Instant Texas Flood Insurance At Great Rates

Find out how much you can save on high quality, high coverage flood insurance plans in 10 minutes or less!

Or Speak To A Flood Nerd™ 1-866-990-7482

$2.3M+

Annual Premium Savings

4.9★

Average Ratings

445+

Reviews

5,497+

Happy Clients

We Get It,

Buying Flood Insurance in Texas Is Confusing…

You might be asking:

• What coverage do I need?

• How much is flood insurance in Texas going to cost me?

• How much can I save?

It’s okay, your search for cost-effective Texas flood insurance that doesn’t compromise on coverage ends here.

Meet The Flood Nerd™

Your Texas Flood Expert, Friend, and Guardian

In 2015, Robert Murphy, inspired to help homeowners and businessowners alike, entered the insurance brokerage market with one goal in mind: To help uncertain homeowners find affordable, high quality flood insurance that doesn’t compromise on coverage.

We Find You Great Coverage

While Saving You Up To $1,457+ A Year!

What you seek is:

Enhanced security for your Texas Property.

Significant savings.

Absolute freedom.

Unwavering certainty.

Memorable moments.

Quality family time.

Peaceful travels.

It's As Easy As 1, 2, 3!

1

Fill Out Our Online Form

Complete our easy quote form so we can understand your needs & personalize your rates.

2

Get An Instant Quote

Our team scours insurance companies nationwide to instantly present the best coverage & rate options for your needs.

3

Get Coverage

If you’re happy with the coverage options, you can sign up easily directly from our online portal.

Meet Some Of Our 5,497+ Happy Clients

Who've Seen HUGE Savings

Round Up Savings on Texas Flood Insurance Get Free Quote And Save Big

What is flood insurance and why is it important to consider?

As the Head Flood Nerd at Better Flood, we understand the critical importance of flood insurance in safeguarding Texas homes. A typical Texas homeowner’s policy does not include coverage for flood damage, which means flooding is not covered under standard homeowner insurance policies and requires a separate purchase to ensure protection. Flood insurance specifically covers damage to your home and personal possessions caused by rising water from an external source, such as street flooding. This specialized coverage is essential, particularly given the recent weather events across Texas and the United States, which have vividly demonstrated the devastating impact floods can have.

Even in areas considered low-risk based on flood maps, unexpected and severe flood events can occur, making it clear that no one is completely safe from this natural disaster. Thus, having separate flood insurance is crucial to protect your home and belongings. By investing in adequate flood insurance coverage, implementing flood-proofing measures, and developing an emergency plan, Texans can significantly reduce the potential damage and disruption caused by floods. This proactive approach to flood preparedness ensures that homeowners are not only aware but are also taking necessary steps to mitigate the risks associated with flooding.

Flood Risk Awareness and Preparedness in Texas

While certain regions like Houston are well-known for their high flood risks due to their proximity to waterways and low-lying terrain, the truth is that no part of Texas is immune to the threat of flooding. Even areas considered low-risk based on flood maps can still experience devastating flood events, as seen in the aftermath of major storms and hurricanes like Harvey.

Staying informed about your property’s specific flood risk is crucial for all Texans. By consulting the latest flood map data and understanding your area’s flood history, you can take proactive steps to mitigate potential damage:

- Invest in flood insurance coverage: Flood damage is typically not covered by standard homeowner’s insurance policies. Securing adequate flood insurance is essential for protecting your home and belongings.

- Implement flood-proofing measures: Simple steps like elevating utilities, installing backflow valves, and using flood-resistant materials can significantly reduce the impact of floodwaters on your property.

- Develop an emergency plan: Have an evacuation plan in place and keep emergency supplies on hand. Know the designated evacuation routes and shelters in your area.

- Stay vigilant: Monitor weather reports and heed all evacuation orders or flood warnings issued by local authorities.

By taking a proactive approach to flood preparedness and understanding the risks highlighted by resources like flood maps for areas such as Houston, Texans can minimize the potential damage and disruption caused by these devastating natural disasters.

Here’s the 411 on Texas Flood Insurance from the folks who know flood insurance best – the Flood Nerds

I’m Robert Murphy, the Head Flood Nerd at Better Flood. We Flood Nerds love to shop for flood insurance and save people money. If you’re tired of rising premiums or just need cheap flood insurance fast, let the Flood Nerds find you the best coverage and price.

Texas Homeowner’s Insurance Doesn’t Cover Flooding

A typical Texas homeowner’s policy is written through Farmers, State Farm, Allstate, or GEICO. These policies protect your home from fires, tornados, and theft. But they don’t cover the damage from flooding.

Call your homeowner’s agent and ask them to add a flood endorsement to your policy, and listen to them laugh. But it’s not funny.

To get flood coverage, you must purchase a separate flood insurance policy. And unfortunately, those Farmers, State Farm, and other insurance agents will just stick you in the National Flood Insurance Program (NFIP). It’s the easiest thing for them and the most expensive thing for you.

Flood Nerds are Texas Flood Insurance Experts. We know the Texas private flood insurance market like the back of our hand and we will always find you the best coverage and rate.

Does Renters Insurance Cover Flood damage?

Renters insurance generally does not cover flood damage to personal belongings. As a tenant, it’s essential to verify whether your residence is situated in a flood-prone area. If so, acquiring separate flood insurance is advisable to ensure your possessions are safeguarded against such risks. Always remember that standard renters policies exclude flood coverage.

Do You Need Texas Flood Insurance?

If flood insurance is so necessary in Texas, shouldn’t homeowner’s policies provide it?

No Way!

The NFIP had a stranglehold on the flood insurance market for years. Too many people think they don’t need coverage if they aren’t in a high-risk flood zone. And they find out they’re wrong the hard way.

“Through the ages, I’ll remember – blue eyes crying in the rain”

Willie Nelson, 1975

No wonder Old Willie was crying. When the rain comes down and down, the water washes everything away. And when it rains in Texas, it pours.

Even Texas’s low-risk areas are still at risk. That’s because 20% of all flooding events in the US annually happen in those “low-risk” areas.

Did you think about buying flood insurance when you bought your house but said, “If the lender doesn’t require it, I must not need it”? The real estate agent may have even told you it wasn’t necessary.

Ever see a big storm coming and think about flooding? When the storm’s on the way, it’s too late to buy insurance. Maybe this last flood didn’t affect you. But what about the next flood or the one after that?

