California Flood Insurance Is Broken. We’re Here to Fix It.

California Flood Insurance Is Broken. We’re Here to Fix It.

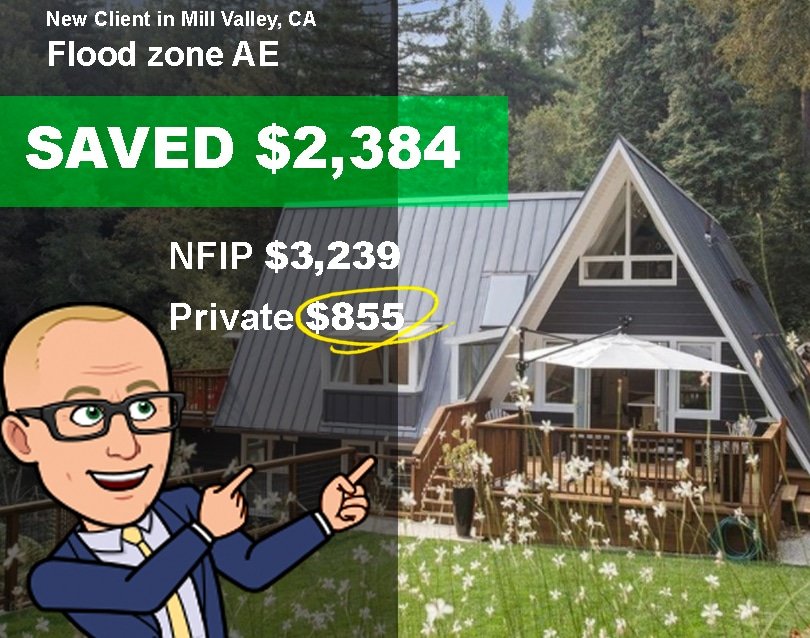

Outdated maps, overpriced premiums, and agents who don’t specialize. If your California flood insurance policy hasn’t been rebuilt by a Flood Nerd — you're likely overpaying, under-covered, or both.

Outdated maps. Rising rates. Weak coverage.

If your flood insurance in California hasn’t been reviewed by a Flood Nerd, you’re likely overpaying — and your policy could leave you exposed when it matters most.

Coverage starts under $1,200/year — while flood damage averages $120K.

✅ We shop top CA flood insurers — not just FEMA

✅ Access to 4 exclusive underwriters

✅ Commercial + residential flood insurance

✅ Automatic re-shopping if premiums spike

“We’ve helped homeowners in Fresno, LA, Sacramento, and beyond.”

The $120,000 Mistake Most Californians Don’t See Coming

Think flood damage is no big deal? Think again.

It starts like every other day in California — blue skies, maybe a few clouds.

Then it starts to rain. Not heavy, just steady. You think nothing of it.

You get home. Kids are in the bath. Dinner’s on. You scroll your phone.

Then bam — your floors are wet.

You check the back door. The patio’s flooded.

Water’s seeping in from the walls. Under the doors. Through the foundation.

In 15 minutes, your living room is underwater.

“We have a relatively new home — built in 2017. Still smelled like fresh paint. But during last winter’s storm, four inches of water made its way inside. Laminate floors, carpet, sofas… all destroyed.”

r/cherrys13, r/sandiego-

This is exactly how it happens — fast, silent, and devastating.

And here’s what nobody tells you:

Homeowner’s insurance won’t cover it.

Repairing flood damage costs $120,000 on average.

Flood insurance? It’s usually $500–$1,200 a year.

- That’s the trade-off:

👉 Pay $1,000 now… or $120,000 later — with interest.

By the time you realize you’re screwed, it’s too late.

You’re ripping out floors, tossing out furniture, and begging a loan officer for mercy.

Most people don’t take action because they think:

“That won’t happen to me.”

But every flood victim thought the exact same thing — right before the water came in.

“In CA HOMEOWNER policies typically exclude Mudslide and Flooding damage EXCEPT when it comes from a BURNSCAR Debrisflow.”

– @FTP_Adjusting

In the aftermath, the story repeats:

“I thought my homeowner’s insurance covered floods…”

“The government policy didn’t pay out enough…”

“I didn’t think it would happen to me…”

THE TAKEAWAY:

Even brand-new homes in “safe” areas can flood—your structure, possessions, foundation, even mold costs can be wiped out.

Homeowner’s insurance often won’t cover floods—especially runoff from roof breaches or post-fire mudslides.

