Discover the Secret to Affordable Flood Protection:

Get Private Insurance Now!

Take charge of flood protection with Flood Nerds and private flood insurance, saving big.

Benefit from dependable coverage that provides peace of mind in the face of flood risks.

True Private Flood Insurance

Revealing the Untold Value of True Private Flood Insurance

Hey there, seeker of financial security,

Welcome to the realm of True Private Flood Insurance! You’re on a quest, not just for protection, but for clarity amidst the murky waters of insurance options. Fear not, for you’ve embarked on a journey that promises enlightenment and empowerment.

So, what’s the deal? Why should you care? And most importantly, how can we guide you through this maze?

Here at Flood Nerds, we’re more than just flood insurance enthusiasts; we’re your dedicated allies in the quest for the best flood insurance coverage. Our mission? To explore our exclusive private flood insurance options that offer solid coverage at competitive rates for you.

Now, let’s address a critical concern. Not all private flood insurance options are created equal. Shockingly, many insurance agents, lacking specialized focus, unknowingly peddle policies that may not fully meet your needs. That’s why it’s crucial to partner with someone who understands the complexities of flood insurance and can help you navigate the fine print.

Rest assured, when you receive a quote from us, it’s based on thorough research and industry knowledge. While we can’t guarantee every aspect of the policy, we strive to offer options that provide reliable coverage, minimizing surprises or major gaps in protection.

Ready to take the plunge? Let’s navigate these waters together. Reach out to us today, and let’s work together to find a flood insurance solution that fits your unique needs and budget.

Unraveling the Alternative – Private Flood Insurance

Ah, the age-old tale of insurance woes! Since the dawn of the National Flood Insurance Program (NFIP) in 1968, it’s been a rollercoaster ride of premiums, policies, and perplexity. But fear not, dear reader, for there’s a glimmer of hope on the horizon – the emergence of Private Flood Insurance.

Picture this: While the NFIP struggles to keep its head above water, private insurers boldly step onto the scene, offering a fresh perspective on flood coverage. It’s like watching the underdog rise to the occasion, armed with innovative solutions and a dash of audacity.

But let’s rewind a bit, shall we? In the early days, the NFIP monopolized the flood insurance market, leaving property owners with limited options and hefty premiums. Then came the “Write Your Own” program in 1983, a feeble attempt to shake things up, but alas, it was merely a cosmetic makeover.

Fast forward to 2012, a year that would forever change the flood insurance landscape. Congress, in a stroke of brilliance, granted private insurers the power to rate and write their own policies. And thus, the era of Private Flood Insurance was born.

Now, you might be wondering, what sets private flood insurance apart from its government counterpart? Well, my friend, allow me to enlighten you. Private flood insurance offers a breath of fresh air in a sea of bureaucracy. With flexible policies, competitive rates, and a keen eye for innovation, private insurers have revolutionized the flood insurance market.

But here’s the kicker – many insurance agents still haven’t caught on to the private flood insurance wave. Bless their hearts, they mean well, but navigating the complexities of flood insurance requires a certain finesse. It’s like asking a fish to ride a bicycle – entertaining, perhaps, but not exactly productive.

So, as you set sail on your quest for flood insurance nirvana, remember this: Not all heroes wear capes, and not all insurance agents are flood insurance gurus. But fear not, for Flood Nerds are here to save the day! With our expertise and dedication, we’ll guide you through the turbulent waters of flood insurance, ensuring you find a policy that’s as unique as you are.

Ready to dive in? Let’s navigate these waters together, shall we?

