Get Flood Insurance Illinois & Save Money Too.

People in Illinois save on average $500 to $1,457+ on their annual flood premiums.

In many cases, we save them even more. Get the cheapest flood insurance in Illinois without sacrificing coverage.

Get flood insurance from a Flood Nerd® at Better Flood Insurance® and save big time.

featured on

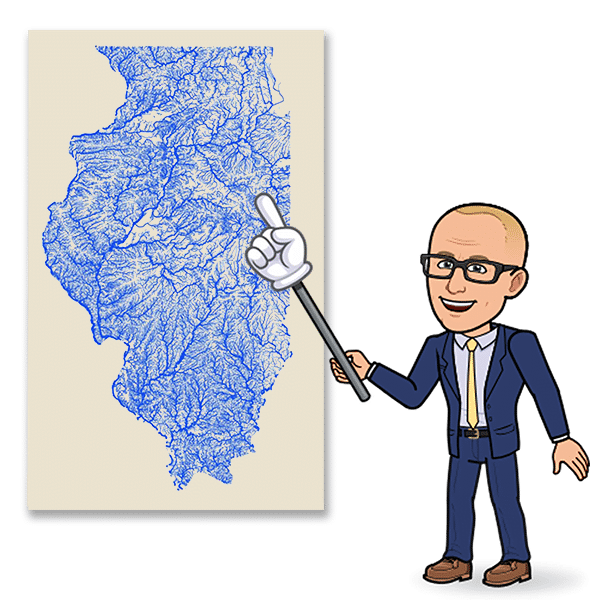

Quick Guide to Illinois Flood Insurance

How much is flood insurance in Illinois?

Get Cheap Flood Insurance without Compromising Coverage

★★★★★

"Same Coverage at a Better Rate"

-Mohammed K

Flood Nerds will shop the private flood insurance markets and then compare them to the NFIP, guaranteeing you the better option. We will send you the cheapest flood insurance rates within minutes.

★★★★★

"Quick Response, Very Knowledgable"

– Robert W

Paying for low-cost flood insurance is awesome. And letting the Flood Nerds shop your property has other benefits – you can get better coverage while saving money, and you can get it fast.

★★★★★

"Would highly recommend Better Flood for your flood insurance needs."

– Varun K

Better Flood Insurance is an independent flood insurance broker that shops flood insurance ONLY. Flood Nerds are Flood insurance experts. We have 5000+ happy clients and 390+ 5-star reviews.

Does my Illinois homeowner insurance cover flooding?

A typical Illinois homeowners’ policy is written through Farmers, State Farm, Allstate, and Progressive, for instance, excludes flooding as something that will be covered under their homeowner’s policy.

In most cases, the only way to get flood coverage is by purchasing a stand-alone flood insurance policy. However, you should ask your homeowners agent if you can add an endorsement to your homeowner’s policy to cover flooding. Yet, don’t be too surprised if the answer is NO.

Do I need flood insurance in Illinois?

It is important to have flood insurance coverage in Illinois because our beloved Cowboy State has seen a fair share of flooding, and more is likely coming.

We believe that most homeowners think about Flood insurance in Illinois at some point, maybe before buying a home or during the closing process. Many of us only think about flooding when a big storm is threatened.

If your home or business is in a flood zone, that is considered a low flood risk area. Sadly, many homeowners decide to forgo purchasing coverage because they believe they are safe from flooding. Some real estate and insurance agents may even say you don’t need it.

I ask you to consider the facts: 20 percent of all flooding events across our nation come in areas that are considered low risk. After our last few major storms (Hurricane Harvey), we saw flooding in these low-risk areas. 80Eighty percent of these individuals had water in their homes or buildings and didn’t have flood insurance coverage.

In Harris county, nearly 135,000 homes were damaged. Three-fourths of these properties were considered low to moderate risk.

We often hear that people believe the government will help, which is true. However, a few things must align for you to get government assistance.

