Get Flood Insurance Maryland & Save Money Too.

People in Maryland save on average $500 to $1,457+ on their annual flood premiums.

Get flood insurance from a Flood Nerd® at Better Flood Insurance® and save big time.

SPEAK TO A FLOOD NERD

1-866990-7482

featured on

What is the Cost of Flood Insurance Maryland?

Flood Insurance Maryland Cost?

Get Cheap Flood Insurance without Compromising Coverage

Affordable Coverage

★★★★★

“Same Coverage at a Better Rate”

-Mohammed K

Flood Nerds will shop the private flood insurance markets and then compare them to the NFIP, guaranteeing you the better option. We will send you the cheapest flood insurance rates within minutes.

Quick Quote & Coverage

★★★★★

“Quick Response, Very Knowledgable”

– Robert W

Paying for low-cost flood insurance is awesome. And letting the Flood Nerds shop your property has other benefits – you can get better coverage while saving money, and you can get it fast.

We Have Satisfied Clients

★★★★★

“Would highly recommend Better Flood for your flood insurance needs.”

– Varun K

Better Flood Insurance is an independent flood insurance broker that shops flood insurance ONLY. Flood Nerds are Flood insurance experts. We have 5000+ happy clients and 390+ 5-star reviews.

Does my Maryland homeowner insurance cover flooding?

Many popular companies, including Farmers, State Farm, Allstate, and Progressive, exclude natural flooding from homeowner policies. This leaves stand-alone flood insurance policies as the sole remedy. Though you can request an endorsement from your homeowner’s agent to include coverage for flooding, be prepared for the answer to be a NO.

Do I need flood insurance in Maryland?

Flood insurance is a crucial shield against damage in the beloved state of Maryland, which has seen its fair share of flooding, with more in store. Though many property owners may consider flood insurance at some point, such as before buying a home or during the closing, the thought often gets skipped until a looming storm or news of flooding nearby spurs them into action. Many who live in a ‘lower flood risk’ rating zone (flood zone X) wrongly choose to forgo insurance, which is an ill-advised move. Some realtors and insurance agents even reinforce this position.

Think about this: Did you know that in our country, 20% of flooding incidents happen to areas classified as low flood risk? The aftermath of Hurricane Harvey revealed this undesired reality. Sadly, 80% of individuals without flood coverage were affected by home or workplace damage.

Nearly 135,000 houses in Harris County were damaged due to flooding, with 75% belonging to the low to moderate risk category. In this calamity, people often depend on the government for aid but certain conditions must be fulfilled to receive assistance. Firstly, the president of the United States must declare the flooding event as a state of emergency. Otherwise, there won’t be any aid. Secondly, homeowners who do not have flood coverage receive an average of $5,000 in assistance. However, this amount is far lesser than the average cost of damage, which exceeds $58,000, and the money given by the government is a loan that you will eventually have to pay back. Therefore, it is wise to opt for flood insurance coverage to avoid jeopardizing your financial future.

