Instant Flood Insurance for Flood Zone AE at Great Rates

Save big with our reliable flood insurance plans—fast quotes, faster coverage.

$2.3M+

Annual Premium Savings

4.9★

Average Ratings

445+

Reviews

5,497+

Happy Clients

How to Save Money on Flood Insurance in Flood Zone AE.

We Get It,

Buying Flood Insurance in Flood Zone AE Is Confusing…

You might be asking:

• What coverage do I need?

• How much is flood insurance in flood zone AE going to cost me?

• How much can I save?

It’s okay, your search for cost-effective AE flood insurance that doesn’t compromise on coverage ends here.

Meet The Flood Nerd™

Your Flood Zone AE Expert, Friend, and Guardian

In 2015, Robert Murphy, inspired to help homeowners and businessowners alike, entered the insurance brokerage market with one goal in mind: To help uncertain homeowners find affordable, high quality flood insurance that doesn’t compromise on coverage.

We Find You Great Coverage

While Saving You Up To $1,457+ A Year!

What you seek is:

Enhanced security for your Flood Zone AE Property.

Significant savings.

Absolute freedom.

Unwavering certainty.

Memorable moments.

Quality family time.

Peaceful travels.

It's As Easy As 1, 2, 3!

1

Fill Out Our Online Form

Complete our easy quote form so we can understand your needs & personalize your rates.

2

Get An Instant Quote

Our team scours insurance companies nationwide to instantly present the best coverage & rate options for your needs.

3

Get Coverage

If you’re happy with the coverage options, you can sign up easily directly from our online portal.

AE flood Zone Flood Insurance Expert

As a recognized expert in Flood Zone AE insurance, I, Robert Murphy, alongside my team of Flood Nerds at Better Flood Insurance, specialize in finding cost-effective flood insurance solutions. Our expertise extends to understanding the intricacies of Flood Zone AE and helping you reduce your premiums. If you’re seeking information on what Flood Zone AE means, its impact on insurance costs, or ways to save on flood insurance, you’ve come to the right place. At Better Flood Insurance, we have the answers and insights to guide you through the complexities of flood insurance in Flood Zone AE, ensuring you’re well-informed and financially protected.

In this page we will explore key topics related to flood zone AE.

- Understanding the Meaning of Flood Zone AE

- Flood Insurance Costs in Zone AE: What to Expect

- Choosing Between Private Flood Insurance and FEMA Policies in AE Zones

- Building a Home in Flood Zone AE: Considerations and Tips

- Analyzing the Risks: Is Flood Zone AE a Cause for Concern?

- Key Factors Influencing Flood Insurance Costs in Zone AE

- Buying a Home in High-Risk Flood Zone AE: What You Need to Know

- How to Determine if Your Home is in Flood Zone AE

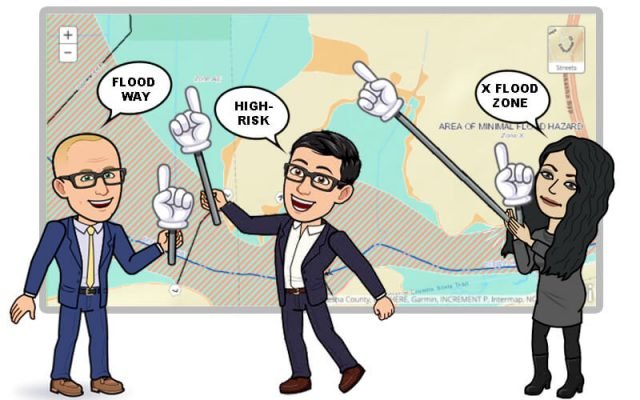

What is flood zone AE?

Splash into the World of Flood Zone AE – Where Being Prepared is Cooler Than Being Soaked!

Welcome to Flood Zone AE, the splashy neighborhood on FEMA’s floodplain maps! If your property is chillin’ in this zone, it’s tagged as a higher-risk area for floods. But hey, don’t get your flippers in a twist just yet! Being in Zone AE isn’t a guarantee of an indoor pool party courtesy of Mother Nature. In fact, there are some pretty nifty perks to living here.

What is flood zone AE exactly? It’s tagged as a higher-risk area for floods.

First off, your area is on the map – like, literally. This means Uncle Sam’s got your back with flood mitigation efforts. Think of it as an army of levees, flood walls, and barrier islands flexing their muscles to keep you dry. These big guns work hard to divert water away from your hood during epic downpours.

