Get Flood Insurance in PA & Save Money Too.

People in PA save on average $500 to $1,457+ on their annual flood premiums.

Get flood insurance from a Flood Nerd® at Better Flood Insurance® and save big time.

featured on

Flood Insurance In PA: A Simple (But Complete) Guide

Get Cheap Flood Insurance without Compromising Coverage

★★★★★

"Same Coverage at a Better Rate"

-Mohammed K

Flood Nerds will shop the private flood insurance markets and then compare them to the NFIP, guaranteeing you the better option. We will send you the cheapest flood insurance rates within minutes.

★★★★★

"Quick Response, Very Knowledgable"

– Robert W

Paying for low-cost flood insurance is awesome. And letting the Flood Nerds shop your property has other benefits – you can get better coverage while saving money, and you can get it fast.

★★★★★

"Would highly recommend Better Flood for your flood insurance needs."

– Varun K

Better Flood Insurance is an independent flood insurance broker that shops flood insurance ONLY. Flood Nerds are Flood insurance experts. We have 5000+ happy clients and 390+ 5-star reviews.

Does my Pennsylvania homeowner insurance cover flooding?

A typical Pennsylvania homeowners’ policy is written through Farmers, State Farm, Allstate, and Progressive, for instance, excludes flooding as something that will be covered under their homeowner’s policy.

In most cases, the only way to get flood coverage is by purchasing a stand-alone flood insurance policy. However, you should ask your homeowners agent if you can add an endorsement to your homeowner’s policy to cover flooding. Yet, don’t be too surprised if the answer is NO.

How much is flood insurance in PA?

It is important to have flood insurance coverage in Pennsylvania because our beloved State has seen a fair share of flooding, and more is likely coming.

We believe that most homeowners think about Flood insurance in Pennsylvania at some point, maybe before buying a home or during the closing process. However, many of us only think about it when a big storm is looming, or we have heard on the news that there is flooding forecasted or happening too close to our home.

How much is flood insurance in Pa?

If your home or business is in a flood zone, that is considered a low flood-risk area. Sadly, many homeowners decide to forgo purchasing coverage because they believe they are safe from flooding. Some real estate and insurance agents may even say you don’t need it.

I ask you to consider the facts: 20 percent of all flooding events across our nation come in areas that are considered low risk. After our last few major storms (Hurricane Harvey), we saw flooding in these low-risk areas. 80 percent of these individuals had water in their homes or building and didn’t have flood insurance coverage.

In Harris county, nearly 135,000 homes were damaged. Three-fourths of these properties were considered low to moderate risk.

We often hear that people believe the government will help, which is true. However, a few things must align for you to get government assistance.

The president of the United States must declare the flooding event a state of emergency. If this doesn’t happen, then there won’t be assistance.

The average amount of assistance homeowners get after a flood when they do not have flood coverage is $5,000. The average cost of damage to one’s property after a flood is $38,000+. That $5K you get from the government? It comes as a loan, and you will need to pay it back. Are you willing to gamble your financial future by forgoing flood insurance coverage?

