Instant Wisconsin Flood Insurance at Great Rates.

Save big with our reliable Wisconsin flood insurance plans—fast quotes, faster coverage.

$2.3M+

Annual Premium Savings

4.9★

Average Ratings

445+

Reviews

5,497+

Happy Clients

Get Cheap Flood Insurance Wisconsin without Compromising Your Coverage.

We Get It,

Buying Flood Insurance in Wisconsin Is Confusing…

You might be asking:

• What coverage do I need?

• How much is flood insurance in Wisconsin going to cost me?

• How much can I save?

It’s okay, your search for cost-effective Wisconsin flood insurance that doesn’t compromise on coverage ends here.

Meet The Flood Nerd™

Your Florida Flood Expert, Friend, and Guardian

In 2015, Robert Murphy, inspired to help homeowners and businessowners alike, entered the insurance brokerage market with one goal in mind: To help uncertain homeowners find affordable, high quality flood insurance that doesn’t compromise on coverage.

We Find You Great Coverage

While Saving You Up To $1,457+ A Year!

What you seek is:

Enhanced security for your Wisconsin Property.

Significant savings.

Absolute freedom.

Unwavering certainty.

Memorable moments.

Quality family time.

Peaceful travels.

It's As Easy As 1, 2, 3!

1

Fill Out Our Online Form

Complete our easy quote form so we can understand your needs & personalize your rates.

2

Get An Instant Quote

Our team scours insurance companies nationwide to instantly present the best coverage & rate options for your needs.

3

Get Coverage

If you’re happy with the coverage options, you can sign up easily directly from our online portal.

Wisconsin Flood Insurance FAQ

What is flood insurance and why do I need it in Wisconsin?

Flood insurance is a type of property insurance that covers losses and damages caused by flooding. In Wisconsin, heavy rains, melting snow, and overflowing rivers can all lead to significant flood events. Even if you live in a low-risk area, 20% of flood insurance claims come from properties outside high-risk zones.

Does homeowners insurance cover flood damage?

No, standard homeowners insurance policies do not cover flood damage. You need a separate flood insurance policy to protect your home and belongings from flood-related losses.

What are the types of flood insurance available in Wisconsin?

In Wisconsin, you can choose between National Flood Insurance Program (NFIP) policies and private flood insurance policies. NFIP policies are backed by the federal government and have standard coverage limits, while private flood insurance can offer higher limits and additional coverage options.

How much does flood insurance cost in Wisconsin?

The cost of flood insurance varies depending on factors such as your property’s location, elevation, and the type of coverage you choose. On average, NFIP policies cost around $700 per year, but private flood insurance policies can be more affordable and offer better coverage.

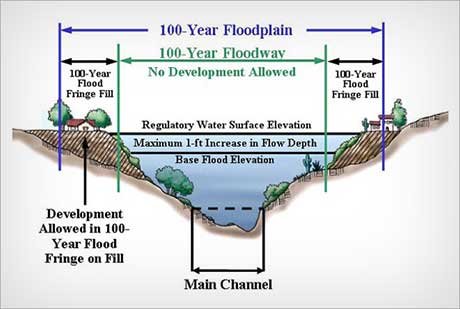

How do I determine my flood risk in Wisconsin?

You can determine your flood risk by consulting FEMA’s Flood Insurance Rate Maps (FIRMs) or using an online flood zone lookup tool. Enter your address to find out if you’re in a high-risk flood zone and to understand your specific risk.

What is the difference between NFIP and private flood insurance?

NFIP policies offer up to $250,000 in building coverage and $100,000 in contents coverage. Private flood insurance can provide higher limits, additional living expenses, and broader coverage for items such as basements and pools. Private policies also typically have shorter waiting periods and may not require an elevation certificate.

Do I need an elevation certificate to get flood insurance in Wisconsin?

For NFIP policies, an elevation certificate is often required to determine your property’s flood risk and insurance premium. Private flood insurers may not require an elevation certificate, making the process simpler and quicker.

Can I purchase flood insurance at any time?

Yes, you can purchase flood insurance at any time. However, NFIP policies typically have a 30-day waiting period before coverage begins, while private flood insurance policies often have shorter waiting periods or none at all if required by a lender.

How do I file a flood insurance claim in Wisconsin?

To file a flood insurance claim, contact your insurance provider as soon as possible after the flood event. Document all damages with photos and keep receipts for any repairs or temporary housing. Your insurance company will guide you through the claims process and help you get the necessary compensation.

Where can I buy flood insurance in Wisconsin?

