Discover Instant CA Flood Insurance Deals!

Save big with our reliable flood insurance plans—fast quotes, faster coverage.

$2.3M+

Annual Premium Savings

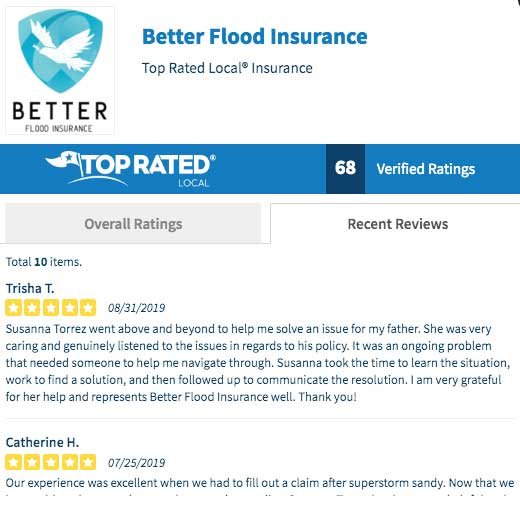

4.9★

Average Ratings

445+

Reviews

5,497+

Happy Clients

We Get It,

Buying Flood Insurance in California Is Confusing…

You might be asking:

• What coverage do I need?

• How much is flood insurance in California going to cost me?

• How much can I save?

It’s okay, your search for cost-effective CA flood insurance that doesn’t compromise on coverage ends here.

Meet The Flood Nerd™

Your CA Flood Expert, Friend, and Guardian

In 2015, Robert Murphy, inspired to help homeowners and businessowners alike, entered the insurance brokerage market with one goal in mind: To help uncertain California homeowners find affordable, high quality flood insurance that doesn’t compromise on coverage.

We Find You Great Coverage

While Saving You Up To $1,457+ A Year!

What you seek is:

Enhanced security for your California Property.

Significant savings.

Absolute freedom.

Unwavering certainty.

Memorable moments.

Quality family time.

Peaceful travels.

It's As Easy As 1, 2, 3!

1

Fill Out Our Online Form

Complete our easy quote form so we can understand your needs & personalize your rates.

2

Get An Instant Quote

Our team scours insurance companies nationwide to instantly present the best coverage & rate options for your needs.

3

Get Coverage

If you’re happy with the coverage options, you can sign up easily directly from our online portal.

Get Cheap Flood Insurance without Compromising Coverage

★★★★★

"Same Coverage at a Better Rate"

-Mohammed K

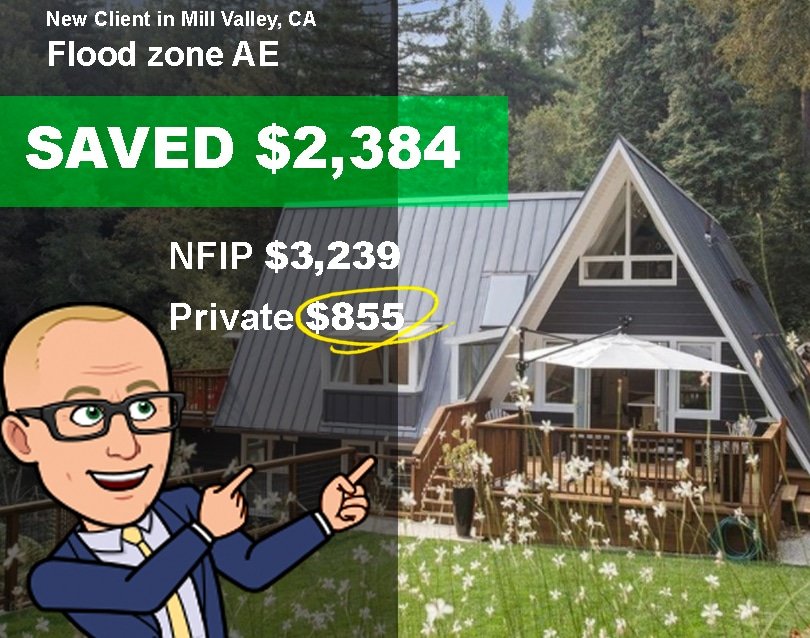

Flood Nerds will shop the private flood insurance markets and then compare them to the NFIP, guaranteeing you the better option. We will send you the cheapest flood insurance rates within minutes.

