If you’re thinking about buying a home in a flood-prone area, investing in flood insurance can save you time and money. While most standard homeowners insurance will cover damage caused by rain and the occasional falling tree limb, damage from flooding that occurs from water rising up outside the home will only be covered if you have flood insurance.

If I live in a low-risk flood zone, do I really need flood insurance?

While flood insurance isn’t federally required, anyone can be vulnerable to the financial and physical damage of floods. Flooding can be caused by a variety of factors including snow melt, poor drainage systems, large accumulations of rainfall and even broken water mains.

How is flood insurance different than other types of insurance?

Flood insurance is not normally included in your homeowner’s insurance package, so you shouldn’t assume it comes standard with your homeowner’s policy. Homeowner’s insurance is normally sold as an all-risk policy, covering all causes of loss except those specifically excluded in the policy. Flood insurance, also known as “single peril” insurance, only covers what is specifically noted in the policy.

What is covered by a standard flood insurance policy?

Under the basic content coverage of flood insurance, any personal belongings that have been damaged on the first floor or higher are covered. This can include items like clothing, furniture, washers and dryers and area rugs, among others.

What is not covered by a standard flood insurance policy?

For the purposes of flood insurance, a basement is defined as any area of a building, including a sunken room or sunken area of a room, that has its floor below ground level on all sides. Any personal belongings that are located in a basement, such as furniture and electronics, are not covered under the standard flood insurance policy. In addition to damaged basement belongings, there is no coverage for damage caused by moisture, mildew or mold that could have been prevented by the property owner. This can include mold or mildew that could have been prevented by removing wet carpet or setting up fans.

YES PLEASE SHOP FOR MY FLOOD INSURANCE

What is a special flood hazard area (SFHA)?

Special flood hazard areas, also known as floodplains, are areas of land that are vulnerable to a high risk of flooding. In high risk areas, there is at least a 1 in 4 chance of flooding during a 30-year mortgage.

What are important questions I should ask my flood insurance provider?

There are a variety of important questions you should ask your flood insurance agents before deciding on a policy that is best for you. Below are a few basic questions to keep in mind when discussing flood insurance policies with your agent:

- Do I live in a high-risk area or flood zone?

- How will my location affect the cost and benefits of my flood insurance policy?

- What will be covered by my new policy?

- What will not be covered by my new policy?

- What is the typical cost range per policy fee? Premium fee?

- Are there any hidden expenses?

- Do I need coverage for my building? Belongings? Both?

How is my flood insurance premium calculated?

A number of factors will be considered when determining your flood insurance premium. These factors can include things like: the type of coverage being purchased, the age of the building, location and flood zones.

Is there a waiting period before my policy takes effect?

There is usually a 30-day waiting period from the date of purchase before your policy goes into full effect. Check with your agency representative to be sure.

YES PLEASE SHOP FOR MY FLOOD INSURANCE

How can I tell what caused the damage to my property?

Damage caused by rising waters will be covered by your flood insurance policy. Any damage caused by falling water and rising winds is not considered flood damage and should not be included in your claim. Talk to your flood insurance agent to learn more about what is covered in your policy.

What should I do after experiencing flood damage?

If you need to file a claim due to flood damage, contact your insurance agent as soon as possible. To help speed up the filing process, be sure to have your insurance policy number on hand before calling. After you’ve contacted your agent, start compiling a list of all damaged or lost valuables. Your insurance provider will assign a professional claims adjuster to help evaluate your losses. Within sixty days of the flood you will make your official claim for damages, also known as the “Proof of Loss”, with the help of your claims adjuster.

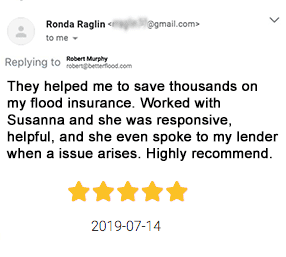

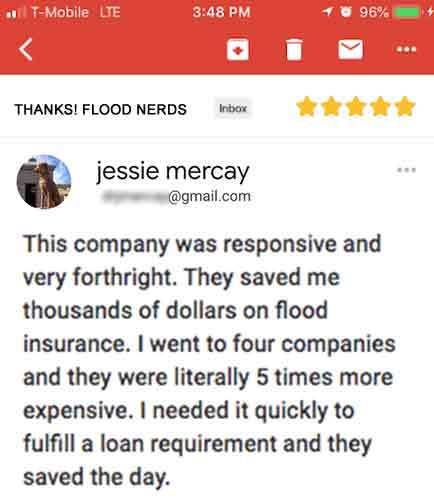

At Better Flood Insurance, we want to make the purchasing of flood insurance as easy as possible. Our goal is to get you comprehensive coverage at a fair and reasonable price. You can Apply Online right now and know your options for coverage in just 24 hours.