Instant Flood Insurance Cost Calculator with Great Rates.

Save big with our reliable flood insurance cost plans—fast quotes, faster coverage.

Or Speak to a Flood Nerd 1-866-990-7482

$2.3M+

Annual Premium Savings

4.9★

Average Ratings

445+

Reviews

5,497+

Happy Clients

We Get It,

Buying Flood Insurance at a good Cost

Is Confusing…

You might be asking:

• What coverage do I need?

• How much is flood insurance in going to cost me?

• How much can I save?

It’s okay, your search for cost-effective flood insurance that doesn’t compromise on coverage ends here.

Meet The Flood Nerd™

Your Flood Expert, Friend, and Guardian

In 2015, Robert Murphy, inspired to help homeowners and businessowners alike, entered the insurance brokerage market with one goal in mind: To help uncertain homeowners find affordable, high quality flood insurance that doesn’t compromise on coverage.

We Find You Great Coverage

While Saving You Up To $1,457+ A Year!

What you seek is:

- Enhanced security for your New Jersey Property.

- Significant savings.

- Absolute freedom.

- Unwavering certainty.

- Memorable moments.

- Quality family time.

- Peaceful travels.

It’s As Easy As 1, 2, 3!

1

Fill Out Our Online Form

Complete our easy quote form so we can understand your needs & personalize your rates.

2

Get An Instant Quote

Our team scours insurance companies nationwide to instantly present the best coverage & rate options for your needs.

3

Get Coverage

If you’re happy with the coverage options, you can sign up easily directly from our online portal.

GET MY INSTANT SAVINGS NOW ►►►

Discover the True Cost of Peace of Mind

Hey there, future flood-proof champion! We see you’re on the hunt for the holy grail of flood insurance: strong coverage at a price that doesn’t make your wallet weep. Well, you’ve navigated to the right shore. Welcome to the ultimate destination for demystifying flood insurance costs with a twist only a Flood Nerd could provide.

Why You’re Here (And Why We’re Glad You Are!)

If you’ve ever found yourself lost in the murky depths of flood insurance options, you’re not alone. The quest for affordable, solid coverage is fraught with confusing terms and hidden reefs. That’s where we, your trusty Flood Nerds, come in. Armed with our flood insurance cost calculator, we’re here to guide you to safe harbors.

The Magic Behind Our Calculators

Our dual-action calculators are like having a Flood Nerd right in your pocket. First up, the NFIP vs. Private Market Calculator slices through the fog, offering clear comparisons that make choosing the right path a breeze. It’s your first step toward not just saving money but ensuring your coverage is as watertight as your home.

But wait—there’s more! Our Cost of Being Uninsured Calculator isn’t just a tool; it’s your wake-up call. By shedding light on the potential cost of flood damage, it’s the nudge many need to take action. Don’t let the next storm reveal the price of being unprepared.

Why Flood Nerds? Because We Get It

Let’s be real: finding a lower quote might seem like a win, but in the flood insurance game, not all policies are created equal. Those bargain-bin rates often skimp on coverage, leaving you exposed when you least expect it. And let’s not even start on the other guys—those who prioritize their bottom line over your well-being.

With Flood Nerds, you’re choosing partners who shop the market for A-rated underwriters only, guaranteeing that you not only get the lowest price but also the coverage you truly need. We’re about making sure that, come flood time, you’re not just a statistic of the ill-prepared.

Don’t Wait for the Floodwaters to Rise

You wouldn’t be here if part of you wasn’t already considering the leap into better flood insurance. Trust that instinct. The difference between regret and relief is often just a few clicks away. Fill out our form today and let us tailor the perfect flood insurance policy for you—one that balances affordability with the robust coverage you deserve.

Join the Flood Nerds Family

It’s not just about selling you a policy; it’s about welcoming you into a community that knows the value of peace of mind. Don’t be one of those who find out their coverage is lacking when it’s too late. With a Flood Nerd by your side, you’re not just insured; you’re prepared, protected, and poised to face whatever the weather throws your way.

Dive into savings. Navigate to security. Calculate your way to confidence. With Flood Nerds, the path to affordable and strong flood insurance is clearer than ever. Don’t let the opportunity to safeguard your financial and emotional investments slip away. Calculate your flood insurance cost today and anchor your peace of mind for tomorrow.

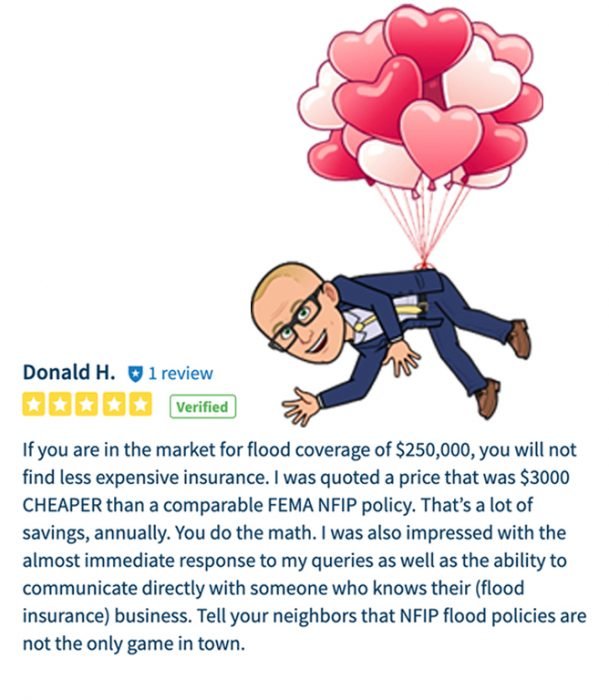

Instead of just talking savings, let’s reveal them. Flood Nerd brings you unparalleled savings and exclusive access, revolutionizing how you insure. Ready to unlock extraordinary rates only we can offer?