A “low-risk” area isn’t a “no-risk” area in Texas.

The government has been collecting flood data for the last 50 years. This data shows that recent major storms have caused flooding in low-risk areas. And 90% of people who had flood water in their homes after these storms didn’t have flood insurance.

Don’t buy the lie that low risk equals no risk. Buy flood insurance!

Are flood insurance policies transferable?

Flood insurance policies can be transferred from a seller to a buyer when the property involved is situated in an area prone to high flood risk. However, this transferability isn’t guaranteed in every case. It is advisable to consult your insurance agent to explore the specifics of your situation and confirm whether the policy can be transferred in your particular case.

Can flood insurance be paid monthly?

Can flood insurance be paid monthly? No. You pay your flood insurance premium on an annual basis. However, if your mortgage lender sets up an escrow account, then the payments can effectively be made monthly by your lender. In some cases, mortgage lenders might set up an escrow account to pay flood insurance on your behalf. It is important to understand that although the payment may be handled monthly through escrow, the full annual premium is still required to initiate and put your flood insurance policy into effect.

What Happens If it Floods and You Don’t Have Insurance?

If your home is damaged by rising water and you don’t have Texas flood insurance, you are responsible for paying to repair the damage.

Flooding is one of the most expensive causes of damage to repair. It can cost $40,000 to $90,000, and that’s not even considering the damage to the contents of your home.

The devastating impact of Hurricane Harvey on Texas serves as a stark reminder of the importance of having adequate flood insurance coverage. This catastrophic event left hundreds of thousands of homeowners across the state uninsured and facing immense financial burdens. One such example is the Miller family from Galveston, whose home was completely submerged during the hurricane. Without flood insurance, they were left to bear the overwhelming costs of repairs and replacement of their belongings entirely out of pocket. Unfortunately, their story is just one of hundreds of thousands that unfolded in the aftermath of Harvey, highlighting the critical need for proper flood insurance in Texas.

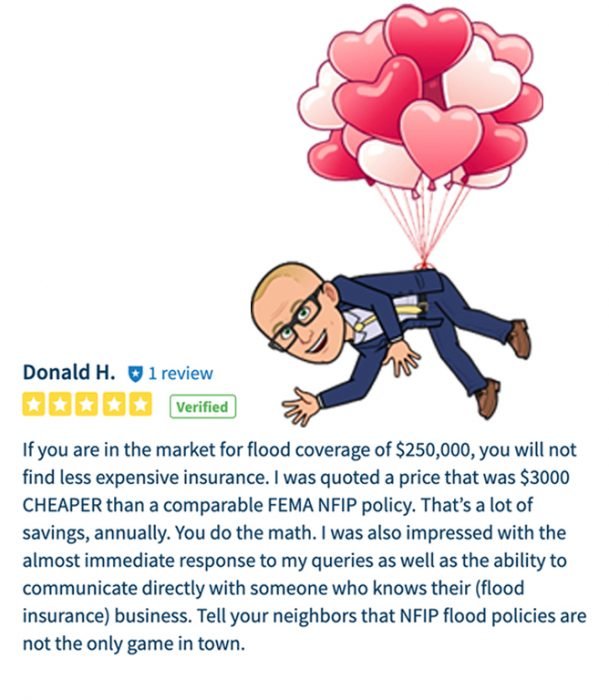

Alarmingly, even those with coverage through the National Flood Insurance Program (NFIP) may not have been getting the best value for their money. According to industry reports, a staggering 97% of NFIP policyholders could have paid less for their Texas flood insurance while still receiving larger claims payouts if they had opted for private flood insurance Texas providers. This revelation underscores the importance of exploring all available options and securing the most comprehensive and cost-effective flood insurance Texas coverage to safeguard your home and financial well-being against the devastating effects of Texas flooding events like Hurricane Harvey.

You say, “Yeah, but if you are such a Flood Nerd, you know the government will step in and help.”

Ha!

Government assistance after a flood is another lie. It’s a whopper too.

Exactly

You get a loan of about $5,000 to cover that average of $40,000 to $90,000 in damage.

Now you know why so many properties are abandoned or foreclosed after flood damage. In Houston, foreclosure started after the floods from Hurricane Harvey spiked 76%.

“The nine most terrifying words in the English language are:

I’m from the Government, and I’m here to help.”

Ronald Regan, former California Governor and President of the US

For you to get that government “assistance,” all these pieces must fall into place:

√ The Texas Governor must request a federal declaration of disaster.

√ The President must declare the area a disaster to make federal assistance available.

√ You must apply for that assistance.

√ If you get it, the assistance will be in the form of a loan you MUST pay back.

√ That glorious assistance will be about $5,000.

What can individuals do if they disagree with the adjuster's damage assessment during a flood insurance claim?

If you find yourself in disagreement with the damage assessment conducted by your adjuster in a flood insurance claim, begin by clearly expressing your concerns to the adjuster to see if a compromise can be reached. If a satisfactory resolution is not achieved through direct discussion, the next step is to approach the adjuster’s supervisor for a review of the assessment. Concurrently, it may be beneficial to get in touch with your insurance agent for additional guidance and support. Furthermore, if the disagreement persists, you have the option to file an appeal with FEMA, where your case can be re-evaluated independently. This structured approach ensures that your concerns are heard and addressed at multiple levels.

Flooding is the number one natural disaster in Texas ~ If you don’t have flood insurance, you face financial ruin.

Federal assistance may help some, but it is better to have flood insurance rather than to rely on the government.

How does the flood claim process work, and what is involved in filing a claim?

The flood claim process begins when you notify your insurance company about a loss due to flooding. They then assign an insurance adjuster to your case. The primary role of this adjuster is to evaluate the extent of the damage and estimate the compensation for the losses that your policy covers.

To formalize your claim, you will need to complete and sign a Proof of Loss form, which the adjuster will provide. This document should detail all the damages and is essential for the processing and approval of your insurance claim. It’s crucial to review this form carefully and ensure it is accurate before signing it. If additional damages are discovered after submission, it’s possible to update the form to reflect these changes.

How are flood damages valued, and what are the two methods used for determining the covered amount?

Flood damages are assessed using two primary valuation methods to determine the amount covered under a typical Dwelling Form: Replacement Cost Value (RCV) and Actual Cash Value (ACV).

