Flood After Fire

2023 – What is a burn scar and how does it relate to flooding?

Flooding after a fire is often more severe, as debris and ash rush in the form of mudflows.

As if a fire wasn’t bad enough when rainwater moves across charred and ground that has been stripped of all living vegetation that would normally absorb excess water. Often times, these areas that have wildfires are mountainous, meaning when the waterfalls it usually picks up soil, sediment, and rushes in the form of a flash flood causing significant damage to anything in its path.

Your home might have survived the fire but is now at greater risk of being damaged by floodwaters!

First, off we want to sympathize with your community loss so let’s take a moment of silence for those losses…..

Floods are our nation’s number one natural disaster. Now is your time to take important steps to reduce the financial loss that can happen after a wildfire has damaged and drastically changed the landscape and ground conditions around your property.

You now have an increased risk of Flooding. THE TIME TO BUY FLOOD INSURANCE IS NOW.

Normally there is a 30-day waiting period from the date of purchase until your flood insurance coverage takes effect. However, in the case of post-wildfire conditions, your property can be covered immediately after the purchase of the flood insurance policy.

Why do I need to buy flood insurance?

Most homeowner’s policies do not cover flood damage, which includes mudflow. An average flood policy could be around $890 a year, and some are as low as $516 for areas that are in a moderate to low-risk flood map. Heres the thing your home, if there was not a fire that stripped the vegetation, is likely in a low-risk flood zone so take advantage of this rate and get the coverage for the now increase risk.

There is now a strong likelihood of flash flooding as a result of wildfire. Check with your County flood control district to see if they have a preliminary analysis of the flood risk due to the fire your area sustained.

As with anything you should have a preparation plan in action.

• Plan your evacuation routes.

• Keep important papers in a safe place that is waterproof.

• Take photos or video of the contents of your home both inside and outside.

We can help you with getting a flood policy in effect due to the increased risk of wildfire on federal land.

PLEASE NOTE that in order to get the wildfire waver of the 30-day wait period you will need to purchase the policy within 60 days of the “official wildfire containment date”

Here are a few more FAQ for flooding after wildfires

What is a Flood?

The NFIP defines a flood as a general and temporary condition of partial or complete inundation of 2 or more properties (at least 1 of which is the policyholder) and/or 2 or more acres of normally dry land.

Does my Homeowner Policy Cover Flood?

Flood damage is not typically covered by a homeowner’s policy.

What is a Special Flood Hazard Area (SFHA)?

Also, know as a high-risk flood zone.

An area having special flood, mudflow, or flood-related erosions hazards, and shown on a Flood Hazard Boundary Map (FHBM) or Flood Insurance Rate Map (FIRM) as Zone A, AO, A1-A30, AE, AR, AH, V1-V30, VE, or V.

What are the Non-Special Flood Hazard Area (NSFHA)?

These are areas of a moderate to low risk flood shown on the FIRM as B, C, D or X. A low to moderate risk does not necessarily mean there is no risk of flooding.

What is a Pre-FIRM Building?

A building for which construction or substantial improvement occurred before December 31, 1974, or before the effective date of an initial Flood Insurance Rate Map (FIRM).

What is a Post-FIRM Building?

A building for which construction or substantial improvement occurred after December 31, 1974, or on or after the effective date of an initial Flood Insurance Rate Map (FIRM).

What is a basement?

Any area of the building, including any sunken room or sunken portion of a room, having its floor below ground level (subgrade) on all sides.

What is an enclosure?

hat portion of an elevated building below the lowest elevated floor that is either partially or fully shut in by rigid walls.

What is the Cost of the Flood Insurance?

The amount you pay is calculated based on:

Year of Construction

Building occupancy

Number of Floors

Location of Contents

Flood Zone/Risk (see what are the different flood zones)

Location of the lowest floor in relation to the base flood elevation/depth on the flood map

Deductible

Amount of Coverage

Primary vs. Secondary

Non-Residential vs. Other Non-Residential

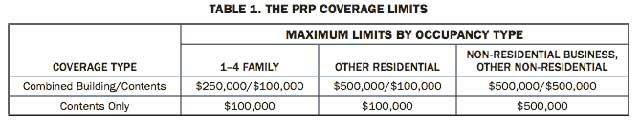

How much coverage is available?

1-4 Family – $250,000 Building $100,000 Contents

Other Residential (5 units or more) – $500,000 Building $100,000 Contents

Non-Residential – $500,000 Building $500,000 Contents

Residential Condominium Association

Policy (Master) $250,000 per unit up to the Replacement Cost of the Association, whichever is less, building. $100,000 Contents Contents Coverage is available for renters and tenants.

What is the NFIP Preferred Risk Policy (PRP)?

The PRP offers lower-cost protection for homes, apartments and businesses located in areas of low to

moderate flood risk. These areas are shown on the Flood Insurance rate Map as B, C, X, AR and A99.

Available for 1-4 Family Homes, Other Residential, Non-Residential Buildings and content only policies.

What qualifies as a Primary Residence?

For Single Family and 2-4 Family Homes to qualify as a primary residence the owner must live there

more than 50% of the time. The owner will need to provide proof of residency by providing a copy of

their driver’s license, auto registration, auto insurance, voter’s registration, children’s school documents

or Homestead Tax Credit From. The insured can sign a dated statement which will indicated they will live

at this location for more than 50%. Policyholders could meet the qualifications if active military

deployed for 50% or more, displaced due residents or absent from primary residence due to business

travel, hospitalizations and/or vacation. There is a $25 surcharge for primary residence, and a $250

surcharge for all others.

What is an elevation certificate and when is it needed?

