Get Flood Insurance Hawaii & Save Money Too.

People in Hawaii save on average $500 to $1,457+ on their annual flood premiums.

In many cases, we save them even more. Get the cheapest flood insurance in Hawaii without sacrificing coverage.

Get flood insurance from a Flood Nerd® at Better Flood Insurance® and save big time.

featured on

Save Money On Your Flood Insurance Hawaii

Get Cheap Flood Insurance without Compromising Coverage

Affordable Coverage

★★★★★

"Same Coverage at a Better Rate"

-Mohammed K

Flood Nerds will shop the private flood insurance markets and then compare them to the NFIP, guaranteeing you the better option. We will send you the cheapest flood insurance rates within minutes.

Quick Quote & Coverage

★★★★★

"Quick Response, Very Knowledgable"

– Robert W

Paying for low-cost flood insurance is awesome. And letting the Flood Nerds shop your property has other benefits – you can get better coverage while saving money, and you can get it fast.

We Have Satisfied Clients

★★★★★

"Would highly recommend Better Flood for your flood insurance needs."

– Varun K

Better Flood Insurance is an independent flood insurance broker that shops flood insurance ONLY. Flood Nerds are Flood insurance experts. We have 5000+ happy clients and 390+ 5-star reviews.

Flood Insurance In Hawaii

Aloha! My name is Robert Murphy, and I’m the Top Flood Nerd™ at Better Flood. We Flood Nerds are flood insurance experts. Flood insurance is complicated, especially with terrain like you have in Hawaii. But we Flood Nerds thrive on complexity and we love to shop for flood insurance. Most people in Hawaii think they are stuck with flood insurance through the government’s National Flood Insurance Program (NFIP). But that’s not true. So, if you’re tired of paying flood insurance premiums that get more and more expensive each year or you just need cheap flood insurance fast, let us find you the best coverage and price.

Does my Hawaii homeowners insurance cover flooding?

Do I need flood insurance in Hawaii?

What are my flood insurance options in Hawaii?

National Flood Insurance Program Hawaii

Hawaii private flood insurance market

How much does flood insurance cost in Hawaii?

4 things you need to know about flood insurance in Hawaii Islands?

Hawaii Flood Insurance calculator

Cost of flood insurance in Hawaii?

Hawaii Homeowner’s Insurance Doesn’t Cover Flooding

A typical homeowner’s policy for a home in Hawaii is written through State Farm, USAA, or First Insurance Company of Hawaii. These policies protect your home from things like fires and theft. But they don’t cover damage to the structure or contents from rising water. If the wind blows the roof off and rain gets inside, you are covered. But if there is a flood or a tsunami, you are out of luck if you don’t have flood insurance. Your homeowner’s policy won’t cover damage to the building or your belongings.

Don’t believe me? Just give your homeowner’s agent a jingle and ask them about adding a flood coverage endorsement to your homeowner’s policy. When the aka’aka stops, they’ll tell you it’s not possible. But the risk of flooding isn’t funny in Hawaii. Flooding is a serious business in Hawaii.

You Must Have Flood Insurance for Flood Protection in Hawaii

If you want to protect your property from flood damage or tsunami damage, you must have a separate flood insurance policy. And unfortunately, most State Farm, USAA, and other insurance agents will just write you a policy through the National Flood Insurance Program (NFIP). It’s their easiest and only way to get you a policy. Unfortunately, it is often the most expensive flood insurance you can buy. The Write Your Own arm of the NFIP lets the big insurers slap their company’s logo on an NFIP policy so it looks like private flood insurance. Of the approximately 60,000 NFIP flood policies recently in effect in Hawaii, 58,704 of those were just Write Your Own policies – national flood insurance under a private logo.

These people probably think they are saving money with a private Hawaii flood insurance policy, but they aren’t.

We Flood Nerds are Hawaii Flood Insurance Experts. We know all the ins and outs of the Hawaii private flood insurance market and we know the NFIP too. That’s why we can always find you the very best coverage for the absolute very best price.

Getting a quote for Hawaii flood insurance is fast and free. You should do it now.

Do You Need Hawaii Flood Insurance?

