Instant Delaware Flood Insurance at Great Rates.

Save big with our reliable Delaware flood insurance plans—fast quotes, faster coverage.

$2.3M+

Annual Premium Savings

4.9★

Average Ratings

445+

Reviews

5,497+

Happy Clients

Save money on your Delaware flood insurance Now.

We Get It,

Buying Flood Insurance in Delaware Is Confusing…

You might be asking:

• What coverage do I need?

• How much is flood insurance in Delaware going to cost me?

• How much can I save?

It’s okay, your search for cost-effective Delaware flood insurance that doesn’t compromise on coverage ends here.

Meet The Flood Nerd™

Your Delaware Flood Expert, Friend, and Guardian

In 2015, Robert Murphy, inspired to help homeowners and businessowners alike, entered the insurance brokerage market with one goal in mind: To help uncertain Delaware homeowners find affordable, high quality flood insurance that doesn’t compromise on coverage.

We Find You Great Coverage

While Saving You Up To $1,457+ A Year!

What you seek is:

Enhanced security for your Delaware Property.

Significant savings.

Absolute freedom.

Unwavering certainty.

Memorable moments.

Quality family time.

Peaceful travels.

It's As Easy As 1, 2, 3!

1

Fill Out Our Online Form

Complete our easy quote form so we can understand your needs & personalize your rates.

2

Get An Instant Quote

Our team scours insurance companies nationwide to instantly present the best coverage & rate options for your needs.

3

Get Coverage

If you’re happy with the coverage options, you can sign up easily directly from our online portal.

Understanding the Cost of Delaware Flood Insurance

Floods are unpredictable and can occur anywhere, disrupting lives and causing extensive damage. Safeguarding your Delaware home with flood insurance is an essential step in securing your peace of mind. Understanding the costs involved is crucial, as it allows you to make informed decisions regarding the protection of your cherished possessions.

Does my homeowner's policy cover flood damage in Delaware?

Many homeowners are under the misconception that their standard insurance policies include flood coverage. However, typical homeowners insurance policies in Delaware do not cover flood damage. This means that damage from flooding—caused by storms, hurricanes, or other water-related events—is not covered under these policies. Often, homeowners in Delaware need to purchase separate flood insurance to protect their property from such risks.

Now that you’re informed, you are wiser and safer. To address this critical need, our company offers a convenient online option where Delaware homeowners can start their quote process to obtain flood insurance tailored to their specific needs. This streamlined service ensures that homeowners can quickly and easily secure the strong coverage they need to safeguard their homes against flood damage. By being proactive, you not only understand the limitations of typical homeowners’ insurance but also take crucial steps to protect your property.

Why Trust Our Expertise?

Our dedicated team of Flood Nerds brings extensive knowledge and experience to help you navigate through the myriad of options available for flood insurance in Delaware. Our commitment is to empower you with insights so you can confidently select the appropriate coverage. By opting for our private flood insurance options, a majority of our clients save between $500 and $2,500 on their Delaware flood insurance policies.

How to Estimate Your Costs

To assist you in estimating the Delaware flood insurance cost, we offer a user-friendly calculator. However, for a comprehensive and reliable quote that aligns with your specific needs, we recommend completing our quick, no-obligation quote form. Typically, our Delaware clients pay between $500 and $1,500 annually for optimal home flood insurance.

What is not covered by the NFIP?

The National Flood Insurance Program (NFIP) has certain exclusions that Delaware homeowners should be aware of. Notably, the NFIP does not cover the cost of debris removal or additional living expenses if your home becomes uninhabitable due to flooding. It also excludes coverage for items stored in basements and structures not attached to the main property, such as detached garages and sheds, unless a separate policy is obtained. For detailed coverage information, visiting the NFIP website is recommended.