An elevation certificate is a document completed by an engineer, architect or land surveyor which

provides information on the elevation of the building/land & machinery equipment and flood map

information. An elevation certificate is required for Post-FIRM Buildings located in the SFHA, and optional for Pre-FIRM Buildings located in the SFHA. The elevation certificate is not required in the

NSFHA – B, C or X.

What is covered under the Flood Insurance Policy?

Contents and building coverage are purchased separately (for the PRP there is a predetermined combination coverage for both contents and building coverage). There is a separate deductible for each.

Examples of Building Coverage:

Electrical/Plumbing Systems, furnace, water heater, Foundation walls etc…

Examples of Contents Coverage:

Personal belongs, curtains, washer, dryers

See Summary of Coverage or Flood Policy for more information.

What is not covered for building or personal property?

Additional living expenses, loss of use or access to insured property, business interruptions, property

and belongs outside of an insured building such as trees, plants, wells etc…

See Summary of Coverage or Flood Policy for more information.

Can I buy flood insurance if I am a renter?

Yes, if you are a renter you can purchase a contents only flood policy up to $100,000 that covers your personal property and contents. Please be aware there is limited coverage for contents in a basement

and/or a Post-FIRM enclosure in certain SFHA. See what is a basement, and limited flood insurance

coverage for basements, and Post-FIRM enclosure in certain SFHA.

Also, under the Dwelling Form the maximum amount payable for improvements and betterments is 10%

of the contents limit of liability shown on the declaration page. Under the form such property includes

improvements such as fixtures, alterations, installations and additions that become part of the building,

and must be acquired or made solely at the tenant’s expense. Use of this option reduces the policy limits

of insurance available. This policy is issued in the tenant’s name only.

Can I buy flood insurance if I am a Commercial Tenant?

Yes, if you are a tenant you can purchase a contents only flood policy up to $500,000 that covers your

business contents. Please be aware there is limited coverage for contents in a basement and/or Post-

FIRM enclosure in certain SFHA. See what is a basement, and limited flood insurance coverage for

basements, and Post-FIRM enclosure in certain SFHA.

Also, under the General Property Form the maximum amount payable for improvements and betterments is 10% of the contents limit of liability shown on the declaration page. Under the form such property includes improvements such as fixtures, alterations, installations and additions that become part of the building, and must be acquired or made solely at the tenant’s expense. Use of this option reduces the policy limits of insurance available. This policy is issued in the tenant’s name only.

Bailee’s Customer Goods including garment contractors, cleaners, shoe repair shops, processors of goods belonging to others, and similar risk are not covered. There are certain types of c

Form and NFIP Manual for ineligible risk.

If building coverage is purchased by a tenant due to a lease agreement then the building owner must be named on the policy. A separate policy for building, and a separate policy for contents is required.

Limited Flood Insurance Coverage for Basements, and Post-FIRM Enclosures in Certain Special Flood Hazard Areas (SFHA)

In a basement & Post FIRM enclosures in certain SFHA, the Flood Insurance will cover your home’s foundation elements and equipment necessary to support the building like the furnace, water heater, circuit breakers etc…. some items are covered under building like the furnace and hot water heater, and others are covered under contents coverage like a washer and dryer, or a food freezer and the food in it.

The Flood Insurance does not cover basement improvements such as finished walls, floors, ceiling or personal belongings kept in a basement. It is very important you read the policy form for property covered to understand the limited coverage in basements and post-firm enclosure in certain flood zones.

How much is the deductible?

There is a separate deductible for the building, and a separate deductible for the Contents.

The minimum deductible is reflected below.

The maximum deductible is

Single Family, 2-4 Family $1,000 – $10,000

Other Residential, Non-Residential or Other Non-Residential $1,000-$50,000

When does the Policy become effective?

FEMA indicates a flood policy must be purchased prior to the flooding event in order to have coverage. Generally, there is a standard 30-day waiting period. The 30-day waiting period does not apply when there is Post-Wildfire conditions provision in which the 30 day-day waiting period does not apply. (See FEM W-18001 Guidance on the Application of Post-Wildfire Exception to 30-Day Waiting Period for New Policies). The coverage would be effective 12:01 am (local time) on the date of loss. There is a no waiting

period when the flood insurance is initially purchased in connection with the making, increasing, extending or renewal of a loan provided that the policy is applied at or before closing. There is a 1-day waiting period when flood insurance is initially purchased during the 13-month period on the effective date of a map revisions when the building is revised to show the building to be in the SFHA and previously was not.

What is Post-Wildfire Conditions?

The 30-day waiting period does not apply and coverage becomes effective immediately if

a. The covered property experiences damage caused by flood that originated on federal land;

b. Post-wildfire conditions on federal lands caused or worsened the flooding; and

c. The insured purchased the policy either:

i. Before the fire containment date; or

ii. During the 60-calendar day period following the fire containment date.

Containment date determined by FEMA

(See FEM W-18001 Guidance on the Application of Post-Wildfire Exception to 30-Day Waiting Period for

New Policies)

How can I pay for my Policy?

It is highly suggested to pay by credit card or e-check to ensure the Flood Carrier receives payment. Payment generally is made by check, credit card, or e-check.

How long is my policy good for?

The policy term is one year, and you will receive a renewal bill prior to the end of the term to renew. There is a 30 grace period after the expiration of the policy. Do not let your flood policy lapse as doing so could cause you to lose any discounted rates you may have received.

Can I cancel my flood policy?

There are only specific reason a flood policy can be cancelled. See NFIP Flood Manual Cancellation Section for a list of Cancellation Reasons.