Get Flood Insurance Michigan & Save Money Too.

People in Michigan save on average $500 to $1,457+ on their annual flood premiums.

Get flood insurance from a Flood Nerd® at Better Flood Insurance® and save big time.

featured on

How to SAVE MONEY Flood Insurance Michigan

How much is flood insurance in Michigan?

Floods can happen anywhere, at any time. It can be a painful experience, especially when you have to think about all the damage to your home and all the costs involved in getting your life back together. With unpredictable weather patterns that bring flooding to unexpected places, it’s important to consider flood insurance for your home in Michigan.

There are different levels of protection available depending on where you live. Knowing how much flood insurance in Michigan will cost you is part of protecting what matters most.

Our team of Flood Nerds is experienced in understanding all the options available for your property so that you can confidently make an educated decision. Most of our clients save from $500 – $2,500 on their Michigan flood insurance by moving to one of our many private flood insurance options.

To determine the cost of flood insurance in Michigan, certain variables need to be considered. For an accurate estimate, we’ve created a quick calculator below. But, to obtain a reliable assessment, we recommend requesting a free quote that only takes a few minutes to complete.

Most of our clients in Michigan pay between $500 and $1,500 for home flood insurance.

Learn how much flood insurance coverage could cost for your Michigan home with us today.

Get Cheap Flood Insurance without Compromising Coverage

★★★★★

"Same Coverage at a Better Rate"

-Mohammed K

Flood Nerds will shop the private flood insurance markets and then compare them to the NFIP, guaranteeing you the better option. We will send you the cheapest flood insurance rates within minutes.

★★★★★

"Quick Response, Very Knowledgable"

– Robert W

Paying for low-cost flood insurance is awesome. And letting the Flood Nerds shop your property has other benefits – you can get better coverage while saving money, and you can get it fast.

★★★★★

"Would highly recommend Better Flood for your flood insurance needs."

– Varun K

Better Flood Insurance is an independent flood insurance broker that shops flood insurance ONLY. Flood Nerds are Flood insurance experts. We have 5000+ happy clients and 390+ 5-star reviews.

Finding Cheap Flood Insurance in Michigan, the Flood Nerd™ Way

You’ve probably heard it before – finding cheap flood insurance in Michigan can be daunting. But have no fear; flood nerds are here! If you’re looking for cheap flood insurance in Michigan, then you’ve come to the right place. We shop for the cheapest flood insurance policies that don’t compromise on coverage and have a few exclusive cheap Flood insurance companies in Michigan. Let us show you how we do it.

Step 1: Get us your information by filling out our online form

The first step to getting your cheap flood insurance in Michigan is getting your Flood Nerd your property information using our online form. This will allow us to shop your property and compare it to the NFIP to ensure you get the cheapest flood insurance policy.

Step 2: Shop Around and Compare Rates

Don’t just accept the first quote you get from your local agent – let a flood nerd shop around and compare rates to our pre-flood nerd-approved options to ensure you have found a flood insurance company with your flood nerds’ help getting the better deal. The NFIP has had a monopoly on flood insurance for many years, and now it is time to save money in Michigan.

Step 3: Utilize Exclusive Companies

Since Flood Nerds only work in flood insurance, we have many more options than others, and we have some exclusive relationships with several companies that can offer low-cost policies not available to an agent that isn’t a flood insurance expert in Michigan – giving our customers access to even more savings opportunities than they would find elsewhere. By leveraging our exclusive relationships, customers can save hundreds of dollars on their premiums while still receiving better coverage and peace of mind knowing their property is protected from floods.

It doesn’t have to be difficult or expensive to get quality flood insurance in Michigan. With Flood Nerds on your side, you can feel confident that you’re getting great coverage without compromising on coverage or quality of service. We understand that everyone’s situation is different, so we strive to provide personalized solutions tailored specifically for each customer’s needs and budget constraints – so why wait? Contact us today, and let us help you find cheap flood insurance in Michigan!

Flood Insurance Michigan

Does my Michigan homeowner insurance cover flooding?

