Instant NC Flood Insurance at Great Rates. Fast Coverage.

Guaranteed.

Save big with our reliable North Carolina flood insurance plans—fast quotes, faster coverage.

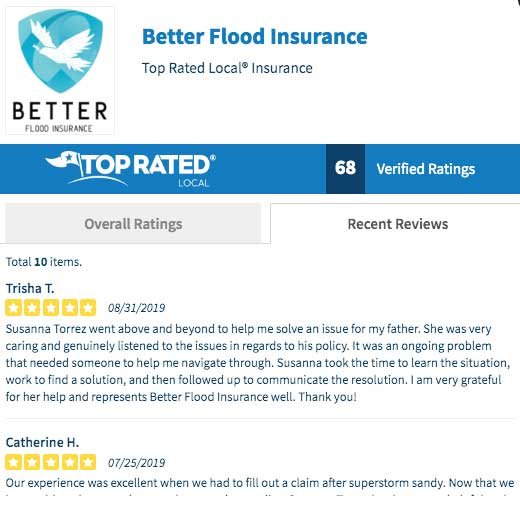

$2.3M+

Annual Premium Savings

4.9★

Average Ratings

445+

Reviews

5,497+

Happy Clients

We Get It,

Buying Flood Insurance in NC Is Confusing…

You might be asking:

• What coverage do I need?

• How much is flood insurance in North Carolina going to cost me?

• How much can I save?

It’s okay, your search for cost-effective NC flood insurance that doesn’t compromise on coverage ends here.

Meet The Flood Nerd™

Your NC Flood Expert, Friend, and Guardian

In 2015, Robert Murphy, inspired to help homeowners and businessowners alike, entered the insurance brokerage market with one goal in mind: To help uncertain North Carolina homeowners find affordable, high quality flood insurance that doesn’t compromise on coverage.

We Find You Great Coverage

While Saving You Up To $1,457+ A Year!

What you seek is:

Enhanced security for your North Carolina Property.

Significant savings.

Absolute freedom.

Unwavering certainty.

Memorable moments.

Quality family time.

Peaceful travels.

It's As Easy As 1, 2, 3!

1

Fill Out Our Online Form

Complete our easy quote form so we can understand your needs & personalize your rates.

2

Get An Instant Quote

Our team scours insurance companies nationwide to instantly present the best coverage & rate options for your needs.

3

Get Coverage

If you’re happy with the coverage options, you can sign up easily directly from our online portal.

NC flood insurance

Does my North Carolina homeowner insurance cover flooding?

A typical North Carolina homeowners’ policy is written through Farmers, State Farm, Allstate, and Progressive, for instance, excludes flooding as something that will be covered under their homeowner’s policy.

In most cases, the only way to get flood coverage is by purchasing a stand-alone flood insurance policy. However, you should ask your homeowners agent if you can add an endorsement to your homeowner’s policy to cover flooding. Yet, don’t be too surprised if the answer is NO.

How much does Flood insurance cost in NC?

Do I need flood insurance in North Carolina?

It is important to have flood insurance coverage in North Carolina because our beloved state has seen a fair share of flooding, and there is likely more coming. We believe that most homeowners think about flood insurance in North Carolina at some point, maybe before buying a home or during the closing process. However, many of us only think about it when a big storm looms or we have heard on the news that there is flooding forecasted or happening too close to our home.

North Carolina has experienced significant flooding events in recent years, with Charlotte being one of the areas heavily impacted. In 2020, Tropical Storm Eta caused widespread flooding in the Charlotte area, leading to numerous road closures, evacuations, and property damage. Such events highlight the importance of flood preparedness and the need for adequate flood insurance coverage, even in areas not traditionally considered high-risk flood zones.

If your home or business is in a flood zone, that is considered a low flood-risk area. Sadly, many homeowners decide to forgo purchasing coverage because they believe they are safe from flooding. Some real estate and insurance agents may even say you don’t need it. However, I ask you to consider the facts: 20 percent of all flooding events across our nation come in areas that are considered low risk. After our last few major storms (Hurricane Harvey), we saw flooding in these low-risk areas. 80 percent of these individuals had water in their homes or buildings and didn’t have flood insurance coverage.

