Instant Tennessee Flood Insurance at Great Rates.

Save big with our reliable Tennessee flood insurance plans—fast quotes, faster coverage.

$2.3M+

Annual Premium Savings

4.9★

Average Ratings

445+

Reviews

5,497+

Happy Clients

We Get It,

Buying Flood Insurance in Tennessee Is Confusing…

You might be asking:

• What coverage do I need?

• How much is flood insurance in Tennessee going to cost me?

• How much can I save?

It’s okay, your search for cost-effective TN flood insurance that doesn’t compromise on coverage ends here.

Meet The Flood Nerd™

Your Tennessee Flood Expert, Friend, and Guardian

In 2015, Robert Murphy, inspired to help homeowners and businessowners alike, entered the insurance brokerage market with one goal in mind: To help uncertain TN homeowners find affordable, high quality flood insurance that doesn’t compromise on coverage.

We Find You Great Coverage

While Saving You Up To $1,457+ A Year!

What you seek is:

Enhanced security for your Tennessee Property.

Significant savings.

Absolute freedom.

Unwavering certainty.

Memorable moments.

Quality family time.

Peaceful travels.

It's As Easy As 1, 2, 3!

1

Fill Out Our Online Form

Complete our easy quote form so we can understand your needs & personalize your rates.

2

Get An Instant Quote

Our team scours insurance companies nationwide to instantly present the best coverage & rate options for your needs.

3

Get Coverage

If you’re happy with the coverage options, you can sign up easily directly from our online portal.

Get Cheap Flood Insurance TN without Compromising Your Coverage.

Get Cheap Flood Insurance without Compromising Coverage

★★★★★

"Same Coverage at a Better Rate"

-Mohammed K

Flood Nerds will shop the private flood insurance markets and then compare them to the NFIP, guaranteeing you the better option. We will send you the cheapest flood insurance rates within minutes.

★★★★★

"Quick Response, Very Knowledgable"

– Robert W

Paying for low-cost flood insurance is awesome. And letting the Flood Nerds shop your property has other benefits – you can get better coverage while saving money, and you can get it fast.

★★★★★

"Would highly recommend Better Flood for your flood insurance needs."

– Varun K

Better Flood Insurance is an independent flood insurance broker that shops flood insurance ONLY. Flood Nerds are Flood insurance experts. We have 5000+ happy clients and 390+ 5-star reviews.

Does my Tennessee homeowner insurance cover flooding?

Do I need flood insurance in Tennessee?

It is important to have flood insurance coverage in Tennessee because our beloved Cowboy State has seen a fair share of flooding, and more is likely coming.

We believe most homeowners think about Flood insurance in Tennessee at some point, maybe before buying a home or during the closing process. However, many of us only think about it when a big storm is looming, or we have heard on the news that there is flooding forecasted or happening too close to our home.

If your home or business is in a flood zone, that is considered a low flood-risk area. Sadly, many homeowners decide to forgo purchasing coverage because they believe they are safe from flooding. Some real estate and insurance agents may even say you don’t need it.

I ask you to consider the facts: 20 percent of all flooding events across our nation come in areas that are considered low risk. After our last few major storms (Hurricane Harvey), we saw flooding in these low-risk areas. 80 percent of these individuals had water in their homes or buildings and didn’t have flood insurance coverage.

In Harris county, nearly 135,000 homes were damaged. Three-fourths of these properties were considered low to moderate risk.

We often hear that people believe that the government will help, which is true. However, a few things must align for you to get government assistance.

1 – The president of the United States must declare the flooding event a state of emergency. If this doesn’t happen, then there won’t be assistance.

2 – Homeowners’ average amount of assistance after a flood, when they do not have flood coverage, is $5,000. The average cost of damage to one’s property after a flood is $38,000+. That $5K you get from the government? It comes as a loan, and you will need to pay it back. Are you willing to gamble your financial future by forgoing flood insurance coverage?

