Get Flood Insurance WV & Save Money Too.

People in West Virginia save on average $500 to $1,457+ on their annual flood premiums.

In many cases, we save them even more. Get the cheapest flood insurance in WV without sacrificing coverage.

featured on

Get Cheap Flood Insurance WV without Compromising Your Coverage.

Get Cheap Flood Insurance without Compromising Coverage

★★★★★

"Same Coverage at a Better Rate"

-Mohammed K

Flood Nerds will shop the private flood insurance markets and then compare them to the NFIP, guaranteeing you the better option. We will send you the cheapest flood insurance rates within minutes.

★★★★★

"Quick Response, Very Knowledgable"

– Robert W

Paying for low-cost flood insurance is awesome. And letting the Flood Nerds shop your property has other benefits – you can get better coverage while saving money, and you can get it fast.

★★★★★

"Would highly recommend Better Flood for your flood insurance needs."

– Varun K

Better Flood Insurance is an independent flood insurance broker that shops flood insurance ONLY. Flood Nerds are Flood insurance experts. We have 5000+ happy clients and 390+ 5-star reviews.

Does my West Virginia homeowner insurance cover flooding?

A typical West Virginia homeowners’ policy is written through Farmers, State Farm, Allstate, and Progressive, for instance, excludes flooding as something that will be covered under their homeowner’s policy.

In most cases, the only way to get flood coverage is by purchasing a stand-alone flood insurance policy. However, you should ask your homeowners agent if you can add an endorsement to your homeowner’s policy to cover flooding. Yet, don’t be too surprised if the answer is NO.

Do I need flood insurance in West Virginia?

It is important to have flood insurance coverage in West Virginia because our beloved Cowboy State has seen a fair share of flooding, and there is likely more coming.

We believe that most homeowners think about Flood insurance in West Virginia at some point, maybe before buying a home or during the closing process. However, many of us only think about it when a big storm is looming, or we have heard on the news that there is flooding forecasted or happening too close to our home.

If your home or business is in a flood zone, that is considered a low flood-risk area. Sadly, many homeowners decide to forgo purchasing coverage because they believe they are safe from flooding. Some real estate and insurance agents may even say you don’t need it.

I ask you to consider the facts: 20 percent of all flooding events across our nation come in areas that are considered low risk. After our last few major storms (Hurricane Harvey), we saw flooding in these low-risk areas. Eighty percent of these individuals had water in their homes or buildings and didn’t have flood insurance coverage.

In Harris county, nearly 135,000 homes were damaged. Three-fourths of these properties were considered low to moderate risk.

We often hear that people believe that the government will help, which is true. However, a few things must align for you to get government assistance.

1 – The president of the United States must declare the flooding event a state of emergency. If this doesn’t happen, then there won’t be assistance.

2 – Homeowners’ average amount of assistance after a flood, when they do not have flood coverage, is $5,000. The average cost of damage to one’s property after a flood is $38,000+. That $5K you get from the government? It comes as a loan, and you will need to pay it back. Are you willing to gamble your financial future by forgoing flood insurance coverage?

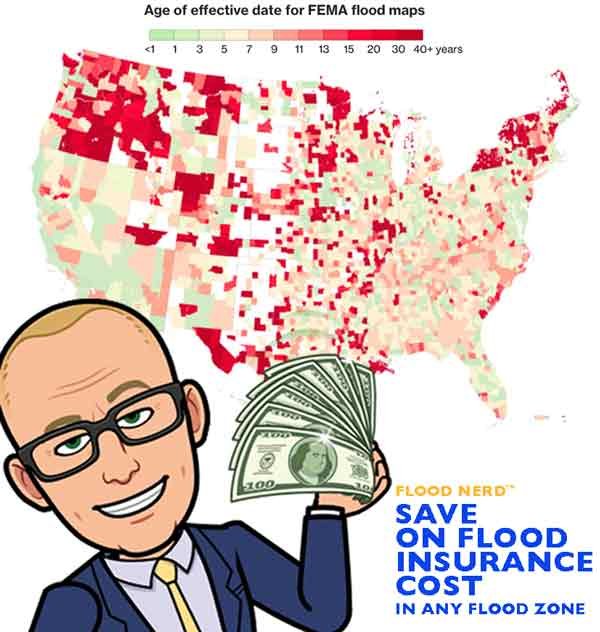

One more note on these low-risk flood zone maps. Many of these maps are over 40 years old. If the area has been developed, then there is likely more concrete, creating a barrier for land that, previously, might have absorbed the massive downpour.