★★★★★

"Quick Response, Very Knowledgable"

– Robert W

Paying for low-cost flood insurance is awesome. And letting the Flood Nerds shop your property has other benefits – you can get better coverage while saving money, and you can get it fast.

★★★★★

"Would highly recommend Better Flood for your flood insurance needs."

– Varun K

Better Flood Insurance is an independent flood insurance broker that shops flood insurance ONLY. Flood Nerds are Flood insurance experts. We have 5000+ happy clients and 390+ 5-star reviews.

California Flood Insurance Quote

Here’s the 411 on California Flood Insurance from the people who know it best – the Flood Nerds

Flood Insurance Quote | Flood Insurance California

I’m Robert Murphy, the Head Flood Nerd at Better Flood. We Flood Nerds love to shop for flood insurance and save people money. If you’re tired of rising premiums or just need cheap flood insurance fast, let the Flood Nerds find you great coverage and a great price.

What are the flood insurance requirements in California?

In California, there is no statewide mandate for homeowners to carry flood insurance; however, the necessity to purchase such insurance can be influenced by the location of the home relative to flood zones and the conditions of the mortgage. Homes situated in Special Flood Hazard Areas (SFHA), as designated by FEMA, must have flood insurance if the mortgage is federally backed. For homes outside these high-risk areas, while not federally required, flood insurance may still be stipulated by the mortgage lender as a condition of the loan agreement.

Standard Homeowner’s Insurance Does NOT Cover Flooding

A typical California homeowner’s policy is written through Farmers, State Farm, Allstate, or Progressive. These policies protect your home from things like fires and theft. But what they don’t cover is damage from flooding.

Go ahead, ask your homeowner’s agent to add a flood endorsement to your policy, and watch them laugh.

But it’s not funny.

In most cases, the only way to get flood coverage is by purchasing a separate flood insurance policy. And unfortunately, most local insurance agents will just stick you in the National Flood Insurance Program (NFIP) – easy for them – expensive for you.

Flood Nerds are Flood Insurance Specialists. We look for and often find you great coverage and rate and the search is free.

What does NFIP flood insurance cover for a home in California?

Yuba County including Marysville and Wheatland have 3,445 National flood insurance program policies that pay a total of $1,759,063 to the federal program making the average policy $510. Consider This About the NFIP. The NFIP covers your home’s structure, including the essentials like electrical and plumbing systems. It also extends to built-in appliances such as refrigerators and dishwashers, personal belongings like clothing, furniture, and electronics, plus expensive valuables up to a cap of $2,500. Even detached garages and the costs of debris removal are included in the coverage. That’s comprehensive, right? But let’s dive deeper. The NFIP made flood insurance available to more than 20,000 communities in the United States. That’s great. However, California has a growing private flood insurance market, and private markets usually provide better premiums than the government. For decades, the NFIP over-charged 50% of its policyholders and under-charged the other 50%, all while racking up $42 billion in taxpayer-funded losses, equating to more than half of every claim paid by the NFIP since 1978. Think about that! If you overcharge half and undercharge half, no one pays the correct premium. Are you gambling that you are the undercharged half? About 30% of NFIP claims payments go to the same 3% of insured repetitive loss structures year after year. This means that the other 97% of flood-exposed policyholders could have paid less and still netted larger claims payouts if they had been in the private flood insurance. It doesn’t make sense to risk losing everything if you don’t have flood insurance. And it doesn’t make sense to overpay for flood insurance.

Do You Really Need Flood Insurance in California?

So, if flood insurance was necessary for California wouldn’t homeowner’s policies cover it?

Heck No!

The NFIP had a stranglehold on the flood insurance market for years. Too many people think if they aren’t in a high-risk flood zone they don’t need coverage. And they find out they’re wrong the hard way.

