$2.3M+

Annual Premium Savings

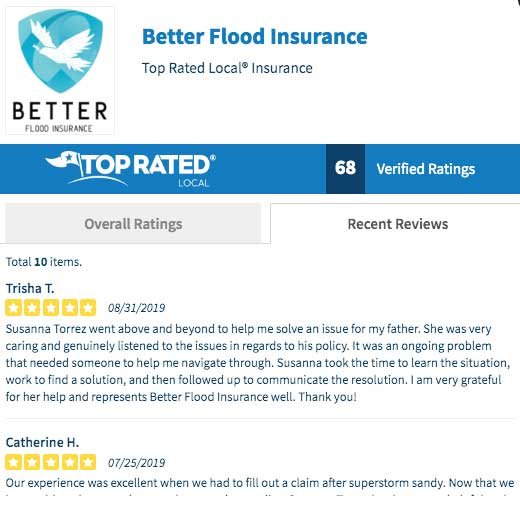

4.9★

Average Ratings

445+

Reviews

5,497+

Happy Clients

2025 – Lloyd’s of London Flood Insurance

When it comes to protecting your home from floods, you need more than just basic coverage—you need expertise, flexibility, and the reassurance of a trusted name. That’s where Lloyd’s of London Flood Insurance steps in. Lloyd’s isn’t just another insurance provider; it’s the world’s oldest and most trusted insurance marketplace, operating since 1688. They’ve been insuring everything from global shipping fleets to celebrity body parts, and now they’re bringing their expertise to flood insurance for U.S. homeowners.

Lloyd’s of London offers a flood insurance solution that stands out from the traditional, government-backed National Flood Insurance Program (NFIP). Unlike the NFIP, which caps residential property coverage at $250,000, Lloyd’s offers customizable coverage with higher limits that can be tailored to your property’s value. You’ll also benefit from coverage in areas that NFIP often excludes, such as basements, and avoid the hassle of an elevation certificate in many cases. Whether your home is in a high-risk flood zone or you simply want broader, stronger coverage, Lloyd’s of London provides the security and peace of mind you need.

Who is this Lloyd guy in London and what does he have to do with flood insurance?

Lloyd’s of London Insurance

You might be wondering, who is this Lloyd guy in London, and what does he have to do with flood insurance? Well, Lloyd’s isn’t actually a single company. Lloyd’s of London is a marketplace where syndicates, made up of companies and individuals, come together to share risks. Established in 1688, Lloyd’s is one of the strongest financial entities in the world, with an A+ rating from A.M. Best. This isn’t just any insurance—it’s backed by centuries of expertise and the strength of a global marketplace.

Lloyd’s of London also known as Lords of London and just simply Lloyd’s is one of the strongest financial entities in the world. As the name suggests, it is located in the financial district of London.

Here’s a link to their website.

Mr. Heath insured those vaccinated against smallpox that they would not contract the disease. This encouraged more people to be vaccinated and helped halt an outbreak of smallpox in Britain. He insured a monkey in a vaudeville act and when it died, he paid out the claim, claimed the monkey’s body, and had it stuffed and installed in his office.

Things Lloyd’s of London Had Insured

Lloyd’s of London isn’t new to risk-taking—since 1688, they’ve been insuring not just homes but some of the most unique things you could imagine:

• Betty Grable’s legs for $1 million each

• Keith Richard’s hands for $1.6 million

• Bruce Springstein’s voice for $6 million

• Dolly Parton’s iconic assets for $4 million

From insuring celebrity body parts to undersea monsters (yes, they insured a prize for capturing the Loch Ness monster!), Lloyd’s has covered it all. This legacy of taking on unusual risks gives you confidence that they can handle whatever flood-related challenges may come your way.

Lloyd’s of London Flood Insurance in the US

Not satisfied with insuring body parts, lake monsters, satellites, and such Lloyd’s flood insurance became available as soon as Congress acted to make it possible.

The Homeowners Flood Insurance Affordability Act (HFIAA), passed in 2014, ended the 50-year monopoly the federal government held on the flood insurance market. The act was a move to finally create a stable, private flood insurance market for property in the US.

Lloyd’s of London flood insurance started out small in the US. There were just a few Coverholders in 2014. A Coverholder is a company that’s authorized by a Lloyd’s Managing Agent to enter into a contract underwritten by the syndicate. That’s a bunch of complicated words to say that the insurance is backed by the financial strength of the Lloyd’s syndicate.

Comparative Breakdown: Lloyd’s of London Flood Insurance vs. NFIP Flood Insurance

When deciding between Lloyd’s of London and the National Flood Insurance Program (NFIP), it’s important to understand the key differences in coverage, cost, and flexibility. Here’s how Lloyd’s of London stands apart:

Higher Coverage Limits

NFIP: Coverage is capped at $250,000 for your home and $100,000 for contents, which often isn’t enough for high-value properties.

Lloyd’s of London Flood Insurance: No hard caps here! Lloyd’s offers significantly higher coverage limits tailored to your home’s value, providing peace of mind that your investment is fully covered.

