Get Flood Insurance Long Beach CA & Save Money Too.

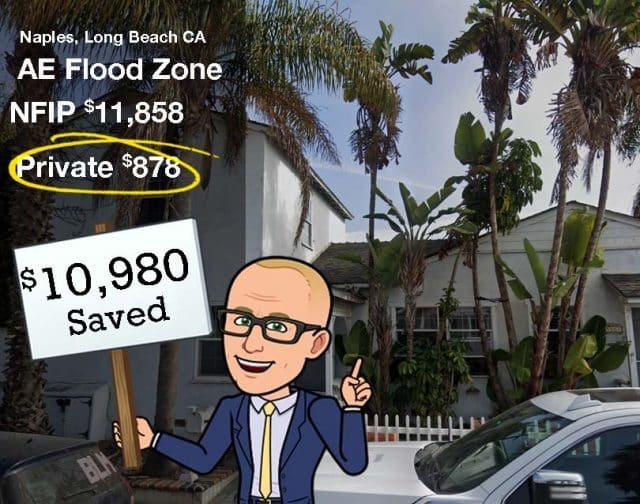

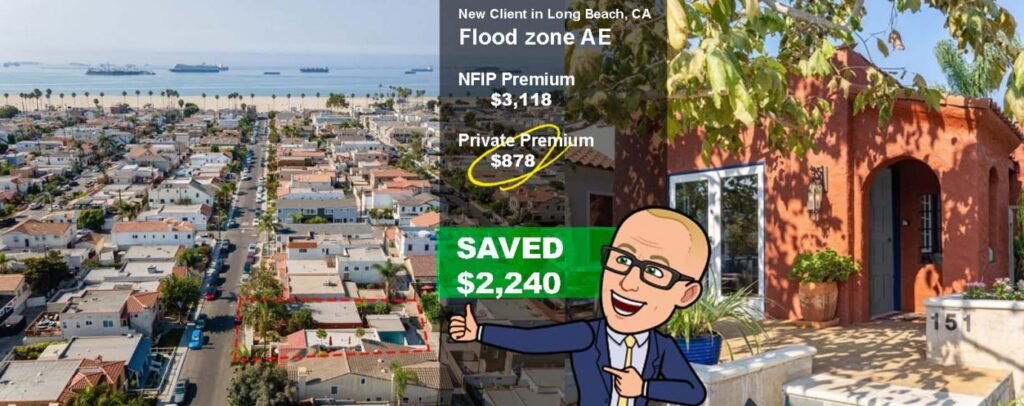

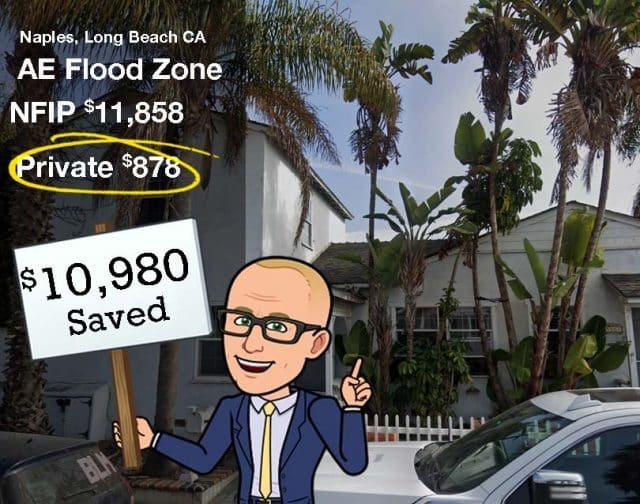

People in Long Beach CA save on average $500 to $1,457+ on their annual flood premiums.

People in Long Beach CA save on average $500 to $1,457+ on their annual flood premiums.

featured on

Here’s the 562 on Flood Insurance Long Beach CA from the people who know it well – the Flood Nerds™

Standard Homeowner’s Insurance Does NOT Cover Flooding in Long Beach CA

A typical California homeowner’s policy is written through Farmers, State Farm, Allstate, or Progressive. These policies protect your home from things like fires and theft. But what they don’t cover is damage from flooding.

Go ahead, ask your homeowner’s agent to add a flood endorsement to your policy, and watch them laugh. But it’s not funny.

