Slash Your Florida Flood Costs with Flood Nerds!

Find out how much you can save on high quality, high coverage flood insurance plans in 10 minutes or less!

Or Speak To A Flood Nerd™ 1-866-990-7482

$2.3M+

Annual Premium Savings

4.9★

Average Ratings

445+

Reviews

5,497+

Happy Clients

We Get It,

Buying Flood Insurance in Florida Is Confusing…

You might be asking:

• What coverage do I need?

• How much is flood insurance in Florida going to cost me?

• How much can I save?

It’s okay, your search for cost-effective Florida flood insurance that doesn’t compromise on coverage ends here.

Meet The Flood Nerd™

Your Florida Flood Expert, Friend, and Guardian

In 2015, Robert Murphy, inspired to help homeowners and businessowners alike, entered the insurance brokerage market with one goal in mind: To help uncertain homeowners find affordable, high quality flood insurance that doesn’t compromise on coverage.

We Find You Great Coverage

While Saving You Up To $1,457+ A Year!

What you seek is:

Enhanced security for your Florida Property.

Significant savings.

Absolute freedom.

Unwavering certainty.

Memorable moments.

Quality family time.

Peaceful travels.

It's As Easy As 1, 2, 3!

1

Fill Out Our Online Form

Complete our easy quote form so we can understand your needs & personalize your Florida rates.

2

Get An Instant Quote

Our team scours Florida flood insurance companies statewide to instantly present the best coverage & rate options for your needs.

3

Get Coverage

If you’re happy with the coverage options, you can sign up easily directly from our online portal.

Florida flood insurance guide to save money (That ANYONE Can Follow)

How much is flood insurance in Florida?

Looking for the best value on how much is flood insurance in Florida?

Look no further and find out with our tool below how much is flood insurance in Florida. We shop around to provide reliable coverage solutions, competitive rates and peace of mind that you are protected from financial loss due to flooding. Our experts have decades of experience and knowledge when it comes to helping our customers get the lowest possible prices on their flood insurance policies while ensuring they have great protection.

With your flood nerd, getting maximum savings without sacrificing coverage has never been easier! Get a customized flood insurance quote in Florida and find out how much is flood insurance in Florida for your specific property – we guarantee you won’t find better rates anywhere else!

Contact us today for more information about your affordable dedicated and transparent flood insurance options!

What does flood insurance cover in Florida?

In Florida, flood insurance provides coverage for both the structure of your home and the personal possessions inside it against damage caused by flooding. This coverage is essential as standard homeowners’ insurance policies do not typically include flood damage. Additionally, considering Florida’s high risk of flooding due to its geography and climate, securing flood insurance is a prudent step for protecting your investment. It can help cover the costs of repairs and replacements, minimizing financial disruptions following a flood event. Furthermore, having flood insurance may also be a requirement by your mortgage lender, especially if you live in a high-risk flood zone.

Does my Florida homeowners insurance cover flooding?

Do I need flood insurance in Florida?

What are my flood insurance options in Florida?

Florida NFIP flood insurance

Florida private flood insurance market

How much does flood Insurance cost in Florida?

7 things you need to know about flood insurance in Florida?

Florida Flood Insurance calculator

Cost of flood insurance in Florida? (click on your city to find the average)

Florida NFIP flood insurance.

There are many options available in Florida regarding flood insurance, but they basically fall into two main categories. The Government option, also known as FEMA or NFIP, and then the private flood insurance market.

The National Flood Insurance Program (NFIP), also known as FEMA, is the government option for flood insurance. The NFIP has enjoyed a 50-state monopoly on the flood insurance market.

Florida private flood insurance market

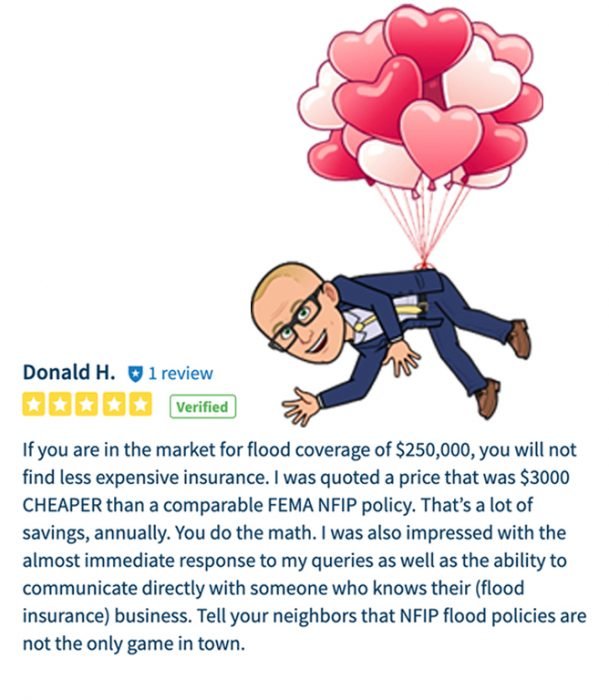

There are alternatives to NFIP or government insurance. It is called Private flood insurance, most notably Lloyd’s of London Flood insurance. However, there are other options available in Florida. We shop all the options for your property in your region to ensure you are getting the best premium. Please click here if you are ready to have us do the work for you.

There are alternatives to NFIP or government insurance. It is called Private flood insurance, most notably Lloyd’s of London Flood insurance. However, there are other options available in Florida. We shop all the options for your property in your region to ensure you are getting the best premium. Please click here if you are ready to have us do the work for you.

Our shopping includes the NFIP because sometimes we find that you can get a much better premium with government subsidies.

Cost of flood insurance in Florida

Lloyd’s of London Flood Insurance Florida Market

Florida is fortunate to have many Lloyds of London flood insurance options. Although many Lloyds flood insurance companies will have you assume that there is only one option, nothing could be further from the truth.

Lloyd’s of London has a rich history attributed to having invented the first modern insurance model. Unlike most of its competition, Lloyds of London is not a company but a corporate body. This structure works well since it has been around for over 330 years. Lloyds operates under multiple financial backers pooling their capital to spread the risk.

Not “private flood insurance” but NFIP Resellers

Suppose you have Nationwide Flood Insurance, State Farm Flood Insurance, Progressive Flood Insurance, or any of the logos below. In that case, you are buying the NFIP flood policy that is just being resold through a government program. These companies are private companies, but their flood insurance is not. Here is a list of the 70 companies that resell the NFIP policy.

https://www.fema.gov/wyo_company

I have two blog posts that deep dive into Lloyds of London and what they mean to Florida’s flood insurance market. If you are interested, the links are below.