In Harris county, nearly 135,000 homes were damaged. Three-fourths of these properties were considered low to moderate risk. We often hear that people believe that the government will help, which is true. However, a few things must align for you to get government assistance. 1 – The president of the United States must declare the flooding event a state of emergency. If this doesn’t happen, then there won’t be assistance. 2 – Homeowners’ average amount of assistance after a flood, when they do not have flood coverage, is $5,000. The average cost of damage to one’s property after a flood is $38,000+. That $5K you get from the government? It comes in the form of a loan, and you will need to pay it back. Are you willing to gamble on your financial future by forgoing flood insurance coverage?

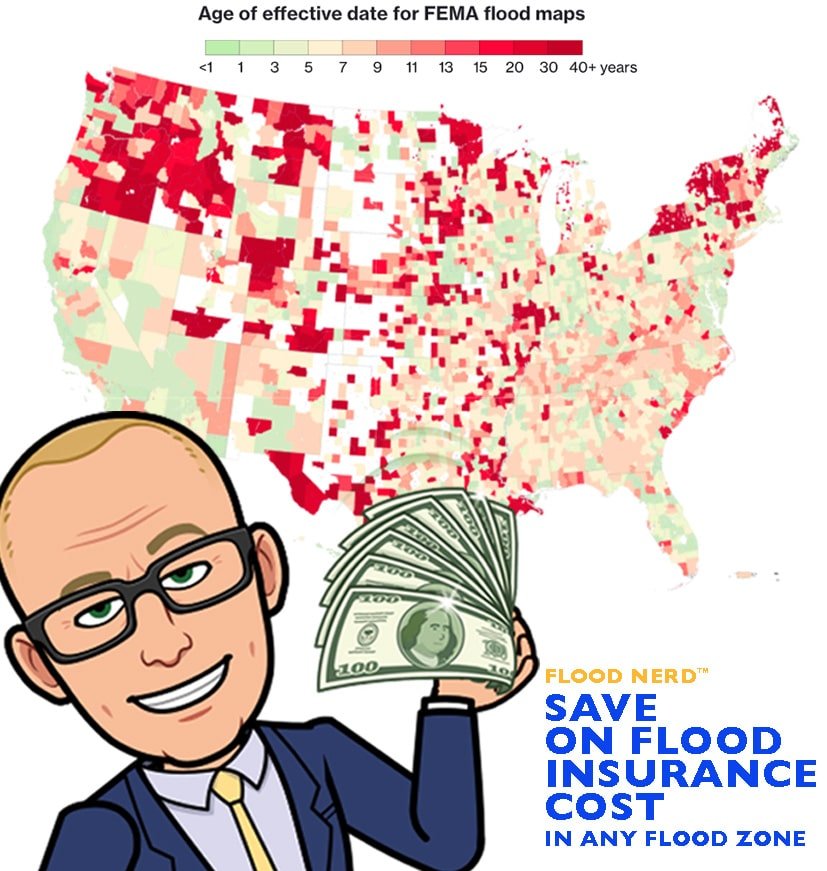

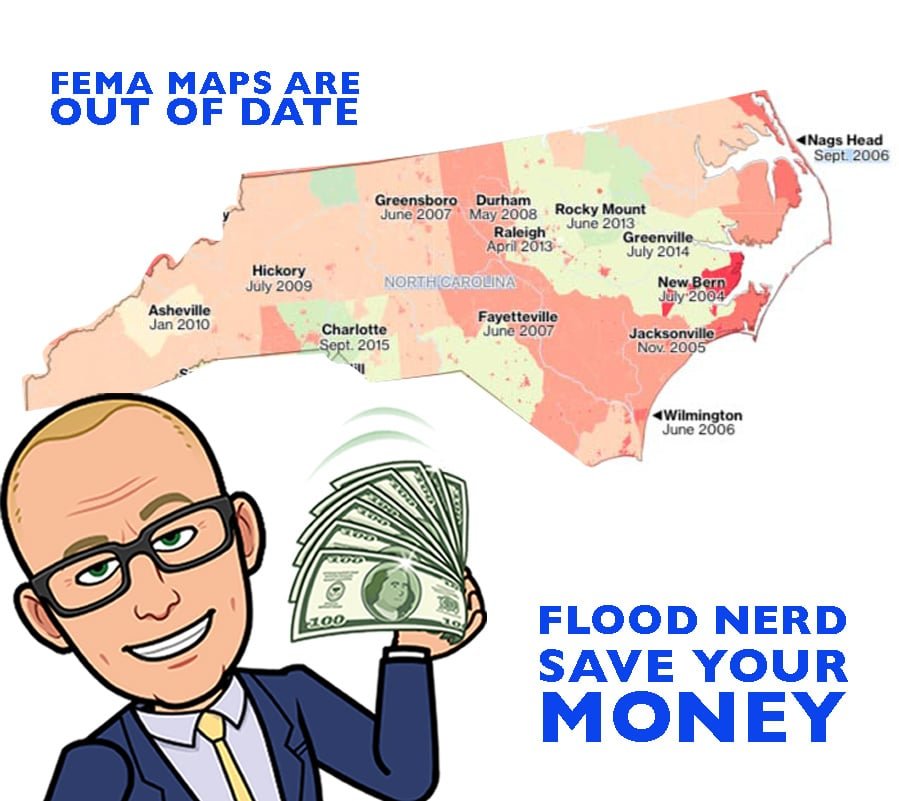

One more note on these low-risk flood zone maps. Many of these maps are over 40 years old. If the area has been developed, there is likely more concrete, creating a barrier for land that previously might have absorbed the massive downpour. Because of all these factors, it is difficult for property owners to know their true risk of flooding. FEMA admits that their flood maps only give an idea of part of the risk. Our recent storms are facts that it can rain anywhere within North Carolina, and you should consider getting flood coverage so you are not uninsured when you need it most.

FEMA’s National Flood Insurance Program (NFIP) and all federally backed lenders rely on these North Carolina flood insurance map to assess risk, set premiums and determine who is required to purchase flood insurance. Bad information about an area’s flood risk can leave property owners under or uninsured.

