Most Flood Insurance in New York Is a Total Scam…

Here’s How to Actually Protect Your Property Before the Next Storm Hits.

Tired of overpriced, cookie-cutter policies? We shop the NFIP + top-rated Flood Nerd® approved private insurers to get you better coverage without the runaround.

⭐ we specialize in NY flood insurance

⭐ New York approved "A rated" Underwriters

⭐ Zero Phone calls or sales pressure

The Flood Horror Story Every New Yorker Fears (But Few Are Prepared For)

It always starts the same way: rain.

Just a little heavier than usual. Then come the alerts — flash flood warnings, subway delays, and social posts of basements filling like bathtubs.

By the time you realize it’s serious, it’s too late. Your property is underwater. Your photos, furniture, and foundation are soaked.

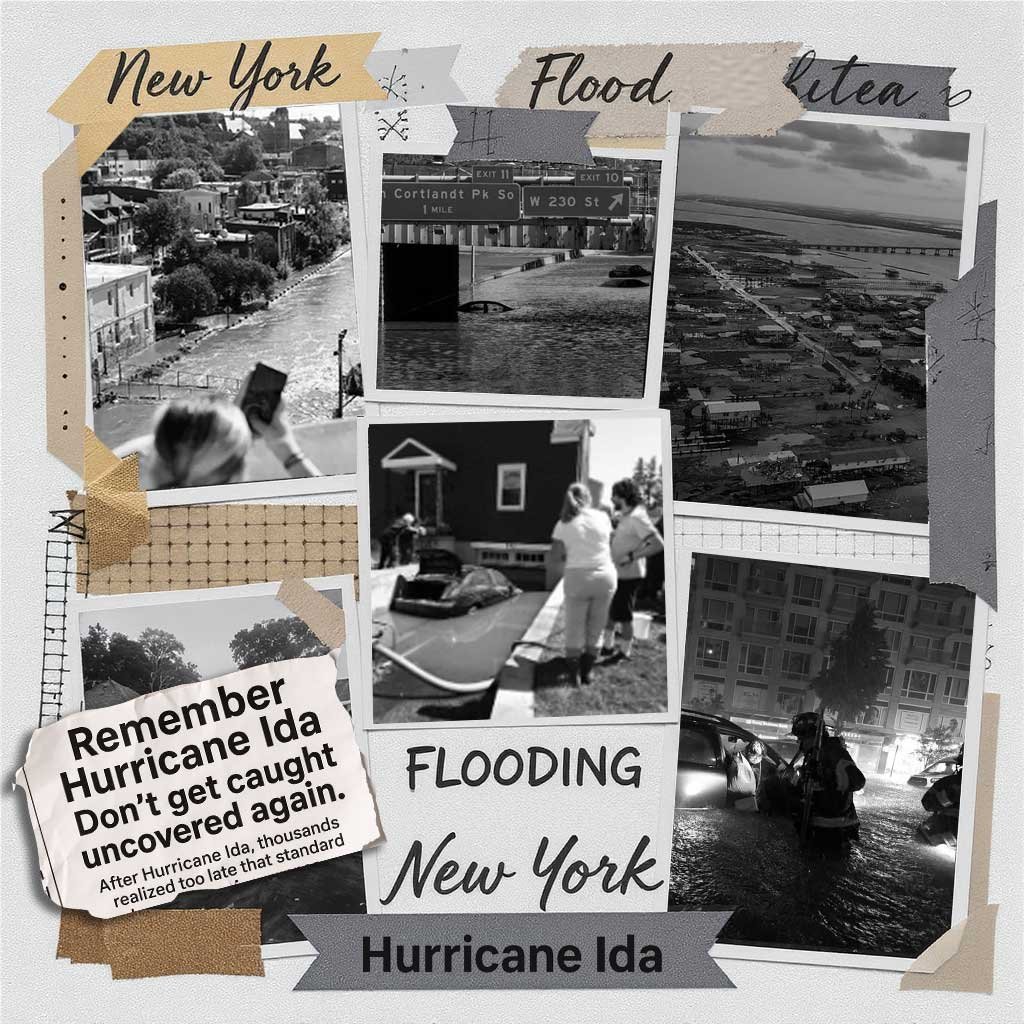

That’s exactly what happened to homeowners in Queens and Long Island during Ida… and again in 2023. And it’s happening more often, not less.

