Slash Your Florida Flood Costs with Flood Nerds!

Find out how much you can save on high quality, high coverage flood insurance plans in 10 minutes or less!

Or Speak To A Flood Nerd™ 1-866-990-7482

$2.3M+

Annual Premium Savings

4.9★

Average Ratings

445+

Reviews

5,497+

Happy Clients

We Get It,

Buying Flood Insurance in Florida Is Confusing…

You might be asking:

• What coverage do I need?

• How much is flood insurance in Florida going to cost me?

• How much can I save?

It’s okay, your search for cost-effective Florida flood insurance that doesn’t compromise on coverage ends here.

Meet The Flood Nerd™

Your Florida Flood Expert, Friend, and Guardian

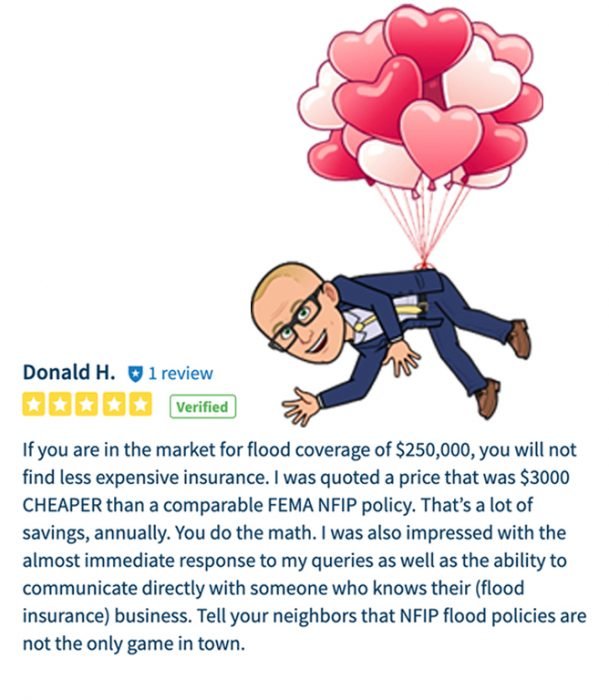

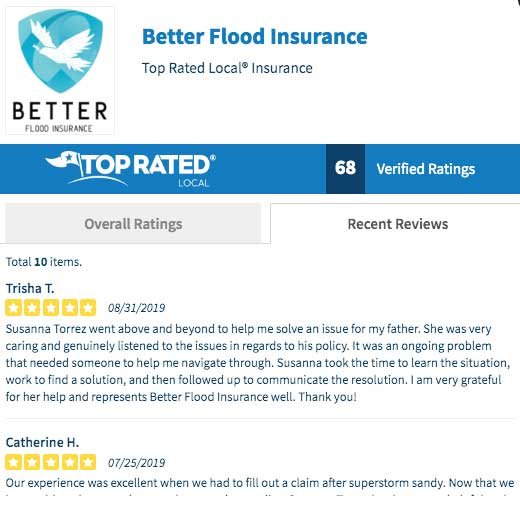

In 2015, Robert Murphy, inspired to help homeowners and businessowners alike, entered the insurance brokerage market with one goal in mind: To help uncertain homeowners find affordable, high quality flood insurance that doesn’t compromise on coverage.

We Find You Great Coverage

While Saving You Up To $1,457+ A Year!

What you seek is:

Enhanced security for your Florida Property.

Significant savings.

Absolute freedom.

Unwavering certainty.

Memorable moments.

Quality family time.

Peaceful travels.

It's As Easy As 1, 2, 3!

1

Fill Out Our Online Form

Complete our easy quote form so we can understand your needs & personalize your Florida rates.

2

Get An Instant Quote

Our team scours Florida flood insurance companies statewide to instantly present the best coverage & rate options for your needs.

3

Get Coverage

If you’re happy with the coverage options, you can sign up easily directly from our online portal.

Florida flood insurance guide to save money (That ANYONE Can Follow)

How much is flood insurance in Florida?

Looking for the best value on how much is flood insurance in Florida?

Look no further and find out with our tool below how much is flood insurance in Florida. We shop around to provide reliable coverage solutions, competitive rates and peace of mind that you are protected from financial loss due to flooding. Our experts have decades of experience and knowledge when it comes to helping our customers get the lowest possible prices on their flood insurance policies while ensuring they have great protection.

