Instant Colorado Flood Insurance at Great Rates.

Save big with our reliable Colorado flood insurance plans—fast quotes, faster coverage.

$2.3M+

Annual Premium Savings

4.9★

Average Ratings

445+

Reviews

5,497+

Happy Clients

How much is Flood Insurance in Colorado?

We Get It,

Buying Flood Insurance in Colorado Is Confusing…

You might be asking:

• What coverage do I need?

• How much is flood insurance in Colorado going to cost me?

• How much can I save?

It’s okay, your search for cost-effective CO flood insurance that doesn’t compromise on coverage ends here.

Meet The Flood Nerd™

Your Colorado Flood Expert, Friend, and Guardian

In 2015, Robert Murphy, inspired to help homeowners and businessowners alike, entered the insurance brokerage market with one goal in mind: To help uncertain homeowners find affordable, high quality flood insurance that doesn’t compromise on coverage.

We Find You Great Coverage

While Saving You Up To $1,457+ A Year!

What you seek is:

Enhanced security for your Colorado Property.

Significant savings.

Absolute freedom.

Unwavering certainty.

Memorable moments.

Quality family time.

Peaceful travels.

It's As Easy As 1, 2, 3!

1

Fill Out Our Online Form

Complete our easy quote form so we can understand your needs & personalize your rates.

2

Get An Instant Quote

Our team scours insurance companies nationwide to instantly present the best coverage & rate options for your needs.

3

Get Coverage

If you’re happy with the coverage options, you can sign up easily directly from our online portal.

Why Every Colorado Homeowner Needs Flood Insurance

Did you know that during the lifetime of a 30-year mortgage, your home is three times more likely to be impacted by a flood than by a fire? This is a stark reminder of the unpredictable nature of flooding, which can cause extensive damage even with just a few inches of water. It’s a common misconception that only homes in high-risk flood zones are vulnerable. In fact, 25% of all flood claims come from areas considered to be at low-to-moderate risk for floods.

Homeowner’s insurance policies typically do not cover flood damage, leaving many unsuspecting homeowners at significant financial risk when disaster strikes. This is why having flood insurance is not just a precaution; it’s a necessary safeguard for your home and financial well-being.

About 30% of NFIP claims payments go to the same 3% of insured repetitive loss structures year after year. This means that the other 97% of flood-exposed policyholders are footing that bill. They could have paid less and still netted larger claims payouts if they had been in the private flood insurance market. Don’t risk losing everything if you don’t have flood insurance. Don’t overpay for flood insurance. Save Money on Colorado Flood Insurance. Free quote. We shop all options for Colorado Flood Insurance, not just FEMA and NFIP. Get the best coverage & price when we compare policies from over 40 private flood insurers. We only deal with flood insurance. The Flood Nerds are Flood Experts.

By understanding the importance of flood insurance and reviewing your options, you can ensure that you are adequately protected without overpaying. Remember, the right flood insurance isn’t just a policy—it’s peace of mind.

Save Money on Colorado Flood Insurance

Understand your options for Flood Insurance in Colorado – Explained by real flood experts – the Flood Nerds™

I am Robert Murphy, the Lead Flood Expert at Better Flood Insurance Agency based in Colorado. Our team at Flood Nerds takes pride in calling Colorado our home, and we find joy in helping fellow residents navigate through the challenges of finding affordable flood insurance. We understand the pain that comes along with rising premiums and the urgency to secure flood insurance quickly. Allow the Colorado Flood Nerds to assist you in discovering the optimal coverage at the best possible pricing.

How Much is Flood Insurance in Colorado?

Are you paying too much for your flood insurance premium? Most people are, and they don’t even know it. There’s a good chance you could be saving money on flood insurance if you have a flood nerd shop around. Don’t overpay on your flood insurance – find out how much you could save!

With the right help and a flood nerd, flood insurance in Colorado doesn’t have to be expensive. Instead of worrying about how much flood insurance is in Colorado and how much your premium is going to cost you every year, why not get an expert on your side and figure out the best coverage options for you?

Get the most out of your flood insurance policy with a flood nerd. Our team of experts will review your policy and compare it to NFIP and show our pre-vetted private flood insurance market so that you don’t have to worry about overpaying or missing important coverage. Get smarter about your flood risk today.

Does my homeowner's policy cover flood damage in Colorado?