Delaware’s geographic location and climate can expose homeowners to significant flood risks. Recognizing the limitations of NFIP coverage is crucial, as these can leave gaps in your flood protection strategy. Private flood insurance options from companies like Lloyds of London Flood Insurance might offer more expansive coverage, including debris removal and living expenses—areas not typically supported by the NFIP. These policies can be customized to meet broader needs, featuring higher coverage limits and fewer restrictions.

Concerns about basement content coverage are particularly relevant in Delaware, where many homes utilize basement space extensively. Private policies can be designed to include coverage for these areas, providing strong protection for your property. This is especially advantageous for homeowners who store valuable items in their basements or reside in flood-prone areas.

Engaging with Your Flood Nerd is essential when navigating the complexities of flood insurance options available in Delaware. Your Flood Nerd can clarify the terms and conditions of both NFIP and private insurance offerings, helping you select a policy that aligns with your risk profile and property specifics. Their expert guidance is vital for crafting a flood insurance strategy that ensures strong coverage tailored to the unique needs of Delaware homeowners.

To understand what your current or potential flood insurance policy covers, the NFIP website is a valuable starting point. For more personalized guidance tailored to your specific needs, consulting with Your Flood Nerd offers critical insights, ensuring you secure adequate protection for your home.

Get Cheap Flood Insurance without Compromising Coverage

★★★★★

"Same Coverage at a Better Rate"

-Mohammed K

Flood Nerds will shop the private flood insurance markets and then compare them to the NFIP, guaranteeing you the better option. We will send you the cheapest flood insurance rates within minutes.

★★★★★

"Quick Response, Very Knowledgable"

– Robert W

Paying for low-cost flood insurance is awesome. And letting the Flood Nerds shop your property has other benefits – you can get better coverage while saving money, and you can get it fast.

★★★★★

"Would highly recommend Better Flood for your flood insurance needs."

– Varun K

Better Flood Insurance is an independent flood insurance broker that shops flood insurance ONLY. Flood Nerds are Flood insurance experts. We have 5000+ happy clients and 390+ 5-star reviews.

Access Potential Savings

Explore potential savings and uncover the ideal flood insurance coverage for your Delaware home by utilizing our efficient tools and consulting our expert team.

Your Comprehensive Guide to Delaware Flood Insurance

Many leading insurance providers, such as Farmers, State Farm, Allstate, and Progressive, do not include natural flood coverage in their standard homeowner’s policies, leaving Delaware residents to seek specialized standalone flood insurance policies. Despite popular misconception, even residences in lower flood risk areas, classified as flood zone X, greatly benefit from having flood insurance in Delaware.

Recognizing the Real Risks

Did you know that 20% of all flood incidents in the U.S. occur in areas classified as having low flood risk? Recent events and data reveal that Delaware can experience significant rainfall leading to flooding, emphasizing the importance of being adequately covered.

Navigating the Complexities

With outdated flood zone maps and rapidly developing areas, determining the accurate flood risk for a property in Delaware can be challenging. However, relying on our extensive knowledge and proficiency, we guide you through understanding your true flood risk and ensuring you are not left unprotected when it matters most.

Secure Your Future with Delaware Flood Insurance

Securing flood insurance is a wise choice to safeguard your financial future. Many residents, unfortunately, depend on government aid, which often proves to be insufficient and conditional. To avoid such pitfalls and ensure your tranquility, entrust your Delaware flood insurance needs to our expert team, and explore comprehensive and reliable insurance options tailored to your needs.

Connect with Our Experts Today!

Uncover the savings and fortify your Delaware home against potential flood damages by obtaining a personalized flood insurance quote from our experienced and trusted Flood Nerds today!

Navigating Flood Coverage in Delaware Homeowner Insurance

In Delaware, securing your home against natural disasters is crucial, but it’s important to note that many mainstream insurance providers, including Farmers, State Farm, Allstate, and Progressive, typically do not cover natural flooding in their standard homeowner’s policies. This necessitates exploring specialized stand-alone Delaware flood insurance policies to ensure comprehensive protection.