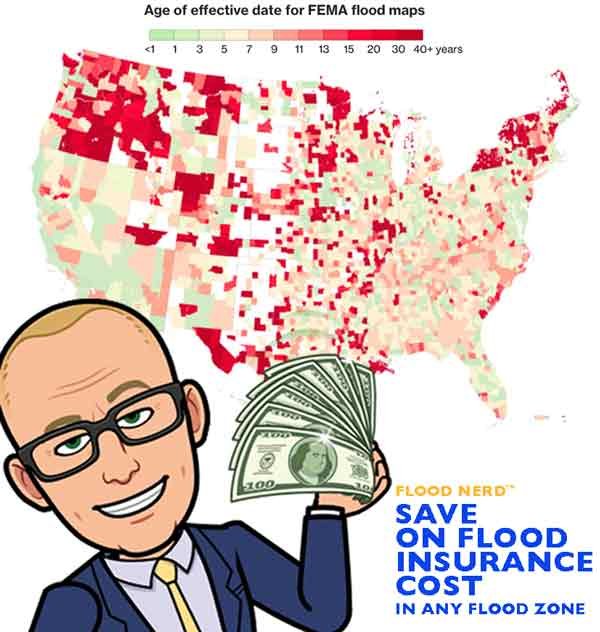

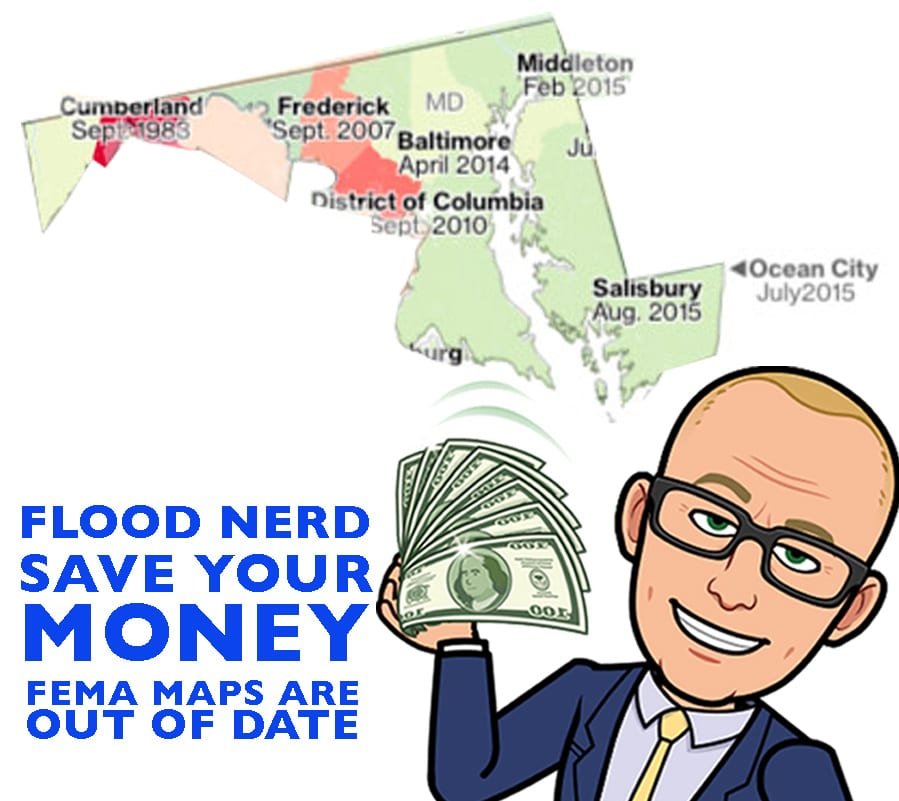

One more note on these low-risk flood zone maps. Many of these maps are over 40-years old. If the area has been developed, there is likely more concrete, creating a barrier for land that previously might have absorbed the massive downpour.

Because of all these factors, it is difficult for property owners to know their true risk of flooding. FEMA admits that their flood maps only give an idea of part of the risk. Our recent storms are facts that it can rain anywhere within Maryland, and you should consider getting flood coverage so you are not uninsured when you need it most.

Maryland Flood Zone Map

Because of all these factors, it is difficult for property owners to know their true risk of flooding. FEMA admits that their flood maps only give an idea of part of the risk. Our recent storms are facts that it can rain anywhere within Maryland, and you should consider getting flood coverage so you are not uninsured when you need it most.

FEMA flood zone maps often take years to go into effect after the terrain is studied. This gives the impression that the area is “are up to date” than it is.

The average cost for Maryland flood insurance in these Low-risk areas is $595 per year.

FFEMA’sNational Flood Insurance Program (NFIP) and all federally backed lenders rely on these Maryland flood insurance maps to assess risk, set premiums and determine who is required to purchase flood insurance. Bad information about an area’s flood risk can leave property owners under or uninsured.

How much is flood insurance in Maryland?

Maryland NFIP flood insurance.

There are many options available in Maryland regarding flood insurance, but they fall into two main categories. The Government policy is also known as NFIP or FEMA and the Private Flood insurance market.

The National Flood Insurance Program (NFIP), also known as FEMA, is the government option for flood insurance. The NFIP has enjoyed a 50-state monopoly on the flood insurance market.