Example: If your home is worth $500,000, NFIP’s coverage leaves a huge gap. With Lloyd’s, you can insure the full value, ensuring complete protection.

Customizable Coverage Options

NFIP: The NFIP offers a “one-size-fits-all” approach, leaving gaps in areas like basement coverage.

Lloyd’s of London Flood Insurance: Lloyd’s offers flexible options, including basement contents coverage and adjustable deductibles, so your policy is built to suit your needs.

Example: Store valuable items like electronics in your basement? With Lloyd’s, you’re covered, while NFIP leaves these vulnerable.

Elevation Certificates

NFIP: Often requires an elevation certificate to determine your property’s flood risk, which can be time-consuming and costly.

Lloyd’s of London Flood Insurance: Skip the hassle—Lloyd’s generally doesn’t require an elevation certificate, making it easier and faster to secure protection.

Example: Want to avoid the bureaucratic paperwork? Lloyd’s has your back, getting you insured without the red tape.

Claims Process and Flexibility

NFIP: Slow and standardized claims process, especially after widespread disasters.

Lloyd’s of London Flood Insurance: Claims with Lloyd’s are handled faster thanks to their syndicate flexibility, ensuring you get back on track quickly.

Example: When disaster strikes, Lloyd’s adjusters prioritize swift payouts, while NFIP might leave you waiting for months.

Pricing and Premiums

NFIP: The NFIP calculates premiums based on government-set rates, which often don’t reflect your property’s true risk or value. This approach means you could end up paying more than necessary for a low-risk home or paying too little initially, only to face unexpected rate hikes later. NFIP rates can be inconsistent, leaving many homeowners scratching their heads.

Lloyd’s of London Flood Insurance: Lloyd’s pricing is more competitive and market-driven. Since Lloyd’s policies are underwritten privately, they can offer tailored rates that reflect your specific property risk—often at a lower cost, especially in areas where NFIP rates are artificially inflated. In short, you pay based on your actual risk, not just a blanket rate, which often results in significant savings compared to the NFIP.

Example: Imagine you’re living in a moderate-risk flood zone, and the NFIP hits you with a rate that feels unnecessarily steep. With Lloyd’s flexible underwriting, you could save hundreds each year—keeping more money in your pocket and enjoying better protection tailored to your home’s true risk.

Breadth of Policy Coverage

NFIP: NFIP’s standard policies are often limited. Coverage doesn’t extend to detached structures like garages or guest houses, and there are also caps on personal property coverage. You might end up with gaps in protection that leave your outbuildings or prized possessions vulnerable when floods strike.

Lloyd’s of London Flood Insurance: Lloyd’s of London flood insurance offers broader coverage. Not only can it cover detached structures, but it also includes high-value belongings that might otherwise be left out. Lloyd’s policies often come with more simpler definitions of what constitutes a flood event, reducing the chances of denied claims. Most offer loss-of-use coverage too. Simply put, you get the security of knowing your entire property—inside and outbuilding—can be protected under one strong policy.

Example: With NFIP, you might need separate policies to protect your garage or guesthouse. But with Lloyd’s, you can get an all-in-one solution that covers these outbuildings, saving you from worrying about piecemeal coverage.

Flexibility in Underwriting

NFIP: The NFIP follows rigid federal guidelines, meaning there’s little flexibility in how they assess risk and set premiums. If your property is in a flood zone, it’s automatically slapped with high premiums, regardless of your individual circumstances or the specifics of your property.

Lloyd’s of London Flood Insurance: Lloyd’s is different. Each syndicate operates with its own set of underwriting guidelines, giving you multiple opportunities for coverage. If one syndicate turns you down due to a past claim or specific risk, another may be willing to take you on. This flexibility means that Lloyd’s can offer better options to homeowners with unique situations, like properties with previous flood damage or those recently placed in higher-risk zones due to map changes.

Example: Suppose your home had prior flood damage, and the NFIP has locked you into steep premiums. With Lloyd’s of London, if one syndicate says “no,” there’s still hope. Another syndicate could say “yes”—giving you a second (or even third) shot at securing affordable flood protection.

Not All Private Insurance is Lloyd’s Flood Insurance

Not all private insurance is Lloyd’s of London flood insurance. And not all Lloyd’s flood insurance is the same. It depends on the Coverholder.

Confused?

Of course, you are! Flood insurance is confusing – but we Flood Nerds thrive on bringing order to the chaos of the flood insurance market.

See it’s like this.

Every Coverholder has their own underwriting rules. One Coverholder may turn their nose up at the chance to insure your property while another Coverholder will jump on the opportunity. Flood Nerds know what the different Lloyd’s flood insurance underwriters want. That’s what makes us experts at matching your coverage needs with the company that has the best policy and price for you.

Aside from Lloyd’s Coverholders, there are other insurance companies that offer flood insurance. When Flood Nerds shop for insurance, we shop for all options.

WYO Private Insurance

Let’s take just a minute to cover the Write Your Own (WYO) type of private flood insurance. This is the flood insurance provided by Allstate, State Farm. Farmer’s, Geico, and many of the other large insurance companies.