While it is possible to inquire about adding an endorsement to your existing homeowner’s policy to include flood coverage, it’s often the case that this request is declined, leaving many homeowners seeking alternative solutions to secure their homes adequately against the risks of flooding.

Do I need flood insurance in Delaware?

Flood insurance is a crucial shield against damage in the beloved state of Delaware, which has seen its fair share of flooding, with more in store. Though many property owners may consider flood insurance at some point, such as before buying a home or during the closing, the thought often gets skipped until a looming storm or news of flooding nearby spurs them into action. Many who live in a ‘lower flood risk’ rating zone (flood zone X) wrongly choose to forgo insurance, which is an ill-advised move. Some realtors and insurance agents even reinforce this position.

Think about this: Did you know that in our country, 20% of flooding incidents happen to areas classified as low flood risk? The aftermath of Hurricane Harvey revealed this undesired reality. Sadly, 80% of individuals with no flood coverage were affected by damages to their homes or workplaces.

Nearly 135,000 houses in Harris County were damaged due to flooding, with 75% of them belonging to low to moderate risk category. In case of this calamity, people often depend on the government for aid but there are certain conditions that must be fulfilled to receive assistance. Firstly, the president of the United States must declare the flooding event as a state of emergency, otherwise, there won’t be any aid. Secondly, homeowners who do not have flood coverage receive an average of $5,000 in assistance. However, this amount is far lesser than the average cost of damage, which exceeds $58,000, and the money given by the government is actually a loan that you will eventually have to pay back. Therefore, it is wise to opt for flood insurance coverage to avoid jeopardizing your financial future.

One more note on these low-risk flood zone maps. Many of these maps are over 40-years old. If the area has been developed, then there is likely more concrete, creating a barrier for land that, previously, might have absorbed the massive downpour.

Because of all these factors, it is difficult for property owners to know their true risk of flooding. FEMA admits that their flood maps only give an idea of part of the risk. Our recent storms are facts that it can rain anywhere within Delaware, and you should consider getting flood coverage so you are not uninsured when you need it most.

Delaware flood zone map

FEMA flood zone maps often take years to go into effect after the terrain was studied, this gives the impression that the area is “more up to date” than it really is.

Delaware flood insurance rate map

The average cost for Delaware flood insurance in these Low-risk areas is $595 per year.

FEMA’s National Flood Insurance Program (NFIP) and all federally backed lenders rely on these Delaware flood insurance maps to assess risk, set premiums, and determine who is required to purchase flood insurance. Bad information about an areas flood risk can leave property owners under or uninsured.

Delaware NFIP flood insurance.

Delaware has a good selection of flood insurance options that can generally be divided into two major categories. The first one is the government option, which is the National Flood Insurance Program (NFIP) or FEMA. This plan has been in control of the market for fifty long years. The second category is offered by the private flood insurance market.

Not “private flood insurance” but NFIP Resellers

If your flood coverage is through Nationwide, State Farm flood insurance, or Progressive, or features any of the logos below, it means you purchased the government-managed NFIP flood policy being sold by private insurers. When it comes to flood insurance, these companies may be privately held, but their policies are not. Below is a list of 70 companies that resell the NFIP policy.

Delaware private flood insurance market

There are alternatives to the National Flood Insurance Program or government-based coverage. Private flood insurance, such as Lloyd’s of London Flood Insurance, is a reputable alternative. Additionally, other alternatives are available in Delaware. We peruse many options for your property within the region to ensure you receive adequate, cheap flood insurance. To let us do the work for you, click the linked word here.

We usually include the NFIP in our shopping because of government subsidies, you can sometimes get a better premium.

get a flood insurance quote

Lloyd’s of London Flood Insurance Delaware Market

Delaware is fortunate to have access to a range of Lloyd’s of London flood insurance options. While some Lloyd’s flood insurance providers may mislead you into thinking there is only one Lloyd’s choice, let me assure you that there are many available.