A typical Michigan homeowners’ policy is written through Farmers, State Farm, Allstate, and Progressive, for instance, excludes flooding as something that will be covered under their homeowner’s policy.

In most cases, the only way to get flood coverage is by purchasing a stand-alone flood insurance policy. However, you should ask your homeowners agent if you can add an endorsement to your homeowner’s policy to cover flooding. Yet, don’t be too surprised if the answer is NO.

Do I need flood insurance in Michigan?

It is important to have flood insurance coverage in Michigan because our beloved Cowboy State has seen a fair share of flooding, and more is likely coming.

We believe that most homeowners think about Flood insurance in Michigan at some point, maybe before buying a home or during the closing process. However, many of us only think about it when a big storm looms, or we have heard on the news that there is flooding forecasted or happening too close to our home.

If your home or business is in a flood zone, that is considered a low flood risk area. Sadly, many homeowners decide to forgo purchasing coverage because they believe they are safe from flooding. Some real estate and insurance agents may even say you don’t need it.

Flood Zone Maps Michigan

I ask you to consider the facts: 20 percent of all flooding events across our nation come in areas that are considered low risk. After our last few major storms (Hurricane Harvey), we saw flooding in these low-risk areas. In 80 percent of these individuals had water in their homes or buildings and didn’t have flood insurance coverage.

In Harris county, nearly 135,000 homes were damaged. Three-fourths of these properties were considered low to moderate risk.

Michigan flooding map

We often hear that people believe that the government will help, which is true. However, a few things must align for you to get government assistance.

1 – The president of the United States must declare the flooding event a state of emergency. If this doesn’t happen, then there won’t be assistance.

2 – Homeowners’ average amount of assistance after a flood, when they do not have flood coverage, is $5,000. The average cost of damage to one’s property after a flood is $38,000+. That $5K you get from the government? It comes as a loan, and you will need to pay it back. Are you willing to gamble on your financial future by forgoing flood insurance coverage?