Now, let’s talk about those “low risk” zones, the X Marks the Not-So-Spot areas. They’re like the underdogs of flood zones, often getting soggy feet when the skies decide to unload. But here’s the cool part for you AE-ers: if you’ve got a mortgage, you’re required to have flood insurance. It’s like having an umbrella that covers not just you, but your entire financial future from rain checks. Think of flood insurance as your financial lifeguard, ready to save you from drowning in debt if the waters decide to waltz in.

For the folks in the lower risk zones, not having flood insurance can be like riding a bike without a helmet – risky business! So give yourself a pat on the back, because being in Flood Zone AE means you’re ahead in the flood game.

AE flood zone meaning

Dive a bit deeper, and you’ll find that AE zones have something called a Base Flood Elevation (BFE) – a fancy term for how high the waters could rise. It’s like having the flood version of a weather forecast. Meanwhile, those in the plain A zone are left playing the guessing game.

Adjacent to our splashy AE zone, you’ll find other flood zones like:

- Flood Zone X (the low-key, moderate risk zones, also known as X-500, C, or B).

- Flood Zone AE (that’s us, the cool cats required to have flood insurance by law).

- Flood Zone VE (the beachfront properties with high risks, where waves do more than just lap at your doorstep).

Feeling a bit waterlogged with all this info? Don’t worry, our flood zone chart is like a life raft in a sea of terms!

Remember, being in Flood Zone AE is like having a backstage pass to flood preparedness – it’s better to be in the know than underwater!

Unpacking Flood Zone AE: Serious Soaker or Minor Puddle?

Is flood zone AE bad?

Understanding the AE flood zone meaning involves looking at the intricacies of risk and regulations in these high-risk zones.

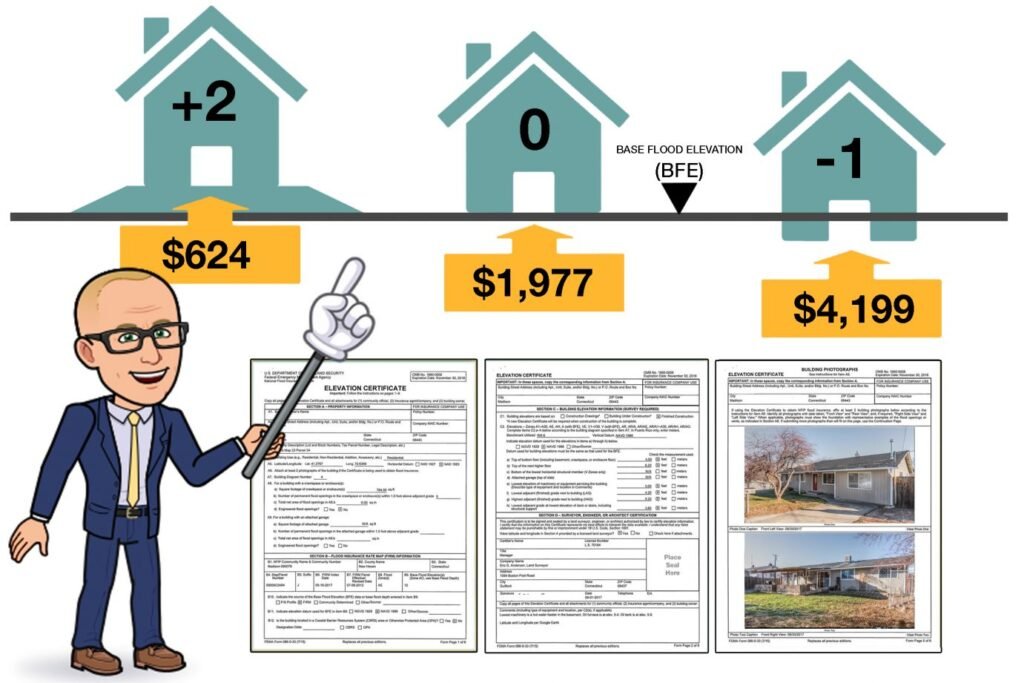

BFE Decoded: Your Premium’s Best Friend (or Foe)

Dive into the world of Base Flood Elevation (BFE) and discover its superhero-like role in the flood insurance saga. Picture BFE as the yardstick measuring flood waters: properties above it bask in lower premiums thanks to their “safe zone” status, while those below might feel the pinch in their wallets. It’s not just about height; factors like age and foundation type also step into this insurance tango.

