How to get cheap flood insurance and better coverage in 3 min

Flood Insurance is probably one of the most misunderstood types of property insurance. Most insurance agents don’t understand the policies and many refuse to write flood insurance.

The problem is most homeowners think that flooding is covered by their property policy. On quick review you will find out that flood insurance isn’t covered. On top of that your property had a higher risk of flooding than ever burning down to the ground.

Plus the repairs from a flood could cost way north of $35,000 and will likely be the largest damage you will ever have in your home.

In this article you will learn how to get cheap flood insurance that won’t break your budget and protect your investment for as little as one dollar and twenty cents a day.

Lets start with a little bit of history

NFIP / FEMA / The government flood insurance policy

In 1968 the national flood insurance program was created in an effort to protect properties that were prone to flooding and couldn’t buy insurance because at that time no private flood insurance company had the desire and capital to cover the risk of flooding. So our government developed the NFIP to fill the coverage gap.

To date most of the flood insurance policies in the United States are written on the government policy and for most people the policy is really affordable.

PRP or Prefered Risk Policy / NFIP

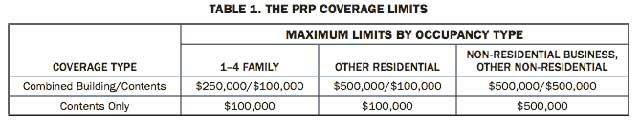

The NFIP Preferred Rate Policy can be placed on any property that is not in a high risk flood zone (usually identified with a X flood zone) on a flood insurance rate map. And the average policy for a 1-4 unit home that is your primary residence can cost as little as $439 a year.

Higher Risk Flood Zones or AE Flood zone / NFIP

Rates in an AE flood zone with the NFIP are determined by a few unique factors and your premiums are rated on these factors. This is where you really need a flood insurance expert to write these policies because they are more complex with the NFIP and if your agent doesn’t write them all the time you could end up paying more then you should or need to. We often correct other agents’ work to find savings. If you think you might be overpaying we can do a free audit of your current policy please send over the declaration page and an elevation certificate if you have one.

A good way to make sure you are not over paying is to ask your agent how many flood insurance policies they have on their books if it is under 700 they are not an expert and you should look elsewhere.

AE flood zone rates with the NFIP are determined by the year of construction, your coverage amount, the deductible, your foundation and any mitigation your local community may have done to get credit.

What kind of cheap flood insurance options do I have?

There are basically two types of flood insurance options, the government options which is identified as the NFIP or FEMA policy and the Private flood insurance market which is anything that is not the NFIP/FEMA policy.

Private companies like Geico flood insurance, State Farm flood insurance, Allstate flood insurance, Metlife, Amica, Assurant flood insurance and many others on the image below are private companies but they are reselling the NFIP or government policy so they are really not offering a true private flood insurance policy.

Nationwide Flood Insurance of NFIP

Better overall cheap flood insurance policy is the NFIP PRP for low to moderate risk flood zones usually identified with an X flood zone.

AE flood Zone Cheap flood insurance

Private flood insurance can be cheaper then the NFIP policies for those who have a property that is in a high risk flood zone. These private flood insurance policies can be 20% – 50% less then the NFIP because they use a more advanced risk model.

Private flood insurance policies are written by Lloyds of London flood insurance and there are more then 30 syndicates that write flood insurance under various names. They all have different appetites for the type of coverage that they choose to offer coverage for. We shop all options for your property to ensure you are getting the best coverage as the cheapest premium.

Most private flood insurance policies are broader than the NFIP. Meaning they offer better coverage for the risk of flooding and most can offer higher coverage then the maxim coverage available with the NFIP which is $250,000 building residential (1 – 4 units homes) and NFIP maximum of $500,000 building for commercial properties.

NFIP Maximum Coverage Limits