Lloyd’s of London boasts a rich history and pioneered the first modern insurance model. Unlike its competitors, Lloyd’s isn’t strictly a company, but rather a long-standing corporate body. This structure has functioned flawlessly for over three centuries by distributing the risk among multiple financial backers who pool their capital.

If you’re interested in diving deeper into Lloyd’s of London and why they’re crucial to Delaware’s flood insurance market, I’ve included two blog posts below.

Lloyd’s of London Flood Insurance

FEMA vs Private Flood Insurance

Lloyds provides flood insurance coverage to countries worldwide, including India, Australia, and much of Europe, as part of its strategy of risk diversification. The aim of insurance, after all, is to spread risk as far and wide as possible.

My joke goes that Lloyds is banking on God’s promise not to flood the world again, so they need not pay out the entire world’s flood claims.

How much does flood insurance cost in Delaware?

Getting a quote for flood insurance in Delaware is influenced by many factors. The government has offered a heavily subsidized policy if your house is situated in a low-to-moderate risk area. This policy provides coverage based upon predetermined limits and is called the Preferred Risk Policy (PRP) now retired but still around. If your house is in an X-flood zone, which the lender does not require, the PRP policy is highly recommended if you can get it.

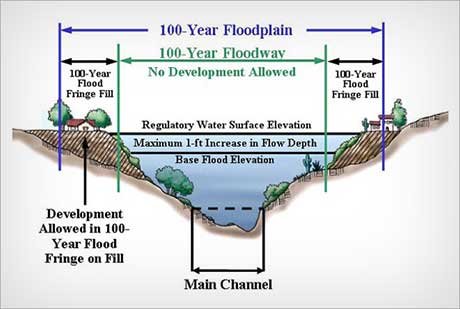

DELAWARE flood Zone AE

Is your home in a flood zone AE?

Don’t worry- we’ve got you covered. At Better Flood Insurance, our team of flood nerds focuses on helping homeowners understand the complexities of being in a flood zone AE and how best to protect themselves against flooding costs. We start by providing clarity into what an AE zone means for you and help you determine if it’s been affecting your premiums unfairly.

Our mission is to give people control over their flood insurance premiums so they don’t have to pay more than necessary or be tricked into buying expensive coverage options. With our help, we can provide simple solutions to the confusion surrounding AE zones, and better we shoop for your protection to get you good flood insurance at a lower rate than traditional local agents near you can offer.

Let a flood nerd shop your home today and take control of your flood insurance premiums!

Our example is in Sussex, but the premiums will be the same if in Rehoboth Beach, Lewes, Dewey Beach, Freeport, New Castle, Bethany Beach, and many other Delaware flood ones.

In our example, the Base Flood Elevation (BFE is 44) and is a home that is built before 1973

NFIP option in Delaware Flood Zone AE

NFIP – Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

NFIP Annual premium in High-Risk flood zone is $ 5,582.60

This option is what we see if the property has had a flood loss before, and either doesn’t have an Elevation Certificate applied or the Elevation certificate showing that the lowest floor is 4 feet under the BFE for the area. You can use 10% of your coverage to cover other structures on your property

Delaware Private flood insurance – Lloyds of London Flood Insurance (option 1)

Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

Lloyds of London (option 1) Annual premium in High-Risk flood zone is $ 852.00

This option is great, and we are very happy when we can get this option. They can be a bit choosey about what risk they will accept and will not take anything that has had a flood loss. They do offer coverage for basements, about $2,000 for loss of use, $2,000 for other structures, but they can’t increase this coverage. They do not require an Elevation Certificate to rate.

Delaware Private flood insurance – Lloyds of London Flood Insurance (option 2)

Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

Lloyds of London (option 2) Annual premium in High-Risk flood zone is $631.52

This option is great, and we are very happy when we can get this option for our clients as well. They seem to be writing almost all risks; however, they do not write any property that is in a designated floodway or has the depth of -4 under the BFE. In our example, with our BFE being 44 feet, if the lowest floor is 40 feet, then they will not accept this risk. They will not take anything that has had a flood loss. They do offer limited coverage for basements and do not require an Elevation Certificate to rate, and as a percentage of coverage for loss of use. If you want coverage for other structures, then that will need to be added.