AE Zone Roulette: Playing the Flood Insurance Game

Step into Flood Zone AE, the land of “might flood, might not.” It’s a bit of a gamble – being in a high-risk area means potentially higher premiums, especially if you’re near water or in historically soggy spots. But remember, elevation and smart building features can be your lucky charms, helping you score lower rates.

Building Smarter, Paying Less: The Construction Cheat Sheet

Unlock the secrets of savvy building to keep your premiums in check. Whether it’s choosing sturdy masonry over whimsical wood frames or elevating your foundation to new heights, every detail counts. Don’t forget flood mitigation tricks like barriers and sump pumps – they’re like your insurance cost kryptonite!

Aging Gracefully: How Your Property’s Vintage Affects Your Wallet

Time travel through your property’s history and see how its age and condition play a lead role in your insurance story. Older properties might carry the weight of higher premiums, but modern, code-compliant constructions can enjoy the perks of lower rates. It’s a tale of risk, resilience, and renovation!

Balancing Act: Juggling Coverage Limits and Deductibles

Enter the balancing world of coverage limits and deductibles. It’s a high-wire act where higher deductibles can mean lower premiums – but beware, it’s a riskier path with more out-of-pocket expenses during crunch time. On the flip side, lower deductibles can ease your mind but might weigh heavier on your budget.

The Ghosts of Floods Past: How Claims History Haunts Your Premiums

Uncover how the echoes of past claims can haunt your current premiums. Properties with a history of waving the flood flag might find themselves paying more for the fear of future watery woes. It’s a reminder that sometimes, history does repeat itself, at least in the insurance world.

Water, Water Everywhere: Location’s Role in Your Insurance Tale

Navigate the waters of location-based risks. Proximity to rivers or coastlines can crank up your premiums, while local topography and drainage systems play their parts in this aquatic drama. It’s a story of risk, environment, and how nature’s whims can dictate your insurance fate.

Community Chronicles: The Power of Local Flood Management

Zoom out to the bigger picture where community flood management efforts shape individual insurance stories. Adhering to FEMA’s guidelines and implementing local mitigation strategies can be a game-changer, potentially offering sweet discounts and safer dwellings in the flood narrative.

Climate Change Plot Twist: Adapting to a Watery Future

Brace for the plot twist brought by climate change – a character that’s reshaping flood risk assessments and insurance costs. As weather patterns get more dramatic, the flood risk script gets a rewrite, with premiums adapting to this ever-changing climatic drama.

Legal Labyrinths: Navigating the Maze of Insurance Regulations

Finally, delve into the intricate world of insurance laws and regulations. Like a complex puzzle, changes in FEMA policies and state-specific rules can lead to shifts in premiums, painting a dynamic, ever-evolving picture of flood insurance costs.

Understanding Flood Zone AE: A Homeowner’s Guide to Risk and Protection”

Welcome to the intriguing world of Flood Zone AE. It’s a place where homeowners can often find themselves navigating a mix of natural beauty and potential water woes. Here’s a quick tour through what makes Flood Zone AE unique, and why being informed is your best strategy.

The Home Insurance and Flood Saga:

- The Great Divide: Think of your standard home insurance as a trusty umbrella. It’s great for a bit of rain (like fire or theft) but when it comes to the floodwaters of Zone AE, it politely steps aside. Historically, insurers waved goodbye to flood coverage due to its costly nature, leaving homeowners to look elsewhere.

- NFIP to the Rescue: Recognizing the gap, the government introduced the National Flood Insurance Program (NFIP) in the late 1960s, specifically to address the flood risk. It’s like a specialized lifeboat, designed for those choppy flood waters.

Why Floods Demand Attention:

- The Frequent Visitor: Flooding isn’t just a rare event; it’s actually the most common natural disaster in the U.S. The stats speak volumes – nearly every county has seen flood events.

- High Costs of a Wet Visit: A little water goes a long way. Just an inch of flooding can lead to significant expenses, often outstripping the costs associated with other home insurance claims.

The Surprising Reality:

- A Common Oversight: Despite the prevalence of floods, many homeowners overlook the need for specific flood insurance. It’s a bit like having a safety net that’s missing a few crucial strings.

- Comparing Risks: Interestingly, your home is more likely to have a close encounter with a flood than a fire during the lifespan of a 30-year mortgage. It’s a statistic that often takes homeowners by surprise.