Lloyds of London Flood Insurance

FEMA vs Private flood insurance

Lloyd’s also insures the world for flood insurance, meaning they cover flooding events in India, Australia, and much of Europe. The “game” of insurance is to spread your risk since Lloyd’s is worldwide.

I joke here that Lloyd’s is banking on God’s promise that he won’t flood the entire world again, …..so they won’t have to pay out the whole world’s flood claim.

What is the cost of flood insurance in Florida?

Many factors go into getting the cost of flood insurance for Florida. If your home is considered a low-to-moderate risk, you can get a heavily subsidized policy through the government.

Living in Florida, do you know how much it costs to get flood insurance?

With our years of experience in the flood insurance industry, we know that getting reliable coverage doesn’t have to break your bank. Our experts have great advice on seeking out the best deals and saving money without sacrificing quality or coverage.

Our experience shows that most Florida flood insurance policies cost around $500 to $1,500 per year. Although there are certain areas that incur higher expenses, we, being the flood geniuses that we are, find the cheapest flood insurance rates in Florida by scouring many options available in the market.

Stop worrying about rising premiums and start saving with your Flood Nerd to find an inexpensive yet competitive policy with good coverage. Get ready for peace of mind knowing that if a flood happens, you won’t be hit with nasty surprises.

Find your perfect policy today before it’s too late.

Want to know the average cost of flood insurance in Florida

In Florida, the cost of flood insurance can vary significantly depending on the flood zone classification as well as geographic location. According to the National Flood Insurance Program (NFIP), which sets the rates for flood insurance policies, these costs are determined by the U.S. government based on the area’s risk level.

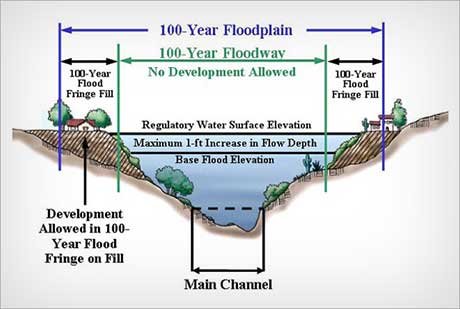

Flood zones are categorized from high risk to minimal risk. For instance, Zones A and V are designated as Special Flood Hazard Areas (SFHA), indicating high-risk areas often close to water bodies. Conversely, Zone X includes shaded areas (moderate-risk) and unshaded areas (minimal-risk), while Zone D covers regions where flood hazards are undetermined.

Here’s a breakdown of the average annual and monthly rates for flood insurance as determined by the NFIP:

– Zone A: $851 annually, $71 monthly

– Zone AE: $897 annually, $75 monthly

– Zone AH: $530 annually, $44 monthly

– Zone AO: $344 annually, $29 monthly

– Zone D: $995 annually, $83 monthly

– Zone V: $2,546 annually, $212 monthly

– Zone VE: $630 annually, $53 monthly

– Zone X: $517 annually, $43 monthly

Alongside these zone-specific rates, it is also insightful to look at the average flood rates in specific cities and counties within Florida. Here is a direct quote from previous findings that provides detailed rates for various locations:

“The average flood rate in Edgewater, Florida is $385. In Holly Hill, Florida, the average flood rate is $456. New Smyrna Beach, Florida has an average flood rate of $411. Ormond Beach Florida sees an average flood rate of $437. Ponce Inlet, Florida has an average flood rate of $313. Port Orange, Florida has an average flood rate of $474. South Daytona, Florida has an average flood rate of $479. Volusia County, Florida has an average flood rate of $396. Wakulla County, Florida has an average flood rate of $1,379. And finally, Walton County, Florida has an average flood rate of $452.”

These figures highlight the variability in flood insurance costs not only across different flood zones but also across different geographical locations within the state. Whether you live on the coast or inland near rivers and lakes, it’s crucial to understand both the zone classification and local area prices to fully grasp the potential costs of flood insurance in Florida.

How can one pay less for flood insurance in Florida?

To reduce the cost of flood insurance in Florida, consider taking several steps to minimize the risk and thereby lower your insurance premiums. Firstly, opt to increase your insurance deductible, which is the amount you pay out-of-pocket before your insurance kicks in; a higher deductible generally means lower monthly or annual payments.

Secondly, obtain and submit an elevation certificate for your property. This document details your home’s elevation compared to the potential floodwaters and can demonstrate lower risk, which might reduce your premium costs.

Additionally, make structural improvements to your home to enhance its resistance to flood damage. Actions such as raising the height of your house, retrofitting utilities to higher levels, adding flood vents, or eliminating basements can all contribute to lower flood insurance rates by reducing the likelihood and potential severity of flood damage.

Does my Florida homeowner insurance cover flooding?

A typical Florida homeowners’ policy is written through Farmers, State Farm, Allstate, and Progressive, for instance, excludes flooding as something that will be covered under their homeowner’s policy.

Most cases, the only way to get flood coverage is by purchasing a stand-alone flood insurance policy. However, you should ask your homeowners agent if you can add an endorsement to your homeowner’s policy to cover flooding. Yet, don’t be too surprised if the answer is NO.

Do I need flood insurance in Florida?

It is important to have flood insurance coverage in Florida because our beloved Cowboy State has seen a fair share of flooding, and more is likely coming.

Most homeowners think about flood insurance in Florida at some point before buying a home or during the closing process.

Many of us only think about it when a big storm looms. Or we have heard on the news that active flooding is forecasted.

Is flood insurance required in Florida?

It is important to have flood insurance coverage in Florida because our beloved Sunshine State has seen a fair share of flooding, and more is likely coming. Most homeowners think about flood insurance in Florida at some point before buying a home or during the closing process. Many of us only think about it when a big storm looms. Or we have heard on the news that active flooding is forecasted. If your home or business is in a flood zone, that is considered a low flood risk area. Sadly, many homeowners decide to forgo purchasing coverage because they believe they are safe from flooding. Some real estate and insurance agents may even say you don’t need it. I ask you to consider the facts: 20 percent of all flooding events across our nation come in areas that are considered low risk. After our last few major storms (Hurricane Harvey), we saw flooding in these low-risk areas. 80 percent of these individuals had water in their homes or building and didn’t have flood insurance coverage. In Harris county, nearly 135,000 homes were damaged. Three-fourths of these properties were considered low to moderate risk.