In most cases, the only way to get flood coverage in flood zones in Long Beach CA is by purchasing a separate flood insurance policy. And unfortunately, most local insurance agents will just stick you in the National Flood Insurance Program (NFIP) – easy for them – expensive for you.

Flood Nerds are Flood Insurance Specialists. We look for and often find you great coverage and rate and the search is free.

Do You Really Need Flood Insurance in Long Beach California?

The NFIP had a stranglehold on the flood insurance Long Beach CA markets for years. Too many people think if they aren’t in a high-risk flood zone map so they don’t need coverage. And they find out they’re wrong the hard way.

“It never rains in California….it pours man it pours”

Albert Hammond 1972

That popular song from the ’70s is still true today. California sees more than its fair share of flooding. Especially in the San Joaquin county flood areas. And all the fires cause more risk as vegetation is no longer holding back mudslides.

Even if you are in what NFIP calls a “low-risk area” you are still at risk. That’s because 20% of all flooding events in the US every year happen in those “low risk” areas.

Maybe you thought about buying flood insurance when you bought your house but said “Naw – the lender doesn’t require it so I must not need it”. Your real estate agent may have even told you it wasn’t necessary.

Or maybe you saw a big storm coming and thought about the risk of flooding. But by then it was too late to buy a policy. You dodged the bullet that time. But what about the next?

Just because the flood zones in Long Beach Ca. consider your property a “low risk” it doesn’t mean you aren’t at risk.

The government has been collecting flood data for the last 50 years in Long Beach CA. This data shows that recent major storms resulted in the damaging flood are in these low-risk areas. And 90% of people who had floodwater in their homes after these flooding storms didn’t have flood insurance.

Don’t buy the lie about low risk – buy flood insurance!

Get Cheap Flood Insurance without Compromising Coverage

★★★★★

"Same Coverage at a Better Rate"

-Mohammed K

Flood Nerds will shop the private flood insurance markets and then compare them to the NFIP, guaranteeing you the better option. We will send you the cheapest flood insurance rates within minutes.

★★★★★

"Quick Response, Very Knowledgable"

– Robert W

Paying for low-cost flood insurance is awesome. And letting the Flood Nerds shop your property has other benefits – you can get better coverage while saving money, and you can get it fast.

★★★★★

"Would highly recommend Better Flood for your flood insurance needs."

– Varun K

Better Flood Insurance is an independent flood insurance broker that shops flood insurance ONLY. Flood Nerds are Flood insurance experts. We have 5000+ happy clients and 390+ 5-star reviews.

Long Beach Flood Zone Maps

The original federal maps that covered flood insurance in Long Beach CA flood risk were created in the ’70s. Technology has advanced since then, but that doesn’t mean all the maps have been updated. And those maps are important. The NFIP and all federally backed lenders rely on these maps to assess risk, set premiums, and determine who is required to purchase flood insurance.

Bad Long Beach CA flood zone maps leave property owners under or uninsured.

And Los Angeles County has many bad maps. Out-of-date maps cause problems. If the area has been developed, then there is likely more concrete creating a barrier for land that previously could have absorbed a massive downpour.

And Long Beach CA City limits, Los Angeles County, and surrounding areas such as Los Angeles CA, Malibu CA, Santa Clarita CA, Santa Monica CA, Pasadena CA, Palmdale CA, Manhattan Beach CA, Lancaster CA, Lakewood CA, Glendale CA, Downey CA to name a few has been growing. Since 1970 California’s population grew from 19.9 million to 39.5 million. Those people need places to live and work and that means development. So if your home was built after the 1970s and it could have an outdated flood map that doesn’t reflect recent development you are probably at risk for flooding and don’t even know it.

Any property owner that is financed will be required to purchase a flood insurance Long Beach CA policy if your structure is on a flood risk map. Owners of properties outside of these Long Beach CA Flood zone maps will not be required to carry flood insurance, but it is important to remember that a line drawn on a map doesn’t protect your property from flooding. FEMA estimates that twenty percent of their claims on any given year come from Long Beach CA and surrounding areas.

Even FEMA admits that the Long Beach CA flood maps only partially reflect the real risk. Recent storms are proof it can rain anywhere in California’s borders.

Flood coverage gives you peace of mind and flood insurance in Long Beach CA really isn’t as bad as you think. The average cost for California flood insurance in Stockton is $500 to $850 per year.

No matter what the map says, it’s better to have coverage and not need it than to not have coverage and wish you did.