Replacement Cost Value (RCV) refers to the amount it would cost to replace the damaged part of a building with materials of similar kind and quality, without deducting for depreciation. For a property to qualify for RCV, there are specific criteria that need to be met: the property in question must be a single-family dwelling, it has to be the owner’s main residence, inhabited for at least 80% of the year, and the coverage must equal at least 80% of the building’s total replacement cost or be the maximum available according to the National Flood Insurance Program (NFIP) standards.

On the other hand, Actual Cash Value (ACV) considers the replacement cost of the damaged portion of the building while also accounting for depreciation based on age and condition. This means ACV is essentially the RCV minus depreciation. Items prone to wear and tear such as appliances and carpets are typically valued using ACV; for instance, carpets can depreciate annually between 10% to 14% depending on their quality. Depreciation plays a significant role in the calculation of ACV. Personal property under the NFIP is also valued on an ACV basis.

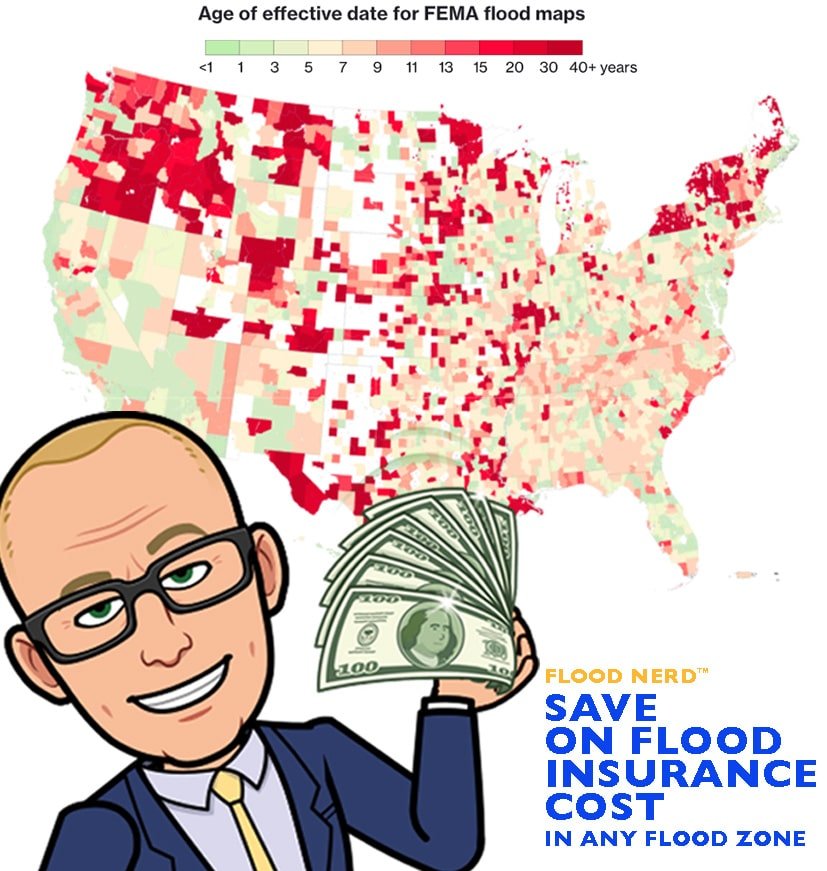

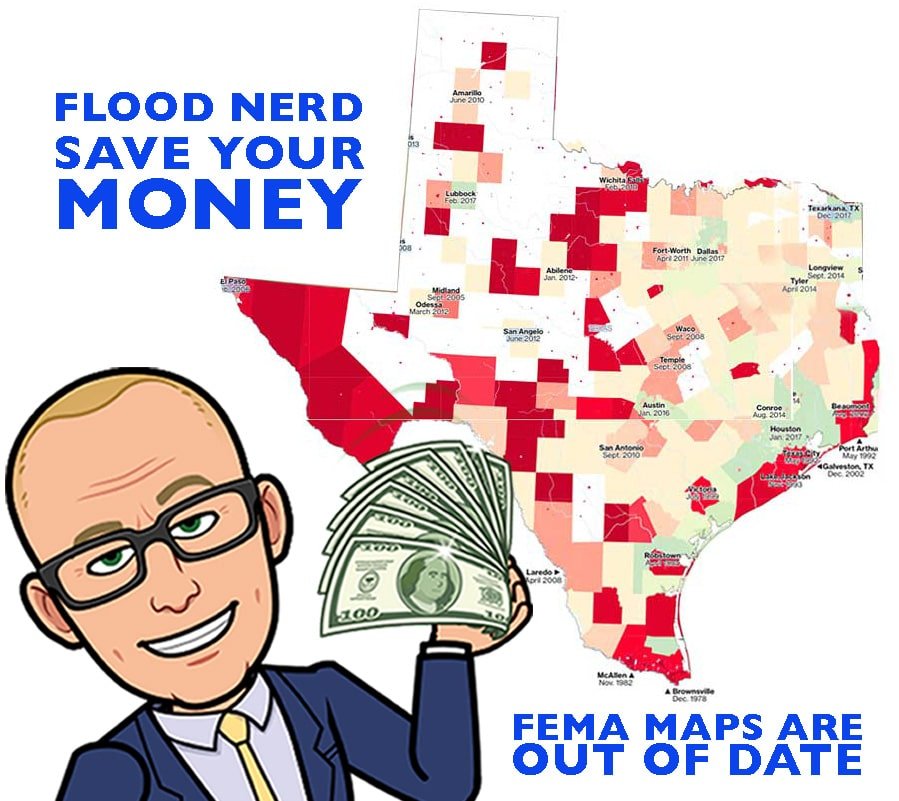

Flood Maps in Texas

Many of the flood maps for Texas are over 40 years old. If the area has been developed since the flood map was created, it is no longer accurate. The development covers dirt with concrete and asphalt; the ground just can’t absorb water as it did before. And when it rains, that water must go somewhere. Bad maps don’t reflect the actual risk of flooding.

This leaves property owners under or uninsured.

And Texas has many bad maps. In Harris County, 134,000 homes flooded during Harvey. Three-quarters of those homes were in low to moderate-risk zones. 80% of the people in the low-risk zones didn’t have flood insurance.

In 2002, from June 29 to July 7, over 35 inches of rain fell in the Hill Country and South Central Texas. The Guadalupe River flowed over the spillway at Canyon Lake for the first time.