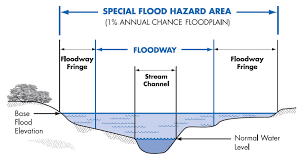

WV Flood Map

Because of all these factors, it is difficult for property owners to know their true risk of flooding. FEMA admits that their flood maps only give an idea of part of the risk. Our recent storms are facts that it can rain anywhere within West Virginia, and you should consider getting flood coverage so you are not uninsured when you need it most.

FEMA flood zone maps often take years to go into effect after the terrain was studied, this gives the impression that the area is “more up to date” than it is.

The average cost for West Virginia flood insurance in these Low-risk areas is $595 per year.

FEMA’s National Flood Insurance Program (NFIP) and all federally backed lenders rely on these West Virginia flood insurance map to assess risk, set premiums and determine who is required to purchase flood insurance. Bad information about an area’s flood risk can leave property owners under or uninsured.

Use this WV flood tool to see if you are paying too much.

How much is flood insurance in West Virginia?

West Virginia NFIP flood insurance.

There are many options available in West Virginia regarding flood insurance, but they fall into two main categories. The government option is also known as the NFIP or FEMA option, and the Private flood insurance market.

The National Flood Insurance Program (NFIP), also known as FEMA, is the government option for flood insurance. The NFIP has enjoyed a 50-state monopoly on the flood insurance market.

Not “private flood insurance” but NFIP Resellers

If you have Nationwide Flood Insurance, State Farm Flood Insurance, Progressive Flood Insurance, or any the of the logos below, then you are buying the NFIP flood policy that is just being resold through a government program. These companies are private companies, but their flood insurance is not. Here is a list of the 70 companies that resell the NFIP policy.

West Virginia private flood insurance market

There are alternatives to the NFIP or government insurance. It is called Private flood insurance, most notably Lloyd’s of London Flood insurance. However, there are other options available in West Virginia. We shop all the options for your property in your region to ensure you are getting the best premium. Please click here if you are ready to have us do the work for you.

Our shopping includes the NFIP because sometimes we find that you can get a much better premium with government subsidies.

Lloyd’s of London Flood Insurance West Virginia Market

West Virginia is fortunate to have many Lloyd’s of London flood insurance options. Although many Lloyd’s flood insurance companies will have you assume that there is only one option, nothing could be further from the truth.

Lloyd’s of London has a rich history attributed to having invented the first modern insurance model. Unlike most of its competition, Lloyd’s of London is not a company but a corporate body. This structure works well since it has been around for over 330 years. Lloyd’s operates under multiple financial backers pooling their capital to spread the risk.

I have two blog posts that deep dive into Lloyds of London and what they mean to West Virginia’s flood insurance market. If you are interested, the links are below.

Lloyd’s of London Flood Insurance

FEMA vs Private Flood Insurance

Lloyd’s also insures the world with flood insurance, meaning they cover flooding events in India, Australia, and much of Europe. The “game” of insurance is to spread your risk since Lloyds is worldwide.

I joke here that Lloyd’s is banking on God’s promise that he won’t flood the entire world again, …..so they won’t have to pay out the whole world’s flood claim.

How much does flood insurance cost in West Virginia?

Many factors go into getting the cost of flood insurance for West Virginia. If your home is in what is considered a low-to-moderate risk, you can get a heavily subsidized policy through the government.

West Virginia flood insurance low-to Moderate Risk rate and cost.

This is Flood Zone X, which is not lender required flood zone.

This is usually identified as an X-flood zone. Then we would suggest the government Preferred Risk Policy (PRP) which is a subsidized policy and has set flood insurance coverage limits (see grid below):

NFIP Maximum Coverage Limits

NFIP Maximum Coverage Limits

The average cost for flood insurance in West Virginia with the maximum set limits in these Low-risk flood zone areas is $405 – $700 per year.

Your property is in a higher-risk flood zone, usually identified with a Flood Zone AE. Your lender will require you to have flood insurance. The cost of flood insurance in West Virginia depends on many factors unique to the structure. We will try to give you an idea of the most common homes we see in West Virginia with a slab-on-grade foundation.

We will look at the West Virginia cost of flood insurance for the NFIP maximum of $250,000 for the (building only) with NO CONTENTS and our recommended deductible of $5,000.

We will be rating this example on the NFIP and on a few of our private flood insurance policies, specifically Lloyd’s flood insurance options in West Virginia.

Cost of Flood Insurance in WEST VIRGINIA in high-risk flood zone AE

Our example is in Kanawha, WV, but the premiums will be the same if in Logan, Charleston, Greenbrier, Wood, Putnam, Wheeling, and many other West Virginia flood ones.