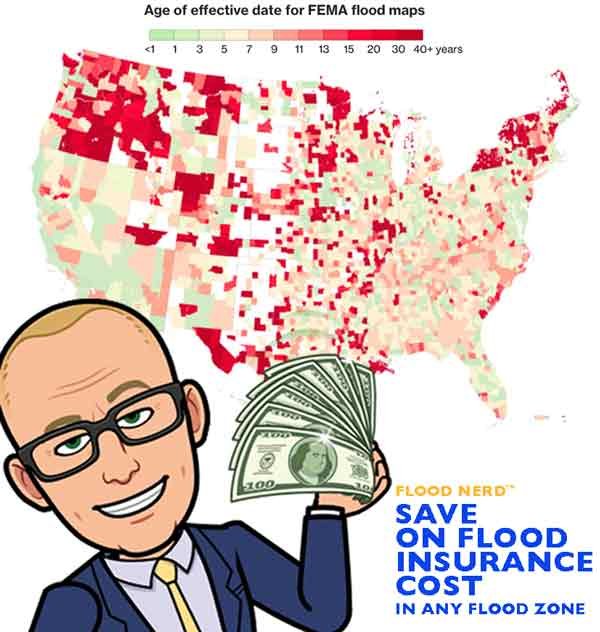

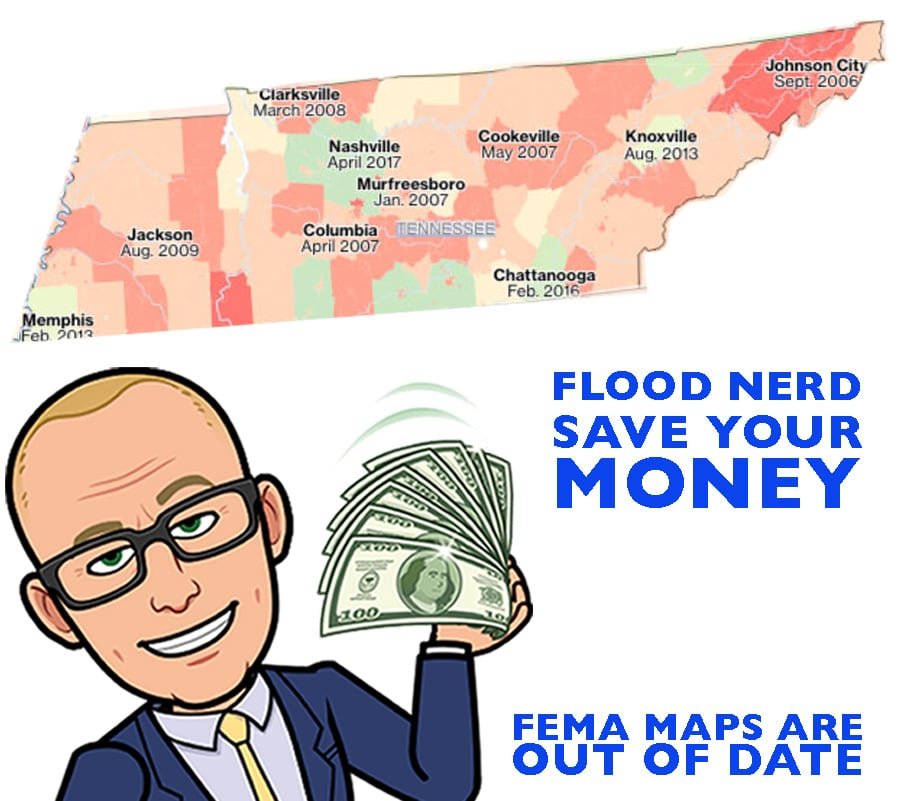

One more note on these low-risk flood zone maps. Many of these maps are over 40 years old. If the area has been developed, then there is likely more concrete, creating a barrier for land that, previously, might have absorbed the massive downpour.

