Washington Flood Insurance That Saves You BIG – Fast & Affordable!

Most homeowners overpay for flood insurance without knowing it. Get the best rates, guaranteed coverage, and instant quotes—so you can stop worrying today.

$2.3M+

Annual Premium Savings

4.9★

Average Ratings

445+

Reviews

5,497+

Happy Clients

Save Money on your flood insurance in Washington State

We Get It,

Buying Flood Insurance in Washington State Is Confusing…

You might be asking:

• What coverage do I need?

• How much is flood insurance in Washington State going to cost me?

• How much can I save?

It’s okay, your search for cost-effective Washington State flood insurance that doesn’t compromise on coverage ends here.

Meet The Flood Nerd™

Your Washington State Flood Expert, Friend, and Guardian

In 2015, Robert Murphy, inspired to help homeowners and businessowners alike, entered the insurance brokerage market with one goal in mind: To help uncertain WA homeowners find affordable, high quality flood insurance that doesn’t compromise on coverage.

We Find You Great Coverage

While Saving You Up To $1,457+ A Year!

What you seek is:

Enhanced security for your Washington State Property.

Significant savings.

Absolute freedom.

Unwavering certainty.

Memorable moments.

Quality family time.

Peaceful travels.

It's As Easy As 1, 2, 3!

1

Fill Out Our Online Form

Complete our easy quote form so we can understand your needs & personalize your rates.

2

Get An Instant Quote

Our team scours insurance companies nationwide to instantly present the best coverage & rate options for your needs.

3

Get Coverage

If you’re happy with the coverage options, you can sign up easily directly from our online portal.

Recent Flooding Events and Changing Weather Patterns in Washington

In recent years, Washington state has experienced an increase in severe flooding events, likely exacerbated by changing weather patterns and climate change. Major flooding incidents like the record-breaking rainfall and subsequent flooding in November 2021, which impacted western Washington counties, serve as stark reminders of the state’s vulnerability to these natural disasters. The catastrophic damage caused by these events highlights the importance of being proactively prepared with adequate flood insurance coverage, even in areas that were previously considered low-risk.

The impacts of these recent flooding events have been significant across Washington. The November 2021 floods, triggered by an atmospheric river event, caused widespread damage across multiple counties, with an estimated 500 homes and businesses impacted in Whatcom County alone. In Lewis County, over 20 miles of roads and infrastructure sustained substantial damage, with repair costs projected to exceed $5 million.

Furthermore, preliminary assessments by FEMA indicate that the flooding may lead to the redrawing of flood maps for certain areas, potentially reclassifying some regions as higher-risk flood zones. These events underscore the dynamic nature of flood risks and the importance of regularly reassessing and updating flood preparedness measures, including adequate insurance coverage, to protect residents and property owners in Washington.

Does my homeowner’s insurance cover flooding?

Do I need flood insurance in Washington?

What are my flood insurance options in Washington state?

Washington NFIP flood insurance

Washington private flood insurance market

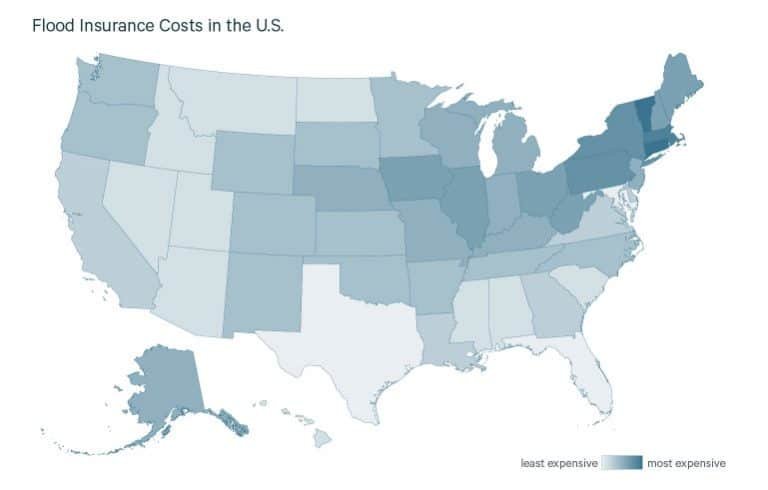

How much does flood insurance cost in Washington State?

