date, with a total cost of $215,735,820. That would make the average flood rate for New Jersey $961. Of course, some will pay more, and some will pay less.

Click here to have our shop and save money.

Flood Maps NJ

Hello, New Jersey! Thanks for visiting our page for all your flood insurance needs.

Let’s start with a group of areas, including Absecon, Galloway, and Hamilton, New Jersey, where the average flood rate is $854. The premiums in these areas add up to $409,967, with 480 flood policies in effect.

Atlantic City, New Jersey, is up next! Atlantic City has 7,021 flood policies, with $6,364,954 in written premiums. The average flood rate here is $907.

In Brigantine, New Jersey, we find an average flood rate of $646. The premiums add up to $4,484,105 with 6,945 in active flood policies.

The average flood rate rises to $690 in Egg Harbor, New Jersey. Egg Harbor has 791 flood policies in effect with $545,406 in premiums.

$849 is the average flood rate for Linwood, Mullica, and Pleasantville, New Jersey. These areas have a combined premium of $448,018 and 528 flood policies in force.

Longport, New Jersey, has 1,418 active flood policies with $1,363,476 in premiums. The average flood rate for Longport is $962.

In Margate City, New Jersey, the premiums total $4,940,099, with 5,479 flood policies in effect. Margate City has an average flood rate of $902.

925 is the total number of active policies in Somers Point, New Jersey. The premiums here total $750,127, which allows the average flood rate to be $811.

The premiums add up to $3,982,089 in Ventnor, New Jersey. Ventnor has an average flood rate of $856, including 4,654 active flood policies.

Let’s look at a group of areas that include Bergenfield, Dumont, and East Rutherford, New Jersey, where the average flood rate is $2,247. The policies in these areas number 403 with $905,598 in written premiums.

Edgewater, New Jersey, has 2,142 active flood policies. The premiums here total $730,695, allowing the average flood rate to be $341.

The average flood rate jumps to $1,886 in Englewood, New Jersey. Englewood has 431 flood policies in effect, with $812,823 in flood premiums.

Looking at Fair Lawn and Garfield, New Jersey, we see 449 flood policies active with $1,061,787 in total premiums. The average flood rate for these areas is $2,365. Give us a call to check your rates!

$1,544 is the average flood rate for Hackensack, New Jersey. Hackensack has 662 active flood policies with $1,022,432 in written premiums.

Let’s check out a group of areas, including Hillsdale, Lodi, and Lyndhurst, New Jersey, where the active flood policies number 689 with $1,135,517 in flood premium. The average flood rate for these areas is $1,648.

In Little Ferry, New Jersey, the flood premium is $1,753,268, with 907 flood policies in effect. The average flood rate for Little Ferry is $1,933.

Three hundred forty-nine flood policies are in effect in Mahwah and Moonachie, New Jersey. These areas have $759,715 in flood premiums which allows the average flood rate to be $2,177.

The New Jersey Meadowlands, New Jersey, has an average flood rate of $1,603. New Jersey Meadowlands has 3,082 active flood policies with $4,940,824 in written premiums.

Let’s look at a group of areas that include New Milford, Ramsey, Ridgefield Park, Ridgefield, Saddle Brook, and Teaneck, New Jersey, where the premiums add up to $2,054,751 with 1,266 flood policies in effect. The average flood rate for these areas is $1,623.

Our next group includes Oakland, Paramus, Park Ridge, Ridgewood, Rochelle Park, Rutherford, Wallington, and Westwood, New Jersey, where the average flood rate is $1,713. The active flood policies here number 1,988 with $3,406,392 in written premium.

Burlington, New Jersey, has 976 flood policies in effect with $1,430,637 in total premiums. The average flood rate in Burlington is $1,466.

Another group of areas includes Cinnaminson, Delanco, Delran, Mount Laurel, Palmyra, and Pemberton, New Jersey. These areas have an average flood rate of $1,003. The total number of active flood policies is 1,065, with $1,068,323 in flood premiums.