It doesn’t make sense to risk losing everything if you don’t have flood insurance. And it doesn’t make sense to overpay for flood insurance.’ In California, while the state government doesn’t mandate that every homeowner must purchase flood insurance, the situation changes based on where you live and the type of mortgage you have. Particularly, if your home is located in a Special Flood Hazard Area (SFHA) and you hold a federally backed mortgage, the government requires you to have flood insurance. Even if you are not in a SFHA, your mortgage lender might still require you to carry it. Therefore, understanding the specific requirements of your location and mortgage type can prevent you from either risking too much or overpaying.

“It never rains in California….it pours man it pours”

Albert Hammond 1972

That popular song from the 70’s is still true today. California sees more than its fair share of flooding. Especially in the southern areas.

Even if you are in a low risk area you are still at risk. That’s because 20% of all flooding events in the US every year happen in those “low risk” areas.

Maybe you thought about buying flood insurance when you bought your house but said “Naw – the lender doesn’t require it so I must not need it”. The real estate agent may have even told you it wasn’t necessary.

Or maybe you saw a big storm coming and thought about the risk of flooding. But then it was too late to buy a policy. You dodged the bullet that time. But what about the next?

Just because you are in a “low risk” area doesn’t mean you aren’t at risk.

The government has been collecting flood data for the last 50 years. This data shows that recent major storms resulted in flooding in these low-risk areas. And 90% of people who had flood water in their homes after these flooding storms didn’t have flood insurance.

Don’t buy the lie about low risk – buy flood insurance!

Do I need flood insurance in California?

In California, standard homeowner’s insurance policies do not cover damage resulting from external flooding. Consequently, for those residing in areas prone to flooding as designated by FEMA’s mapping, it is advisable to secure flood insurance. This coverage becomes essential to safeguard both your residence and personal possessions against the effects of flood waters. While state law does not mandate the possession of flood insurance, lenders might require it for homes situated in recognized high-risk flood zones.

How can someone buy flood insurance in California?

Purchasing flood insurance in California involves several steps. First, you need to consider where to buy the insurance. While many opt for the National Flood Insurance Program (NFIP) managed by FEMA, others turn to private insurance companies which might provide more flexible options. Here’s what typically influences the cost of your flood insurance policy:

1. Location of your residence: Areas at a higher risk of flooding will generally have higher insurance premiums.

2. Characteristics of your home: This includes the age, construction materials, size, and the overall build quality of your home.

3. Elevation of your home: Houses located at lower elevations may face higher flood risks and, consequently, higher insurance rates.

4. Deductible amount: Opting for a higher deductible can lower your premium costs but means paying more out of pocket before insurance kicks in during a flood event.

5. Coverage amount: The extent of coverage you choose will also affect your premium. More comprehensive coverage usually results in higher costs.

Your premium rates are affected by these criteria, which are evaluated by the insurance provider to determine your policy costs. For exact quotes and to purchase a policy, contact insurance agents specializing in flood coverage, or visit websites dedicated to insurance sales for detailed guidance and to compare various options.

What does flood insurance cover in California?

In California, flood insurance is designed to mitigate the financial impact of damage due to events such as coastal surges, river overflows, or sudden snowmelt in areas like the Sierra Nevada. It covers costs related to damage to both the physical structure of insured homes and the personal belongings within them. Specifically, there are two primary types of coverages available through the National Flood Insurance Program (NFIP):

1. Building Coverage: This part of the policy takes care of expenses to either repair or completely rebuild a home or attached structures, like a garage, if they are affected by floodwaters. The policy caps the reimbursement for building repairs or rebuilding at $250,000.

2. Contents Coverage: This coverage is for repairing or replacing personal items such as clothes, electronics, and furniture that are damaged by flooding. The maximum coverage for personal property claims is set at $100,000.

Both types of coverages have individual deductibles, meaning the homeowner must pay a predetermined out-of-pocket amount before insurance payments kick in. Opting for a higher deductible can decrease the cost of the premium, but it also means receiving less money from a claim when damages occur.

What are the flood insurance rates by flood zone in California?

In California, the cost of flood insurance is influenced by the flood zone designation assigned by FEMA, which reflects the property’s flood risk. Properties within the A or V zones, identified to have at least a 1% annual chance of flooding or are within a 100-year flood plain, face the highest risks and consequently higher insurance premiums. The average annual flood insurance rate for these high-risk zones is approximately $1,161. For properties in zones B, C, or X, where the flood risk is deemed moderate to low, the average premium is lower, about $622 annually. In areas where the risk level is undetermined, labeled as zone D, the average yearly rate is still relatively high, at $1,121. These figures are derived from analyses of data from the National Flood Insurance Program (NFIP).