Many Colorado homeowners mistakenly believe their standard insurance policies include flood coverage. Yet, typical homeowners insurance policies in Colorado do not protect against flood damage. This absence means that any damage from flooding—whether from rapid snowmelt, mountain runoff, or heavy rain—is not covered under standard policies. Consequently, homeowners in Colorado often need to purchase separate flood insurance to protect their property from such environmental hazards.

Now that you’re equipped with this knowledge, you are better prepared and safer. To meet this essential need, our company provides a convenient online service where Colorado homeowners can initiate their quote process to obtain flood insurance that is customized to their particular requirements. This efficient service ensures homeowners can swiftly and effortlessly obtain the robust protection they need to secure their homes against flood damage. By taking proactive measures, you not only recognize the gaps in typical homeowners’ insurance but also take essential steps to protect your property.

Colorado Homeowner’s Insurance Does NOT Cover Flooding

In Colorado, typical homeowner’s insurance policies provided by insurers like Farmers, State Farm, Allstate, or Progressive are designed to protect your home against threats like theft, fire, and wind damage. However, these policies do not cover flood damage, which poses a significant risk in many parts of the state.

Requesting an endorsement for flood coverage might seem like a straightforward solution, but unfortunately, most insurance agents will not offer this option. Instead, in Colorado, securing a separate flood insurance policy is essential. Often, when homeowners seek flood coverage through standard insurance channels, they are directed towards the National Flood Insurance Program (NFIP)—a common but costly option.

But don’t worry! As the Colorado Flood Insurance Experts at Flood Nerds, we’re here to help you navigate these waters. We are committed to securing the best coverage and rates for you, and our search service is completely free. With our expertise, you can ensure that your home is protected without overpaying.

Get a Colorado Flood Insurance Quote

When it comes to flood insurance in Colorado, you need to make sure you’re shopping around for the best flood insurance quote. But how can you compare the different policies when all of the language is so technical? Plus it takes so much time.

Get an expert in your corner who understands what all the insurance jargon means. From NFIP to private quotes, your flood nerd will make sure you get the cheapest flood insurance rate that doesn’t compromise your coverage.

Let us take away the hassle of understanding your Colorado flood insurance quote. Our flood nerds are here to help you get a great deal on your coverage.

Do You Really Need Colorado Flood Insurance?

Many residents of Colorado might question the necessity of flood insurance due to the state’s absence of coastline. However, Colorado’s unique geography, which includes both sprawling flatlands and towering mountains, presents significant flood risks, especially from heavy rains, rapid snowmelt, and river overflows.

Understanding Flood Zones in Colorado

Colorado has numerous designated flood zones, highlighting areas where flood insurance is not just advisable but often required. If you live in Colorado, it’s crucial to check if your property falls within one of these zones. Yet, even if your property is not in a designated flood zone, you’re not immune to flooding. Historical data and recent events demonstrate that flooding in low-risk areas is more common than many believe, accounting for 20% of all flooding incidents nationally.

The Real Risks of Flooding in Colorado

The devastating floods of 2013, which resulted in losses over $2 billion, are a stark reminder of Colorado’s vulnerability to such natural disasters. These events can occur unexpectedly and cause significant damage, impacting residents across various regions of the state. The common misconception that “it doesn’t flood in Colorado” could lead to a lack of preparedness, leaving properties unprotected.

“The weather man is always right – said no one, ever.”

Why Choose Flood Insurance in Colorado?

Given the unpredictable nature of weather patterns and the increasing occurrence of flood events even in low-risk areas, opting for flood insurance is a prudent decision for Colorado homeowners. Don’t be misled by the “low-risk” myth—floods can happen to anyone, anywhere, and the financial consequences of being unprepared can be severe.

How We Can Help

At Flood Nerds, we specialize in providing tailored flood insurance solutions in Colorado. We compare policies from over 40 private insurers, not just FEMA and NFIP, ensuring you receive the best coverage and prices. Our dedicated team of flood insurance experts is here to help you understand your flood risks and guide you through securing the appropriate insurance to safeguard your home and belongings.

Act Now: Secure Your Home

Don’t risk the financial security of your home by foregoing flood insurance. Even if you are in a low-risk area or your lender hasn’t required it, flood insurance remains a vital safeguard. Save money on Colorado flood insurance by getting a free quote from us today. We shop all available options to find you the most effective and affordable coverage.