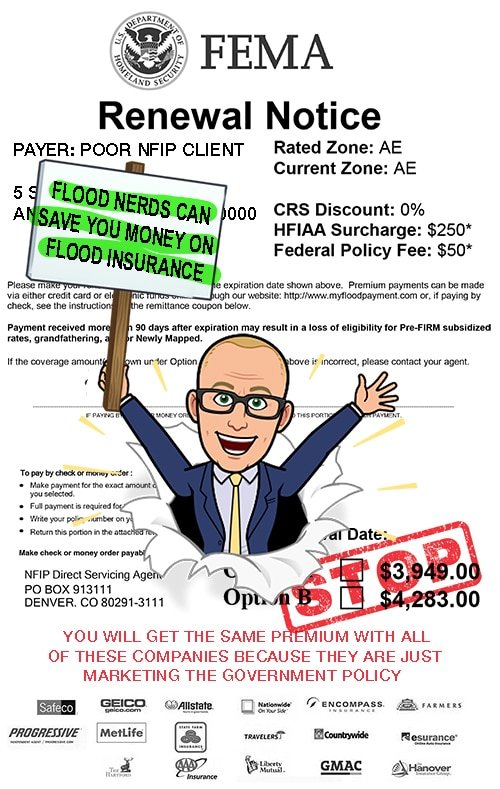

Find Out the Cost Difference Between Government and Private Flood Insurance

Embracing the Alternative – Private Flood Insurance

History of Private Flood Insurance

Embark on a journey through time, where the tale of Private Flood Insurance unfolds with a promise of personalized protection. Born from the need for flexibility and reliability, private flood insurance emerged as a beacon of hope for property owners seeking sanctuary from the storm.

Benefits Over NFIP Policies

Step into the realm of private flood insurance, where the spotlight shines on you, the property owner. Here, amidst a landscape of options, you are not just a policyholder – you are the protagonist in a story of tailored coverage and individualized care.

With us, your trusted Flood Nerds, by your side, navigating the waters of private flood insurance becomes a breeze. Our exclusive relationship with the finest underwriters ensures that your unique needs are met with precision and expertise. From strong coverage to competitive rates, we leave no stone unturned in our quest to safeguard your property.

The Role of Your Flood Nerd

But let us not forget, dear reader, that this journey is not about us – it’s about you. Your flood nerd is here to shoulder the burden of insurance jargon and policy complexities, allowing you to focus on what truly matters – peace of mind.

We understand that private flood insurance may not always be the most affordable option. In such cases, we pledge to act in your best interests, guiding you towards the government option if it offers better coverage at a lower cost. After all, our mission is to protect what matters most – your property and your peace of mind.

So, as we embark on this voyage together, know that your flood nerd is here to guide you every step of the way. With us by your side, you can rest assured that your property is in capable hands – because when it comes to flood insurance, your peace of mind is our priority.

Innovation Makes Private Flood Insurance Cheaper

Escaping the Shackles of Bureaucracy

Bid farewell to the sluggishness of bureaucracy, for in the realm of private flood insurance, swift action reigns supreme. Freed from the red tape that often plagues government programs, private insurers offer a claims process that’s as efficient as it is effective. With fewer hoops to jump through and less paperwork to wade through, you can rest assured that help is never far away.

Breaking Free from Limitations

Gone are the days of settling for less-than-adequate coverage. With private flood insurance, the sky’s the limit when it comes to protecting your property. Say goodbye to the government’s restrictive maximums – in the private market, your coverage options are as vast as your imagination. Whether you seek to safeguard your structure with replacement cost coverage or ensure that every last possession is accounted for, the power is in your hands.

Unleashing the Power of Technology

While the National Flood Insurance Program (NFIP) languishes in a sea of stagnation, the private flood insurance market forges ahead, fueled by the fires of innovation. At the heart of this revolution lies technology – a powerful tool that empowers insurers to better understand and mitigate risk. Through the use of advanced risk modeling techniques, private insurers gain unparalleled insight into flood patterns and potential damage, allowing them to tailor coverage to the unique needs of each policyholder.

Embracing the Future

With each passing day, the gap between government and private flood insurance widens, as the latter continues to push the boundaries of what’s possible. As we stand on the brink of a new era in flood protection, one thing is abundantly clear – innovation is the key to a safer, more secure future. And with private flood insurance leading the charge, the possibilities are truly endless.

Better Flood Data Makes for Better Flood Insurance

Your Protection, Our Priority

At the heart of every decision we make lies a singular focus – your protection. While we can’t claim to understand the intricacies of your property until we’ve had the privilege of examining it firsthand, we can assure you that your needs are our top priority. By entrusting us with the task of securing flood insurance for your home, you’re taking the first step towards safeguarding your financial future.

Facing the Facts

Let’s talk numbers for a moment. The average cost of flood damage in the United States now exceeds $120,000 – a staggering sum that few can afford to shoulder without assistance. Yet, despite the undeniable risks posed by flooding, far too many property owners remain uninsured, blissfully unaware of the financial catastrophe that awaits them in the event of a disaster.