Because of all these factors, it is difficult for property owners to know their true risk of flooding. FEMA admits that their flood maps only give an idea of part of the risk. Our recent storms are facts that it can rain anywhere within Tennessee, and you should consider getting flood coverage so you are not uninsured when you need it most.

FEMA flood zone maps often take years to go into effect after the terrain was studied; this gives the impression that the area is “more up to date” than it is.

The average cost for Tennessee flood insurance in these Low-risk areas is $595 per year.

FEMA’s National Flood Insurance Program (NFIP) and all federally backed lenders rely on these Tennessee flood insurance maps to assess risk, set premiums, and determine who is required to purchase flood insurance. Bad information about an areas flood risk can leave property owners under or uninsured.

How much is flood insurance in Tennessee?

Tennessee NFIP flood insurance.

There are many options available in Tennessee regarding flood insurance, but they fall into two main categories. The Government option also referred to as FEMA or NFIP, and the private flood insurance market.

The National Flood Insurance Program (NFIP), also known as FEMA, is the government option for flood insurance. The NFIP has enjoyed a 50-state monopoly on the flood insurance market.

What is not covered by the NFIP?

It’s crucial to recognize that the NFIP’s coverage limitations could leave notable gaps in your flood protection plan. For Tennessee homeowners seeking more robust coverage, exploring additional flood insurance options from private insurers is advisable. Private flood insurance typically extends beyond NFIP offerings, covering debris removal and living expenses if your home is uninhabitable after a flood—key areas where NFIP might not provide support. These private policies can be adapted to meet broader needs, featuring higher coverage limits and fewer restrictions.

Moreover, coverage for contents stored in basement areas is a significant concern, particularly for those in Tennessee who utilize these spaces extensively. Private insurance policies can be adjusted to cover these risks, ensuring comprehensive protection for your property. This is especially beneficial for homeowners with valuable items stored in basement areas or those in regions prone to flooding.

Engaging with Your Flood Nerd is also crucial when considering the range of flood insurance options available in Tennessee. Your Flood Nerd can demystify the terms and conditions of both NFIP and private insurance offerings, assisting you in choosing a policy that matches your risk profile and property specifics. Their expert advice is essential for developing a flood insurance plan that provides strong protection tailored to the specific needs of Tennessee homeowners.

To fully understand what is covered by your existing or prospective flood insurance policy, the NFIP website remains a useful resource. However, for tailored guidance that addresses your particular requirements, consulting with Your Flood Nerd in Tennessee offers invaluable personalized insight, ensuring you secure sufficient coverage for your home.

Not “private flood insurance” but NFIP Resellers

If you have Nationwide Flood Insurance, State Farm Flood Insurance, Progressive Flood Insurance, or any of the of the logos below, then you are buying the NFIP flood policy that is just being resold through a government program. These companies are private companies, but their flood insurance is not. Here is a list of the 70 companies that resell the NFIP policy.

Tennessee private flood insurance market

There are alternatives to the NFIP or government insurance. It is called Private flood insurance, most notably Lloyd’s of London Flood insurance. However, there are other options available in Tennessee. We shop all the options for your property in your region to ensure you are getting the best premium. Please click here if you are ready to have us do the work for you.

Our shopping includes the NFIP because sometimes we find that you can get a much better premium with government subsidies.

Lloyd’s of London Flood Insurance Tennessee Market

Tennessee is fortunate to have many Lloyd’s of London flood insurance options. Although many Lloyd’s flood insurance companies will have you assume that there is only one option, nothing could be further from the truth.

Lloyd’s of London has a rich history attributed to having invented the first modern insurance model. Unlike most of its competition, Lloyd’s of London is not a company but a corporate body. This structure works well since it has been around for over 330 years. Lloyd’s operates under multiple financial backers pooling their capital to spread the risk.

I have two blog posts that deeply dive into Lloyd’s of London and what they mean to Tennessee’s flood insurance market. If you are interested, the links are below.

