What is BFE (Base Flood Elevation)?

Base Flood Elevation (BFE) refers to the height to which a flood is predicted to reach during the base flood, which has a 1% chance of occurring in any given year. It is based on statistical analysis of river flow, storm tides, hydrologic effects, and rainfall levels. BFE provides a consistent standard for managing floodplain development.

Why does BFE matter?

BFE is used as the regulatory standard for the National Flood Insurance Program (NFIP). It determines the minimum elevation that buildings must be elevated to in order to reduce the risk of flood damage. BFE also impacts flood insurance premiums and a community’s participation in the NFIP. Understanding your property’s BFE helps determine your flood risk.

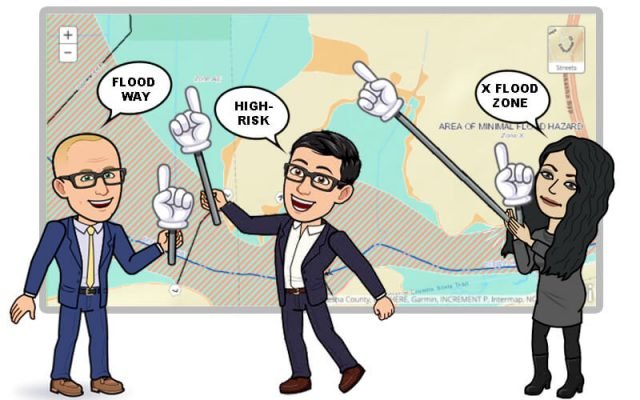

Finding your BFE:

The Federal Emergency Management Agency (FEMA) provides Flood Insurance Rate Maps (FIRMs) that outline a community’s different flood zones and show BFE data. However, FIRMs may not reflect changes to property and landmarks. Consulting with local floodplain managers, land surveyors, or engineers can provide a more accurate BFE assessment.

Impact of BFE on flood insurance:

Flood insurance rates are determined by a property’s flood zone and relation to the BFE. Rates are lowest for properties well above BFE. Properties below BFE can expect very high premiums. There are private flood insurance alternatives to the NFIP that may offer more competitive pricing.

Building above the base flood elevation:

Constructing new buildings above the BFE provides enhanced flood protection. It also reduces insurance costs compared to building at the BFE level. Many communities require 2-3 feet above BFE for an added factor of safety.

Finding BFEs in Your Town:

Use the FEMA Map Service Center to find your property and identify flood hazards. Cross-reference with local flood maps for greater detail. Work with town building officials to determine requirements related to BFE. A land survey can provide an accurate elevation certificate.