Get a RCBAP Master Policy and Save Money Too

Our clients saved thousands of dollars on their master flood policy, which is hundreds per unit owner.

2025 – How to Explain RCBAP Flood Insurance to Your Condo Association

What Condo Board Members Need to Know About Flood Insurance (RCBAP)

“R-E-S-P-E-C-T find out what it means to me”……sings Aretha before the “sock it to me sock it to me sock it to me”. Sure, you may know R-E-S-P-E-C-T but if you don’t know R-C-B-A-P a flood can sock it to your entire building, the Condo Association, and residents.

As a Condo Association Board Member (President, Treasurer, or Secretary) it’s your responsibility to protect the building. But that’s not easy when it comes to flood insurance.

That’s why you need a Flood Nerd to help you understand the coverage so you can explain it to your community.

Good thing you are here, I’m Robert Murphy the Official Flood Nerd™ and I’m going to explain flood insurance for condo associations. It is one of the most misunderstood categories of flood coverage and most agents don’t truly understand it themselves. But I’m not like most agents. All I do is flood coverage: no car insurance, no life insurance, no fire insurance. I’m a total Geek on flood insurance and I’m going to explain what you need to know as a Condo Association Board Member.

Let’s start with when the Condo Association flood policy is required for the building (as opposed to an individual condo policy).

When RCBAP Is Required

A Residential Condominium Building Association Policy (RCBAP) is the name of the flood insurance policy written on Condo Association buildings by FEMA through the government’s National Flood Insurance Program (NFIP).

Wow! That’s a mouthful of the alphabet for sure. But we nerds do love our acronyms!

In a North Carolina court case (Porter versus Beaver Dam Run) the courts ruled that when a condo association is required by state law to maintain insurance “against all risks of direct physical loss commonly insured against,” so long as the insurance is “available,” then if flood insurance is available through FEMA and the building is in a high-risk zone, the association must purchase protection.

Sounds like common sense, right? But until this ruling in 2018, this was a common question with no clear answer.

See your standard hazard policy, general liability, or other such policies you might have as a Condo Association don’t cover losses due to a flood. Only flood insurance can do that.

If you are in a high-risk flood zone, the association must purchase flood insurance. If you are in a lower risk zone, you should purchase flood insurance because flood damage is a financial catastrophe just waiting to happen. It all boils down to the location of the buildings.

Understanding Flood Maps

Those FEMA folks work with the Army Corps of Engineers to create maps for every geographic area of the United States. These maps are supposed to be updated every few years, but it’s a government operation so there are some maps that date back to the ’70s!

The flood map determines if you are in a risky flood zone. High-risk zones are called A or V flood zones and of course, there are AE and VE zones too. Because you know acronyms!

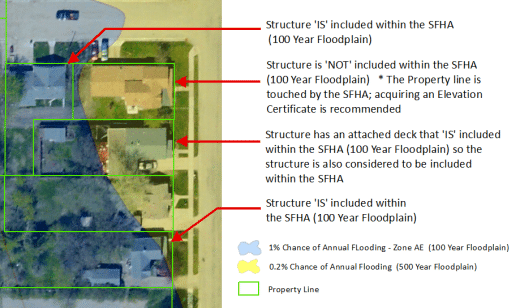

Take a look at this sample map of a special flood hazard area (SFHA).

Determining flood zone isn’t so simple, is it?

The blue area is the high-risk area (flood zone AE) and the tan area is not in a high-risk flood zone. Notice that if any piece of the building is in the high-risk area, then the entire building is considered to be at high risk.

Condo Associations can have multiple buildings and not all buildings may be in a high-risk zone.

These maps are used by the NFIP to set the premiums and rates for each RCBAP policy. Depending on the circumstances, the Condo Association may be required to get an Elevation Certificate (EC) for each structure contingent on the flood zone. An EC may show the building sits higher than the Base Flood Elevation (BFE) and this could lead to a better premium. So the EC may cost money upfront, but sometimes save you for years in lower premiums.

Understanding the Difference in Replacement Cost Value

There’s a big difference between what your normal Condo Association Hazard Insurance covers and what an RCBAP covers. And these differences impact the amount of coverage considered to be the replacement cost.

Let’s first focus on the differences between Replacement Cost Value (RCV) for RCBAP flood insurance and regular Hazard Insurance.

For our example, we’ll take a high-rise condominium (anything over 4 floors) with coverage of $10Mill.

The average flood policy for a $10Mill building will typically have higher Replacement Cost Values. That’s because, in a Condominium Association, every unit owner is legally liable for a representative part of the building.

Replacement cost and the risk of underinsurance

In a condo building, if there is a flood and some units have coverage and some do not, everyone is responsible for the damage of the uninsured portion. So smart Condo Board Members insure at the actual replacement cost or the NFIP maximum of $250,000 per unit. This also avoids the co-insurance penalty the NFIP imposes when you under-insure a building. If a building is worth $10 million and it is only insured for $5 million and incurs a $5 million loss, the insurance company with a co-insurance penalty won’t pay the $5 million. They assume the Condo Association took on 50% co-insurance. So instead of paying $5 million, they will pay $2.5 million. Ouch! Now the policy isn’t paying enough, lawsuits are flying, and a special assessment is necessary to make up the difference. Now Condo Board Members are personally liable because insurance is part of their fiduciary responsibility. See how complicated Condo Flood Insurance can be? But as a Flood Nerd, I love to unravel complicated situations for my customers. So, let’s slide into what that insurance covers.

What the replacement cost covers

The Condominium Hazard Insurance Policy covers damage from wind or fire. Most state condo laws require this policy to cover from the drywall out. But it can vary from state to state.