A Wake-Up Call

Consider this your wake-up call – a sobering reminder of the very real dangers that lurk just beyond your doorstep. With 95% of properties damaged in major flooding events lacking adequate coverage, the odds are stacked against the unprepared. And while it’s easy to dismiss flood insurance as an unnecessary expense, the truth is far more sinister.

Our Commitment to You

As your trusted advisors in all things flood-related, we’re here to guide you through the maze of insurance options and ensure that you’re equipped with the knowledge and protection you need to weather any storm. From scouring the market for the best rates to providing personalized recommendations tailored to your unique circumstances, we’re committed to putting your needs first every step of the way.

Conclusion

So, before you dismiss the idea of flood insurance as just another unnecessary expense, consider this – can you afford to roll the dice with your financial future? With our help, you don’t have to. So take the first step towards peace of mind today and let us show you just how affordable and invaluable flood insurance can be.

Get Fast, Better Coverage with Private Flood Insurance

Paying lower prices for flood insurance is awesome. But the private flood insurance market has other benefits – you can get better coverage while saving money and you can get it fast.

With over 40 private flood insurance companies to shop, Flood Nerds can tailor your coverage to your unique needs.

The NFIP makes you wait 30 days for coverage. If you are buying a home that can really mess up your closing date!

Waiting periods for private flood insurance are as short as 10 days or 15 days and the Flood Nerds even know about options with no waiting period!

Your loan will close on time when you get Better Flood Insurance from the Flood Nerds.

The private flood insurance market lets you cover more of your assets. And insurance is all about CYA (covering your ass-ets)

The NFIP only covers up to $250,000 for the building and $100,000 in contents.

With some private flood insurance you can get coverage for:

• Actual replacement cost of the structure

• Temporary living expense coverage

• Basement contents (Limited but better then nothing)

• Pool repair/refill

• Higher coverage limits on detached structures

Private flood insurance offers higher coverage limits too – up to $2,000,000 for your home and $500,000 for your personal items. Not all policies cover all things. So tell your Flood Nerd what is important to you (maybe you don’t have a basement but need to cover the pool) and we’ll shop for the coverage you want.

Get a Free Quote from Flood Insurance shoppers – The Flood Nerds

Better Flood Insurance starts with a free quote from the Flood Nerds.

Your personal Flood Nerd will shop the private flood insurance markets and then compare them to the NFIP and guarantee that you get the good option. We even have tricks in our pocket protectors to save with the NFIP coverage too.

Private Flood Insurance for Commercial Properties

As with a homeowner’s policy, most business insurance policies do not cover flooding.

The only way to get coverage is with a stand-alone commercial flood insurance policy.

Businesses Have Two Options for Commercial Flood Insurance

Buy the government flood coverage with a limit of $500,000 for the building and $500,000 for the contents.

Buy a private flood insurance commercial policy.

Get broader coverage with higher limits.

Take advantage of business income or business interruption coverage. Historically flooding shuts down businesses for 64 days and many never come back. Dreams – washed away with the floodwaters.

About 25% of small businesses never reopen following a natural disaster.

Protect your business and inventory with private flood insurance.

Do Lenders Accept Private Flood Insurance?

Just because the lender says the government requires you to have flood insurance doesn’t mean you have to buy government flood insurance. Your lender will absolutely accept private flood insurance shopped by the Flood Nerds. That’s because we only shop with insurance carriers that are ‘A’ rated by AM Best, the folks in charge of insurance report cards.

Flood Nerds find you an good policy and a good price.

Private flood insurance companies comply with all government and FEMA guidelines. Your lender will approve your policy, and you’ll close on time. We can get a policy the same day we receive payment making the process of buying a property that requires flood insurance cost-effective and straightforward.

Private Flood Insurance Doesn’t Need an Elevation Certificate

Remember the private insurers aren’t relying on those dusty old and outdated paper maps. They use the latest technology to assess the rate. They don’t need no stinking badges or Elevation Certificates to determine the risk of flooding.

This technology saves money for millions of NFIP policyholders.

There are over 40 flood insurance options, including the Lloyds of London insurance market. Shopping with or without an Elevation Certificate is confusing and time consuming. Get a Flood Nerd to do the work for you. Got an Elevation Certificate? Share it with a Flood Nerd for the good rate guaranteed!

Private Flood Insurance is the Alternative to Excess Coverage

NFIP only lets you buy $250,000 worth of coverage. With property values and the cost of rebuilding going up and up, $250,000 in coverage doesn’t go very far any more.

