Get Flood Insurance Connecticut & Save Money Too.

People in Connecticut save on average $500 to $1,457+ on their annual flood premiums.

In many cases, we save them even more. Get the cheapest flood insurance in CT without sacrificing coverage.

Get flood insurance from a Flood Nerd® at Better Flood Insurance® and save big time.

featured on

Save Money on Connecticut Flood Insurance

How Much is Flood Insurance in CT?

Free quote. We shop all options for Connecticut Flood Insurance, not just FEMA and NFIP. Get the best coverage & price when we compare policies from over 40 private flood insurers. We only deal with flood insurance. The Flood Nerds are Flood Experts.

Get Cheap Flood Insurance without Compromising Coverage

★★★★★

"Same Coverage at a Better Rate"

-Mohammed K

Flood Nerds will shop the private flood insurance markets and then compare them to the NFIP, guaranteeing you the better option. We will send you the cheapest flood insurance rates within minutes.

★★★★★

"Quick Response, Very Knowledgable"

– Robert W

Paying for low-cost flood insurance is awesome. And letting the Flood Nerds shop your property has other benefits – you can get better coverage while saving money, and you can get it fast.

★★★★★

"Would highly recommend Better Flood for your flood insurance needs."

– Varun K

Better Flood Insurance is an independent flood insurance broker that shops flood insurance ONLY. Flood Nerds are Flood insurance experts. We have 5000+ happy clients and 390+ 5-star reviews.

Learn everything you need to know about saving money on Flood Insurance from the folks who know flood insurance best – the Flood Nerds

Hi! I’m Robert Murphy, the Top Flood Nerd at Better Flood. Flood Nerds love to shop for flood insurance and we find historic savings on Connecticut flood insurance. If you’re tired of increasing premiums or just need to get cheap flood insurance quickly, let the Flood Nerds find you the best coverage and price.

Connecticut Homeowner’s Insurance Excludes Flooding

A typical Connecticut homeowner’s policy is written through Traveler’s, Nationwide, Allstate, or State Farm. These policies protect your home from things like fires, storms, and theft. But they don’t cover the damage from flooding.

Call your homeowner’s agent and ask them to add a flood endorsement to your policy. They will just laugh. But it’s not funny. Flooding is a serious risk in Connecticut.

To be protected against flood damage, you must purchase a separate flood insurance policy. And unfortunately, those Nationwide, Allstate, and other insurance agents will just stick you in the National Flood Insurance Program (NFIP). It’s easy for them but very expensive for you. Of the approximately 34,000 flood policies recently in effect in Connecticut, 32,000 of those were these Write Your Own policies that are just NFIP under a private logo. That’s not how to save money on Connecticut flood insurance.

The Flood Nerds are Connecticut Flood Insurance Experts. We know the Connecticut private flood insurance market like the back of our hand and we will always find you the best coverage and rate.

GETTING A QUOTE FOR CONNECTICUT FLOOD INSURANCE IS FREE

Is CT Flood Insurance Really Necessary?

If flood insurance is so necessary for Connecticut property owners shouldn’t homeowner’s policies provide it?

No Way!

The National Flood Insurance Program (NFIP) had a stranglehold on the flood insurance market for years. Too many people think if they aren’t in a high-risk flood zone they don’t need coverage. And they find out they’re wrong the hard way.

“Kylie is calling from Connecticut. It’s probably nothing, yeah, nothing at all”

Nothing at all, yeah. That’s unless there’s been a coastal storm or rain. Then Kylie is calling from Connecticut for help. She’s washed out. In 1955 back-to-back hurricanes inundated most of the state with rain. The rivers and creeks rose. Farmington, Putnam, Naugatuck, Waterbury, and Winsted were washed out. 87 people died.

And when it rains in Connecticut, it pours.

Even areas of Connecticut considered to be low-risk areas are still at risk. That’s because 20% of all flooding events in the US every year happen in those “low risk” areas.

Did you think about buying flood insurance when you bought your house but said “If the lender doesn’t require it I must not need it”? Maybe the real estate agent told you it wasn’t necessary.

Ever see a big storm coming and think about flooding? When the storm’s on the way, it’s too late to buy insurance. Maybe the flood of 2018 when 8 inches fell over the tri-state area didn’t affect you. But what about the next flood or the one after that?