You can buy flood insurance through Better Flood Insurance, your dedicated flood nerds! We shop multiple options, including exclusive ones that other agents don’t have access to, ensuring you get strong coverage at an affordable price. We offer both NFIP policies and private flood insurance options. By leveraging our extensive network, we can compare various policies and provide you with the best possible coverage tailored to your needs. Contact us to explore your flood insurance options and get the protection you deserve.

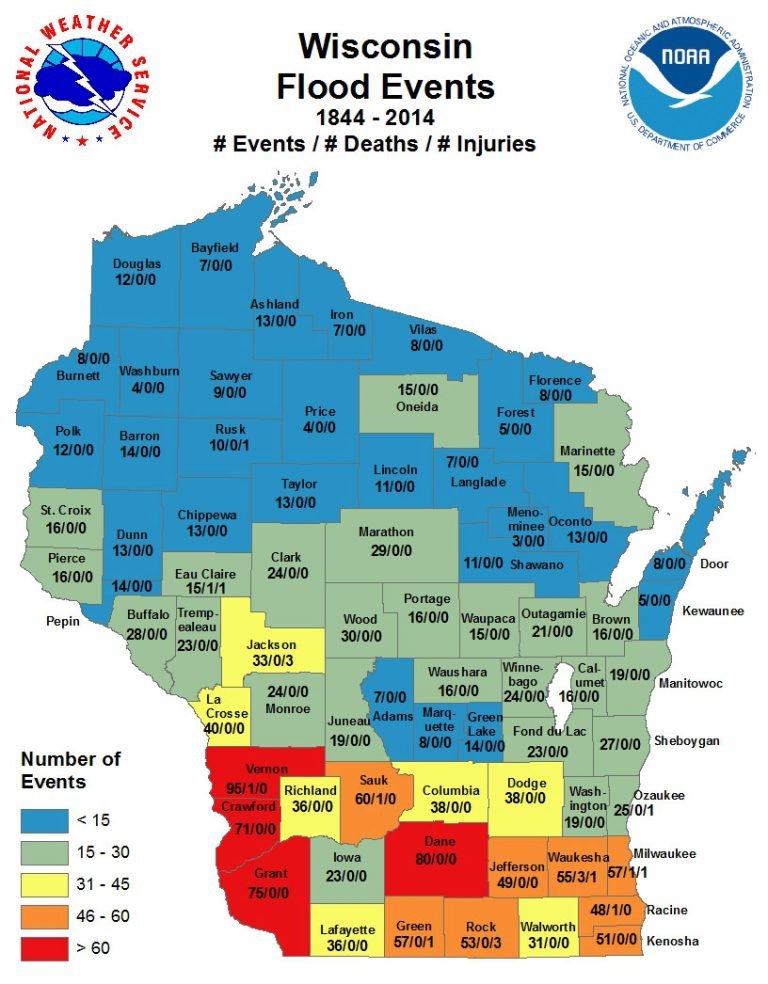

Wisconsin Flooding map

The Importance of Flood Insurance in Wisconsin

Wisconsin, known for its beautiful lakes, rivers, and the mighty Mississippi, isn’t immune to the dangers of flooding. From the shores of Lake Michigan to the Wisconsin Dells, flood risks are a serious concern for homeowners across the state. Even in areas where you might not expect it, such as the rolling farmlands of the Driftless Area or the bustling streets of Milwaukee, flooding can occur and cause significant damage.

Why Flood Insurance is Essential

Flood insurance is not just for those living near water bodies like Lake Winnebago or the Fox River. In fact, 20% of flood insurance claims come from low to moderate-risk areas. Whether you’re in Madison or up in Green Bay, it’s crucial to understand that heavy rainfall, snowmelt, and rising rivers can all contribute to unexpected flooding. The cost of flood damage can be staggering, with average claims in Wisconsin reaching over $22,000.

Recent Changes in Flood Insurance Regulations

The introduction of FEMA’s Risk Rating 2.0 has brought significant changes to how flood insurance premiums are calculated. This new methodology considers various factors, such as distance to water, property elevation, and flood frequency, providing more accurate risk assessments. For Wisconsin residents, this means a more tailored premium that reflects the true risk of flooding in your area, whether you’re in Eau Claire or Sheboygan.

Flood Plain Map Wisconsin

I ask you to consider the facts: 20 percent of all flooding events across our nation come in areas that are considered low risk. After our last few major storms (Hurricane Harvey), we saw flooding in these low-risk areas. Eighty percent of these individuals had water in their homes or building and didn’t have flood insurance coverage.