Sixty-nine lives were lost, 204,000 homes flooded, and $125 billion in damage. This was just a few years after the 1998 flood, which was a 500-year flood.

It can rain anywhere in Texas.

No matter what the map says, it’s better to have coverage and not need it than not to have coverage and wish you did.

How do individuals determine if they need flood insurance and assess their risk of flood damage?

To decide whether flood insurance is necessary, it’s important to consider the location of your home relative to established flood zones, which are classified by the Federal Emergency Management Agency (FEMA). If your mortgage lender mandates flood insurance due to your home’s placement in a designated high-risk flood area, it’s clear you will require coverage.

Even if such insurance isn’t mandated by a lender, it is still wise to evaluate the potential for flood damage. Statistics from FEMA illustrate that floods can affect areas outside the designated high-risk zones, with 20% of claims filed for properties located outside these zones. This signifies that floods do not strictly adhere to predicted areas, and assessing your vulnerability is crucial.

Investing in flood insurance is further encouraged by the fact that this type of coverage is generally subsidized by the government, making it an affordable safeguard. This can provide considerable peace of mind in protecting your substantial investment in your home. For an accurate assessment of your specific flood risk, consulting with specialists, such as insurance agents knowledgeable in regional flood risks, is advisable. They can offer tailored advice based on an in-depth analysis of your home’s location and related factors.

When is flood insurance required, and what are the circumstances where lenders may mandate it?

Flood insurance is typically mandated by lenders when a property is situated in an area designated as high-risk for floods. However, lenders have the discretion to require flood insurance for any property, regardless of its flood risk classification, as a condition of providing a loan. It is crucial for homeowners to carefully review their mortgage agreements to understand the requirements regarding flood insurance before buying or refinancing their property.

To ensure immediate coverage, homeowners should secure flood insurance either on or before the closing date of their home purchase or refinancing. Failure to do so will result in a standard waiting period of 30 days before the flood insurance policy takes effect. The National Flood Insurance Program (NFIP) oversees flood insurance, although it is administered by various companies. It is advisable for homeowners to buy both their homeowners and flood insurance policies from the same insurance provider to simplify the claims process, potentially dealing with a single claims adjuster for incidents involving both policies.

Flood Insurance Options in Texas

Most homeowners, real estate agents, and lenders don’t realize you have many options when it comes to Texas flood insurance. But the Flood Nerds know all about getting cheap flood insurance in Texas. We know more than 5 Ways to Save on Flood Insurance. There are two markets for flood insurance in Texas.

Comparison of Flood Insurance Options in Texas

While the National Flood Insurance Program (NFIP) has been the traditional option for flood insurance in texas, many savvy homeowners are exploring private flood insurance texas providers for more comprehensive and potentially cheap flood insurance texas coverage. These private market insurers offer several advantages over the NFIP:

- Customizable coverage limits: Private insurers allow you to tailor your policy to your specific needs, with coverage limits often exceeding the NFIP’s maximums of $250,000 for your home’s structure and $100,000 for personal belongings.

- Additional protection: Many private policies include extras like replacement cost value coverage, coverage for living expenses if displaced, and protection for basements and high-value items that may be excluded under NFIP policies.

- Competitive pricing: By leveraging their underwriting expertise and risk models, private insurers can often provide lower “flood insurance texas cost” than the NFIP, especially for low-to-moderate risk properties.

- Fewer restrictions: Private policies typically have fewer eligibility restrictions than the NFIP, making it easier to secure coverage even for properties with previous flood claims or those outside FEMA-designated flood zones.

While the NFIP remains a viable option, particularly for high-risk properties, exploring the private flood insurance texas market is a wise move for Texans seeking comprehensive protection at competitive flood insurance texas cost rates. By shopping around and comparing quotes from multiple providers, homeowners can find the best value policy to safeguard their homes and belongings against the potentially devastating effects of texas flooding.

FEMA texas

The Federal Emergency Management Administration runs the National Flood Insurance Program, and they are the government option for flood insurance. They’ve had a 50-year monopoly on the market, and the premiums reflect their dominance.

The NFIP uses resellers. Companies like State Farm, Nationwide, and Progressive (just a few examples) sell you a policy under their company name. Still, it’s an NFIP policy with their insurance company logo. If you have flood insurance through one of the big national insurance companies, you have a government policy in disguise. That’s NOT the way to save money on flood insurance in Texas. Wonder if your flood insurance is through a reseller? Check out this list of companies that resell the NFIP policy.

The private flood insurance market

Texas is big enough to handle a robust private flood insurance market. You can tap into the Lloyds of London flood insurance syndicate for Texas flood insurance. You can often get great rates with Lloyds because they spread the risk worldwide. The risk of the entire planet flooding at once is very small. We Flood Nerds joke, “God said he wouldn’t flood the world again, and Lloyds of London takes him at his word”. Now you know what makes a Flood Nerd laugh.

But getting the right Texas flood insurance is no laughing matter. There are so many options, and it’s easy to confuse the private flood insurance market with that NFIP re-sellers. You must let a Flood Nerd shop for your cheapest flood insurance in Texas.

We shop all the options for your property in your region of Texas and ensure you get the best premium. We’ll even check out the NFIP to ensure that all the bases are covered.

How much does flood insurance Cost in Texas and what are the factors that influence the cost?

Texas has everything from mountains to hills to coastal plains. One major factor in the cost of flood insurance for Texas is the property location and the company you choose to write the coverage for. Premiums for homes in low-to-moderate risk are lower, and premiums in high-risk areas are higher.

In Texas, flood insurance costs and the factors influencing these costs vary significantly across different areas. The average cost for the 784,865 NFIP (National Flood Insurance Program) policies in force is $581.00, totaling $435,171,125. Factors like flood zones, the elevation of homes, the amount of coverage selected, and the chosen deductible play crucial roles in determining these costs.

For instance, Aransas County has 3,086 NFIP policies with a written premium of $1,560,060, making the county average premium around $506. Similarly, Houston, which leads the state in flood policies, has an average premium of $580 for its 150,213 policies. The variance in premiums across the state can also be seen in Port Aransas and Rockport with averages of $739 and $555, respectively.

Moreover, premiums in cities like Sealy and Austin average at $592, whereas Bandera County and Bastrop County have higher averages of $708 and $728, respectively. This pattern continues with Bee County and Beeville at $747, and Bell County, including Harker Heights and Killeen, at $686. Larger cities such as San Antonio and Dallas show premiums of $683 and $663, respectively, reflecting the influence of urban flood risks and zone classifications.