In Connecticut, a “low-risk” area isn’t a “no-risk” area.

The government has been collecting flood data for the last 50 years. This data shows that recent major storms cause flooding in low-risk areas. And 90% of people who had floodwater in their homes after these flooding events didn’t have flood insurance.

Don’t buy the lie that low-risk equals no-risk. Buy flood insurance!

What Happens When You Flood Without CT Flood Insurance?

When your home is damaged by floodwaters and you don’t have a Connecticut flood insurance policy you must pay to repair the damage.

Flooding is one of the most expensive causes of damage to repair. It can cost $40,000 to $90,000 and that’s not even considering the damage to the contents of your home.

Right now you are saying “Yeah, but if you are such a Flood Nerd you know the government will step in and help”.

Ha!

Government assistance after a flood is another lie. It’s a whopper too.

“The nine most terrifying words in the English language are:

I’m from the Government, and I’m here to help.”

Ronald Regan, 40th President of the US

In order for you to get that government “assistance” all these pieces must fall into place:

√ The Connecticut Governor must request a federal declaration of disaster.

√ The President must declare the area a disaster area to make federal assistance available.

√ You must apply for that assistance.

√ If you get it, the assistance will be in the form of a loan you MUST pay back.

√ That glorious assistance will be about $5,000.

Exactly

You get a loan of about $5,000 to cover an average of $40,000 to $90,000 in damage.

Now you know why so many properties are abandoned or foreclosed after flood damage. In Houston, foreclosure starts after the floods from Hurricane Harvey spiked 76%. People lost everything and just walked away. Sad.

Flooding is the number one natural disaster in the US ~ If you don’t have flood insurance you face financial ruin.

Since 1980, 80% of federal disaster declarations have been for floods.

When that happened, federal assistance helped a little, but too many people discovered that is far better to have flood insurance rather than to rely on the government.