In Harris county, nearly 135,000 homes were damaged. Three-fourths of these properties were considered low to moderate risk.

We often hear that people believe that the government will help, which is true. However, a few things must align for you to get government assistance.

Flooding in Wisconsin map

1 – The president of the United States must declare the flooding event a state of emergency. If this doesn’t happen, then there won’t be assistance.

2 – Homeowners’ average amount of assistance after a flood, when they do not have flood coverage, is $5,000. The average cost of damage to one’s property after a flood is $38,000+. That $5K you get from the government? It comes as a loan, and you will need to pay it back. Are you willing to gamble your financial future by forgoing flood insurance coverage?

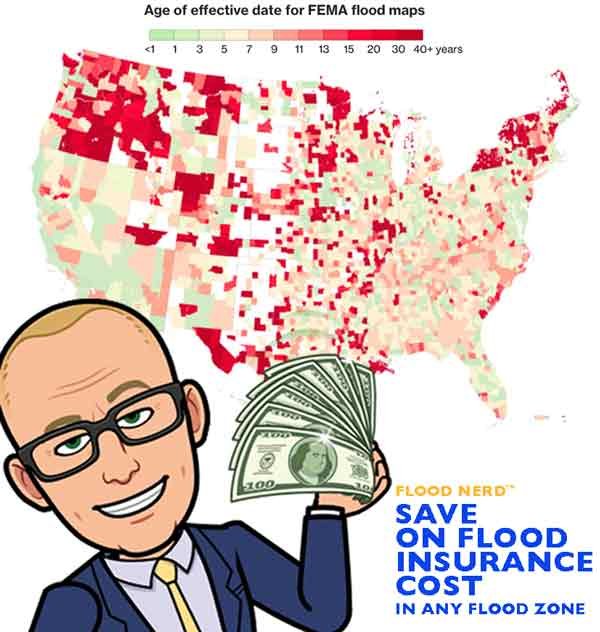

Wisconsin Flood zone map

One more note on these low-risk flood zone maps. Many of these maps are over 40 years old. If the area has been developed, there is likely more concrete, creating a barrier for land that, previously, might have absorbed the massive downpour.

Because of all these factors, it is difficult for property owners to know their true risk of flooding. FEMA admits that their flood maps only give an idea of part of the risk. Our recent storms are facts that it can rain anywhere within Wisconsin, and you should consider getting flood coverage so you are not uninsured when you need it most.

FEMA flood zone maps often take years to go into effect after the terrain was studied; this gives the impression that the area is “more up to date” than it is.

The average cost for Wisconsin flood insurance in these Low-risk areas is $595 per year.

FEMA’s National Flood Insurance Program (NFIP) and all federally backed lenders rely on these Wisconsin flood insurance maps to assess risk, set premiums, and determine who is required to purchase flood insurance. Bad information about an area’s flood risk can leave property owners uninsured.

How much is flood insurance in Wisconsin?

There are many options available in Wisconsin regarding flood insurance, but they fall into two main categories. The National Flood Insurance Program (NFIP) is government-run through FEMA and the Private flood insurance market (Typically Lloyds of London, but other smaller options are out there as well)

Wisconsin NFIP flood insurance.

The National Flood Insurance Program (NFIP), also known as FEMA, is the government option for flood insurance. The NFIP has enjoyed a 50-state monopoly on the flood insurance market.

Not “private flood insurance” but NFIP Resellers

If you have Nationwide Flood Insurance, State Farm Flood Insurance, Progressive Flood Insurance, or any of the logos below, Suppose you have Nationwide Flood Insurance, State Farm Flood Insurance, Progressive Flood Insurance, or any of the logos below. In that case, you are buying the NFIP flood policy that is just being resold through a government program. These companies are private companies, but their flood insurance is not. Here is a list of the 70 companies that resell the NFIP policy.

Private flood insurance in Wisconsin

There are alternatives to the NFIP or government insurance. It is called Private flood insurance, most notably Lloyd’s of London Flood insurance. However, there are other options available in Wisconsin. We shop all the options for your property in your region to ensure you are getting the best premium. Please click here if you are ready to have us do the work for you.

Our shopping includes the NFIP because sometimes we find that you can get a much better premium with government subsidies.

GET A QUOTE

Lloyd’s of London Flood Insurance Wisconsin Market

Wisconsin is fortunate to have many Lloyd’s of London flood insurance options. Although many Lloyds flood insurance companies will have you assume that there is only one option, nothing could be further from the truth.