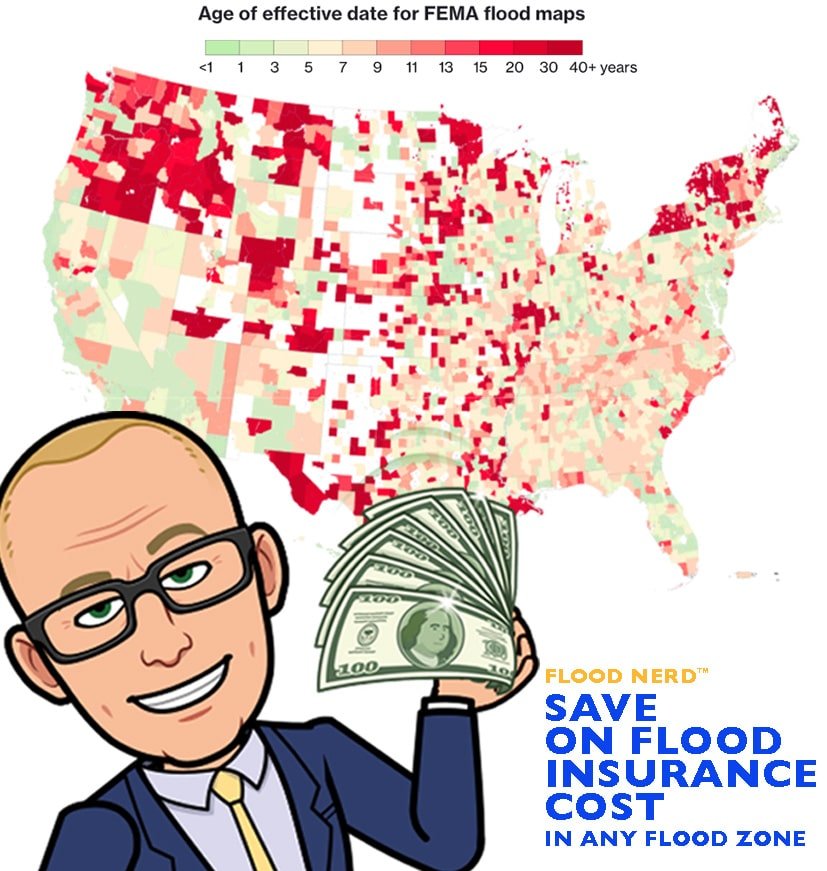

One more note on these low-risk flood zone maps. Many of these maps are over 40 years old. If the area has been developed, there is likely more concrete, creating a barrier for land that previously might have absorbed the massive downpour.

Because of all these factors, it is difficult for property owners to know their true risk of flooding. FEMA admits that their flood maps only give an idea of part of the risk. Our recent storms are facts that it can rain anywhere within Pennsylvania, and you should consider getting flood coverage so you are not uninsured when you need it most.

FEMA flood zone maps often take years to go into effect after the terrain was studied; this gives the impression that the area is “more up to date” than it is.

How much does flood insurance cost in PA?

The average cost for Pennsylvania flood insurance in these Low-risk areas is $595 per year.

FEMA’s National Flood Insurance Program (NFIP) and all federally backed lenders rely on these Pennsylvania flood insurance maps to assess risk, set premiums, and determine who is required to purchase flood insurance. Bad information about an area’s flood risk can leave property owners under or uninsured.

PA NFIP flood insurance.

There are many options available in Pennsylvania regarding flood insurance, but they fall into two main categories.

The government flood insurance options, also called NFIP or FEMA

The private flood insurance market

The National Flood Insurance Program (NFIP), also known as FEMA, is the government option for flood insurance. The NFIP has enjoyed a 50-state monopoly on the flood insurance market.

Not “private flood insurance” but NFIP Resellers

Suppose you have Nationwide Flood Insurance, State Farm Flood Insurance, Progressive Flood Insurance, or any of the logos below. In that case, you are buying the NFIP flood policy that is just being resold through a government program. These companies are private companies, but their flood insurance is not. Here is a list of the 70 companies that resell the NFIP policy.

PA private flood insurance market

There are alternatives to the NFIP or government insurance. It is called Private flood insurance, most notably Lloyd’s of London Flood insurance. However, there are other options available in Pennsylvania. We shop all the options for your property in your region to ensure you are getting the best premium. Please click here if you are ready to have us do the work for you.

Our shopping includes the NFIP because sometimes we find that you can get a much better premium with government subsidies.

Lloyd’s of London Flood Insurance PA

Pennsylvania is fortunate to have many Lloyd’s of London flood insurance options. Although many Lloyd’s flood insurance companies will have you assume that there is only one option, nothing could be further from the truth.

Lloyd’s of London has a rich history attributed to having invented the first modern insurance model. Unlike most of its competition, Lloyd’s of London is not a company but a corporate body. This structure works well since it has been around for over 330 years. Lloyd’s operates under multiple financial backers pooling their capital to spread the risk.

I have two blog posts that deeply dive into Lloyds of London and what they mean to Pennsylvania’s flood insurance market. If you are interested, the links are below.

Lloyd’s of London Flood Insurance

Fema vs Private flood insurance

Lloyd’s also insures the world with flood insurance, meaning they cover flooding events in India, Australia, and much of Europe. The “game” of insurance is to spread your risk since Lloyds is worldwide.

My joke here is that Lloyds is banking on God’s promise that he won’t flood the entire world again, …..so they won’t have to pay out the whole world’s flood claim.

How much does flood insurance cost in Pennsylvania?