The next areas in New Jersey are Evesham, Medford, Moorestown, Southampton, and Willingboro. In these areas, the flood premiums total $542,463. The average flood rate is $650, which includes 835 active flood policies.

$1,953 is the average flood rate in Camden, New Jersey. Camden has 611 flood policies in effect with $1,193,123 in total premiums.

When we study Cherry Hill and Winslow, New Jersey, the flood premiums add up to $355,871. These areas have 365 flood policies active, which makes the average flood rate $975.

In Pennsauken and Voorhees, New Jersey, the flood policies number 306 with $364,279 in written premiums. These areas have an average flood rate of $1,190.

Five thousand fifty-seven flood policies are in effect in Avalon, New Jersey. Avalon has $3,508,153 in flood premiums which allows the average flood rate to be $694.

Next is Cape May Point, New Jersey, where the average flood rate rises to $814. The premiums here total $351,690, and the active flood policies number is 432.

The average flood rate rises to $967 in Cape May, New Jersey. Cape May has 2,628 flood policies in effect with $2,540,924 in total premiums.

Lower New Jersey has a lower average flood rate of $584. Lower has 2,598 active flood policies with $1,516,066 in written premiums.

$907,021 is the total flood premiums in Middle, New Jersey. Middle has 1,092 flood policies, which makes the average flood rate $831.

The active flood policies number 6,299 in North Wildwood, New Jersey. North Wildwood has an average flood rate of $721 which includes $4,541,748 in flood premiums.

Ocean City, New Jersey, has 16,874 flood policies in effect. The average flood rate in Ocean City is $638, which includes $10,757,470 in total premiums.

The flood premium totals $3,333,430 in Sea Isle City, New Jersey. The active flood policy number 6,514 allows the average flood rate to be $512.

In Stone Harbor, New Jersey, the active flood policies number 2,699. The average flood rate in Stone Harbor is $897, which includes $2,421,225 in premiums.

The average flood rate rises to $1,007 in Upper New Jersey. Upper has 470 flood policies in effect with $473,262 in total premiums.

We’ll look at a large group of areas that includes West Cape May, Livingston, Maplewood, Millburn, Nutley, Orange Township, Bayonne, Guttenberg, and Harrison, New Jersey. These areas have an average flood rate of $1,089. The premiums in these areas add up to $2,503,875, and the active policies number 2,299.

478 is the total number of active flood policies in West Wildwood, New Jersey. The premiums total $546,568, making the average flood rate $1,143.

The average flood rate drops to $540 in Wildwood Crest, New Jersey. Wildwood Crest has 4,321 flood policies in effect with $2,333,852 in premiums.

Our final area of New Jersey is in Wildwood, where the flood policies total 3,671. The premiums add up to $2,900,597, allowing the average flood rate to be $790.

The average flood rate in Downe and Belleville, New Jersey, is $765. The number of active flood policies totals 552 with $422,087 in total premiums.

Bloomfield, New Jersey, has 475 flood policies in effect with $845,268 in written premium. Bloomfield has an average flood rate of $1,780.

Next is Fairfield, New Jersey, where the average flood rate jumps to $2,170. The premiums total $2,204,559, with 1,016 flood policies in effect. Give us a call, Fairfield!

The following areas have an average flood rate of $1,898: Montclair, Newark, West Orange, and Greenwich, New Jersey. The premiums add up to $1,814,448 with 956 active flood policies.

Hoboken, New Jersey, has 9,650 flood policies in effect with $7,640,652 in written premiums. The average flood rate in Hoboken is $792.

The average flood rate drops to $749 in Jersey City, New Jersey. The premiums add up to $5,534,041, with 7,385 active flood policies.

In Kearny and Lambertville, New Jersey, the premiums total $895,927 with 352 active flood policies. These areas have an average flood rate of $2,545. Give us a call to check your flood rates!

Five hundred-six flood policies are in effect in North Bergen, New Jersey. The flood premiums add up to $292,994, which allows the average flood rate to be $579.

Weehawken, New Jersey, has $452,386 in written premiums. Weehawken has an average flood rate of $597, including 758 in flood policies.