In our example, the Base Flood Elevation (BFE is 609) and is a home that is built before 1973

NFIP option in West Virginia Flood Zone AE

NFIP – Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

NFIP Annual premium in High-Risk flood zone is $3,706.00

This option is what we see if the property has had a flood loss before and either doesn’t have an Elevation Certificate applied or the Elevation certificate shows that the lowest floor is 4 feet under the BFE for the area. You can use 10% of your coverage to cover other structures on your property

West Virginia Private flood insurance – Lloyd’s of London Flood Insurance (option 1)

Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

Lloyd’s of London (option 1) Annual premium in High-Risk flood zone is $901.74

This option is great, and we are very happy when we can get this option. They can be a bit choosey about what risk they will accept and will not take anything that has had a flood loss. They offer basements coverage, about $2,000 for loss of use, and $2,000 for other structures, but they can’t increase this coverage. They do not require an Elevation Certificate to rate.

West Virginia Private flood insurance – Lloyd’s of London Flood Insurance (option 2)

Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

Lloyd’s of London (option 2) Annual premium in High-Risk flood zone is $914.81

This option is great, and we are very happy when we can get this option for our clients. They seem to be writing almost all risks; however, they do not write any property in a designated floodway or have a depth of -4 under the BFE. In our example, with our BFE being 609, they will not accept this risk if the lowest floor is 605. They will not take anything that has had a flood loss. They offer limited coverage for basements and do not require an Elevation Certificate to rate, and as a percentage of coverage for loss of use. If you want coverage for other structures, that will need to be added.

Private Flood insurance option (option 3) Not Lloyd’s

Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

The annual premium in High-Risk flood zone is $3,161.22

This option will take properties that have had one flood loss for more than five years and the payout was under $100,000 on the claim. Their coverage matches the NFIP. They will write practically all risks, don’t need an elevation certificate to rate, and are a bit lower in premium than the NFIP.

Private Flood Insurance – Lloyd’s of London (option 4)

This option must be written on the Replacement Cost Value (RCV) of the building, otherwise, there is a co-insurance penalty that kicks in. So, $250,000 might be a bit low in California, but to keep this going, let’s just use that for this option

Coverage of $250,000 (RCV) building coverage, No Contents, and $5,000 deductible

The annual premium in a High-Risk flood zone is $801.02 (great price).

This options rating system is all over the board. Sometimes we get a crazy great price, but other times the premium is way higher than the NFIP will consider taking a property that has had one flood loss before as long as it has been more than ten years and the payout was under $50,000 on the claim. Their preferred coverage is at replacement cost, which is slightly different from some of our other Lloyd’s flood options. We usually reserve this one if the property doesn’t fit the above options. We can adjust coverages to control premiums. As mentioned before, these underwriters’ rates are all over the board. It is worth shopping through to ensure we are getting you the best premium possible. They don’t need an elevation certificate to rate.

Private Flood Insurance – Lloyd’s of London (option 5)

Coverage of $250,000 (RCV) building coverage, No Contents, and $5,000 deductible.

The annual premium in High-Risk flood zone is $1,026.84

This option came from the company that used to run the NFIP program, so the coverage matches the NFIP coverage with two differences. They offer living expenses which will cover your cost when you are displaced from your home during repairs (most Lloyds flood policies offer this). They also offer swimming pool clean out, which is kind of unique so if you have a pool ask for this coverage.

Private Flood Insurance – Lloyd’s of London (option 6)

Coverage of $250,000 (RCV) building coverage. No Contents and $5,000 deductible.

The annual premium in High-Risk flood zone is $904.05

This options rating system is also all over the board. Sometimes we get a crazy low price; other times, the premium is way higher than the NFIP. They will consider taking a property that has had one flood loss before as long as it has been more than ten years and the payout was under $25,000 on the claim. They have been rumored to give a low price the first year and then non renew following years or sometimes they jack the price way up, so we will watch them. They have a slick system, and their underwriting is managed by a 3rd party, which also sometimes seems to be a glitch.

There are more options coming online every day, and we are working to be looking into every viable option.

Use this WV flood tool to gauge if you are paying too much for flood insurance.

Currently, West Virginia has 15,110 NFIP policies in force to date, with a total cost of $16,683,897. That would make the average flood rate for West Virginia $1,104. Of course, some will pay more, and some will pay less.

Click here to have our shop and save money.

Hello, West Virginia! Thanks for visiting our page for all your flood insurance needs.

Let’s start with Phillip and Braxton, West Virginia, where the total number of flood policies is 137, with $152,104 in premiums. The average flood rate for these areas is $1,110.

Next is Berkeley, West Virginia, where the average flood rate is $962. The policies in Berkeley number 175 with $168,432 in flood premiums.