Locations such as Lake Jackson and Pearland, with premiums of $397 and $480 respectively, demonstrate how lower-risk zones and favorable elevation can lead to more affordable insurance rates. On the contrary, areas like Falfurrias, Brown County, and Brownwood, facing higher flood risks or adverse geographical features, have an elevated average premium of $935.

Understanding these variations is crucial for homeowners and potential buyers. Those residing in preferred or moderate risk zones, such as Zone X, often find flood insurance through NFIP to be very affordable, contrasting with higher-risk areas where premiums escalate due to increased exposure to flood hazards.

In summary, Texas showcases a broad spectrum of flood insurance premiums influenced by localized flood risks, elevation levels, coverage amounts, and deductibles. This detailed understanding helps residents and insurers alike in navigating the complexities of flood insurance costs in various Texan communities.

Flood Zone X – Texas Low to Moderate Risk Zone

Lenders don’t require flood insurance in this zone. But remember, floods like those in Houston happen in low-risk zones, and the map may be old.

We usually suggest the government Preferred Risk Policy (PRP) for properties in the X Flood Zone. The government subsidizes a portion of the premium and limits the coverage, which keeps the rates low.

The average cost for PRP flood insurance in Texas with the maximum set limits in low-risk flood zone areas is $634 per year.

Flood Zone AE in Texas

A higher-risk flood zone is Flood Zone AE Texas. If your property is in Zone AE, your lender will require you to have flood insurance.

The cost of flood insurance in Texas in flood zone AE depends on factors that are unique to the structure.

For example, look at a house built on a slab-on-grade foundation in Austin. The Base Flood Elevation (BFE) is 576, and the home was built in 1974. The sample policy is for flood coverage at the NFIP maximum of $250,000 for the building. It doesn’t include contents and the deductible is our recommended amount of $5,000.

While the example house is in Austin, the premiums will be the same as in Dallas, El Paso, Houston, Ft. Worth, Brownsville, and most other Texas cities and counties in AE flood zones.

The NFIP option in Texas Flood Zone AE is $2,172.00

This would be the price if the property had a previous flood loss and either doesn’t have an Elevation Certificate or the Elevation Certificate shows the lowest floor is 4 feet under the BFE. This policy lets you use 10% of your coverage to cover other structures on your property

Let’s look at the Texas private flood insurance market and compare the options. The coverage and deductible are exactly the same.

The Texas Lloyds of London policy would be $688.00

This option is great, but they won’t cover property with a prior flood loss. But they will cover more than the NFIP and about $2,000 for loss of use. $2,000 for other structures doesn’t increase this coverage. They don’t require an Elevation Certificate.

Texas private flood insurance (Not Lloyds) is $1,932.30

This option will take properties with one prior flood loss if it was more than five years ago and the claim was under $100,000. They will write practically all risks, and you don’t need an elevation certificate.

Replacement Cost Value Coverage

Standard flood insurance provides coverage for a set amount. But with flood insurance from the private marketplace, you can insure the actual cost of replacing the home. These policies must be written for the actual replacement cost. The $250,000 example we are using is probably a little low for replacement cost, but we’ll stick with that amount to keep the comparison the same.

So for $250,000 replacement cost value building coverage, 20% contents coverage, 10% other structures, and 10% loss of use with a $5,000 deductible, the annual premium for RCV coverage is $1,475.00. That’s more insurance for a lower price than the NFIP!

What does flood insurance cover and what does it not cover?

Flood insurance policies, whether obtained from private insurers or through the National Flood Insurance Program (NFIP), generally cover physical damage to your property and possessions resulting from flooding. This typically includes structural damage, essential systems like plumbing and electrical, permanent fixtures, and large appliances. However, coverage details can differ significantly between private policies and those offered by the NFIP.

Private flood insurance may offer additional options not available through the NFIP, such as replacement cost coverage for personal possessions or coverage for temporary living expenses if your home is uninhabitable. It’s crucial to consult with an flood nerd who can help you explore various private flood insurance products to find one that best suits your needs.

Keep in mind that neither NFIP nor private flood insurance typically covers damage caused by moisture, mildew, or mold that could have been avoided by the property owner. Furthermore, valuable papers, precious metals, and currency are usually excluded from flood insurance policies. Outdoor property such as decks, fences, and swimming pools are also generally not covered.

Flood Zone V and VE in Texas

NFIP insurance for homes in Texas’s V and VE flood zones is crazy expensive. Once I saw a premium of $30,000 a year for a single-home family. This is ridiculous!!

To save you money, the Flood Nerds shop flood insurance for your V or VE flood zone properties on the private flood market is underwritten by Lloyds of London.

We see savings in the thousands with this approach, AND we have been able to double and triple coverage for properties on the Texas Gulfcoast.

The problem with the NFIP approach is they take a one-size-fits-all approach to coverage. The results are premiums far too high for waterfront houses.

Many coastal Texas homes are custom-built. The NFIP doesn’t consider this, but Lloyd’s of London’s other private flood insurers do. They offer variable coverage options as well as significant savings.

For example, in a VE flood zone map, a home on the Bolivar peninsula needs $250,000 of coverage, with no contents coverage and a $5,000 deductible.

The NFIP annual cost for flood insurance in the texas VE flood zone is $12,278.00.

Ouch!

The same coverage for the same property on the private market is under $2,500.

How can flood insurance be purchased, and what are the options available?

Flood insurance can be obtained through two primary avenues: private insurers and the federal government’s National Flood Insurance Program (NFIP). This type of insurance is essential to cover damages to both the physical structure of a property and its contents, applying to both homes and businesses. The NFIP provides a basic level of coverage which includes a cap on damages per person and per incident, as well as for property damage. However, these caps might not fully cover all potential losses. To supplement this, one can opt for Excess flood coverage, which provides additional protection beyond the limits of the NFIP policy, securing greater financial coverage for higher risk or value properties.

Find out more about

– how flood insurance Texas works

In Texas, flood insurance helps protect homeowners and businesses from the financial devastation caused by flooding by providing coverage for damage to property and possessions that are not typically covered by a standard homeowner or business insurance policy.

– how to save money in flood zone AE Texas

Flood Nerds can help Texans in AE flood zones save money on their flood insurance by offering personalized advice and guidance to make sure they are receiving the coverage they need at the lowest possible cost.