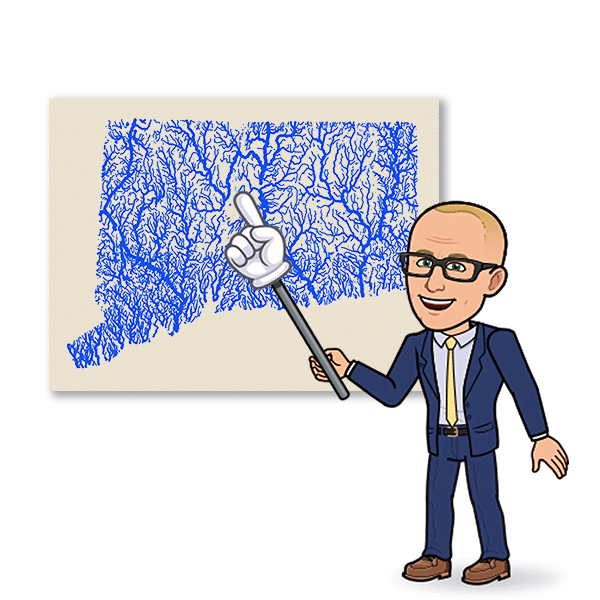

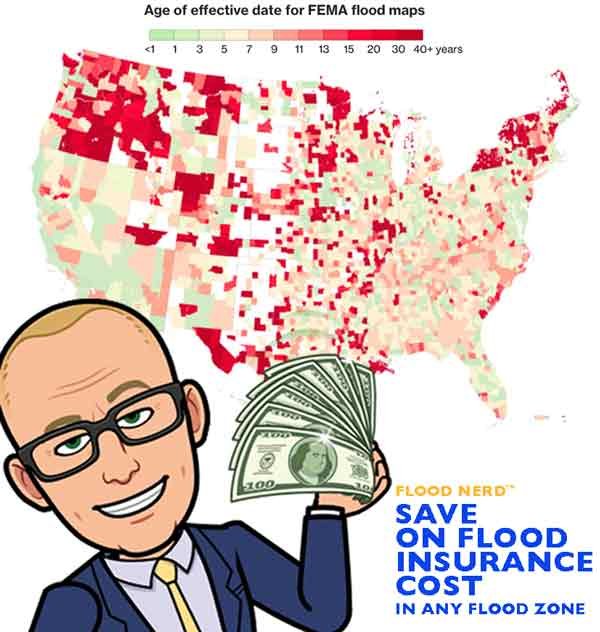

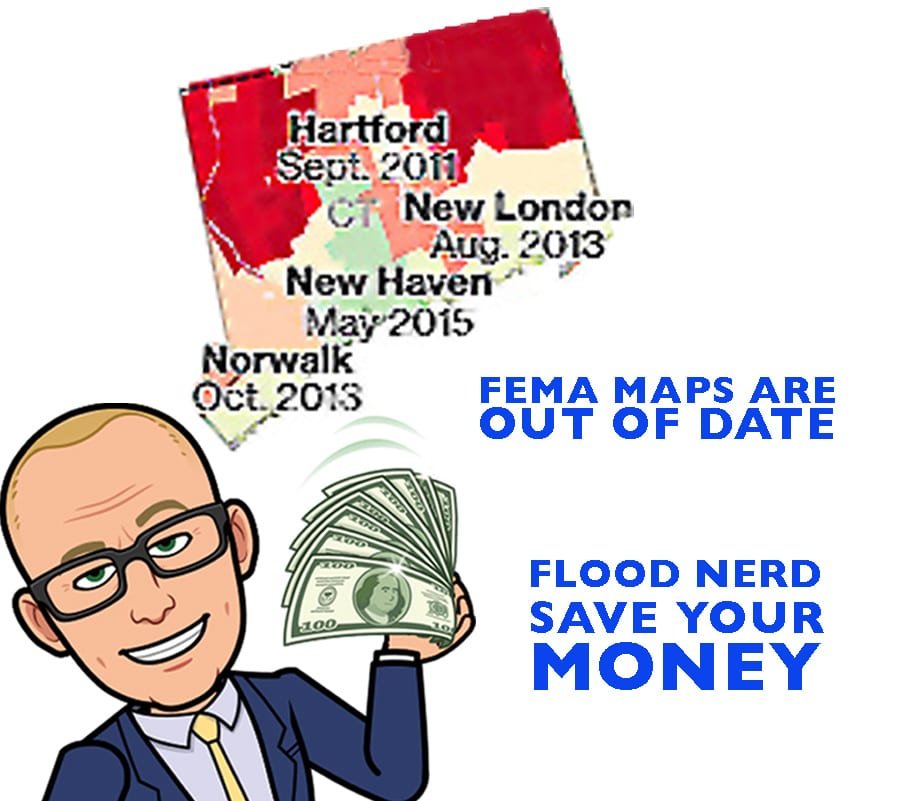

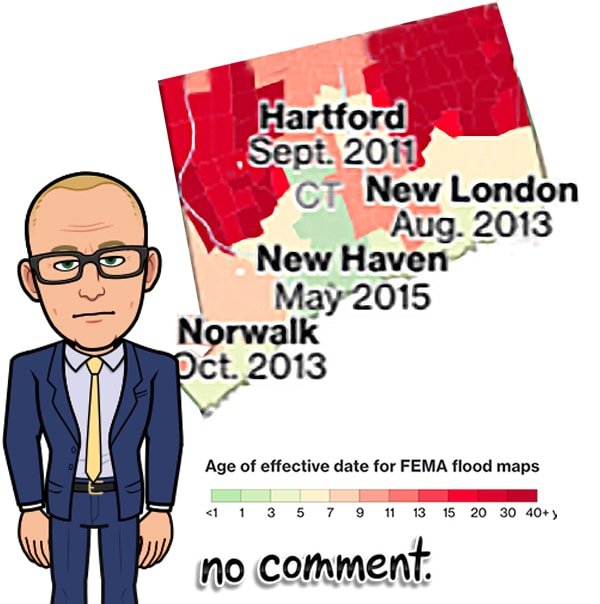

Flood Maps in Connecticut

Many of the flood maps for Connecticut date back to colonial times. Well, not really but they are more than 40 years old. If your property is in an area that has been developed after the flood map was created, the map isn’t accurate anymore. That’s because development literally changes the landscape. Buildings, parking lots, and driveways cover the soil with concrete. Now the land doesn’t absorb water the way it did before. It runs off. So when it rains that water must flow somewhere and that may not be where it flowed before development. Bad maps don’t reflect the actual risk of flooding.

