Slash AE Zone Flood Insurance this Instant with Your Flood Nerds

Find out how much you can save on high quality, high coverage flood insurance plans in 10 minutes or less!

$2.3M+

Annual Premium Savings

4.9★

Average Ratings

445+

Reviews

5,497+

Happy Clients

Get Cheap Flood Insurance without Compromising Coverage

"Same Coverage at a Better Rate"

-Mohammed K

Flood Nerds will shop the private flood insurance markets and then compare them to the NFIP, guaranteeing you the better option. We will send you the cheapest flood insurance rates within minutes.

"Quick Response, Very Knowledgable"

– Robert W

Paying for low-cost flood insurance is awesome. And letting the Flood Nerds shop your property has other benefits – you can get better coverage while saving money, and you can get it fast.

"Would highly recommend Better Flood for your flood insurance needs."

– Varun K

Better Flood Insurance is an independent flood insurance broker that shops flood insurance ONLY. Flood Nerds are Flood insurance experts. We have 5000+ happy clients and 390+ 5-star reviews.

Dear Defender Against High Waters,

Ever felt like flood insurance costs in AE flood zones are a riddle wrapped in a mystery inside an enigma?

Well, what if I told you that the Flood Nerds™ have cracked the code?

Yes, we’ve got the secret sauce, the magic formula, the… you get the picture.

We’re all about slicing and dicing those high costs with not one,

not two,

but five proven strategies.

Here’s the deal:

We’re Like Bargain Hunters for Flood Insurance:

Think of us as your personal flood insurance shopper, zipping through the aisles of the flood insurance supermarket.

We don’t just stick to one brand; we check them all out, comparing prices across various lender-approved private flood insurance markets to nab you the best rates and coverage for your spot in an AE flood zone.

Feeling Overwhelmed?

Say No More:

With so many options out there, diving into the flood insurance pool can feel like trying to drink from a fire hose.

Who’s got the time?

Who wants the headache?

That’s where the magic happens when you team up with us.

The Flood Nerds are on it, leaving you free to focus on, well, literally anything else.

Here’s Your Crossroads, Friend:

You’ve got two paths in front of you.

Path one, you roll up your sleeves and dive into the sea of options using the info on this page.

A noble quest, but fraught with peril (okay, maybe just a lot of time and confusion).

Or, path two, the smart path: you let the Flood Nerds take the wheel.

Fill out our form, sit back, and let us reveal the treasure trove of savings waiting for you in the realm of AE zone flood insurance costs.

Why Us? Because We’re Obsessed with Your Win:

It’s not just about finding you a deal;

it’s about finding you the deal that makes your wallet sing and your heart dance.

We’re not just in the business of selling flood insurance;

we’re in the business of making heroes out of homeowners and businesses alike,

turning the tide on flood insurance costs.

So, what’s it going to be?

Ready to join forces and turn the flood insurance game on its head?

Let’s make this journey together, and show those flood insurance costs who’s boss.

Because with the Flood Nerds by your side, the forecast is always looking up.