How to save money on Flood Insurance in Washington state’s VE flood zone

Five things you need to know about flood insurance in Seattle WA

Washington Flood Insurance calculator

Cost of flood insurance in Washington? (click on your city to find the average)

Chelan County, WA | Clallam County, WA | Clark County, WA | Vancouver, WA | Woodland, WA |

Cowlitz, WA | Aberdeen, WA | Hoquiam WA | Ocean Shores, WA | Island County, WA |

Auburn & Bellevue, WA | Port Townsend, WA | Kent, WA | King County, WA | North Bend, WA |

Redmond, WA | Renton, WA | Seattle, WA | Snoqualmie, WA | Centralia, WA |

Chehalis, WA | Mason, WA | Okanogan County, WA | Long Beach, WA | Orting WA |

Pierce County, WA | Puyallup, WA | Summer City, WA | Tacoma, WA | University Place, WA |

Burington WA | Skagit County, WA | Snohomish County, WA | Stanwood & Sultan, WA | Thurston County, WA |

Whatcom County, WA | Ferndale & Everson, WA | Toppenish, WA | Yakima & Wapato, WA | Yakima County, WA |

Olympia, WA | Lummi Indian Res., WA | Pacific County, WA | Jefferson County, WA | Kelso, & Longview, WA |

Does homeowner insurance cover flooding?

A typical Washington homeowners policy written through Farmers, State Farm, Allstate, and Progressive, for instance, exclude flooding as something that the policy covers under their homeowner’s policy.

In most cases, the only way to get flood coverage is by purchasing a stand-alone flood insurance policy. However, you should ask your homeowners agent if you can get an endorsement of your homeowner’s policy to cover flooding. Don’t be too surprised if the answer is NO.

Do you Need flood insurance in Washington?

It is important to have flood insurance coverage in Washington because our beloved state has seen a fair share of flooding.

Most Homeowners who own property in Washington think about flood insurance at some point, maybe before buying a home or during the closing process, however, many of us only think about it when a big storm is looming or we have heard on the news that there is flooding forecasted. This time is too late.

If your home or business is in a flood zone that is considered a low flood-risk area, you are still at risk.

You may decide to forgo purchasing flood insurance coverage.

Your real estate agent and other insurance agents out of ignorance about the real risk might have told you-you didn’t need flood insurance because the property is in a non-lender-required flood zone.

Statistically, 20-percent of all flooding events across our nation come in areas that are considered low risk.

And our last few significant storms there was flooding in these low-risk areas an 90 percent of all those who had flood water in their home or building didn’t have flood insurance coverage.

We often hear that people believe that the government will help them, and this is true.

However, a few things must align for you to get government assistance.

1) the president of the united states must declare the flooding event as a state of emergency if this doesn’t happen, then there won’t be assistance.

2) the average amount of aid a homeowner gets after a flood when they do not have flood coverage is $5,000, the average cost of damage to one’s property after a flood is $38,000+, and that $5K you get from the government? It comes as a loan, and you will need to pay it back. Are you willing to gamble your financial future by forgoing flood insurance coverage?