What Happens If You Have a Flood But Not Flood Insurance in Colorado?

This one is easy! When your home is damaged by a flood and you don’t have flood insurance you are stuck paying for the damage.

Flooding is one of the most expensive causes of damage to repair. It can cost $40,000 to $90,000 to fix the house. That’s not including the contents.

Maybe you are betting the government will step in and help.

Ha!

That’s another lie.

“The nine most terrifying words in the English language are:

I’m from the Government, and I’m here to help.”

Ronald Regan, former California Governor and President of the US

For you to get that government “assistance” in Colorado, this is what must happen:

√ The Governor of Colorado must request a federal declaration of disaster.

√ The President must declare the area a disaster area to make federal assistance available.

√ You must apply for that assistance.

√ Assistance will be in the form of a loan you MUST pay back.

√ That glorious assistance will be about $5,000.

Seriously.

You’ll land a loan of about $5,000 to cover the average $40,000 to $90,000 of damage.

Now you understand why so many properties are abandoned or foreclosed after having flood damage?

Flooding is the number two natural disaster in Colorado, just after wildfire ~ If you don’t have flood insurance, you face financial ruin.

So it is better to have Colorado flood insurance rather than bet on a government bailout.

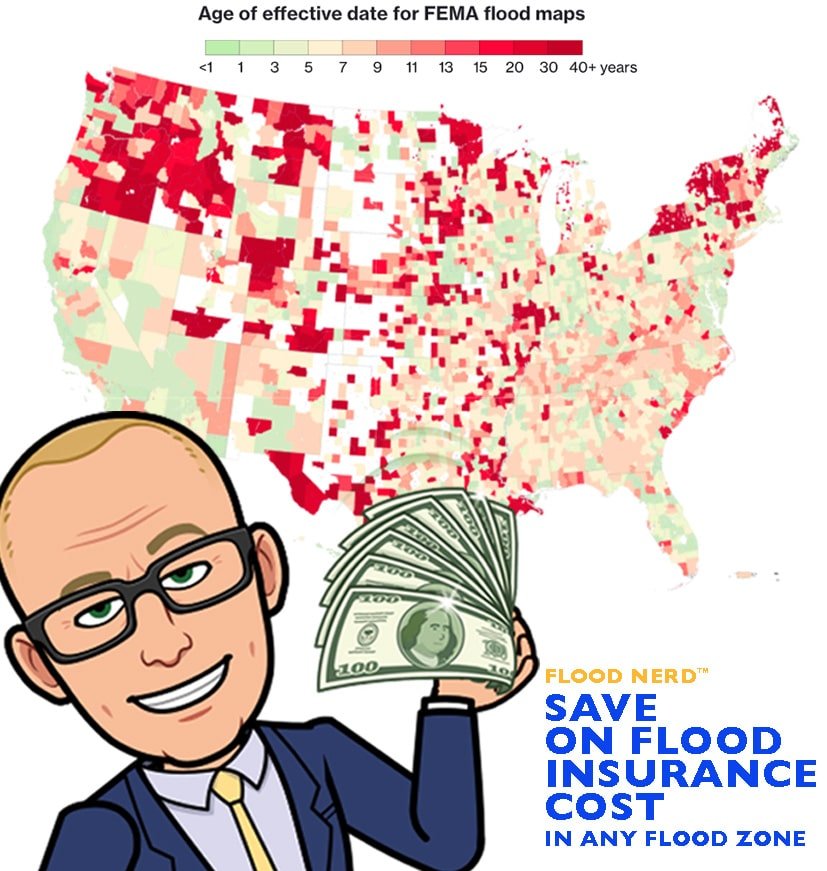

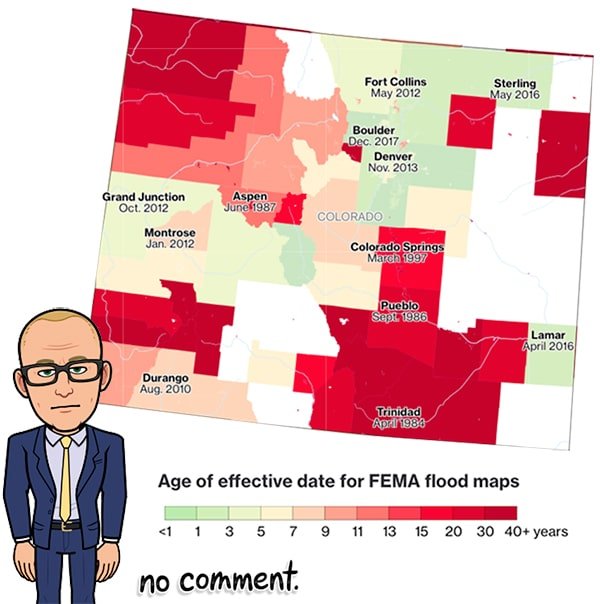

Flood Maps in Colorado

Many Colorado flood zone maps are more than 40 years old. Since then, areas have been developed and more pavement and buildings mean less ground to absorb water. Out-of-date maps are a real problem. The NFIP and all federally backed lenders rely on flood zone map to assess risk, set premiums and determine who is required to purchase flood insurance.

Bad Colorado flood zone maps leave property owners under or uninsured.

An outdated flood map that doesn’t reflect recent development puts you at risk for flooding without you knowing it.

Even FEMA admits that the flood maps only partially reflect the real risk.

Flood coverage gives you peace of mind and Colorado flood insurance rates aren’t as bad as you think. Colorado flood insurance averages between $405 – $700 a year.

No matter what the map says, it’s better to have coverage and not need it than to not have coverage and wish you did.

Flood Insurance Quote in Colorado

Most homeowners, real estate agents, and lenders don’t realize you have many options when it comes to Colorado flood insurance. But the Flood Nerds know all about getting cheap flood insurance in Colorado. We know more than 5 Ways to Save on Flood Insurance. There are basically two markets for Colorado flood insurance.

National Flood Insurance Program (NFIP)

The NFIP is run by the Federal Emergency Management Administration. This is the government option for flood insurance and many people think it’s the only way to get Colorado flood insurance. That’s because they held a 50-year monopoly on the market and their premiums reflect that dominance.