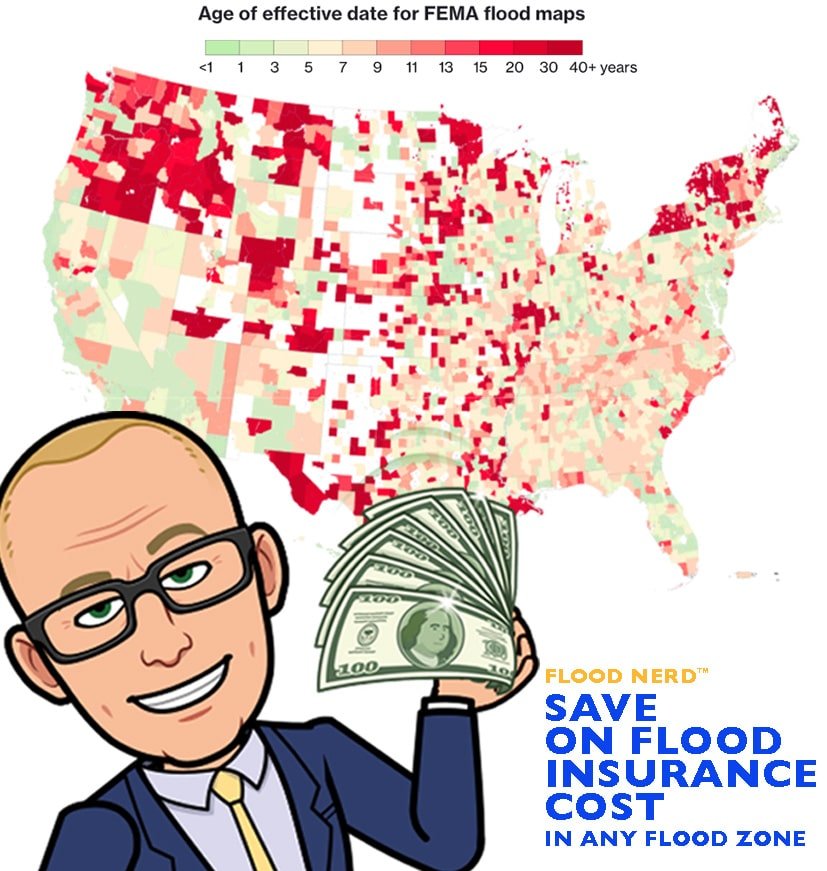

Premiums are spiking unpredictably—the new FEMA pricing model could increase your costs by thousands overnight.

The future isn’t awaiting—it’s happening now. Rising flood risk isn’t decades away—it’s today.

This isn’t about fear‑mongering—it’s about survival. Without expert flood coverage in California, you are gambling with your financial future.

$2.3M+

Annual Premium Savings

4.9★

Average Ratings

445+

Reviews

5,497+

Happy Clients

Get California Flood Insurance That’s Smarter, Stronger, and Actually Built for You

Most insurance agents treat flood coverage like an afterthought — a box to check and forget.

They quote the same tired policy from FEMA, ignore your actual risks, and leave you exposed.

We don’t do lazy. We do flood insurance — and only flood insurance.

We shop dozens of top-rated providers — including exclusive underwriters most agents don’t even know exist — to find strong, affordable protection tailored to your exact property.

Whether it’s your home, rental, or a $5 million commercial asset — we’ve got you covered.

Here’s What You’ll Get When You Request Your Free Quote:

✅ Tailored Flood Insurance Match

You’ll get a quote that actually fits your property’s risk — not just whatever satisfies a mortgage lender. We recommend coverage that delivers real payout power when the flood hits. The decision is yours — but your Flood Nerd has your back.

✅ Smart Premium Monitoring (Auto-ReShopping Included)

Flood rates rise — that’s normal. A 12–16% increase doesn’t mean panic. But if your policy jumps drastically above standard trends, we take immediate action.

We automatically shop for better options — across FEMA and private markets — before you even receive your renewal notice.

This applies to all clients, not just FEMA. Because price hikes should never catch you off guard.

✅ Commercial Flood Expertise

From multi-unit properties and warehouses to retail spaces and investor portfolios — we understand commercial flood exposure and how to insure it right the first time.

We’ve placed coverage for millions in real estate assets, and we’ll make sure your investment is protected — without paying inflated, blanket premiums.

✅ Flood Zone Determination — Free With Every Quote

With every quote, we provide your official FEMA flood zone determination — no fluff, no assumptions. Just the hard data on your property’s risk.

✅ Access to Top-Tier Flood Markets

We partner with the best flood insurers in the country — including select underwriters most agents can’t access because they don’t specialize in flood. That’s not luck. That’s reputation.

✅ Policy Rescue (Optional)

Already covered? We’ll review your policy and identify weak coverage, bloated rates, or flat-out mistakes — which we fix every week for frustrated clients burned by undertrained agents.