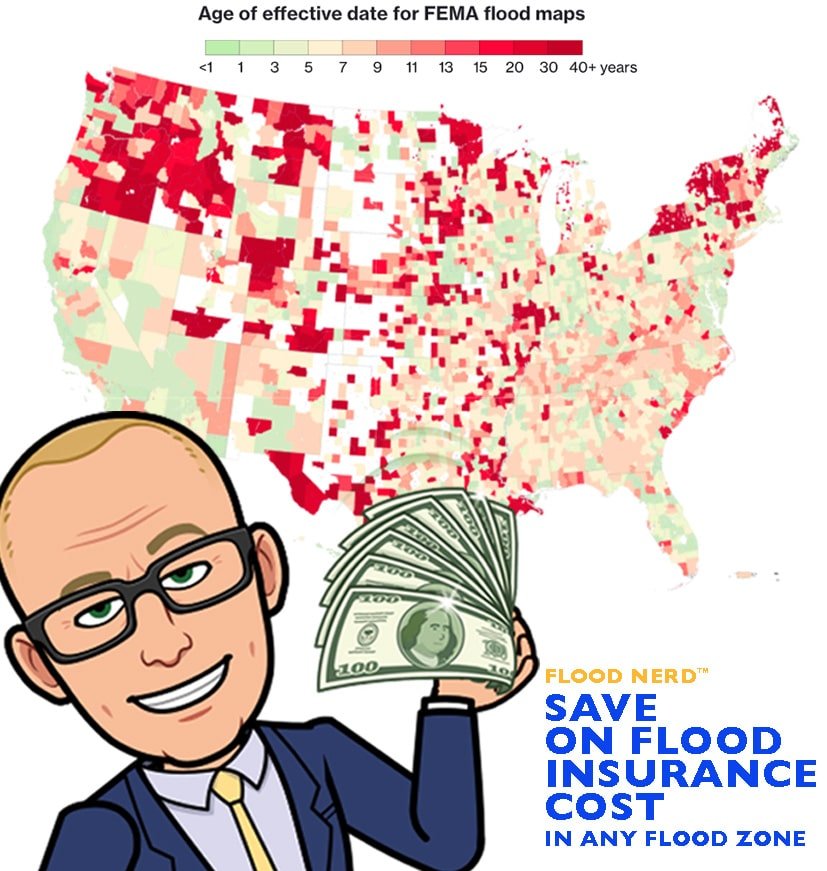

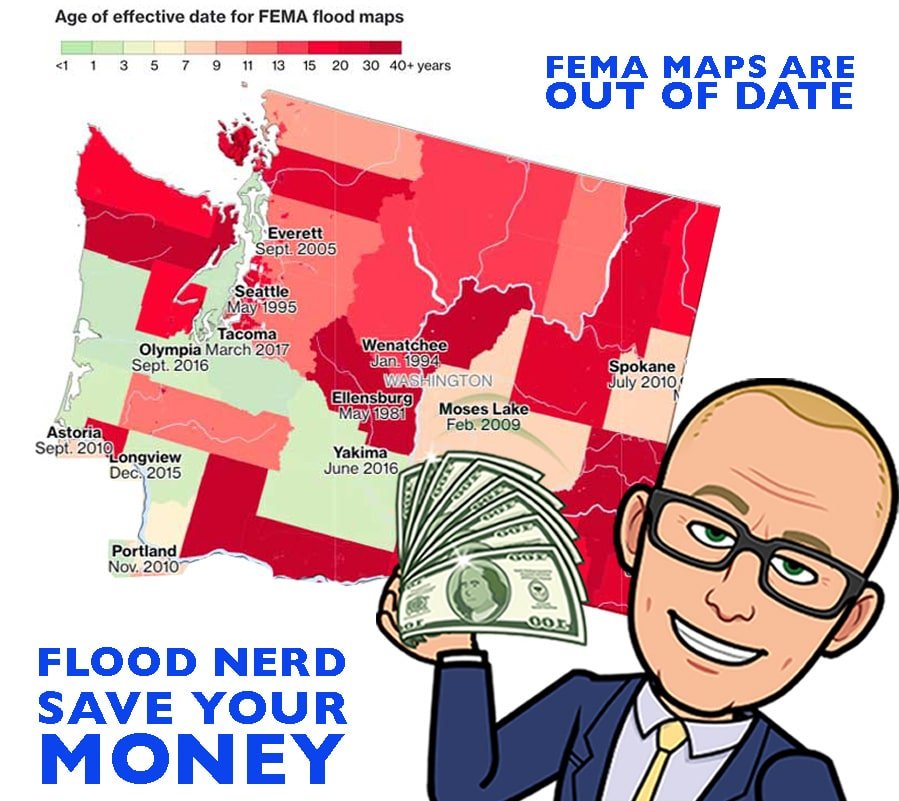

One more note on these low-risk flood zone maps. Many of them are over 40+ years old.

If the area was developed, there is likely more concrete creating a barrier for land that might have absorbed the massive downpour.

Because of all these factors, it is tough for property owners to know their actual risk of flooding. FEMA admits that their flood maps only give an idea of part of the risk. Our recent storms are facts that it can rain anywhere within Washington’s borders, and you should consider getting flood coverage so you are not uninsured when you need it most.

Fema flood zone maps often take years to go into effect after the terrain was studied; this gives the impression that the area is “more up to date” than it is.

The average cost for flood insurance in Washington in these Low-risk areas is $405 – $700 per year

FEMA’s National Flood Insurance Program (NFIP), and all federally backed lenders rely on these maps to assess risk, set premiums and determine who is required to purchase flood insurance.

Inadequate information about an area’s flood risk can leave property owners under or uninsured.

What are my flood insurance options in Washington?

Washington NFIP flood insurance.

There are many options available in Washington regarding flood insurance, but they fall into two main categories.

The Government option also called the NFIP, FEMA, or The Private flood insurance market.

The National Flood Insurance Program (NFIP), also known as FEMA, is the government option for flood insurance. The NFIP has enjoyed a 50-state monopoly on the flood insurance market.

Not private flood insurance but NFIP Resellers

Suppose you have Nationwide flood insurance, State Farm Flood Insurance, Progressive Flood Insurance, or any of the logos below. In that case, you are buying the NFIP flood policy that has their logo on the declaration page and are just reselling through a government program. These companies are private companies, but their flood insurance is not. Here is a list of the 70 companies that resell the NFIP policy.

Washington private flood insurance market

There are alternatives to the NFIP or government insurance, and this is called Private flood insurance most notably Lloyds of London Flood insurance. However, there are other options available in Washington. We shop all the possibilities for your property in your region to ensure you are getting the best premium if you are ready to have us do the work for you click here.

Our shopping includes the NFIP because sometimes we find that you can get a much better premium with government subsidies.