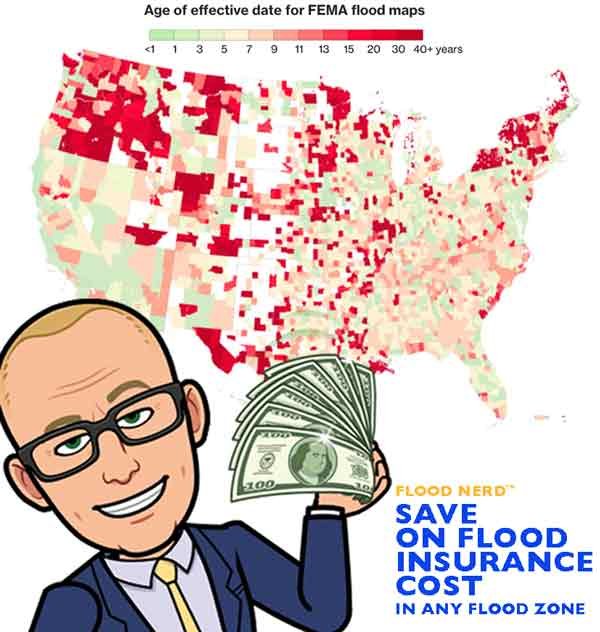

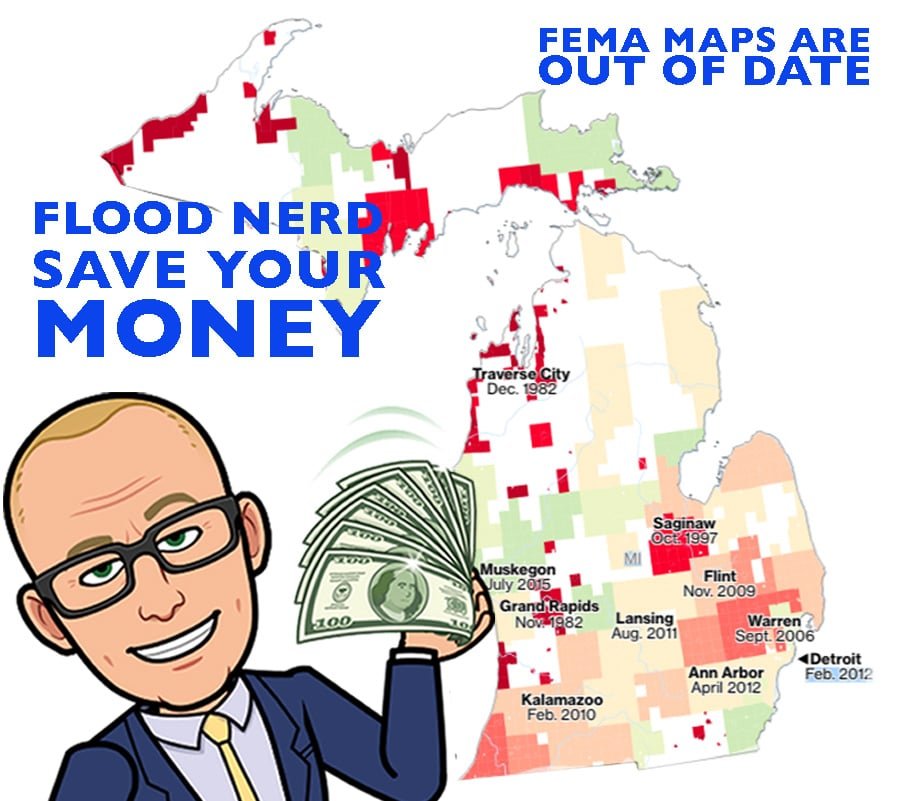

One more note on these low-risk flood zone maps. Many of these maps are over 40 years old. If the area has been developed, there is likely more concrete, creating a barrier for land that previously might have absorbed the massive downpour.

Because of all these factors, it is difficult for property owners to know their true risk of flooding. FEMA admits that their flood maps only give an idea of part of the risk. Our recent storms are facts that it can rain anywhere within Michigan, and you should consider getting flood coverage so you are not uninsured when you need it most.

FEMA flood zone maps often take years to go into effect after the terrain was studied; this gives the impression that the area is “more up to date” than it is.

FEMA flood zone maps often take years to go into effect after the terrain was studied; this gives the impression that the area is “more up to date” than it is.

The average cost for Michigan flood insurance in these Low-risk areas is $595 per year.

FEMA’s National Flood Insurance Program (NFIP) and all federally backed lenders rely on these Michigan flood insurance maps to assess risk, set premiums, and determine who is required to purchase flood insurance. Bad information about an area’s flood risk can leave property owners under or uninsured.

How much is flood insurance in Michigan?

There are many options available in Michigan regarding flood insurance, but they fall into two main categories.

The government option (the NFIP, also called FEMA)

The Private Flood insurance market

Michigan NFIP flood insurance.

The National Flood Insurance Program (NFIP), also known as FEMA, is the government option for flood insurance. The NFIP has enjoyed a 50-state monopoly on the flood insurance market.

Not “private flood insurance” but NFIP Resellers

If you have Nationwide Flood Insurance, State Farm Flood Insurance, Progressive Flood Insurance, or any of the of the logos below, then you are buying the NFIP flood policy that is just being resold through a government program. These companies are private companies, but their flood insurance is not. Here is a list of the 70 companies that resell the NFIP policy.

Cheap Flood Insurance Michigan

Michigan private flood insurance market

There are alternatives to the NFIP or government insurance. It is called Private flood insurance, most notably Lloyd’s of London Flood insurance. However, there are other options available in Michigan. We shop all the options for your property in your region to ensure you are getting the best premium. Please click here if you are ready to have us do the work for you.

Our shopping includes the NFIP because sometimes we find that you can get a much better premium with government subsidies.

Lloyd’s of London Flood Insurance Michigan Market

Michigan is fortunate to have many Lloyd’s of London flood insurance options. Although many Lloyd’s flood insurance companies will have you assume that there is only one option, nothing could be further from the truth.