North Carolina residents can access the latest flood maps and information through the North Carolina Floodplain Mapping Program (https://flood.nc.gov/ncflood/). This program provides detailed flood maps, flood risk data, and resources to help homeowners, businesses, and communities understand their flood risk and make informed decisions about flood insurance and mitigation strategies. Additionally, FEMA’s Flood Map Service Center (https://msc.fema.gov/portal/home) offers access to official flood maps for North Carolina and other states.

One more note on these low-risk flood zone maps. Many of these maps are over 40 years old. If the area has been developed, there is likely more concrete, creating a barrier for land that previously might have absorbed the massive downpour.

Because of all these factors, it is difficult for property owners to know their true risk of flooding. FEMA admits that their flood maps only give an idea of part of the risk. Our recent storms are facts that it can rain anywhere within North Carolina, and you should consider getting flood coverage so you are not uninsured when you need it most.

One more note on these low-risk flood zone maps. Many of these maps are over 40 years old. If the area has been developed, there is likely more concrete, creating a barrier for land that previously might have absorbed the massive downpour.

Because of all these factors, it is difficult for property owners to know their true risk of flooding. FEMA admits that their flood maps only give an idea of part of the risk. Our recent storms are facts that it can rain anywhere within North Carolina, and you should consider getting flood coverage so you are not uninsured when you need it most.

FEMA flood zone maps often take years to go into effect after the terrain was studied; this gives the impression that the area is “more up to date” than it is.

The average cost for North Carolina flood insurance in these Low-risk areas is $595 per year.