Furthermore, if you are residing in a Special Flood Hazard Area (SFHA) in Florida and have a federally backed mortgage, the U.S. government mandates that you must have flood insurance. Additionally, your mortgage lender may still require you to carry flood insurance, even if it’s not a government requirement. Moreover, if you’re a Florida homeowner and have home insurance through Citizens Insurance, be aware that the legislation now requires you to purchase flood insurance. Specifically, all homeowners with Citizens Insurance are mandated to secure flood insurance by March 1, 2027. This legislative move underscores the critical nature of flood insurance in protecting your home and financial stability in Florida.

Given these points, while the threat of flooding may sway some to consider insurance, others are compelled by legal obligations to secure coverage. Either way, it is wise to assess the necessity of flood insurance to mitigate the potentially devastating effects of flooding in Florida.

What is the risk of flooding in Florida?

Flooding poses a significant risk to Florida, given its coastal geography. Current statistics show that one in four homeowners in the state has opted for flood insurance. Among the flood zones, Zone X experiences substantial losses, second only to Zone AE. Predictive analysis by Risk Factor indicates that within the next 30 years, more than 200,000 properties could be at risk due to rising sea levels. Additionally, studies highlighted by Scientific American suggest that climate change is expected to increase flood risks nationwide by 26%. Given these factors, it is advisable for all residents, regardless of location within the state, to consider flood insurance, as even minimal water intrusion can result in considerable financial losses.

Florida flooding

If your home or business is in a flood zone, that is considered a low flood risk area. Sadly, many homeowners decide to forgo purchasing coverage because they believe they are safe from flooding. Some real estate and insurance agents may even say you don’t need it.

I ask you to consider the facts: 20 percent of all flooding events across our nation come in areas that are considered low risk. After our last few major storms (Hurricane Harvey), we saw flooding in these low-risk areas. 80 percent of these individuals had water in their homes or building and didn’t have flood insurance coverage.

In Harris county, nearly 135,000 homes were damaged. Three-fourths of these properties were considered low to moderate risk.

Florida Flood Insurance Rate Map

We often hear that people believe the government will help, which is true. However, a few things must align for you to get government assistance.

1 – The president of the United States must declare the flooding event a state of emergency. If this doesn’t happen, then there won’t be assistance.

2 – Homeowners’ average amount of assistance after a flood, when they do not have flood coverage, is $5,000. The average cost of damage to one’s property after a flood is $38,000+. That $5K you get from the government? It comes as a loan, and you will need to pay it back. Are you willing to gamble on your financial future by forgoing flood insurance coverage?

https://www.bloomberg.com/graphics/2017-fema-faulty-flood-maps/

One more note on these low-risk flood zone maps. Many of these maps are over 40 years old. If the area has been developed, there is likely more concrete, creating a barrier for land that previously might have absorbed the massive downpour.

FEMA flood maps Florida

Because of all these factors, it is difficult for property owners to know their true risk of flooding. FEMA admits that their flood maps only give an idea of part of the risk. Our recent storms are facts that it can rain anywhere within Florida, and you should consider getting flood coverage so you are not uninsured when you need it most.

FEMA flood zone maps often take years to go into effect after the terrain was studied, this gives the impression that the area is “more up to date” then it really is. Find our more about Florida flood insurance rate maps here.

Flood insurance Florida

The average cost for Florida flood insurance in these Low-risk areas is $595 per year.

FEMA’s National Flood Insurance Program (NFIP) and all federally backed lenders rely on these Florida flood insurance maps to assess risk, set premiums, and determine who is required to purchase flood insurance. Bad information about an area’s flood risk can leave property owners under or uninsured.

Florida flood insurance low-to Moderate Risk rate and cost.

This is Flood Zone X, which is not lender required flood zone.

This is usually identified as an X-flood zone. Then we would suggest the government Preferred Risk Policy (PRP) which is a subsidized policy and has set flood insurance coverage limits (see grid below):

Here is a link if you want to really dig into this one. Be ready for an eye chart because every option is a public record and should be standardized to accost whoever writes these policies.

Flood zone X Florida

The average cost for flood insurance in Florida with the maximum set limits in these Low-risk flood zone areas is $405 – $700 per year.

Your property is in a higher-risk flood zone. It is usually identified with a Flood Zone AE Florida. Your lender will require you to have flood insurance. The cost of flood insurance in Florida depends on many factors unique to the structure. We will try to give you an idea of the most common homes we see in Florida with a slab-on-grade foundation.

We will look at the Florida cost of flood insurance for the NFIP maximum of $250,000 for the (building only) with NO CONTENTS and our recommended deductible of $5,000.

We will be rating this example on the NFIP and on a few of our private flood insurance policies, specifically Lloyds flood insurance options in Florida.

Cost of Flood Insurance in Flood zone AE Florida

Your flood nerd shops for cheap flood insurance in Florida and below is and example of how we do it. Our example is Collier County, but the premiums will be the same in Hollywood, Fort Lauderdale, Miami Beach, Lee County, Jacksonville, and many other Florida flood ones.

There are multiple flood insurance companies in Florida, including the National Flood Insurance Program (NFIP). To ensure that you get the lowest premium available for your property without compromising the coverage, you can explore several options, or you can use a one stop shop such as The Flood Nerds™. We offer you an opportunity to shop around and select the right policy for your coverage and without draining your wallet.

In our example, the Base Flood Elevation (BFE is 8) and is a home that is built before 1973

NFIP option in Florida Flood Zone AE

NFIP – Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

NFIP Annual premium in High-Risk flood zone is $7,543

This option is what we see if the property has had a flood loss before and either doesn’t have an Elevation Certificate applied or the Elevation certificate shows that the lowest floor is 4 feet under the BFE for the area. You can use 10% of your coverage to cover other structures on your property.

Florida Private flood insurance – Lloyd’s of London Flood Insurance (option 1)

Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

Lloyds of London (option 1) The annual premium in a high-risk flood zone is $745.09

This option is great, and we are very happy when we can get this option. Lloyd’s can be a bit choosey about what risk they will accept and will not take anything that has had a flood loss. They offer basements coverage, about $2,000 for loss of use and $2,000 for other structures, but they can’t increase this coverage. They do not require an Elevation Certificate to rate.