Flooding is a serious problem in Hawaii, and since Hawaii homeowner’s insurance doesn’t cover the risk you should have flood insurance.

One of the downsides of the NFIP is that it created a misperception that if you aren’t in a high-risk flood zone, you don’t need flood insurance. That’s just wrong. If it can rain, it can flood. And if Chile can have an earthquake, Hawaii can have a tsunami.

In 1960, the Vivaldi earthquake shook Chile and the resulting tsunami killed 61 people in Hilo and flooded countless homes and businesses. Hawaii doesn’t need a Kona storm, tropical storm, or tsunami to create a flood. In November of 2020, it rained and it rained hard and fast on the Big Island. Kapapala Ranch received over 37 inches of rain in just 24 hours. The water overwhelmed existing streams and even cut new streambeds. The flooding was catastrophic. sadly, 300 homes were destroyed.

Source

When it rains in Hawaii, it pours. Hawaii averages 11 flash floods in Honolulu County each year.

And more than coastal areas are at risk. According to FEMA, the government agency that oversees the government flood insurance program, 25% of claims they pay out are in low-risk areas.

Yes, you need to buy flood insurance if you own a home or business in Hawaii.

In high-risk areas, lenders require buyers to purchase flood insurance. Just because your lender didn’t require it for your loan doesn’t mean you are safe from flooding.

That’s not hyperbole, it’s just a fact. One we Flood Nerds never forget.

See, over the last 50 years, the government has collected flood data and it shows that recent major storms cause flooding in low-risk areas. And 90% of people who had floodwater in their homes after these flooding storms didn’t have flood insurance.

In Hawaii, there is no such thing as no risk of flooding. So, ask a Flood Nerd to help you get private flood insurance and save money on Hawaii flood insurance!

Flooding Without Flood Insurance Is Pilikia

Pilikia means trouble of any size in Hawaiian. And if your home is damaged by flooding and you don’t have flood insurance you have BIG pilikia. You must pay to repair the damage. You may wipe out your savings or try to get a loan, but it’s all on you.

Flooding is one of the most expensive causes of damage to repair. It can cost $40,000 to $90,000 and that’s not even considering the damage to the contents of your home.

And flooding without flood insurance causes financial ruin. When a flood washes away your home, it doesn’t wash the mortgage away too. People that don’t have flood insurance or savings to rebuild often just walk away from the home. It’s sad but true. People dealing with foreclosure and trying to start over are at a disadvantage. In addition to losing their home and possessions, they lose their credit rating too due to the foreclosure.

The government isn’t going to help.

The myth of significant government assistance after a disaster is spread by people who have never lived through a disaster.

Here’s what really happens with government “assistance”:

The Governor of Hawaii must request a federal declaration of disaster.

The President must declare the area a disaster area making federal assistance available.

You must fill out forms to apply for that assistance.

If you are approved, “assistance” comes in the form of an SBA-backed loan you MUST pay back.

That government assistance will be about $6,000.

Crazy right?

The government will loan you $6,000 to cover your loss, which will average about $40,000 to $90,000. Plus you’ll pay interest on that loan.

This is why so many properties are abandoned or foreclosed on after flooding. In Houston, the foreclosure start rates after the Hurricane Harvey floods spiked 76%. A Federal Reserve of New York report found that after people lost their homes to Hurricane Katrina, they just left the state. Now, you can drive your car out of Louisiana, but you aren’t driving away from Hawaii. It’s costly just to leave the state, much less have the financial resources necessary to start over in a new place.

Flooding is one of the most common natural disasters in Hawaii ~ If you don’t have flood insurance you face financial ruin.

Source

Since 1980, 80% of federal disaster declarations have been for floods.

When disaster strikes, federal assistance may help a little, but only a little. It’s better to have the security of flood insurance rather than rely on the government.