1. The president of the United States must declare the flooding event a state of emergency. If this doesn’t happen, then there won’t be assistance.

2. The average amount of assistance homeowners get after a flood when they do not have flood coverage is $5,000. The average cost of damage to one’s property after a flood is $38,000+. That $5K you get from the government? It comes as a loan, and you will need to pay it back. Are you willing to gamble on your financial future by forgoing flood insurance coverage?

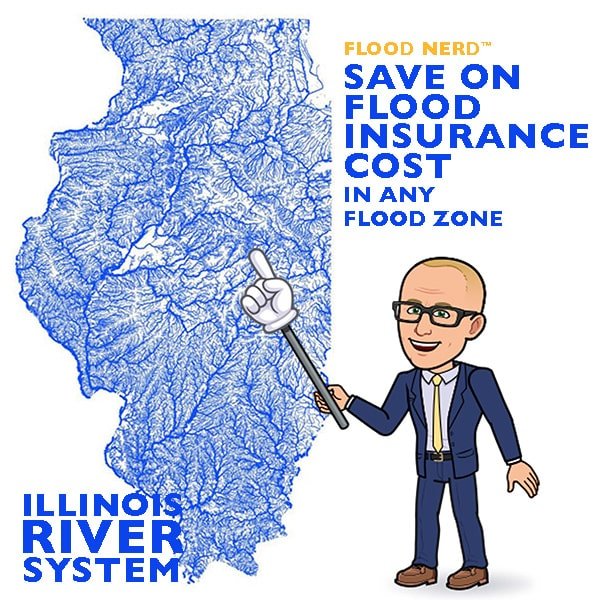

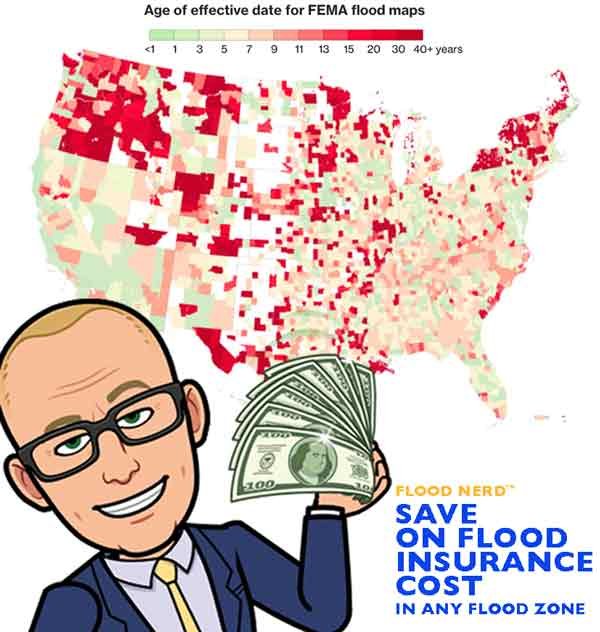

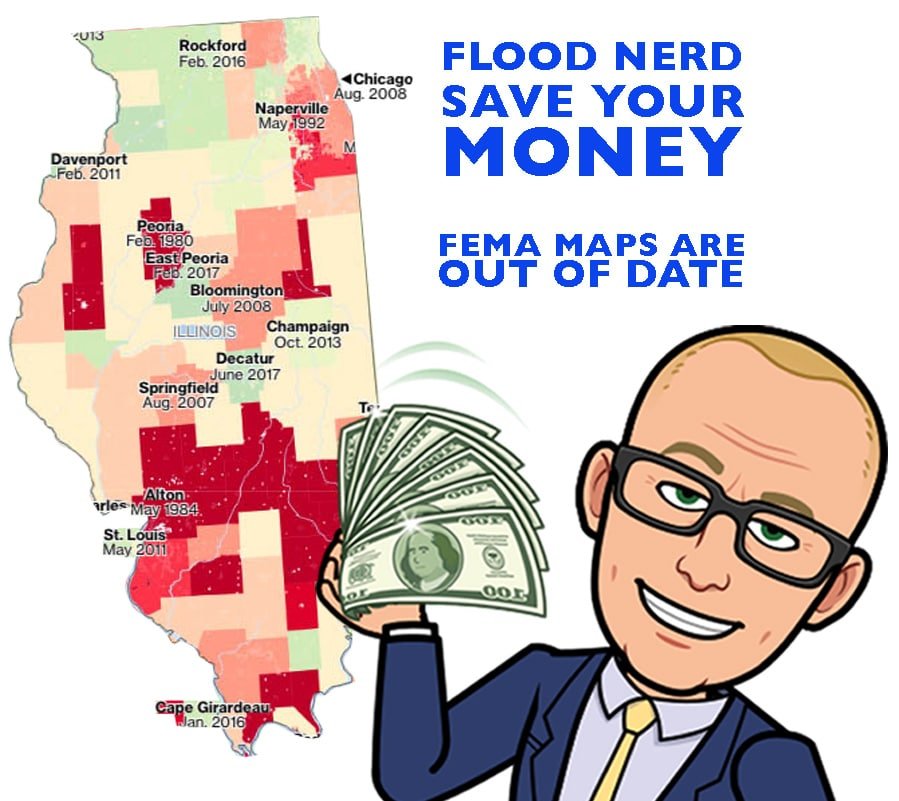

One more note on these low-risk flood zone maps. Many of these maps are over 40 years old. If the area has been developed, there is likely more concrete, creating a barrier for land that previously might have absorbed the massive downpour.

Because of all these factors, it is difficult for property owners to know their true risk of flooding. FEMA admits that their flood maps only give an idea of part of the risk. Our recent storms are facts that it can rain anywhere within Illinois, and you should consider getting flood coverage so you are not uninsured when you need it most.

FEMA flood zone maps often take years to go into effect after the terrain was studied; this gives the impression that the area is “more up to date” than it is.

The average cost for Illinois flood insurance in these Low-risk areas is $595 per year.

FEMA’s National Flood Insurance Program (NFIP) and all federally backed lenders rely on these Illinois flood insurance maps to assess risk, set premiums, and determine who is required to purchase flood insurance. Bad information about an area’s flood risk can leave property owners under or uninsured.

Illinois NFIP flood insurance.

Illinois has many options regarding flood insurance, but they fall into two main categories. The Government policy (called NFIP or FEMA) and Private flood insurance