Lloyd’s of London has a rich history attributed to having invented the first modern insurance model. Unlike most of its competition, Lloyds of London is not a company but a corporate body. This structure works well since it has been around for over 330 years. Lloyds operates under multiple financial backers pooling their capital to spread the risk.

I have two blog posts that deep dive into Lloyds of London and what they mean to Michigan’s flood insurance market. If you are interested, the links are below.

Lloyd’s of London Flood Insurance

FEMA vs Private flood insurance

Lloyd’s also insures the world for flood insurance, meaning they cover flooding events in India, Australia, and much of Europe. The “game” of insurance is to spread your risk since Lloyds is worldwide.

My joke here is that Lloyds is banking on God’s promise that he won’t flood the entire world again, …..so they won’t have to pay out the whole worlds flood claim.

How much does flood insurance cost in Michigan?

Many factors go into getting the cost of flood insurance for Michigan. If your home is in what is considered a low-to-moderate risk, you can get a heavily subsidized policy through the government.

Michigan flood insurance low-to Moderate Risk rate and cost.

This is Flood Zone X, which is not lender required flood zone.

This is usually identified as an X-flood zone. Then we would suggest the government Preferred Risk Policy (PRP) which is a subsidized policy and has set flood insurance coverage limits (see the grid below):

Here is a link if you want to dig into this one. Be ready for an eye chart because every option is public record and should be standardized to accost whoever writes these policies.

The average cost for flood insurance in Michigan with the maximum set limits in these Low-risk flood zone areas is $405 – $700 per year.

Your property is in a higher-risk flood zone, usually identified with a Flood Zone AE. Your lender will require you to have flood insurance. The cost of flood insurance in Michigan depends on many factors unique to the structure. We will try to give you an idea of the most common homes we see in Michigan with a slab-on-grade foundation.

We will look at the Michigan cost of flood insurance for the NFIP maximum of $250,000 for the (building only) with NO CONTENTS and our recommended deductible of $5,000.

We will be rating this example on the NFIP and on a few of our private flood insurance policies, specifically Lloyds flood insurance options in Michigan.

Cost of Flood Insurance in MICHIGAN in high-risk flood zone AE

Our example is Clay, but the premiums will be the same in Harrison, Lansing, Detroit, Dearborn, and many other Michigan flood ones.

In our example, the Base Flood Elevation (BFE is 579) and is a home that is built before 1973

NFIP option in Michigan Flood Zone AE

NFIP – Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

NFIP Annual premium in High-Risk flood zone is $3,599.00

This option is what we see if the property has had a flood loss before and either doesn’t have an Elevation Certificate applied or the Elevation certificate showing that the lowest floor is 4 feet under the BFE for the area. You can use 10% of your coverage to cover other structures on your property

Michigan Private flood insurance – Lloyd’s of London Flood Insurance (option 1)

Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

Lloyd’s of London (option 1) Annual premium in High-Risk flood zone is $815.00

This option is great, and we are very happy when we can get this option. They can be a bit choosey about what risk they will accept and will not take anything that has had a flood loss. They offer basements coverage, about $2,000 for loss of use, and $2,000 for other structures, but they can’t increase this coverage. They do not require an Elevation Certificate to rate.

Michigan Private flood insurance – Lloyds of London Flood Insurance (option 2)

Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

Lloyd’s of London (option 2) Annual premium in High-Risk flood zone is $984.58

This option is great, and we are very happy when we can get this option for our clients. They seem to be writing almost all risks; however, they do not write any property in a designated floodway or has a depth of -4 under the BFE. In our example, with our BFE being 579, they will not accept this risk if the lowest floor is 575. They will not take anything that has had a flood loss. They offer limited coverage for basements and do not require an Elevation Certificate to rate and as a percentage of coverage for loss of use. If you want coverage for other structures, that will need to be added.

Private Flood insurance option (option 3) Not Lloyd’s

Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

The annual premium in a High-Risk flood zone is $3,240.00

This option will take properties that have had one flood loss for more than five years, and the payout was under $100,000 on the claim. Their coverage matches the NFIP. They will write practically all risks, don’t need an elevation certificate to rate, and are a bit lower in premium than the NFIP.

