Get Flood Insurance & Save Money Too.

By buying flood with a Flood Nerd our clients save on average $500 to $1,457+ on their annual premiums.

In many cases, they save even more

featured on

FEMA Flood Maps and What You Need to Know about Flood Insurance Rate Maps

Hurricane! Tornado! Fire! Earthquake!

So many terrible things can happen to your home. But did you know that flooding is the number one natural disaster we face in the U.S.?

All it takes is a few inches of water to cause catastrophic damage to your property. And if you don’t have flood insurance, a flood can ruin your finances now and in the future. That means taking on a second job, raiding the retirement account, or even forgoing retirement to earn enough money to repair flood damage.

Buying flood insurance is much different than buying homeowners insurance. When it comes to homeowners insurance, the company just figures out what your house is worth and what it would cost to repair it, then they factor in the chances of a loss and those rates are pretty standard. With flood insurance, two houses side-by-side may pay different rates for the same coverage and insurance amounts.

Yes, flood insurance is confusing. That’s why you need a Flood Nerd as your sherpa to guide you through the process and help you avoid common pitfalls like overpaying or underinsuring.

In this page, your trusty Flood Nerd will guide you through the complexities of FEMA flood maps, 100-year flood zones, and what to do if a new flood map affects your home. Heck, I’ll even show you how to determine your flood zone.

Why FEMA Flood Maps Were Created

In 1968, Congress passed the National Flood Insurance Act of 1968. Many private insurers had abandoned the flood insurance market and people struggled to get coverage for their homes and businesses.

The Federal Emergency Management Administration was charged with providing flood insurance, encouraging and supporting floodplain management, and developing maps of flood hazard zones.

The first task resulted in the National Flood Insurance Program (NFIP) which started covering flood risks in 1973.

The second task helped communities identify and reduce the risks of flood disasters and make those communities and their residents safer from floods.

The third task for creating maps was supposed to facilitate the other two tasks. In theory at least.

In practice, this Congressional action created a 50-year monopoly on the flood insurance market. Private insurers were locked out, even though they increasingly had access to technology that allowed them to better calculate the risk of flooding more accurately than relying on maps.

How FEMA Flood Maps are Created

FEMA’s Risk Mapping Assessment and Planning Program is the official process used to create FEMA flood maps. These maps are the Flood Insurance Risk Maps (FIRM) that identify special hazard areas at high risk of flooding. They are the work product created by studying an area’s history of flooding, looking at what flood mitigation features are in place, and then analyzing the risk and creating a map. Then FEMA may or may not meet with community officials to get their input. Once the map is issued, the public has 90 days to comment and appeal. As you can imagine, all this bureaucratic work takes lots of time. After all, they are the government and they are here to help!

FEMA is required to update the flood maps every five years. But the United States is huge and updating those maps doesn’t always happen on time. A Department of Homeland Security report by the Auditor General found 58% of all of FEMA’s maps are outdated.

That’s important because changes in land use alters the way water flows. And when a flood map reaches its 5th birthday without an update the risk level moves to “unknown”.

These flood maps can also cause confusion because they give rise to the 100-year and 500-year floods. They aren’t what you think!

What is a 100-Year Flood Zone?

One thing FEMA has done a great job with is confusing the insurance-buying public.

Have you ever heard the term 100-year flood zone? It doesn’t mean what you think it means.

It sounds like a lovely place that only floods every 100 years. So, if it flooded 5 years ago you are good for another 95 years. Right?

WRONG! A 100-year flood zone means that on any given day you have a 1% chance of flooding. Now that’s a horse of a different color!

The myth of the 100-year flood is dangerous. That’s because, over the span of a 30-year mortgage, there is a 1-in-4 chance of a flood happening. Over a 100-year period, there is a 67% chance of a flood. Trust this Flood Nerd, I did the math for you!

How Flood Maps are Used

When you take out a mortgage to buy a home there’s about a 100% chance that the lender will check to see if the property is located in an area at risk for flooding.

That’s because federal law requires any lender with access to federal money or backed by federal money (and that’s just about all of them) to obtain a flood zone determination (FZD) before they make a loan. The FZD is an official document that tells the lender if flood insurance is required on the property. The FZD is generated based on FEMA’s flood insurance maps.

If the property is on a high-risk flood zone map (usually identified as A or AE or V or VE) you will be required to buy flood insurance. If your property is in another zone, you should still buy flood insurance, but it’s not required.

How Do I Know If I Am In a Flood Zone?

Flood zones are technically special hard areas. In most cases, the flood maps will show the community’s flood zones, the floodplain boundaries, and the Base Flood Elevation (BFE) which is how high the floodwaters are determined to go.