The National Flood Insurance Program (NFIP), also known as FEMA, is the government option for flood insurance. The NFIP has enjoyed a 50-state monopoly on the flood insurance market.

Not “private flood insurance” but NFIP Resellers

Suppose you have Nationwide Flood Insurance, State Farm Flood Insurance, Progressive Flood Insurance, or any of the logos below. In that case, you are buying the NFIP flood policy that is just being resold through a government program. These companies are private companies, but their flood insurance is not. Here is a list of the 70 companies that resell the NFIP policy.

Illinois private flood insurance market

Cheap flood insurance in Illinois

There are alternatives to NFIP or government insurance. It is called Private flood insurance, most notably Lloyd’s of London Flood insurance. However, there are other options available in Illinois. We shop all the options for your property in your region to ensure you are getting the best premium. Please click here if you are ready to have us do the work for you.

Our shopping includes the NFIP because sometimes we find that you can get a much better premium with government subsidies.

Flood insurance quote Illinois

Lloyd’s of London Flood Insurance Illinois Market

Illinois is fortunate to have many Lloyd’s of London flood insurance options. Although many Lloyd’s flood insurance companies will have you assume that there is only one option, nothing could be further from the truth.

Lloyd’s of London has a rich history attributed to having invented the first modern insurance model. Unlike most of its competition, Lloyd’s of London is not a company but a corporate body. This structure works well since it has been around for over 330 years. Lloyd’s operates under multiple financial backers pooling their capital to spread the risk.