This leaves Connecticut property owners under or uninsured.

And Connecticut has many bad maps. The First Street Foundation (a non-profit think tank that studies this flood stuff) estimates that more than 46,000 Connecticut homes are at a greater risk of flooding than the maps indicate.

After Tropical Storm Irene, only about 30% of losses in Connecticut were covered by insurance.

And Connecticut isn’t alone. In one county in Texas, 134,000 homes flooded during Harvey. Three-quarters of those homes were in low to moderate risk zones. 80% of the people in the low-risk zones didn’t have flood insurance.

Connecticut isn’t just at risk from coastal storms. It seems each Spring, floods from ice dams cause flooding in some parts of the state.

It can flood anywhere in Connecticut.

No matter what the map says, it’s better to have coverage and not need it than to not have coverage and wish you did.

Connecticut Flood Insurance Options

Most homeowners, real estate agents, and lenders don’t realize you have many options when it comes to buying Connecticut flood insurance. But the Flood Nerds know all about getting cheap flood insurance in Connecticut. We know more than 5 Ways to Save on Flood Insurance. In Connecticut, you have basically two markets for flood insurance.

Connecticut NFIP

The National Flood Insurance Program is run by the Federal Emergency Management Administration. This is the government option for flood insurance. They’ve basically had a 50-year monopoly on the market and the premiums reflect their dominance.

The NFIP mainly uses resellers. These companies like Traveller’s, Nationwide, and Progressive (just a few examples) sell you a policy under their company name, but really it’s an NFIP policy with their insurance company’s logo on it.

If you see one of these logos on your flood policy, you have an NFIP policy written through one of these big insurance companies.

This is a government policy in disguise. That’s NOT the way to save money on flood insurance in Connecticut. Wonder if your flood insurance is through a reseller? Check out this list of companies that resell the NFIP policy.

Connecticut Private flood insurance market

Connecticut may be small in square miles, but it is large enough to handle a robust private flood insurance market. You can even tap into the Lloyds of London flood insurance syndicate for Connecticut flood insurance. Often you can get great rates with Lloyds because they spread the risk all over the world. The risk of the entire planet flooding at once is very small. We Flood Nerds joke “God said he wouldn’t flood the world again and Lloyds of London takes him at his word”. Now you know what makes a Flood Nerd laugh.

But getting the right Connecticut flood insurance is no laughing matter. There are so many real private options that it is easy to confuse the private flood insurance market with those NFIP re-sellers. That’s why you need to let a Flood Nerd shop for your cheapest flood insurance in Connecticut.

We shop all the flood insurance options for your property in Connecticut and ensure you get the best premium. We’ll even check out the NFIP to make sure that all the bases are covered.

The Cost of Flood Insurance in Connecticut

Connecticut has everything from coastal cities to rural towns. And it’s blessed with many rivers, streams, and creeks.

One major factor in the cost of flood insurance for Connecticut is the property location and the company you choose to write the coverage. Premiums for homes in low-to-moderate risk are lower and premiums in high-risk areas are higher.

Flood Zone X – Connecticut Low to Moderate Risk Zone

Lenders don’t require flood insurance in this zone. But remember, floods like those from ice dams and storms can happen in low-risk zones, and the map may be old.

For properties in the X Flood Zone, we usually suggest the government Preferred Risk Policy (PRP). The government subsidizes a portion of the premium and limits the coverage, so this keeps the rates low.

The average cost for PRP flood insurance in Connecticut with the maximum coverage limits in low-risk flood zone areas is $699 per year.

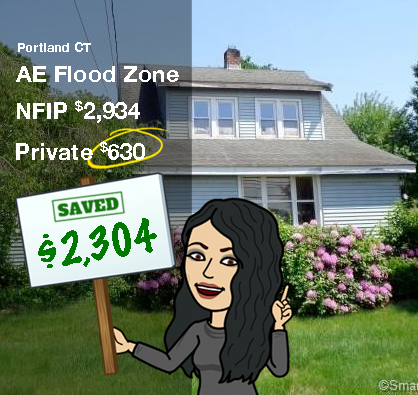

Flood Zone AE in Connecticut

A higher risk flood zone is Flood Zone AE. If your property is in Zone AE, your lender will require you to have flood insurance.