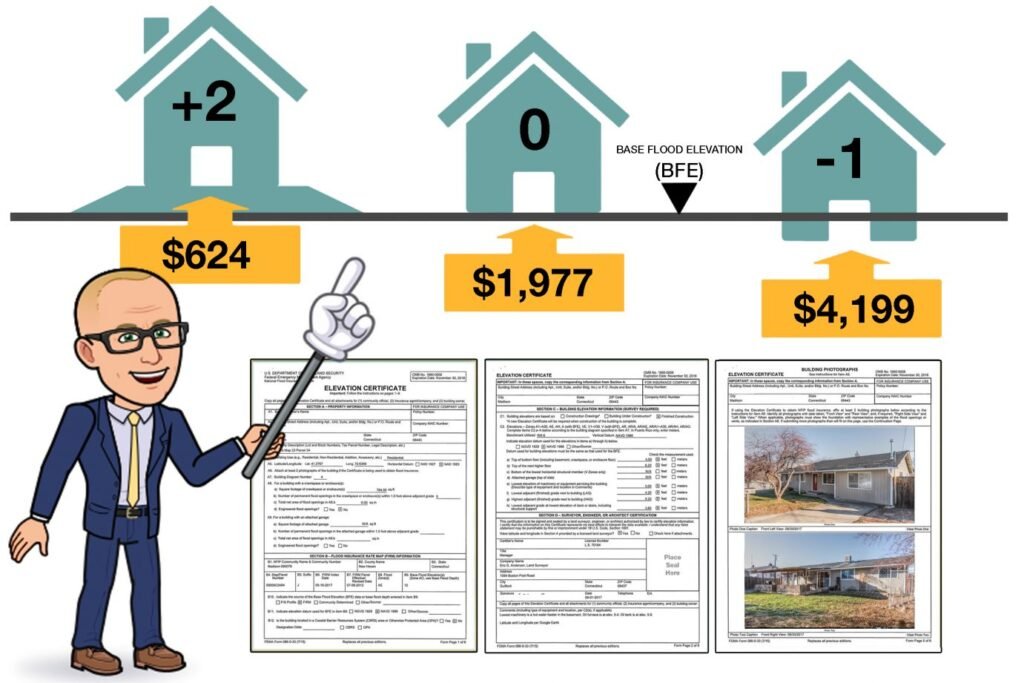

Method 2: The Elevation Certificate (EC) – A Breakthrough in AE Zone Flood Insurance Cost Savings

Hey, friend, ready for the next golden nugget in slashing your flood insurance costs?

Let’s dive into the world of Elevation Certificates (EC) and uncover how this piece of paper might just be your secret weapon against those pesky rising premiums.

Feeling the Pinch of Rising AE Zone Flood Insurance Costs?

If your bill for flood insurance in an AE flood zone seems to be scaling an endless peak, climbing by about 25% annually, you might be ensnared in a clever trap set by the NFIP.

Here’s the Scoop:

You’re not alone.

This isn’t random bad luck;

it’s a strategic move by the NFIP.

They’ve got this rule – no Elevation Certificate (EC), no mercy.

The NFIP is on a mission, pushing everyone to get an EC by making those without one feel the pinch with higher premiums.

The EC Saga – More Twists Than Your Favorite Mystery Novel:

Here’s the thing –

the NFIP has convinced themselves that every property under the sun (or clouds, more aptly) needs an EC.

It’s their way of ensuring you play by their rules, subjecting you to a financial nudge (or push) towards getting that certificate.

And the real kicker?

Most folks don’t even realize this is the game being played at their expense.

The Cost of Being in the Dark?

It’s Not Cheap:

Now, getting your hands on an EC can cost a pretty penny, ranging from $500 to $1,200.

And if your insurance agent isn’t up to speed on the whole EC drama, guess who’s footing the bill for their knowledge gap?

Yep, you guessed it.

But, Here’s Where the Flood Nerds Shine:

Unlike most, we’re knee-deep (pun intended) in everything flood insurance, including the NFIP’s EC obsession.

Our pro move?

If you’re stepping into the homebuying arena and flood insurance is on the table, get the seller involved.

Ask them to provide an EC or cover the cost

– it’s a savvy strategy that could save you big.

Thinking EC or Eyeing the Private Market?

We’ve Got You:

If the thought of shelling out for an EC has you sweating bullets, or if you’re curious if the private market holds the key to your flood insurance freedom, the Flood Nerds are at your service.

We’re here to hook you up with an EC estimate or guide you through the wonders of private flood insurance options.

So, there it is –

your second masterstroke in our playbook to beat down those flood insurance costs.

With the Flood Nerds in your corner, navigating the flood insurance maze just got a whole lot easier.

Ready to turn the page to the next cost-saving secret?

Method 3: Timing is Everything –

Snatch Your Flood Insurance Bargain When the Flood Zone Changes

Alright, intrepid homeowner, brace yourself for the next insider secret that could save you a bundle on flood insurance.

This one’s all about perfect timing and a little thing called FEMA map updates.

FEMA’s Map Roulette –

Keeping You on Your Toes:

Picture this – FEMA, the big boss of flood maps, regularly rolls out updates.

These aren’t just any updates; they’re the kind that can shift your property from a chill “X” zone to a high-stakes “AE” zone faster than you can say “flood.”

When this happens, the clock starts ticking, and you’ve got one year to act or face the music.

The Golden Year –

Your Window to Insurance Savings:

Here’s where it gets juicy.

If you find your humble abode suddenly in the spotlight of a higher-risk zone, you’re handed a golden ticket – a year to grab flood insurance at rates so low, you’ll want to pinch yourself.