I have two blog posts that deep dive into Lloyds of London and what they mean to Illinois’s flood insurance market. If you are interested, the links are below.

Illinois Lloyd’s of London Flood Insurance

FEMA vs. Private flood insurance

Lloyd’s also ensures the world for flood insurance, meaning they cover flooding events in India, Australia, and much of Europe. The “game” of insurance is to spread your risk since Lloyd’s is worldwide.

My joke here is that Lloyds is banking on God’s promise that he won’t flood the entire world again, so they won’t have to pay out the whole world’s flood claim.

How much does flood insurance cost in Illinois?

Many factors go into getting the cost of flood insurance for Illinois. If your home is in what is considered a low-to-moderate risk, you can get a heavily subsidized policy through the government.

Illinois flood insurance low-to Moderate Risk rate and cost.

This is Flood Zone X, which is not lender required flood zone.

This is usually identified as an X-flood zone. Then we would suggest the government Preferred Risk Policy (PRP) which is a subsidized policy and has set flood insurance coverage limits (see the grid below):

NFIP Maximum Coverage Limits

NFIP Maximum Coverage Limits

Here is a link if you want to dig into this one. Be ready for an eye chart because every option is a public record and should be standardized to accost whoever writes these policies.

The average cost for flood insurance in Illinois with the maximum set limits in these Low-risk flood zone areas is $405 – $700 per year.

Your property is in a higher-risk flood zone, usually identified with a Flood Zone AE. Your lender will require you to have flood insurance. The cost of flood insurance in Illinois depends on many factors unique to the structure. We will try to give you an idea of the most common homes we see in Illinois with a basement foundation.

We will look at the Illinois cost of flood insurance for the NFIP maximum of $250,000 for the (building only) with NO CONTENTS and our recommended deductible of $5,000.

We will be rating this example on the NFIP and a few of our private flood insurance policies, specifically Lloyds flood insurance options in Illinois.

Cost of Flood Insurance in ILLINOIS in high-risk flood zone AE

Our example is in Chicago, but the premiums will be the same in Bellwood, Des Plaines, Prospect Heights, Will, and many other Illinois flood ones.

In our example, the Base Flood Elevation (BFE is 642) and is a home that is built before 1973

NFIP option in Illinois Flood Zone AE

NFIP – Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

NFIP Annual premium in High-Risk flood zone is $6,861.00

This option is what we see if the property has had a flood loss before and either doesn’t have an Elevation Certificate applied or the Elevation certificate showing that the lowest floor is 4 feet under the BFE for the area. You can use 10% of your coverage to cover other structures on your property.

Illinois Private flood insurance – Lloyd’s of London Flood Insurance (option 1)

Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

Lloyds of London (option 1) Annual premium in High-Risk flood zone is $937.00

This option is great, and we are very happy when we can get this option. They can be a bit choosey about what risk they will accept and will not take anything that has had a flood loss. They offer basements coverage, about $2,000 for loss of use and $2,000 for other structures, but they can’t increase this coverage. They do not require an Elevation Certificate to rate.

Illinois Private flood insurance – Lloyd’s of London Flood Insurance (option 2)

Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

Lloyd’s of London (option 2) Annual premium in High-Risk flood zone is $1,126.00

This option is great, and we are very happy when we can get this option for our clients. They seem to be writing almost all risks; however, they do not write any property in a designated floodway or has a depth of -4 under the BFE. In our example, with our BFE being 642, they will not accept this risk if the lowest floor is 638. They will not take anything that has had a flood loss. They offer limited coverage for basements and do not require an Elevation Certificate to rate and as a percentage of coverage for loss of use. If you want coverage for other structures, that will need to be added.

Let us do the flood insurance shopping for you – Save time.

Let us do the flood insurance shopping for you – Save time.

Private Flood insurance option (option 3) Not Lloyd’s

Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

The annual premium in a High-Risk flood zone is $4,911.00

This option will take properties with one flood loss for more than five years, and the payout was under $100,000 on the claim. Their coverage matches the NFIP. They will write practically all risks, don’t need an elevation certificate to rate, and are a bit lower in premium than the NFIP.