$229 is the average flood rate in West New York, New Jersey. The policies number 1,282 with $293,472 in flood premium.

When we look at another group of areas that include Ewing, Lawrence, Carteret, Dunellen, East Brunswick, Monroe, Old Bridge, Perth Amboy, South Brunswick, South Plainfield, and South River, New Jersey, we find $3,193,817 is the flood premium total. These areas have 2,355 active flood policies, which makes the average flood rate $1,356.

The average flood rate in Hamilton, New Jersey, is $1,327. The premiums add up to $698,234 with 526 flood policies in effect.

Let’s check out another group of areas that include Princeton, Trenton, West Windsor, Edison, Middlesex, Piscataway, Sayreville, and South Amboy, New Jersey: Princeton, Trenton, West Windsor, Edison, Middlesex, Piscataway, Sayreville, and South Amboy, New Jersey, where the active flood policies number 1,741. The premiums total $2,520,577, allowing the average flood rate to be $1,448.

In Woodbridge, New Jersey, there are 430 flood policies in effect. The average flood rate in Woodbridge is $1,118, which includes $480,940 in written premiums.

Two hundred forty flood policies are active in Aberdeen and Atlantic Highlands, New Jersey. The premiums in these areas total $231,533, allowing the average flood rate to be $965.

There is a $437,547 total premium in Asbury Park, New Jersey. The active flood policy number 527 allows the average flood rate to be $830.

Avon-By-The-Sea, New Jersey, has an average flood rate of $662. The premiums here total $273,597, with 415 flood policies in effect.

Next is Belmar, New Jersey, where there are 896 flood policies active. The average flood rate in Belmar is $585, which includes $524,073 in written premiums.

The average flood rate in Bradley Beach and Brielle, New Jersey, is $580. The premiums here total $373,248, with 643 flood policies in effect.

Now let’s look at Deal, Freehold, and Howell, New Jersey, where there are 461 active flood policies, where 461 active flood policies exist. The average flood rate for these areas is $693, including $319,297 in total premiums.

Hazlet, New Jersey, has $353,854 in written premiums with 492 flood policies in effect. The average flood rate in Hazlet is $719.

The average flood rate rises to $1,203 in Highlands, New Jersey. Highlands has 1,063 active flood policies with $1,279,124 in flood premiums.

There are 1,690 flood policies in effect in Keansburg, New Jersey. Keansburg has an average flood rate of $914, including $1,544,861 in written premiums.

$1,032 is the average flood rate for Keyport and Little Silver, New Jersey. These areas’ premiums add up to $486,880 with 472 active flood policies.

The average flood rate drops to $801 in Long Branch, New Jersey. Long Branch has 2,005 flood policies in effect with $1,605,728 in total premiums.

Again, the average flood rate rises to $1,297 in Manasquan, New Jersey. The premiums in Manasquan total $1,936,768, with 1,493 active flood policies.

Let’s check out a few areas, including Marlboro, Neptune City, and Ocean, New Jersey, where the flood policies total 618. The premiums add up to $533,218, allowing the average flood rate to be $863.

Middletown, New Jersey, has 2,648 flood policies in effect, with $2,171,705 in flood premiums. The average flood rate in Middletown is $820.

The average flood rate drops to $623 in Monmouth Beach, New Jersey. Monmouth Beach has 1,751 active flood policies with $1,090,408 in written premiums.

$617 is the average flood rate in Neptune, New Jersey. The premiums total $469,455, with 761 flood policies active.

In Oceanport, New Jersey, the premiums add up to $634,502. Policies number 711 allow the average flood rate to be $892.

Stopping by Rumson, New Jersey, we find 605 active flood policies. The average flood rate in Rumson is $1,172, which includes $709,320 in written premiums.

The average flood rate drops a little to $1,110 in Sea Bright, New Jersey. Sea Bright has 1,096 active flood policies with $1,216,362 in flood premiums.

Next up, look at Sea Girt and Spring Lake Heights, New Jersey, where the premiums total $275,346 with 407 flood policies active. The average flood rate for these areas is $677.