Knowledge is Your Best Tool:

- Flood Zone AE is designated by FEMA as a high-risk area prone to flooding. While called the “100-year floodplain,” this term is misleading – it does not mean the area will only flood once every 100 years. Rather, it indicates there is a 1% chance of a flood occurring any given year.

This 1% annual risk may seem low, but over a 30-year mortgage, homeowners in Flood Zone AE face a surprisingly high 26% chance of experiencing a flood at least once. Many are caught off guard by this compounding risk over time.

While your home insurance provides a blanket of security for many scenarios, it leaves a gap where floods are concerned, especially in a zone like AE. It’s important to be aware of this, not as a cause for alarm, but as an opportunity for better preparation. Flood Insurance: An Informed Choice: In the context of Flood Zone AE, knowing about and considering flood insurance isn’t just about buying another policy; it’s about understanding your environment and making informed decisions to protect your home and financial stability.

Rather than the impractical and extremely costly approach of elevating structures, which should only be considered if flooding occurs frequently, the better strategy is maximizing your flood insurance coverage to the highest affordable level. Private flood insurance can provide robust protection at reasonable rates, especially when working with experts like the Flood Nerds who shop the market for the best value policies.

Counterintuitively, being in a higher-risk Flood Zone AE could actually be an advantage. Federal law requires flood insurance for any government-backed mortgage in these zones. This leads local governments to implement large-scale mitigation efforts like levees and drainage systems that have proven highly effective at reducing flood risks. Ironically, many lower-risk “Flood Zone X” areas lack such protective measures, and property owners often forgo coverage, leaving them dangerously exposed when floods inevitably occur.

So while the “high-risk” AE designation may seem concerning, it ensures community protection efforts and mandates the financial safety net of flood insurance that owners in lower-risk zones frequently neglect at their own peril. In summary, while Flood Zone AE brings its own set of challenges, being informed and aware can turn a potentially stressful situation into a manageable one. It’s all about understanding the landscape, knowing the risks, and making choices that fit your unique situation as a homeowner.

How much is flood insurance in zone AE?

Navigating the Flood Insurance Waters in Zone AE – A Flood Nerd’s Guide!

Curious about the price tag on flood insurance in Zone AE?

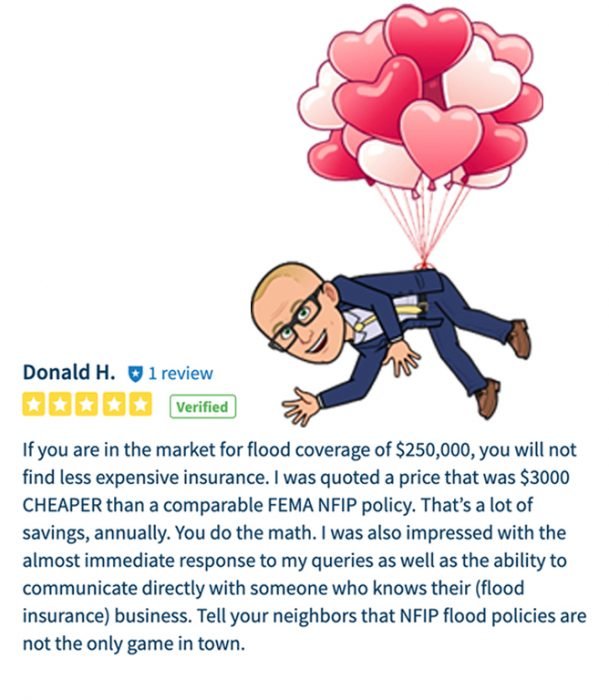

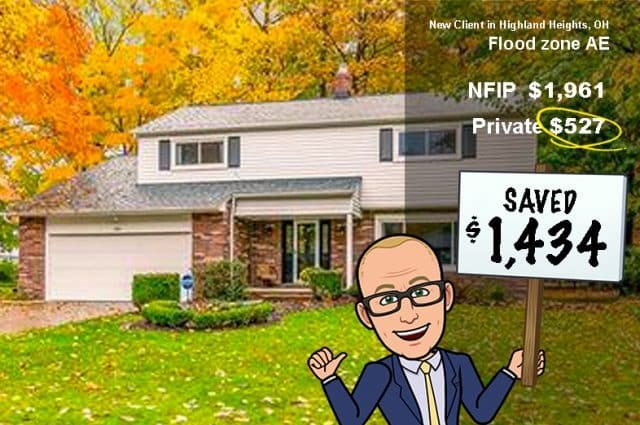

So how much does flood insurance cost in zone AE? Based on our data, average costs range from $500 to $1500 annually for standard NFIP policies.