In Texas, flood insurance typically costs homeowners between $500 and $1,500 annually depending on the property’s location and risk of flooding.

– how to get the cheap flood insurance in Texas

By allowing a Flood Nerd™ to analyze your property, they can help you find the most affordable flood insurance by comparing rates from various providers and leveraging discounts that are available.

– how to shop for flood insurance quote in Texas

To get a flood insurance quote in Texas, you can carefully analyze your property with a flood nerd who will compare rates from multiple providers and help you take advantage of discounts to find the most affordable policy available.

The flood nerd offers an invaluable service, as they are knowledgeable of all the different flood insurance companies in Texas and can help you find the most competitive rate tailored to your specific needs.

The flood nerds can shop through a variety of private flood insurance options in Texas in minuets not hours, this allows us to find the right private flood insurance price for you.

– Texas flood insurance rate maps

Flood insurance rates in Texas are determined by FEMA flood insurance rate maps, which detail the risk level of flooding for different areas in the state. Depending on the perceived risk of your property’s location, the corresponding rate you receive can be higher or lower than average.

Average Flood Insurance Costs in Texas by Area

How much does flood insurance cost in Texas? If you look at the number of NFIP policies and the combined premium, you can see people pay way too much in Texas for flood insurance.

Texas has 784,865 NFIP policies in force at a total cost of $435,171,125

How much does flood insurance cost in Texas? If you look at the number of NFIP policies and the combined premium, you can see people pay way too much in Texas for flood insurance.

Texas has 784,865 NFIP policies in force at a total cost of $435,171,125

That’s an average of $581.00

Aransas County has 3,086 flood NFIP policies with $1,560,060 written premium. That makes the county average premium around $506. The private market is probably a better solution. Click here to have our shop and save you money.

Aransas Pass and Fulton have 1147 policies with a total premium of $603,457. The average policy rate is $526.

Houston leads the state in flood policies with 150,213. The total premium is $87,140,405. The average in your area is $580. You need flood insurance in Houston and if you are paying more, get a free quote from a Flood Nerd.

Port Aransas has 5,084 policies with a total written premium of $3,758,878. The average for this area is $739.

Rockport has a written premium of $1,606,256 for 2,894 policies. The average premium for Rockport is $555.

Sealy and Austin combine 509 policies. The combined policy premiums are $301,194, with an average of $592. Paying more? Get a free quote.

Bandera County has 386 policies for a total of $273,500. The average policy premium is $708.

Bastrop County totals 608 policies. The total premium written is $442,420, and the average is $728.

Bee County and Beeville combine for a total premium of $211,247 for 283 policies. Your average is $747.

Bell County, Harker Heights, and Killeen have a $539,511 written premium. The average for this area is $686 for 787 policies.

Salado, Temple, and Alamo Heights have 592 policies. The total written premium is $428,772. The average premium for this area is $723.

Bexar County has 1455 policies with a $695,116 written premium. The average policy runs $478.

San Antonio has 5,380 policies! The total NFIP premium in San Antonio is $3,674,811. The average policy cost here is $683 for government flood insurance.

Alvin pays the government an average policy cost of $650. There are 2,274 policies that cost $1,478,886.

Angleton and the Village of Bailey’s Prairie have 1,689 policies! The average policy costs $692. The total written premium is $800,248!

Brazoria County has 18,646 policies written for the enormous amount of $10,535,906! The average policy cost in your area is $565.

Towns in that area, like Brazoria, Brookside Village, Freeport, and Village of Jones Creek, have a combined total of 1,614 policies. The total premium is $1,116,760. The average policy costs $692.

Looking at Clute and Danbury, the policy premiums combine for $357,885. A total of 808 NFIP policies are issued in your area. That averages $443 per policy.

Lake Jackson has an average policy cost of $397. The total policy cost here is $1,439,394 for 3,622 policies!

Manvel has 1,248 policies with total premiums of $651,535. The average policy runs $522.

In Pearland, there are 8,326 policies. These policies total $3,996,654. The average policy in Pearland costs $480.

The total premium written in Richwood and Surfside Beach is $2,304,003. The typical NFIP policy here is an expensive $2028. These two cities have 1,136 policies.

Sweeny and West Columbia have 571 policies. These policies total $281,056, and the average NFIP premium for this area is $492.

Brazos, Bryan, and College Station have 1,582 policies. The typical rate for these Texas cities is $553. The total premium price here is $874,553.

Falfurrias, Brown County, and Brownwood’s total price tag comes in at $466,951. The average is a little higher here at $935. And there are only 499 policies in effect here!

Burnet, Granite Shoals, Horseshoe Bay, and Marble Falls, Texas, have a total premium price tag of $989,663. There are 1,234 policies with an average of $796.

Caldwell and San Marcos have 950 policies for a total cost of $582,944. Your average policy rate is $613.

Written premiums in Calhoun total $1,424,252. The average policy fee is $790. The number of policies in Calhoun totals 1,803.

Port Lavaca and Sea Drift have 689 policies totaling $430,234. The typical rate here is $624.

2,835 NFIP policies are in effect in Brownsville. This totals $1,613,108, with the average rate at $569.

The premiums were written in Cameron equal $1,697,451. Your policy count is higher here at 3,275! The average policy fees in Cameron are $518. Do you have NFIP coverage?

In Harlingen, the average premium is $469. There are 2,019 NFIP policies written that total up to $947,796.

La Feria and Laguna Vista have 968 policies. These policies total up to $343,046 in premiums. The average policy cost here is $354!

One thousand two hundred thirty-nine policies are in effect in Palm Valley, Port Isabel, and San Benito. The average price for these policies is $588. The total premium written is $728,489.

Hello South Padre Island! You have a ton of policies – 8,178! Your average policy rate is $443 through the NFIP! The total price of the policies in your area is $3,622,415. Need more than $250,000 in coverage? The Flood Nerds can help.

Anahuac and Beach City have 510 policies. The total premiums here are $217,095, and the average government flood policy is $425.

Chambers pays a typical policy rate of $490. Premiums here total at $1,435,733 with 2,932 policies in effect.

In Mont Belvieu, premiums total only $234,700. The average here is $430. There are 546 policies in effect.

Allen and Collin pay an average NFIP rate of $448. Four hundred seventy-four policies total $212,427.