TN Lloyds of London Flood Insurance

Tennessee Private flood insurance vs FEMA

Lloyd’s also insures the world with flood insurance, meaning they cover flooding events in India, Australia, and much of Europe. The “game” of insurance is to spread your risk since Lloyds is worldwide.

My joke here is that Lloyds is banking on God’s promise that he won’t flood the entire world again, …..so they won’t have to pay out the whole world’s flood claim.

How much does flood insurance cost in Tennessee?

Many factors go into getting the cost of flood insurance for Tennessee. If your home is in what is considered a low-to-moderate risk, you can get a heavily subsidized policy through the government.

Tennessee flood insurance low-to Moderate Risk rate and cost.

This is Flood Zone X, which is not lender required flood zone.

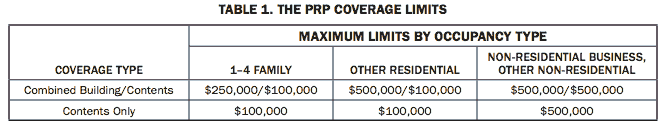

This is usually identified as an X-flood zone. Then we would suggest the government Preferred Risk Policy (PRP) which is a subsidized policy and has set flood insurance coverage limits (see the grid below):

The average cost for flood insurance in Tennessee with the maximum set limits in these Low-risk flood zone areas is $405 – $700 per year.

Your property is in a higher-risk flood zone, usually identified with a Flood Zone AE. Your lender will require you to have flood insurance. The cost of flood insurance in Tennessee depends on many factors unique to the structure. We will try to give you an idea of the most common homes we see in Tennessee with a slab-on-grade foundation.

We will look at the Tennessee cost of flood insurance for the NFIP maximum of $250,000 for the (building only) with NO CONTENTS and our recommended deductible of $5,000.

We will be rating this example on the NFIP and on a few of our private flood insurance policies, specifically Lloyds flood insurance options in Tennessee.

Cost of Flood Insurance in TENNESSEE in high-risk flood zone AE

Our example is in Nashville, but the premiums will be the same if in Memphis, Chattanooga, Knox, Rutherford, and many other Tennessee flood ones.

In our example, the Base Flood Elevation (BFE is 416.3) is a home that is built before 1973

NFIP option in Tennessee Flood Zone AE

NFIP – Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

NFIP Annual premium in High-Risk flood zone is $ 2,946.00

This option is what we see if the property has had a flood loss before and either doesn’t have an Elevation Certificate applied or the Elevation certificate shows that the lowest floor is 4 feet under the BFE for the area. You can use 10% of your coverage to cover other structures on your property.

Tennessee Private flood insurance – Lloyd’s of London Flood Insurance (option 1)

Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

Lloyds of London (option 1) Annual premium in High-Risk flood zone is $889.01

This option is great, and we are very happy when we can get this option. They can be a bit choosey about what risk they will accept and will not take anything that has had a flood loss. They offer basements coverage, about $2,000 for loss of use, and $2,000 for other structures, but they can’t increase this coverage. They do not require an Elevation Certificate to rate.

Tennessee Private flood insurance – Lloyd’s of London Flood Insurance (option 2)

Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

Lloyd’s of London (option 2) Annual premium in High-Risk flood zone is $900.90

This option is great, and we are very happy when we can get this option for our clients. They seem to be writing almost all risks; however, they do not write any property in a designated floodway or have the depth of -4 under the BFE. In our example, with our BFE being 416.3, they will not accept this risk if the lowest floor is 412. They will not take anything that has had a flood loss. They offer limited coverage for basements and do not require an Elevation Certificate to rate as a percentage of coverage for loss of use. If you want coverage for other structures, that will need to be added.

Private Flood insurance option (option 3), Not Lloyd’s

Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

The annual premium in a High-Risk flood zone is $2,356.00

This option will take properties that have had one flood loss as long as it has been more than five years and the payout was under $100,000 on the claim. Their coverage matches the NFIP. They will write practically all risks, don’t need an elevation certificate to rate, and are a bit lower in premium than the NFIP.