With your flood nerd, getting maximum savings without sacrificing coverage has never been easier! Get a customized flood insurance quote in Florida and find out how much is flood insurance in Florida for your specific property – we guarantee you won’t find better rates anywhere else!

Contact us today for more information about your affordable dedicated and transparent flood insurance options!

What does flood insurance cover in Florida?

In Florida, flood insurance provides coverage for both the structure of your home and the personal possessions inside it against damage caused by flooding. This coverage is essential as standard homeowners’ insurance policies do not typically include flood damage. Additionally, considering Florida’s high risk of flooding due to its geography and climate, securing flood insurance is a prudent step for protecting your investment. It can help cover the costs of repairs and replacements, minimizing financial disruptions following a flood event. Furthermore, having flood insurance may also be a requirement by your mortgage lender, especially if you live in a high-risk flood zone.

Does my Florida homeowners insurance cover flooding?

Do I need flood insurance in Florida?

What are my flood insurance options in Florida?

Florida NFIP flood insurance

Florida private flood insurance market

How much does flood Insurance cost in Florida?

7 things you need to know about flood insurance in Florida?

Florida Flood Insurance calculator

Cost of flood insurance in Florida? (click on your city to find the average)

Do I need flood insurance in Florida?

What are my flood insurance options in Florida?

Florida NFIP flood insurance

Florida private flood insurance market

How much does flood Insurance cost in Florida?

7 things you need to know about flood insurance in Florida?

Florida Flood Insurance calculator

Cost of flood insurance in Florida? (click on your city to find the average)

Florida NFIP flood insurance.

There are many options available in Florida regarding flood insurance, but they basically fall into two main categories. The Government option, also known as FEMA or NFIP, and then the private flood insurance market.

The National Flood Insurance Program (NFIP), also known as FEMA, is the government option for flood insurance. The NFIP has enjoyed a 50-state monopoly on the flood insurance market.

Florida private flood insurance market

There are alternatives to NFIP or government insurance. It is called Private flood insurance, most notably Lloyd’s of London Flood insurance. However, there are other options available in Florida. We shop all the options for your property in your region to ensure you are getting the best premium. Please click here if you are ready to have us do the work for you.

There are alternatives to NFIP or government insurance. It is called Private flood insurance, most notably Lloyd’s of London Flood insurance. However, there are other options available in Florida. We shop all the options for your property in your region to ensure you are getting the best premium. Please click here if you are ready to have us do the work for you.

Our shopping includes the NFIP because sometimes we find that you can get a much better premium with government subsidies.

Cost of flood insurance in Florida

Lloyd’s of London Flood Insurance Florida Market

Florida is fortunate to have many Lloyds of London flood insurance options. Although many Lloyds flood insurance companies will have you assume that there is only one option, nothing could be further from the truth.

Lloyd’s of London has a rich history attributed to having invented the first modern insurance model. Unlike most of its competition, Lloyds of London is not a company but a corporate body. This structure works well since it has been around for over 330 years. Lloyds operates under multiple financial backers pooling their capital to spread the risk.

Not “private flood insurance” but NFIP Resellers

Suppose you have Nationwide Flood Insurance, State Farm Flood Insurance, Progressive Flood Insurance, or any of the logos below. In that case, you are buying the NFIP flood policy that is just being resold through a government program. These companies are private companies, but their flood insurance is not. Here is a list of the 70 companies that resell the NFIP policy.

https://www.fema.gov/wyo_company

I have two blog posts that deep dive into Lloyds of London and what they mean to Florida’s flood insurance market. If you are interested, the links are below.

Lloyds of London Flood Insurance

FEMA vs Private flood insurance

Lloyd’s also insures the world for flood insurance, meaning they cover flooding events in India, Australia, and much of Europe. The “game” of insurance is to spread your risk since Lloyd’s is worldwide.

I joke here that Lloyd’s is banking on God’s promise that he won’t flood the entire world again, …..so they won’t have to pay out the whole world’s flood claim.

What is the cost of flood insurance in Florida?

Many factors go into getting the cost of flood insurance for Florida. If your home is considered a low-to-moderate risk, you can get a heavily subsidized policy through the government.