Flooding Martinsburg, WV

Moving on to Boone, West Virginia, we find 286 flood policies. The premiums in Boone total $281,529, which allows the average flood rate to be $984.

Let’s look at Weirton and Milton, West Virginia. These two areas have a combined premium total of $243,929. The active policy number 155 allows the average flood rate to be $1,574.

The average flood rate drops to $1,195 in Wellsburg, West Virginia. There are 200 active flood policies with $239,044 in written premiums.

Again, the flood rate drops to $840 when we look at Cabell, West Virginia. The premiums in Cabell add up to $229,389 with 273 active flood policies.

Huntington, West Virginia, has $21,931 in written premiums. The average flood rate in Huntington is $1,076, which includes 197 active flood policies.

We’ll look at a group of areas that include Calhoun, Doddridge, and Gilmer, West Virginia. These areas have an average flood rate of $839. The policies here total 177 with $148,541 in flood premiums.

One hundred sixty-five flood policies are active in Clay, West Virginia. Clay has an average flood rate of $749, including $123,636 in total premiums.

The average flood rate drops to $592 in Fayette, West Virginia. The premiums here total $94,721, with 160 flood policies in effect.

The next group includes Glenville, Grant, and Alderson, West Virginia, where the active flood policies total 197. The premiums add up to $291,232, which allows the average flood rate to be $1,478.

$238,190 in flood premiums exist in Greenbrier, West Virginia. The policies here, number 305, allow the average flood rate to be $781.

In Rainelle and Ronceverte, West Virginia, the average flood rate rises to $1,763. The premiums add up to $149,884 with 85 active policies. Give us a call to check your flood rates!

When we look at White Sulphur Springs, West Virginia, the average flood rate drops to $1,086. The flood policies number 142 with $154,278 in written premiums.

One hundred seventy-seven flood policies are in effect in Hampshire, West Virginia. Hampshire has $180,902 in flood premiums which allows the average flood rate to be $1,022.

Let’s look at a group of areas that include Hancock, Bridgeport, and Clarksburg, West Virginia, where the average flood rate is $1,437. The number of active flood policies is 202, with $290,248 in total premiums.

Our next group includes New Cumberland, Hardy, and Moorefield, West Virginia, where the premiums add up to $169,972. The policies here, number 163, allow the average flood rate to be $1,043.

$856 is the average flood rate for Harrison, West Virginia. Harrison has 141 flood policies in effect with $120,705 in flood premiums.

The average flood rate rises to $1,221 in Jackson County, West Virginia. There are 133 active flood policies in Jackson with $162,365 in written premiums.

Charles Town, WV flooding

In Jefferson County, West Virginia, the policies number 167 with $246,516 in flood premiums. This causes the average flood rate to rise to $1,476.

Harpers Ferry, West Virginia

The average flood rate rises again to $1,843 in Charleston, West Virginia. The premiums total $669,052 with 363 active flood policies. Give us a call, Charleston!

$225,765 is the premium total for Clendenin and South Charleston, West Virginia. These two areas have 177 flood policies, which allows the average flood rate to be $1,276.

There are 226 active flood policies in Dunbar, West Virginia. The average flood rate in Dunbar is $1,193, including $269,535 in written premiums.

Kanawha river flooding WV

Hello Kanawha County, West Virginia! You all have the highest active flood policies in the state at 1,616! The premiums here total $1,491,481, which allows the average flood rate to be $923.

Elkview, WV flooding

Look at Nitro, West Virginia, where the average flood rate is $907. Nitro has 129 flood policies in effect with $116,994 in total premiums.

Flooding in Weston, WV

Checking in on St. Albans, Lewis, and Weston, West Virginia, we find $235,211 in flood premiums. These areas have 188 active flood policies, which makes the average flood rate $1,251.

The average flood rate drops to $821 in Lincoln, West Virginia. The premiums in Lincoln total $145,311, with 177 flood policies in effect.

Logan, West Virginia, has 577 active flood policies with $544,975 in flood premiums. The average flood rate in Logan is $944.

Next, we’ll look at Marion, West Virginia, where the average flood rate drops to $855. The premiums here total $159,893, which include 187 flood policies in effect.

$680 is the average flood rate for Marshall, West Virginia. There are 129 active flood policies with $87,674 in written premiums.

In McDowell, West Virginia, there are 125 flood policies in effect with $88,629 in flood premiums. The average flood rate in Mc Dowell is $709.

The average flood rate jumps to $1,356 in Welch, West Virginia. Welch has 101 active flood policies and $136,995 in flood premiums.

$1,111 in the average flood rate in Mercer, West Virginia. Mercer has $218,897 in written premiums with 197 flood policies in effect.