With over 50,000+ properties we have shopped for flood insurance, our data shows that the average cost in Flood Zone AE ranges from $500 to $1500 for the standard coverage of $250,000 for buildings and $100,000 for contents.

However, beware of underinsuring your home; with inflation, $250,000 might not fully cover your needs.

Remarkably, even with higher coverage in the private flood insurance market, rates often stay within this range, although coastal properties might be slightly higher. Remember, these figures can vary based on several factors but hold true for the majority of properties.

The Players in Flood Insurance

You’ve got two main players: the government’s NFIP (FEMA’s product) and private insurers like Lloyds of London flood insurance. Each uses different methods to determine your rate. NFIP’s new Risk Rating 2.0 system, for example, looks beyond just flood zones and considers various risk factors. Meanwhile, private insurers use advanced models to set their rates, often offering more comprehensive coverage and higher limits.

Examples of Premium Calculations

NFIP Premiums: They use a mix of variables reflecting a property’s flood risk. The average NFIP cost is around $739 per year, but keep in mind, many policies are underinsured. For example, 40% of policies fall into the $0-1,000 range.

Private Market Premiums: They accounted for $506 million in premiums in 2022. These policies can offer up to $4 million for your house and $500,000 for belongings, often with additional benefits like living expenses during repairs.

Influence of House Characteristics on Cost

Various factors like the age of your home, elevation above the Base Flood Elevation (BFE), and construction materials affect your rates. For instance, properties over two feet above the BFE get better rates. However, homes in floodways or low-lying areas might see higher rates. The proximity to water bodies also plays a crucial role.

Impact of Risk Rating 2.0

FEMA’s Risk Rating 2.0 aimed to create ‘equity in action’ but had mixed results. It corrected subsidies for oceanfront properties but didn’t fully address discrepancies in risk assessment. We often find discrepancies between NFIP and private market rates, suggesting NFIP might still underestimate certain risks.

Using Our Flood Insurance Calculator

Below, you’ll find our calculator that uses real aggregated data to give you an estimate of your potential quote. For a more accurate figure, allow us to shop around for you – most quotes are obtained within 9-15 minutes, depending on the property’s complexity.

Discounts and Ways to Reduce Costs

The best way to reduce costs in Flood Zone AE is to let us shop the market for you. Being upfront about past flood events is crucial, as many private insurers have specific criteria for coverage based on previous losses. Let the Flood Nerds handle the details to ensure you get the best possible rate without the hassle.

Riding the Flood Waves: Unpacking Flood Insurance Costs in Zone AE

Evolving Flood Insurance Landscape: NFIP's Journey and the Rise of Private Coverage

Dive into the story of flood insurance, and you’ll find it’s a tale of changing tides. In the late 1960s, the government launched the National Flood Insurance Program (NFIP), a beacon of hope in the stormy seas of flood risk. Picture NFIP as a sturdy lifeboat, initially crafted to navigate homeowners safely through flood-prone areas.

NFIP: The Hero with a Twist

- A Rocky Voyage: While NFIP was hailed as a savior, the journey wasn’t all smooth sailing. Over its half-century monopoly, the program encountered choppy waters. Mismanagement became a frequent storm on the horizon, and the ship began to sway.

- A Tale of Two Tides: Picture this: luxurious oceanfront properties receiving subsidies, while inland homes often faced the brunt of inflated premiums. Lawmakers, steering the ship, seemed to chart a course favoring high-risk coastal properties, leaving others to navigate the financial squalls.

- Financial SOS: The result? NFIP found itself in turbulent financial waters, with debts piling up like a storm surge, forcing it to seek rescue in the form of billions from the treasury.

Enter the New Heroes: Private Flood Insurance & Flood Nerds

- Rising Stars: As NFIP struggled to stay afloat, a new wave of heroes emerged – private flood insurance offerings, led by pioneers like Lloyds. These new players brought innovation, stability, and a fairer weather approach to flood coverage.

- Flood Nerds: Your Navigators: In this dynamic seascape, Flood Nerds emerge as savvy navigators, guiding you to the best coverage. They possess the charts and compasses to determine when NFIP is your safest harbor, or when setting sail with a private policy is the wiser course.

In this evolving world of flood insurance, understanding the history and current options is key. NFIP, once the lone lifeboat, now shares the waters with robust private alternatives. As a homeowner in Flood Zone AE, your voyage to secure coverage can be navigated with expertise and insight, ensuring you find a safe harbor in either NFIP’s or private insurance’s protective arms.