Private Flood insurance option (option 3) Not Lloyds

Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

Annual premium in High-Risk flood zone is $ 3,742.00

This option will take properties that have had one flood loss as long as it has been more than five years, and the payout was under $100,000 on the claim. Their coverage matches the NFIP. They will write practically all risks, don’t need an elevation certificate to rate, and are a bit lower in premium than the NFIP.

Private Flood insurance – Lloyds of London (option 4)

This option must be written on the Replacement Cost Value (RCV) of the building, otherwise there is a co-insurance penalty that kicks in. So, $250,000 might be a bit low in California, but to keep this going, let’s just use that for this option

Coverage of $250,000 (RCV) building coverage, No Contents and $5,000 deductible

Annual premium in High-Risk flood zone is 868.75 (great price).

This options rating system is all over the board. Sometimes we get a crazy great price, but other times the premium is way higher than the NFIP will consider taking a property that has had one flood loss before as long as it has been more than ten years and the payout was under $50,000 on the claim. Their preferred coverage is at replacement cost, which is a bit different from some of our other Lloyd’s flood options. We usually reserve this one if the property doesn’t fit into any of our options above. We can adjust coverages to control premium. As mentioned before, this underwriters’ rates are all over the board. It is worth shopping through to make sure we are getting you the best premium we can. They don’t need an elevation certificate to rate.

Private Flood insurance – Lloyds of London (option 5)

Coverage of $250,000 (RCV) building coverage, No Contents and $5,000 deductible.

Annual premium in High-Risk flood zone is $ 1,184.00

This option came out of the company that used to run the NFIP program, so the coverage almost exactly matches the NFIP coverage with two differences. They offer living expenses which will cover your cost, when you are displaced from your home during repairs (most Lloyds flood policies offer this). They also offer swimming pool clean out, which is kind of unique so if you have a pool ask for this coverage.

Private Flood insurance – Lloyds of London (option 6)

Coverage of $250,000 (RCV) building coverage. No Contents and $5,000 deductible.

Annual premium in High-Risk flood zone is $ 538.20

This options rating system is also all over the board. Sometimes we get a crazy low price; other times the premium is way higher than the NFIP. They will consider taking a property that has had one flood loss before as long as it has been more than ten years and the payout was under $25,000 on the claim. They have been rumored to give a low price the first year and then non renew following years or sometimes they jack the price way up so we will watch them. They have a slick system, and their underwriting is managed by a 3rd party, which also seems to be a glitch sometimes.

There are more options coming online every day, and we are working to be looking into every viable option.

Currently, Delaware has 26,786 NFIP policies in force to date with the total cost of $19,394,560. That would make the average flood rate for Delaware $724. Of course, some will pay more, and some will pay less.

Flood areas in Delaware

Click here to have us shop and save you money.

Hello, Delaware! Thanks for visiting our page for all your flood insurance needs.

Let’s start off with Bowers, Delaware, where the average flood rate is $928. The premiums here total $104,856 with 113 active flood policies.

Next up is Dover, Delaware where there are 146 flood policies in effect with $121,138 in premiums. This allows the average flood rate to be $830.

Let’s look at Kent, Delaware, where the average flood rate is just a little higher than Dover, at $831. The policies active number 606 with $503,481 in flood premiums.

Middletown Delaware flooding

Now, we’ll look at a group of areas that include Milford, Smyrna, and Middletown, Delaware, where the premiums total $177,905 with 169 flood policies in effect. The average flood rate for these areas is $1,053.

In Delaware City, Delaware, the average flood rate rises to $1,077. The premiums here total $160,409 with 149 active flood policies.

Elsmere, Delaware has 124 flood policies in effect with $218,048 in written premium. Elsmere has an average flood rate of $1,758.