FEMA’s National Flood Insurance Program (NFIP) and all federally backed lenders rely on these North Carolina flood insurance map to assess risk, set premiums and determine who is required to purchase flood insurance. Bad information about an area’s flood risk can leave property owners under or uninsured.

How much is flood insurance in North Carolina?

North Carolina NFIP flood insurance.

There are many options available in North Carolina regarding flood insurance, but they fall into two main categories. The Government option is also known as the NFIP, FEMA, and the Private flood insurance market.

The National Flood Insurance Program (NFIP), also known as FEMA, is the government option for flood insurance. The NFIP has enjoyed a 50-state monopoly on the flood insurance market.

Not “private flood insurance” but NFIP Resellers

If you have Nationwide Flood Insurance, State Farm Flood Insurance, Progressive Flood Insurance, or any of the logos below, then you are buying the NFIP flood policy that is just being resold through a government program. These companies are private companies, but their flood insurance is not. Here is a list of the 70 companies that resell the NFIP policy.

North Carolina private flood insurance market

There are alternatives to the NFIP or government insurance. It is called Private flood insurance, most notably Lloyds of London Flood insurance. However, there are other options available in North Carolina. We shop all the options for your property in your region to ensure you are getting the best premium. Please click here if you are ready to have us do the work for you.

Our shopping includes the NFIP because sometimes we find that you can get a much better premium with government subsidies.

Lloyd’s of London Flood Insurance North Carolina Market

North Carolina is fortunate to have many Lloyd’s of London flood insurance options. Although many Lloyd’s flood insurance companies will have you assume that there is only one option, nothing could be further from the truth.

Lloyd’s of London has a rich history attributed to having invented the first modern insurance model. Unlike most of its competition, Lloyd’s of London is not a company but a corporate body. This structure works well since it has been around for over 330 years. Lloyd’s operates under multiple financial backers pooling their capital to spread the risk.

I have two blog posts that deeply dive into Lloyds of London and what they mean to North Carolina’s flood insurance market. If you are interested, the links are below.

Lloyd’s of London Flood Insurance

FEMA vs Private flood insurance market

Lloyd’s also insures the world with flood insurance, meaning they cover flooding events in India, Australia, and much of Europe. The “game” of insurance is to spread your risk since Lloyds is worldwide.

My joke here is that Lloyds is banking on God’s promise that he won’t flood the entire world again, …..so they won’t have to pay out the whole worlds flood claim.

How much does flood insurance cost in North Carolina?

Many factors go into getting the cost of flood insurance for North Carolina. If your home is in what is considered a low-to-moderate risk, you can get a heavily subsidized policy through the government.

North Carolina flood insurance low-to a Moderate Risk rate and cost.

This is Flood Zone X, which is not lender required flood zone.

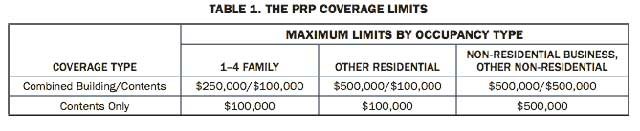

This is usually identified as an X-flood zone. Then we would suggest the government Preferred Risk Policy (PRP) which is a subsidized policy and has set flood insurance coverage limits (see the grid below):

The average cost of flood insurance in North Carolina

The average cost for flood insurance in North Carolina with the maximum set limits in these Low-risk flood zone areas is $405 – $700 per year.

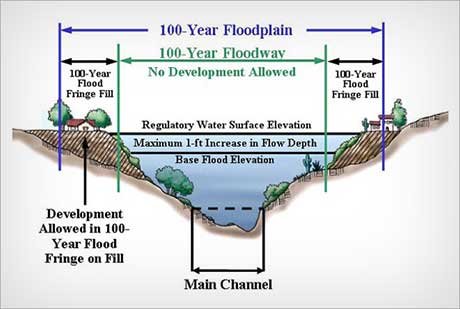

Your property is in a higher-risk flood zone, usually identified with a Flood Zone AE. Your lender will require you to have flood insurance. The cost of flood insurance in North Carolina depends on many factors unique to the structure. We will try to give you an idea of the most common homes we see in North Carolina with a slab-on-grade foundation.