Living in Florida, do you know how much it costs to get flood insurance?

With our years of experience in the flood insurance industry, we know that getting reliable coverage doesn’t have to break your bank. Our experts have great advice on seeking out the best deals and saving money without sacrificing quality or coverage.

Our experience shows that most Florida flood insurance policies cost around $500 to $1,500 per year. Although there are certain areas that incur higher expenses, we, being the flood geniuses that we are, find the cheapest flood insurance rates in Florida by scouring many options available in the market.

Stop worrying about rising premiums and start saving with your Flood Nerd to find an inexpensive yet competitive policy with good coverage. Get ready for peace of mind knowing that if a flood happens, you won’t be hit with nasty surprises.

Find your perfect policy today before it’s too late.

Want to know the average cost of flood insurance in Florida

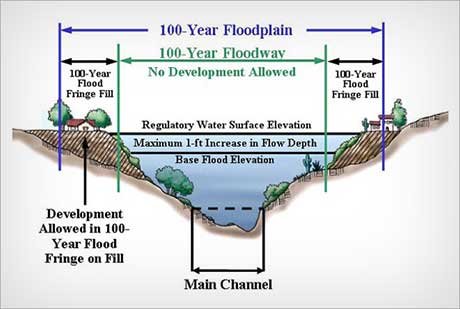

In Florida, the cost of flood insurance can vary significantly depending on the flood zone classification as well as geographic location. According to the National Flood Insurance Program (NFIP), which sets the rates for flood insurance policies, these costs are determined by the U.S. government based on the area’s risk level.

Flood zones are categorized from high risk to minimal risk. For instance, Zones A and V are designated as Special Flood Hazard Areas (SFHA), indicating high-risk areas often close to water bodies. Conversely, Zone X includes shaded areas (moderate-risk) and unshaded areas (minimal-risk), while Zone D covers regions where flood hazards are undetermined.

Here’s a breakdown of the average annual and monthly rates for flood insurance as determined by the NFIP:

– Zone A: $851 annually, $71 monthly

– Zone AE: $897 annually, $75 monthly

– Zone AH: $530 annually, $44 monthly

– Zone AO: $344 annually, $29 monthly

– Zone D: $995 annually, $83 monthly

– Zone V: $2,546 annually, $212 monthly

– Zone VE: $630 annually, $53 monthly

– Zone X: $517 annually, $43 monthly

Alongside these zone-specific rates, it is also insightful to look at the average flood rates in specific cities and counties within Florida. Here is a direct quote from previous findings that provides detailed rates for various locations:

“The average flood rate in Edgewater, Florida is $385. In Holly Hill, Florida, the average flood rate is $456. New Smyrna Beach, Florida has an average flood rate of $411. Ormond Beach Florida sees an average flood rate of $437. Ponce Inlet, Florida has an average flood rate of $313. Port Orange, Florida has an average flood rate of $474. South Daytona, Florida has an average flood rate of $479. Volusia County, Florida has an average flood rate of $396. Wakulla County, Florida has an average flood rate of $1,379. And finally, Walton County, Florida has an average flood rate of $452.”

These figures highlight the variability in flood insurance costs not only across different flood zones but also across different geographical locations within the state. Whether you live on the coast or inland near rivers and lakes, it’s crucial to understand both the zone classification and local area prices to fully grasp the potential costs of flood insurance in Florida.

How can one pay less for flood insurance in Florida?

To reduce the cost of flood insurance in Florida, consider taking several steps to minimize the risk and thereby lower your insurance premiums. Firstly, opt to increase your insurance deductible, which is the amount you pay out-of-pocket before your insurance kicks in; a higher deductible generally means lower monthly or annual payments.

Secondly, obtain and submit an elevation certificate for your property. This document details your home’s elevation compared to the potential floodwaters and can demonstrate lower risk, which might reduce your premium costs.

Additionally, make structural improvements to your home to enhance its resistance to flood damage. Actions such as raising the height of your house, retrofitting utilities to higher levels, adding flood vents, or eliminating basements can all contribute to lower flood insurance rates by reducing the likelihood and potential severity of flood damage.

Does my Florida homeowner insurance cover flooding?

A typical Florida homeowners’ policy is written through Farmers, State Farm, Allstate, and Progressive, for instance, excludes flooding as something that will be covered under their homeowner’s policy.