Many factors go into getting the cost of flood insurance for Pennsylvania. If your home is in what is considered a low-to-moderate risk, you can get a heavily subsidized policy through the government.

PA flood insurance low-to Moderate Risk rate and cost. This is Flood Zone X, which is not lender required flood zone.

This is usually identified as an X-flood zone. Then we would suggest the government Preferred Risk Policy (PRP) which is a subsidized policy and has set flood insurance coverage limits (see the grid below):

NFIP Maximum Coverage Limits

Cost of flood insurance in PA

The average cost for flood insurance in Pennsylvania with the maximum set limits in these Low-risk flood zone areas is $405 – $700 per year.

Your property is in a higher-risk flood zone, usually identified with a Flood Zone AE. Your lender will require you to have flood insurance. The cost of flood insurance in Pennsylvania depends on many factors unique to the structure. We will try to give you an idea of the most common homes we see in Pennsylvania with a slab-on-grade foundation.

We will look at the Pennsylvania cost of flood insurance for the NFIP maximum of $250,000 for the (building only) with NO CONTENTS and our recommended deductible of $5,000.

We will be rating this example on the NFIP and on a few of our private flood insurance policies, specifically Lloyd’s flood insurance options in Pennsylvania.

Cost of Flood Insurance in PA in high-risk flood zone AE

Our example is Philadelphia, but the premiums will be the same if in Kingston, Wilkes Barre, Pittsburgh, Harrisburg, and many other Pennsylvania flood ones.

In our example, the Base Flood Elevation (BFE is 634) and is a home that is built before 1973

Cheap flood insurance PA

NFIP option in PA Flood Zone AE

NFIP – Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

NFIP Annual premium in High-Risk flood zone is $4,069.00

This option is what we see if the property has had a flood loss before and either doesn’t have an Elevation Certificate applied or the Elevation certificate shows that the lowest floor is 4 feet under the BFE for the area. You can use 10% of your coverage to cover other structures on your property

Flood insurance quote pa

Pennsylvania Private flood insurance – Lloyd’s of London Flood Insurance (option 1)

Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

Lloyd’s of London (option 1) Annual premium in High-Risk flood zone is $907.15 (Great Price!)

This option is great, and we are very happy when we can get this option. They can be a bit choosey about what risk they will accept and will not take anything that has had a flood loss. They do offer coverage for basements, about $2,000 for loss of use, $2,000 for other structures, but they can’t increase this coverage. They do not require an Elevation Certificate to rate.

Pennsylvania Private flood insurance – Lloyd’s of London Flood Insurance (option 2)

Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

Lloyds of London (option 2) Annual premium in High-Risk flood zone is $1,082.70

This option is great, and we are very happy when we can get this option for our clients. They seem to be writing almost all risks; however, they do not write any property in a designated floodway or have a depth of -4 under the BFE. In our example, with our BFE being 634, they will not accept this risk if the lowest floor is 360. They will not take anything that has had a flood loss. They offer limited coverage for basements and do not require an Elevation Certificate to rate, as a percentage of coverage for loss of use. If you want coverage for other structures, that will need to be added.

Private Flood insurance option (option 3), Not Lloyd’s

Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

The annual premium in a High-Risk flood zone is $3,663.00

This option will take properties that have had one flood loss for more than five years and the payout was under $100,000 on the claim. Their coverage matches the NFIP. They will write practically all risks, don’t need an elevation certificate to rate, and are a bit lower in premium than the NFIP.

Private Flood Insurance – Lloyd’s of London (option 4)

This option must be written on the Replacement Cost Value (RCV) of the building. Otherwise, there is a co-insurance penalty that kicks in. So, $250,000 might be a bit low in California, but to keep this going, let’s just use that for this option

Coverage of $250,000 (RCV) building coverage, No Contents and $5,000 deductible

The annual premium in a High-Risk flood zone is $1,295.34

This options rating system is all over the board. Sometimes we get a crazy great price, but other times the premium is way higher than the NFIP will consider taking a property that has had one flood loss before as long as it has been more than ten years and the payout was under $50,000 on the claim. Their preferred coverage is at replacement cost, slightly different from some of our other Lloyd’s flood options. We usually reserve this one if the property doesn’t fit the above options. We can adjust coverages to control premiums. As mentioned before, these underwriters’ rates are all over the board. It is worth shopping through to ensure we are getting you the best premium possible. They don’t need an elevation certificate to rate.