We will look at the North Carolina cost of flood insurance for the NFIP maximum of $250,000 for the (building only) with NO CONTENTS and our recommended deductible of $5,000.

We will be rating this example on the NFIP and on a few of our private flood insurance policies, specifically Lloyd’s flood insurance options in North Carolina.

Cost of Flood Insurance in NORTH CAROLINA in high-risk flood zone AE

Our example is Dare, NC, but the premiums will be the same if in Currituck, Carteret, Nags Head, New Hanover, Carolina Beach, and many other North Carolina flood ones.

Flood Insurance companies in NC

In our example, the Base Flood Elevation (BFE 8) and is a home that is built before 1973

NFIP option in North Carolina Flood Zone AE

NFIP – Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

NFIP Annual premium in High-Risk flood zone is $ 4,835.00

This option is what we see if the property has had a flood loss before and either doesn’t have an Elevation Certificate applied, or the Elevation certificate shows that the lowest floor is 4 feet under the BFE for the area. You can use 10% of your coverage to cover other structures on your property. NC flood insurance increases are expected in the Government policy.

North Carolina Private flood insurance – Lloyd’s of London Flood Insurance (option 1)

Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

Lloyd’s of London (option 1) Annual premium in High-Risk flood zone is $ 756.40

This option is great, and we are very happy when we can get this option. They can be a bit choosey about what risk they will accept and will not take anything that has had a flood loss. They offer basements coverage, about $2,000 for loss of use, and $2,000 for other structures, but they can’t increase this coverage. They do not require an Elevation Certificate to rate.

North Carolina Private flood insurance – Lloyds of London Flood Insurance (option 2)

Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

Lloyd’s of London (option 2) Annual premium in High-Risk flood zone is $ 806.81

This option is great, and we are very happy when we can get this option for our clients. They seem to be writing almost all risks; however, they do not write any property in a designated floodway or has a depth of -4 under the BFE. In our example, with our BFE being 8, they will not accept this risk if the lowest floor is 4. They will not take anything that has had a flood loss. They do offer limited coverage for basements and do not require an Elevation Certificate to rate, and as a percentage of coverage for loss of use. If you want coverage for other structures, that will need to be added.

Private Flood insurance option (option 3) NOT Lloyd’s

Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

Private flood insurance (option 3) Not Lloyds,

The annual premium in a High-Risk flood zone is $ 2,815.56

This option will take properties that have had one flood loss for more than five years and the payout was under $100,000 on the claim. Their coverage matches the NFIP. They will write practically all risks, don’t need an elevation certificate to rate, and are a bit lower in premium than the NFIP.

Private Flood Insurance – Lloyd’s of London (option 4)

This option must be written on the building’s Replacement Cost Value (RCV). Otherwise, there is a co-insurance penalty that kicks in. So, $250,000 might be a bit low in California, but to keep this going, let’s just use that for this option

Coverage of $250,000 (RCV) building coverage, No Contents, and $5,000 deductible

The annual premium in a High-Risk flood zone is $ 721.60(great price).

This options rating system is all over the board. Sometimes we get a crazy great price, but other times the premium is way higher than the NFIP will consider taking a property that has had one flood loss before as long as it has been more than ten years and the payout was under $50,000 on the claim. Their preferred coverage is at replacement cost, slightly different from some of our other Lloyd’s flood options. We usually reserve this one if the property doesn’t fit the above options. We can adjust coverages to control premiums. As mentioned before, these underwriters’ rates are all over the board. It is worth shopping through to ensure we are getting you the best premium possible. They don’t need an elevation certificate to rate.

Private Flood Insurance – Lloyd’s of London (option 5)

Coverage of $250,000 (RCV) building coverage, No Contents, and $5,000 deductible.