Lloyd’s of London has a rich history attributed to having invented the first modern insurance model. Unlike most of its competition, Lloyd’s of London is not a company but a corporate body. This structure works well since it has been around for over 330 years. Lloyd’s operates under multiple financial backers pooling their capital to spread the risk.

I have two blog posts that deeply dive into Lloyd’s of London and what they mean to Wisconsin’s flood insurance market. If you are interested, the links are below.

Lloyd’s of London Flood Insurance

Private flood insurance vs. FEMA

Lloyd’s also ensures the world for flood insurance, meaning they cover flooding events in India, Australia, and much of Europe. The “game” of insurance is to spread your risk since Lloyd’s is worldwide.

My joke here is that Lloyd’s is banking on God’s promise that he won’t flood the entire world again, …..so they won’t have to pay out the whole world’s flood claim.

How much does flood insurance cost in Wisconsin?

Many factors go into getting the cost of flood insurance for Wisconsin. If your home is in what is considered a low-to-moderate risk, you can get a heavily subsidized policy thoughthrough the government.

Wisconsin flood insurance low-to Moderate Risk rate and cost. This is Flood Zone X, which is not lender required flood zone.

This is usually identified as an X-flood zone. Then we would suggest the government Preferred Risk Policy (PRP) which is a subsidized policy and has set flood insurance coverage limits (see gthe rid below):

The average cost for flood insurance in Wisconsin with the maximum set limits in these Low-risk flood zone areas is $405 – $700 per year.

If your property is in ha igher-risk flood zone, it is usually identified with a Flood Zone AE. Your lender will require you to have flood insurance. The cost of flood insurance in Wisconsin depends on many factors unique to the structure. We will try to give you an idea of the most common homes we see in Wisconsin with a basement foundation.

We will look at the Wisconsin cost of flood insurance for the NFIP maximum of $250,000 for the (building only) with NO CONTENTS and our recommended deductible of $5,000.

We will be rating this example on the NFIP and on a few of our private flood insurance policies, specifically Lloyds flood insurance options in Wisconsin.

Cost of Flood Insurance in WISCONSIN in high-risk flood zone AE

Our example is Green Bay, but the premiums will be the same if in Fond du Lac, La Crosse, Milwaukee, Winnebago, and many other Wisconsin flood ones.

In our example, the Base Flood Elevation (BFE is 591) and is a home that is built before 1973

NFIP option in Wisconsin Flood Zone AE

NFIP – Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

NFIP Annual premium in High-Risk flood zone is $3,022.00

This option is what we see if the property has had a flood loss before and either doesn’t have an Elevation Certificate applied, or the Elevation certificate shows that the lowest floor is 4 feet under the BFE for the area. You can use 10% of your coverage to cover other structures on your property.

Wisconsin Private flood insurance – Lloyd’s of London Flood Insurance (option 1)

Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

Lloyds of London (option 1) Annual premium in High-Risk flood zone is $807.53

This option is great, and we are very happy when we can get this option. They can be a bit choosey about what risk they will accept and will not take anything that has had a flood loss. They offer basements coverage, about $2,000 for loss of use, and $2,000 for other structures, but they can’t increase this coverage. They do not require an Elevation Certificate to rate.

Wisconsin Private flood insurance – Lloyd’s of London Flood Insurance (option 2)

Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

Lloyd’s of London (option 2) Annual premium in High-Risk flood zone is $1,034.15

This option is great, and we are very happy when we can get this option for our clients. They seem to be writing almost all risks; however, they do not write any property in a designated floodway or have a depth of -4 under the BFE. In our example, with our BFE being 591, they will not accept this risk if the lowest floor is 587. They will not take anything that has had a flood loss. They offer limited coverage for basements and do not require an Elevation Certificate to rate as a percentage of coverage for loss of use. If you want coverage for other structures, that will need to be added.

Private Flood insurance option (option 3) Not Lloyd’s

Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

The annual premium in High-Risk flood zone is $2,720.45

This option will take properties that have had one flood loss as long as it has beenfor more than five years, and the payout was under $100,000 on the claim. Their coverage matches the NFIP. They will write practically all risks, don’t need an elevation certificate to rate, and are a bit lower in premium than the NFIP.

Private Flood Insurance – Lloyd’s of London (option 4)

This option must be written on the building’s Replacement Cost Value (RCV); otherwise. Otherwise, there is a co-insurance penalty that kicks in. So, $250,000 might be a bit low in California, but to keep this going, let’s use that for this option

Coverage of $250,000 (RCV) building coverage, No Contents ,anda $5,000 deductible

The annual premium in High-Risk flood zone is $1,258.66.