Private Flood Insurance – Lloyd’s of London (option 4)

This option must be written on the building’s Replacement Cost Value (RCV). Otherwise, there is a co-insurance penalty that kicks in. So, $250,000 might be a bit low in California, but to keep this going, let’s just use that for this option

Coverage of $250,000 (RCV) building coverage, No Contents, and a $5,000 deductible

The annual premium in a High-Risk flood zone is $819.20 (Cheap flood insurance Illinois).

This options rating system is all over the board. Sometimes we get a crazy great price, but other times the premium is way higher than the NFIP will consider taking a property that has had one flood loss before as long as it has been more than ten years and the payout was under $50,000 on the claim. Their preferred coverage is at replacement cost, slightly different from some of our other Lloyd’s flood options. We usually reserve this one if the property doesn’t fit the above options. We can adjust coverages to control premium. As mentioned before, these underwriters’ rates are all over the board. It is worth shopping to ensure we get you the best premium possible. They don’t need an elevation certificate to rate.

Private Flood Insurance – Lloyd’s of London (option 5)

Coverage of $250,000 (RCV) building coverage, No Contents, and a $5,000 deductible.

The annual premium in a High-Risk flood zone is $1,215.86

This option came from the company that used to run the NFIP program, so the coverage matches the NFIP coverage with two differences. They offer living expenses covering your cost when you are displaced from your home during repairs (most Lloyds flood policies offer this). They also offer swimming pool clean-out, which is unique, so if you have a pool, ask for this coverage.

Private Flood Insurance – Lloyd’s of London (option 6)

Coverage of $250,000 (RCV) building coverage. No Contents and a $5,000 deductible.

The annual premium in a High-Risk flood zone is $904.05

This options rating system is also all over the board. Sometimes we get a crazy low price; other times, the premium is way higher than the NFIP. They will consider taking a property that has had one flood loss before as long as it has been more than ten years and the payout was under $25,000 on the claim. They have been rumored to give a low price the first year and then non-renew following years, or sometimes they jack the price way up so that we will watch them. They have a slick system, and their underwriting is managed by a 3rd party, which also sometimes seems to be a glitch.

More options are coming online every day, and we are working to be looking into every viable option.

Illinois has 39,975 NFIP policies in force, with a total cost of $41,782,653. That would make the average for Illinois $1,045. Of course, some will pay more, and some will pay less.

Flood insurance quote Illinois

Click here to have our shop and save you money.

Hello, Illinois! Thanks for visiting our page for all your flood insurance needs.

Let’s start with Adams, Illinois. Adams has 144 total flood policies with $188,427 in written premiums. The average flood rate for Adams is $1,309.

Next, let’s look at Alexander, Cairo, Calhoun, Beardstown, and Urbana, Illinois, where the average flood rate for these areas is $813. The total number of active flood policies is 398, with $323,737 in total premiums.

Now, we’ll check out Belvidere, Loves Park, Cass, Champaign, Mattoon, and Arlington Heights, Illinois, where there are 552 flood policies in effect. The flood premiums in these areas total $440,276, which allows the average flood rate to be $798.

In Bellwood, Illinois, the average flood rate is much higher than the state average, coming in at $2,107. The total number of flood policies is 589, with $1,240,804 in total premiums.

Brookfield and Buffalo Grove, Illinois ,have $147,346 in flood premiums and 135 total active flood policies. The average flood rate for Brookfield and Buffalo Grove is $1,091.

Four hundred ninety flood policies are in effect in Calumet City, Illinois. The premiums in Calumet City total $367,870, which causes the average flood rate to be $751.

Hello Windy City – also known as Chicago, Illinois! So glad to have you stop by our page! You all have 1,052 active flood policies and $606,033 in total flood premiums. Chicago’s average flood rate is $576.