What are the 10 most expensive cities in California for flood insurance?

The 10 cities in California that have the highest average flood insurance premiums, as determined through recent data analysis, are as follows: Malibu ranks the most expensive with an average annual premium of $3,533. It is followed by San Rafael at $1,833; Garden Grove closely behind at $1,806; then Santa Ana at $1,473; San Mateo at $1,426; Menlo Park at $1,412; Watsonville at $1,389; Napa at $1,374; Long Beach at $1,329; and Palo Alto rounding out the list at $1,261 annually.

What are the 10 cheapest cities in California for flood insurance?

Based on a detailed analysis of the 50 cities in California with the most National Flood Insurance Program (NFIP) policyholders, the following cities have been identified as having the lowest average annual flood insurance premiums: 1. Elk Grove – $458 2. Sacramento – $461 3. West Sacramento – $472 4. Yuba City – $526 5. Alameda – $540 6. Marysville – $541 7. Merced – $550 8. Santa Paula – $576 9. Arvin – $584 10. Stockton – $638 These figures represent the average cost of flood insurance in each city, highlighting those with the most affordable rates in the state.

What Happens If it Floods and You Don’t Have Insurance?

If your home is damaged by rising water and you don’t have flood insurance you are responsible for paying to repair the damage.

Flooding is one of the most expensive causes of damage to repair. It can cost $40,000 to $90,000 and that’s not even considering the damage to the contents of your home.

Right now you are saying “Yeah, but if you are such a Flood Nerd you know the government will step in and help”.

Ha!

Don’t get caught buying this lie.

“The nine most terrifying words in the English language are:

I’m from the Government, and I’m here to help.”

Ronald Regan, former California Governor and President of the US

In order for you to get that government “assistance” the planets and stars must align thusly:

√ The Governor of the state must request a federal declaration of disaster.

√ The President must declare the area a disaster area to make federal assistance available.

√ You must apply for that assistance.

√ Assistance will be in the form of a loan you MUST payback.

√ That glorious assistance will be about $5,000.

Yup

You get a loan of about $5,000 to cover that average of $40,000 to $90,000 in damage.

Now you understand why so many properties are abandoned or foreclosed after having flood damage?

Flooding is the number one natural disaster in the United States ~ If you don’t have flood insurance you face financial ruin.

So while federal assistance is still a vital part of disaster recovery, it is better to have flood insurance rather than relying on government bailout.

