The Flood Nerds are ready to show you what we can do, and we do more than educate you about the VE flood zone. Sure, we do some of that, but there is already some great information. What we do is get you a better deal on flood insurance.

Heck, the NFIP’s 50-year monopoly on flood insurance allowed them to write the book on United States flood insurance literally. So, if you are doing a research paper, move along; there’s not much for you here. But if you want to save money on flood insurance, don’t click away! You’re in the best place to get the best deal on flood insurance.

Flood insurance is all we do. We love it and are your experts on flood insurance for AE and VE zones.

Hey, you want to save money on flood insurance on your property in a VE flood zone and we want to make it happen. We’re like a perfect match!

When you hire a Flood Nerd, we get right to work and use 5 proven ways to control your flood insurance cost. Plus we also shop your property out to the private flood insurance markets.

Of course, you didn’t! That’s how you got stuck with that NFIP policy! But now that you know about the Flood Nerds, you can sit back, relax, and know you’ll get the best flood insurance for your money.

Put the Flood Nerds to work for you

.It’s free to look!

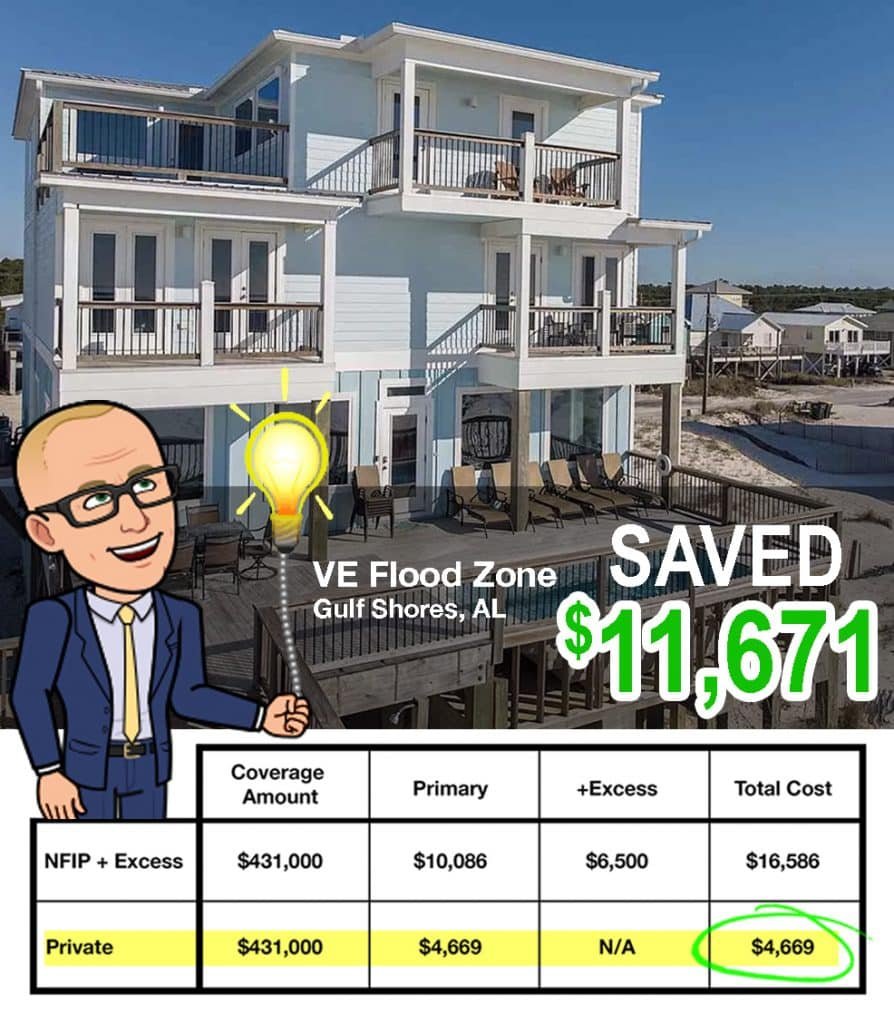

ACK! Their lender required more flood coverage than the $250,000 NFIP limit. They needed coverage of $431,000 and were $181,000 short!