$689,426 is the written flood premium total for Cook, Illinois. Cook has an average flood rate of $1,546 with 446 total active flood policies.

Looking at Crestwood and Deerfield, Illinois, we find 284 flood policies with $212,310 in premiums. The average flood rate for Crestwood and Deerfield is $748.

The average flood goes up to $894 in Des Plaines, Illinois. Des Plaines has the highest number of active flood policies at 1,868, which includes $1,669,828 in flood premiums.

Dixmoor and Elgin, Illinois, has 255 flood policies and $269,668 in written premiums. The average flood rate for Dixmoor and Elgin is $1,058.

There are $161,359 premiums written in Elmhurst, Illinois. The total number of active flood policies is 252, with $640 as an average flood rate.

Looking at Evanston and Flossmoor, Illinois, we find an average flood rate of $945. The premiums here total $147,365 with 156 active policies.

When we combine Franklin Park and Glencoe, Illinois, we find 487 flood policies in effect and $936,723 in written premiums. The average flood rate in these areas is $1,923.

Glenview, Illinois, has an average flood rate of $828. Glenview has 246 active flood policies and $203,702 in written premiums.

The premiums in Harvey, Illinois, total $172,567 with 161 active flood policies. The average flood rate in Harvey is $1,072.

The average flood rate drops to $507 in Hinsdale, Illinois. Hinsdale has 314 flood policies and $159,173 in written flood premiums.

$1,147 is the average flood rate for Hoffman Estates and Justice, Illinois. These areas have 196 active flood policies and $224,744 in flood premiums.

Lansing and Matteson, Illinois, have 250 flood policies and an average flood rate of $1,196. The premiums for these areas total $298,990.

The average flood rate rises to $2,328 in Melrose Park, Illinois. There are 267 active flood policies in Melrose and $621,703 in written premiums.

When we look at Midlothian, Illinois, the average flood rate drops to $1,357. The number of flood policies in effect is 179, with $242,851 in premiums.

The flood rate drops again to $1,064 in Mount Prospect, Illinois. Mount Prospect has 150 active flood policies and $159,578 in total flood premiums.

In Northbrook, Illinois, there are 146 flood policies with $75,040 in total premiums. The average flood rate in Northbrook is $514.

$1,381 is the average flood rate for Northfield, Illinois. Northfield has 167 active flood policies and $230,652 in written premiums.

Look at Northlake and Oak Forest, Illinois, where the average flood rate is $1,746. The premiums in these areas total $438,362, which include 251 flood policies in effect.

Four hundred ninety-three policies are in effect in Oak Lawn, Illinois. Oak Lawn has an average flood rate of $793 which includes $390,834 in total premiums.

Now, we’ll check out Orland Park, Palatine, Park Ridge, and Posen, Illinois. These areas have an average flood rate of $791. The active flood policies here total 389 with $307,513 in written premiums.

Palos Heights and Palos Hills, IllinoisFour hundred ninety-three, has 148 flood policies in effect and $182,184 in premiums. Palos Heights and Palos Hills have an average flood rate of $1,231.

The average flood rate for Prospect Heights, Illinois, is $615. The active flood policies in Prospect Heights total 1,113 with $684,981 in total premiums.

$1,610 is the average flood rate for River Grove and Riverside, Illinois. The total number of active flood policies is 184, with $296,274 in total premiums.

Five hundred sixty-eight flood policies are active in Rolling Meadows, Illinois. The premiums here total $204,359 with an average flood rate of $360.

Let’s look at Schaumburg, Schiller Park, Stone Park, and Tinley Park, IllinoisFive hundred sixty-eight, where there are 528 flood policies in effect and $803,143 in total flood premiums. The average flood rate for these areas is $1,521.

The average flood rate in Skokie and South Holland, Illinois, is $523. The premiums here total $94,116, and there are 180 total policies in effect.

Westchester, Illinois, has an average flood rate of $1,911. There are 383 active flood policies in Westchester. The premiums here total $731,953.