The cost of flood insurance in Connecticut in flood zone AE really depends on factors that are unique to the structure.

As an example, let’s look at a house built on a subgrade basement in Bridgeport. The Base Flood Elevation (BFE) is 135.2 and the home was built before 1920. The sample policy is for flood coverage at the NFIP maximum of $250,000 for the building only. It doesn’t include contents and the deductible is our recommended amount of $5,000.

While the example house is in Bridgeport, the premiums will be the same as in Fairfield, Greenwich, Norwalk, Stamford, Stratford, Banford, Milford, and most other Connecticut cities and counties in AE flood zones.

The NFIP option in Connecticut Flood Zone AE is $3,363.00

This would be the price if the property had a previous flood loss and either doesn’t have an Elevation Certificate or the Elevation Certificate shows the lowest floor is 4 feet under the BFE. This policy lets you use 10% of your coverage to cover other structures on your property

Now, let’s look at the real Connecticut private flood insurance market and compare the options. The coverage and deductible are exactly the same.

The Connecticut Lloyds of London policy would be $864.40

This option is great but they won’t cover a property with a prior flood loss. But they will cover more than the NFIP and about $2,000 for loss of use. $2,000 for other structures doesn’t increase this coverage. They don’t require an elevation certificate.

Connecticut private flood insurance (Not Lloyds) is $2676.00

This option will take properties with one prior flood loss if it was more than 5 years ago and the claim was under $100,000. They will write practically all risks, and you don’t need an elevation certificate.

Replacement Cost Value Coverage

Standard flood insurance provides coverage for a set amount. But with flood insurance from the private marketplace, you can insure for the actual cost to replace the home. These policies must be written for the actual replacement cost. The $250,000 example we are using is probably a little low for replacement cost, but to keep the comparison the same we’ll stick with that amount.

So for $250,000 replacement cost value building coverage, 20% contents coverage, 10% other structures, and 10% loss of use with a $5,000 deductible the annual premium for RCV coverage is $4,064. That’s way more insurance and better coverage for only a slightly higher price than the NFIP!

While the example house is in Bridgeport, the premiums will be the same as in Fairfield, Greenwich, Norwalk, Stamford, Stratford, Banford, Milford, and most other Connecticut cities and counties in AE flood zones.

The NFIP option in Connecticut Flood Zone AE is $3,363.00

This would be the price if the property had a previous flood loss and either doesn’t have an Elevation Certificate or the Elevation Certificate shows the lowest floor is 4 feet under the BFE. This policy lets you use 10% of your coverage to cover other structures on your property

Now, let’s look at the real Connecticut private flood insurance market and compare the options. The coverage and deductible are exactly the same.

The Connecticut Lloyds of London policy would be $864.40

This option is great but they won’t cover a property with a prior flood loss. But they will cover more than the NFIP and about $2,000 for loss of use. $2,000 for other structures doesn’t increase this coverage. They don’t require an elevation certificate.

Connecticut private flood insurance (Not Lloyds) is $2676.00

This option will take properties with one prior flood loss if it was more than 5 years ago and the claim was under $100,000. They will write practically all risks, and you don’t need an elevation certificate.

Replacement Cost Value Coverage

Standard flood insurance provides coverage for a set amount. But with flood insurance from the private marketplace, you can insure for the actual cost to replace the home. These policies must be written for the actual replacement cost. The $250,000 example we are using is probably a little low for replacement cost, but to keep the comparison the same we’ll stick with that amount.

So for $250,000 replacement cost value building coverage, 20% contents coverage, 10% other structures, and 10% loss of use with a $5,000 deductible the annual premium for RCV coverage is $4,064. That’s way more insurance and better coverage for only a slightly higher price than the NFIP!

Flood Zone V and VE in Connecticut

NFIP insurance for homes in the V and VE flood zones of Connecticut is crazy-expensive. Once I saw a premium of $30,000 a year for a single home family. This is ridiculous!!

To save you money, the Flood Nerds shop flood insurance for your V or VE flood zone properties on the private flood market underwritten by Lloyds of London.

We see savings in the thousands with this approach AND we have been able to double and triple coverage for properties on the Connecticut Atlantic coast.