This isn’t Lloyd’s of London flood insurance. It is government flood insurance with a big insurance company logo on it. These companies sign a contract with the government that prohibits them from selling any other flood insurance but guarantees that they can charge those overpriced government rates. Great for the insurance company – not always so good for you.

How Lloyd’s Keeps the Cost of Flood Insurance Down

Syndicates are all about spreading the risk. And Lloyd’s flood insurance surely spreads the risk. They cover the entire globe! And if you think about it – when it comes to minimizing risks, it just makes sense.

It is very unlikely that India will have a major flooding event at the same time as the United States and Africa.

Lloyd’s flood insurance banks on God’s promise not to flood the entire world again! They know the chances of paying out the whole world’s flood claim is probably about the same as paying out on the Loch Ness monster.

Lloyd’s even reinsures the National Flood Insurance Program (NFIP) here in the US because it is now more than $25 billion dollars in Debt (that’s a B and a lot of zero’s -25,000,000,000).

The NFIP uses old maps and political pressure to calculate the cost of insurance – that’s why they are in debt.

Lloyd’s flood insurance uses sophisticated technology here on Earth and with satellites in space. Accurate topography maps and fine-tuned algorithms allow the Lloyd’s Coverholders to more accurately calculate the cost of coverage. This modern approach saves homeowners and business owners thousands each year.

Is Lloyd’s of London Flood Insurance Right for You?

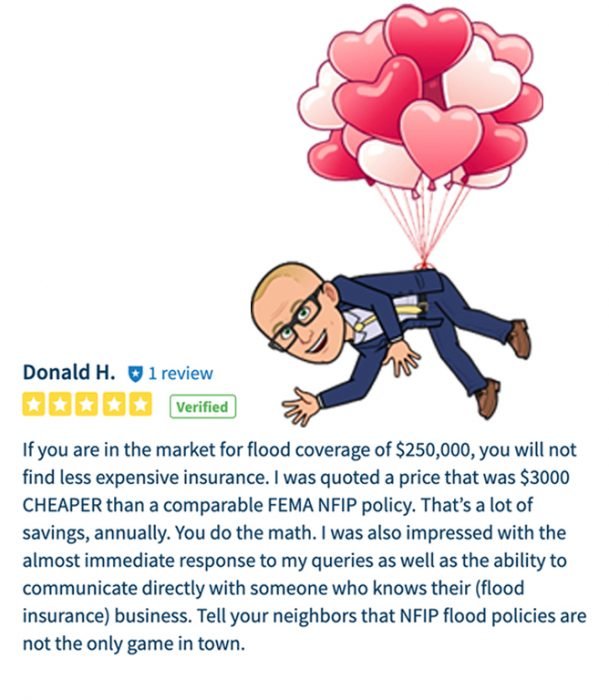

If your home or property has never had a flood before and your cost of flood insurance is really high, Lloyd’s of London flood insurance may save you 20% – 50% over the NFIP option.

Once, a Flood Nerd saved someone $7000!

The only way to know if Lloyd’s flood insurance will save you money is to shop all the options. So, let a Flood Nerd do the dirty work for you. It’s free to get a quote. And while we’re at it, we’ll shop ALL your flood insurance options to make sure the Lloyd’s of London flood insurance price is the best one available.

States Where Lloyd’s of London Flood Insurance is Available

See your state on the list? Then Lloyd’s flood insurance may save you money. Let a Flood Nerd find out for you.

Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, Tennessee, Texas, Virginia, Washington, West Virginia, Wisconsin, and Wyoming.

Don’t buy a Lemon. Let a Flood Nerd make an apples-to-apples comparison of all your flood insurance options, including Lloyd’s of London flood insurance.

ROBERT MURPHY

Robert Murphy is the Founder of Better Flood Insurance, a nationwide Flood Insurance Agency. He is the Head Flood Nerd and is passionate about teaching people the importance of flood insurance.

Meet The Flood Nerd™

Your Flood Expert, Friend, and Guardian

In 2015, Robert Murphy, inspired to help homeowners and business owners alike, entered the insurance brokerage market with one goal in mind: To help uncertain homeowners find affordable, high-quality flood insurance that doesn’t compromise on coverage.

We Get It,

Buying Flood Insurance Is Confusing…

You might be asking:

• What coverage do I need?

• How much is flood insurance going to cost me?

• How much can I save?

It’s okay, your search for cost-effective flood insurance that doesn’t compromise on coverage ends here.

It's As Easy As 1, 2, 3!

1

Fill Out Our Online Form

Complete our easy quote form so we can understand your needs & personalize your rates.

2

Get An Instant Quote

Our team scours insurance companies nationwide to instantly present the best coverage & rate options for your needs.

3

Get Coverage

If you’re happy with the coverage options, you can sign up easily directly from our online portal.

It's As Easy As 1, 2, 3!

1

Fill Out Our Online Form

Complete our easy quote form so we can understand your needs & personalize your rates.

2

Get An Instant Quote

Our team scours insurance companies nationwide to instantly present the best coverage & rate options for your needs.

3

Get Coverage

If you’re happy with the coverage options, you can sign up easily directly from our online portal.