Not “Private flood insurance” but NFIP Resellers

Suppose you have Nationwide Flood Insurance, State Farm Flood Insurance, Progressive Flood Insurance, or any of the logos below. In that case, you are buying the NFIP flood policy that is just being resold through a government program. These companies are private companies, but their flood insurance is not. Here is a list of the 70 companies that resell the NFIP policy.

Maryland private flood insurance market

There are alternatives to the National Flood Insurance Program or government-based coverage. Private flood insurance, such as Lloyd’s of London Flood Insurance, is a reputable alternative. Additionally, other alternatives are available in Maryland. We peruse many options for your property within the region to ensure you receive adequate, cheap flood insurance. To let us do the work for you, click the linked word here.

We usually include the NFIP in our shopping because of government subsidies; you can sometimes get a better premium.

Lloyd’s of London Flood Insurance Maryland Market

Maryland has access to many Lloyd’s of London flood insurance options. While some Lloyd’s flood insurance providers may mislead you into thinking there is only one Lloyd’s choice, let me assure you that many are available.

Lloyd’s of London boasts a rich history and pioneered the first modern insurance model. Unlike its competitors, Lloyd’s isn’t strictly a company but a long-standing corporate body. This structure has functioned flawlessly for over three centuries by distributing the risk among multiple financial backers who pool their capital.

I’ve included two blog posts below if you’re interested in diving deeper into Lloyd’s of London and why they’re crucial to Maryland’s flood insurance market.

Lloyd’s of London Flood Insurance

FEMA vs Private Flood Insurance

Lloyds provides flood insurance coverage to countries worldwide, including India, Australia, and much of Europe, as part of its risk diversification strategy. The aim of insurance, after all, is to spread risk as far and wide as possible.

My joke goes that Lloyds is banking on God’s promise not to flood the world again, so they need not pay out the entire world’s flood claims.

How much does flood insurance cost in Maryland?

Getting a quote for flood insurance in Maryland is influenced by many factors. The government has offered a heavily subsidized policy if your house is in a low-to-moderate risk area. This policy provides coverage based upon predetermined limits and is called the Preferred Risk Policy (PRP), now retired but still around. If your house is in an X-flood zone, which the lender does not require, the PRP policy is highly recommended if you can get it.

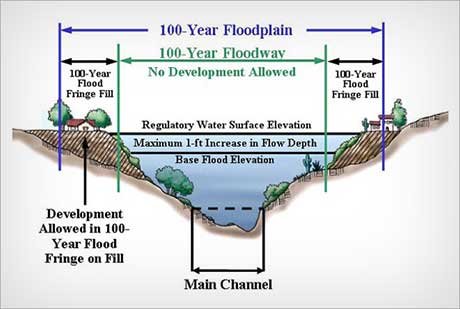

Maryland flood Zone AE

Is your home in a flood zone AE?

Don’t worry- we’ve got you covered. At Better Flood Insurance, our team of flood nerds focuses on helping homeowners understand the complexities of being in a flood zone AE and how best to protect themselves against flooding costs. We start by clarifying what an AE zone means for you and help you determine if it’s been affecting your premiums unfairly.

Our mission is to give people control over their flood insurance premiums so they don’t have to pay more than necessary or be tricked into buying expensive coverage options. With our help, we can provide simple solutions to the confusion surrounding AE zones. Better we shoop for your protection to get you good flood insurance at a lower rate than traditional local agents near you can offer.

Let a flood nerd shop your home today and take control of your flood insurance premiums!

Flood Insurance Maryland

The average cost for flood insurance in Maryland with the maximum set limits in these Low-risk flood zone areas is $405 – $700 per year.

Your property is in a higher-risk flood zone, usually identified with a Flood Zone AE. Your lender will require you to have flood insurance. The cost of flood insurance in Maryland depends on many factors unique to the structure. We will try to give you an idea of the most common homes we see in Maryland with a slab-on-grade foundation.

We will look at the Maryland cost of flood insurance for the NFIP maximum of $250,000 for the (building only) with NO CONTENTS and our recommended deductible of $5,000.

We will be rating this example on the NFIP and on a few of our private flood insurance policies, specifically Lloyds flood insurance options in Maryland.