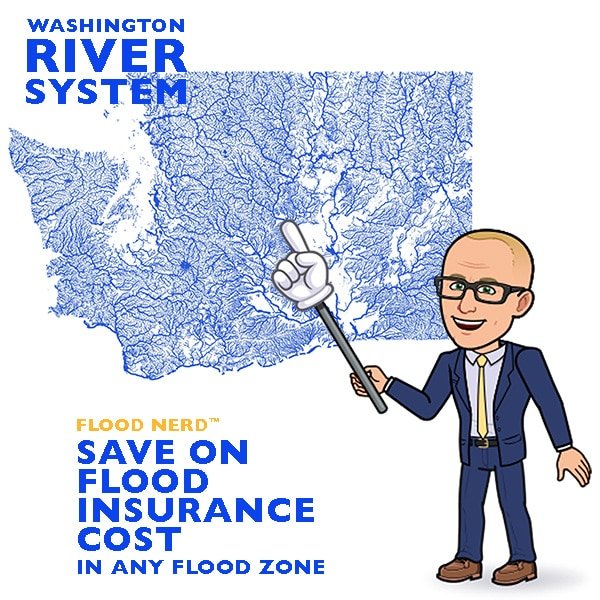

Understanding Flood Risks in Washington State

Flooding in Washington state has been a persistent concern, with many areas prone to these natural disasters. The state’s diverse geography, from coastal regions to river basins and mountainous terrain, contributes to the flood risks faced by residents and property owners. Accurate flood maps and understanding localized flood patterns are crucial for assessing potential threats and implementing effective mitigation strategies.

Washington state flood maps, maintained by FEMA, play a vital role in identifying high-risk areas and informing flood insurance requirements. However, these maps are constantly evolving as new data becomes available and weather patterns shift. Property owners are encouraged to regularly check the latest flood maps for their area to ensure they have a comprehensive understanding of their flood risks and insurance needs. The average cost of flood insurance in Washington state can vary significantly based on factors such as location, elevation, and flood zone classification.

Lloyds of London flood Insurance Washington Market

Washington is fortunate to have many Lloyds of London flood insurance options. Although many flood insurance companies will have you assume that there is only one option, nothing could be further from the truth.

Lloyd’s of London has a rich history attributed to having invented the first modern insurance model. Unlike most of its competition, Lloyd’s of London is not a company but rather a corporate body; this structure works quite well since it has been around for over 330 years. Lloyd’s operates under multiple financial backers pooling their capital to spread the risk.

I have two blog post that takes a deep dive into Lloyd’s of London and what they mean to Washington’s flood insurance market if you are interested, the links are below.

Lloyd’s of London Flood Insurance

Lloyd’s also ensures the world for flood insurance, meaning they cover flooding events in India, Australia as well as much of Europe, you see the “game” of insurance is to spread your risk. Since Lloyds is worldwide they can easily do this.

My joke here is that Lloyds is banking on God’s promise that he won’t flood the entire world again, …..so they won’t have to pay out the whole worlds flood claim.

Many factors go into getting the Cost of flood insurance for Washington if your home in what is considered a low-to-moderate risk.

Washington’s low-to a Moderate Risk rate and cost.

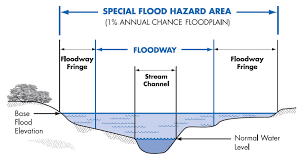

(This is Flood Zone X) which is not a lender-required flood zone.

This flood policy is usually identified as an X-flood zone then we would suggest the government Preferred Risk Policy (PRP) which is a subsidized policy and has set flood insurance coverage limits (see the grid below)

The average cost for flood insurance in Washington with the maximum set limits in these Low-risk flood zone areas is $405 – $700 per year

The average cost of flood insurance in Washington state can vary greatly depending on several factors. According to data from FEMA’s National Flood Insurance Program (NFIP), the average annual premium for flood insurance in Washington is around $900. However, this figure can be significantly higher or lower based on the specific location and flood risk level of a property. For instance, homes in high-risk flood zones, such as those classified as Flood Zone AE or VE, can expect to pay substantially more for coverage, often exceeding $1,500 annually. Conversely, properties in low-to-moderate risk areas may qualify for the NFIP’s Preferred Risk Policy, which can cost as little as $400 per year. It’s also important to note that these costs can fluctuate over time due to factors like changes in flood maps, insurance rate revisions, and the occurrence of major flooding events in the area. Consulting with a flood insurance specialist can help Washington residents accurately assess their specific risks and obtain quotes tailored to their property’s unique circumstances.

Suppose your property is in a higher-risk flood zone, usually identified with a Flood zone AE. Your lender will require you to have flood insurance

The cost of flood insurance in Washington depends on many factors unique to the structure. We are going to try to give you an idea of the most common homes we see in Washington with subgrade crawlspaces.