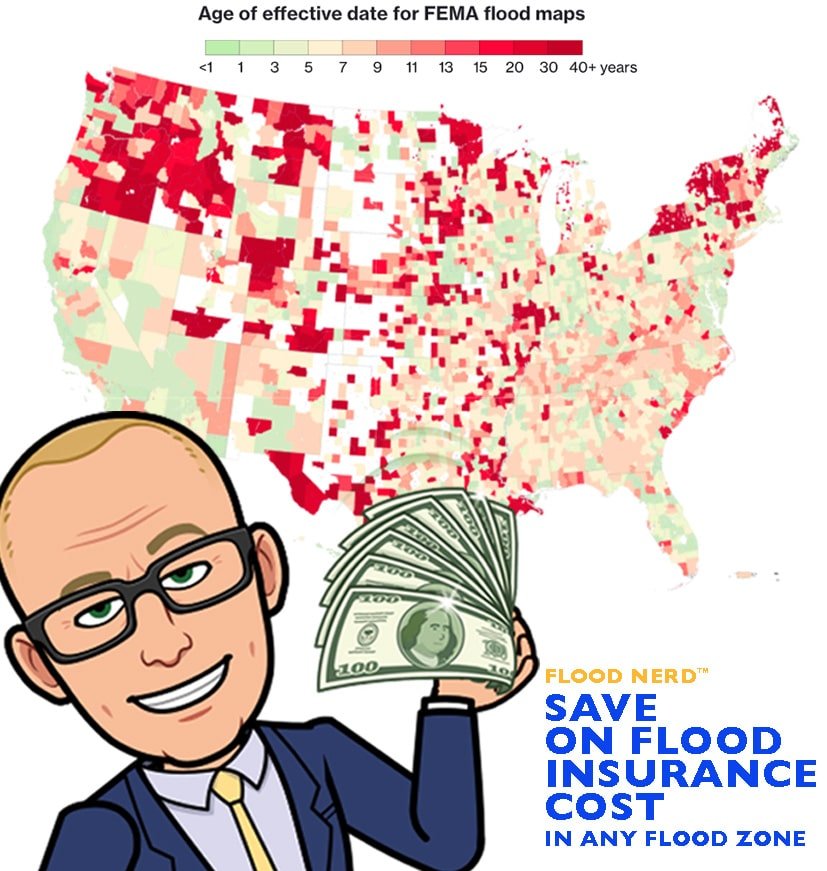

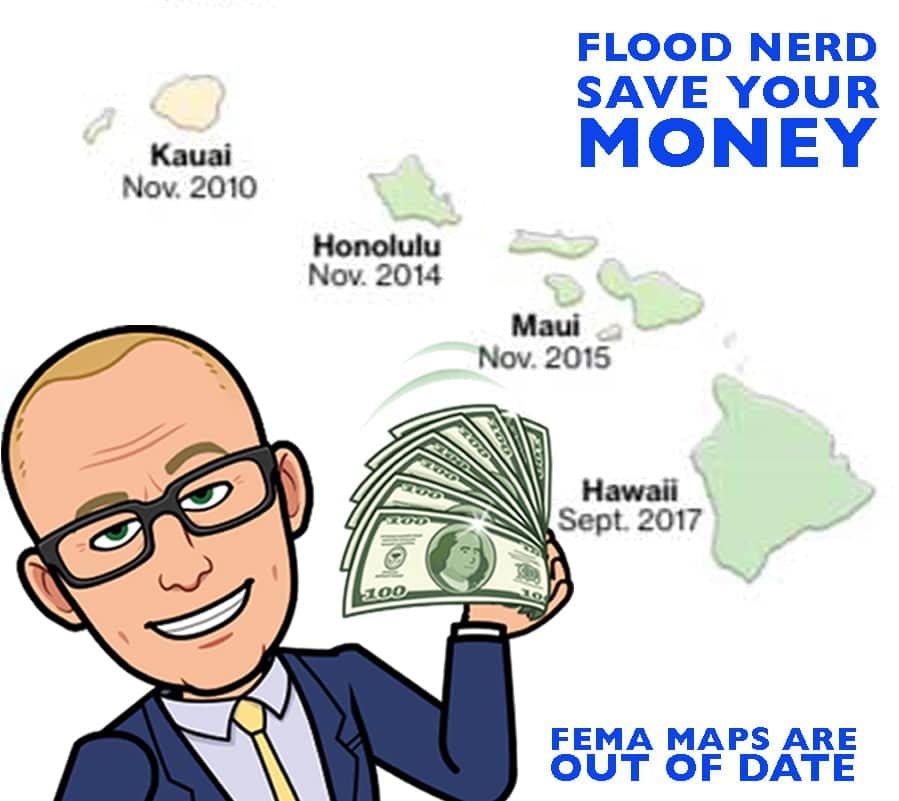

Flood Maps in Hawaii

FEMA is supposed to update flood maps every 5 years. But in reality, that doesn’t happen. There are areas of the Hawaiian islands designated Flood Zone D, which means FEMA has never created the first map, much less updated it! If your property is in an area that was developed after the flood map was last updated, the map isn’t accurate anymore.

Even on flat land development literally changes the landscape. And on hilly or mountainous terrain the effect of development is amplified. Buildings, parking lots, and driveways cover the soil with concrete. Once covered, the soil isn’t able to absorb water any longer. It has to go somewhere and development changes how the water flows. Areas that were high and dry before neighboring development may be subject to flash flooding. Incorrect maps don’t accurately reflect the risk of flooding.

Hawaii property owners relying on those bad maps are left under or uninsured.

In April of 1974 in Kauai, on the island of Oahu torrential rain fell and caused flooding that killed 4 people and destroyed many lives, homes, and livelihoods.

Source

And Kauai is in a “low risk” flood zone, Flood Zone X.

That wasn’t some freak occurrence. On December 14, 1991, persistent, heavy early morning rains fell and the Anahola Stream was inundated. More homes were destroyed, more lives were lost. And to this day, the Anahola Stream is considered a low-risk flood area.

It can flood anywhere in Hawaii.

No matter what the map says, it’s better to have coverage and not need it than to not have coverage and wish you did.

Hawaii Flood Insurance Options Lloyds of London Flood Insurance Hawaii Market

Most homeowners, real estate agents, and lenders don’t realize all the many options you have when buying Hawaii flood insurance. But the Flood Nerds have the 411 on cheap flood insurance in Hawaii. We know more than 5 Ways to Save on Flood Insurance in Hawaii. There are two markets for flood insurance in Hawaii: the national government and private insurance companies.

