Instant Flood Insurance at Great Rates.

Alternative to State Farm Flood Insurance.

Save big with our reliable cheaper flood insurance plans—fast quotes, faster coverage.

$2.3M+

Annual Premium Savings

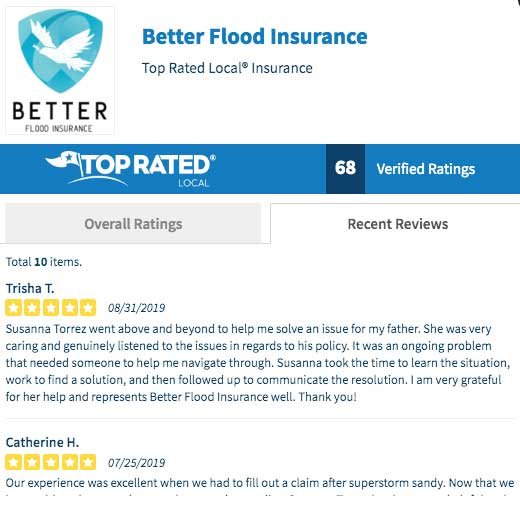

4.9★

Average Ratings

445+

Reviews

5,497+

Happy Clients

Need to save money where you can in these hard economic times?

You can save money by switching your flood insurance to the private flood markets if your State Farm Flood Insurance is expensive.

Your State Farm Flood Insurance Agent probably can’t get them for you.

Stop paying too much for flood insurance.

Switch today with a free quote.

4.7 stars on top-rated national says it all.

★★★★★

Here’s the Lazy Way to Save Money on State Farm Flood Insurance

How Much Should You Pay for Flood Insurance?

Use this tool to see how much you can save with private flood insurance.

Your State Farm Flood Insurance policy doesn’t really handle your flood coverage. Your information is sent over to an underwriter with the National Flood Insurance Program (NFIP).

That NFIP underwriter is not an agent and might not care about saving you money.

They just want to write your policy and move on to the next one. And your State Farm Agent might not know enough about flood insurance to question the NFIP price they get.

We think too many people with State Farm Flood Insurance pay more for coverage than they would with private flood insurance.

Flood Nerds save people from overpaying for flood insurance.

It's As Easy As 1, 2, 3!

1

Fill Out Our Online Form

Complete our easy quote form so we can understand your needs & personalize your rates.

2

Get An Instant Quote

Our team scours insurance companies nationwide to instantly present the best coverage & rate options for your needs.

3

Get Coverage

If you’re happy with the coverage options, you can sign up easily directly from our online portal.

Find Out the Cost Difference Between Government and Private Flood Insurance

If you are reading this page, you probably need to save money and we should see if you can pay less then your current State Farm flood insurance policy.

State Farm, Allstate, Geico, Nationwide, and even USAA (and all on the image below) are well-known insurance company names and some are really good companies however none of them underwrite write your flood policy they all farm that out to the NFIP.

These companies sell flood insurance, but they don’t write the policy.

They’ve had a non-compete agreement for many years with the NFIP.

This could keep you locked into an expensive policy and thinking there is no other alternative for flood insurance.

And maybe, your local State Farm insurance agent might not even know there is an alternative.

There have been alternatives to national flood insurance since 2012.

However, the government’s Write Your Own program discourages competition with the private insurance market, and this lock-out coupled with an uninformed State Farm insurance rep could keep you from getting better coverage or a better price for your flood insurance.

What works well for State Farm Flood Insurance might not work best for your budget.

So use the lazy way to find the best price.

Ask a Flood Nerd to shop for flood insurance.

WE shop the true private flood insurance and compare it to the NFIP to get you a great price and an even better policy.

You don’t need to do anything and we promise that we won’t try to sell you auto, life, or dental insurance.

State Farm Flood Insurance hasn’t been offered since 2010.

Back in 2010, State Farm quit writing new Flood Insurance Policies.

They pulled out of the Write Your Own Program with the NFIP.

So how do you still have a State Farm Flood Insurance Policy?

Your local State Farm Agent is just entering your information into a portal that goes directly to the NFIP where an underwriter rates your policy.

Underwriters may be great at their job, but their job isn’t to save you money.

They are most likely going to plug in your information and get the system to spit out a rate and send that over to your agent.

And unless your agent is one of the few that really does understand flood insurance you will likely just get passed the number without them questioning it.

Click to get a Flood Nerd to find better coverage and a better premium.

Which is cheaper – the State Farm Flood Insurance you have through the NFIP or a policy through a private insurance company?

How hard is it to click?

It isn’t.

But comparing the ins and outs of flood insurance can be confusing.

So, be lazy, and let a flood nerd get you a comparison.

A Flood Nerd will figure out if the NFIP policy through State Farm is cheaper (it might be) or if you can do better.

Stretch your budget and save the lazy way.

You have nothing to lose and money to save for just comparing coverages.

Find out if you are paying too much for flood insurance.

Get a Flood Nerd to compare what you pay for State Farm Flood Insurance with what you will pay for private flood insurance.

It just takes a few minutes to fill out our property information form.

It’s not that hard to save money on flood insurance.

We typically find flood insurance policies with premiums in the $500 – $1500.

You work hard, take a break, and save some money.

Flood Nerds often save hundreds to thousands for our clients.

Just click!

"Very helpful and very fast Will get you the lowest rate out there."

Chris GHomeowner

"Very helpful and very fast Will get you the lowest rate out there."

Chris GHomeowner

"Easy to work with, best rates I’ve seen."

Ori SNew Home TX

"Excellent service and remarkable competitive prices."

Jerry GreiderConnecticut - Replacing Expensive Policy

"My Flood nerd was very kind and responsive! She made it easy to find a policy that would work for us."

Cathy & Michael ReyesIllinois - Replacing Expensive Policy

"This experience was so easy and my flood nerd was very professional to work with."

Cyndy WebbCommercial Property - West Virginia

"They are very good to work with. Very professional and helpful."

Dave DelmedicoTexas - Mobile Home

"The process was quick and easy and much better than the lender provided flood insurance!!"

Trent SearleArkansas - Replace Expensive Policy

"My flood nerd was very helpful, answered questions promptly and I was able to save hundreds of dollars on my policy."

Liz GreenMassachusetts - Replacing Expensive Policy

"My 2nd policy with them."

Dee OpgenortCalifornia - Landlord

"Better Flood insurance went above and beyond to make sure my experience working with them was pleasant."

Leanna SaundersWashington - Replacing Expensive Policy

"Wonderful service and the best price ! Thank you!"

Bonnie CiallellaNorth Dakota - Refinancing

"My flood nerd was prompt, efficient and professional- both via email and on our call. Nice job!"

John & Cynthia DillenPennsylvania - Replacing Expensive Policy

"My flood nerd was great. Fast turn around of emails and of policy and he was great about getting multiple quotes an explaining them."

Jen & Steve BowheyVirginia - New Home

"The process and pricing was exceptional"

Sarah VergasonNew York - Homeowner

"My Flood Nerd provided excellent service. His response was extremely fast and he gave me an affordable coverage option. He responded to my questions and was very willing to help."

Marne SouthOhio - New Home

Previous

Next