In the aftermath, the story repeats:

“I thought my homeowner’s insurance covered floods…”

“The government policy didn’t pay out enough…”

“I didn’t think it would happen to me…”

And while the water recedes, the damage sticks around — financially and emotionally.

The truth? If you live in New York (especially NYC, Long Island, or upstate floodplains), a major flood event is not an ‘if’ — it’s a ‘when.’

And unless you have the right coverage, you’ll be left holding the bag.

Why Most Flood Insurance Fails You (And Leaves You Screwed When You Need It Most

Let’s be real — most flood insurance is outdated, overpriced, and underwhelming.

You’d think that something as important as flood insurance would be built to actually protect you, right?

Wrong.

Here’s what 99% of homeowners in New York don’t know until it’s too late:

💀 The NFIP is a relic.

The coverage limits were set in 1974 — and they’ve never been updated.

→ If your home is worth more than $250K (and whose isn’t in NY?), you’re dangerously underinsured.

→ Want to replace your kitchen, furniture, or fix your foundation? Too bad. You’ll need a second policy just to get close.

🧠 Most agents don’t specialize in flood.

They’re experts in auto and homeowners insurance — flood is just an add-on they don’t understand.

→ They won’t tell you this… but if they had any ethics, they’d say, “Talk to the Flood Nerd.”

→ Instead, you get false confidence and a ticking time bomb on your coverage.

🏦 Your mortgage lender’s “required coverage”?

It’s the bare minimum — meant to protect them, not you.

→ Their box is checked. If you flood? You’re on your own.

🚨 Most NFIP policies are written wrong.

You heard that right. Most agents have no idea how to properly write a flood policy.

→ They fill out a form, send it to the NFIP, and pray the overworked underwriter catches what they missed.

→ Spoiler: they don’t. You find out when your claim gets denied and you’re stuck footing a $10K+ insurance bill.

📞 Quote comparison sites? Total joke.

They don’t include private carriers. They don’t include exclusive underwriters. And they definitely don’t care.

→ Your contact info gets resold to 15 lazy agencies who spam your phone and fight over who can sell you the fastest, sloppiest policy.

→ You’re just a lead to them — not someone they care to protect.

🗺️ And the flood zone maps in New York? Laughably outdated.

Most were drawn when only the rich had satellite phones and planes. They’re a joke — and climate change doesn’t care.

Bottom line: If you're buying flood insurance the old way — you’re overpaying for the illusion of safety.

Don’t find out the hard way.

Skip the Guesswork — Let the Flood Nerd Find You the Strongest, Cheapest Coverage in NY

At Better Flood, we don’t sell car insurance. We don’t upsell you on bundles. We don’t tack flood onto other policies as an afterthought.

We ONLY do flood — and we’ve built an unfair advantage for New Yorkers who want coverage that actually works:

We’ve helped thousands of property owners across NYC, Long Island, and upstate protect their homes and businesses faster, cheaper, and smarter than the old-school agents ever could.

Done right the first time.

$2.3M+

Annual Premium Savings

4.9★

Average Ratings

445+

Reviews

5,497+

Happy Clients

What New Yorkers Say About Better Flood

They Switched to Better Flood. Here’s Why.

Local Coverage Questions

Yes! We proudly serve Long Beach and the surrounding coastal areas. We help residents find the most affordable and accurate flood insurance options — without the stress.

Absolutely. With thousands of active policies across Suffolk County, including Islip and Brookhaven, we've got flood insurance options that your local agent probably doesn't even know exist.

Of course! We serve all five boroughs and understand the unique flood risks facing New York City residents. From coastal flooding to storm surge, we've got you covered.