Traditionally they would purchase the $250,000 NFIP max and then add a $181,000 excess flood policy on top. The excess flood policy works on top of the primary flood policy.

If God forbid there was a flood loss (and that is why you have insurance in the first place), the primary flood policy would pay first, up to the limit of the policy. If the damages were more, the excess policy would cover the remaining balance up to its coverage limit.

First, we evaluated the NFIP + Excess route; but because we know flood insurance we had a pretty good idea this wasn’t going to be the most cost-effective solution.

Next, we shopped around the private flood insurance options to find a single policy for the total coverage needed.

We look at around 40 different private flood insurance options. Because we are Flood Nerds, we know the slight variations in underwriting and premiums.

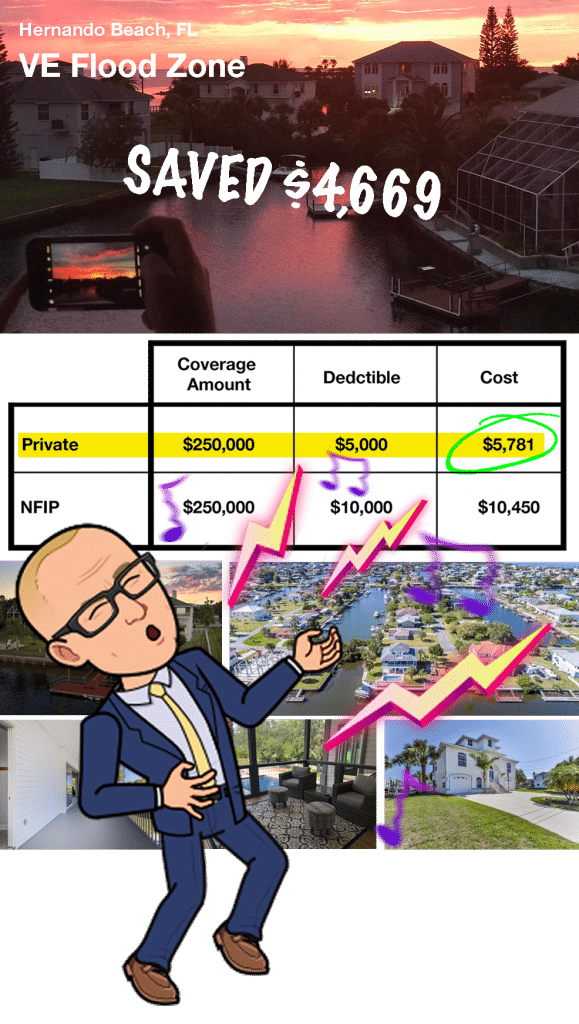

This fantastic client was sick and tired of ever-increasing government flood insurance premiums.

Here’s his story.

He bought the home in 1988, has always had flood coverage, and never made a claim.

His job is very stressful. It’s emotionally and mentally taxing, and his waterfront house is a retreat where all the tension from work dissolves. But, this isn’t his primary home.

So, he must pay higher premiums because the government flood program uses a different rating table for second homes. And they penalize you with extra fees.

And if that’s not bad enough, if he ever had a claim, the NFIP flood insurance would only payout the Actual Cash Value (ACV) because it’s his second home.

This means his claim would be deprecated, or in plain English, he would get less. No wonder his NFIP policy was adding to his stress!

The Flood Nerds understood the situation perfectly. We’re not only insurance professionals, but we must buy our own insurance policies too. So, we felt his pain and agreed that it stinks the government policy costs more and would pay less on losses to his second home. But, some of our private flood insurance companies do not punish you for having a second home.