Private Flood Insurance – Lloyd’s of London (option 4)

This option must be written on the building’s Replacement Cost Value (RCV). Otherwise, there is a co-insurance penalty that kicks in. So, $250,000 might be a bit low in California, but to keep this going, let’s just use that for this option

Coverage of $250,000 (RCV) building coverage, No Contents, and a $5,000 deductible

The annual premium in a High-Risk flood zone is $814.70 (great price).

This options rating system is all over the board. Sometimes we get a crazy great price, but other times the premium is way higher than the NFIP will consider taking a property that has had one flood loss before as long as it has been more than ten years and the payout was under $50,000 on the claim. Their preferred coverage is at replacement cost, which is slightly different from some of our other Lloyd’s flood options. We usually reserve this one if the property doesn’t fit the above options. We can adjust coverages to control premiums. As mentioned before, these underwriters’ rates are all over the board. It is worth shopping to ensure we get you the best premium possible. They don’t need an elevation certificate to rate.

Private Flood Insurance – Lloyd’s of London (option 5)

Coverage of $250,000 (RCV) building coverage, No Contents, and $5,000 deductible.

The annual premium in a High-Risk flood zone is $ 1,033.23

This option came from the company running the NFIP program, so the coverage matches the NFIP coverage with two differences. They offer living expenses which will cover your cost when you are displaced from your home during repairs (most Lloyds flood policies offer this). They also offer swimming pool clean out, which is kind of unique so if you have a pool, ask for this coverage.

Private Flood Insurance – Lloyd’s of London (option 6)

Coverage of $250,000 (RCV) building coverage. No Contents and $5,000 deductible.

The annual premium in a High-Risk flood zone is $940.18

This options rating system is also all over the board. Sometimes we get a crazy low price; other times, the premium is way higher than the NFIP. They will consider taking a property that has had one flood loss before as long as it has been more than ten years and the payout was under $25,000 on the claim. They have been rumored to give a low price the first year and then non renew following years, or sometimes they jack the price way up so that we will watch them. They have a slick system, and their underwriting is managed by a 3rd party, which also sometimes seems to be a glitch.

More options are coming online every day, and we are working to be looking into every viable option.

Currently, Tennessee has 28,551 NFIP policies in force to date, with a total cost of $24,574,361. That would make the average flood rate for Tennessee $861. Of course, some will pay more, and some will pay less.

Click here to have us shop and save you money.

Hello, Tennessee! Thanks for visiting our page for all your flood insurance needs.

Let’s start with a group including Oak Ridge, Oliver Springs, Shelbyville, Cleveland, and Cannon, Tennessee, where the average flood rate is $974. The number of policies in these areas totals 411, with $400,445 in total premiums.

The next group includes Blount, Maryville, and Bradley, Tennessee, where the number of policies adds up to 299. The flood premiums total $265,790, allowing the average flood rate to be $889.

In Carter, Tennessee, the average flood rate is $1,050. Carter has 255 active flood policies with $267,864 in written premiums.

The average flood rate in Elizabethton, Johnson City, and Ashland City, Tennessee, is $1,281. The policies here number 470 with $602,270 in flood premiums.

$891 is the average flood rate in Cheatham, Tennessee. The premiums in Cheatham total $228,069, with 256 active flood policies.

Looking at Pegram, Cocke, Tullahoma, and Alamo, Tennessee, we find an average flood rate of $930. There are 252 flood policies in effect with $234,247 in total premiums.

Now let’s check out Belle Meade, Forest Hills, and Goodlettsville, Tennessee, where 296 active flood policies exist. The average flood rate for these areas is $807, including $238,852 in flood premiums.

Flood insurance Nashville, TN

Hello Nashville, Tennessee! Nashville has the highest number of active policies in the state, with 5,874! The premiums in Nashville total $5,081,825, allowing the average flood rate to be $865.