Some insurance companies are just re-sellers of the NFIP policy. They sell you an NFIP policy with their insurance company’s logo on it. If you have Nationwide flood insurance, State Farm flood insurance, Progressive flood insurance or a policy by any other re-seller you just have NFIP insurance under a private skin. That’s NOT private flood insurance and it is NOT the way to save money on Colorado flood insurance. Is your current policy through a re-seller? Check out this list of companies that resell the NFIP policy.

What is not covered by the NFIP?

The National Flood Insurance Program (NFIP) has certain exclusions that homeowners in Colorado should be aware of. Notably, the NFIP does not cover the costs of debris removal or additional living expenses if your home becomes uninhabitable due to flooding. It also excludes coverage for items stored in basements and structures not attached to the main property, such as detached garages and sheds, unless a separate policy is secured. For a detailed understanding of coverage limitations, visiting the NFIP website is recommended.

Colorado’s diverse geography from plains to high mountains can expose homeowners to varied flood risks. Understanding the limitations of NFIP coverage is critical, as it may leave significant gaps in your flood protection strategy. Private flood insurance options from companies like Lloyds of London Flood Insurance can offer more comprehensive coverage, including debris removal and living expenses—areas not typically supported by the NFIP. These policies can be tailored to meet broader requirements, providing higher coverage limits and fewer restrictions.

The issue of basement content coverage is especially pertinent in Colorado, where mountain and foothill homes often include basement spaces used for living or storage. Private insurance policies can be adapted to include these areas, ensuring some protection for your property. This is particularly beneficial for homeowners who store valuable items in their basements or live in regions susceptible to flash floods or snowmelt runoff.

Working with Your Flood Nerd is crucial when exploring the flood insurance options available in Colorado. Your Flood Nerd can help demystify the terms and conditions of both NFIP and private insurance offerings, aiding you in selecting a policy that matches your risk profile and property characteristics. Their expert advice is invaluable for developing a flood insurance strategy that provides strong coverage tailored to the unique needs of Colorado homeowners.

How to Get Flood Insurance Without a Flood Elevation Certificate?

Obtaining flood insurance without an elevation certificate can simplify the process while still ensuring adequate coverage. Providers like Better Flood Insurance and your Flood Nerd offer a solution by comparing rates across various insurers, including both private companies and the National Flood Insurance Program (NFIP). They assist in finding the most competitive pricing and appropriate coverage levels for your needs. To explore your options and see the types of coverage available to you, visit their quote page. This eliminates the need for an elevation certificate, which can save both time and money.