So, that’s the type of policy the Flood Nerds searched for when shopping flood insurance for his property. We also looked for policies that payout on Replacement Cost Value (RCV). That’s insurance-speak for paying what it costs to replace covered items. In other words, if you have damage that costs $1,000 to repair or replace, then you get $1,000 without depreciation.

We reduced this client’s premium and stress about his flood insurance. And we found a policy that pays out on RCV. Now he can enjoy the view without worrying about his coverage.

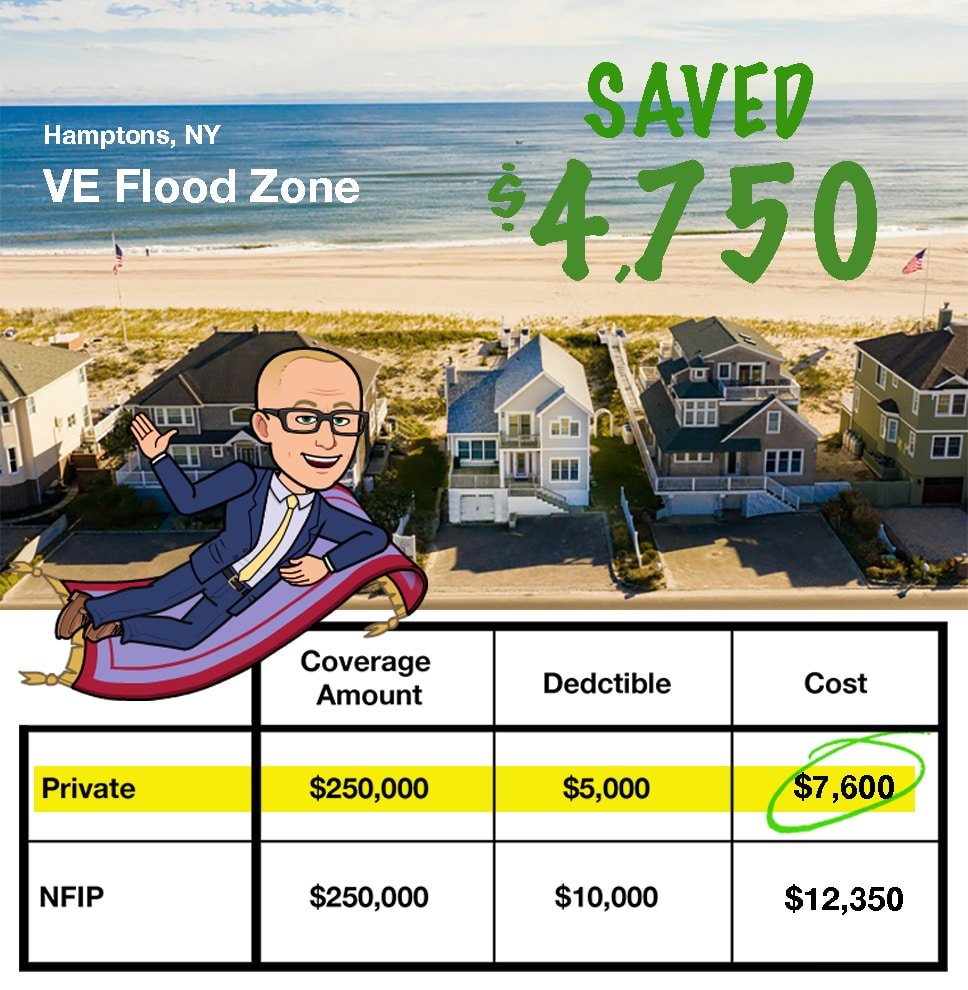

The Flood Nerds have helped so many people with properties on the coast.

Most beach houses fall into two main categories: elevated or at grade. Rates also consider if the home was built before or after the community entered the flood insurance program. NFIP uses pre-firm or post-firm to designate these properties. The private flood insurance premiums for coverage in a VE flood zone are pretty consistent across carriers. The slight variations are just the result of local taxes and fees.