This is thanks to the government throwing you a lifeline with subsidized premiums and access to the Preferred Risk Policy (PRP).

Miss this window?

Let’s just say you’ll wish you hadn’t.

Premiums skyrocket, and procrastination becomes your least favorite word.

Selling Your Castle?

Here’s a Savvy Move:

Even if you’re eyeing a move, securing a PRP while it’s in your grasp is like finding an extra diamond in your treasure chest.

Not only does this policy sweeten the deal for potential buyers (right up there with those quartz countertops they’ve been eyeing), but it also sweeps the flood insurance headache off the negotiation table.

Think of it as your secret weapon, making your home as irresistible as it is financially savvy.

Why This Matters – Beyond the Savings:

Grabbing flood insurance during this golden window isn’t just about saving some green;

it’s about peace of mind and making smart, strategic moves in the often unpredictable game of home ownership.

So, there you have it – your third power move in our quest to conquer flood insurance costs.

With this trick up your sleeve, you’re not just a homeowner; you’re a savvy strategist, turning the tides in your favor.

Ready for the next piece of the puzzle? The Flood Nerds are here to lead the way!

Method 4: Unlocking Savings with Flood Mitigation Magic

Roll up your sleeves, because it’s time to dive into the world of flood mitigation improvements, the unsung hero in your quest to vanquish high flood insurance premiums.

Yes, my friend, there are indeed spells you can cast upon your property to shrink those daunting insurance costs, and who better to guide you through these mystical arts than your trusty Flood Nerds?

A Peek Behind the Flood Mitigation Curtain:

Imagine us, your Flood Nerds, with our capes and magnifying glasses, taking a close look at your property and its Elevation Certificate (EC).

We’re like detectives on the hunt for clues on how to slash your NFIP flood insurance premiums.

And guess what?

We’ve got a trick or two up our sleeves

.

Flood Venting: Your Premium-Reducing Superpower:

Ever thought about flood venting?

It’s a game-changer, especially if your abode boasts a crawlspace, garage, or an unfinished lower level yearning for some daylight.

By introducing vents, you’re essentially lifting your home on the insurance rate scale.

Suddenly, that not-so-glamorous lowest level doesn’t count against you anymore.

Now, it’s all about the floor above, which could dramatically alter your rates for the better.

Picture it: the Base Flood Elevation (BFE) no longer holds you back; instead, it propels you towards savings.

And yes, while it’s a bit on the nerdy side, these are the secrets we Flood Nerds live for.

Elevating Your Home’s Inner Workings:

But why stop there?

Hoisting your mechanical systems –

think water heater, furnace, air handler –

from the depths of your lowest floor to the lofty heights of your roof or attic isn’t just an exercise in heavy lifting.

It’s a strategic move that scores you premium credits faster than you can say “flood insurance relief.”

And the best part?

More money stays snug in your wallet, right where it belongs.

Why This Matters to You:

Engaging in flood mitigation isn’t just about playing defense against the elements;

it’s an offensive move in the financial game of homeownership.

With the Flood Nerds as your guides, t

urning your property into a flood insurance savings powerhouse is not just possible;

it’s inevitable.

And there you have it –

your fourth potent strategy in our epic journey to defeat the flood insurance beast.

With each method, you’re not just saving dollars;

you’re investing in the future peace and prosperity of your castle.

Ready to explore more secrets with the Flood Nerds?

Let’s keep this adventure going!

Method 5: The Grand Finale –

Let the Flood Nerds Take the Wheel

And now,

for the crescendo of our symphony of savings,

the pièce de résistance that ties all our flood-fighting strategies together:

unleashing the full might of the Flood Nerds to shop your flood insurance.

This isn’t just a method;

it’s the master key to unlocking unparalleled savings.

The Flood Nerds’ Special Sauce:

Picture this:

we, your devoted Flood Nerds,

merging the wisdom of the ages

(well, the previous four methods)

with our own sprinkle of secret strategies.

We then channel this potent blend of knowledge and nerdy superpowers into scouring the private flood insurance markets for the Holy Grail of policies just for you.

Only the Best for Our Fellow Flood Fighters:

Our quest doesn’t lead us to just any old insurers.

Oh no,

we set our sights on the elite,

the prescreened underwriters who not only promise the moon and stars in coverage but also deliver them,

along with the best prices to match.