Maryland flood Map

Cost of Flood Insurance in MARYLAND in high-risk flood zone AE

Our example is Ocean City, but the premiums will be the same if in Talbot, Worcester, Prince George’s Baltimore, Anne Arundel, and many other Maryland flood ones.

In our example, the Base Flood Elevation (BFE is 5) and is a home that is built before 1973

NFIP option in Maryland Flood Zone AE

NFIP – Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

NFIP Annual premium in High-Risk flood zone is $4,930.09

This option is what we see if the property has had a flood loss before and either doesn’t have an Elevation Certificate applied, or the Elevation certificate shows that the lowest floor is 4 feet under the BFE for the area. You can use 10% of your coverage to cover other structures on your property.

Maryland Private flood insurance – Lloyd’s of London Flood Insurance (option 1)

Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

Lloyd’s of London (option 1) Annual premium in a High-Risk flood zone is $758.89

This option is great, and we are very happy when we can get this option. They can be a bit choosey about what risk they will accept and will not take anything that has had a flood loss. They offer basements coverage, about $2,000 for loss of use, and $2,000 for other structures, but they can’t increase this coverage. They do not require an Elevation Certificate to rate.

Maryland Private flood insurance – Lloyd’s of London Flood Insurance (option 2)

Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

Lloyd’s of London (option 2) Annual premium in High-Risk flood zone is $849.67

This option is great, and we are very happy when we can get this option for our clients. They seem to be writing almost all risks. However, they do not write any property in a designated floodway or has a depth of -4 under the BFE. In our example, with our BFE being 5, they will not accept this risk if the lowest floor is 1. They will not take anything that has had a flood loss. They offer limited coverage for basements and do not require an Elevation Certificate to rate and as a percentage of coverage for loss of use. If you want coverage for other structures, that will need to be added.

Private Flood insurance option (option 3) Not Lloyd’s

Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

The annual premium in a High-Risk flood zone is $3,401.52

This option will take properties that have had one flood loss for more than five years, and the payout was under $100,000 on the claim. Their coverage matches the NFIP. They will write practically all risks, don’t need an elevation certificate to rate, and are a bit lower in premium than the NFIP.

Private Flood Insurance – Lloyd’s of London (option 4)

This option must be written on the building’s Replacement Cost Value (RCV). Otherwise, there is a co-insurance penalty that kicks in. So, $250,000 might be a bit low in California, but to keep this going, let’s just use that for this option

Coverage of $250,000 (RCV) building coverage, No Contents, and a $5,000 deductible

The annual premium in a High-Risk flood zone is $849.67 (a great price).

This options rating system is all over the board. Sometimes we get a crazy great price, but other times the premium is way higher than the NFIP will consider taking a property that has had one flood loss before as long as it has been more than ten years and the payout was under $50,000 on the claim. Their preferred coverage is at replacement cost, slightly different from some of our other LLloyd’sflood options. We usually reserve this one if the property doesn’t fit the above options. We can adjust coverages to control premiums. As mentioned before, this underwriter’s rates are all over the board. It is worth shopping through to ensure we are getting you the best premium possible. They don’t need an elevation certificate to rate.

Private Flood Insurance – Lloyd’s of London (option 5)

Coverage of $250,000 (RCV) building coverage, No Contents, and a $5,000 deductible.

The annual premium in a High-Risk flood zone is $1,115.86

This option came from the company that used to run the NFIP program, so the coverage matches the NFIP coverage with two differences. They offer living expenses covering your cost when you are displaced from your home during repairs (most Lloyds flood policies offer this). They also offer swimming pool clean-out, which is kind of unique so if you have a pool ask for this coverage.

Private Flood Insurance – Lloyd’s of London (option 6)

Coverage of $250,000 (RCV) building coverage. No Contents and $5,000 deductible.

The annual premium in a High-Risk flood zone is $669.00

This options rating system is also all over the board. Sometimes we get a crazy low price; other times, the premium is way higher than the NFIP. They will consider taking a property that has had one flood loss before as long as it has been more than ten years and the payout was under $25,000 on the claim. They have been rumored to give a low price the first year and then non-renew the following years, or sometimes they jack the price way up so we will watch them. They have a slick system, and their underwriting is managed by a 3rd party, which also sometimes seems to be a glitch.