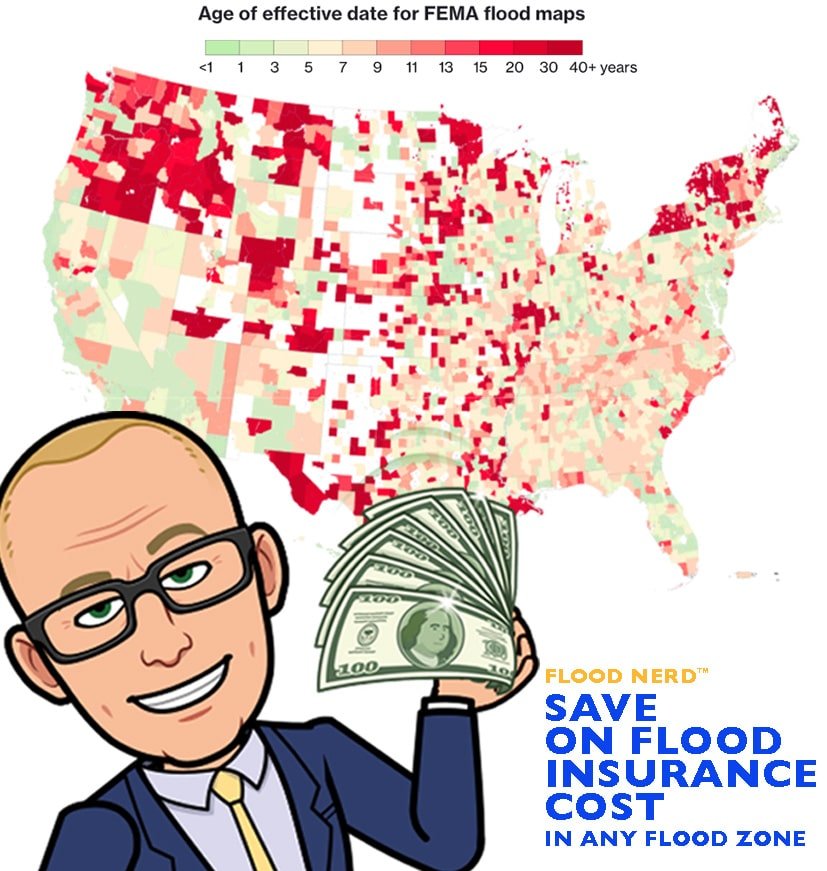

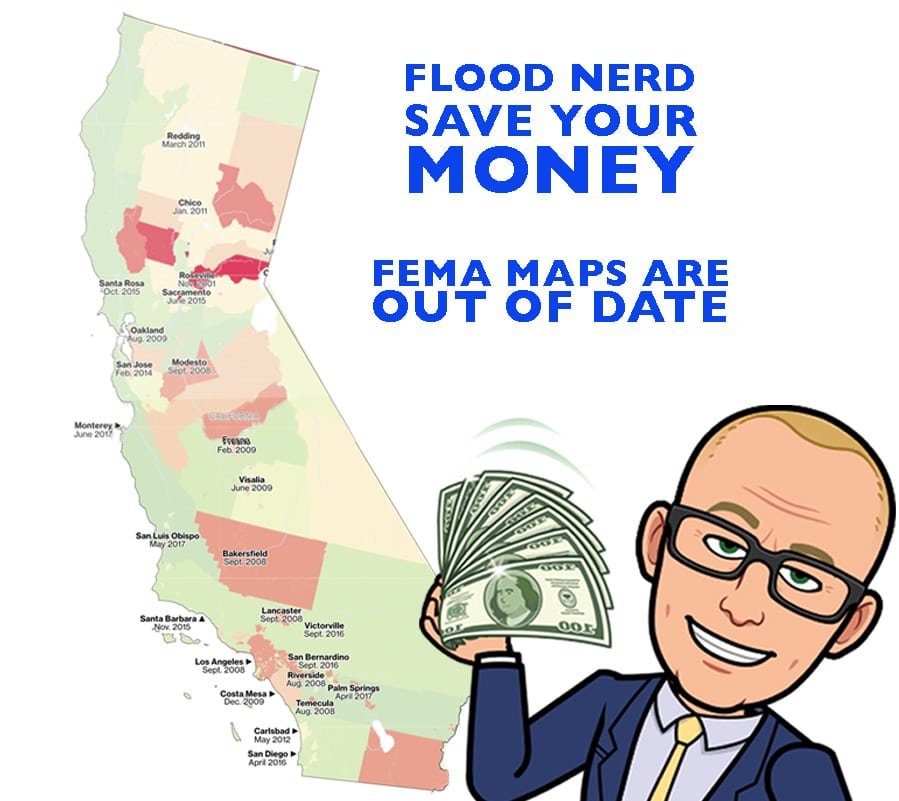

Flood Maps in California

The original federal maps that cover California flood zones were created in the ’70s. Technology has advanced since then, but that doesn’t mean all the maps have been updated. And those maps are important. The NFIP and all federally backed lenders rely on these maps to assess risk, set premiums, and determine who is required to purchase flood insurance.

Bad maps leave property owners under or uninsured.

And California has many bad maps. Out of date maps cause problems. If the area has been developed, then there is likely more concrete creating a barrier for land that previously could have absorbed a massive downpour.

And California has been growing. Since 1970 California’s population grew from 19.9 million to 39.5 million. Those people need places to live and work and that means development. So if your home was built after the 1970’s and has an outdated flood map that doesn’t reflect recent development you are probably at risk for flooding and don’t even know it.