NFIP Hawaii

The National Flood Insurance Program is the government option for flood insurance. It is administered by FEMA and has held a 50-year monopoly on the market. The premiums they charge reflect their power over the “free” market.

The NFIP mainly uses resellers like State Farm, USAA, and First Insurance Company of Hawaii (to name a few) to sell you a policy under their company name. But the insurance company isn’t covering you. You are getting an NFIP policy with an insurance company’s logo on it.

Check your existing policy. If you see one of these logos, you don’t have private flood insurance. You have a government policy with an insurance company logo. It could be a wolf in sheep’s clothing.

It is nothing more than a government policy in disguise. And chances are that’s not the best value for flood insurance in Hawaii. If you want to see if your policy is one of these incognito NFIP policies, check out this list of companies that resell the NFIP policy.

Hawaii Private Flood Insurance

Hawaii may be a chain of small islands, but it is large enough to handle a thriving private flood insurance market. You can even tap into the Lloyds of London flood insurance syndicate to get Hawaii flood insurance. Lloyds spreads the risk all over the globe, so you get better rates. The risk of flooding the entire Earth at the same time is very small. We Flood Nerds joke “God said he wouldn’t flood the world again and Lloyds of London takes him at his word”. Now you know what makes a Flood Nerd laugh.

We Flood Nerds love a good laugh, but we know getting affordable Hawaii flood insurance is serious business. There are so many great real private insurance company options that it is easy to confuse the true private flood insurance market with NFIP re-sellers.

A Flood Nerd will shop all the flood insurance options for your Hawaii property to ensure you get the best premium. And after we check the private market, we’ll compare it with the NFIP to make sure you always get the best price and coverage for Hawaii flood insurance.