Private Flood Insurance – Lloyd’s of London (option 4)

This option must be written on the Replacement Cost Value (RCV) of the building, otherwise, there is a co-insurance penalty that kicks in. So, $250,000 might be a bit low in California, but to keep this going, let’s just use that for this option

Coverage of $250,000 (RCV) building coverage, No Contents and $5,000 deductible

The annual premium in a High-Risk flood zone is $482.25 (a great price).

This options rating system is all over the board. Sometimes we get a crazy great price, but other times the premium is way higher than the NFIP will consider taking a property that has had one flood loss before as long as it has been more than ten years and the payout was under $50,000 on the claim. Their preferred coverage is at replacement cost, slightly different from some of our other Lloyd’s flood options. We usually reserve this one if the property doesn’t fit the above options. We can adjust coverages to control premiums. As mentioned before, this underwriters’ rates are all over the board. It is worth shopping through to ensure we are getting you the best premium possible. They don’t need an elevation certificate to rate.

Private Flood Insurance – Lloyd’s of London (option 5)

Coverage of $250,000 (RCV) building coverage, No Contents, and a $5,000 deductible.

The annual premium in a High-Risk flood zone is $1,015.86

This option came from the company that used to run the NFIP program, so the coverage matches the NFIP coverage with two differences. They offer living expenses covering your cost when you are displaced from your home during repairs (most Lloyds flood policies offer this). They also offer swimming pool clean-out, which is kind of unique so if you have a pool, ask for this coverage.

Private Flood Insurance – Lloyd’s of London (option 6)

Coverage of $250,000 (RCV) building coverage. No Contents and $5,000 deductible.

The annual premium in a High-Risk flood zone is $904.05

This options rating system is also all over the board. Sometimes we get a crazy low price; other times, the premium is way higher than the NFIP. They will consider taking a property that has had one flood loss before as long as it has been more than ten years and the payout was under $25,000 on the claim. They have been rumored to give a low price the first year and then non-renew following years, or sometimes they jack the price way up, so we will watch them. They have a slick system, and their underwriting is managed by a 3rd party, which also sometimes seems to be a glitch.

More options are coming online every day, and we are working to be looking into every viable option.

Michigan Flood Plain Map

Currently, Michigan has 20,232 NFIP policies in force to date with a total cost of $20,395,079. That would make the average for Michigan $1,008. Of course, some will pay more, and some will pay less.

Click here to have us shop and save you money.

Flood Insurance Michigan

Hello, Michigan! Thanks for visiting our page for all your flood insurance needs.

Let’s start with Saugatuck and Alpena, Michigan. In Saugatuck and Alpena, the average flood rate is $684. These areas have 175 active flood policies with $119,615 in total premiums.

Next, let’s check out Standish and Orangeville, Michigan, where there are 100 flood policies in effect. The premiums here total $117,236, allowing the average flood rate to be $1,172.

Next, we’ll look at Bangor, Michigan, where there are $349,549 in total flood premiums and 354 active flood policies. The average flood rate for Bangor is $987.

Bay City and Fraser, Michigan, are next, with an average flood rate of $716. There are 209 active flood policies and $149,625 in premiums in Bay City and Fraser.

$1,073 is the average flood rate for Hampton and Kawkawlin, Michigan. This includes 154 flood policies and $165,272 in total premiums.

251 flood policies are active in Midland, Michigan. Midland has $220,588 in flood premiums, which causes the average flood rate to be $879.

Let’s check out a group of areas: Pinconning, New Buffalo, and Battle Creek, where the average flood rate is $680. There are 224 flood policies and $152,364 in premiums in these areas.

The average flood rate in East Lansing, Michigan, is much higher than the state average at $2,604. There are 121 active flood policies and $315,098 in total premiums. Please contact us in East Lansing so we can check prices for you!

In Lansing, Michigan, the average flood rate drops to $1,971, which is still higher than the state average! This includes 360 flood policies in effect and $709,477 in flood premiums.

There are $204,627 flood premiums in Eaton Rapids, Burton, Alma, and Fairhaven, Michigan. The total number of active flood policies here is 201, which causes the average flood rate to be $1,018.