Flood Insurance Cost Calculator

Get a Quote

“Very helpful and very fast Will get you the lowest rate out there.”

Chris GHomeowner

“Very helpful and very fast Will get you the lowest rate out there.”

Chris GHomeowner

“Easy to work with, best rates I’ve seen.”

Ori SNew Home TX

“Excellent service and remarkable competitive prices.”

Jerry GreiderConnecticut – Replacing Expensive Policy

“My Flood nerd was very kind and responsive! She made it easy to find a policy that would work for us.”

Cathy & Michael ReyesIllinois – Replacing Expensive Policy

“This experience was so easy and my flood nerd was very professional to work with.”

Cyndy WebbCommercial Property – West Virginia

“They are very good to work with. Very professional and helpful.”

Dave DelmedicoTexas – Mobile Home

“The process was quick and easy and much better than the lender provided flood insurance!!”

Trent SearleArkansas – Replace Expensive Policy

“My flood nerd was very helpful, answered questions promptly and I was able to save hundreds of dollars on my policy.”

Liz GreenMassachusetts – Replacing Expensive Policy

“My 2nd policy with them.”

Dee OpgenortCalifornia – Landlord

“Better Flood insurance went above and beyond to make sure my experience working with them was pleasant.”

Leanna SaundersWashington – Replacing Expensive Policy

“Wonderful service and the best price ! Thank you!”

Bonnie CiallellaNorth Dakota – Refinancing

“My flood nerd was prompt, efficient and professional- both via email and on our call. Nice job!”

John & Cynthia DillenPennsylvania – Replacing Expensive Policy

“My flood nerd was great. Fast turn around of emails and of policy and he was great about getting multiple quotes an explaining them.”

Jen & Steve BowheyVirginia – New Home

“The process and pricing was exceptional”

Sarah VergasonNew York – Homeowner

“My Flood Nerd provided excellent service. His response was extremely fast and he gave me an affordable coverage option. He responded to my questions and was very willing to help.”

Marne SouthOhio – New Home

Previous

Next

What are the restrictions on properties with unrepaired flood damage or other designations from FEMA or local authorities?

Properties that have not been repaired after flood damage, those categorized as Severe Repetitive Loss properties by FEMA, as well as properties marked by state or local authorities for not complying with floodplain management regulations (under Section 1316), are ineligible for coverage.

What actions can policyholders take regarding their existing policies under private options to keep their cost?

Private Markets for Flood Insurance offers several options to manage and stabilize your flood insurance costs. Mostly having a Flood Nerd shopping for you you will get the most affordable price for your property. Other examples with one underwriter policyholders can choose to lock in their premium rate for a period of time: a one-year rate lock option is available which keeps the premium the same for two years, and a two-year rate lock keeps the premium the same for three years. Moreover, policyholders have the option to pre-pay their insurance premiums; paying for two years upfront ensures that the premium will not increase in the second year, and paying for three years upfront secures the rate for the entirety of those three years.

What are the different options available for premium payment?

We offer several payment methods for your convenience:

- Secure ACH (e-check) transfer: Direct and secure, ideal for quick processing.

- Credit/Debit card: Please note, a 3% processing fee is added to card payments.

- Mail-in paper check: Ensure it arrives before your policy begins. Keep in mind that mailed checks are processed as ACH transactions, making e-checks a quicker and safer option.

What are the eligibility criteria for properties seeking coverage under Flood Nerd’s options?

To qualify for flood insurance through Flood Nerds, properties must meet specific criteria:

- No unrepaired damage: Properties with unresolved flood damage are ineligible.

- Not classified as Severe Repetitive Loss: Properties designated by FEMA in this category cannot receive coverage.

- Compliance with floodplain laws: Properties noncompliant with local or state floodplain management regulations, especially under Section 1316, are disqualified.

What is the purpose of the Flood Nerd shopping for your coverage?

Flood Nerds ensure you get reliable and strong flood insurance quickly. We thoroughly vet all policies to only offer options with a solid AM Best rating of A or higher, guaranteeing robust financial backing. Additionally, we have access to exclusive coverage options that many agents are unaware of, allowing us to provide you with the best quotes swiftly.

What is required to obtain coverage with one of the Flood Nerds options?

To secure flood insurance through Flood Nerds, clients must complete a detailed form, which only takes a few minutes. We are committed to working with honest clients who provide accurate information. By taking the time to fill out our form, you can ensure that you receive the most accurate quote, potentially saving you thousands of dollars. Our thorough approach helps us tailor coverage that meets your specific needs, offering peace of mind when it matters most.