While the NFIP historically required an elevation certificate to assess a property’s flood risk accurately, their Risk Rating 2.0 system, introduced in 2020, no longer mandates this document for all properties. However, possessing an elevation certificate might still be advantageous in certain cases. It’s advisable to consult with your Flood Nerd who can analyze your specific situation to determine if using your existing elevation certificate could result in lower premiums with the NFIP, particularly if your property has favorable flood risk characteristics.

On the other hand, the private flood insurance market has leveraged advanced technologies to enhance the accuracy of property risk assessments. By utilizing detailed topographical data and sophisticated modeling techniques, private insurers are able to offer tailored policies that more accurately reflect the true risk of flooding at your location. This not only often results in more competitive rates but also provides coverage options that might not be available through the NFIP.

By allowing your Flood Nerd to shop around from our exclusive selection of insurance options in Colorado, you position yourself to secure strong coverage at an affordable price. This approach ensures that you receive the most effective coverage, tailored to the specific demands and risks of your property, without the hassle and expense of obtaining an elevation certificate. Whether you’re navigating the updated guidelines of the NFIP or exploring the innovative offerings of private insurers, your Flood Nerd will guide you through the process, ensuring that your flood insurance solution is both understandable and cost-effective.

Private flood insurance market

Colorado isn’t stuck with the NFIP. There is a robust private flood insurance market and you can even tap into the Lloyds of London flood insurance syndicate for Colorado flood insurance. Sometimes you can get real good rates with Lloyds because they spread the risk all over the world and the risk of the entire planet flooding at once is very small. We Flood Nerds like to say, “God said he wouldn’t flood the world again and Lloyds of London takes him at his word”. Now you know what makes a Flood Nerd snort and laugh.

But getting the Colorado flood insurance isn’t a laughing matter. There’s so many options and it’s easy to confuse the private flood insurance market with those NFIP re-sellers. But the Flood Nerds know the ins and outs of private flood insurance. Take the easy way out and just ask a Flood Nerd to get you a free quote for cheap flood insurance in Colorado.

We shop all the options for your property in your area of Colorado to get you the best premium. We’ll even check out the NFIP to make sure that all the bases are covered.

How Much is Flood Insurance in Colorado?

Understanding the cost of flood insurance in Colorado involves considering several factors, including the location of your property, its value, and the coverage specifics. At The Flood Nerds, we are dedicated to helping you secure the best flood insurance coverage at the most competitive prices by comparing policies from over 40 private insurers, not just FEMA and NFIP.

Factors Influencing Flood Insurance Costs The cost of flood insurance can vary significantly based on your property’s risk zone, value, and chosen deductibles. Properties in high-risk flood zones typically face higher premiums, while those in low-to-moderate risk zones, such as Flood Zone X in Colorado, may benefit from lower rates.

Average Costs Across Colorado The average cost for a flood insurance policy in Colorado through the NFIP stands at approximately $813.64, but this can differ drastically from city to city:

- Denver: $984.31

- Colorado Springs: $791.14

- Aurora: $599.31

- Fort Collins: $526.40

- Lakewood: $510.17

- Thornton: $481.42

- Arvada: $655.94

- Pueblo: $847.81

- Westminster: $576.84

- Centennial: $501.58

These variations reflect the diverse geography and flood risk profiles across the state. While lenders may not require flood insurance in lower-risk zones, it is crucial to remember that floods can and do occur in these areas, and relying on outdated flood maps could leave you unprotected.

Get a Personalized Quote Today Don’t settle for a one-size-fits-all approach to your flood insurance. Let The Flood Nerds find you a tailored solution that not only fits your budget but also provides adequate protection for your home. Contact us now for a free quote, and learn how you could save by exploring all available options for flood insurance in Colorado. Remember, we’re here to help you navigate the complexities of flood insurance, ensuring you get the coverage you need at a price you can afford.

Flood Zone AE in Colorado

A higher risk flood zone is Flood Zone AE. If your property is in Zone AE, your lender will require you to have flood insurance.

The cost of flood insurance in Colorado Zone AE really depends on factors that are unique to the structure.