Is flood zone AE Bad?

Flood Zone AE: To Insure or Not to Insure, That is the Question!

Is flood zone AE bad? While AE zones do carry a suposed higher risk, flood insurance and smart construction practices can help mitigate the dangers. Proper precautions go a long way in making AE zones safe and insurable.

Ever find yourself staring at your lovely home and wondering, “Is my cozy castle in a flood zone? Do I need flood insurance, or can I just float by without it?” Well, don’t just paddle around in uncertainty, let the Flood Nerds guide you!

When Mother Nature decides to throw a pool party without an invite, it can be a real soaker. If your home is chilling in Flood Zone AE, you might be scratching your head, thinking, “Is this ‘AE’ thing as scary as it sounds?” Spoiler alert: It’s complicated, but don’t sweat it, we’re here to untangle the knots!

Flood insurance is like that trusty umbrella on a rainy day – it’s there to keep your financial future from getting drenched. We get it, nobody likes to think about their home turning into an accidental aquarium. That’s why we’re here to bring you some peace of mind. With the right coverage, you can protect your nest egg from those unexpected flood fiestas – because let’s face it, some of these flood claims can hit harder than a tidal wave, soaring over $80,000!

Enter Better Flood Insurance – your flood-fighting sidekick! We’re not just experts in flood insurance; we’re like your personal flood insurance shopping assistants. We’ll dive deep into the sea of options and fish out the best policy for you, making sure it’s a whale of a deal. We’ll even compare it with the NFIP to ensure you’re getting top-notch coverage without emptying your treasure chest.

So, don’t let flood worries capsize your boat. With Flood Nerd by your side, navigating flood insurance is a breeze. We’ll help you anchor down the perfect coverage, keeping your financial ship steady and seaworthy. Call us, and let’s make some waves with smart, affordable flood insurance!

Flood Nerds to the Rescue: Picking the Perfect Flood Insurance in AE Zones!

Welcome to the splashy world of AE zones, where choosing flood insurance can feel like navigating a water park without a map. But fear not! Your trusty Flood Nerds are here with their super floaties to guide you through the wild waves of FEMA policies and the private insurance ocean.

FEMA vs. Private Insurance: The Great Flood Insurance Showdown!

FEMA Fun: Sure, it might be your wallet-friendly option, especially with those sneaky subsidized policies. But hey, remember, FEMA comes with its own set of rules – it’s like the strict lifeguard at the pool. Luckily, we Flood Nerds know all the tricks to make FEMA work for you.

Private Insurance Party: Think of private insurance as the VIP lounge of flood coverage. You get broader coverage, higher limits, and rates that actually make sense. But beware! Some insurers play the old bait-and-switch game with low first-year rates and then – surprise! – hike it up the next year. We Flood Nerds don’t play that game. We only team up with the good guys, the insurers who offer fair rates without the nasty next-year surprises.

Flood Nerd Wisdom on Rates:

- Gone are the days when FEMA rates were all about your flood zone. Now, it’s more about how high your house sits and how much bling it’s got. As for private insurers, they’re like the tech-geeks of insurance, using fancy models that look beyond just flood zones.

- Got a sweet subsidized rate from FEMA? Call us, the Flood Nerds, pronto! We’re like the superheroes of flood insurance, making sure you snag the same great deal as the previous homeowner. Just remember, FEMA’s got its own drama with debt and rising rates, so watch out for those sneaky fees.

Flood Nerd Tip: Sometimes, mixing a cocktail of FEMA and private coverage gets you the best flood protection bang for your buck. We can help you figure out the perfect mix.

So, before you dive into the flood insurance sea, grab your phone and call your friendly neighborhood Flood Nerds at 866-990-7482. We’re like your personal flood insurance GPS, navigating you to savings and stellar coverage in the thrilling world of AE zones. Suit up and let’s make a splash with the right coverage!

Sometimes the FEMA Flood Zone AE Policy Makes Sense

Choosing Your Flood Insurance: The Flood Nerds’ Guide to Smart Savings!

In Florida, there are over 1 million policies in effect, with average costs of $550 for AE zone properties.

Welcome to the world of Flood Insurance, where the Flood Nerds are like your personal shopping guides, zipping through the maze of policies to find your golden ticket!