Even FEMA admits that the flood maps only partially reflect the real risk. Recent storms are proof it can rain anywhere in California’s borders.

Flood coverage gives you peace of mind and flood insurance rates in California aren’t as bad as you think. The average cost for California flood insurance in low risk areas is $850 per year.

No matter what the map says, it’s better to have coverage and not need it than to not have coverage and wish you did.

Flood Insurance Options in California

Most homeowners, real estate agents, and lenders don’t realize you have options when it comes to California flood insurance. But the Flood Nerds know all about getting cheap flood insurance in California. We know more than 5 Ways to Save on Flood Insurance. There are basically two markets for flood insurance in California.

NFIP

The National Flood Insurance Program is run by the Federal Emergency Management Administration and they are the government option for flood insurance. They’ve basically had a 50-year monopoly on the market and the premiums reflect their dominance.

Within the NFIP you find re-sellers. These are companies that sell you a policy under their company name, but basically it’s just an NFIP policy with an insurance company logo on it. If you have Nationwide flood insurance, State Farm flood insurance, Progressive flood insurance or a policy by any other re-seller you just have NFIP insurance under a private skin. That’s NOT the way to save money on flood insurance in California. Think you might have flood insurance through a re-seller? Check out this list of companies that resell the NFIP policy.

Private flood insurance market

California isn’t stuck with the NFIP. There is a robust private flood insurance market and you can even tap into the Lloyd’s of London flood insurance syndicate for California flood insurance. Sometimes you can get real good rates with Lloyds because they spread the risk all over the world and the risk of the entire planet flooding at once is very small. We Flood Nerds like to say “God said he wouldn’t flood the world again and Lloyds of London takes him at his word”. Now you know what makes a Flood Nerd laugh.

But getting the right flood insurance is no laughing matter. There’s so many options and it’s easy to confuse the private flood insurance market with those NFIP re-sellers. That’s why you need to hire a Flood Nerd to get cheap flood insurance in California.

We shop many of the options for your property in your region of California and ensure you get the great premium. We’ll even check out the NFIP to make sure that all the bases are covered.

The Cost of Flood Insurance in California

One major factor in the cost of flood insurance for California is the property location and the company you choose to write the coverage. Premiums for homes in low-to-moderate risk are lower and premiums in high risk areas are higher.

Flood Zone X – California Low-to Moderate Risk Zone

Lenders don’t require flood insurance in this zone. But remember, floods happen in low risk zones, and the map may be old.

For properties in the X Flood Zone we usually suggest the government Preferred Risk Policy (PRP). The government subsidizes a portion of the premium and limits the coverage, so this keeps the rates low. The average cost for PRP flood insurance in California with the maximum set limits in low risk flood zone areas is $700 – $900 per year.

Flood Zone AE in California

A higher risk flood zone is Flood Zone AE. If your property is in Zone AE, your lender will require you to have flood insurance.

The cost of flood insurance in California in this zone really depends on factors that are unique to the structure.

As an example, let’s look at a house built on a slab on grade foundation. The Base Flood Elevation (BFE) is 136.6 and the home was built in 1974. The policy is for flood coverage at the NFIP maximum of $250,000 for the building only. It doesn’t include contents and the deductible is our recommended amount of $5,000.

Our example is a house in Los Angeles but the premiums will be the same as in Alameda, Arvin, Novato, San Rafael, Merced, Garden Grove, Huntington Beach, Newport Beach, Santa Ana, Elk Grove, Sacramento, San Bernardino, Ocean Side, San Diego, Stockton, San Mateo, Santa Barbara, Milpitas, Palo Alto, San Jose, Santa Cruz, Vacaville, Yuba City, Visalia, Santa Paula, Simi Valley and most other California cities and counties in AE flood zones.

The NFIP option in California Flood Zone AE is $3,465.00

This would be the price if the property had a previous flood loss and either doesn’t have an Elevation Certificate or the Elevation Certificate shows the lowest floor is 4 feet under the BFE. This policy lets you use 10% of your coverage to cover other structures on your property

Now, let’s look at the California private flood insurance market and compare the options. The coverage and deductible are exactly the same.