Florida Private flood insurance – Lloyd’s of London Flood Insurance (option 2)

Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

Lloyd’s of London (option 2) The annual premium in a high-risk flood zone is $866.04

This option is great, and we are very happy when we can get this option for our clients. The underwriter seems to be writing almost all risks. However, they do not write any property in a designated floodway or has a depth of -4 under the BFE.

In our example, with our BFE being 8, they will not accept this risk if the lowest floor is 4. They will not take anything that has had a flood loss. They offer limited coverage for basements and do not require an Elevation Certificate to rate as a percentage of coverage for loss of use. If you want coverage for other structures, that must be added

Private Flood Insurance option (option 3) Not Lloyd’s

Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

Private flood insurance (option 3)

The annual premium in a high-risk flood zone is $ 3,131.75

This option will take properties that have had one flood loss as long as it has been more than five years and the payout was under $100,000 on the claim. Their coverage matches the NFIP. They will write practically all risks, don’t need an elevation certificate to rate, and are a bit lower in premium than the NFIP

Private Flood Insurance – Lloyd’s of London (option 4)

This option must be written on the building’s Replacement Cost Value (RCV). Otherwise, there is a co-insurance penalty that kicks in. So, $250,000 might be a bit low in California, but to keep this going, let’s just use that for this option.

Coverage of $250,000 (RCV) building coverage, No Contents and $5,000 deductible

The annual premium in high-risk flood zone is $877.59 (a great price).

This options rating system is all over the board. Sometimes we get a crazy great price, but other times the premium is way higher than the NFIP will consider taking a property that has had one flood loss before as long as it has been more than ten years and the payout was under $50,000 on the claim. Their preferred coverage is at replacement cost, slightly different from some of our other Lloyd’s flood options. We usually reserve this one if the property doesn’t fit the above options. We can adjust coverages to control premium. As mentioned before, these underwriters’ rates are all over the board. It is worth shopping through to ensure we are getting you the best premium possible. They don’t need an elevation certificate to rate.

Private Flood Insurance – Lloyd’s of London (option 5)

Coverage of $250,000 (RCV) building coverage, No Contents, and $5,000 deductible.

The annual premium in high-risk flood zone is $996.30

This option came from the company that used to run the NFIP program, so the coverage matches the NFIP coverage with two differences. They offer living expenses covering your cost when you are displaced from your home during repairs (most Lloyds flood policies offer this). They also offer a unique swimming pool clean-out, so if you have a pool, ask for this coverage.

Private Flood Insurance – Lloyd’s of London (option 6)

Coverage of $250,000 (RCV) building coverage. No Contents and a $5,000 deductible.

The annual premium in a high-risk flood zone is $862.14.

This options rating system is also all over the board. Sometimes we get a crazy low price; other times, the premium is way higher than the NFIP. They will consider taking a property that has had one flood loss before as long as it has been more than ten years and the payout was under $25,000 on the claim. They have been rumored to give a low price the first year and then non-renew following years, or sometimes they jack the price way up, so we will watch them. They have a slick system, and their underwriting is managed by a 3rd party, which also sometimes seems to be a glitch.

More options are coming online every day, and we are working to be looking into every viable option.

Currently, Florida has 1,770,452 NFIP policies in force to date with the total cost of $974,338,089. That would make the average flood rate for Florida $550. Of course, some will pay more, and some will pay less.

Flood insurance rate map Florida

Click here to have us shop and save you money.

Hello, Florida! Thanks for visiting our page for all your flood insurance needs.

Let’s start off with Alachua, Florida where the average flood rate is $594. The premiums in Alachua total $923,836 with 1,555 total active flood policies.

Flood insurance Gainesville, FL

Next up is Gainesville, Florida, where the active flood policies total 1,367 with $855,545 in written premium. The average flood rate in Gainesville is $626.

We’ll look at Bay, Florida next where the flood premiums total $6,305,765 with 14,470 flood policies in effect. The average flood rate in Bay is $436.

The average flood rate rises to $575 in Lynn Haven, Florida. Lynn Haven has 1,856 flood policies active with $1,067,339 in total premiums.

Flood insurance Panama City, FL

Hello Panama City Beach, Florida! Thanks for stopping by! The active flood policies number 12,324. The average flood rate in Panama City Beach is $285 which includes $3,517,901 in written premium.

In Panama City, the average flood rate goes up to $648. The premiums in Panama City, Florida add up to $1,542,109 with 2,381 flood policies in effect.

The active flood policies number 23,259 in Brevard County, Florida. The premiums here total $9,830,743 which allows the average flood rate to be $423.

$975,787 is the flood premium total in Cape Canaveral, Florida. Cape Canaveral has an average flood rate of $300 which includes 3,248 flood policies in effect.

There are 6,461 flood policies active in Cocoa Beach, Florida. The premiums total $2,371,963 in Cocoa Beach, which allows the average flood rate to be $367.

Flood insurance Indialantic, FL

Let’s look at Indialantic and Lauderdale Lakes, Florida, where the active flood policies add up to 1,775. The average flood rate for these areas is $411 which includes $730,303 in total premiums.

The average flood rate drops to $344 in Indian Harbor Beach, Florida. The premiums here total $650,029 with 1,890 flood policies active.

Flood insurance Melbourne, FL

4,145 flood policies are active in Melbourne, Florida. The average flood rate in Melbourne is $419 which includes $1,736,178 in flood premiums.

Palm Bay, Florida’s average flood rate lowers to $390. The premiums here add up to $1,242,073 with 3,187 flood policies in effect.

Let’s check out Rockledge, Florida, where the active flood policies total 1,101 with $417,990 in written premium. The average flood rate in Rockledge is $380.

The average flood rate rises just a bit to $382 in Satellite Beach, Florida. Satellite Beach has $813,844 in flood premiums with 2,130 flood policies in effect.

In Titusville, Florida, we find 1,367 active flood policies with $580,448 in flood premiums. This allows the average flood rate in Titusville to be $425.

When we check out West Melbourne, Florida, we see 1,319 flood policies in effect with $492,062 in written premium. The average flood rate in West Melbourne is $373.

The average flood rate rises to $430 in Broward County, Florida. Broward County has 5,237 active flood policies with $2,253,136 in total premiums.

The premiums in Coconut Creek, Florida total $674,319. The flood policies total 1,766 which allows the average flood rate to be $382.

The active flood policies total 3,041 in Copper City, Florida. The average flood rate in Copper City is $383 which includes $1,165,468 in written premium.

In Coral Springs, Florida, there are 8,287 flood policies in effect with $3,207,222 in flood premiums. The average flood rate in Coral Springs is $387.

