SHOULD YOU BUY A HOME IN A FLOOD PLAIN? READ THIS BEFORE YOU REGRET IT

So, you’ve found the house.

It’s got the perfect location. The kitchen of your dreams. That backyard oasis where you can already picture summer BBQs and late-night fires.

Then BAM—three little words crash the party: Flood. Risk. Zone.

Now, you’re sweating.

Is this home a deal-breaker? Is flood insurance going to cost you your firstborn? Should you run for the hills—or is there a way to make this work?

Buckle up, because I’m about to tell you exactly what you need to know about buying a home in a flood zone—without getting wrecked by hidden costs, bad policies, or a gut-wrenching disaster down the line.

FIRST—WHAT EVEN IS A FLOOD ZONE?

FEMA has these fancy maps that tell you how likely it is that a certain area is going to flood. They slap labels on different sections of land, ranking them from “Not likely” (yeah right) to “You might as well buy a boat.”

But here’s the kicker: flood maps change all the time. One year, a home is in a safe zone. Next year? Boom—it’s a high-risk flood zone.

And here’s the part nobody talks about: Being in a flood zone isn’t necessarily a bad thing. In fact, it can be a smart move. Why? Because when a property is officially in a flood zone, local governments are required to take flood mitigation efforts seriously.

Think massive drainage projects, levees, improved byways—all designed to protect homes in high-risk flood zones. And guess what? These efforts work. When historic floods hit, the properties required to carry flood insurance are often the ones that don’t flood—while the ones outside the map, with no insurance, end up underwater (literally).

So, the reality? Nowhere is truly safe. The smartest move you can make? Get flood insurance no matter where you buy.

FLOOD INSURANCE: THE HIDDEN PRICE TAG

So, let’s talk about the elephant in the room: flood insurance.

If your dream home sits in a high-risk zone, you’re probably required to have flood insurance if you have a mortgage. And let me tell you—it’s not like regular homeowners’ insurance. That policy? Doesn’t. Cover. Flooding.

Here’s what most people don’t realize:

The price of flood insurance can vary wildly—from a few hundred bucks to several thousand per year.

The wrong policy could leave you high and dry (literally) when you need it most.

The seller’s current rate doesn’t mean squat. Their policy is based on their situation. Yours could be completely different based on when you buy, how you finance, and how underwriting changes.

Want to know the fastest way to check what flood insurance will cost before you buy? Ask a Flood Nerd. Click here and we’ll shop the best options for you.

REAL STORY: WHAT IT’S LIKE TO BUY IN A FLOOD ZONE

Meet Brax P. in Phoenix, AZ. He’s currently under contract on a home near a street that’s in a high-risk AE flood zone—1% annual flood risk. He did his research and heard flood insurance could be anywhere from $500 to $10,000 per year depending on the home’s elevation above the Base Flood Elevation (BFE). He even looked into getting an elevation certificate, but at $400, he wasn’t sure if it was worth it.

His question? How do I get the best flood insurance rate?

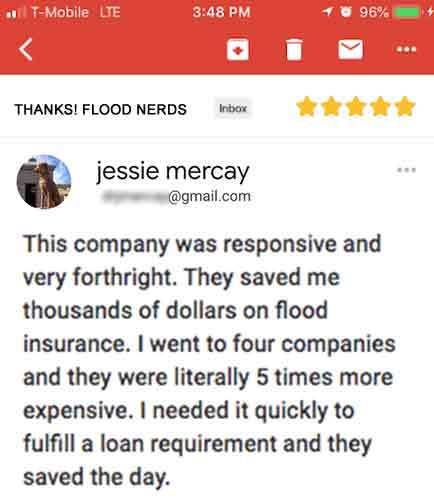

The answer? Shop the market. Just like Brax, you shouldn’t settle for the first quote you get. Prices vary massively between providers, and working with a flood insurance specialist (not just any insurance agent) is the only way to ensure you’re getting the best coverage at the lowest price.

HOW TO AVOID GETTING SCREWED

If you’re still considering buying a home in a flood zone, here’s how you play it smart:

KNOW THE FLOOD HISTORY.

Ask the seller if the home has ever flooded. They are legally required to tell you in many states.

If they “don’t know” (which is a red flag), pull the flood history reports yourself.

GET MULTIPLE INSURANCE QUOTES—BEFORE YOU BUY.

Banks don’t care how much you’ll pay—they just want you to have a policy.

Work with an independent flood insurance expert (not just your home insurance guy) to find the best deal.

CHECK THE ELEVATION CERTIFICATE.

If an elevation certificate exists, get it. It could provide useful information on the property’s risk level.

However, you don’t need one just to get a quote. The main reason to get one is if you’re hoping to remove the flood insurance requirement—which is a long shot. If that interests you, check out this article.

LOOK AT THE BASEMENT SITUATION.

Finished basements can be a huge liability.

Most flood insurance policies DO NOT cover finished basement damage.

If the home has one, make sure you understand exactly what’s covered and what’s not.

CONSIDER FLOOD MITIGATION EFFORTS—WITH A GRAIN OF SALT.

Government mitigation efforts (like better drainage systems) can help reduce flood risks.

However, insurance discounts for flood mitigation are often minimal—especially with private flood insurance.

If a property already has mitigation features, great! But spending a ton on new mitigation measures may not lower your insurance much.

The best sign mitigation has worked? A home that has never flooded despite being in a high-risk area. But remember—only Mother Nature decides when and where flooding will happen.

BOTTOM LINE? DON’T GAMBLE—GET FLOOD SMART.

Most people don’t think about flood risk until it’s too late.

But you? You’re smarter than that.

Before you sign anything, make sure you KNOW what you’re walking into. If you’re even thinking about buying in a flood zone, let us help you shop your flood insurance options before you get locked into a bad deal.

📩 Click here to get a flood insurance quote. No spam, no pressure—just the info you need to make the right call.

Because the only thing worse than buying a home in a flood zone… is buying one without knowing what you’re in for.