This options rating system is all over the board. Sometimes we get a crazy great price, but other times the premium is way higher than the NFIP will consider taking a property that has had one flood loss before as long as it has been more than ten years and the payout was under $50,000 on the claim. Their preferred coverage is at replacement cost, slightly different from some of our other Lloyd’s flood options. We usually reserve this one if the property doesn’t fit into any of our options abovethe above options. We can adjust covepremiumso control premium.

As mentioned before, thisthese underwriters’ rates are all over the board. It is worth shopping through to ensure we are getting you the best premium possible. They don’t need an elevation certificate to rate.

Private Flood Insurance – Lloyd’s of London (option 5)

Coverage of $250,000 (RCV) building coverage, No Contents, and $a 5,000 deductible.

The annual premium in High-Risk flood zone is $1,015.86

This option came out offrom the company that used to run the NFIP program, so the coverage is almost exactly from the company that used to run the NFIP program, so the coverage matches the NFIP coverage with two differences. They offer living expenses which will cover your cost when you are displaced from your home during repairs (most Lloyds flood policies offer this). They also offer swimming pool clean out, which is unique, so if you have a pool, ask for this coverage.

Private Flood Insurance – Lloyd’s of London (option 6)

Coverage of $250,000 (RCV) building coverage. No Contents and a $5,000 deductible.

Annual The annual premium in High-Risk flood zone is $1,305.05

This options rating system is also all over the board. Sometimes we get a crazy low price; other times, the premium is way higher than the NFIP. They will consider taking a property that has had one flood loss before as long as it has been more than ten years and the payout was under $25,000 on the claim. They have been rumored to give a low price the first year and then non in renew following years, or sometimes they jack the price way up so that we will watch them. They have a slick system, and their underwriting is managed by a 3rd party, which also sometimes seems to be a glitch.

More options are coming online every day, and we are working to be looking into every viable option.

Wisconsin Flood Zone map

Currently, Wisconsin has 12,112 NFIP policies in force to date, with a total cost of $11,790,299. That would make the average for Wisconsin $973. Of course, some will pay more, and some will pay less.

Click here to have our shop and save money.

Flood Insurance Wisconsin

Hello, Wisconsin! Thanks for visiting our page for all your flood insurance needs.

Let’s start with Adams and Allouez, Wisconsin, where there are 145 flood policies in effect with $121,469 in total premiums. The average flood rate here is $838.

Next, we move on to Green Bay, Wisconsin. Green Bay is the home of the Green Bay Packers! Green Bay has the highest number of flood policies in the state at 707! The premiums here total up to $802,194, with an average flood rate of $1,135.

In Howard and Suamico, Wisconsin, we have an average flood rate of $1,050. The total number of policies here is 122, with $128,137 in total premiums.

$1,061 is the average flood rate for Burnett and Chippewa, Wisconsin. The premiums here total $156,013, with 147 active flood policies.

In Eau Claire, Wisconsin, there are 104 active flood policies. The premium here totals $105,515, allowing the average flood rate to be $1,015.

Check out Columbia and Columbus, Wisconsin, where the average flood rate is $939. The active flood policies total 131 with $123,032 in premiums.

There are 162 active flood policies in Dane, Wisconsin. The average flood rate is $656, with $106,297 in total premiums.

When we look at Madison, Wisconsin, we see an average flood rate of $540. The active policies in Madison total 221 with $119,334 in total premiums.

$828 is the average flood rate for Dodge and Door, Wisconsin. The premiums for these areas total up to $139,869, with 169 flood policies in effect.

One hundred fifty-four flood policies are active in Sturgeon Bay and Dunn, Wisconsin. The average flood rate for these areas is $791,w hich includes $121,793 in total flood premiums.

Next, we’ll look at Fond du Lac, Wisconsin, where the average flood rate is $857. The total number of active flood policies in Fond du Lac is 480. The premiums here total $325,893.

In Kewaskum, Grant, and Fort Atkinson, Wisconsin, there are135 active flood policies with $130,603 in premiums. The average flood rate for these areas is $967.

Jefferson, Wisconsin, has an average flood rate of $1,143 with 155 active policies. The premiums in Jefferson total up to $177,104.

$196,252 is the total premiumspremium for Juneau, Kenosha, and Pleasant Prairie, Wisconsin. The average flood rate for all these areas is $755, including 260 flood policies.