Before private flood insurance, if your NFIP policy was maxed out at $250,000 and your property was worth way more you had to buy Excess Flood coverage.

Now with a private flood insurance policy, all you need is one policy!

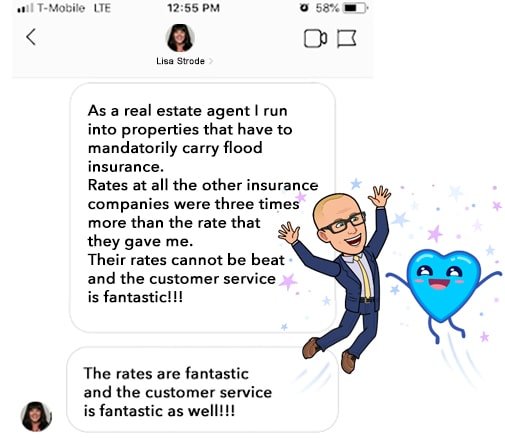

Private flood insurance can save up to 50% on the premium over the NFIP in certain situations. Private flood can be cheaper than NFIP, especially in the A and V flood zones.

On average, we find savings of $250 – $2,500 for residential flood insurance and unheard-of savings for commercial properties.

What’s Covered By a Private Flood Insurance Policy

Coverage from some private flood insurance market covers damage caused by rising water.

Standard private flood coverage

• The building that is listed on the policy.

• If the home is your primary residence, you may have coverage for loss of use

• Personal contents, which protects the property or possessions inside your home.

• For commercial properties, you can buy coverage for loss of use or loss of business. Tell your Flood Nerd to shop this coverage.

• It may include cleaning up/repairing the swimming pool

This coverage may sound like your standard homeowner policy coverage. But your homeowner’s policy excludes all damage from rising water.

NFIP Penalty for Second Homes

Instead of congratulating you for owning a second property as an income producing property or a vacation home, the government flood insurance punishes you. The NFIP policy has different rates that are higher rates and added fees for a second home investment property.

Some private flood insurance does not penalize you for a second home.

The NFIP does. If the property is in a flood zone, the NFIP policy automatically slaps on a $250 fee on top of the already high premium. This is wrong.

Private flood insurance companies do not charge a $250 penalty for an additional home. That is the right way to do business.

Private Flood Insurance Is the great for the A and V Flood Zone Maps

Private flood insurance is good option for properties that are in high-risk flood zone maps such as the A and V flood zone maps.

If your property has never had a flood loss before private flood insurance will cost less and provide even better coverage.

Flood Nerds study all the ins and outs of flood insurance so let us get you a free, no-obligation quote today. We’ll even scope out the Lloyds of London syndicate for you.

We have access policies that have been with us for 20 years. Check out our reviews.

Any Property Can Flood

Lenders require flood insurance when the structure is located in a “high risk” flood zone (flood zone AE, A, or flood zone VE, V).

But a house in any location can flood.

Just because the mortgage company or bank doesn’t ask for flood insurance doesn’t mean you don’t need it.

Wherever it rains, it can flood, and you don’t even need to be close to a lake, ocean, river, or creek for your house to flood.

Every year, 25% of all flood claims are in areas that are not in the high-risk flood zones (A or V).

Don’t feel a false sense of security because your structure is outside of a high risk area or your lender doesn’t require it. Feel real security with flood insurance.

Disadvantages of Private Flood Insurance

There are a few disadvantages of private flood insurance and it isn’t the good option for every situation. But, Flood Nerds know when private flood insurance makes sense and when it doesn’t. That’s why we shop all options to compare private and government prices.

Deductibles often are higher on private flood policies than with the NFIP. Now some people think that is a downside, but honestly you NEVER want to turn in a small claim for loss under a flood policy. If you do that, you may be out of the private flood insurance market for 5 years or more. And when forced back into the NFIP it’s going to cost a small fortune over those years.

With private flood insurance you run a small risk of having your policy non renewed because their underwriting parameters change. When Better Flood Insurance shops your policy, if this ever happens, we will find you another option or two.

There are times when the NFIP has a better price than the private flood market. For example, if your policy is grandfathered for a prior flood zone, then the NFIP will subsidize the insurance policy. How do you know if this applies to your property? You ask a Flood Nerd. They know more about grandfathers than a nursing home!