Flood zone map Nashville, TN

A group of areas, including Oak Hill, Decatur, Dyer, Dyersburg, Green, and Morristown, Tennessee, have an average flood rate of $949. These areas have 535 flood policies, with $507,546 in total premiums.

Fayette County, TN flood map

Let’s look at Fayette, Humboldt, Giles, and Pulaski, Tennessee, which have $230,788 in flood premiums. The policies here, number 249, allow the average flood rate to be $927.

Flood insurance Chattanooga, TN

Welcome to our site in Chattanooga, Tennessee! Chattanooga, you all have 1,400 active flood policies. The premiums here total $1,351,504, which causes the average flood rate to be $965.

In East Ridge, Tennessee, the average flood rate is $1,191. The premiums in East Ridge total $434,542 with 365 active flood policies.

Hamilton county, TN flood zone map

Next up is Hamilton, Tennessee, where there are 265 flood policies in effect. Hamilton has an average flood rate of $668 with $176,993 in total flood premiums.

$1,650 is the average flood rate in Red Bank, Tennessee. Red Bank has 116 active flood policies and $191,384 in written premiums.

Two hundred thirty-one flood policies are in effect in Soddy-Daisy, Tennessee. Soddy-Daisy has an average flood rate of $902. The premiums total $208,265 in Soddy-Daisy.

The average flood rate in Hardin, Kingsport, and Brownsville, Tennessee, is $857. These areas have 375 active flood policies with $321,211 in premiums.

The premiums total $314,668 in Paris, Hickman, and Waverly, Tennessee. The average flood rate for these areas is $1,380, with 228 flood policies in effect.

A group of areas that include White Pine, Johnson, Mountain City, and Farragut, Tennessee, have 201 active flood policies. The average flood rate here is $793, with $159,448 in total flood premiums.

In Knox, Tennessee, the average flood rate is $769. The premiums in Knox total $467,567 with 608 flood policies in effect.

Flood insurance Knoxville, TN

The average flood rate rises to $922 in Knoxville, Tennessee. Knoxville has 370 flood policies in effect with $341,268 in premiums.

Looking at a group that includes Lauderdale, Loudon, Jackson, and Madison, Tennessee, we find an average flood rate of $775. These areas have $330,176 in flood premiums with 426 active flood policies.

In Marion, South Pittsburg, Lewisburg, and Marshall, Tennessee, we find $185,193 in total flood premiums with 214 active flood policies. The average flood rate for these areas is $865.

The average flood rate in Columbia, Maury, and Spring Hill, Tennessee, is $699. The premiums for these areas total $217,286, with 311 flood policies in effect.

Clarksville, TN flood map

The average flood rate rises to $1,007 in Clarksville, Tennessee. Clarksville has 349 active flood policies with $351,380 in flood premiums.

When we look at Montgomery, Obion, and Union, Tennessee, we find 174 flood policies. These areas have an average flood rate of $959, including $166,911 in total premiums.

Collierville, TN flood map

The average flood rate drops to $662 in Perry, Polk, and Cookeville, Tennessee. These areas have 212 active flood policies with $140,299 in written premiums.

Looking at Putnam, Dayton, and Spring City, Tennessee, we find 149 active flood policies. The premiums here total $126,714, allowing the average flood rate to be $850.

Another group, Roane, Millersville, Portland, and Lavergne, Tennessee, has an average flood rate of $862. The premiums here add up to $285,229 with 331 active flood policies.

In Murfreesboro, Tennessee, there are 507 flood policies with $433,071 in flood premiums. The average flood rate in Murfreesboro is $854.

The average flood rate drops to $659 in Rutherford, Tennessee. Rutherford has 612 active flood policies and $403,022 in written premiums.

Two hundred two policies are in effect in Smyrna, Tennessee. Smyrna has $178,035 in flood premiums which allows the average flood rate to be $881.