The problem with the NFIP approach is they take a one-size-fits-all approach to coverage. The results are premiums far too high for waterfront houses.

Many coastal Connecticut homes are custom built. The NFIP doesn’t take this into consideration but Lloyds of London other private flood insurers do. They offer variable coverage options as well as significant savings.

For example, a Fairfield home on the Connecticut coast, in a VE flood zone map needs $250,000 of coverage, with no contents coverage and a $5,000 deductible.

The NFIP annual cost for flood insurance in a Connecticut VE flood zone is $12,278.00

Ouch!

The same coverage for the same property on the private market is under $2,500.00

Average Flood Insurance Costs in Connecticut by Area

How much does flood insurance cost in Connecticut? If you look at the number of NFIP policies and the combined premium you can see people pay way too much in Connecticut for flood insurance.

Connecticut has 37,322 NFIP policies in force at a total cost of $52,057,947. That makes the average flood policy in Connecticut $1,394.00 for NFIP. Most of these people would save money if they had private flood insurance! Let’s STOP THE MADNESS!

Bridgeport, CT

Average Cost of Flood

Insurance $1,055

Fairfield, CT

Average Cost of Flood

Insurance $1,610

Greenwich, CT

Average Cost of Flood

Insurance $1,502

Norwalk, CT

Average Cost of Flood

Insurance $1,678

Stamford, CT

Average Cost of Flood

Insurance $992

Stratford, CT

Average Cost of Flood

Insurance $1,421

Westport, CT

Average Cost of Flood

Insurance $1,972

East Hartford, CT

Average Cost of Flood

Insurance $990

Enfield & Farmington, CT

Average Cost of Flood

Insurance $1,188

Glastonbury, CT

Average Cost of Flood

Insurance $1,188

Manchester, CT

Average Cost of Flood

Insurance $1,248

New Britain, CT

Average Cost of Flood

Insurance $1,248

Southington, CT

Average Cost of Flood

Insurance $1,111

West Hartford, CT

Average Cost of Flood

Insurance $1,111

Wethersfield & Windsor, CT

Average Cost of Flood

Insurance $1,391

Clinton, CT

Average Cost of Flood

Insurance $1,338

Old Saybrook, CT

Average Cost of Flood

Insurance $1,619

Westbrook, CT

Average Cost of Flood

Insurance $1,619

Branford, CT

Average Cost of Flood

Insurance $1,475

East Haven, CT

Average Cost of Flood

Insurance $1,515

Guilford, CT

Average Cost of Flood

Insurance $1,515

Hamden, CT

Average Cost of Flood

Insurance $1,842

Madison, CT

Average Cost of Flood

Insurance $1,842

Meriden, CT

Average Cost of Flood

Insurance $1,842

Melford, CT

Average Cost of Flood

Insurance $1,067

New Haven, CT

Average Cost of Flood

Insurance $1,529

West Haven, CT

Average Cost of Flood

Insurance $1,085

East Lyme, CT

Average Cost of Flood

Insurance $1,106

Groton, CT

Average Cost of Flood

Insurance $1,984

Noank, CT

Average Cost of Flood

Insurance $1,310

Stonington, CT

Average Cost of Flood

Insurance $1,672

Waterford, CT

Average Cost of Flood

Insurance $1,672

Norwich & Old Lyme CT

Average Cost of Flood

Insurance $1,455

Groton Long Point

Average Cost of Flood

Insurance $1,984

New London, CT

Average Cost of Flood

Insurance $1,310

Bridgeport, CT | Fairfield, CT | Greenwich, CT | Norwalk, CT | Stamford, CT |

Stratford, CT | Westport, CT | East Hartford, CT | Enfield & Farmington, CT | Glastonbury, CT |

Manchester, CT | New Britain, CT | Southington, CT | West Hartford, CT | Wethersfield & Windsor, CT |

Clinton, CT | Old Saybrook, CT | Westbrook, CT | Branford, CT | East Haven, CT |

Guilford, CT | Hamden, CT | Madison, CT | Meriden, CT | Melford, CT |

New Haven, CT | West Haven, CT | East Lyme, CT | Groton, CT | Noank, CT |

Stonington, CT | Waterford, CT | Norwich & Old Lyme CT | Groton Long Point | New London, CT |

How much does flood insurance cost Connecticut

COST OF FLOOD INSURANCE IN CONNECTICUT

Currently, the state of Connecticut has had 37,322 NFIP policies in force to date with the total cost of $52,057,947 that would make the average for our state $1,394 of course, some will pay more and some will pay less.