With us, you’re not just getting a policy;

you’re securing a fortress,

backed by the most highly-rated insurers in the land.

Sleep easy,

knowing that when the waters rise,

your flood insurance is an impenetrable shield.

Why This Journey Matters:

Entrusting the Flood Nerds with your flood insurance needs isn’t just a savvy financial move;

it’s a leap into a future where flood insurance woes are but a whisper of the past.

We’re not just shopping; we’re strategizing,

ensuring that every facet of your policy is tailored to the unique contours of your property and your life.

Our Epic Quest Recap:

Let’s take a moment to gaze back across the terrain we’ve traversed together:

- Knowledge Is Power: Understanding the ins and outs of AE flood zones and the NFIP’s quirky ways.

- Elevation Certificates (EC): Your secret weapon in the battle against rising premiums.

- Timely Action: Seizing the moment when FEMA maps change to lock in astonishing rates.

- Flood Mitigation: Small improvements with big impacts on your insurance costs.

- The Flood Nerds Shopping Extravaganza: Where all these strategies converge, leading to the ultimate savings.

In our journey through the flood insurance landscape,

we’ve laughed,

we’ve learned,

and most importantly,

we’ve discovered that with the right crew by your side,

even the most daunting challenges can become thrilling adventures.

So, what say you?

Are you ready to hand over the reins and watch as we,

your trusty Flood Nerds,

chart a course to savings beyond your wildest dreams?

Let’s make your flood insurance quest the most rewarding adventure yet.

Will homeowners’ insurance cover flood damage in zone AE?

Homeowners’ insurance does not typically cover flood damage, including in zone AE. Flood damage is usually not included in standard policies and is considered an excluded peril. Therefore, incidents directly related to flooding will not be eligible for a claim under standard homeowners’ insurance. An exception could be if the flooding is a secondary effect of a covered event; for instance, if damage from a covered cause like a fallen tree leads to flooding, then the resulting water damage might be claimable. However, for comprehensive flood protection in all scenarios, it is advisable to obtain a specific flood insurance policy.

Do private flood insurance companies offer elevation discounts in zone AE?

Yes, private flood insurance companies do offer elevation discounts in zone AE. For example, Rocket Flood, a private insurer, utilizes advanced LiDAR technology to accurately determine the elevation levels of properties. Based on these measurements, homes and businesses located at higher elevations are eligible for substantial premium reductions—potentially up to 40%. This discount is granted when the elevated position of the property is verified, reflecting lower flood risk.

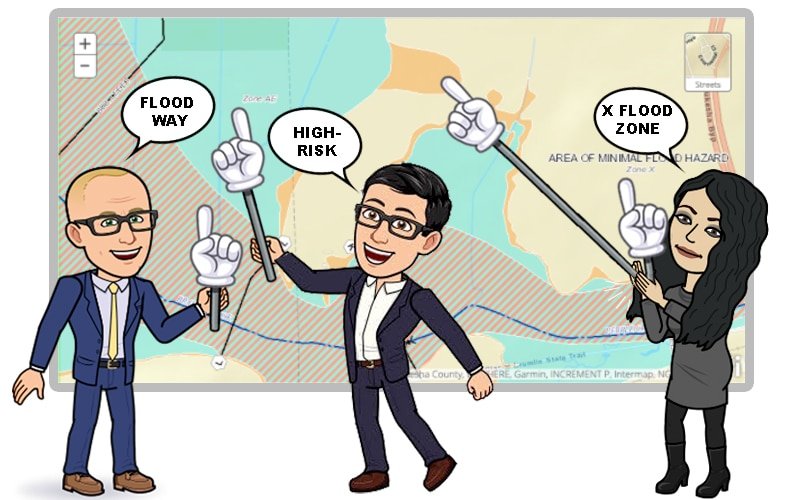

An AE flood zone is considered to have a high risk of flooding, making it one of the more undesirable flood zones. Properties located within AE zones are subject to federal requirements to carry flood insurance if the mortgage is backed by the government. Additionally, private lenders typically also mandate proof of flood insurance before approving loans for properties in these areas. While AE zones are high-risk, the most severe flood zone designation is the V zone, which primarily includes properties on beachfronts or near bodies of water at low elevations. Due to the extreme risk of flood damage, properties in V zones face much higher insurance premiums, potentially costing several thousand dollars each year.