Flooding in Gatlinburg, TN

Gatlinburg, Tennessee, has $285,745 in flood premiums with 382 active flood policies. The average flood rate in Gatlinburg is $748.

Flooding in Gatlinburg, Tennessee

In Pigeon Forge, Tennessee, we find an average flood rate of $985. The number of flood policies in effect in Pigeon Forge is 442, with $435,520 in written premiums.

When we look at Sevier, Arlington, Lakeland, and Millington, Tennessee, we see 391 flood policies with $268,865 in flood premiums. The average flood rate for these areas is $688.

The average flood rate goes up to $1,015 in Sevierville, Tennessee. Sevierville has $404,000 in flood premiums with 398 policies in effect.

$503 is the average flood rate for Bartlett, Tennessee. Bartlett has 278 active flood policies, with $139,815 in flood premiums.

Collierville, TM flood map

Four hundred nine flood policies are active in Collierville, Tennessee. The average flood rate in Collierville is $505, which includes $206,615 in written premiums.

The average flood rate goes up to $582 in Germantown, Tennessee. Germantown has $315,870 in flood premiums and 543 flood policies in effect.

Flood insurance Memphis, TN

Hello Memphis, Tennessee! Thanks for stopping by! Memphis has $1,055,316 in flood premiums with an average flood rate of $689. Memphis has 1,531 active flood policies.

Shelby County, TN flood zone map

Shelby, Tennessee, has 483 active flood policies with $307,992 in flood premiums. The average flood rate for Shelby is $638.

Let’s check out a group of places, including Carthage, Smith, Stewart, Bristol, and Sullivan, Tennessee, where there are 422 flood policies in effect. The average flood rate for these areas is $1,053, which includes $444,333 in written premiums.

Flood insurance Gallatin, TN

$764 is the average flood rate for Gallatin, Tennessee. Gallatin has 238 flood policies active with $181,825 in flood premiums.

The average flood rate drops to $651 in Hendersonville, Tennessee. The premiums in Hendersonville total $255,702, with 393 flood policies in effect.

Sumner County, TN flood maps

Two hundred sixty-one flood policies are active in Sumner, Tennessee. Sumner has $186,676 in flood premiums which allows the average flood rate to be $715.

Looking at Atoka, Tipton, Erwin, and Unicoi, Tennessee, we find an average flood rate of $655. The premiums for these areas add up to $181,406 with 277 active flood policies.

Our last group of areas includes Washington, Wayne, and Mt. Juliet, Tennessee, where the number of active flood policies adds up to 321. The premiums calculate out to $292,171, which allows the average flood rate to be $910.

Brentwood, Tennessee, has an average flood rate to be $980. The number of active flood policies includes 478. The premiums in Brentwood total up to $468,352.

$483,353 is the total for the flood premiums in Franklin, Tennessee. Franklin has 570 flood policies in effect which causes the average flood rate to be $848.

Williamson County, TN flood map

The average flood rate drops to $686 in Williamson, Tennessee. Williamson has 635 active flood policies and $435,720 in written premiums.

Two hundred eighty flood policies are active in Lebanon, Tennessee. Lebanon has an average flood rate of $1,102, including $308,570 in flood premiums. Give us a call Lebanon!

Finally, we’ll look at Wilson, Tennessee, where the average flood rate is $554. The active policy number 471 with $260,996 in written premium.

Thanks for checking out all the flood information on Tennessee!!

For decades, the NFIP has over-charged 50 percent of its policyholders and under-charged the other 50 percent while it has racked up $42 billion in taxpayer-funded losses, equating to more than half of every claim paid by the NFIP since 1978.

About 30 percent of NFIP claims payments go to the same 3 percent of insured “repetitive loss” structures yearly. When you do the math, this means that the other 97 percent of their flood-exposed constituents could have paid in less and still netted larger claims payouts if they had better access to private flood insurance. A recent white paper by Milliman found that 90 percent of homes in Sandy-struck New York and New Jersey would see reduced flood insurance rates through private insurers.