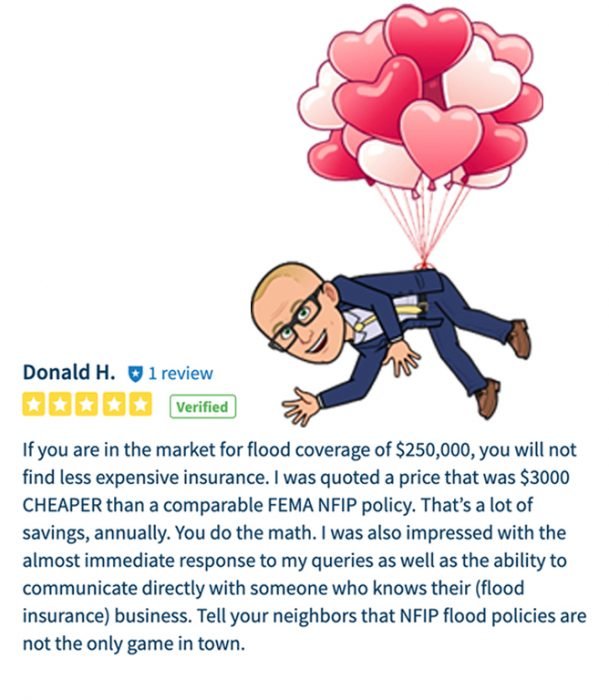

We will look at the cost of flood insurance for the NFIP maximum of $250,000 for the (building only) with NO CONTENTS and our recommended deductible of $5,000.

We will rate all these examples on the NFIP and on a few of our Lloyds options.

Cost of Flood Insurance in Washington in high-risk flood zone AE

Cost of Flood Insurance in Washington (WA) State within a High-risk Flood zone

Our example is Mount Vernon, but the premiums will be the same if in Seattle, Centralia, Burlington, Snoqualmie, Redmond, Vancouver, Aberdeen, Hoquiam, North Bend, and many other Washington state flood zones.

We will rate all these examples on the NFIP and on a few of our Lloyds options.

Cost of Flood Insurance in Colorado in high-risk flood zone AE.

Our example is in Mount Vernon, but the premiums will be the same if in high-risk flood zones in Chelan County, Clallam County, Clark County, Cowlitz County, Grays Harbor County, Island County, King County, Kitsap County, Kittitas County, Lewis County, Mason County, Okanogan County, Pacific County, Pierce County, Skagit County, Snohomish County, Thurston County, Whatcom County, and Yakima County.

In our example, the Base Flood Elevation (BFE is 29) is a home built before 1973.

NFIP option in Washington state Flood Zone AE

Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

NFIP Annual premium in High-Risk flood zone is $1,095.00

This option is what we see if the property has had a flood loss before and either doesn’t have an Elevation Certificate applied or the Elevation certificate showing that the lowest floor is 4 feet under the BFE for the area. You can use 10% of your coverage to cover other structures on your property

How much does Washington (WA) private flood insurance cost? – Lloyds of London Flood Insurance in Washington State (option 1)

Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

Lloyds of London Washington State (option 1)

The annual premium in a High-Risk flood zone is $842.33

This option is great, and we are thrilled when we can get this option. They can be a bit choosey about what risk they will accept and will not take anything that has had a flood loss. They do offer coverage for basements (one of the few). This policy also has about $2,000 for loss of use. $2,000 for other structures can’t increase this coverage, so if you have a larger structure, please speak with your agent about how to increase this coverage or maybe get a separate policy for this “other structure” on your property. They do not require an Elevation Certificate to rate.

Washington Private flood insurance – Lloyd’s of London Flood Insurance

(option 2)

Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

Lloyd’s of London (option 2) Annual premium in High-Risk flood zone is $776.78

This option is great, and we are delighted when we can get this option for our clients as well. They seem to be writing almost all risks. However, they do not write any property that is in a designated floodway or has a depth of -4 under the BFE in our example, with our BFE being 29, if the lowest floor is 25, then they will not accept this risk, they will not take anything that has had a flood loss. They offer limited basements coverage, about 2% of the building coverage (this is better than the NFIP but not exactly what we would like to see – better than nothing, though). They do not require an Elevation Certificate to rate. And as a percentage of coverage for loss of use, usually 10% of coverage. If you want coverage for other structures, then that will need to be added to this policy. Note: make sure to tell your agent if there are any other structures on the property if the policy doesn’t have that written on the policy, there will not be coverage for any other structure.

Private Flood insurance option (option 3)

Washington Private flood insurance (option 3), Not Lloyd’s

Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

The annual premium in a High-Risk flood zone is $2,850.00

This option will take properties that have had one flood loss before as long as it has been more than five years and the payout was under $100,000 on the claim. Their coverage matches the NFIP. I will write practically all risks, don’t need an elevation certificate to rate, and are sometimes a bit lower in premium than the NFIP. In this case, the NFIP Lloyd’s and NFIP are beating this option.

Washington State V and VE flood zones

V and VE flood zones with the NFIP can be extremely expensive. We have seen a premium that is $30,000 a year for a single-home family. This is ridiculous!!

We suggest you let us shop your V or VE flood zones onto the private flood Market that Lloyds of London underwrite.

We have been able to double or even triple coverage for oceanfront properties.

The main issue that we see with beachfront properties is that on the NFIP, they have a one-size-fits-all solution, and many properties are paying over what we consider is a fair premium for waterfront houses.