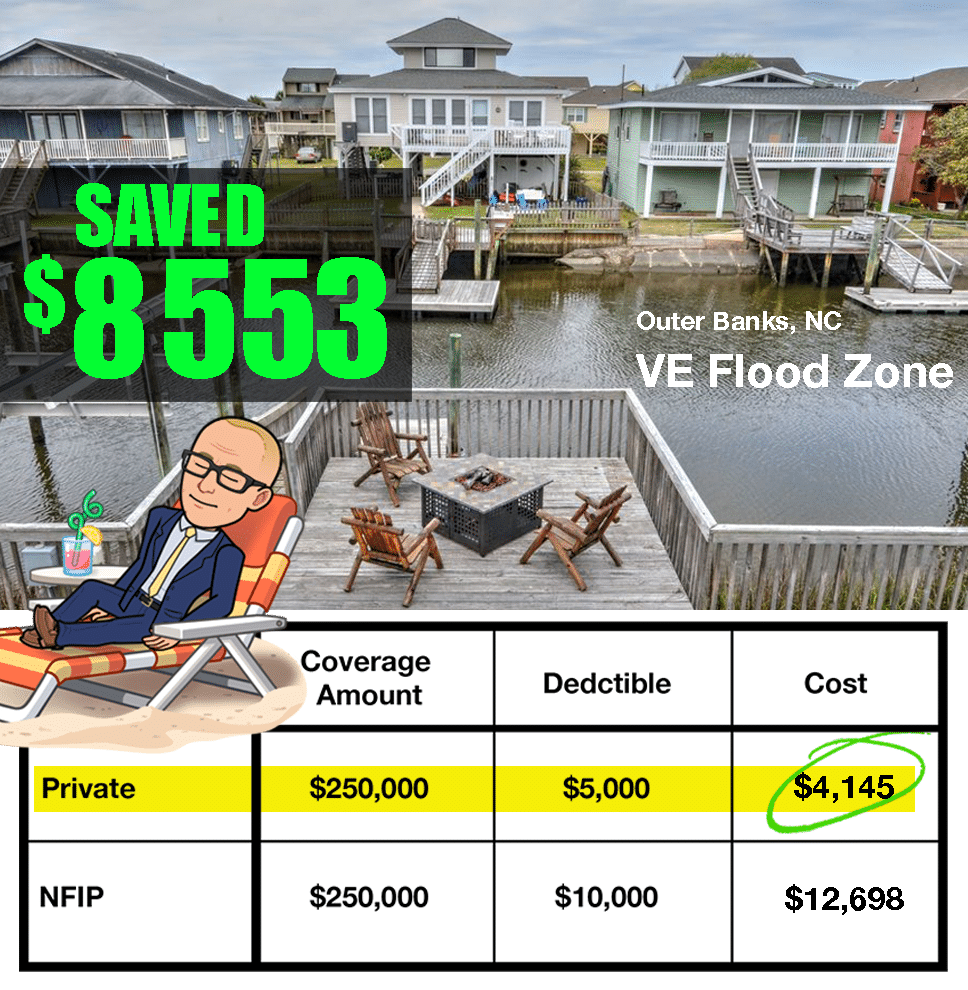

Coverage for this beach home is just another day at the office for the Flood Nerds. This awesome home was constructed in 2008 and built-in compliance with the current flood zone and base flood elevation (BFE). But FEMA introduced a new map in 2018 and it raised the BFE three feet.

Now, we could have made some changes to the NFIP policy to control the flood insurance cost.

But, we knew that we would score a lower premium with the private market. So the Flood Nerds shopped the home on the private flood insurance market and saved this client thousands.

You will too!

The Flood Nerds know the private flood insurance market. We also know that not all policies are equal. We want you to understand your coverage. Let us translate the insurance language for you because it’s tricky. We understand what we are selling, we know how to explain it to you, and we care. That’s why everyone from homeowners to real estate agents and mortgage lenders love the Flood Nerds.

We know you’ll love us too.