Hello Dallas! How ‘bout them Cowboys? You have a total of 4,955 NFIP policies. The typical rate is $663 with $3,286,025 in written premiums.

Let’s not forget about Frisco, Garland, and McKinney! Frisco is the home of the Cowboy’s training center! The total number of NFIP policies in these cities is 1,230! The total premiums come in at $844,651, and the average policy rate at $687.

Plano and Richardson combine 1,075 policies. The average rate is $499. The total premiums cost $536,155.

One thousand one hundred nine policies are in effect in Comal. The average cost in this area is $532. The premiums total $590,375.

New Braunfels has an average rate of $628 per policy. The premiums written total $1,095,282 for 1,743 policies.

Combine the Desoto, Duncanville, and Farmers Branch areas, and you’ll find 657 policies in effect. The total premium is $714,973 and the average rate is pretty high at $1088.

Grapevine and Grand Prairie have a total of 528 policies. These total $323,561, and the average policy cost is $613.

The following cities are included in the next analysis: Irving, Lewisville, Mesquite, and Denton. These cities have 2,000 NFIP policies in effect. The average rate here is $811. The total amount of written premium comes in at $1,622,667.

Fort Worth, your Water Gardens, and Stockyard are sites to behold. The average policy cost is pretty stunning, too, at $883. 2,490 total policies cost $2,199,603.

Premiums for Ector and Odessa total $1,282,655 for 959 policies. The average rate in this area is higher than other cities at $1,338.

El Paso flood policies average $767. There are 3,876 policies in El Paso that total $2,972,990.

Six hundred twenty-seven policies are written in Ellis, Mansfield, and Waxahachie. These premiums add up to $364,370 and the average is $581.

In Big Oaks, 757 NFIP policies are in effect. The Big Oaks average policy rate is $353. The premiums total at $267,459.

The total premiums written in First Colony are $525,438 for 1,427 policies. That makes the average rate in First Colony $368.

Fort Bend County has 37,225 active policies with $14,876,334 in written premiums. The average rate for a flood policy in Fort Bend County is $400.

The average Fulshear policy rate is $374. 1,201 policies total $449,788.

Four thousand three hundred thirty-one policies are in effect in Missouri City. These premiums total $1,665,920, with the average policy rate at $385.

Pecan Grove has an average rate of $369. This includes 1,607 policies with a total premium of $592,334.

When we look at Richmond and Rosenberg, they combine 1,398 NFIP policies in effect. Their premiums total $668,517, which makes the average $478.

Simonton and Stafford have 858 policies with a total premium of $522,740. The average for your cities is $609.

The average policy cost in Sugar Land is $401. There are 3,970 policies for a total written premium of $1,595,398.

There are 731 policies in effect in the City of Weston Lakes. These premiums add up to $302,569. The average rate for Weston Lakes is $414.

In Clear Lake Shores, the NFIP policies total up to $409,538 in premiums. The average of 547 policies is $749.

The City of Dickinson has 2,659 policies for a total of $1,497,885 in premiums. The average rate for Dickinson flood insurance is $563.

The average policy cost for Friendswood is $412. There are 8,352 policies with a total premium of $3,439,799.

When looking at Galveston County versus Galveston City, Galveston County has only 9,655 policies in effect with $12,173,203 in premiums for an average policy cost of $1,260. But the Galveston City average rate is $1558! The city of Galveston pays $25,100,881 for 16,116 policies in effect.

Not too far away in Hitchcock, premiums average $686. The policy totals in Hitchcock are $627,091 for 914 policies.

Jamaica Beach has a higher average policy rate of $1,454. This rate is calculated from 939 policies in effect totaling $1,365,774.

Kemah pays an average rate of $851. The total premium written for your area is $479,805. This includes 564 policies in effect.

The premium total for La Marque is $934,739 for 1,913 policies. This makes the average rate $489, a little lower than other cities in your county.

League City has over 18,403 policies in effect! Your premiums in League City total up to $7,468,264, which makes the average policy cost $406.

The average policy rate is $400 in Santa Fe! There are 1,370 policies for a total of $548,129 for NFIP premiums.

Texas City pays an average of $448. The total premiums are $2,193,520, with 4,899 policies in effect.

Tiki Island has one of the highest average rates in Texas at $3,971 per policy. The premiums written here total $2,148,260, with only 541 policies written.

One thousand six hundred sixty-one policies are written in Guadalupe. This totals to $1,869,090 in premiums and averages out to $1,125 per policy.

Hardin has 1,932 policies in effect. The average policy costs $516 with $996,167 in premiums in effect.

The City of Lumberton has an average policy cost of $469. There are 937 policies in effect with $439,692 in premiums.

In Baytown, there are 4,683 policies with premiums totaling $2,364,402. The average policy costs $505 in Baytown.

Bellaire pays an average rate of $882. There are 5,101 NFIP policies in Bellaire for $4,500,850 in premiums.

Looking at Bunker Hill Village and Chelford for a total of 900 policies. The average is $399. The premiums for these 900 policies total up to be $359,407.

$489 is the average policy rate for Deer Park. This includes 4,531 policies in effect with $2,216,937 in premiums.

The average flood insurance rate for El Lago or Galena Park is $572. They have 1,161 policies for a total of $663,612 in premiums.

Harris County has a lot of policies in effect, second only to Houston, with 121,729 policies! Your premiums total $54,014,554, which makes the average premium $444.

Hello, Humble has $604,760 in premiums from 927 policies. The average policy rate for Humble is $652.

Looking at Hunter’s Creek Village and Jacinto City, there are $451,927 in premiums written from 1,050 policies. The average is $430 per policy.

Jersey Village has an average policy rate of $858. This is for 1,382 policies with a total premium of $1,185,750.

$473 is the average rate for Katy. There are 2,149 policies written in Katy with total premiums of $1,017,481.

Four thousand nine hundred sixty-one policies are in effect in La Porte. The premiums total $2,946,020 for an average rate of $594.

Nassau Bay has an average rate of $827. The premium total is $1,148,385 for 1,389 policies.

Pasadena has10,478 policies and total premiums of $5,015,720. This makes your average $479.

The city of Seabrooke has 3,396 policies in effect. The average rate is $918 for Seabrooke, which pays $3,117,754 in premiums.

Let’s look at a group of cities – Shoreacres, South Houston, Southside Place, and Spring Valley Village. The premium total for these cities is $2,121,208 for 2,652 policies. This makes the average premium $800 for these lovely Texas cities.