In Wheeling, Illinois, the flood premiums add up to $962,305. The average flood rate is $1,56 which includes 616 flood policies.

We find 467 active flood policies with $697,850 in total premiums in Wilmette and Winnetka, Illinois. The average flood rate for Wilmette and Winnetka is $1,494.

Let’s check out a group of areas: De Kalb, Tuscola, and Villa Grove, Illinois. These areas have an average flood rate of $1,073. The flood premium totals $277,921, with 259 flood policies in effect.

The average flood rate in Addison, Illinois, is $1,440. There are 436 active flood policies and $627,730 in premiums.

Aurora, Illinois,, has 614 flood policies in effect. The average flood rate for Aurora is $772, which includes $473,742 in written premium.

We’ll look at Bolingbrook, Carol Stream, Glen Ellyn, and Lisle, Illinois now, where the average flood rate is $979. The flood premiums for these areas total up to $498,338. The active flood policies add up to 509.

$868 is the average flood rate for Downers Grove and Du Page, Illinois. There are 901 flood policies, with $781,813 in premiums in these areas.

Checking on Naperville, Illinois, we find 444 active flood policies with an average flood rate of $667. The premiums in Naperville total $296,155.

Moving on to St. Charles, Oak Brook, Willowbrook, Wood Dale, Morris, Hancock, Colona, and Iroquois, Illinois, we find the flood premiums for all of these areas total $761,081 with 775 flood policies active. The average flood rate for these areas is $982.

Now, look at Villa Park, Wheaton, Dwight, Grundy, Henderson, and Coal Valley, Illinois, where the average flood rate rises to $1,292. The premiums for these areas are $722,428, with 559 flood policies in effect.

Next is Watseka, Illinois, where 352 active flood policies have $269,801 in flood premiums. The average flood rate in Watseka is $766.

Jackson and Grafton, Illinois, has an average flood rate of $1,289. The premiums for these areas are $190823 with 148 flood policies in effect.

$1,030 is the average flood rate for Jersey and Algonquin, Illinois. Jersey and Algonquin have 156 active flood policies and $160,664 in written premiums.

Two hundred twenty-six flood policies are in effect in Kane, Illinois. Kane has an average flood rate of $1,302, including $294,262 in flood premiums.

Let’s look at Montgomery, South Elgin, Kankakee, La Salle, and Marseilles, Illinois, where there is an average flood rate of $1,098. These areas have 707 active flood policies and $776,216 in written flood premiums.

Now, we’ll check out Bourbonnais, Bradley, Joliet, North Utica, and Ottawa, Illinois, which have 838 flood policies. Their average flood rate is $1,366 which includes $1,144,748 in active flood premiums.

Fox Lake, Illinois, has an average flood rate of $1,457. The flood premiums in Fox Lake total up to $362,748, and the active policies add up to 249.

The average flood rate rises to $1,700 when we look at Grayslake and Gurnee, Illinois. These areas have $263,479 in flood premiums and 155 flood policies.

The rate drops to $1,041 in Highland Park, Illinois. Highland Park has 186 active flood policies and $193,679 in premiums.

Another group of areas includes Lake Forest, Lake, Mundelein, North Chicago, Waukegan, and Lee, Illinois, where the flood premiums add up to $1,725,583! The average flood rate for these locations is $889, which includes 1,940 flood policies.

The next group is Libertyville, Lincolnshire, Riverwoods, Round Lake Beach, Rochelle, and Livingston, Illinois, where the average flood rate is $1,141. The number of active flood policies is 662, with $755,505 in total flood premiums.

There are 174 flood policies active in Pontiac, Illinois. Pontiac has an average flood rate of $856, including $149,028 in flood premiums.

Eighty-two flood policies exist in Decatur, Illinois. The average flood rate in Decatur is $756, and the premiums total $62,021.

Granite City, Illinois, has $273,102 in written premiums. The average flood rate in Granite City is $719, while there are 380 active flood policies.