The annual premium in a High-Risk flood zone is $ 846.96

This option came from the company that used to run the NFIP program, so the coverage matches the NFIP coverage with two differences. They offer living expenses which will cover your cost when you are displaced from your home during repairs (most Lloyds flood policies offer this). They also offer swimming pool clean out, which is unique, so if you have a pool, ask for this coverage.

Private Flood Insurance – Lloyd’s of London (option 6)

Coverage of $250,000 (RCV) building coverage. No Contents and $5,000 deductible.

The annual premium in a High-Risk flood zone is $ 904.25

This options rating system is also all over the board. Sometimes we get a crazy low price; other times, the premium is way higher than the NFIP. They will consider taking a property that has had one flood loss before as long as it has been more than ten years and the payout was under $25,000 on the claim. They have been rumored to give a low price the first year and then non renew following years or sometimes they jack the price way up so that we will watch them. They have a slick system, and their underwriting is managed by a 3rd party, which also sometimes seems to be a glitch.

More options are coming online every day, and we are working to be looking into every viable option.

Currently, North Carolina has 134,987 NFIP policies in force to date, with a total cost of $109,932,602. That would make the average flood rate for North Carolina $814. Of course, some will pay more, and some will pay less.

Click here to have our shop and save you money.

Flood Insurance NC

Hello, North Carolina! Thanks for visiting our page for all your flood insurance needs.

Let’s start with Beaufort County, North Carolina, where the average flood rate is $755. The premiums in Beaufort total $1,698,459, with 2,249 active flood policies.

Next up is a group of areas that include Belhaven, Carolina Shores, Caswell Beach, and Leland, North Carolina, where the flood policies number 2,175. The premiums in these areas add up to $1,347,473, which allows the average flood rate to be $620.

Washington, North Carolina, has $1,171,459 in flood premiums. The average flood rate is $974, which includes 1,203 active flood policies.

The average flood rate rises to $1,047 in Bald Head Island, North Carolina. The premiums total $1,236,297 with 1,181 flood policies in effect.

Flood Insurance in Brunswick County

Three thousand seven hundred four flood policies are active in Brunswick, North Carolina. The average flood rate in Brunswick is $508, including $1,880,248 in flood premiums.

The average flood rate jumps to $2,075 in Holden Beach, North Carolina. Holden Beach has 1,822 active flood policies with $3,781,080 in premiums. Give us a call at Holden Beach to check flood rates!

The premiums in Oak Island, North Carolina, add up to $4,535,181, with 3,311 flood policies. Oak Island has an average flood rate of $1,370.

When we look at Ocean Isle Beach, North Carolina, the average flood rate rises to $1,629. The premiums in Ocean Isle Beach total $3,863,549, with 2,372 flood policies active.

Flood insurance Asheville NC

Let’s check out a group of areas, including Southport, Asheville, and Buncombe, North Carolina, where the flood policies number 1,339 with $1,722,983 in total flood premium. The average flood rate for these areas is $1,287.

There are 1,045 flood policies active in St. James, North Carolina. The average flood rate in St. James is $484, including $505,000 in written premium for 654.

Next, look at Sunset Beach, North Carolina, where the average flood rate is $687. The flood policies number 1,559 with $1,071,810 in flood premiums.

Our next two areas include Camden and Beaufort, North Carolina, where the flood policies add up to 1,611 with $1,202,189 in total premiums. The average flood rate for Camden and Beaufort is $746.

$1,046,799 is the premium total in Elizabeth City, North Carolina. The active flood policy number 1,476 allows the average flood rate to be $709.

Next is Atlantic Beach, North Carolina, where the average flood rate is $747. The flood policies total 2,927 with $2,185,838 in flood premiums.

The average flood rate drops slightly to $724 in Carteret, North Carolina. Carteret has $2,717,013 in written premiums with 3,753 flood policies in effect.

A few areas, including Cedar Point and Cary, North Carolina, have 1,118 flood policies active with $653,558 in total premiums. The average flood rate for these areas is $585.