When Private Flood Insurance Steals the Show:

- The Nerdy Know-How: We’re not just insurance geeks; we’re private flood insurance maestros! We jive with insurers like Lloyds of London, often snagging you 20-50% savings compared to NFIP rates.

- Tech-Savvy Shopping: Picture us using cool gadgets like LIDAR maps and high-tech risk models to zoom in on your property’s true flood potential. We check out everything – from your home’s foundation style to the cost of rebuilding your castle.

- The Flood Insurance Custom Tailor: Private insurers are like the fashion designers of insurance, offering policies that fit your home like a glove with higher coverage limits and broader terms. And hey, some even throw in perks like “pool clean out” coverage!

Sometimes, NFIP is the Unsung Hero:

- Flood Nerds’ Magic Tricks: We’ve got some savvy moves for making NFIP policies work harder for you. Got an Elevation Certificate? We’ll use it like a wand to make those NFIP rates shrink.

- History Detective Work: We love a good throwback! Finding historical maps to show your home was built to code can mean premium prices taking a nosedive.

- New Kid on the Block? No Problem! Just moved into the AE zone? We might find you a sweet NFIP discount if you act fast after the map update – think of it as a housewarming gift from FEMA!

In the quirky world of flood insurance, whether it’s the sleek private policies or the dependable NFIP, we’ve got the know-how to find your perfect match. With Flood Nerds on your side, navigating flood insurance becomes less of a chore and more of an adventure. Ready to find your policy treasure? Let’s set sail!

Buying a House in a Flood Zone AE?

House Hunting in Flood Zones? Let Flood Nerds Make It Rain Savings!

Are you diving into the house-buying pool in a flood zone? Guess what? The Flood Nerds are like your personal savings superheroes, ready to swoop in and save you some serious cash!

Picture this: The seller’s got a shiny “new map” rate. What do we do? We play the switcheroo and transfer their cool subsidy right to you. That’s more dollars staying in your pocket – cha-ching!

Now, let’s talk about our secret weapon: the Flood Nerd ninja move. It’s called “grandfathering for continuous coverage.” Sounds mysterious, right? Here’s the scoop – if the property’s got the old-school flood insurance charm, we can pass that sweet, sweet subsidized deal to you when you snap up your new home or business.

But wait, there’s more! Got an Elevation Certificate from the seller? Hand it over to us, your trusty Flood Nerds. We’ll use it to slash your flood insurance costs like a hot knife through butter.

Worried about closing delays? Not on our watch! We move faster than a cheetah on an espresso shot to make sure your flood coverage is locked and loaded in record time.

So, when you’re out there scouting for your dream pad in flood territory, remember – Flood Nerds are your go-to crew for making sure you’re covered, without breaking the bank. Let’s make your flood insurance experience a smooth sail!

Building in an AE Flood Zone

Home Building Adventure in Flood Zone AE: Your Blueprint to Stay High and Dry!

Embarking on the epic journey of building your dream home in the adventurous Flood Zone AE? Grab your captain’s hat, because navigating these waters requires some savvy planning and a sprinkle of fun! Here’s your treasure map to a flood-savvy home:

Flood Map Treasure Hunt: Start by consulting FEMA’s flood map and chatting with your local floodplain manager. You’ll need to find the magical number known as the Base Flood Elevation (BFE) for your plot.

Elevation Certificate – Your Golden Ticket: Hire a trusty land surveyor to certify your home will sit proudly above the BFE. This certificate isn’t just a fancy paper; it’s your key to snagging flood insurance.

Build Smart, Stay Dry: Dreaming of a basement? Think again! Keep your living spaces above the BFE. For everything below, think car parks, storage, and flood-smart designs like breakaway walls.

Material Matters: Below the BFE, go for the tough guys – concrete, pressure-treated lumber, and steel. Steer clear of the flood’s kryptonite like carpet and drywall.

Elevate Your Essentials: Electrical and heating systems, plumbing, and AC units? They need to be high-riders too, above the BFE to keep them safe from splashy intruders.

Flood-Proofing Finesse: If you’re really in the thick of it, consider some extra shields like impermeable membranes, sump pumps, and floodwalls. It’s like building your very own fortress!

Building in Flood Zone AE can be more thrilling than a rollercoaster, but with the right prep, your dream home will be a safe haven, ready to face whatever watery challenges come its way. Remember, knowledge of elevation and compliance with floodplain rules are your best pals in this adventure!

Flood Zone AE Florida

Florida flood insurance is required for about 1.7 million properties at last count. There are many private flood insurance options for Florida property owners. The average flood insurance cost for Florida is $550. Are you paying more? Let a Flood Nerd shop for Florida flood insurance.