Five hundred forty-four flood policies are in effect in Madison, Illinois. The premiums in Madison add up to $539,742, allowing the average flood rate to be $992.

Looking at Pontoon Beach, Wood River, Crystal Lake, and Holiday Hills, Illinois, we find the flood premiums total $312,968, and the active policies add up to 316. The average flood rate for these areas is $990.

Let’s focus on Massac, Metropolis, Johnsburg, and Marengo, Illinois, where the average flood rate is $1,082. These areas have $353,972 in flood premiums. They also have 327 active flood policies.

$1,366 is the average flood rate for McHenry, Illinois. McHenry has $717,095 in total flood premiums and 525 policies in effect.

Bloomington and Monroe, Illinois, have an average flood rate of $1,114. The policies here total 207, while the flood premiums add up to $230,528.

When we check out Jacksonville, Meredosia, and Ogle, Illinois, we find the premiums here total up to $244,605 with 258 active flood policies. The average flood rate for these areas is $948.

Peoria, Illinois, has an average flood rate of $1,230. Peoria’s flood premiums total $507,915. There are 413 active flood policies in Peoria.

Three hundred forty-two flood policies are in effect in Hull, Pike, Andalusia, and Carbon Cliff, Illinois. The average flood rate here is $702, which includes $240,238 in flood premiums.

Prairie Du Rocher, Randolph, Hillsdale, and Moline, Illinois, have $526,543 in written premiums with 426 active flood policies. The average flood rate for these areas is $1,236.

Looking at Rock Island, Illinois, we find an average flood rate of $983. Rock Island has 410 active flood policies and $402,906 in written premiums.

$924 is the average flood rate for Harrisburg, Belleville, and Cahokia, Illinois. The premiums here total up to $279,996 with 303 flood policies.

The average flood rate drops to $765 when we look at Sangamon, Caseyville, and Dupo, Illinois. The premiums for these areas add up to $266,845, with 349 active flood policies.

East St. Louis, Illinois, has an average flood rate of $1,344. The premiums in East St. Louis are $439,534, with 327 flood policies in effect.

Six hundred eleven flood policies are active in O’Fallon, St. Clair, Tazewell, and Union, Illinois. These areas have an average flood rate of $800, including $488,531 in written premiums.

$1,487 is the average flood rate for Freeport and East Peoria, Illinois. Freeport and East Peoria have $230,457 in total premiums and 155 active flood policies.

Whiteside, Illinois, has an average flood rate of $870. Whiteside’s premiums total $157,399 with 181 flood policies in effect.

719Seven hundred nineteen flood policies are in effect in Will, Illinois. The average flood rate in Will is $1,193, which includes $858,100 in total premiums.

Looking at Marion and Williamson, Illinois, we find 166 policies with $140,953 in flood premiums. The average flood rate for Marion and Williamson is $849.

Machesney Park, Illinois, has an average flood rate of $1,168. The premiums in Machesney Park add up to $268,686 with 230 active flood policies.

Let’s look at Rockford, Illinois, where there are 328 flood policies in effect with $382,793 in written premiums. Rockford’s average flood rate is $1,167.

Lastly, let’s check out South Beloit, Winnebago, and Woodford, Illinois, where the average flood rate is $1,418. The premiums for these areas total $452,288 with 319 active flood policies.

Thanks for checking out all the flood information on Illinois!!

Flood Insurance Cost Calculator

For decades, the NFIP has over-charged 50 percent of its policyholders and under-charged the other 50 percent, while it has racked up $42 billion in taxpayer-funded losses, equating to more than half of every claim paid by the NFIP since 1978.

About 30 percent of NFIP claims payments go to the same 3 percent of insured “repetitive loss” structures year after year early. When you do the math, this means that the other 97 percent of their flood-exposed constituents could have paid in less and still netted larger claims payouts if they had better access to private flood insurance. A recent white paper by Milliman found that 90 percent of homes in Sandy-struck New York and New Jersey would see reduced flood insurance rates through private insurers.