Most cases, the only way to get flood coverage is by purchasing a stand-alone flood insurance policy. However, you should ask your homeowners agent if you can add an endorsement to your homeowner’s policy to cover flooding. Yet, don’t be too surprised if the answer is NO.

Do I need flood insurance in Florida?

It is important to have flood insurance coverage in Florida because our beloved Cowboy State has seen a fair share of flooding, and more is likely coming.

Most homeowners think about flood insurance in Florida at some point before buying a home or during the closing process.

Many of us only think about it when a big storm looms. Or we have heard on the news that active flooding is forecasted.

Is flood insurance required in Florida?

It is important to have flood insurance coverage in Florida because our beloved Sunshine State has seen a fair share of flooding, and more is likely coming. Most homeowners think about flood insurance in Florida at some point before buying a home or during the closing process. Many of us only think about it when a big storm looms. Or we have heard on the news that active flooding is forecasted. If your home or business is in a flood zone, that is considered a low flood risk area. Sadly, many homeowners decide to forgo purchasing coverage because they believe they are safe from flooding. Some real estate and insurance agents may even say you don’t need it. I ask you to consider the facts: 20 percent of all flooding events across our nation come in areas that are considered low risk. After our last few major storms (Hurricane Harvey), we saw flooding in these low-risk areas. 80 percent of these individuals had water in their homes or building and didn’t have flood insurance coverage. In Harris county, nearly 135,000 homes were damaged. Three-fourths of these properties were considered low to moderate risk.

Furthermore, if you are residing in a Special Flood Hazard Area (SFHA) in Florida and have a federally backed mortgage, the U.S. government mandates that you must have flood insurance. Additionally, your mortgage lender may still require you to carry flood insurance, even if it’s not a government requirement. Moreover, if you’re a Florida homeowner and have home insurance through Citizens Insurance, be aware that the legislation now requires you to purchase flood insurance. Specifically, all homeowners with Citizens Insurance are mandated to secure flood insurance by March 1, 2027. This legislative move underscores the critical nature of flood insurance in protecting your home and financial stability in Florida.

Given these points, while the threat of flooding may sway some to consider insurance, others are compelled by legal obligations to secure coverage. Either way, it is wise to assess the necessity of flood insurance to mitigate the potentially devastating effects of flooding in Florida.

What is the risk of flooding in Florida?

Flooding poses a significant risk to Florida, given its coastal geography. Current statistics show that one in four homeowners in the state has opted for flood insurance. Among the flood zones, Zone X experiences substantial losses, second only to Zone AE. Predictive analysis by Risk Factor indicates that within the next 30 years, more than 200,000 properties could be at risk due to rising sea levels. Additionally, studies highlighted by Scientific American suggest that climate change is expected to increase flood risks nationwide by 26%. Given these factors, it is advisable for all residents, regardless of location within the state, to consider flood insurance, as even minimal water intrusion can result in considerable financial losses.

Florida flooding

If your home or business is in a flood zone, that is considered a low flood risk area. Sadly, many homeowners decide to forgo purchasing coverage because they believe they are safe from flooding. Some real estate and insurance agents may even say you don’t need it.

I ask you to consider the facts: 20 percent of all flooding events across our nation come in areas that are considered low risk. After our last few major storms (Hurricane Harvey), we saw flooding in these low-risk areas. 80 percent of these individuals had water in their homes or building and didn’t have flood insurance coverage.

In Harris county, nearly 135,000 homes were damaged. Three-fourths of these properties were considered low to moderate risk.

Florida Flood Insurance Rate Map

We often hear that people believe the government will help, which is true. However, a few things must align for you to get government assistance.

1 – The president of the United States must declare the flooding event a state of emergency. If this doesn’t happen, then there won’t be assistance.

2 – Homeowners’ average amount of assistance after a flood, when they do not have flood coverage, is $5,000. The average cost of damage to one’s property after a flood is $38,000+. That $5K you get from the government? It comes as a loan, and you will need to pay it back. Are you willing to gamble on your financial future by forgoing flood insurance coverage?

https://www.bloomberg.com/graphics/2017-fema-faulty-flood-maps/

One more note on these low-risk flood zone maps. Many of these maps are over 40 years old. If the area has been developed, there is likely more concrete, creating a barrier for land that previously might have absorbed the massive downpour.