Real Coverage. Real Strategy. No Guesswork.

We don’t write the policy — we find the best damn one for your situation, every single year.

Flood insurance is changing fast. But with Better Flood, you’re ahead of it.

Smart, Affordable Flood Insurance — Built for California Property Owners

Get Your California Flood Insurance Quote

Meet The Flood Nerd™

Your CA Flood Expert, Friend, and Guardian

In 2015, Robert Murphy, inspired to help homeowners and businessowners alike, entered the insurance brokerage market with one goal in mind: To help uncertain California homeowners find affordable, high quality flood insurance that doesn’t compromise on coverage.

⚔️ Side-by-Side: Agent vs Flood Nerd®

Who Do You Trust to Protect Your Property from a $120,000 Flood Bill?

Just quoting FEMA's NFIP — no strategy, no savings, no clue.

Pro Tip:

Ask your agent how many flood policies they've written this year. If it's under 75… they're not a flood expert.

Here’s What California Homeowners Are Saying About Better Flood Insurance - aka Your Flood Nerd

Over $2.3 Million Saved. 5,497+ Clients Protected. 500+ 5-Star Reviews.

Frequently Asked Questions

Most Californians are still sitting on outdated FEMA policies slapped together by generalist agents who specialize in home and auto — not flood. They don't shop the market. They don't know the loopholes. And they definitely don't have access to the exclusive flood underwriters we work with.

Worse? We see flood policies every day that were flat-out written wrong — junk coverage, overpriced premiums, or missing key protections entirely.

Why? Because most agents just hand the policy off to a lazy underwriter who doesn't understand the risk, cost strategy, or compliance.

We fix those mistakes almost every day. If you've got a policy and want a second opinion — we'll give you a free flood audit and show you exactly what's working… and what's not.

Want to see if your agent got it wrong? 👉 Request a Free Flood Policy Audit

So, what's happening is that the vast majority of claims are coming in in what is considered a lower risk flood zone. FEMA says 25%, but over the past five years, almost 95% of all of the flooding that we have seen from the major storms have been in areas where people have not had coverage because they thought they were safe and they were in a flood zone that required coverage.

So please consider getting the coverage now and not waiting.

But the damage won't stop at the loan amount.

Many homeowners are left with having to take out second loans or disaster loans or exhaust their savings to pay for damage that they could have avoided. The average claim is usually around $120,000-$230,000, while the average policy is usually under $1,200.

And when FEMA is the best fit?

We'll tell you straight — and monitor your premium. If it spikes beyond 16%, we automatically shop for better options.

Local Coverage Questions — California

Why California Property Owners Can’t Afford to Wait

It starts like any other day in California.

Rain tapping your windows. Nothing new.

But by midday, the skies open up.

A few hours later, your backyard’s a lake.

By dinner, water’s inside — destroying floors, furniture, and peace of mind.

Too late to call for coverage.

Too late to fix what’s already gone.

This Isn’t a Hypothetical.

🚨 2023: Atmospheric rivers dumped 30+ inches in days — flooding Monterey, Merced, Sonoma.

🔥 Burn scars triggered deadly mudslides in Santa Cruz and Ventura.

🌨️ 2024: Sierra snowmelt + saturated ground = levee breaches and washed-out roads.

🛑 Thousands lost everything — many without proper flood coverage.

Waiting = overpaying or being dangerously underinsured.

Or worse… both.

🛑 California 🛑

Average Flood Damage:

💸💸💸$120,000💸💸💸

🟢 California 🟢

Average Policy (Strong Coverage):

💰💰 $500–$1,200 💰💰

💸 If Flooding Hits Before You’re Covered?

You’re stuck footing the bill.

And the average flood claim in California? $120,000+.

That’s a second mortgage.

Or a loan just to stay in your home.

Here’s the Bottom Line:

Floods in California don’t give you warnings.

They show up in the night.

They pour in after a wildfire.

They rush in from rivers you didn’t even know were near you.

And FEMA’s new system ensures waiting will cost you — in premiums, protection, and peace of mind.

🧨 California’s Hidden Flood Trap

Thanks to FEMA’s Outdated Maps & New Risk Modeling, Even “Low-Risk” Zones Are in the Danger Zone

FEMA flood maps in California are often 50+ years out of date, and the landscape has drastically changed.

Run through this list. If you check even one, your risk (and premiums) could be climbing fast:

💡 Pro Tip: Over 95% of flood damage in recent California storms happened outside high-risk zones.

👉 If you haven’t had a Flood Nerd audit your property and coverage, you're flying blind.

FLOOD NERDS CA FLOOD INSURANCE - Done right the first time.