How to save money on Flood Insurance in Washington state’s VE flood zones

All homes that are ocean-facing are custom built, so with this special consideration, our Lloyds of London VE flood zone and other Private Flood Insurance options for oceanfront properties consider this with variable coverage options and significant savings. Below is a case study for a property we were shopping for just last week.

Our example was in a VE flood zone map in the Copalis Beach, WA, area.

For the coverage of $250,000 with no contents and a $5,000 deductible, the NFIP annual cost for flood insurance in a VE flood zone is $13,859.00. Ouch!

Since we are who we are and experts in Flood Insurance, we will look at every property in every way possible to ensure that we are getting the best premium for our clients, and WE often Do (smile wink)

We tried this same property on our Private flood options and were able to get the premium to under $2,500, and we have, in some cases with similar properties, get the annual premium to $600. This was a feather in our cap and made our clients very happy. Again all properties are unique in these VE flood zones, but if we can find a private flood policy for you, we guarantee it will be better than the NFIP option. Let us help you save money today.

Things you need to know about flood insurance in Washington State

COST OF FLOOD INSURANCE IN WASHINGTON STATE

Currently, Washington State has 35,250 NFIP policies in force to date with a total cost of $31,765,783, which would make the average for our state $901.00; of course, some will pay more, and some will pay less.

Let us do your Flood Insurance shopping to guarantee you get the best rate.

COST OF FLOOD INSURANCE IN CHELAN COUNTY, WASHINGTON STATE

Chelan County, you have 418 flood policies and are paying a total of $255,672 to the federal government for your flood insurance, making your average cost $611.65. If you are paying more, let us shop for a new policy might be a good idea.

COST OF FLOOD INSURANCE IN CLALLAM COUNTY, WASHINGTON STATE

Clallam County, your average is $900.51 with 365 policies and paying a total of $328,688. What a beautiful place to live for “the strong people” and Sol Duc River or along the shores of Lake Crescent or Hoh River. We would be honored and willing to shop a flood policy for any Werewolf, Shape Shifter, or Vampire who would like to save money on their flood insurance.

Clark County has 525 NFIP policies and is paying $352,142. Making your average $670.74, which is an excellent price for flood insurance if you are getting this price, keep the policy in place as long as you can; if you aren’t getting this price, it might be a good idea to look for another option or have us Flood NERDS shop for you.

COST OF FLOOD INSURANCE IN VANCOUVER, WASHINGTON STATE

City of Vancouver, Washington life and festivals continue even if flooding is forecasted love this drive. I guess paying the average of $859.86 for flood coverage through the NFIP allows you to know you will be covered in the event of a flood for a reasonable premium. With 447 flood policies and paying collectively $384,454. This interactive city map is fantastic.

COST OF FLOOD INSURANCE IN WOODLAND, WASHINGTON STATE

In Woodland, Washington, you have 513 flood policies and are spending a total of $385,360, making your average flood policy $751.19. Being the home of the Hulda Klager Lilac Garden, I bet the city smells amazing from April through May. Although we don’t sell Volcano insurance, we can help you with your flood insurance if you pay more than the average $751.19. Let us see if we can find better coverage at a better price. And buy Volcano insurance.

COST OF FLOOD INSURANCE IN COWLITZ, KELSO, AND LONGVIEW, WASHINGTON STATE

County of Cowlitz, WA, the City of Kelso, and the City of Longview, collectively, you have the 885 FEMA flood policies and are paying a total of $573,926 with the average flood policy of $648.50. With the rich Columbia River and Kalama River, my mouth is watering with the anticipation of the smoked salmon I intend to have with my scrambled eggs, spinach, feta cheese, and sourdough toast. The Smoked Salmon is from WA, of course. =)

COST OF FLOOD INSURANCE IN ABERDEEN, WASHINGTON STATE

In Aberdeen, WA, you have 470 National flood insurance program policies that pay a total of $722,484 to the federal program making the average cost of flood insurance $1,537.20. I would love to help you see if we can find a better premium for you. We are flood experts (Flood NERDS) and can help commercial properties, Condominium HOA, and residential properties control flood insurance costs and the Private flood insurance market in WA is growing. Let us shop for you by filling out our intake form.

COST OF FLOOD INSURANCE IN HOQUIAM, WASHINGTON STATE

Hoquiam, WA, has 572 flood policies and pays a total of $898,973 to FEMA, making your average flood policy $1,571.63. I would think we can do better.

COST OF FLOOD INSURANCE IN OCEAN SHORES, WASHINGTON STATE

Ocean Shores, you understand the draw of the water is on a peninsula and all your inter-connected lakes and canals. And you have your share of bird species. $411.86 is the average flood policy for this area (you guys have one of the best premiums considering all the water). If you aren’t paying this amount or if your NFIP premium jumps way up (+25% is forecasted shortly), it might be a good idea to keep your options open and let the flood nerds shop. You have 608 flood policies and are paying a total of $250,420

COST OF FLOOD INSURANCE IN ISLAND COUNTY, WASHINGTON STATE

Island County, Washington, is my favorite, with all the bridges and water. You have 946 flood policies and are spending $1,078,829. Bringing your average to $1,140.41. I have a deal for you if I can save you money and you rent your home for VRBO, let me know that I would love to spend a week in this beautiful country.