More options are coming online every day, and we are working to be looking into every viable option.

Maryland has 66,641 NFIP policies in force to date, with a total cost of $38,179,561. That would make the average flood rate for Maryland $573. Of course, some will pay more, and some will pay less.

Click here to have us shop and save you money.

Flood Insurance Rate Map Maryland

Hello, Maryland! Thanks for visiting our page for all your flood insurance needs.

LLet’sstart off with Allegany, Maryland, where the average flood rate is $1,625. The premiums total $341,289, with 210 flood policies in effect.

In Annapolis, Maryland, the active flood policies number 511 with $506,967 in written premium. The average flood rate in Annapolis is $992.

Next is Anne Arundel, Maryland, where the premiums add up to $3,621,848 with 5,477 flood policies. The average flood rate in Anne Arundel is $661.

Baltimore Maryland Flooding

Three thousand six hundred eleven flood policies are active in Baltimore, Maryland. Baltimore has $3,908,741 in written premiums, which makes the average flood rate $1,082.

Calvert, Maryland, has an average flood rate of $878. The premiums here total $485,548 with 553 policies active.

$735 is the average flood rate in Chesapeake Beach, Maryland. Chesapeake Beach has 180 flood policies in effect with $132,321 in written premiums.

The average flood rate drops to $534 in North Beach, Maryland. North BBeach’spremiums total $57,107 with 107 active flood policies.

One hundred five flood policies are active in Caroline, Maryland. Caroline has $72,471 in flood premiums which allows the average flood rate to be $690.

Now let’s look at a group of areas that include Federalsburg, Elkton, and North East, Maryland. These areas have $214,155 in written premiums. The active flood policies, number 151, allow the average flood rate to be $1,418.

The average flood rate drops to $961 in Carroll, Maryland. Carroll has 180 flood policies in effect with $172,902 in flood premiums.

$646,913 is the flood premium total in Cecil, Maryland. Cecil has an average flood rate of $1,388, including 466 active flood policies.

The average flood rate drops to $232 in Perryville, Maryland. Perryville has 155 flood policies in effect with $35,912 in flood premiums.

Port Deposit, Maryland, has 177 flood policies active with $90,307 in written premium. Port Deposit has an average flood rate of $510.

In Charles, Maryland, the average flood rate rises to $754. Charles active flood policies number 670 with $505,008 in flood premiums.

189 is the total of flood policies in effect in Cambridge, Maryland. Cambridge has an average flood rate of $529, including $99,901 in total premiums.

Now, look at Dorchester, Maryland, where the premiums total $1,111,398. The active flood policy number 1,283 allows the average flood rate to be $866.

There are 592 flood policies in effect in Frederick, Maryland. Frederick has an average flood rate of $1,024, including $606,483 in written premiums.

Garrett and Aberdeen, Maryland’s premiums add up to $117,754. The policies here, number 142, allow the average flood rate to be $829.

Bel Air, Gaithersburg, and Hagerstown, Maryland, have an average flood rate of $868. The premiums here total $130,256, with 150 flood policies in effect.

$705 is the average flood rate for Harford, Maryland. Harford has 442 flood policies active with $311,818 in flood premiums.

In Havre De Grace, Maryland, the active policies number 394 with $300,384 in written premium. The average flood rate for Havre De Grace is $762.

One thousand eighty-one flood policies are active in Howard, Maryland. The average flood rate in Howard is $730, which includes $789,036 in flood premiums.

Hello Baltimore! Glad you all stopped by! The average flood rate for Baltimore, Maryland is $759. The premiums in Baltimore total $2,133,333, with 2,810 flood policies in effect.

Next up is Chestertown, Maryland, where the active flood policies number 102. The premiums in Chestertown total $114,264, which allows the average flood rate to be $1,120. Give us a call, Chestertown!

The average flood rate drops to $833 in Kent, Maryland. The premiums here total $209,937 with 252 active flood policies.

Check out Rock Hall, Maryland, where the premiums total $210,637. The flood policies total 236, allowing the average flood rate to be $893.