Flood Zone AE New Jersey

Sandy caused incredible flooding in New Jersey. It’s not a question of “if” it’s a question of “when” it will happen again. New Jersey has about 225,000 active flood insurance policies. Most New Jersey flood insurance policies are for the AE flood zone. A few are in the VE flood zone. The average cost of flood insurance in the NJ AE flood zone is $961. Why not see if a Flood Nerd can reduce your cost of flood insurance in New Jersey.

Flood Zone AE New York

Sandy clearly showed the damage a hurricane can do when it hits a populated area. New York has 178,000 active flood insurance policies, many of which are in the high-risk flood zones.

The average flood insurance policy in the AE flood zone NY is about $1,155. If you are paying more, let a Flood Nerd do the shopping.

Flood zone AE Hawaii

Oddly for an island state, Hawaii is mostly in flood zone AE. Some coastal areas are in flood zone VE. There are ways to save money on flood zone AE insurance in Hawaii. There are 61,000 active Hawaii flood insurance policies with an average premium of $673.

Want to pay less for flood insurance in Hawaii? Let a Flood Nerd shop for you. Even a Hawaii VE flood zone, we can find something better.

Flood Zone AE in Louisiana

Louisiana flood zone AE accounts for most of the 500,000 flood insurance policies in the state. There are a few flood insurance policies that are in the Louisiana VE flood zone. The average cost for Louisiana flood insurance is $656.

North Carolina Flood Zone AE

North Carolina flood zone AE was hit hard in 2019, and today they are still cleaning up and rebuilding. With 135,000 active flood insurance policies, the dump from Hurricane Dorian cost about $24 billion. Unfortunately, most of the losses were in a North Carolina low-risk flood zone. This just goes to show that it can flood anywhere, even in a North Carolina flood zone X. Don’t be surprised to find FEMA placing more properties in NC flood zone AE.

How to Determine if Your Home is in Flood Zone AE

Curious if your humble abode is a resident of the high-risk Flood Zone AE? Don’t just guess – let’s get you an accurate answer! The best way to unveil the mystery? Fill out our quick form and let a Flood Nerd embark on a quest to fetch your precise Flood Zone Determination.

It’s like sending a message in a bottle and getting back a treasure map. Just enter your details, and we’ll dive into the depths of flood data, emerging with the key info on whether your place is basking in the light blue hues of Flood Zone AE.

AE Flood Map Link: Your First Step to Uncovering the Mystery

So, are you ready to chart the waters of your property’s flood risk? Fill out the form, and our Flood Nerds will be your trusty captains, steering you towards clear and calm understanding. It’s the easiest and most reliable way to check if your home is in the splash zone!

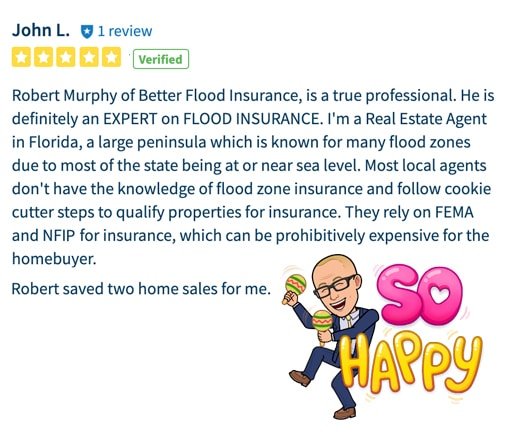

Everyone Saves Money on AE Flood Zone Flood Insurance Cost with a Flood Nerd™

Get Cheap Flood Insurance without Compromising Coverage in Flood Zone AE

★★★★★

"Same Coverage at a Better Rate"

-Mohammed K

Flood Nerds will shop the private flood insurance markets and then compare them to the NFIP, guaranteeing you the better option. We will send you the cheapest flood insurance rates within minutes.

★★★★★

"Quick Response, Very Knowledgable"

– Robert W

Paying for low-cost flood insurance is awesome. And letting the Flood Nerds shop your property has other benefits – you can get better coverage while saving money, and you can get it fast.

★★★★★

"Would highly recommend Better Flood for your flood insurance needs."

– Varun K

Better Flood Insurance is an independent flood insurance broker that shops flood insurance ONLY. Flood Nerds are Flood insurance experts. We have 5000+ happy clients and 390+ 5-star reviews.