When we look at Emerald Isle, North Carolina, the average flood rate rises to $943. The premiums in Emerald Isle total $2,541,006 with 2,696 active flood policies.

Morehead City, North Carolina, has 1,537 flood policies in effect. The premiums in Morehead City total $1,033,896, allowing the average flood rate to be $673.

The average flood rate in Pine Knoll Shores, North Carolina, drops slightly to $652. The flood policies here number 1,325 with $864,002 in written premium.

Again, the average flood rate drops to $554 in Craven, North Carolina. Craven has $1,253,265 in flood premiums with 2,264 active flood policies.

Check out New Bern, North Carolina, where the flood policies number 1,353 with $946,467 in total premium. The average flood rate in New Bern is $700.

Let’s look at a few areas, including River Bend and Cumberland, North Carolina. These areas have premiums that total $682,964. The flood policies add up to 1,193, allowing the average flood rate to be $572.

1,291 is the total number of active flood policies in Fayetteville, North Carolina. The average flood rate here is $584, which includes $753,964 in written premiums.

There are 5,221 flood policies active in Currituck, North Carolina. The premiums here total $4,838,033, allowing the average flood rate to be $927.

Hello Dare, North Carolina! You all have the highest number of active flood policies in the state at 8,635, with $5,737,573 in written premiums. The average flood rate in Dare is $664.

The average flood rate rises to $925 in Duck, North Carolina. The premiums in Duck total $1,049,725, with 1,135 flood policies in effect.

In Kill Devil Hills, North Carolina, the active flood policies number 4,295 with $2,796410 in total premium. The average flood rate here is $651.

The average flood rate jumps to $954 in Kitty Hawk, North Carolina. Kitty Hawk has $1,471,687 in written premium with 1,542 flood policies active.

Manteo, North Carolina, has 997 active flood policies with $666,822 in flood premiums. The average flood rate in Manteo is $669.

$924 is the average flood rate in Nags Head, North Carolina. Nags Head has 3,504 flood policies in effect with $3,237,669 in premiums.

There are 1,027 flood policies active in Southern Shores, North Carolina. The premiums here total $921,289, allowing the average flood rate to be $897.

Let’s check out a group of areas that include Duplin, Winston-Salem, and Greensboro, North Carolina. These areas have premiums that total $1,192,168 and active flood policies that total 1,497. The average flood rate for these areas is $796.

Our next group includes Chapel Hill, Rocky Mount, Harnett, Waynesville, and Johnston, North Carolina, where the average flood rate is $859. The flood policies in effect total 2,633 with $2,262,567 in total premium.

Flood Insurance Durham NC

Durham, North Carolina, has an average flood rate of $860. The premiums here add up to $1,058,109 with 1,230 in active flood policies.

The average flood rate rises to $958 in Hyde, North Carolina. The premiums in Hyde total $1,194,010 with 1,246 flood policies in effect.

Flood Insurance Jacksonville NC

Check out Kinston, Jacksonville, and Oriental, North Carolina, where the flood premiums add up to $1,232,065. The flood policies total 1,761, allowing the average flood rate to be $700.

Flood Insurance Charlotte NC

When we look at Charlotte, North Carolina, we find 2,949 flood policies active. The premiums add up to $1,822,590, allowing the average flood rate to be $618.

Look at Carolina Beach, North Carolina, where the premiums total $3,125,196. The average flood rate in Carolina Beach is $887, which includes 3,523 active flood policies.

Five thousand twenty-five flood policies are active in New Hanover, North Carolina. The premiums total $3,186,566, allowing the average flood rate to be $634.

The average flood rate rises to $649 in Wilmington, North Carolina. The flood policies total 2,936 with $1,904,195 in written premiums.

Again, the average flood rate rises to $1,070 when we look at Wrightsville Beach, North Carolina. Wrightsville Beach has $2,853,648 in flood premiums with 2,666 flood policies.

Once more, the average flood rate rises to $1,344 in North Topsail Beach, North Carolina. The active flood policies total 1,268 with $1,704,186 in total written premiums.