3,256 flood policies are active in Dania Beach, Florida. Dania Beach has an average flood rate of $532 which includes $1,732,933 in total premiums.

Davie, Florida, you all have 7,890 flood policies active with $3,296,976 in premiums. The average flood rate in Davie is $418.

The average flood rate in Deerfield Beach, Florida is $409. The flood premiums total $2,358,305 with 5,768 flood policies in effect.

Flood insurance Ft. Lauderdale, FL

Hello Fort Lauderdale, Florida! You all have quite a few active flood policies, 39,478 to be exact! The premiums here add up to $15,729,818 which allows the average flood rate to be $398.

$244 is the average flood rate for Hallandale Beach, Florida. The policies here number 17,684 with $4,315,432 in total premiums.

Our next city to look at is Hillsboro Beach, Florida, where the flood policies add up to 2,019. The average flood rate in Hillsboro Beach is $407 which includes $822,335 in premiums.

The premiums in Hollywood, Florida add up to $10,816,581. The active flood policies total 22,771 which allows the average flood rate to be $475.

The flood policies in Lauderdale-by-the-Sea, Florida total 3,622. The average flood rate here is $378 which includes $1,369,251 in written premium.

The average flood rate drops a bit to $345 in Lauderhill, Florida. Lauderhill has 3,205 active flood policies with $1,106,460 in total premium.

Next up is Lighthouse Point, Florida where the premiums add up to $1,207,356. The average flood rate in Lighthouse Point is $434 which includes 2,780 flood policies in effect.

Margate, Florida has an average flood rate of $362. The premiums in Margate total $890,450 with 2,457 active flood policies.

When we look at Miramar, Florida, we find 5,935 flood policies in effect. Miramar has an average flood rate of $390 which includes $2,316,044 in flood premiums.

The average flood rate rises to $393 in North Lauderdale, Florida. North Lauderdale has $606,884 in written premium with 1,543 active flood policies.

Again, the average flood rate rises to $439 in Oakland Park, Florida. Oakland Park has 3,680 flood policies in effect with $1,614,350 in flood premiums.

3,790 flood policies are active in Parkland, Florida. Parkland has $1,581,650 in total premium which allows the average flood rate to be $417.

In Pembroke Pines, Florida, the average flood rate is $373. The premiums here total $3,328,284 with 8,932 flood policies in effect.

The active flood policies number 18,522 in Pompano Beach, Florida. The premiums add up to $6,635,290 which allows the average flood rate to be $358.

The premiums total $600,631 in Southwest Ranches, Florida. The average flood rate is $358 which includes 1,202 active flood policies.

The average flood rate in Sunrise, Florida is $403. The premiums total $1,707,984 with 4,233 flood policies in effect.

There are 6,385 flood policies active in Tamarac, Florida. Tamarac has an average flood rate of $344 which includes $2,197,319 in written premium.

Weston, Florida has $2,115,087 in total premiums with 5,697 flood policies in effect. The average flood rate in Weston is $371.

The average flood rate rises to $435 in Wilton Manors, Florida. The premiums in Wilton Manors total $1,112,325 with 2,555 active flood policies.

$779 is the average flood rate in Charlotte County, Florida. The flood policies number 27,911 with $21,748,751 in flood premiums.

Next up is Punta Gorda, Florida, where the premiums total $7,665,890. The average flood rate in Punta Gorda is $891 which includes 8,605 active flood policies.

When we look at Citrus County, Florida, we find the average flood rate rises to $939. The flood policies number 4,504 with $4,227,529 in premiums. Gives us a call to check your rates!

Clay, Florida has 5,824 active flood policies. The premiums here total $2,918,108 which allows the average flood rate to be $501.

Hello Collier County, Florida! The active flood policies total 70,789! The premiums here add up to $31,841,487 which allows the average flood rate to be $450.

The premiums in Marco Island, Florida total $9,286,716. The average flood rate in Marco Island is $586 which includes 15,852 active flood policies.

Flood insurance Naples, FL | Flood zone map Naples, FL

Naples, Florida has 15,041 flood policies in effect with $12,510,383 in written premium. The average flood rate in Naples is $832.

Let’s look at Columbia and Clewiston, Florida where the premiums add up to $950,364. The average flood rate in these areas is $641 which includes 1,482 active flood policies.

Next up is Atlantic Beach, Florida where the average flood rate is $422. The active flood policies total 2,803 with $1,182,890 in written premium.

Flood zones Jacksonville, FL | Jacksonville FL flooding

Our next beachy area is Jacksonville Beach, Florida, where the active policies number 6,256. The average flood rate in Jacksonville Beach is $408 which includes $2,551,637 in active flood premiums.

Flood zone map Jacksonville, FL

Now, we’ll look at Jacksonville, Florida, where the premiums total $11,548,079 with 25,531 flood policies in effect. The average flood rate in Jacksonville is $452.

The policies in Neptune Beach, Florida add up to 1,424. The average flood rate in Neptune Beach is $465 which includes $661,690 in flood premiums.

14,214 is the number of active flood policies in Escambia, Florida. The premiums add up to $5,988,687 which allows the average flood rate to be $421.

Flood insurance Pensacola, FL

The average flood rate rises to $844 in Pensacola Beach – Santa Rosa Island, Florida. The premiums add up to $3,070.249 with 3,639 in active floodpolicies.

Pensacola, Florida has 2,556 flood policies in effect. The average flood rate in Pensacola is $614 which includes $1,568,635.

The premiums in Wellington, Florida total $1,310,589. The active flood policies add up to 3,274 which allows the average flood rate to be $400.

The active flood policies total 2,236 in Flagler Beach, Florida. The average flood rate in Flagler Beach is $487 which includes $1,088,818 in flood premiums.

The average flood rate drops to $397 in Flagler, Florida. The premiums total $1,773,401 with 4,466 active flood policies.

In Palm Coast, Florida, the flood policies number 5,559 with $1,943,233 in written premium. The average flood rate in Palm Coast is $350.

The average flood rate jumps to $1,527 in Franklin, Florida. Franklin has 2,221 active flood policies with $3,391,032 in flood premium.

Now, let’s look at Gulf, Florida, where the premiums add up to $1,036,181. The active flood policies number 1,022 which allows the average flood rate to be $1,014.

$898 is the average flood rate in Hernando, Florida. Hernando has 3,723 flood policies in effect with $3,341,634 in flood premiums.