Private Flood Insurance – Lloyd’s of London (option 5)

Coverage of $250,000 (RCV) building coverage, No Contents, and $5,000 deductible.

The annual premium in a High-Risk flood zone is $1,508.91

This option came from the company that used to run the NFIP program, so the coverage matches the NFIP coverage with two differences. They offer living expenses which will cover your cost when you are displaced from your home during repairs (most Lloyds flood policies offer this). They also offer swimming pool clean out, which is kind of unique so if you have a pool, ask for this coverage.

Private Flood Insurance – Lloyds of London (option 6)

Coverage of $250,000 (RCV) building coverage. No Contents and a $5,000 deductible.

The annual premium in a High-Risk flood zone is $810.00

This options rating system is also all over the board. Sometimes we get a crazy low price; other times, the premium is way higher than the NFIP. They will consider taking a property that has had one flood loss before as long as it has been more than ten years and the payout was under $25,000 on the claim. They have been rumored to give a low price the first year and then non renew following years or sometimes they jack the price way up so we will watch them. They have a slick system, and their underwriting is managed by a 3rd party, which also sometimes seems to be a glitch.

More options are coming online every day, and we are working to be looking into every viable option.

Currently, Pennsylvania has 55,548 NFIP policies in force to date, with a total cost of $65,301,183. That would make the average for Pennsylvania $1,176. Of course, some will pay more, and some will pay less.

Click here to have our shop and save money on your PA flood insurance.

Hello, Pennsylvania! Thanks for visiting our page for all your flood insurance needs.

Let’s start with Gettysburg and Reading, Pennsylvania, where the average flood rate is $1,201. The premiums here total up to $183,739 with 153 active flood policies.

Next up is Bethel Park and Bridgeville, Pennsylvania. In Bethel Park and Bridgeville, there are 115 flood policies in effect with $131,444 in written premiums. This allows the average flood rate to be $1,433.

Now, we’ll look at Carnegie, Pennsylvania. Carnegie has an average flood rate of $1,370. The premiums here total $143,886, with 105 active flood policies.

East Deer and Elizabeth, Pennsylvania, have an average flood rate of $976. The premiums here total $140,539 with 144 flood policies in effect.

Etna, Pennsylvania, has 178 active flood policies with $254,451 in written premiums. The average flood rate for Etna is $1,430.

Now, let’s check out a group of areas, including Hampton, McCandless, Mt. Lebanon, Neville, Penn Hills, and Pitcairn, Pennsylvania, where the premiums total up to $502,831. The average flood rate for these areas is $1,378, including 365 active flood policies.

Next is another group, including McKees Rocks, Millvale, O’Hara, and Oakmont, Pennsylvania. These areas have 399 flood policies, with $560,799 in total premiums. The average flood rate for these areas is $1,406.

Flood insurance Pittsburgh PA

Hello Pittsburgh, Pennsylvania! Home of the Pittsburg Steelers! Glad you all stopped by. You have 453 flood policies that are active and an average flood rate of $2,181. Your premiums add up to $988,170. Give us a call to help you find a lower flood rate!

There are 139 active flood policies in Ross and Scott, Pennsylvania. The premiums here calculate out to $198,728, allowing the average flood rate to be $1,430.

In Shaler, Pennsylvania, the average flood rate is $1,730. Shaler has 147 active policies and $254,268 in written flood premiums.

$1,521 is the average flood rate for Sharpsburg and South Fayette, Pennsylvania. These areas have 157 active flood policies and $238,719 in total premiums.

One hundred twenty-nine flood policies are in effect in Turtle Creek and Upper St. Clair, Pennsylvania. The premiums here total $238,719, with an average flood rate of $976.

Ford City, Pennsylvania, has an average flood rate of $448. Ford City has 175 active flood policies and $78,475 in total premiums.

Another group of areas to look at include Freeport, Kittanning, Bedford, Hyndman, Muhlenberg, Reading, Robeson, Blair, and Freedom, Pennsylvania. These areas have an average flood rate of $1,759. The premiums here total $1,097403, with 624 flood policies in effect.

When we study Bridgewater, Franklin, Exeter, Hamburg, Allegheny, Altoona, Greenfield, and Logan, Pennsylvania, we find premiums that total $636,938 and 595 flood policies active. The average flood rate for these areas is $1,070.