COST OF FLOOD INSURANCE IN BRIDGEPORT, CT

Bridgeport has 1,669 NFIP flood policies and pays a total of $1,761,961 to the federal government for your flood insurance. This makes the average cost $1,055. If you pay more, let a Flood Nerd give you a free quote.

COST OF FLOOD INSURANCE IN FAIRFIELD, CT

The Town of Fairfield pays an average of $1,610 for flood insurance. There are 2,330 policies that cost $3,751,889.

COST OF FLOOD INSURANCE IN GREENWICH, CT

The Town of Greenwich CT has 1,673 NFIP policies and pays a total of $2,513,183 . That makes the average flood insurance premium in Greenwich CT $1,502. As the home of many hedge funds and financial services, let’s be smarter with money. I think a Flood Nerd can shop for better coverage and a better price.

COST OF FLOOD INSURANCE IN NORWALK, CT

Norwalk Connecticut has endured hurricanes and flooding. The average NFIP flood premium in Norwalk is 1,678. You can do better on the private flood insurance market. By the way, that average is based on 2,089 flood policies paying a collective $3,506,434.

COST OF FLOOD INSURANCE IN STAMFORD, CT

Stamford has 2,585 flood policies and pays a total of $2,565,180, making your average flood policy $992. Your average is one of the best in Connecticut.

COST OF FLOOD INSURANCE IN STRATFORD, CT

There are 1,891 FEMA flood policies in Stratford CT that cost a grand total of $2,687,800. That’s an average flood policy premium of $1,421.

COST OF FLOOD INSURANCE IN WESTPORT, CT

Westport has 1,289 government flood insurance policies that send $2,413,290 to the federal program making the average policy $1,972. The good news is that while 26% percent of the town residents live within FEMA’s high-risk flood areas, your town takes flooding seriously and works with the government on flood mitigation measures. As a result, you might find better coverage outside the NFIP program.

COST OF FLOOD INSURANCE IN EAST HARTFORD, CT

East Hartford has 496 flood policies and pays a total of $491,133 to FEMA. That makes the average flood policy $990. If you are paying more than this it might be time to shop.

COST OF FLOOD INSURANCE IN ENFIELD, CT

COST OF FLOOD INSURANCE IN FARMINGTON, CT

COST OF FLOOD INSURANCE IN GLASTONBURY, CT

Enfield, Farmington, and Glastonbury CT pay an average flood premium of $1,188. This area combines 493 flood policies that cost $585,739. If you are one of the folks hit by a huge increase in national flood insurance cost, let a Flood Nerd shop your options and see if we can bring the price down through the private market.

COST OF FLOOD INSURANCE IN MANCHESTER, CT

COST OF FLOOD INSURANCE IN NEW BRITAIN, CT

The Towns of Manchester and New Britain Connecticut combined for 311 flood policies that cost you $388,340. That makes your average flood insurance premium $1,248 for government (not private) flood insurance.

COST OF FLOOD INSURANCE IN SOUTHINGTON, CT

COST OF FLOOD INSURANCE IN WEST HARTFORD, CT

Wethersfield, and Windsor Connecticut pay an average of $1,391 for national flood insurance. There are 267 flood policies with NFIP and paying a total of $368,485. It looks like the Flood map is over 30+ years old. The private flood insurance market may offer better premiums and coverage.

COST OF FLOOD INSURANCE IN WETHERSFIELD, CT

COST OF FLOOD INSURANCE IN WINDSOR, CT

Wethersfield, and Windsor, CT your average flood policy is around $1,391 with 267 flood policies with NFIP and paying the total of $368,485. I pause to wonder if you are overpaying for your flood insurance it looks like the Flood map is over 30+ years old hasn’t the community grown during that time?

COST OF FLOOD INSURANCE IN CLINTON, CT

Clinton Connecticut has 676 active flood insurance policies that cost $904,816 total for NFIP coverage. The average policy is $1,338 in Clinton for government food insurance. If you pay more, let a Flood Nerd shop the private market and get a free quote.