Hello Taylor Lake Village! Glad to see you here! Your average premium is $554. The total premium is $604,650 for 1,091 policies.

West Keegans Bayou and Tomball have 905 policies that total $400,417 in premiums. This makes your average rate $442.

In the city of Webster, your average rate calculates out to be $497! This includes 1,230 policies with $611,482 in premiums.

Three thousand three hundred thirty-one policies are in effect in West University Place. These NFIP policies cost $1,625,598 in premiums and an average policy rate of $488.

Hello Willow Fork Drainage, Texas! Your average rate is $370! In effect are 5,028 policies for a total of $1,861,402 in premiums.

Austin! Weird, wacky, and home of the State Capitol. Your average rate is $647. The premiums in Austin total up to $4,609,074 for 7,127 policies.

Hays has an average rate of $535. The premiums in Hays are $555,281. This includes 1,039 policies.

$460 is the average policy rate for Edinburg. There are 1,366 policies with $628,993 in written premiums in Edinburg, Texas.

Hola Hidalgo! Your average flood rate is $441. You have 5,046 NFIP policies with $2,227,469 in premiums.

Two thousand one hundred ninety-one policies are in effect in McAllen. The average rate in McAllen is $465 based on $1,019,537 paid to Washington for premiums.

Mission City pays $466. 1,013 policies cost $471,905.

Pharr and Weslaco have an average policy rate of $465. Their premiums combine for $455,111 with 978 policies in effect.

Edna and Jackson combined have $403,938 in premiums for 645 policies. This makes the average NFIP flood policy cost $626.

$463 is the average rate for Beaumont. The total in premiums is $4,041,635, with 8,722 policies in effect.

Hello Groves, Texas! Nice to see you here. You pay Washington $1,111,648 in premiums for NFIP insurance. Your average rate is $397 for 2,799 policies!

The average rate is $534 for Jefferson. There are 3,741 total policies in your area that pay $1,996,974 in premiums.

$401 is the average flood rate for Nederland. The premiums in Nederland are $1,060,856 for 2,647 policies.

Port Arthur pays an average flood rate of $505. Seven thousand five hundred-four policies are active in Port Arthur, Texas. The premiums total up to $3,789,501.

A lower average flood rate is $391 for Port Neches, Texas! Port Neches has 2,259 policies in effect with $882,162 in premiums.

Abilene pays an average rate of $994. There are 2,468 policies written in Abilene with a total of $2,453,404 in premiums.

In Boerne and Kendall, the average rate is $729. The policy premiums total up to $409,954 for 562 policies.

The average flood rate in Kingsville and Kleberg is $563. 662 NFIP policies pay $372,927 in premiums.

$530 is the average flood rate in Liberty, Texas. Liberty has 1,533 policies in effect with $812,158 in written premiums.

Hello Llano and Sunrise Beach Village, Texas! Nice to have you here. Your average flood rate is $984! That is based on $765,550 in written premiums for 778 policies.

The city of Lubbock pays more than the state average. Residents pay an average flood rate of $1,134. This rate includes 1,425 policies and $1,616,613 in written premiums.

Bay City, Texas, has 1,008 active policies. The total written premium in Bay City is $620,791. The average for Bay City is $616.

Moving over to Matagorda, the average rate jumps to $1,390. This NFIP flood rate includes 2,037 policies in effect and $2,831,526 in premiums.

Midland has an average flood policy rate of $886. The premiums written in Midland total up to $1,018,066 for 1,149 active policies.

Hello Conroe! There are 1,823 active policies in Conroe. The premiums total $846,046, which makes the average flood rate $464.

Montgomery y’all have a ton of active policies – 25,008 to be exact! The average rate for Montgomery, Texas, is $446, based on total premiums of $11,161,553!

Hello Corpus Christi! The average flood rate in the Sparkling City by the Sea is $535! The total cost is $10,460,310 for 19,565 active policies.

$503 is the average flood rate for Nueces County. There are 5,064 policies in effect in Nueces County. Written premiums total $2,546,346.

Portland has 1,015 policies and an average NFIP flood rate of $438! The total premiums in Portland come in at $444,640.

One thousand nine hundred ninety-four policies are in effect in Bridge City. They cost a total of $1,156,004, making the average rate for Bridge City $580.

Orange County, Texas, has 6,749 active policies! Their premiums add up to $3,398,173, which makes the average policy $504.

Orange City has fewer policies than Orange County. There are 2,379 total active policies. The premiums come in at $1,590,908, making their average rate $669.

In the city of Vidor, the NFIP Flood Insurance rate runs an average of $555. The premiums written here total up to $645,136 for 1,162 policies.

Arlington is the true home of the Cowboys and Globe Life Park! Arlington, Texas, has 1,539 active policies that cost $973,990. The average NFIP policy premium is $633.

$770 is the average flood rate for Travis. In Travis, there are 1,951 policies in effect with $1,501,627 in written premiums.

Hello Laredo! Thanks for visiting our page! The average flood policy in Laredo, Texas is $1,168. The premiums written in this area total up to $1,075,936 for 921 policies.

Wharton County has an average premium of $685. Wharton County has 1,166 active policies which include $798,180 in written premiums!

$808 is the average rate for flood policies in Wichita County and Wichita Falls. There are a total of 968 policies with $781,665 in premiums.

Georgetown has 557 active policies that cost $270,749 for NFIP flood insurance. This makes the average flood rate $486.

In Williamson, the average rate is $591.This includes 1,178 active policies and a premium total of $695,816.

Finally – Consider This About the NFIP!

If you’ve made it to the end of this page, you deserve something special. And that’s the inside scoop on the NFIP!

The NFIP made flood insurance available to more than 20,000 communities in the United States. That’s great. But, Texas has its own private flood insurance market, and private markets usually provide better premiums than the government.

For decades, the NFIP over-charged 50% of its policyholders and under-charged the other 50% all while racking up $42 billion in taxpayer-funded losses.

Think about that! No one pays the correct premium if you overcharge half and undercharge half. Are you gambling that you are the undercharged half?

About 30% of NFIP claim payments go to the same 3% of insured loss structures yearly. This means that the other 97% of flood-exposed policyholders could have paid less and still netted larger claims payouts if they had been in the private flood insurance.

It doesn’t make sense to risk losing everything if you don’t have flood insurance. And it doesn’t make sense to overpay for flood insurance.