In Tyrone, Pennsylvania, the average flood rate is $963. The premiums here total $105,977, with 110 active flood policies.

There are 218 flood policies in effect in Athens, Pennsylvania. Athens has an average flood rate of $723, including $157,641 in written premiums.

$1,265 is the average flood rate for Bensalem, Pennsylvania. Bensalem has 150 active flood policies and $189,734 in flood premiums.

Thanks for stopping by Bristol, Pennsylvania! Bristol’s average flood rate is $1,162, with 706 active flood policies and $820,407 in written premiums!

In Buckingham and Doylestown, Pennsylvania, there are 143 flood policies in effect and $127,245 in flood premiums. These areas have an average flood rate of $890.

Falls, Pennsylvania, has 90 active policies and $90,185 in flood premiums. The average flood rate for Falls is $1,002.

The average rate rises to $1,121 in Lower Makefield, Pennsylvania. Lower Makefield has 329 flood policies active and $368,771 in written premiums.

Looking at Lower Southampton, Middletown, Newtown, Northampton, Solebury, and Tinicum, Pennsylvania, we find an average flood rate of $1,132. These areas have 732 flood policies, with $828,985 in total written premiums.

Now, let’s check out Morrisville, New Hope, Quakertown, and Riegelsville, Pennsylvania, where 491 active flood policies exist. The average flood rate here is $1,620 with $795,421 in premiums. Give us a call to see if we can lower your flood rate!

Now that we’ve looked at Lower Makefield let’s look at Upper Makefield. Upper Makefield, Pennsylvania, has 162 flood policies and $255,033 in written premiums. The average flood rate for Upper Makefield is $1,389.

Upper Southampton and Warminster, Pennsylvania, has an average flood rate of $901. The premiums here total $142,367 with 158 active flood policies.

$830 is the average flood rate for Warrington and Warwick, Pennsylvania. These two areas have 139 policies and $115,309 in total premiums.

Yardley pa flood mapPA

The average flood rate rises to $2,245 in Yardley, Pennsylvania. Yardley has 203 active flood policies and $455,826 in premiums. Give us a call, Yardley!

Butler County PA flood map

When we look at Butler, the average flood rate drops to $1,191. Butler, Pennsylvania, has 117 flood policies and $151,244 in total premiums.

Cranberry, Evans City, and Adams, Pennsylvania, have 162 active flood policies and $171,714 in flood premiums. The average flood rate for these areas is $1,060.

$2,455 is the average flood rate for Johnstown, Pennsylvania. Johnstown has 369 policies in effect and $906,031 in flood premiums. Johnstown, let us check for a lower rate! Check us out!

One hundred fifty-two flood policies are in effect in Stonycreek and Shippen, Pennsylvania. The premiums here total $217,782, allowing the average flood rate to be $1,433.

In Palmerton and Caln, Pennsylvania, we have 103 active flood policies with $143,382 in total flood premiums. The average flood rate for Palmerton and Caln is $1,392.

The flood policies in Downington, Pennsylvania total 143 with $221,663 in flood premiums. The average flood rate for Downington is $1,550.

Let’s look at East Goshen, Easttown, West Chester, West Goshen, Dubois, Lawrence, Mill Hall, and Pine Creek, Pennsylvania where the flood policies total up to 542. The premiums here add up to $574,798, allowing the average flood rate to be $1,061.

The average flood rate is $1,364 for North Coventry, Tredyffrin, West Whiteland, Willistown, Sandy, and Bald Eagle, Pennsylvania. The premiums for these areas calculate up to $611,022 with 448 active flood policies.

Bloomsburg PA flood zone map

Bloomsburg has 302 flood policies in effect with $433,129 in written premiums. Bloomsburg, Pennsylvania’s average flood rate is $1,434.

Columbia county PA flood map

In Scott, Pennsylvania, the average flood rate is $809. Scott has 146 active flood policies and $118,096 in written premiums.

Meadville, Sadsburg, East Pennsboro, Hampden, New Cumberland, and South Middleton, Pennsylvania, have $645,915 in flood premiums with 540 flood policies. These areas have an average flood rate of $1,196.

There are 281 flood policies in effect in Titusville, Lower Allen, and Mount Holly Springs, Pennsylvania. The average flood rate for these areas is $1,267, including $355,972 in total flood premiums.

The flood rate jumps to $2,026 in Derry, Pennsylvania! Derry has 124 active flood policies and $251,235 in premiums. Give us a call, Derry!