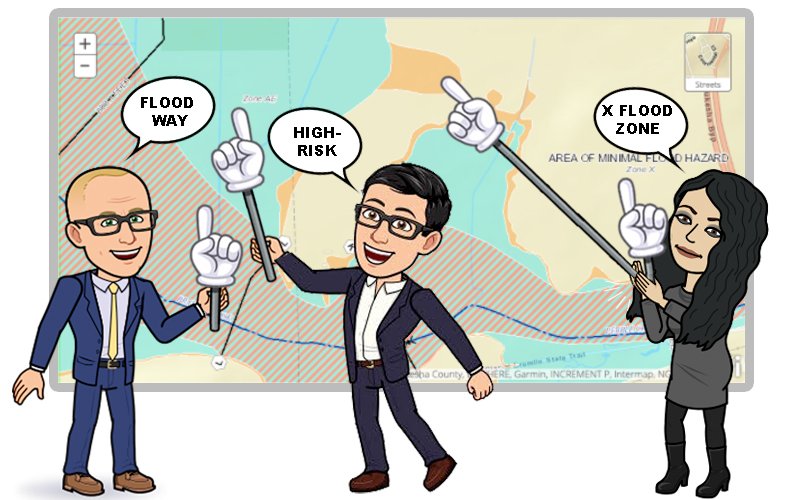

FEMA provides a digital tool to look up flood zone maps online. Use the link to find your community flood map by entering your address. The map will show the area of the floodplain. Diagonal multicolored lines are the floodway and the light blue and tan colors are used to indicate the flood zones.

It’s important to remember that Mother Nature doesn’t always follow these FEMA maps. So, flooding happens in areas that aren’t designated high-risk flood areas.

During Hurricane Harvey, 204,000 homes were damaged in Houston and 75% were not in a 100-year flood zone.

As an absolute Flood Nerd, I can tell you no matter what the map says, you can flood anywhere it can rain.

New Flood Maps

Remember those maps are supposed to be updated every 5 years, so changes do happen. As development changes how water flows in an area, a house can move from one flood zone map to another and never even change its street address.

When FEMA changes a flood map, they provide an incentive to everyone impacted to encourage buying flood insurance. The incentive comes in the form of a heavily subsidized policy IF you make the purchase within 12 months of the change.

And to sweeten the pot, they allow you to pass that subsidy along when you sell the house.

So if your flood zone changes from a low to moderate flood zone (X flood zone) into a higher risk flood zone (A or AE flood zone) and you buy a flood policy from the NFIP within a calendar year of the effective date of the map change, you can get a hugely subsidized policy. You could get a flood policy as low as $500 and then transfer the policy to the buyer when you sell your home. The new owner can keep your savings.

That’s something homeowners should strongly consider if they plan to sell in the next few years. It makes selling in a flood zone much easier.

Flood Nerds like me know how to make this stuff happen, the agent selling homeowners insurance probably doesn’t.

Assessing Risk Without FEMA Flood Maps

There’s another way to assess the risk of flooding without using FEMA flood maps. It’s much more modern, makes use of satellite imagery, GPS mapping, and computer models and algorithms.

That’s how the private flood insurance market figures the cost of flood insurance. And many times not only do they do a better job of assessing the risk, but they can also provide better flood insurance coverage at a lower premium.

We Flood Nerds know all the ins and outs of FEMA flood maps and when the NFIP is best and when its best to buy from a real private flood insurer. For most homeowners, private flood insurance is the affordable option.

FIND OUT IF PRIVATE FLOOD INSURANCE CAN SAVE YOU MONEY

What is Private Flood Insurance?

Private Flood Insurance is the Affordable Option

Don’t settle for expensive national flood insurance through the government. In most cases, private flood insurance is more affordable and gives you better coverage. There are more than 40 private flood insurance options. Shopping for private flood insurance takes time and an understanding of the private flood market. Let a Flood Nerd do the dirty work for you. Better Flood Insurance provides free quotes for private flood insurance from one of our Flood Nerds. The private flood insurance market can be confusing, but making sense of private flood insurance is what the Flood Nerds love to do!

Get Cheap Flood Insurance without Compromising Coverage

Affordable Coverage

★★★★★

"Same Coverage at a Better Rate"

-Mohammed K

Flood Nerds will shop the private flood insurance markets and then compare them to the NFIP, guaranteeing you the better option. We will send you the cheapest flood insurance rates within minutes.

Quick Quote & Coverage

★★★★★

"Quick Response, Very Knowledgable"

– Robert W

Paying for low-cost flood insurance is awesome. And letting the Flood Nerds shop your property has other benefits – you can get better coverage while saving money, and you can get it fast.

We Have Satisfied Clients

★★★★★

"Would highly recommend Better Flood for your flood insurance needs."

– Varun K

Better Flood Insurance is an independent flood insurance broker that shops flood insurance ONLY. Flood Nerds are Flood insurance experts. We have 5000+ happy clients and 390+ 5-star reviews.

Where to Buy Flood Insurance that is Affordable

Better Flood Insurance is a expert flood insurance broker that provides free quotes for private flood insurance from one of our low-cost flood options and we compare that to the NFIP to guarantee we send you the most cheapest flood insurance option. Our experience will show you what you can expect to save.