As an example, let’s look at a house built on a basement in Arvada.The house either doesn’t have an Elevation Certificate applied or the Elevation Certificate shows that the lowest floor is 4 feet under the BFE for the area.

The policy is for flood coverage at the NFIP maximum of $250,000 for the building only. It doesn’t include contents and the deductible is our recommended amount of $5,000.

Our example is a house in Arvada but the premiums will be the same as in Boulder, Denver, Wheat Ridge, Lakewood, Golden, Colorado Springs and many other Colorado cities and counties in AE flood zones.

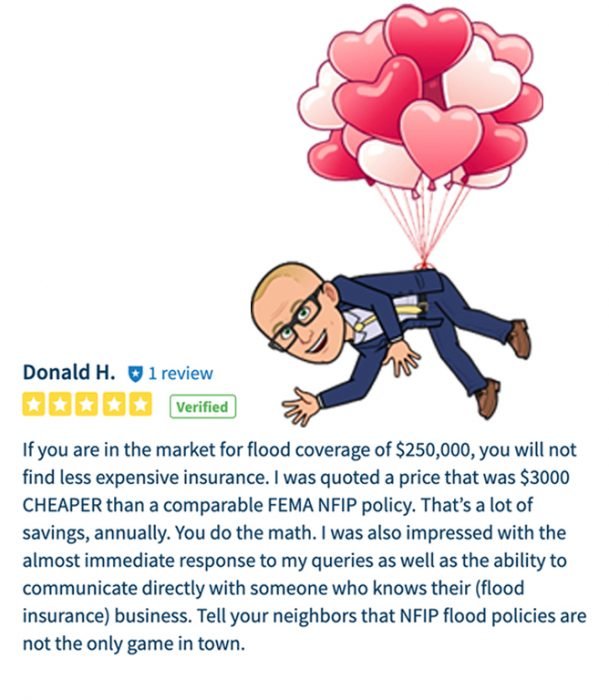

The NFIP option in Colorado Flood Zone AE is $2,541.00

Now, let’s look at the Colorado private flood insurance market and compare the options. The coverage and deductible are exactly the same.

The Colorado Lloyds of London policy would be $849.75

This option is great but they won’t cover a property with a prior flood loss. But they will cover more than the NFIP in the basement and about $2,000 for loss of use. $2,000 for other structures doesn’t increase this coverage. They won’t ask for an Elevation Certificate.

Replacement Cost Value Coverage

Above we compared standard flood insurance at the NFIP maximum. But with private flood insurance, you can insure for the actual cost to replace the home. Let’s look at a policy written for the actual replacement cost. The $250,000 example we are using is probably a little low, but to maintain comparison, we will stick with that amount.

So for $250,000 RCV building coverage, 20% contents coverage, 10% other structures, and 10% loss of use with a $5,000 deductible the annual premium for replacement cost coverage is $1,637.70

Get Cheap Flood Insurance without Compromising Coverage

★★★★★

"Same Coverage at a Better Rate"

-Mohammed K

Flood Nerds will shop the private flood insurance markets and then compare them to the NFIP, guaranteeing you the better option. We will send you the cheapest flood insurance rates within minutes.

★★★★★

"Quick Response, Very Knowledgable"

– Robert W

Paying for low-cost flood insurance is awesome. And letting the Flood Nerds shop your property has other benefits – you can get better coverage while saving money, and you can get it fast.

★★★★★

"Would highly recommend Better Flood for your flood insurance needs."

– Varun K

Better Flood Insurance is an independent flood insurance broker that shops flood insurance ONLY. Flood Nerds are Flood insurance experts. We have 5000+ happy clients and 390+ 5-star reviews.

Average Flood Insurance Costs in Colorado by Area

How much does flood insurance cost in Colorado? If you look at the number of NFIP policies and the combined premium you can see people pay way too much in Colorado for flood insurance.

Statewide, California has 21,035 NFIP policies in force at a total cost of $17,996,733. That’s an average of $855.56

Arvada has 417 flood NFIP Flood policies with $522,770 written premium, making Arvada’s average premium around $1,253. Arvada, the private market could be a better solution for you.

Aurora has about 302 policies with a premium amount of $187,491 written premium. Aurora typically has newer homes built to flood code so if you are paying more than $620 Aurora’s average you’re paying too much.

Boulder leads the state in flood policies with 4,456 and the premium on NFIP’s books is $3,401,225. The average in Boulder is $763. If you are paying more than this it would be a good time to let a Flood Nerd find you a better rate.