Again, the average flood rate drops to $560 in Montgomery, Maryland. Montgomery has 1,958 flood policies in effect with $1,096,400 in written premium.

Rockville, Maryland, has 136 flood policies active with $59,670 in flood premiums. The average flood rate in Rockville is $439.

The average flood rate rises to $1,150 in Laurel, Maryland. Laurel has $228,810 in flood premiums with 199 active flood policies.

Three thousand three hundred forty-three flood policies are active in Prince Georges’s, Maryland. Prince Georges has $2,318,081 in total premiums, which allows the average flood rate to be $693.

Next is Queen Annes, Maryland, where the average flood rate is $607. The premiums in Queen Annes total $1,379,894 which includes 2,272 active flood policies.

$775 is the average flood rate in Crisfield, Maryland. Crisfield has 560 flood policies active with $434,212 in flood premiums.

Somerset, Maryland, has 1,331 active flood policies. The premiums here total $1,087,037, allowing the average flood rate to be $817.

The average flood rate rises to $859 in St. Marys, Maryland. St. Marys has 1,258 flood policies in effect and $1,080,651 in total premiums.

In Easton, Maryland, the premiums total $65,741 with 115 active flood policies. Easton has an average flood rate of $572.

Three hundred nine policies are active in Oxford, Maryland. Oxford has $243,894 in written premiums which allows the average flood rate to be $789.

St. Michaels, Maryland next. The active flood policies number 147 with $126,663 in written premium. The average flood rate in St. Michaels is $862.

$655 is the average flood rate in Talbot, Maryland. Talbot has 1,614 flood policies in effect with $1,057,707 in flood premium.

The average flood rate rises to $837 in Washington, Maryland. Washington’spremiums total $225,243 with 269 active flood policies.

Salisbury, Maryland, has 252 flood policies with $262,927 in written premiums. The average flood rate in Salisbury is $1,043. Give us a call, Salisbury!

Four hundred seventy-four policies are active in Wicomico, Maryland. Wicomico has $292,306 in premiums which allows the average flood rate to be $617.

Ninety policies are active in Berlin, Maryland. Berlin has an average flood rate of $136, including $44,094 in total premiums.

Hello Ocean City! You all have the highest flood policies in the state, with 26,000 active policies. The premiums in Ocean City, Maryland, total $7,588,911, which allows the average flood rate to be $292.

Finally, let’s look at Worcester, Maryland, where the policies number 5,312 with $3,019,760 in flood premiums. The average flood rate in Worcester is $568.

Thanks for checking out all the flood information on Maryland!!

How to save money on Flood Insurance in Maryland VE flood zones

All homes that are ocean-facing are custom built, so with this special consideration, our Lloyd’s of London VE flood zone and other Private Flood Insurance options for oceanfront properties consider this with variable coverage options and significant savings. Below is a case study for a property we were shopping for just last week.

Our example was in the Ocean City, MD area and is in a VE flood zone map.

For the coverage of $250,000 with no contents and a $5,000 deductible, the NFIP annual cost for flood insurance in a VE flood zone is $20,922.00. Ouch!

Since we are who we are and experts in Flood Insurance, we will look at every property every way possible to ensure that we are getting the best premium for our clients, and WE often Do (smile wink)

We tried this same property on our Private flood options and were able to get the premium to under $7,500, and we have, in some cases with similar properties, get the annual premium to $600. This was a feather in our cap and made our clients very happy. Again all properties are unique in these VE flood zones, but if we can find a private flood policy for you, we guarantee it will be better than the NFIP option.

Let us help you save money today.

Maryland Flood Insurance Calculator

For decades, the NFIP has over-charged 50 percent of its policyholders and under-charged the other 50 percent, while it has racked up $42 billion in taxpayer-funded losses, equating to more than half of every claim paid by the NFIP since 1978.

About 30 percent of NFIP claims payments go to the same 3 percent of insured “repetitive loss” structures yearly. When you do the math, this means that the other 97 percent of their flood-exposed constituents could have paid in less and still netted larger claims payouts if they had better access to private flood insurance. A recent white paper by Milliman found that 90 percent of homes in Sandy-struck Maryland and New Jersey would see reduced flood insurance rates through private insurers.