COST OF FLOOD INSURANCE IN AUBURN, AND BELLEVUE, WASHINGTON STATE

COST OF FLOOD INSURANCE IN PORT TOWNSEND AND JEFFERSON COUNTY, WASHINGTON STATE

Auburn, WA; Bellevue, WA; Port Townsend, WA and Jefferson County, WA. We have been blessed to work with many amazing real estate professionals and lenders in this area. We have had much success in saving them significant time and money on flood insurance for their clients, with 846 flood policies paying a total of $669,232. The average cost of flood insurance in this area is $791.05 if you are getting quotes higher, let us see what we can do for you.

COST OF FLOOD INSURANCE IN KENT, WASHINGTON STATE

City of Kent, WA, your average flood policy is around $1,226 with 715 flood policies with NFIP and a total of $876,892. I pause to wonder if you are overpaying for your flood insurance. It looks like the Flood map is over 24 years old. Hasn’t the community grown during that time?

COST OF FLOOD INSURANCE IN KING COUNTY, WASHINGTON STATE

King County, WA, you are our leader in flood policies for Washington State, with 2,290 active flood insurance policies and paying $1,991,568 total for the NFIP coverage. The average cost of flood insurance is $869.68. If you do not see this price, let us know what we can do for you. We guarantee to shop the plan to validate options within your region so you get a fair picture of what flood insurance should cost in your area.

COST OF FLOOD INSURANCE IN NORTH BEND, WASHINGTON STATE

In North Bend, WA, you have 576 flood policies and are paying about that much in premium, $547,412. Your average is about $950.36. The famous cult fiction Twin Peaks brought awareness to how beautiful and eerie this landscape region of Washington state is. What mysteries are keeping?

COST OF FLOOD INSURANCE IN REDMOND, WASHINGTON STATE

The city of Redmond, WA we, have you to thank for all the technology of this century, being the home of Microsoft and Nintendo. Your flood insurance average is $617.89. With 413 NFIP flood policies and paying a total of $255,189. PS thanks for Mario Bros!!

COST OF FLOOD INSURANCE IN RENTON, WASHINGTON STATE

City of Renton in Washington State, located on the southeast side of Lake Washington and divided by Cedar River, you are quite comfortable with water. I love SALMON!! You have 175 flood policies and pay $228,925 to the federal government. I think we can do better than the average flood insurance cost for Renton of $1,308. Give us a call to let us shop for your flood policy at 1-866-990-7482. Your flood nerds.

COST OF FLOOD INSURANCE IN SEATTLE, WASHINGTON STATE

City of Seattle, Washington, you have 796 flood policies and are paying $501,631. The average flood insurance policy for this area is $630.19. This is rather good considering the number of policies if you are accomplishing this low premium by reducing coverage, it might be a good idea to look at coverage through one of our private flood insurance options for Washington state. You might be able to increase your coverage and get a better price and reduce your risk.

COST OF FLOOD INSURANCE IN SNOQUALMIE, WA

The City of Snoqualmie, Washington, has one of our nation’s most beautiful waterfalls. You also have 476 flood policies and are paying $693,660. With the average flood insurance policy being $1,457, if you want to see if we can save you money, I, think we can fill out our intake form to get us shopping.

COST OF FLOOD INSURANCE IN CENTRALIA, WASHINGTON STATE

The city of Centralia, Washington, is a beautiful stopping point between Seattle and Portland, Oregon. The average flood policy in this area is $865.64. With 676 flood policies and paying $585,174 to the federal program.

COST OF FLOOD INSURANCE IN CHEHALIS, WASHINGTON STATE

The city of Chehalis and the rest of Lewis county have 1,177 NFIP policies and pay a total of $1,056,093 to bring your average to $897.27, although Chehalis is paying a slightly higher proportion of $1,588.

COST OF FLOOD INSURANCE IN MASON COUNTY, WASHINGTON STATE

Mason County, you have 392 flood policies and are paying a total of $412,238 to bring your average to $1,051.

COST OF FLOOD INSURANCE IN OKANOGAN COUNTY, WASHINGTON STATE

Okanogan County, WA, you have 239 flood policies, with the average flood insurance cost being $655 and a total payment of 156,611.

COST OF FLOOD INSURANCE IN LONG BEACH AND PACIFIC COUNTY, WASHINGTON STATE

Long Beach, WA, and Pacific County, Washington combined have 763 flood policies; $326,324 is what you are shipping to DC in flood premiums, bringing your average to $427.68. WOW, if you are getting this premium, then maybe I should hire you. I am looking for good flood nerds that know how to save money on the cost of flood insurance in Washington state.