$588 is the average flood rate in Spring Lake, New Jersey. The active flood policies number 715 with $420,387 in flood premiums.

In Union Beach, New Jersey, the flood premiums total $985,317. The average flood rate in Union Beach is $858, which includes 1,148 active policies.

Let’s look at a group of areas, including Wall, Denville, and Dover, New Jersey, where active flood policies add up to 778 with $1,655,085 in written premiums. The average flood rate for these areas is $2,127.

Our next group includes East Hanover, Jefferson, and Long Hill, New Jersey, where the average flood rate is $1,361. The premiums in these areas add up to $616,643, with 453 flood policies in effect.

The average flood rate rises to $2,125 in Lincoln Park, New Jersey. The active flood policies total 619 with $1,315,549 in total flood premium.

Looking at Montville and Parsippany-Troy Hills, New Jersey, the average flood rate drops to $1,684. The premiums in these areas total $910,963, with 541 flood policies in effect.

Seven hundred-four flood policies are active in Pequannock, New Jersey. The premiums here total $1,455,885, allowing the average flood rate to be $2,068.

Barnegat Light, New Jersey, has $735,091 in flood premiums. The average flood rate is $802, which includes 917 active flood policies.

There are 427 flood policies active in Barnegat, New Jersey, with $309,810 in total premiums. The average flood rate in Barnegat is $726.

Check out Bay Head, New Jersey, where the average flood rate is $1,280. The premiums in Bay Head total $930,698 with 727 active flood policies.

The average flood rate drops to $1,158 in Beach Haven, New Jersey. Beach Haven has 2,136 flood policies in effect, with $2,473,636 in written premiums.

When we look at Berkeley, New Jersey, the flood rate drops to $671. The policies here number 2,613 with $1,752,780 in flood premium.

$3,197,449 is the flood premium total in Brick, New Jersey. Brick has 4,221 inactive flood policies, which makes the average flood rate $758.

Harvey Cedars, New Jersey, has an average flood rate of $1,024. The premiums here total $977,960, with 955 flood policies in effect.

The average flood rate drops to $846 in Lacey, New Jersey. Lacey has 2,796 flood policies active, with $2,365,849 in written premiums.

In Lavallette, New Jersey, the active flood policies number 2,110 with $1,669,921 in flood premiums. The average flood rate in Lavallette is $791.

There are 2,458 flood policies active in Little Egg Harbor, New Jersey. The premiums here total $2,254,344, which allows the average flood rate to be $917.

Six thousand five hundred fifty-four flood policies are inactive in Long Beach, New Jersey. The average flood rate in Long Beach is $1,065, which includes $6,981,212 in written premiums.

Let’s look at a group of areas that include Manchester, Clifton, and Passaic, New Jersey, where the average flood rate is $2,078. The policies here number 362 with $752,207 in flood premiums.

Mantoloking, New Jersey, has 405 active flood policies. The average flood rate here is $1,737, including $703,364 in total premiums.

The average flood rate drops to $875 in Ocean Gate, New Jersey. Ocean Gate has 402 flood policies in effect, with $351,621 in flood premiums.

The premiums in Ocean, New Jersey Ocean, New Jersey premiums total $811,271 with 935 active flood policies. The average flood rate in Ocean is $868.

Next is Point Pleasant Beach, New Jersey, where the flood policies in effect total 1,804. The premiums in Point Pleasant Beach total $2,636,548, which allows the average flood rate to be $1,462.

$668 is the average flood rate in Point Pleasant, New Jersey. Point Pleasant has $1,234,615 in premiums with 1,847 active flood policies.

The average flood rate rises to $1,014 in Seaside Heights, New Jersey. The active policies number 1,375 with $1,394,507 in flood premiums.

Again, the average flood rate rises slightly to $1,190 in Seaside Park, New Jersey. The premiums in Seaside Park total $1,573,328, with 1,322 active flood policies.

1,510 is the total number of active flood policies in Ship Bottom, New Jersey. Ship Bottom has $1,732,731 in written premium, which allows the average flood rate to be $1,148.