Natural disasters are common in California, earthquakes, wildfires, and mudslides. But in some areas, such as Long Beach CA, and Los Angeles County, flooding poses a major threat. City officials consider flooding to be the natural disaster most likely to affect the Long Beach area. For this reason, property owners within the city, county, and outlying areas are strongly urged to consider purchasing flood insurance to protect themselves financially.

Options for flood insurance Long Beach CA

Most homeowners, real estate agents, and lenders don’t realize you have options when it comes to flood insurance in Long Beach CA. But the Flood Nerds know all about getting cheap flood insurance in Long Beach CA and surrounding areas. We know more than 5 Ways to Save on Flood Insurance. There are basically two markets for flood insurance in Long Beach CA the Government option and the private market.

Long Beach California National Flood Insurance Program

The National Flood Insurance Program (NFIP) is run by the Federal Emergency Management Administration (FEMA) and they are the government option for Long Beach CA flood insurance. They’ve basically had a 50-year monopoly on the market and the premiums reflect their dominance.

Within the California NFIP, you will find re-sellers. These are companies that sell you a policy under their company name, but basically, it’s just an NFIP policy with an insurance company logo on it. If you have Nationwide flood insurance, State Farm flood insurance, Progressive flood insurance, or a policy by any other re-seller you just have NFIP insurance under a private company skin. That’s NOT the way to save money on flood insurance in Long Beach California. Think you might have flood insurance through a re-seller? Check out this list of companies that resell the NFIP policy.

Long Beach CA Private flood insurance market

Long Beach CA flood insurance isn’t stuck with the NFIP. There is a robust private flood insurance market and you can even tap into the Lloyds of London flood insurance syndicate for flood insurance in Long Beach CA. Sometimes you can get really good rates with Lloyds because they spread the risk all over the world and the risk of the entire planet flooding at once is very small. We Flood Nerds like to say “God said he wouldn’t flood the world again and Lloyds of London takes him at his word”. Now you know what makes a Flood Nerd laugh.

But getting the right flood insurance is no laughing matter. There are so many options and it’s easy to confuse the private flood insurance market with those NFIP re-sellers. That’s why you need to hire a Flood Nerd to get cheap California flood insurance in Long Beach CA.

We shop many options for your property in your Long Beach CA area and ensure you get a great premium. We’ll even check out the NFIP to make sure that all the bases are covered.

The Cost of Flood Insurance in Long Beach California

One major factor in the cost of flood insurance for Long Beach CA is the property location and the company you choose to write the coverage. Premiums for homes in low-to-moderate risk are lower and premiums in high-risk areas are higher.

Flood Zone X – Long Beach CA Low-to Moderate Risk Zone

Lenders don’t require flood insurance in this zone. But remember, floods happen in low-risk zones, and the map may be old.

For properties in the X Flood Zone, we use to suggest the government Preferred Risk Policy (PRP) but the NFIP 2.0 Risk Rating removed this policy from what the NFIP offers. The government used to subsidize a portion of the premium and limit the coverage, so this kept the rates low. The average cost for PRP flood insurance in California with the maximum set limits in low-risk flood zone areas is $500 – $900 per year. If you are buying a new home it is always a good idea to ask if the seller has flood coverage and get a copy of their policy if they are getting the subsidies we Flood Nerds know how to get this same subsidy for you when you buy your new home.

Flood Zone AE in Long Beach CA

A higher-risk flood zone is Flood Zone AE. If your property is in Zone AE, your lender will require you to have flood insurance.

The cost of Long Beach CA flood insurance in this zone really depends on factors that are unique to the structure.

As an example, let’s look at a house built on a slab on grade foundation. The home was built in 1974. The policy is for flood coverage at the NFIP maximum of $250,000 for the building only. It doesn’t include contents and the deductible is our recommended amount of $5,000.

Our example is a house in Long Beach CA flood insurance but the premiums will be the same as in Los Angeles County flood insurance, Beverly Hills Californa, Burbank California, Calabasa California, Downey California, Glendale California, Los Angeles California, Malibu California, Manhattan Beach California flood insurance, Santa Clarita California, Santa Monica California, and most other California cities and counties in AE flood zones.

The NFIP option in Long beach Flood Zone AE is $11,858

(wow this clients old agent was so clueless and cost this client for many years don’t be suckered as well)