FEMA flood maps Florida

Because of all these factors, it is difficult for property owners to know their true risk of flooding. FEMA admits that their flood maps only give an idea of part of the risk. Our recent storms are facts that it can rain anywhere within Florida, and you should consider getting flood coverage so you are not uninsured when you need it most.

FEMA flood zone maps often take years to go into effect after the terrain was studied, this gives the impression that the area is “more up to date” then it really is. Find our more about Florida flood insurance rate maps here.

Flood insurance Florida

The average cost for Florida flood insurance in these Low-risk areas is $595 per year.

FEMA’s National Flood Insurance Program (NFIP) and all federally backed lenders rely on these Florida flood insurance maps to assess risk, set premiums, and determine who is required to purchase flood insurance. Bad information about an area’s flood risk can leave property owners under or uninsured.

Florida flood insurance low-to Moderate Risk rate and cost.

This is Flood Zone X, which is not lender required flood zone.

This is usually identified as an X-flood zone. Then we would suggest the government Preferred Risk Policy (PRP) which is a subsidized policy and has set flood insurance coverage limits (see grid below):

Here is a link if you want to really dig into this one. Be ready for an eye chart because every option is a public record and should be standardized to accost whoever writes these policies.

Flood zone X Florida

The average cost for flood insurance in Florida with the maximum set limits in these Low-risk flood zone areas is $405 – $700 per year.

Your property is in a higher-risk flood zone. It is usually identified with a Flood Zone AE Florida. Your lender will require you to have flood insurance. The cost of flood insurance in Florida depends on many factors unique to the structure. We will try to give you an idea of the most common homes we see in Florida with a slab-on-grade foundation.

We will look at the Florida cost of flood insurance for the NFIP maximum of $250,000 for the (building only) with NO CONTENTS and our recommended deductible of $5,000.

We will be rating this example on the NFIP and on a few of our private flood insurance policies, specifically Lloyds flood insurance options in Florida.

Cost of Flood Insurance in Flood zone AE Florida

Your flood nerd shops for cheap flood insurance in Florida and below is and example of how we do it. Our example is Collier County, but the premiums will be the same in Hollywood, Fort Lauderdale, Miami Beach, Lee County, Jacksonville, and many other Florida flood ones.

There are multiple flood insurance companies in Florida, including the National Flood Insurance Program (NFIP). To ensure that you get the lowest premium available for your property without compromising the coverage, you can explore several options, or you can use a one stop shop such as The Flood Nerds™. We offer you an opportunity to shop around and select the right policy for your coverage and without draining your wallet.

In our example, the Base Flood Elevation (BFE is 8) and is a home that is built before 1973

NFIP option in Florida Flood Zone AE

NFIP – Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

NFIP Annual premium in High-Risk flood zone is $7,543

This option is what we see if the property has had a flood loss before and either doesn’t have an Elevation Certificate applied or the Elevation certificate shows that the lowest floor is 4 feet under the BFE for the area. You can use 10% of your coverage to cover other structures on your property.

Florida Private flood insurance – Lloyd’s of London Flood Insurance (option 1)

Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

Lloyds of London (option 1) The annual premium in a high-risk flood zone is $745.09

This option is great, and we are very happy when we can get this option. Lloyd’s can be a bit choosey about what risk they will accept and will not take anything that has had a flood loss. They offer basements coverage, about $2,000 for loss of use and $2,000 for other structures, but they can’t increase this coverage. They do not require an Elevation Certificate to rate.

Florida Private flood insurance – Lloyd’s of London Flood Insurance (option 2)

Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

Lloyd’s of London (option 2) The annual premium in a high-risk flood zone is $866.04

This option is great, and we are very happy when we can get this option for our clients. The underwriter seems to be writing almost all risks. However, they do not write any property in a designated floodway or has a depth of -4 under the BFE.

In our example, with our BFE being 8, they will not accept this risk if the lowest floor is 4. They will not take anything that has had a flood loss. They offer limited coverage for basements and do not require an Elevation Certificate to rate as a percentage of coverage for loss of use. If you want coverage for other structures, that must be added

Private Flood Insurance option (option 3) Not Lloyd’s