Let’s check out a few areas that include Highlands and Plant City, Florida, where the active flood policies total 1,516. The premiums add up to $906,124 which allows the average flood rate to be $598.

The premiums in Hillsborough, Florida total $25,002,234. The average flood rate in Hillsborough is $673 which includes 37,159 flood policies in effect.

Flood insurance Tampa, FL

Hello Tampa, Florida! So nice of you to stop by our page! Tampa has an average flood rate of $832. The flood policies number 27,896 which includes $23,200,853 in active flood policies.

Our next group of areas include Temple Terrace and Sebastian, Florida. These two areas have 1,494 active flood policies with $684,886 in written premium. The average flood rate for these areas is $458.

The average flood rate rises a little to $491 in Indian River, Florida. Indian River has $6,502,532 in flood premiums with 13,250 flood policies in effect.

The active flood policies in Indian River Shores number 3,202. The premiums total $1,825,106 which allows the average flood rate to be $570.

3,924 flood policies are active in Vero Beach, Florida. The average flood rate in Vero Beach is $596 which includes $2,336,982 in flood premiums.

The premiums total $1,233,258 in Lake County, Florida. The active flood policies number 2,529 which allows the average flood rate to be $488.

The average flood rate rises to $629 in Bonita Springs, Florida. The number of flood policies here total 11,982 with $7,533,619 in written premium.

Welcome to our page Cape Coral, Florida! Cape Coral, you all have 33,640 flood policies in effect with $23,958,243 in total premium. The average flood rate in Cape Coral is $712.

Flood Insurance Fort Myers FL

In Fort Myers Beach, Florida, the average flood rate jumps to $1,202. The premiums add up to $7,049,140 with 5,866 active flood policies.

Next up is Fort Myers, Florida, where the premiums total $3,574,874 with 6,308 flood policies in effect. Fort Myers has an average flood rate of $567.

69,644 flood policies are in effect in Lee County, Florida. Lee has $47,488,623 in total flood premiums which allows the average flood rate to be $682.

Sanibel, Florida has an average flood rate of $1,219. The premiums total $9,412,327 with 7,721 active flood policies.

The average flood rate drops to $505 in Leon County, Florida. The active flood policies total 1,617 with $815,852 in written premium.

The premiums in Tallahassee, Florida total $1,237,328 with 1,884 flood policies in effect. The average flood rate in Tallahassee is $657.

The active flood policies add up to 1,038 in Anna Maria, Florida. The average flood rate in Anna Maria is $1,843 which includes $1,913,484 in total premiums. Give us a call Anna Maria!

Flood insurance Bradenton, FL

The average flood rate in Bradenton Beach, Florida is $1,087. The premiums total $1,641,451 with 1,510 flood policies in effect.

Next, let’s look at Bradenton, Florida where the active flood policies number 4,382. The average flood rate here is $679 which includes $2,977,037 in flood premium.

$4,290,075 is the premium total in Holmes Beach, Florida. Holmes Beach has 3,239 in active flood policies which allows the average flood rate to be $1,325.

Longboat Key, Florida has 10,280 active flood policies with $7,472,803 in written premium. The average flood rate in Longboat Key is $727.

The average flood rate drops to $593 in Manatee County, Florida. The premiums here add up to $13,517,870 with 22,794 flood policies in effect.

The policies in Palmetto total 2,267. The premiums here add up to $1,644,667 which allows the average flood rate to be $725.

The premium total in Marion County is $1,435,442. The average flood rate in Marion County is $429 which includes 3,060 flood policies in effect.

In Ocala and Biscayne Park, Florida, the active flood policies total 1,369. The premiums for these areas total $1,108,474 which allows the average flood rate to be $810.

15,364 flood policies are active in Martin County, Florida. The average flood rate for Martin County is $489 which includes $7,507,283 in written premium.

The average flood rate in Stuart, Florida is $581. The premiums total $615,980 which includes 1,061 active flood policies.

In Aventura, Florida, the premiums add up to $3,413,009 with 17,909 flood policies in effect. The average flood rate in Aventura is $191.

When we look at Bal Harbour, Florida, we find the average flood rate is $383. The premiums here total $1,235,248 with 3,225 active flood policies.

Next up, let’s check out Bay Harbor Islands, Florida, where the active flood policies number 2,271 with $1,618,464 in written premium. The average flood rate here is $713.

The average flood rate stays the same at $713 in Coral Gables, Florida. Coral Gables has $3,320,346 in flood premium with 4,658 in flood policies.

Cutler Bay, Florida has 7,395 flood policies in effect with $4,710,959 in flood premiums. The average flood rate in Cutler Bay is $637.

$430 is the average flood rate in Doral, Florida. The premiums add up to $1,759,564 with 4,091 flood policies in effect.

We’ll check out a group of areas that include Florida City, Hialeah Gardens, and Opa-Locka, Florida where the flood policies total 1,833 with $1,149,979 in flood premiums. The average flood rate for these areas is $627.

In Hialeah, Florida, we find $5,187,940 in written premium. The average flood rate in Hialeah is $387 which includes 13,391 flood policies in effect.

The average flood rate rises a bit to $428 in Homestead, Florida. Homestead has 5,879 active flood policies with $2,518,177 in written premium.

The premiums in Key Biscayne, Florida total $4,129,283. The flood policies active here add up to 6,820 which allows the average flood rate to be $605.

The active flood policies in Miami Beach, Florida number 45,715! The average flood rate in Miami Beach is $589 which includes $26,929,494 in flood premiums.

Miami Gardens, Florida’s average flood rate is a little lower at $564. The premiums in Miami Gardens total $3,995,292 with 7,709 flood policies in effect.

Let’s look at Miami Lakes, Florida where the premiums total $1,877,334. The average flood rate in Miami Lakes is $416 which includes 4,540 in active flood policies

Flood insurance Destin, FL

The active flood policies in Destin, Florida add up to 7,012. The average flood rate in Destin is $457 which includes $3,202,631 in written premium.

Fort Walton Beach, Florida has an average flood rate of $564. The premiums here total $1,017,276 with 1,803 active flood policies.

10,631 flood policies are active in Okaloosa County, Florida. The premiums here total $4,732,306 which allows the average flood rate to be $445.

The average flood rate rises to $609 in Okeechobee County, Florida. The policies here number 1,467 with $894,057 in written premium.

Flood insurance Apopka, FL

Hello Orange County, Florida! Orange County, you all have 10,484 active flood policies. The premiums here total $4,690,296 which allows the average flood rate to be $447.

