Why You Need Flood Insurance: A Vital Lifeline Against Nature's Wrath

Imagine this: the skies darken, the wind howls, and the rain pours down in relentless sheets, turning serene streams into raging rivers and quiet streets into turbulent torrents. It’s the kind of scene that belongs in an apocalyptic movie, but for many, it’s an all-too-real nightmare. Flooding, one of the most devastating natural disasters, doesn’t just knock on your door; it bursts through uninvited, wreaking havoc in its wake.

Now, let’s get real. If you think your standard homeowners or renters insurance has your back in these wet and wild situations, think again. Flood damage? Not covered. That’s right—your regular insurance policy, the one you thought was your safety net, isn’t going to do squat when the water starts rising. This is where flood insurance becomes not just a recommendation but a necessity—a shield against the relentless, unpredictable force of nature.

The Unseen Risk: Floods Aren’t Just a Coastal Problem

Let’s debunk a myth right here, right now. Floods aren’t just a coastal thing. Sure, hurricanes and storm surges grab the headlines, but Mother Nature has more than one trick up her sleeve. Flash floods, heavy rainfall, snowmelt, and even blocked drainage systems can turn any tranquil town into a waterlogged disaster zone. And that means whether you’re nestled in the mountains, settled by a river, or living it up in suburbia, you’re not immune.

Consider this: according to the Federal Emergency Management Agency (FEMA), over 20% of flood insurance claims come from properties outside of high-risk flood zones. That’s right—your cozy inland home could be at risk, and you wouldn’t even know it until it’s too late.

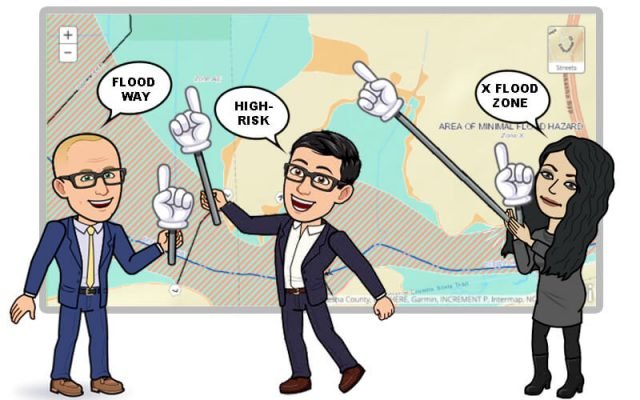

Designated Flood Zones: The High-Stakes Neighborhoods

If you’re living in one of those alphabet soup flood zones—A, AE, AH, AO, A1-A30—congratulations, you’ve hit the flood risk jackpot. These zones aren’t just suggestions; they’re mandates. If your home sits in one of these high-risk areas, flood insurance isn’t optional. It’s a requirement if you want to secure that federally-backed mortgage.

But let’s be clear: just because you’re not in a high-risk zone doesn’t mean you’re off the hook. Flooding doesn’t respect boundaries drawn on a map. And while you might think you’re safe, water has a funny way of finding its path, often where you least expect it. In fact, during most major storms, it’s often those in “low-risk” zones—where flood insurance isn’t required—who end up suffering the most. Many homeowners in these areas mistakenly believe they’re safe, not realizing that flood maps are frequently redrawn. These maps can be influenced by the unpopularity of mandating flood insurance, especially in regions with new construction. Sadly, when disaster strikes, the vast majority of flood victims are those who didn’t have coverage, thinking they were out of harm’s way. It’s a harsh reality, but one that underscores the critical importance of flood insurance for everyone, regardless of where you live.

The Financial Tsunami: Flood Damage Isn’t Just Wet Carpets

When you think of flood damage, maybe soggy carpets or a waterlogged basement come to mind. But the reality is much grimmer. We’re talking about catastrophic damage—your home’s foundation weakened, electrical systems fried, plumbing turned into a nightmare, and all those precious belongings reduced to waterlogged wreckage. It’s not just a mess; it’s a financial tsunami.

Let’s put it in perspective: just one inch of floodwater can cause up to $25,000 in damage. Imagine if your entire ground floor is submerged. The repair costs soar, and without flood insurance, those expenses come straight out of your pocket. It’s not just inconvenient; it’s life-altering.

NFIP Coverage Limits: When Standard Isn’t Enough

The National Flood Insurance Program (NFIP) is a lifeline for many, offering up to $250,000 for building damage and $100,000 for contents. But here’s the kicker—these limits might not cover everything. If your home is worth more or if you’ve got high-end belongings, you might be left with a coverage gap.

That’s where excess flood insurance comes into play, bridging the gap between what NFIP offers and what you actually need. Think of it as the difference between surviving and fully recovering. Because let’s face it—when disaster strikes, you don’t want to just scrape by. You want to bounce back, stronger and more resilient.

The Recovery Lifeline: Why Flood Insurance Is Your Best Friend

When the waters recede, the real challenge begins. Rebuilding your home, replacing your belongings, and getting your life back on track isn’t just about hard work—it’s about having the financial means to do so. Without flood insurance, you’re left to navigate that journey alone, burdened by the costs and the stress.

Flood insurance, on the other hand, is your safety net. It’s the reassurance that you won’t have to shoulder the entire financial burden on your own. It’s the difference between despair and hope, between being overwhelmed and being empowered to rebuild.

Federal Disaster Aid: A Small Band-Aid for a Big Wound

You might think, “I’ll just rely on federal disaster aid if the worst happens.” But here’s the harsh truth: federal aid is often too little, too late. Disaster grants typically max out at around $5,000, and that’s only if your area is declared a federal disaster zone.

Compare that to the extensive protection flood insurance offers, and it’s clear: federal aid is a small band-aid on a very big wound. It might help in the short term, but it won’t provide the holistic recovery that flood insurance can deliver.

Broad, Extensive, Holistic, Inclusive Coverage: The Real Deal

Now, let’s talk terminology. The word “comprehensive” gets thrown around a lot in insurance, but it’s a slippery term. Sure, it sounds like it covers everything, but that’s rarely the case. Insurance policies have exclusions, limitations, and fine print that can trip you up when you need them the most.

Instead of falling into the “comprehensive” trap, think in terms of broad coverage, extensive protection, holistic coverage, or inclusive coverage. These terms give you a better idea of what’s really on offer—strong, reliable protection without the unrealistic promise of covering every possible scenario.

Remember, the goal of flood insurance isn’t to promise the impossible. It’s to provide a safety net that’s as wide and strong as possible, giving you the peace of mind that comes with knowing you’re covered when it counts.

Don’t Wait for the Waters to Rise

Flood insurance isn’t just a line item on your budget—it’s a crucial investment in your future. It’s the safeguard that stands between you and financial devastation, the life raft that keeps you afloat when the waters rise. Whether you’re in a high-risk zone or just playing it safe, flood insurance is the smart, proactive move that ensures you’re not caught off guard by Mother Nature’s fury.

So, don’t wait until the storm clouds gather. Act now, secure your flood insurance, and rest easy knowing you’ve taken the best possible step to protect your home, your belongings, and your peace of mind. Because when it comes to floods, it’s not a question of if—it’s a question of when. And when that time comes, you’ll be glad you were prepared.