When we check out Onslow, North Carolina, we find 1,931 flood policies active. The average flood rate in Onslow is $519, which includes $1,002,153 in total premiums.

$1,426 is the average flood rate in Surf City, North Carolina. The premiums in Surf City total $3,056,968, with 2,143 active flood policies. Give us a call, Surf City!

In Pamlico, North Carolina, we see 1,114 flood policies active with $665,763 in written premiums. The average flood rate in Pamlico is $598.

Next is Pasquotank, North Carolina, where the average flood rate is $573. The premiums total $714,990, with 1,247 flood policies in effect.

The average flood rate rises to $614 in Pender, North Carolina. Pender has 1,764 active flood policies with $1,083,567 in total premiums.

Topsail Beach, North Carolina’s average flood rate is $1,476. This includes $1,601,002 in flood premiums with 1,085 flood policies active. Give us a call at Topsail Beach! We’ll check your rates!

Let’s look at a group of areas, including Perquimans, Pitt, and Tyrrell, North Carolina, where the premiums add up to $867,559 with 1,505 flood policies. The average flood rate for these areas is $576.

In Greenville, North Carolina, flood policies number 1,201. The premiums add up to $817,891, allowing the average flood rate to be $681.

Another group that includes Lumberton and Robeson, North Carolina, has an average flood rate of $794. The premiums in these areas add up to $1,020,492, with 1,286 flood policies active.umber 1,201. The premiums add up to $817,891, allowing the average flood rate to be $681.

Another group that includes Lumberton and Robeson, North Carolina, has an average flood rate of $794. The premiums in these areas add up to $1,020,492, with 1,286 flood policies active.

Flood Insurance Raleigh NC

1,977 is the flood policy total in Raleigh, North Carolina. Raleigh has $1,929,725 in flood premiums which allows the average flood rate to be $976.

Let’s check out some more areas – Wake, Wayne, and Wilson, North Carolina. These areas have an average flood rate of $672. The flood premiums add up to $897,791 with 1,336 active flood policies.

Our last group includes Boone, Watauga, and Goldsboro, North Carolina, where the flood policies number 1,322. The average flood rate for these areas is $932, which includes $1,232,243 in flood premium.

Thanks for checking out all the flood information on North Carolina!!

How to save money on Flood Insurance in North Carolina VE flood zones

All homes that are ocean-facing are custom built, so with this special consideration, our Lloyd’s of London VE flood zone and other Private Flood Insurance options for oceanfront properties consider this with variable coverage options as well as significant savings below is a case study for a property we were shopping just last week.

Our example was in the Wilmington, NC, area and is in a VE flood zone map.

For the coverage of $250,000 with no contents and a $5,000 deductible, the NFIP annual cost for flood insurance in a VE flood zone is $ 19,237.00. Ouch!

Since we are who we are and experts in Flood Insurance, we will look at every property every way possible to ensure that we are getting the best premium for our clients, and WE often Do (smile wink)

We tried this same property on our Private flood options and were able to get the premium to under $5,150, and we have, in some cases, with similar properties, get the annual premium to $600. This was a feather in our cap and made our clients very happy. Again all properties are unique in these VE flood zones, but if we can find a private flood policy for you, we guarantee it will be better than the NFIP option.

Let us help you save money today.

NC flood Insurance Cost Calculator

For decades, the NFIP has over-charged 50 percent of its policyholders and under-charged the other 50 percent while it has racked up $42 billion in taxpayer-funded losses, equating to more than half of every claim paid by the NFIP since 1978.

About 30 percent of NFIP claims payments go to the same 3 percent of insured “repetitive loss” structures yearly. When you do the math, this means that the other 97 percent of their flood-exposed constituents could have paid in less and still netted larger claims payouts if they had better access to private flood insurance. A recent white paper by Milliman found that 90 percent of homes in Sandy-struck North Carolina and North Carolina would see reduced flood insurance rates through private insurers.