COST OF FLOOD INSURANCE IN OLD SAYBROOK, CT

COST OF FLOOD INSURANCE IN WESTBROOK, CT

Old Saybrook and Westbrook Connecticut have 1,972 flood policies written through the government and pay total premiums of $3,194,636. Your average is about $1,619 for government flood insurance.

COST OF FLOOD INSURANCE IN BRANFORD, CT

Branford pays an average flood insurance premium of $1,475. That’s based on 1,255 NFIP flood policies that cost a total of $1,852,004.

COST OF FLOOD INSURANCE IN EAST HAVEN, CT

COST OF FLOOD INSURANCE IN GUILFORD, CT

East Haven and Guilford Connecticut combine for 1,569 flood policies and cost $2,377,035. The average flood premium is $1,515 for government flood insurance in New Haven County. I think the private market will save you money. Get a free quote from one of my Flood Nerds.

COST OF FLOOD INSURANCE IN HAMDEN, CT

COST OF FLOOD INSURANCE IN MADISON, CT

COST OF FLOOD INSURANCE IN MERIDEN, CT

Hamden, Madison and Meriden Connecticut combined have 930 flood policies that cost $1,713,713. The average flood insurance policy for this area is $1,842. I think you pay too much for government flood insurance and a Flood Nerd can get that premium down with private flood insurance.

COST OF FLOOD INSURANCE IN MELFORD, CT

Melford Connecticut has 2,876 flood policies and a total premium of $3,070,699. The average government flood insurance policy costs $1,067 for Melford.

COST OF FLOOD INSURANCE IN NEW HAVEN, CT

New Haven pays an average of $1,529 for government flood insurance. There are 933 flood policies that pay $1,427,045 to the federal program.

COST OF FLOOD INSURANCE IN WEST HAVEN, CT

West Haven, Connecticut is home to 1,051 NFIP policies and that cost a grand total of $1,140,505. That makes the average West Haven flood policy cost $1,085.

COST OF FLOOD INSURANCE IN EAST LYME, CT

East Lyme has 404 flood policies that cost a total of $447,195. This makes your average $1,106 for government flood insurance.

COST OF FLOOD INSURANCE IN GROTON LONG POINT, CT

COST OF FLOOD INSURANCE IN GROTON, CT

Groton Long Point and Groton Connecticut combine for 744 flood policies that cost a total of $1,476,791. That makes the average flood insurance cost $1,984. You can do better with the private flood insurance market.

COST OF FLOOD INSURANCE IN NEW LONDON, CT

COST OF FLOOD INSURANCE IN NOANK, CT

New London and Noank Connecticut have a combined 384 flood policies that collectively cost $503,333. The average flood insurance premium for government flood insurance is $1,310.

COST OF FLOOD INSURANCE IN NORWICH, CT

COST OF FLOOD INSURANCE IN OLD LYME TOWN, CT

Norwich City and Old Lyme Town combine for 783 active flood policies that pay a total of $1,139,604. This makes the average flood insurance cost $1,455.

COST OF FLOOD INSURANCE IN STONINGTON, CT

COST OF FLOOD INSURANCE IN WATERFORD, CT

Stonington and Waterford Connecticut pay an average of $1,672 for government flood insurance. There are 1,438 NFIP policies that cost a total of $2,405,632.

Finally – Consider This About the NFIP!

If you’ve made it to the end of this page you deserve something special. And that’s the inside scoop on the NFIP!

The NFIP made flood insurance available to more than 20,000 communities in the United States. That’s great. But, Connecticut has its own private flood insurance market and these private flood insurance markets usually cost less than the government option.

For decades, the NFIP over-charged 50% of its policyholders and under-charged the other 50% all while racking up $42 billion in taxpayer-funded losses.

Now if you overcharge half and undercharge half nobody one pays the right amount. Why gamble that you will be in the undercharged half?

About 30% of NFIP claim payments go to the same 3% of insured loss structures year after year. This means that the other 97% of flood-exposed policyholders are footing the bill and could escape this craziness by switching to private flood insurance.

It doesn’t make sense to risk losing everything if you don’t have flood insurance. And it doesn’t make sense to overpay for flood insurance.