Another significant reason to stay with the NFIP has to do with flood zone map changes. If your policy moves into a high-risk flood zone you can get a subsidy for part of the premium if you act fast. And Flood Nerds operate at the speed of light. And if you can get one of these subsidized policies, you can even transfer it when you sell the house.

Can You Afford to be Uninsured or Underinsured?

The average flood insurance claim is $46,000. If you don’t have that much money in savings, you are one flood away from financial disaster. You seem like a nice person, I would hate for that to happen to you.

That new iPhone may be nifty, but it won’t rebuild your home after a flood loss. Get flood insurance first and then get that new iPhone!

Flooding is the most common and costly natural disaster.

Here’s the cost of flood damage from recent floods

HURRICANE HARVEY 2017

Number of Claims Paid: 76,257

Average Claim: $116,823

HURRICANE KATRINA 2005

Number of Claims Paid: 166,790

Average Claim: $97,474

TORRENTIAL RAIN LOUISIANA 2016

Number of Claims Paid: 26,976

Average Claim: $91,507

TEXAS FLOODING MAY – JUNE 2015

Number of Claims Paid: 6,709

Average Claim: $67,463

SUPERSTORM SANDY 2012

Number of Claims Paid: 132,360

Average Claim: $66,517

TORRENTIAL RAIN SEPTEMBER 2009 GEORGIA

Number of Claims Paid: 2,067

Average Claim: $60,107

HURRICANE IKE 2008

Number of Claims Paid: 46,701

Average Claim: $57,866

HURRICANE IVAN 2004

Number of Claims Paid: 28,154

Average Claim: $57,097

TORRENTIAL RAIN TENNESSEE 2010

Number of Claims Paid: 4,114

Average Claim: $55,974

LATE SPRING STORMS JUNE 2011

Number of Claims Paid: 2,433

Average Claim: $55,326

FLORIDA FLOODING APRIL 2014

Number of Claims Paid: 2,134

Average Claim: $51,703

TORRENTIAL RAIN TEXAS 2016

Number of Claims Paid: 4,748

Average Claim: $50,392

SOUTH CAROLINA FLOODING OCTOBER 2015

Number of Claims Paid: 3,876

Average Claim: $46,697

HURRICANE IRMA 2017

Number of Claims Paid: 21,920

Average Claim: $48,095

MIDWEST WINTER STORMS 2015

Number of Claims Paid: 2,169

Average Claim: $40,552

COLORADO FLOODING SEPT 2013

Number of Claims Paid: 1,734

Average Claim: $39,625

HURRICANE MATTHEW 2016

Number of Claims Paid: 16,586

Average Claim: $39,455

TROPICAL STORM ALLISON 2001

Number of Claims Paid: 30,671

Average Claim: $36,028

PENNSYLVANIA, NEW JERSEY, NEW YORK FLOODS JUNE 2006

Number of Claims Paid: 6,428

Average Claim: $35,671

SOUTH CAROLINA FLOODING LATE WINTER SEVERE STORMS 2016

Number of Claims Paid: 4,751

Average Claim: $34,729

HURRICANE IRENE 2011

Number of Claims Paid: 44,314

Average Claim: $30,369

What is Private Flood Insurance?

Private Flood Insurance is the Affordable Option

Don’t settle for expensive national flood insurance through the government. In most cases, private flood insurance is more affordable and gives you better coverage. There are more than 40 private flood insurance options. Shopping for private flood insurance takes time and an understanding of the private flood market. Let a Flood Nerd do the dirty work for you. Better Flood Insurance provides free quotes for private flood insurance from one of our Flood Nerds. The private flood insurance market can be confusing, but making sense of private flood insurance is what the Flood Nerds love to do!

Get Cheap Flood Insurance without Compromising Coverage

★★★★★

"Same Coverage at a Better Rate"

-Mohammed K

Flood Nerds will shop the private flood insurance markets and then compare them to the NFIP, guaranteeing you the better option. We will send you the cheapest flood insurance rates within minutes.

★★★★★

"Quick Response, Very Knowledgable"

– Robert W

Paying for low-cost flood insurance is awesome. And letting the Flood Nerds shop your property has other benefits – you can get better coverage while saving money, and you can get it fast.

★★★★★

"Would highly recommend Better Flood for your flood insurance needs."

– Varun K