Harrisburg PA flood zone map

Hello Harrisburg, Pennsylvania! You all have quite a few active flood policies – 800! The premiums in Harrisburg total $2,076,043, which causes the average flood rate to be $2,595! Maybe we can lower your premiums! Check us out!

One hundred thirty-two flood policies are in effect in Highspire, Pennsylvania. Highspire has an average flood rate of $1,324, including $174,708 in written premiums.

Let’s check out Londonberry, Lower Paxton, Middletown, and Royalton, Pennsylvania, where the average flood rate is $1,061. These areas have $332,225 in flood premiums and 313 active flood policies.

When we look at Lykens, Middle Paxton, South Hanover, and Steelton, Pennsylvania, we find $408,849 in flood premiums and 299 active flood policies. The average flood rate for these areas is $1,367.

Susquehanna, Pennsylvania, has an average flood rate of $2,047. The flood policies in effect here total 228 with $466,730 in written premiums.

There are 200 active flood policies in effect in Swatara, Pennsylvania, with $230,546 in flood premiums. Swatara has an average flood rate of $1,153.

Chester county PA flood map

The average flood rate in Chadds Ford and Chester, Pennsylvania, is $1,345. The premiums here total $243,523 with 181 active flood policies.

Haverford, Pennsylvania, has 168 flood policies with $181,252 in premiums. The average flood rate for Haverford is $1,079.

$884 is the average flood rate for Marple and Nether Providence, Pennsylvania. The flood policies add up to 156 with $137,851 in total flood premiums.

One hundred seventy-five flood policies are active in Radnor, Pennsylvania. Radnor has an average flood rate of $1,187 with $207,639 in written premiums.

The average flood rate rises to $1,594 in Ridley and Springfield, Pennsylvania. Ridley and Springfield have 177 active flood policies and $282,158 in flood premiums.

The average flood rate in Tinicum and Upland, Pennsylvania, rises to $1,811. The policies here total 233 with $421,959 in flood premiums.

Upper Darby, Pennsylvania, has an average flood rate of $1,769. The policies are active in Upper Darby total 224 with $396,336 in written premiums.

$196,743 is the premium total for Ridgway and Erie, Pennsylvania. The average flood rate for these areas is $1,447, including 136 active flood policies.

Millcreek, Pennsylvania, has an average flood rate of $617. The policies in effect in Millcreek total 141 with $87,043 in written premiums.

There are 111 active flood policies in Chambersburg and Greene, Pennsylvania. The premiums here total $162,383, allowing the average flood rate to be $1,463.

Huntingdon, Pennsylvania, has 104 active flood policies. The premiums in Huntingdon total $120,626 and the average flood rate is $1,160.

Indiana, Pennsylvania has the same number of flood policies as Huntingdon: 104! The average flood rate in Indiana is $1,359, which includes $141,339 in total premiums.

$1,438 is the average flood rate for White and Punxsutawney, Pennsylvania. The premiums here total $156,743 with 109 active flood policies.

In Dickson, Pennsylvania, the average flood rate is $1,335. There are 133 policies in effect with $177,621 in written premiums.

One hundred fourteen flood policies are in effect in Jermyn and Olyphant, Pennsylvania. The premiums written here add up to $156,548, allowing the average rate to be $1,373.

There are 382 flood policies active in Scranton, Pennsylvania. Scranton has an average flood rate of $859 with $382,115 in flood premiums.

Looking at East Hempfield and Ephrata, Pennsylvania, we find an average flood rate of $1,163. The premiums add up to $179,095 with 154 flood policies in effect.

Lancaster PA flood map

Let’s check out Lancaster, Manheim, and Manor, Pennsylvania, where the premiums add up to $402,301 and the active policies total 341. The average flood rate for these areas is $1,180.

Marietta, Pennsylvania, has an average flood rate of $1,605. The premiums here total $176,511 with 110 active flood policies.

The average flood rate is $2,246 in New Castle, Pennsylvania. New Castle has 123 flood policies, with $276,229 in total premiums.

Lebanon and North Cornwall, Pennsylvania, have an average flood rate of $1,432. These two areas combined have $211,958 flood premiums and 148 active flood policies.

Allentown PA flood map

In Allentown, Pennsylvania, there are 121 active flood policies. The average flood rate for Allentown is $2,031, with $245,734 in written premiums.