Looking at La Crosse, Wisconsin, we find an average flood rate of $1,036. There are 590 flood policies in La Crosse, with $611,231 in total premiums.

The average flood rate for Marathon and Rothschild, Wisconsin, is about the same, coming in at $1,032. This includes $161,047 in flood premiums and 156 active flood policies.

The average flood rate drops to $814 in Wausau and Marinette, Wisconsin. The premiums in these areas total $113,178, with 139 active flood policies.

Two hundred thirty-five flood policies are in effect in Fox Point and Glendale, Wisconsin. The premiums total up to $336,358, allowing the average flood rate to be $1,431.

Hello Milwaukee, Wisconsin! Thanks for stopping by! Your average flood rate is $687. The total number of flood policies here is 364, with $250,116 in premiums.

Let’s check out a group of areas: Wauwatosa, Whitefish Bay, and Kendall, Wisconsin, where the average flood rate is $794. The total number of flood policies in effect is 247, including $196,150 in total flood premiums.

Monroe, Wisconsin, has 132 active flood policies and $93,020 in total premiums. The average flood rate for Monroe is $705.

$841 is the average flood rate for Oconto, Wisconsin. The premiums in Oconto total $128,742, which includes 153 flood policies in effect.

One hundred seven flood policies are active in New London, Wisconsin. The average flood rate in New London is $1,253, including $134,076 in total premiums.

Outagamie, Wisconsin, we find 106 flood policies in effect and $107,206 in total premiums. The average flood rate in Outagamie is $1,011.

When we look at Mequon, Wisconsin, we find an average flood rate of $1,209. The total number of policies in effect here is 153, with $157,490 in total flood premiums.

There are 139 total policies in effect in Ozaukee and Saukville, Wisconsin. The premiums in these areas add up to $207,813, which allows the average flood rate to be $1,495.

Racine, Wisconsin, has an average flood rate of $1,147, with 216 flood policies. The premiums in Racine total to$247,818.

Let’s check out Beloit, Reedsburg, Sauk, Sawyer, St. Croix, Arcadia, Brookfield, and Menomonee Falls, Wisconsin. These areas have a total of 565 active flood policies. The average flood rate for all these areas is $777,w hich includes $438,792 in total premiums.

Looking at another group of cities: Janesville, Rock, Plymouth, Sheboygan, Richfield, Washington, Muskego, and New Berlin, Wisconsin, we see the average flood rate is a little higher at $1,112. The flood premiums here total $759,259,w hich includes 683 active flood policies.

In Waukesha, Wisconsin, we find 103 flood policies with $77,992 in flood premiums. The average flood rate for Waukesha is $757.

$885 is the average flood rate for Waupaca and Waushara, Wisconsin. The premiums here total up to $119,493, including 135 total flood policies in effect.

One hundred forty-eight total flood policies are active in Oshkosh, Wisconsin. The average flood rate in Oshkosh is $1,117, which includes $165,326 in flood premiums.

Finally, we check out Winnebago, Wisconsin, where the average flood rate is $944. ThereTheir areaarearea areiisareas s $301,152 in premiums, which includesincludeincludes include includes 319 active flood policies.

Thanks for checking out all the flood information on Wisconsin!!

Cost of Flood Insurance in Wisconsin

For decades, the NFIP has over-charged 50 percent of its policyholders and under-charged the other 50 percent while it has racked up $42 billion in taxpayer-funded losses, equating to more than half of every claim paid by the NFIP since 1978.

About 30 percent of NFIP claims payments go to the same 3 percent of insured “repetitive loss” structures yearly. When you do the math, this means that the other 97 percent of their flood-exposed constituents could have paid in less and still netted larger claims payouts if they had better access to private flood insurance. AAAA recent white paper by Milliman found that 90 percent of homes in Sandy-struck New York and New Jersey would see reduced flood insurance rates through private insurers.

Get Cheap Flood Insurance without Compromising Coverage

★★★★★

"Same Coverage at a Better Rate"

-Mohammed K

Flood Nerds will shop the private flood insurance markets and then compare them to the NFIP, guaranteeing you the better option. We will send you the cheapest flood insurance rates within minutes.

★★★★★

"Quick Response, Very Knowledgable"

– Robert W

Paying for low-cost flood insurance is awesome. And letting the Flood Nerds shop your property has other benefits – you can get better coverage while saving money, and you can get it fast.

★★★★★

"Would highly recommend Better Flood for your flood insurance needs."

– Varun K