Longmont is a neat and growing area, more affordable than Boulder. There are 416 flood policies in this community with a total premium of $438,324. The average NFIP policy is $1,053 the Flood Nerds can get that down to around $759 so let’s work together.

Our wonderful Capitol Denver has a beautiful golden dome and 1,286 flood policies through the NFIP for a total of $1,245,194. Your average premium should be around $968. Paying more? Stop and get a free quote from the Flood Nerds here in Colorado.

The city of Colorado Springs has 1,534 flood policies and El Paso County has 609 policies. Together you pay a combined NFIP premium of $1,647,270. Your average is $783. I see way too many people here overpaying. Whether through the private market or using the NFIP properly, I know the Flood Nerds can save you money.

This city of Lakewood is where our home office is located. There are 380 NFIP policies that cost $329,271 in premium. The average premium in Lakewood CO is $866.50. Don’t pay more, let the Flood Nerds find you Better Flood Insurance.

Wheatridge has a clear creek and beautiful natural parkways. But 243 of your properties are in the mandatory flood insurance zone. $235,935 is what the government is charging for flood insurance bringing the average cost of flood insurance in Wheatridge to $970. I would be honored to find you a better deal.

La Plata County and Durango have 970 combined policies and pay an average of $711 for Colorado flood insurance. Get a quote for a lower price with a Flood Nerd.

Golden and Jefferson County Colorado combined have 549 NFIP active policies with an annual premium of $477,137. The average NFIP flood policy is $869. A private flood policy will cost less than this.

Fort Collins is the nation’s best-mitigated community. Flood mitigation pays because it reduces premiums. Fort Collins has 375 policies that cost $220,182. This makes the average policy in Fort Collins Colorado $587. With the last major Northern Colorado storms that caused flooding, not a single property in the high risk zone flooded. Unfortunately, that water had to go somewhere. So the low and moderate risk zones flooded. Those people in the low-risk zone thought they were safe. Not! A preferred rate flood policy for this area is about $500. Get a preferred rate policy from a Flood Nerd at Better Flood Insurance.

Larimer County and the City of Loveland were inundated in 2012 by the Big Tompson River. That was considered a “100-year flood” but that area had just flooded 38 years prior. There are 697 flood policies in this area and the average flood insurance policy with the NFIP in Loveland or Larimer County is $1,106.

Steamboat Springs has beautiful aspens in the fall. They also have 290 flood insurance policies and cost a total of $218,658. The average flood insurance policy in Steamboat spring $753. Don’t pay more, get a free quote from a Flood Nerd at (866) 990-7482.

The Town of Telluride is cute, quaint and home to 465 flood policies that cost $307,376 for flood coverage. The average is $661 but too many people pay more. Private flood insurance can reduce your premium so you have more money for that new set of skis.

The Town of Frisco, Dillon and all of Summit County has 380 NFIP flood paying properties with an average premium of $436. This number is artificially low because many homes don’t have a mortgage. If they did, the lender would require flood coverage. These property owners are gambling and the statistics are not in their favor.

Made it This Far? Consider This About the NFIP

Wow! You are really interested in the average cost of Colorado flood insurance if you made it to the end of this page! So, here’s a closing thought about FEMA flood insurance.

The NFIP made flood insurance available to more than 20,000 communities in the United States. Awesome! But, Colorado has a competitive private flood insurance market and when you know what you are doing, you can usually find better premiums than the government rate.

For decades, the NFIP over-charged 50% of its policyholders and under-charged the other 50% all while racking up $42 billion in taxpayer-funded losses. If you overcharge half and undercharge the other half no one pays the right amount. Are you gambling you are in the undercharged half?

About 30% of NFIP claims payments go to the same 3% of insured repetitive loss structures year after year. This means that the other 97% of flood-exposed policyholders are footing that bill. They could have paid less and still netted larger claims payouts if they had been in the private flood insurance market.

Don’t risk losing everything if you don’t have flood insurance. Don’t overpay for flood insurance.

Save Money on Colorado Flood Insurance

Free quote. We shop all options for Colorado Flood Insurance, not just FEMA and NFIP. Get the best coverage & price when we compare policies from over 40 private flood insurers. We only deal with flood insurance. The Flood Nerds are Flood Experts.