$1,657 is the average flood rate for Bethlehem, Pennsylvania. Bethlehem has $167,341 in flood premiums and 101 active flood policies.

There are 112 active flood policies in Lower Macungie, Pennsylvania. The average flood rate for Lower Macungie is $1,674, which includes $187,458 in total premiums.

Look at South Whitehall, Whitehall, Edwardsville, and Exeter, Pennsylvania, where the average flood rate is $932. The premiums in these areas add up to $405,463. The active flood policies total 435.

Now, we’ll check out Butler and Duryea, Pennsylvania, where their premiums total $104,767. The average flood rate is $895, which includes 117 flood policies in effect.

Forty Fort, Pennsylvania, has 686 active flood policies with $367,583 in written premiums. Forty Fort’s average flood rate is $536.

Hanover, Pennsylvania, has $385,761 flood premiums with 458 active flood policies. Hanover has an average flood rate of $842.

Kingston, Pennsylvania premiums total $1,147,987 with 1,978 active flood policies! The average flood rate for Kingston, Pennsylvania, is $580.

Hello Plains and Plymouth, Pennsylvania! So glad you all stopped by our page today! The average flood rate for Plains and Plymouth is $1,025. The premiums here add up to $254,318 with 248 active flood policies.

$398 is the average flood rate for Swoyersville, Pennsylvania. Swoyersville has 475 flood policies in effect with $188,837 in written premiums.

There are 320 flood policies active in West Pittston, Pennsylvania. West Pittston has an average flood rate of $943, which includes $301,903 in flood premiums.

One thousand three hundred sixteen flood policies are in effect in Wilkes-Barre, Pennsylvania. Wilkes-Barre has $1,075,430 in flood premiums and an average flood rate of $817.

In Jersey Shore, Pennsylvania, the average flood rate is $1,027. The premiums in Jersey Shore total $186,951 with 182 active flood policies.

Let’s look at a group of areas, including Loyalsock, Lycoming, Old Lycoming, Plunketts Creek, Armagh, and Derry, Pennsylvania. These areas have an average flood rate of $1,057. The premiums for all these areas add up to $410,238 with 388 active flood policies.

Moving on to Muncy Creek, Muncy, Bradford, and Foster, Pennsylvania, where there are 342 flood policies in effect with $412,767 in premiums. These areas have an average flood rate of $1,207.

Lewistown, Pennsylvania, has 167 active flood policies. The average flood rate for Lewistown is $996 which includes $166,379 in written premium.

$832 is the average flood rate for Coolbaugh, Stroud, and Tobyhanna, Pennsylvania. The premiums for these areas add up to $153,893, and the policies total 185.

Three hundred thirty-nine flood policies are in effect for Abington, Pennsylvania. Abington has $362,150 in flood premiums which allows the average flood rate to be $1,068.

Ambler and Bridgeport, Pennsylvania, the premiums add up to $257,839 with 115 active flood policies. Ambler and Bridgeport’s average flood rate is $2,242. Call us to see if we can help with your flood needs!

Cheltenham, Pennsylvania, has an average flood rate of $1,037. The premiums in Cheltenham are $153,476, with 148 active flood policies.

There are 121 flood policies active in Hatboro, Pennsylvania. Hatboro has an average flood rate of $968 with $117,174 in written premiums.

The average flood rate in Horsham, Pennsylvania, is $816. The premiums in Horsham total $95,433, with 117 flood policies in effect.

Let’s look at Lower Merion, Pennsylvania. Lower Merion has 468 flood policies active with $288,754 in premiums. The average flood rate in Lower Merion is $617.

The average flood rate rises to $653 in Lower Moreland, Pennsylvania. Lower Moreland has 314 active flood policies and $204,977 in premiums.

When we look at the average flood rate for Pottstown, Pennsylvania, it jumps to $2,365. There are only 133 flood policies in effect in Pottstown, with $314,530 in flood premiums.

Looking at Springfield and Towamencin, Pennsylvania, we find $117,819 in written premiums with 202 active flood policies. The average flood rate for these two areas is $583.

Upper Dublin, Pennsylvania, has 169 flood policies with $291,540 in flood premiums. The average flood rate for Upper Dublin is $1,725. Upper Dublin – give us a call to check on new flood rates!

