How do I get a LOMA?

WARNING: Are you considering requesting a Letter of Map Amendment (LOMA) to drop your flood coverage, since it might not be required by your lender? While the likelihood of a flood may seem low, the devastating financial and emotional impact of a disaster without adequate coverage far outweighs the risk, no matter how remote it may appear right now.

How to get a LOMA

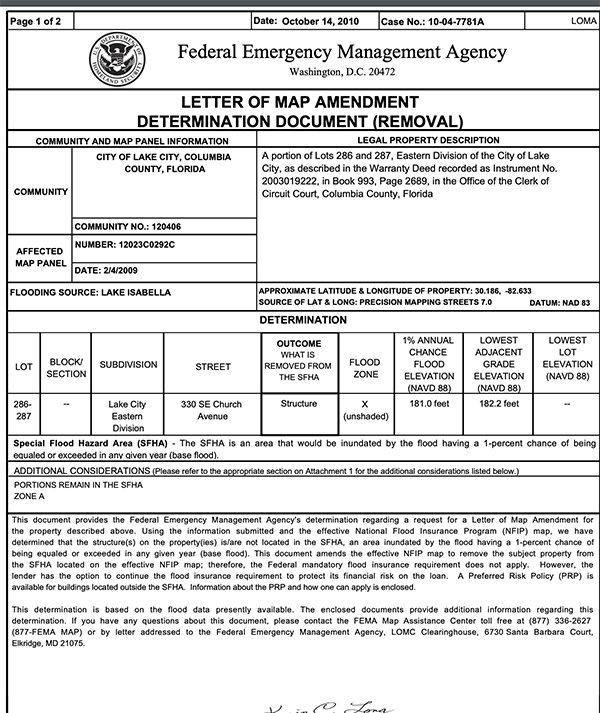

A Letter of Map Amendment (LOMA) is a critical document that serves as an official amendment to the Federal Emergency Management Agency’s (FEMA) Flood Insurance Rate Map (FIRM). It is used to confirm that a property is not located within a Special Flood Hazard Area (SFHA) and is therefore not subject to the mandatory purchase of flood insurance. Obtaining a LOMA can significantly reduce insurance costs for property owners, as it demonstrates a reduction in flood risk.

To obtain a LOMA from FEMA, the property owner must first submit an application along with the required supporting documents. This typically includes:

Property deed or legal documentation

Elevation Certificates

Topographic surveys

Site plans or maps showing the property’s location in relation to the floodplain

Once the application is submitted, FEMA will review and assess the provided documentation to determine if the property is indeed outside the SFHA. The processing time for LOMA applications can vary depending on several factors, such as the complexity of the property, the accuracy of the submitted data, and the current caseload of the agency.

Under normal circumstances, FEMA may take between 30 to 60 days to process a LOMA application. However, this timeframe can be affected by several external factors such as natural disasters, government shutdowns, or an unusually high volume of applications. Additionally, delays can occur if the application is incomplete or contains inaccurate information.

To expedite the LOMA application process and avoid unnecessary delays, consider the following tips:

Provide accurate information: Ensure that all information provided in the application is accurate and up-to-date. Pay close attention to details such as property measurements and elevation data.

Gather required documentation: Assemble all necessary supporting documents before submitting the application. Missing or incomplete documentation will prolong the process.

Follow up: Stay in touch with FEMA throughout the application process and respond to any inquiries or requests for additional information promptly.

Online application: Submitting the application online through the FEMA eLOMA portal can streamline the process and reduce the likelihood of lost or misplaced paperwork.

Work with a professional: Hiring an experienced surveyor or floodplain management professional can help ensure that the application is properly prepared and all the required documentation is in order.

In conclusion, obtaining a LOMA from FEMA typically takes between 30 to 60 days. However, this timeframe can be affected by various factors that include but are not limited to the complexity of the property, the agency’s caseload, natural disasters, and government shutdowns. By providing accurate information, gathering necessary documentation, following up, submitting an online application, and working with a professional, a property owner can increase their chances of a smoother and faster LOMA approval process.

Below is a Conversation with a client on Bigger Pockets.

Shawn Ziegaus, Rental Property Investor from Lake City, FL

Just getting into my first rental. However, the flood insurance we are having to pay is a pretty hefty payment each month. I have been looking into petitioning for the removal of the requirement just solely to be able to increase monthly cash flow. If anyone has any tips on how to go through this process or the best way to increase your odds of being able to get out of it, your input would be greatly appreciated.

*On a side note about this property. Every other house around it is not in the flood zone, and the only piece of the lot that is in the flood zone is a small area in the corner of the front yard. The house is also 13 feet off the ground and is no real danger of flooding (based on the 10-year flood plain) .*

YES PLEASE SHOP MY FLOOD INSURANCE

Hi @Shawn Ziegaus, Have you tried shopping for your flood insurance on the private flood insurance market?

I suggest you Google (private flood insurance) or (Lloyd’s of London flood insurance) skip over the ads and look for an agent that will shop all options (including the NFIP or government option).

We do a free audit of someone’s current policy (and often find errors) as most agents don’t specifically deal with flood insurance and are not experts at how to get the best premium for their clients.

Moving the policy to the private flood insurance market, you might be able to save money.

How to get a LOMA.

Getting a LOMA (Letter of Map amendment) takes a very long time, and there is a trend that the government is not removing properties as readily as it did a few years ago.

We have also seen that properties are removed and then returned the next year.

VERY frustrating.

Anyway, there are a few things I can offer you to see if your home qualifies for the LOMA.

1) First look up your property in this link

https://hazards-fema.maps.

2) Put in your property address

then on the right-hand side, there is a menu tool. Click on it to scroll down and look for the LOMA. Click it on.

This will turn on all the properties that have applied the address.

3) Click on the download, and you will see the pop-up of what the result is.

Look for the area that says OUTCOME and look to see if it says “Removed” or “NOT removed.”

NOTE: you will have to be patient the site is a bit slow, but if you wait for it to develop, you will be able to discover a lot about your area, so be patient.