In other words, a typical Condo Hazard Policy covers the structure of the building and the common areas. It may or may not provide coverage inside a unit. In addition, a Common Condominium Hazard Policy will not cover the foundation of the building. And what good is a building if it doesn’t have a good foundation?

The exact limits of coverage will also vary from state to state because the policy will conform to the state’s laws on condos and insurance.

Now all of these exclusions on the Hazard coverage will reduce the Replacement Cost Value (RCV). And as that number goes down so does your coverage. And your risk for financial loss rises if there is a flood.

On the other hand, the RCBAP Master flood policy with the NFIP will include coverage for the foundation, drywall (and paint), floor covering (carpeting or tile), ceilings, and even include the cabinets, fixtures, and appliances. Please note that subgrade units will have the standard list of NFIP coverage limits.

Remember these are the things excluded on a typical Condo Hazard Master Policy. So because the RCBAP covers more, the RCV will be typically 20% – 35% higher than the Hazard Policy coverage.

Comparing Hazard Coverage and RCBAP Coverage for the Individual Units

Now that we’ve looked at the RCV for the entire building, let’s see how coverage for each individual unit is handled.

Condominium Hazard Master Policy

With the Condo Association’s Hazard Master Policy in place, each unit owner buys their own coverage for their individual unit. This is referred to as HO6 insurance and covers everything from the drywall in as well as the loss of use, liability, and contents. This policy covers things like the interior walls (including the interior of an exterior wall) paint, tile, wallpaper, floor coverings, cabinetry, fixtures, and appliances.

RCBAP Condominium Flood Master Policy

If the Condo Association buys correct RCBAP coverage, then all flood damage to the individual unit is covered. The unit owner only needs to buy flood coverage for contents. This covers things like clothing, TVs and electronic devices, furniture, household goods, and basically anything that you can take out of the unit on a truck. This includes everything that isn’t screwed down or nailed to the building.

It is good to know that 10% of the unit owner’s contents policy can be used for betterments and improvements.

What are Betterments and Improvements?

Betterments and improvements are upgrades a unit owner makes that increase the value of their property without increasing the value of the building itself. Those beautiful bamboo or eucalyptus floors or high-end appliances are betterments and improvements.

Now keeping a record of these betterments and improvements is very important. When you can provide this type of information to the adjuster you are more likely to get the claim payment you expect. Claims are messy. And the more information you provide the adjuster inspecting the damage the more likely you will feel that the payment is fair.

Limits of Coverage

With the RCBAP coverage written under the NFIP, the limits of coverage are set by the government. The maximum for any one unit is also set.

The NFIP maximum coverage for any residential unit is $250,000.

The maximum for the RCBAP is $250,000 per unit x the number of units or the RCV, whichever is less.

Private insurers like Lloyd’s of London generally follow the lead of the NFIP when it comes to master flood insurance policies for Condo Associations.

The problem with this approach is it can lead to gaps in coverage. This is especially true if you work with a flood insurance agent that isn’t a Flood Nerd. They just don’t understand the ramifications of loss and risk of personal liability to Condo Association Board members when the building isn’t adequately covered.

As a Flood Nerd, I see the problem when a policy is written valued at $250,000 when the real value is more like $350,000 per unit. That’s a gap of $100,000 per unit that must be filled. It makes better financial sense to write a policy to cover that gap than to deal with a special assessment when unit owners are already suffering the pain of flood loss. Sadly though few HOA’s cares to insure more than is required leaving a gap in coverage.

Co-Insurance Differences Between NFIP and Private Insurance

When the RCBAP is written through the NFIP, the coverage must be for the entire replacement cost value. If the Condo Board decides to cover for less than 100% of the RCV, the NFIP considers this to be a decision to co-insure the property. So, even in the case of a total loss, they aren’t going to pay out the total policy.

Remember the previous example? In a nutshell, if the Board decides to insure 80% of the RCV, the government figures you have decided to co-insure for 20%. So, when it is time to process any claim, they will automatically deduct 20%. As a Board, you’ll need to collect a special assessment to cover the portion the government policy would not pay.

When you have private flood insurance, the situation may be different for most policies. Some condo flood policies written by Lloyds of London, for example, don’t have a co-insurance penalty. You will need to review with your agent the policy to make sure you understand if a co-insurance penalty will apply or not.

Flood Insurance Is Key to Buying and Selling Condo Units

Congress made some big changes to flood insurance requirements that went into effect in 2016. Sure that has been a number of years, but if your units don’t change hands very often you might not have felt the impact. Yet.

Now the government says any FDIC-backed lender (and that would be all of them) must require flood insurance on any unit that sits in a high-risk flood plain. So, if your Condo building(s) are included on a high-risk map, the only way to avoid flood insurance is to sell every unit on a cash basis. That’s probably not likely.

Even then, it’s not smart. If you are in a high-risk zone, you need to protect the association and the unit owners with flood insurance.

And don’t forget, every year 25% of all flood claims are in areas not considered to be high risk.

Flood Nerds Simplify RCBAP Insurance

I know this whole Condo Flood Insurance thing is confusing and likely to give you a headache. But as a Flood Nerd, I thrive on the complexity. What gives you a headache delights me to no end.

So, let a Flood Nerd shop for your Condo Association Flood Insurance. We’ll check the NFIP and then compare it with the private market and come up with a solution that works great for the Board Members and the Unitholders. And if you need help explaining coverage, a Flood Nerd is at your service to break down the R-C-B-A-P with R-E-S-P-E-C-T.

You relax with a beverage and we do the shopping. Sound good?