We looked at Lower Merion; now, let’s look at Upper Merion, where the average flood rate is $1,805. Upper Merion, Pennsylvania, has 118 active flood policies and $212,940 in premiums.

Now, let’s check on Upper Moreland, Pennsylvania. Upper Moreland has 116 flood policies in effect with $101,092 in total flood premiums. Upper Moreland’s average flood rate is $871.

We’ll look at the last of the Uppers with Upper Providence! Upper Providence, Pennsylvania, has an average flood rate of $1,568. The premiums in Upper Providence total $258,658, with 165 policies active.

Looking at a group that includes West Norriton, Whitemarsh, Bangor, Bethlehem, Lower Mt. Bethel, and Northampton, Pennsylvania, where the premiums add up to $814,967. The flood policies in these areas total to 525, allowing the average flood rate to be $1,552.

Danville PA flood map

Next, look at Whitpain, Danville, Easton, Forks, Palmer, and Upper Mt. Bethel, Pennsylvania, where their flood rate is slightly lower, coming in at $1,387. The premiums here total $731,019 with 527 active flood policies.

Milton, Pennsylvania, has an average flood rate of $1,881! Give us a call, Milton! The active flood policies here total 195 with $366,737 in premiums.

In Sunbury, Pennsylvania, the average flood rate is $936. The premiums in Sunbury are $185,389, with 198 active flood policies.

Looking at West Chillisquaque, Duncannon, and Newport, Pennsylvania, we find 189 flood policies with $235,169 in premiums. The average flood rate for these areas is $1,244.

Hello Philadelphia, Pennsylvania!! Thanks for stopping by! Philadelphia, you all have the highest number of active flood policies in the state: 3,767! The flood premiums in Philadelphia are $3,654,881, which allows the average flood rate to be $970.

$927 is the average flood rate for Matamoras, Westfall, Schuylkill, and St. Clair, Pennsylvania. These areas have $272,494 flood premiums and 294 flood policies.

Three hundred thirty-four flood policies are active in Pine Grove, Port Carbon, Tamaqua, and Monroe, Pennsylvania. The average flood rate for these areas is $1,084, including $362,073 in written premiums.

Selinsgrove PA flood map

Selinsgrove, Pennsylvania, has an average flood rate of $1,045. The policies here number 149 with $155,694 in flood premiums.

The average flood rate for Conemaugh and Windber, Pennsylvania, is $1,173. The premiums here total $154,896, with 132 flood policies in effect.

In Great Bend, Pennsylvania, the premiums are $172,708. The average flood rate for Great Bend is $1,393, with 124 active flood policies.

The flood policies in Lewisburg, Pennsylvania total 162 with $234,446 in written premiums. The average flood rate for Lewisburg is $1,447.

$1,265 is the average flood rate for White Deer, Peters, Damascus, and Hempfield, Pennsylvania. The premiums here total $373,052, with 295 flood policies in effect.

One hundred twenty-seven policies are active in Roscoe and Washington, Pennsylvania. The average flood rate for these areas is $1,575, including $200,032 in flood premiums.

Ligonier, Pennsylvania, has 172 flood policies, with $208,708 in written premiums. The average flood rate for Ligonier is $1,213.

Let’s check out a group of areas where the average flood rate is $999. These areas include Murrysville, North Huntingdon, Dover, Fairview, Manchester, and Newberry, Pennsylvania. There are 470 flood policies in effect with $469,681 in total flood premiums.

Lastly, we’ll look at Unity, West Newton, Hellam, Lower Windsor, Springettsbury, and York, Pennsylvania, where the flood policies total 364 with $480,814 in premiums. These areas have an average flood rate of $1,321.

Thanks for checking out all the flood information on Pennsylvania!!

PA Flood Insurance Cost Calculator

For decades, the NFIP has over-charged 50 percent of its policyholders and under-charged the other 50 percent while it has racked up $42 billion in taxpayer-funded losses, equating to more than half of every claim paid by the NFIP since 1978.

About 30 percent of NFIP claims payments go to the same 3 percent of insured “repetitive loss” structures year after year. When you do the math, this means that the other 97 percent of their flood-exposed constituents could have paid in less and still netted larger claims payouts if they had better access to private flood insurance. In fact, a recent white paper by Milliman found that 90 percent of homes in Sandy-struck New York and New Jersey would see reduced flood insurance rates through private insurers.