Question from client – Controling cost of flood insurance

Hi Robert what can I do to decrease my flood insurance expense

Hi, April that is a great question,

Typically the private flood market and Lloyds of London flood Insurance is much less than the Federal program the NFIP sometimes 50% less.

However, as you have seen in your state there are few private flood insurance option (Superior Flood being one) but they have pulled out or scaled back.

We have many private flood Insurance options and many Lloyds of London flood Insurance options nationwide and we shop all options for any given property.

Kentucky is a tricky state for private flood insurance and I think that this is because the tax code for KY is not standard with the rest of the country, because of this I haven’t seen many private flood insurance options brave enough to enter KY (YET).

I do expect them to soon.

That being said the only option I am seeing is the NFIP option and that is what is driving the premium for the option we found you.

I do have some ideas – because I am a flood Nerd and want to help.

It was good to speak with you. Here are the options we discussed. I adjusted the option to $77,000 of building coverage only (no contents coverage).

If we do a $5K deductible then the premium would be $835.00 annually

If we do a $10K deductible (lender would have to approve) premium would be $712

If we get an Elevation certificate (EC) that show the property as higher then the BFE then our premium could be $529.

I did look at your property an in regards to your son’s property and its relationship to the flood zone also called (BFE)

Attached (PDF and photo below) is an official flood zone Determination (FZD) that show that the BFE (how high the waters will go according to the Core of Engineers) is 396 ft.

I also put in his address to the

website

and I am seeing the elevation of the home is at 397ft this is about a foot above the BFE and might be worth it to get an EC.

Again this site isn’t exact so there is a slim chance that the home might be sitting lower but as long as it isn’t 3ft under the BFE then we will get a favorable rate then not rating with an EC.

Also, something to know is that the government will be forcing all properties to get an EC and premiums will increase every year by 16% – 20% until one is applied. (isn’t government fun??)

If you choose to get an Elevation Certificate. I have a surveyor I think really knows what they are doing in KY.

His Name is: Tim Phipps

Phone:502.249.1717

email: phippstima@yahoo.com

Address is

550 Thompson Road

Bloomfield KY 40008

Tell him the flood Nerd sent you.

Again if you choose to work with us our intent is to shop this policy next year on the Private flood insurance market.

YOUR FLOOD NERD

———— With KY client Pamela – OCT 23, 2018 ———–

Hi Pamela thanks for reaching out, Sorry we didn’t get to you on Friday. let’s try to align on Monday.

You can call the office 1-866-990-7482.

I have three ideas I want to discuss.

Idea 1 – Get an Elevation Certificate

1) you can get a surveyor out to give you an Elevation certificate. I can order it for you or you can google search for your area and elevation certificate. If I order for you I am seeing the cost of $749.

I do think an Elevation Certificate would help your property with the rating. But want to see if we can get ideas on the rating.

If you have a smartphone go to your lower area and ask it if Apple (hey seri what is my elevation) if Google (Hey Alexia,…). or just type into your phone what is my current elevation.

try this link https://www.

The Base Flood Elevation is 780.1 ft this is how high the core of engineers believe the water will rise I am hoping your foundation is no less than 2ft below this number or ideally higher.

Then an Elevation Certificate would benefit you.

Idea 2 – Look at Fema historical maps

Another option is to look at historical maps.

This link should take you right to your areas maps.

if that doesn’t work then try this link

https://msc.fema.gov/portal/

– put in your address

– in the upper right, there is a button for “show all products”

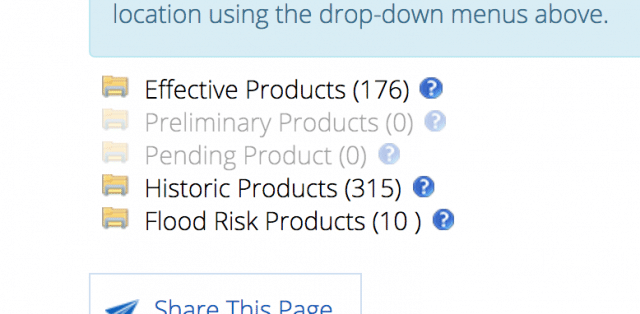

then go to the historic product (image is below)

Look at historical maps 12/04/1979 reason we are looking for this particular date is that the Flood zone determination (FZD) says this is when the community first entered the government program.

WHAT we are trying to do by looking at these maps is find a map that shows that the area where your home (or structure) is was not in a high-risk flood zone at the time of construction, your building was built in 1980 so it is right on the line.

If we can find that the area is not in the flood zone then we might be able to grandfather for built-in compliance at the time of construction.

This could save us on premium though grandfathering the flood zone.

