LOMA should I get one?

Should I get a LOMA?

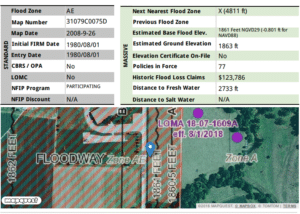

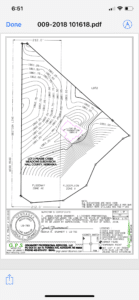

Let’s talk about what a LOMA really does. In the bureaucratic realm, sure, it exempts your property from a mapped flood zone. But does it change the topography of your land? Does it redirect water flow or build a barrier against torrential rains intensified by our changing climate? No, Amy. A LOMA doesn’t alter the earth’s behavior or shift the tide of meteorological events.

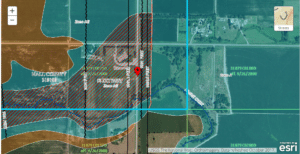

Take a look at your local map. See all that blue? Those are waterways, areas where—LOMA or no LOMA—water could potentially invade. Let’s not forget, water doesn’t adhere to the boundaries we draw; it obeys only the laws of physics.

Consider the economics of your decision. Flood damage doesn’t come cheap. Repairs could run you anywhere from $60,000 to an eye-watering $200,000. Think about it: Are you prepared to pull from your nest egg or burden yourself with high-interest loans? All the while, a flood insurance premium could have offered you the coverage you needed for a fraction of those costs.

Let’s talk about what a LOMA really does. In the bureaucratic realm, sure, it exempts your property from a mapped flood zone. But does it change the topography of your land? Does it redirect water flow or build a barrier against torrential rains intensified by our changing climate? No, Amy. A LOMA doesn’t alter the earth’s behavior or shift the tide of meteorological events.

Take a look at your local map. See all that blue? Those are waterways, areas where—LOMA or no LOMA—water could potentially invade. Let’s not forget, water doesn’t adhere to the boundaries we draw; it obeys only the laws of physics.

Consider the economics of your decision. Flood damage doesn’t come cheap. Repairs could run you anywhere from $60,000 to an eye-watering $200,000. Think about it: Are you prepared to pull from your nest egg or burden yourself with high-interest loans? All the while, a flood insurance premium could have offered you the coverage you needed for a fraction of those costs.

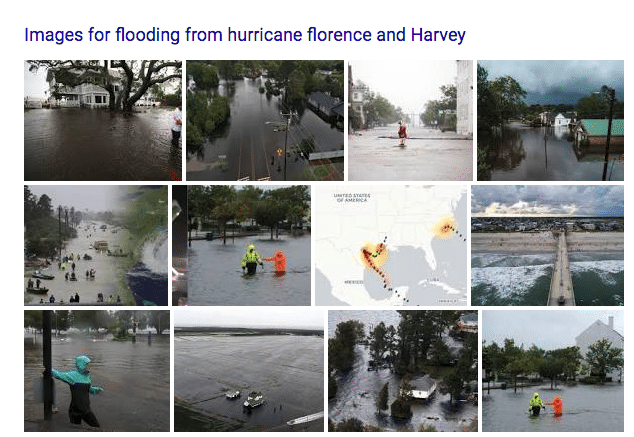

Flooding has been and still is the is the #1 natural disaster the United State faces, costing billions in damage and ruined property as well as lost lives and displaced families.

Let’s cut to the chase. Home insurance companies are not in the business of losing money. They exclude flood risks for a reason: they’re more likely to occur than, say, your home catching fire. You might be inclined to question this logic, but the statistics don’t lie. Flooding remains the United States’ #1 natural disaster, causing billions in damage and leaving countless lives in shambles.

You mentioned your mortgage lender will insist on flood insurance. That’s not a coincidence or a bureaucratic hiccup. It’s mandated by federal law for properties in high-risk flood zones, usually identified with an ‘A’ or ‘V’. You may think a LOMA would free you from this obligation, but many lenders still won’t let you drop the coverage. Why? Because the inherent flood risk remains. Your property’s proximity to a mapped floodway—essentially a fast-moving highway for floodwaters—should be a wake-up call.

Flooding is not covered on your homeowner’s policy.

Let me share a stark reality. In recent floods in the Carolinas and Houston, a staggering 90% of those affected did not have flood coverage. Many of these homeowners resided in areas deemed low-risk—some of which were even rezoned due to political pressure. You see, Mother Nature doesn’t care about our laws or maps. She does what she wants, when she wants.

So, Amy, I’ll leave you with this. Insurance exists for a reason: to protect us from risks we hope never to face. It’s not a game of chance but a safeguard against the inevitable uncertainties of life. If your sole intention is to obtain a LOMA and drop your coverage, we might not be the agency you’re looking for. But if you’re open to truly protecting your property and your peace of mind, let’s talk.

Warm regards, Robert, Your Flood Insurance Advocate

LOMA’s do NOT remove the Risk of Flooding.

P.S. We have some phenomenal Preferred Risk Policies that could provide you with excellent coverage and affordable premiums. It’s something to think about, especially if that LOMA is still a few months out.

This is the type of honest conversation we strive to have with every client, focused on protecting not just property, but lives and peace of mind. If you’re navigating the complexities of LOMA and flood insurance, we’re here to offer real solutions for real risks.

Mother nature doesn’t stay within our map lines.

Flooding has been and still is the is the #1 natural disaster the United State faces, costing billions in damage and ruined property as well as lost lives and displaced families.

I want you to please consider and note that 90% of those that flooded in both Carolina’s and Houston did not have flood coverage (NONE) this was because they were in what is considered a low-risk area, some of these areas have been mapped out due to political pressures (developers not wanting to sell NEW homes that will require flood insurance) some of these areas have never seen the flood waters before. I am willing that ALL of these 600,000+ properties believed it wouldn’t happen to them.

Insurance is there to cover your risk, Home insurance, auto insurance, life insurance and we really hope to never use it. I hope you never ever ever have a flood; I also hope that if you do at least you have some kind of coverage.

If you are looking to just get a LOMA and drop your Coverage, then I don’t know if the FLOOD NeRD is the best to write your policy.

MY thoughts. Welcome yours.

YOUR FLOOd NeRD