The California Lloyds of London policy would be $1,047.09

This option is great but they won’t cover a property with a prior flood loss. But they will cover more than the NFIP in the basement and about $2,000 for loss of use. $2,000 for other structures doesn’t increase this coverage. They don’t require an Elevation Certificate.

California private flood insurance (Not Lloyds) is $1,196.54.

This option will take properties with one prior flood loss if it was more than 5 years ago and the claim was under $100,000. They will write practically all risks, and you don’t need an elevation certificate.

Replacement Cost Value Coverage

Standard flood insurance provides coverage for a set amount. But with flood insurance from the private marketplace, you can insure for the actual cost to replace the home. These policies must be written for the actual replacement cost. With the $250,000 example we are using, that’s probably a little low. But to keep the comparison the same we’ll stick with $250,000.

So for $250,000 RCV building coverage, 20% contents coverage, 10% other structures, and 10% loss of use with a $5,000 deductible the annual premium for RCV coverage is $5,184.00

Flood Zone V and VE in California

NFIP insurance for homes in the V and VE flood zones is extremely expensive. Once I saw a premium of $30,000 a year for a single home family. This is ridiculous!!

To save you money, the Flood Nerds shop flood insurance for your V or VE flood zones properties on the private flood market underwritten by Lloyds of London.

We see savings in the thousands with this approach AND we have been able to double and triple coverage for California’s oceanfront properties.

The problem with the NFIP approach is they take a one-size-fits-all approach to coverage. The results are premiums far too high for waterfront houses.

Coastal California homes are all custom built. The NFIP doesn’t take this into consideration but Lloyds of London’s other private flood insurers do. They offer variable coverage options as well as significant savings.

For example, a home in Rio Del Mar California, in a VE flood zone map needs $250,000 of coverage, with no contents coverage and a $5,000 deductible.

The NFIP annual cost for flood insurance in a VE flood zone is $4,802.

Ouch!

The same coverage for the same property on the private market is under $878.

Average Flood Insurance Costs in California by Area

Flood Insurance in Southern California?

Arvin & Bakersfield CA | Kern County CA | Flood insurance Long Beach CA | Los Angeles flood zones | Malibu & Manhattan Beach CA |

Santa Clarita & Santa Monica CA | Flood insurance Anaheim CA | Fountain Valley CA | Garden Grove CA | Flood Insurance Huntington Beach CA |

Laguna Beach CA | Newport Beach CA | Santa Ana CA | Westminister & Yorba Linda CA | Indio & La Quinta CA |

Riverside CA | Redlands CA | Twentynine Palms CA | Oceanside CA | San Diego CA |

Carpinteria & Goleta CA | Santa Barbara CA | Camarillo, CA | Oxnard CA | Thousand Oaks CA |

San Buenaventura CA | Santa Paula & Simi Valley CA | Fillmore, CA | Moorpark & Ojai, CA | San Bernardino CA |

Flood Insurance in Northern California?

Alameda CA | Fremont & Hayward CA | Oakland CA | San Leandro & Union City CA | Flood insurance Chico ca |

Concord CA | Contra Costa County CA | Martinez & Pleasant Hill CA | San Pablo & Walnut CA | Fresno CA |

Humboldt County CA | Lake County & Lakeport CA | Madera County CA | Belvedere & Fairfax CA | Corte Madera CA |

Marin County & Mill Valley CA | Navato CA | San Rafael & San Anselmo CA | Monterey CA | Merced CA |

Napa CA | Placer County CA | Rocklin & Roseville CA | Elk Grove & Folsom CA | Sacramento CA |

San Joaquin County CA | Lathrop, Lodi, Manteca CA | Stockton CA | San Luis Obispo CA | East Palo Alto & Foster City CA |

Menlo Park CA | San Mateo CA | Milpitas CA | Palo Alto & San Jose CA | Santa Clara CA |

Sunnyvale CA | Santa Cruz CA | Watsonville CA | Redding CA | Siskiyou CA |

Benicia, Fairfield & Solano CA | Suisun, Vacaville & Vallejo CA | Healdsburg & Petaluma CA | Sonoma CA | Stanislaus County CA |

Sutter County CA | Tehama & Red Bluff CA | Tulare County CA | Yolo County, Sacramento CA | Yuba County CA |