The average flood rate drops to $1,037 in New Castle, Delaware. New Castle has 1,795 active flood policies with $1,861,178 in flood premiums.

$1,133 is the average flood rate for Newark, Delaware. Newark has $151,784 in written premium with 134 flood policies in effect.

931 policies are active in Wilmington, Delaware. The premiums here total $794,425 which allows the average flood rate to be $853.

Flooding in Bethany Beach Delaware

There are 1,995 flood policies active in Bethany Beach, Delaware. Bethany Beach has an average flood rate of $825 which includes $1,645,766 in premiums.

Let’s look at Dewey Beach, Delaware next. Dewey Beach has an average flood rate of $687. There are 1,171 active flood policies in Dewey Beach with $804,482 in premiums.

Now we’ll look at Fenwick Island, Delaware where the average flood rate rises to $1,096. The premiums here total $628,849 with 574 flood policies in effect.

In Greenwood and Henlopen Acres, Delaware, we find 136 active flood policies with $116,512 in written premium. These areas have an average flood rate of $857.

Lewes, Delaware has $1,021,744 in flood premiums with 1,107 flood policies in effect. Lewes has an average flood rate of $923.

The average flood rate is $966 in Millsboro, Milton, and Selbyville, Delaware. These areas have a combined premium total of $178,802 with 185 active flood policies.

The average flood rate drops to $368 in Millville, Delaware. Millville has 236 flood policies that are active with $86,786 in premiums.

406 policies are in effect in Ocean View, Delaware. Ocean View has $234,228 in flood premiums which allows the average flood rate to be $577.

The average flood rate rises to $609 in Rehoboth Beach, Delaware. The policies here number 1,103 with $671,186 in flood premiums.

When we look at Slaughter Beach, Delaware, the average flood rate rises to $2,054! Give us a call Slaughter Beach! The premiums here total $254,685 with 124 active flood policies.

$923 is the average flood rate for South Bethany, Delaware. South Bethany has $856,082 in written premium with 927 flood policies in effect.

Flood zone maps Sussex County Delaware

Finally, we’ll look at Sussex, Delaware, where there are 14,446 active flood policies. The premiums here total $8,609,497 which allows the average flood rate to be $596.

Thanks for checking out all the flood information on Delaware!!

How to save money on Flood Insurance in Delaware VE flood zones

All homes that are ocean facing are custom built so with this special consideration our Lloyds of London VE flood zone and other Private Flood Insurance options for oceanfront properties take this into consideration with variable coverage options as well as significant savings below is a case study for a property we were shopping just last week.

Our example was in the Bethany Beach, DE area and is in a VE flood zone map.

For the coverage of $250,000 with no contents and a $5,000 deductible the NFIP annual cost for flood insurance in a VE flood zone is $23,678.00. Ouch!

Since we are who we are and experts in Flood Insurance we will look at every property everyway possible to ensure that we are getting the best premium for our clients and WE often Do (smile wink)

We tried this same property on our Private flood options and were able to get the premium to under $2,500 and we have in some cases with similar properties gotten the annual premium to $600 this was a feather in our cap and made our clients very happy. Again all properties are unique in these VE flood zones but if we can find a private flood policy for you we guarantee it will be better then the NFIP option.

Let us help you save money today.

Flood Insurance Calculator in Delaware

For decades, the NFIP has over-charged 50 percent of its policyholders and under-charged the other 50 percent, while it has racked up $42 billion in taxpayer-funded losses, equating to more than half of every claim paid by the NFIP since 1978.

About 30 percent of NFIP claims payments go to the same 3 percent of insured “repetitive loss” structures year after year. When you do the math, this means that the other 97 percent of their flood-exposed constituents could have paid in less and still netted larger claims payouts if they had better access to private flood insurance. In fact, a recent white paper by Milliman found that 90 percent of homes in Sandy-struck Delaware and New Jersey would see reduced flood insurance rates through private insurers.

Flood Nerd Private Flood Insurance