When we look at Flint, Grand Blanc, Swartz Creek, Sebewaing, Delhi, and Mason, Michigan, we find an average flood rate of $1,138. There are 319 flood policies in effect in these areas and $363,021 in total premiums.

Meridian, Michigan, has 195 flood policies active and $261,393 in flood premiums. The average flood rate for Meridian is $1,340.

Let’s check out another group of areas in Michigan: East Tawas, Oscoda, and Tawas City, where the average flood rate is $726. The total number of active policies here is 166, with $120,528 in written premiums.

Looking at Leoni and Kalamazoo, Michigan, we find 132 active flood policies and an average flood rate of $1,974. The premiums for Leoni and Kalamazoo total up to $260,633. Please contact us to check flood rates for your area!

Hello Grand Rapids, Michigan! Thanks for stopping by! Your average flood rate is $1,515. There are 102 flood policies in effect in Grand Rapids. The premiums total up to $154,560 here.

We’ve got another group of cities to look at Grandville, Lowell, Green Oak, and Hamburg, Michigan, where there are 338 active flood policies. The premiums in these areas total up to $598,917, which causes the average flood rate to be $1,772.

Next, let’s check out Plainfield and Wyoming, Michigan, where the average flood rate jumps to $2,013. The active flood policies here total 182 with $366,354 in total premiums.

Chesterfield, Michigan, has an average flood rate of $888. The total number of flood policies in Chesterfield is 297, with $263,702 in flood premiums.

$988 is the average flood rate for Clinton, Michigan. Clinton has 103 active flood policies and $101,782 in premiums.

Five hundred five flood policies are in effect in Harrison, Michigan. Harrison also has $547,116 in total flood premiums, which causes the average flood rate to be $1,083.

There are 138 flood policies active in Macomb and New Baltimore, Michigan. The average flood rate for Macomb and New Baltimore is $1,032, including $142,349 in written premiums.

There are $231,022 flood premiums and 218 total active flood policies in St. Clair Shores, Michigan. The average flood rate for St. Clair Shores is $1,060.

Look at Sterling Heights, Warren, Erie, and Estral Beach, Michigan. These areas have a combined average flood rate of $1,125. The premiums here total up to $403,856, including 359 active flood policies.

Next, let’s check out Bedford and Berlin, Michigan, where there are 179 flood policies in effect. The average flood rate here is $1,042, with $186,601 in total flood premiums.

Frenchtown, Michigan, has an average flood rate of $943. The total number of flood policies in Frenchtown is 407, with $383,817 in flood premiums.

The average flood rate goes up to $1,176 for Lasalle, Michigan. The number of active policies is 111, including $130,500 in written premiums.

$817 is the average flood rate for Luna Pier, Michigan. The premiums in Luna Pier total $241,923, and the total number of flood policies here is 296.

Three hundred thirty-six policies are active in Monroe, Michigan. The flood premiums in Monroe total $345,494, which allows the average flood rate to be $1,028.

Now let’s check out Muskego, North Muskego, Norton Shores, Farmington Hills, Farmington, Southfield, Troy, Georgetown, and Holland, Michigan. This group has an average flood rate of $856. The active policies here total 873 with $747,227 in total premiums.

Next, we’ll look at Birmingham, Bloomfield, Novi, Royal Oak, Waterford, West Bloomfield, Spring Lake, and Buena Vista, Michigan, where there are 555 flood policies in effect. The premiums in these areas total up to $585,823, allowing the average flood rate to be $1,056.

Carrollton, Michigan, has $108,928 in flood premiums and 130 active flood policies. The average flood rate for Carrollton is $838.

$1,095 is the average flood rate for James, Michigan. James’s total number of active flood policies is 142 with $155,553 in written premiums.

Three hundred seventy-two flood policies are in effect in Saginaw, Michigan. Saginaw has an average flood rate of $693 which includes $257,942 in total premiums.