Next up is Orlando, Florida! Hello Disney! The Boardwalk and any of your parks are an amazing time! The premiums in Orlando add up to $1,632,712 with 3,040 flood policies in effect. The average flood rate in Orlando is $537.

Let’s check out a group of areas that include Winter Park, Kissimmee, and Greenacres, Florida where the flood policies add up to 1,882. The average flood rate for these areas is $517 which includes $972,090 in flood premium.

The average flood rate drops to $489. The premiums here add up to $3,135,010 with 6,414 flood policies in effect.

St. Cloud, Florida has 1,116 active flood policies with $511,044 in flood premium. The average flood rate in St. Cloud is $458.

$367 is the average flood rate in Boca Raton, Florida. Boca Raton has 15,972 active flood policies with $5,861,154 in written premium.

The average flood rate drops to $342 in Boynton Beach, Florida. The premiums total $2,687,191 with 7,849 active flood policies.

In Delray Beach, Florida, the active flood policies number 7,681 with $3,799,961. Delray Beach has an average flood rate of $495.

The premiums in Highland Beach, Florida total $1,121,505. The average flood rate in Highland Beach is $272 which includes 4,120 flood policies in effect.

The policies number 1,341 in Hypoluxo, Florida with $507,773 in written premium. The average flood rate in Hypoluxo is $379.

The average flood rate in Juno Beach, Florida is $317. The flood policies number 1,722 with $545,422 in written premium.

Flood insurance Jupiter, FL

Jupiter, Florida has 8,872 flood policies in effect. The premiums total $2,952,738 which allows the average flood rate to be $333.

Let’s look at Lake Park and Palm Beach Shores, Florida, where the active flood policies total 1,597. The average flood rate for these areas is $426 which includes $679,643 in written premium.

In Lake Worth, Florida, the average flood rate rises to $565. The premiums here total $814,806 with 1,442 in flood premium.

1,167 flood policies are active in Lantana, Florida. Lantana has $658,089 in flood premium which allows the average flood rate to be $564.

There are 3,963 flood policies in effect in North Palm Beach, Florida. The average flood rate here is $244 which includes $968,493 in total premium.

The flood premiums total $736,549 in Ocean Ridge, Florida. Ocean Ridge has 1,237 flood policies active which allows the average flood rate to be $595.

Palm Beach, Florida has 50,725 flood policies in effect. Palm Beach has an average flood rate of $357 which includes $18,089,808 in written premium.

Next up is Palm Beach Gardens, Florida, where the premiums total $1,905,777. The policies total 4,711 which allows the average flood rate to be $405.

The average flood rate rises to $725 in Palm Beach, Florida. Palm Beach has 7,521 active flood policies with $5,451,509 in total premium.

Let’s check out Palm Springs, Florida, where the premiums total $324,822 with 1,291 flood policies in effect. The average flood rate in Palm Springs is $252.

In Riviera Beach, Florida, the average flood rate is $310. The active flood policies number 5,311 with $1,647,173 in written premium.

The active flood policies in Royal Palm Beach, Florida total 1,093 with $434,313 in flood premium. The average flood rate here is $397.

The written premium in South Palm Beach, Florida adds up to $447,834 with 1,735 flood policies in effect. The average flood rate here is $258.

$327 is the average flood rate for Tequesta, Florida. The premiums in Tequesta total $439,377 with 1,342 active flood policies.

West Palm Beach, Florida has 8,021 flood policies in effect. The average flood rate here is $358 which includes $2,871,072 in written premium.

Flood insurance New Port Richey, FL

The average flood rate jumps to $1,120 in New Port Richey, Florida. New Port Richey has 1,218 flood policies active with $1,364,537 in total premiums. Give us a call! We’ll check your rates!

Next up is Pasco County, Florida where there are 22,416 flood policies in effect. The average flood rate here is $783 which includes $17,542,147 in flood premium.

Let’s look at a group of areas that include Port Richey, Belleair Beach, and Belleair, Florida, where the premiums total $2,834,905. The policies add up to 2,460 which allows the average flood rate to be $1,152.

11,615 flood policies are in effect in Clearwater, Florida. The average flood rate in Clearwater is $717 which includes $8,333,218 in written premium.

Dunedin, Florida has $3,598,422 in flood premium with 4,096 active flood policies. The average flood rate in Dunedin is $879.

The premiums add up to $1,616,071 in Gulfport, Florida. The average flood rate here is $587 which includes 2,752 flood policies in effect.

The active flood policies in Indian Rocks Beach, Florida number 2,743. The premiums total $2,400,439 which allows the average flood rate to be $875.

Indian Shores, Florida has 2,890 flood policies active. The average flood rate in Indian Shores is $578 which includes $1,671,749 in written premium.

$669 is the average flood rate in Largo, Florida. The premiums here add up to $1,397,134 with 2,089 flood policies in effect.

There are $3,073,092 in flood premiums with 3,136 policies active in Madeira Beach, Florida. Madeira Beach has an average flood rate of $980.

The average flood rate drops to $761 in North Redington Beach, Florida. The active flood policies total 1,277 with $972,106 in total premium.

The average flood rate rises to $806 in Oldsmar, Florida. The premiums in Oldsmar add up to $1,765,300 with 2,189 flood policies in effect.

Hello Pinellas County, Florida! You all have $21,269,013 in written premium with 33,071 active flood policies. The average flood rate in Pinellas County is $643.

The active flood policies in Pinellas Park, Florida total 3,028. The premiums here add up to $1,835,375 which allows the average flood rate to be $606.

Flood insurance Lakeland, FL

Let’s check out a group of areas that include Redington Beach, Seminole, and Lakeland, Florida, where the flood premiums total $2,016,907. The average flood rate for these areas is $866 which includes 2,328 flood policies in effect.

In Redington Shores, Florida, the average flood rate is $671. The active flood policies number 1,486 with $996,868 in written premiums.

The average flood rate drops to $495 in Safety Harbor, Florida. The premiums in Safety Harbor total $579,668 with 1,171 flood policies in effect.

There are 2,948 active flood policies in South Pasadena, Florida with $1,740,483 in flood premium. The average flood rate here is $590.

The average flood rate jumps to $1,137 in St. Pete Beach, Florida. The premiums in St. Pete Beach total $7,569,604 with 6,656 flood policies in effect.

St. Petersburg, Florida has 35,175 active flood policies. The average flood rate in St. Petersburg is $927 which includes $32,611,156 in written premium.