The Cost of Flood Insurance in Hawaii

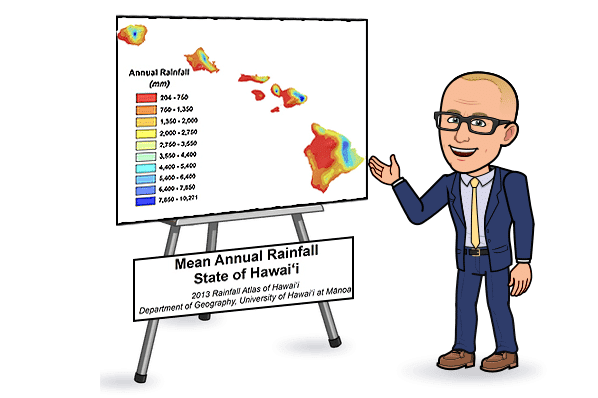

Hawaii has breathtaking mountains, verdant valleys, and beautiful coastlines. There’s a reason people flock to this paradise. But wave action and hilly terrain increase the risk of flooding. And then there’s those pesky Kona storms and torrential rainstorms too.

Courtesy: Giambelluca, T.W., Q. Chen, A.G. Frazier, J.P. Price, Y.-L. Chen, P.-S. Chu, J.K. Eischeid, and D.M. Delparte, 2013: Online Rainfall Atlas of Hawai‘i. Bull. Amer. Meteor. Soc. 94, 313-316, doi: 10.1175/BAMS-D-11-00228.1

Two major factors that impact the cost of your flood insurance in Hawaii is where the property is located and what company you choose to cover the risk.

Flood Zone X Hawaii

Lenders don’t require flood insurance when they provide a mortgage for a property in this flood zone. But remember, floods like those in 1974 and 1991 happen in these “low risk” zones, so you still need coverage even if the lender doesn’t require it.

For properties in the X Flood Zone, we usually suggest the government Preferred Risk Policy (PRP). The government subsidizes a portion of the premium and limits the amount of coverage you can buy, so this helps keep the rates low.

The average cost for PRP flood insurance in Hawaii with the maximum set limits in low-risk flood zone areas ranges from $405 to $700 per year.

Hawaii Flood Zone AE

Flood Zone AE represents a higher risk of flooding. If your property is in Flood Zone AE, your lender will require you to buy flood insurance.

The cost of flood insurance in Hawaii for a building in flood zone AE really depends on factors that are unique to the structure.

As an example, let’s look at a house built on a slab on grade in Kihei, Maui County. The Base Flood Elevation (BFE) is 20 and the home was built before 1963. The sample policy is for flood coverage at the NFIP maximum of $250,000 for the building only. It doesn’t include contents and the deductible is our recommended amount of $5,000.

While the example house is in Kihei, the premiums will be the same as in Honolulu County, Hawaii County, Kauai County, and most other areas in AE flood zones.

The NFIP option for flood insurance in Hawaii Flood Zone AE is $2,241

This would be the cost for a property that experienced a previous flood loss and either doesn’t have an Elevation Certificate or the Elevation Certificate shows the lowest floor is 4 feet under the BFE. This policy lets you apply 10% of your coverage for the other structures that may be on your property

Now, let’s look at the real Hawaii private flood insurance market and compare the options. The coverage and deductible are exactly the same.

The Hawaii private flood policy (not Lloyds of London) policy would be $1,159

This option is great but the property can’t have a flood loss in the last 5 years. And any prior claim must have been under $25,000. The coverage is the same as the NFIP but no Elevation Certificate is required. That saves money because Elevation Certificates are expensive.

Hawaii private flood insurance through Lloyds of London is $750.00

This premium gives you the same $250,000 coverage on the building, no contents coverage, and a $5,000 deductible. This is a great option if the property is no more than 4 feet below the BFE and has never had a flood claim before. And unlike the NFIP policy, you get coverage for loss of use. That’s important when you can’t live in your home and must pay for temporary housing.

There are more options coming online every day, and we are working to be looking into every viable option.

Currently, Hawaii has 60,625 NFIP policies in force to date with the total cost of $40,778,877. That would make the average for Hawaii $673. Of course, some will pay more, and some will pay less.

Click here to have us shop and save you money.