Olé at Lely Resort Condo Association (LOMA)

Dialogue with Flood Nerd about Low-risk flood zone vs High-risk flood zone

Hello, Doris, thanks for letting us look at your property what an honor. Beautiful condo community

It is looking like you are shopping to replace an existing condo unit policy that is written with the NFIP (National Flood Insurance Program)

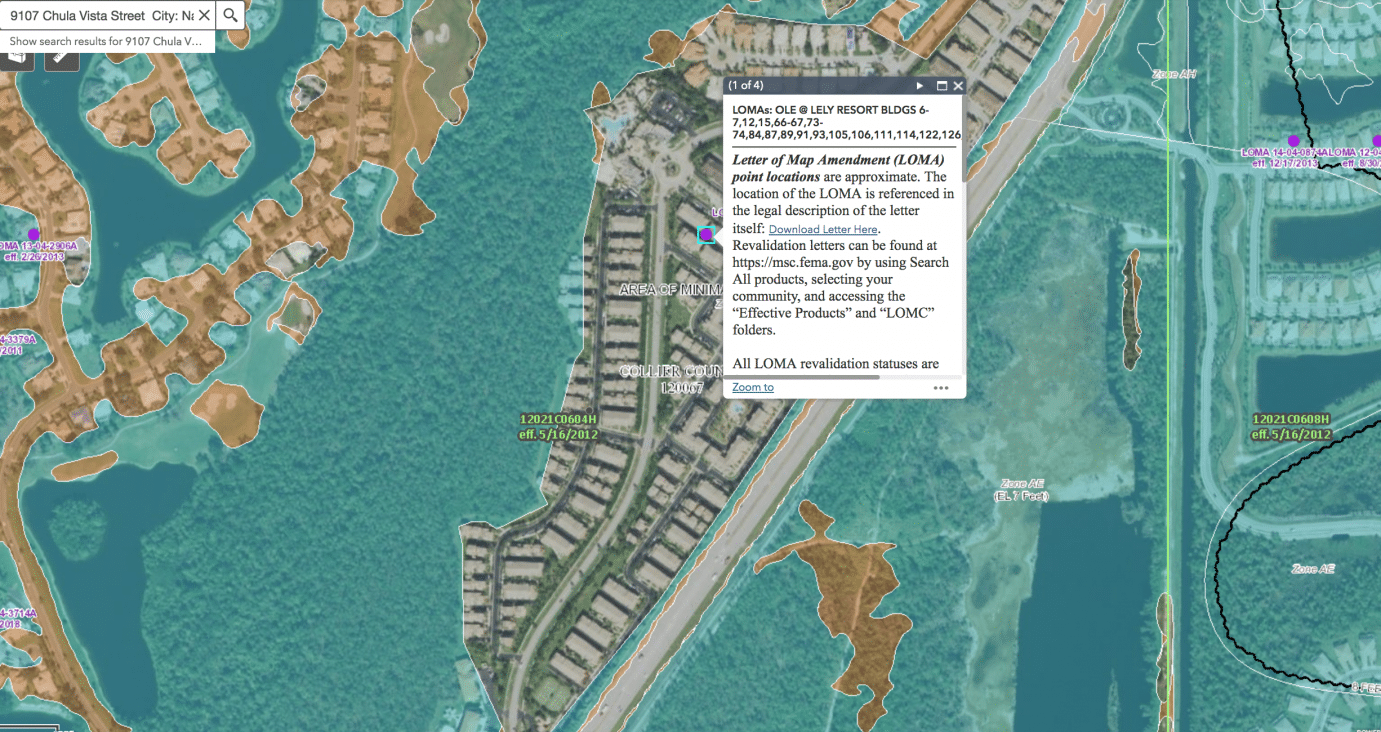

You also noted that your condo unit is in an X flood zone map (considered low risk), when I ran a Flood Zone Determination (FZD) on the building your condominium unit is in. I see a portion of the building you live in – is in an AE flood rate map (high-risk flood zone).

Area mapped out with a LOMA

These “mapping out” of High-Risk flood zones is usually a very political move it is unpopular to make people buy flood insurance, although I fear the major mess your community might be facing if and when there is a flood in your community. I pray it never happens. The only way they would pay for the damage is to asses the whole community your policy will activate to cover this but the damage would likely be greater and if you are one of the few that are wise and have a flood policy in your community the assessment that you would see could be more then 100K and you will likely end up paying for someone else’s lack of having a flood policy because they are not required to. I pray you and your community never have to face this and it really isn’t your fault that the government is allowing communities to move map line so that they won’t have to purchase the federally mandated flood insurance.