Yes, we provide coverage throughout New York State. Whether you're dealing with lake effect flooding, river flooding, or flash floods, we have policies tailored to your specific location's risks.

Why Now – The Risk Is Rising, The Time Is Now

In the last 3 years, New York has been hammered by record floods: Ida in 2021, 8 inches of rain in NYC in 2023, and multiple storm systems in 2024.

Basement drownings.

Destroyed foundations.

Closed subways.

Families caught off guard.

And the science is clear: rising sea levels and extreme weather are here to stay. Floods aren’t rare anymore — they’re seasonal. FEMA’s new Risk Rating 2.0 means many New Yorkers are seeing premium hikes and updated flood zones.

And the next big storm won’t wait for you to get your coverage in order.

Don’t wait until your home is underwater to find out you’re underinsured.

Ready to Protect What Matters? Let’s Get You Covered.

Getting flood insurance shouldn’t be confusing. At Better Flood, it isn’t.

Get started in 60 seconds. We’ll shop private and NFIP rates for you and show you the best options — all without phone calls or sales pressure. ✅ Residential & Commercial properties covered ✅ NYC, Long Island, Upstate — we’ve got you ✅ Exclusive carriers, simple switching, expert support

Frequently Asked Questions (FAQ

Nope. 90% of standard policies don’t cover flood damage. You need a separate policy.

Often, yes. We’ll compare it against vetted private carriers and show you if you’re overpaying.

Yes — we cover all of New York: Brooklyn, Staten Island, Queens, Buffalo, Albany, Rochester, Long Island, and everything in between.

We’re a flood-only insurance agency with real, licensed advisors. No gimmicks. No spam. We never sell your information — ever. Just honest advice and real coverage you can count on.

We sure do. New York City, NY is one of our most served areas, and with more than 54,097 flood policies already active, we know exactly how to navigate the local risks and regulations.

Absolutely — we serve Freeport, NY. It’s one of the most flood-aware areas in the state, and we help homeowners and businesses there get protected without overpaying.

You bet. If you’re located in Long Beach, NY, we’ve got you covered. With a deep understanding of the flood risks in your area, we can match you with smart, affordable insurance solutions.

Yes — we offer tailored flood insurance solutions in Islip, NY. Whether you’re on the coast or inland, our team knows how to find the right protection for your property.

Yes, we provide flood insurance in Babylon, NY. With over 4,587 active flood policies there, we’ve seen it all and can help you secure the coverage you really need.

Absolutely — we serve Brookhaven, NY. It’s one of the most flood-aware areas in the state, and we help homeowners and businesses there get protected without overpaying.

Yes, flood insurance in Southampton, NY is our specialty. We help people like you every day get coverage that fits your risk — not just a one-size-fits-all policy.

Yes, flood insurance in Southold, NY is our specialty. We help people like you every day get coverage that fits your risk — not just a one-size-fits-all policy.

We sure do. Westhampton Beach, NY is one of our most served areas, and with more than 1,042 flood policies already active, we know exactly how to navigate the local risks and regulations.

Yes, we provide flood insurance in Mamaroneck, NY. With over 1,312 active flood policies there, we’ve seen it all and can help you secure the coverage you really need.

Flood Insurance in New York – Everything You Need to Know

We specialize in:

– Flood insurance NYC

– Long Island flood insurance

– Flood insurance quote NY

– How much is flood insurance in New York

– Cheap flood insurance NY

– Flood insurance Brooklyn NY, Buffalo, Rochester, Staten Island, Freeport, and more.

Whether you’re new to flood zones or renewing a decades-old policy, our team helps homeowners and commercial property owners navigate coverage requirements, NFIP rules, elevation certificates, and claim scenarios — with zero stress.

Resources

• Flood Zone VE Savings page

• The Shocking Truth About Your Flood Risk (That No One is Telling You)

Support & Blog

Flood Nerd’s Videos for educational content

Relevant blog posts like “Understanding Flood Insurance in High-Risk Zones” or “How FEMA’s Risk Rating 2.0 Affects Your Premium”

• Is flood zone AE bad?