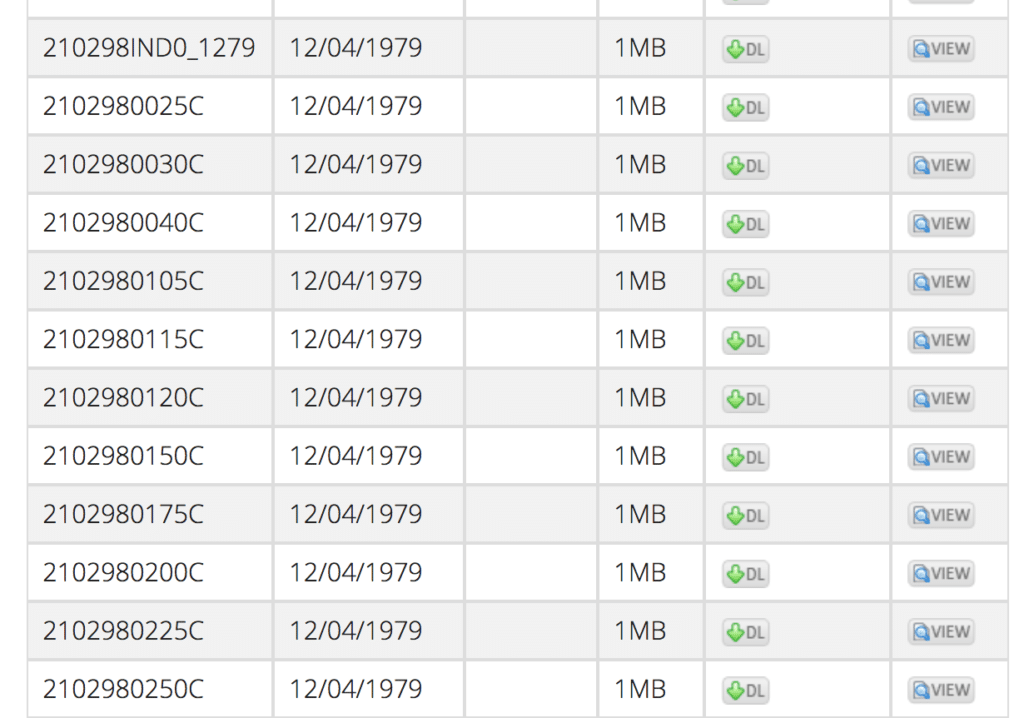

Try looking at these particular map numbers, I am hoping you can navigate the maps much better than I since I am not as familiar with the area. And find the map where you structure is.

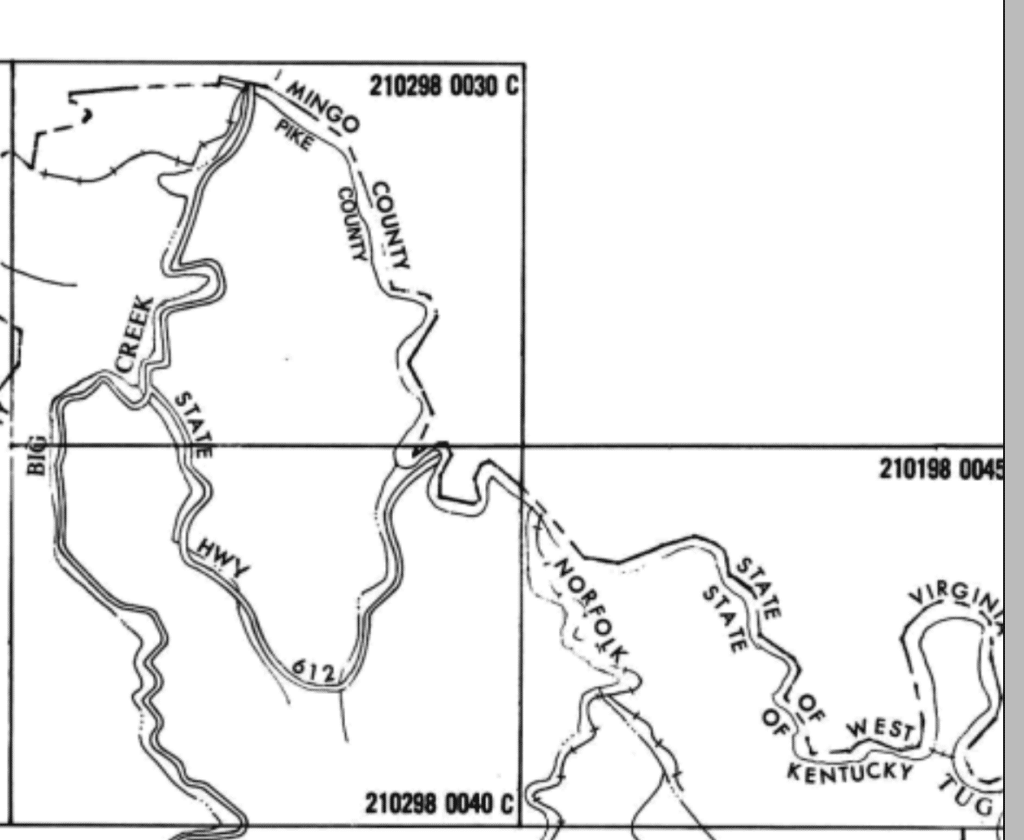

The first map on this list will look like this. if you can identify the general area of where your structure is – zoom in to that area

and then somewhere in the box is a number

this number is the other maps so once you locate the general location of your structure then you can zoom in and get a more detailed map number – write it down then go back to historic product and click on that map number

Once you locate your home let me know the map and I will see if we can grandfather the flood zone.

Ideal 3 – Put in Engineered flood vents on the lowest floor

The goal here is to take the lowest flood out of the “flood insurance rating” and these vents will allow us to do that. Since you primarily live over lowest flood and use the lowest flood to do something for your business this might work.

You will need to work with your local floodplain manager as well as the installer to do this correctly and then you will need to get an Elevation Certificat to “qualify” for the discount.

I hope these get you going in the right direction and I hope we can get a better premium.

If you want to discuss further any one of these options please give us a call 1-866-990-7482

YOUR FLOOD NeRDS.

If you want us to shop let us know