COST OF FLOOD INSURANCE IN ORTING, WASHINGTON STATE

In the city of Orting, WA, you are quite familiar with the damage that flood waters can cause on November 7, 2006, when in 2 hours, many of your houses were drowned halfway. Even if you are in what is considered low to moderate risk, on FEMAS maps, I would still highly recommend that you buy a flood policy they are quite reasonable considering the catastrophic event it would cover. You have 367 active flood policies and are paying a total of $234,924, making the average flood insurance cost $640.

COST OF FLOOD INSURANCE IN PIERCE COUNTY, WASHINGTON STATE

Pierce County, Washington you have 1,492 flood policies and are paying, let’s total $932,315. This cost would make your average $624. If you don’t see this premium, let’s see what we can do about it.

COST OF FLOOD INSURANCE IN PUYALLUP, WASHINGTON STATE

In Puyallup, Washington, Your average flood insurance cost is $819.88. With 376 flood policies and paying the NFIP, the total of $308,276. Thanks for hosting the Washington State Fair with flair, making this event one of our nation’s ten largest.

COST OF FLOOD INSURANCE IN SUMMER CITY, WASHINGTON STATE

COST OF FLOOD INSURANCE IN TACOMA, WASHINGTON STATE

COST OF FLOOD INSURANCE IN UNIVERSITY PARK, WASHINGTON STATE

Summer City, Tacoma, and University Place. With WA combined, you have 492 flood insurance policies. With the average cost of flood insurance in Washington state being $901, your premium average is around $709.12. And you are paying FEMA a total of $348,888.

COST OF FLOOD INSURANCE IN BURLINGTON, WASHINGTON STATE

Burlington is a city in Skagit County, Washington; you have a long history of flooding with 975 flood policies and paying a total of $997,364 in coverage with 975 flood policies. The average is coming to $1,022 i. If you are spending more and have never had a flood, Considering loss, then let’s look at the private flood market for your flood policy. If you are in an area where flood insurance isn’t required, you should consult a flood insurance professional to discuss the potential risk of flooding. Considering the area’s history, I would hate for you to be unprepared and uncovered if water comes into your beloved home.

COST OF FLOOD INSURANCE IN SKAGIT COUNTY, WASHINGTON STATE

Skagit County, Washington State, you have 2,137 active flood insurance policies, with the total premium being $2,137,088, bringing your average premium to $1,000.

COST OF FLOOD INSURANCE IN SNOHOMISH COUNTY, WASHINGTON STATE

COST OF FLOOD INSURANCE IN STANWOOD AND SULTAN, WASHINGTON STATE

Snohomish County with your cities of Stanwood and Sultan Washington. You have 1,978 active flood insurance policies and are paying a total of $2,257,519. This makes the average flood insurance policy cost in Snohomish county, Washington about $1,141.32

COST OF FLOOD INSURANCE IN THURSTON COUNTY & OLYMPIA, WASHINGTON STATE

Thurston County, WA, and Olympia, WA combined, you have 753 Flood policies, paying, on average.and CountTogethertotal of $553,430. Your average flood insurance cost is $734.96. Thanks for your commitment to Earth DAY and creatively leading the US state with your invention of the Procession of Species celebrations.

COST OF FLOOD INSURANCE IN WHATCOM COUNTY & LUMMI INDIAN RESERVATION, WASHINGTON STATE

COST OF FLOOD INSURANCE IN FERNDALE AND EVERSON, WASHINGTON STATE

Whatcom County, WA, Lummi Indian Reservation, Ferndale, WA, Everson City, Washington, you have 1633 NFIP flood policies $1,541,946 is what you are paying in total. Bringing the average flood policy in this area to $944.24

COST OF FLOOD INSURANCE IN TOPPENISH, WASHINGTON STATE

COST OF FLOOD INSURANCE IN YAKIMA AND WAPATO, WASHINGTON STATE

COST OF FLOOD INSURANCE IN YAKIMA COUNTY, WASHINGTON STATE

Toppenish, Washington, Yakima City, and Wapato City have the rest of Yakima Count; your average flood insurance cost is $894.39. With 1131 FEMA flood policies and paying a total of $1,011,553.00

COST OF FLOOD INSURANCE

For decades, the NFIP has over-charged 50 percent of its policyholders and under-charged the other 50 percent while it has racked up $42 billion in taxpayer-funded losses, equating to more than half of every claim paid by the NFIP since 1978

About 30 percent of NFIP claims payments go to the same 3 percent of insured “repetitive loss” structures yearly. When you do the math, this means that the other 97 percent of their flood-exposed constituents could have paid in less and still netted larger claims payouts if they had better access to private flood insurance. A and rine cent white paper by Milliman found that 90 percent of homes in Sandy-struck New York and New Jersey would see reduced flood insurance rates through private insurers.