When we look at Keyser and Morgantown, West Virginia, we find a total of $228,371 in flood premiums. The policies in these areas number 139 which allows the average flood rate to be $1,643. Give us a call at Keyser and Morgantown! We’d love to check your rates.

In Mineral, West Virginia, there are 120 flood policies active with $127,098 in written premiums. The average flood rate in Mineral is $1,059.

The average flood rate drops to $545 in Mingo, West Virginia. Mingo has $185,231 in premiums with 340 flood policies in effect.

$152,162 is the premium total in Morgan, West Virginia. Morgan has an average flood rate of $1,247, including 122 active flood policies.

The total number of policies adds up to 167 in Nicholas and Richwood, West Virginia. The average flood rate is $1,137, including $189,956 in written premium.

Flooding Richwood, WV

Wheeling, West Virginia, has $1,073,135 in flood premiums with 619 active flood policies. The average flood rate in Wheeling is $1,734.

Flooding Wheeling, WV

Look at Pendleton and Preston, West Virginia, where the average flood rate is $1,294. The premiums total $190,153, with 147 flood policies in effect.

The average flood rate jumps to $1845 in Marlinton, West Virginia. Policy number 163 with $300,660 in flood premiums.

One hundred forty-seven flood policies are active in Pocahontas, West Virginia, with $114,923 in written premiums. The average flood rate in Pocahontas is $782.

Putnam, West Virginia, has 334 active flood policies. The average flood rate is $784, which includes $261,764 in flood premiums.

Harman, West Virginia flooding

Let’s look at another group of areas that include Winfield, Elkins, and Tucker, West Virginia, where the average flood rate is $2,430. The premiums add up to $410,730 with 169 flood policies in effect.

There are 193 flood policies active in Raleigh, West Virginia. The premiums here total $224,147, which allows the average flood rate to be $1,161.

The active flood policies number 166 in Randolph, West Virginia. The premiums add up to $152,723, which causes the average flood rate to be $920.

The average flood rate drops to $565 in Roane, West Virginia. Roane has $68,937 in premiums with 122 active flood policies.

Spencer WV flooding | Spencer West Virginia flood

$126,637 is the flood premium total in Summers, West Virginia. Summers has 165 flood policies in effect which allows the average flood rate to be $767.

Parsons, West Virginia, has an average flood rate of $2,517. There are 107 flood policies active with $269,348 in written premiums.

Flooding in Parkersburg, WV

The group up next includes Tyler, Upshur, and Parkersburg, West Virginia, where the flood premium adds up to $170,005. The active policies total 170, allowing the average flood rate to be $1,000.

The average flood rate in Buckhannon, West Virginia, is $978. The premiums add up to $151,647 with 155 flood policies in effect.

One hundred ninety flood policies are active in Wayne, West Virginia. Wayne has an average flood rate of $990, including $188,017 in flood premiums.

The average flood rate drops to $637 in Webster, West Virginia. Webster has 121 active flood policies with $77,061 in written premiums.

When we look at New Martinsville, West Virginia, we see 119 flood policies in effect with $209,241 in flood premiums. New Martinsville’s average flood rate is $1,758. Give us a call! We’d love to check your flood rates!

Wetzel, West Virginia, has an average flood rate of $860. Wetzel has 127 active flood policies with $109,172 in total premiums.

In Vienna, West Virginia, there are 106 flood policies in effect. Vienna has $99,001 in flood premiums which allows the average flood rate to be $934.

$1,082 is the average flood rate for Wood, West Virginia. The premiums in Wood add up to $327,904, including 303 active flood policies.

Looking at Mullens and Oceana, West Virginia, we find 117 flood policies with $132,582 in total premiums. The average flood rate for these areas is $1,133.

Finally, we’ll look at Wyoming, and West Virginia, where there are 304 active flood policies. The average flood rate in Wyoming is $798, which includes $242,688 in flood premium.

Thanks for checking out all the flood information on West Virginia!!

West Virginia flood insurance cost calculator

For decades, the NFIP has over-charged 50 percent of its policyholders and under-charged the other 50 percent while it has racked up $42 billion in taxpayer-funded losses, equating to more than half of every claim paid by the NFIP since 1978.

About 30 percent of NFIP claims payments go to the same 3 percent of insured “repetitive loss” structures yearly. When you do the math, this means that the other 97 percent of their flood-exposed constituents could have paid in less and still netted larger claims payouts if they had better access to private flood insurance. A recent white paper by Milliman found that 90 percent of homes in Sandy-struck West Virginia and New Jersey would see reduced flood insurance rates through private insurers.