Stafford, New Jersey, has an average flood rate of $725. The premiums here total $2,400,716, with 3,312 flood policies in effect.

Now, look at Surf City, New Jersey, where the premiums add up to $1,623,921 with 1,507 active flood policies. The average flood rate in Surf City is $1,078.

Up next is Toms River, New Jersey, where the average flood rate is $864. The active flood policies number 8,964 with $7,745,293 in written premium.

In Tuckerton, New Jersey, there are 473 flood policies in effect with $344,290 in premiums. The average flood rate in Tuckerton is $728.

The active flood policies number 484 in Little Falls, New Jersey. The average flood rate in Little Falls is $1,406, including $680,736 in flood premium.

$1,504 is the average flood rate in Paterson, New Jersey. The premiums here total $1,299,120, with 864 flood policies in effect.

Pompton Lakes, New Jersey, has 508 flood policies, with $1,032,592 in written premiums. The average flood rate in Pompton Lakes is $2,033.

Let’s check out a group of areas that include Totowa, West Milford, and Woodland Park, New Jersey, where the average flood rate is $2,259. These areas have flood premiums that total $1,145,373, with 507 flood policies in effect.

The average flood rate drops to $2,082 in Wayne, New Jersey. Wayne has 747 active flood policies with $1,554,943 in written premiums.

In Carneys Point and Penns Grove, New Jersey, the premiums total $727,283, with 437 flood policies in effect. These areas have an average flood rate of $1,664.

Pennsville, New Jersey, has 978 active flood policies with $998,483 in total premiums. The average flood rate in Pennsville is $1,021.

Looking at a group of areas that include Bernards, Bound Brook, Bridgewater, Montgomery, and North Plainfield, New Jersey, we find 966 active flood policies. The premiums in these areas total $1,648,152, which allows the average flood rate to be $1,706.

Our next group includes Franklin, Hillsborough, and Manville, New Jersey, where the average flood rate is $1,198. The flood policies add up to 992 with $1,188,841 in flood premiums.

$1,176 is the average flood rate in Berkeley Heights and Elizabeth, New Jersey. These areas have $392,720 in total premiums, with 334 flood policies in effect.

Next is Cranford, New Jersey, where 792 active flood policies exist. Cranford has $1,065,113 in total premiums, which allows the average flood rate to be $1,345.

The average flood rate is $1,889 in Kenilworth, Linden, and New Providence, New Jersey. The premiums in these areas add up to $932,919, with 494 flood policies in effect.

Plainfield, New Jersey, has 1,100 active flood policies with $1,945,665 in flood premiums. The average flood rate in Plainfield is $1,769.

There is $871,639 in written premium in Rahway, New Jersey. Rahway has an average flood rate of $1,645, including 530 active flood policies.

The average flood rate rises slightly to $1,673 in Roselle and Scotch Plains, New Jersey. These areas have 499 flood policies in effect with $834,756 in total premiums.

Our last area group includes Springfield, Union, and Westfield, New Jersey, where the premiums add up to $1,495,890. The policy here is number 726, which allows the average flood rate to be $2,060.

Thanks for checking out all the flood information on New Jersey!!

Why Choose Better Flood Insurance for Your Flood Insurance Needs?

As an independent broker, Better Flood Insurance offers a diverse range of flood insurance products tailored to your specific requirements. We have access to exclusive options that are highly sought after in the market, setting us apart from agencies limited to certain insurers or those that specialize only in auto, life, and home insurance.

Your Flood Nerd has the freedom, knowledge, and expertise to select from a wide variety of insurance plans, ensuring strong coverage that fits your unique situation without leaving gaps that could be costly in the event of a flood. Our team is dedicated to guiding you through the selection process, helping you choose vital coverages that protect your home effectively and affordably.

Choosing to work with a Flood Nerd means benefiting from personalized service and expertise that prioritize your property’s safety and your peace of mind. We make it easier and more affordable for homeowners and business owners to secure a solid policy that safeguards their assets.