The average flood rate in Spaulding and St. Charles, Michigan, is $1,012. The total number of active flood policies are

There are 129 flood policies in effect in Thomas, Michigan. Thomas has an average flood rate of $1,048 which includes $135,247 in total premiums.

When we look at Zilwaukee, Michigan, we find an average flood rate of $796. Zilwaukee has 196 active flood policies and $156,072 in written premiums.

$183,058 is the flood premium total for Caledonia and Owosso, Michigan. The average flood rate for Caledonia and Owosso is $1,058, including 173 active flood policies.

The average flood rate drops to $786 in Algonac, Michigan. Algonac has $182,404 in total premiums and 232 total policies in effect.

Clay, Michigan, has quite a few flood policies, 736! The average flood rate in Clay is $837, which includes $616,320 in total flood premiums.

Let’s look at East China, Michigan, where the average flood rate is $995. East China has 136 flood policies, with $135,278 in total written premiums.

Ira, Michigan, has $129,993 in flood premiums and 162 active flood policies. Ira’s average flood rate is $802.

There are 120 flood policies in effect in Three Rivers and Vassar, Michigan. Three Rivers and Vassar have an average flood rate of $829, which includes $99,507 in flood premiums.

Thanks for stopping by Ann Arbor, Michigan! You all have 409 flood policies active and $413,385 in flood premiums. Your average flood rate for Ann Arbor is $1,011.

$1,168 is the average flood rate for Northfield and Allen Park, Michigan. Northfield and Allen Park have $147,108 in flood premiums and 126 flood policies.

Two hundred sixty-seven total flood policies are active in Brownstown and Canton, Michigan. Brownstown and Canton have an average flood rate of $861, which includes $230,016 in flood premiums.

Hello Dearborn Heights! You all have the highest number of flood policies in the state at 833. The premiums in Dearborn Heights add up to $912,817. The average flood rate here is $1,096. Thanks for stopping by Dearborn Heights! Give us a call!

Dearborn, Michigan has quite a few less active flood policies than Dearborn Heights, 141 to be specific. Dearborn’s average flood rate is $1,118, which includes $157,641 in flood premiums.

Detroit! Also known as Motor City! Home of the Detroit Lions! So glad to have you here! Detroit’s average flood rate is $634. The total number of active flood policies in Detroit is 283 and the premiums total $179,335.

$1,064 is the average flood rate for Ecorse and Flat Rock, Michigan. The premiums in Ecorse and Flat Rock total $239,353, and the total number of flood policies in effect is 225.

Two hundred seventy-three flood policies are active in Gibraltar, Michigan. Gibraltar has a total of $336,743 in flood premiums and an average flood rate of $1,233.

Looking at Lincoln Park and Plymouth, Michigan, we see an average flood rate of $920. The total number of flood policies in effect here is 188, which includes $173,007 in total written premiums.

Next, look at Redford and Rockwood, Michigan, where there are 192 policies in effect. The average flood rate for Redford and Rockwood is $972, which includes $186,698 in flood premiums.

Now, we’ll check out Taylor, Michigan, where there are $303,602 in written flood premiums. The number of active policies in Taylor is 226, which allows the average flood rate to be $1,343.

Trenton, Michigan’s average flood rate is $677. Trenton has 252 active flood policies and $170,648 in written flood premiums.

Finally, we’ll look at Woodhaven, Michigan. Woodhaven has 67 active flood policies and $63,804 in flood premiums. The average flood rate for Woodhaven is $952.

Thanks for checking out all the flood information on Michigan!!

Flood Insurance Cost Calculator Michigan

For decades, the NFIP has over-charged 50 percent of its policyholders and under-charged the other 50 percent, while it has racked up $42 billion in taxpayer-funded losses, equating to more than half of every claim paid by the NFIP since 1978.

About 30 percent of NFIP claims payments go to the same 3 percent of insured “repetitive loss” structures yearly. When you do the math, this means that the other 97 percent of their flood-exposed constituents could have paid in less and still netted larger claims payouts if they had better access to private flood insurance. A recent white paper by Milliman found that 90 percent of homes in Sandy-struck New York and New Jersey would see reduced flood insurance rates through private insurers.