Next up is Tarpon Springs, Florida where the premiums add up to $3,223,078 with 3,449 flood policies in effect. Tarpon Springs has an average flood rate of $934.

The average flood rate rises to $978 in Treasure Island, Florida. The premiums total $4,792,871 with 4,899 active flood policies.

6,074 flood policies are active in Polk County, Florida. The average flood rate here is $511 which includes $3,106,261 in written premium.

The premiums in Putnam County, Florida total $786,586 with 1,336 flood policies in effect. The average flood rate in Putnam County is $589.

The active flood policies number 1,069 in Gulf Breeze, Florida. Gulf Breeze has an average flood rate of $667 which includes $711,570 in total premium.

Let’s check out Santa Rosa County, Florida, where there are 13,138 flood policies in effect. The premiums here total $6,725,890 which allows the average flood rate to be $512.

Next up is North Port, Florida, where the flood premiums are $1,022,637 with 2,744 active flood policies. The average flood rate in North Port is $373.

Hello Sarasota, Florida! The active flood policies here total 46,449 with $34,577,164 in written premium. The average flood rate in Sarasota is $744.

Flood insurance Venice, FL

The average flood rate drops to $560 in Venice, Florida. The active flood policies number 5,947 with $3,330,737 in flood premium.

Up next, let’s look at Altamonte Springs, Oviedo, and Sanford, Florida, where the premiums total $974,110. The average flood rate for these areas is $488 which includes 1,995 flood policies in effect.

$497 is the average flood rate in Seminole County, Florida. The active flood policies number 4,309 with $2,142,532 in written premium.

Let’s look at Winter Springs and Debary, Florida, where the active flood policies number $1,223. The average flood rate for these areas is $48 which includes $547,428 in flood premium.

The flood premiums total $1,728,806 in St. Augustine Beach, Florida. The active flood policies total 3,466 which allows the average flood rate to be $499.

The flood policies in effect in St. Augustine, Florida total 4,638 with $4,452,128 in written premium. The average flood rate in St. Augustine is $960.

The average flood rate lowers to $506 in St. Johns County, Florida. The premiums total $14,805,389 with 29,266 flood policies in effect.

Port Pierce, Florida has 4,088 active flood policies with $2,179,705 in total premium. The average flood rate in Port Pierce is $533.

Let’s check out Port St. Lucie, Florida where the average flood rate is $376. The flood premiums total $2,401,818 with 6,381 flood policies in effect.

9,564 flood policies are active in St. Lucie, Florida. The average flood rate in St. Lucie is $350 which includes $3,350,678 in total flood premium.

In Sumter County, Florida, the flood premiums add up to $1,300,552. The active flood policies total 3,517 which allows the average flood rate to be $370.

The average flood rate drops to $210 in Daytona Beach Shores, Florida. The premiums here total $1,270,530 with 5,740 active flood policies.

Hello Daytona Beach, Florida! You all have 7,908 flood policies active with $3,191,572 in premium. The average flood rate in Daytona Beach is $404.

There are 1,121 active flood policies in Deltona, Florida. The average flood rate here is $472 which includes $529,028 in written premium.

$385 is the average flood rate in Edgewater, Florida. The premiums here total $394,931 with 1,027 flood policies in effect.

Holly Hill, Florida has $592,321 in total premium. The active flood policies number 1,299 which allows the average flood rate to be $456.

The flood policies in New Smyrna Beach, Florida total 7,852 with $3,225,046 in written premium. The average flood rate in New Smyrna Beach is $411.

The average flood rate rises to $437 in Ormond Beach, Florida. The premiums total $1,911,216 with 4,372 flood policies in effect.

The premiums total $789,688 in Ponce Inlet, Florida. The average flood rate here is $313 which includes 2,522 active flood policies.

The average flood rate rises to $474 in Port Orange, Florida. The policies number 3,192 with $1,511,746 in written premium.

1,340 flood policies are active in South Daytona, Florida. The premiums total $641,373 which allows the average flood rate to be $479.

The average flood rate drops to $396 in Volusia County, Florida. The active flood policies number 9,046 with $3,579,462 in flood premium.

When we look at Wakulla County, Florida, we see that the average flood rate jumps to $1,379. The flood premiums add up to $1,773,492 with 1,286 flood policies in effect. Give us a call to check your rates Wakulla County!

Finally, let’s check out Walton County, Florida where there are 18,836 flood policies active with $8,508,138 in flood premium. The average flood rate here is $452.

Thanks for checking out all the flood information on Florida!!

How to save money on Flood Insurance in Florida’s VE flood zones

All homes that are ocean-facing are custom built, so with this special consideration, our Lloyd’s of London VE flood zone and other Private Flood Insurance options for oceanfront properties consider this with variable coverage options as well as significant savings below is a case study for a property we were shopping just last week.

Our example was in the Naples, FL area and is in a VE flood zone map.

For the coverage of $250,000 with no contents and a $5,000 deductible the NFIP annual cost for flood insurance in a VE flood zone is $12,922.00. Ouch!

Since we are who we are and experts in Flood Insurance we will look at every property everyway possible to ensure that we are getting the best premium for our clients and WE often Do (smile wink)

We tried this same property on our Private flood options and were able to get the premium to under $5,500 and we have in some cases with similar properties gotten the annual premium to $600 this was a feather in our cap and made our clients very happy. Again all properties are unique in these VE flood zones but if we can find a private flood policy for you we guarantee it will be better than the NFIP option.

Florida Flood insurance cost calculator

For decades, the NFIP has over-charged 50 percent of its policyholders and under-charged the other 50 percent, while it has racked up $42 billion in taxpayer-funded losses, equating to more than half of every claim paid by the NFIP since 1978.

About 30 percent of NFIP claims payments go to the same 3 percent of insured “repetitive loss” structures year after year. When you do the math, this means that the other 97 percent of their flood-exposed constituents could have paid in less and netted larger claims payouts if they had better access to private flood insurance. A recent white paper by Milliman found that 90 percent of homes in Sandy-struck Florida and Florida would see reduced flood insurance rates through private insurers.

References

the following documents contain additional hydrologic data, flood photos, historic flood descriptions, floodplain delineations and other pertinent information, and should be considered supplemental to this flood warning plan:

https://bsa.nfipstat.fema.gov/reports/1011.htm#COT

https://www.fema.gov/average-claim-payments-date-loss

https://www.fema.gov/national-flood-insurance-program