Insurance, any type of insurance is intended to save us from Financial Ruin, yet why do we choose to go without it?

When Hurricane Harvey made landfall and Hurricane Irma was 7 days out, our phones started lighting up, most people of whom did not currently have flood coverage wanted to get it and as fast as they could.

Unfortunately, it was too late for them and our heartstrings were tugged as we told them they could buy it but it would not take effect for 30 days (NFIP policy).

By this time Private Flood insurance option put what they call a moratorium (a temporary prohibition) on the writing of new flood insurance policies in an area when there is forecasted flooding.

Why isn’t flood insurance high on our list of must-haves for coverage?

FEMA has statistics that show 25-present of all flood claims are from policyholders that don’t live in the High-Risk Flood area where they would have been required to have flood insurance.

I get it we are constantly having to juggle our household budget.

When the skies are clear it is easy to believe we don’t need flood insurance.

And many decide to gamble the risk.

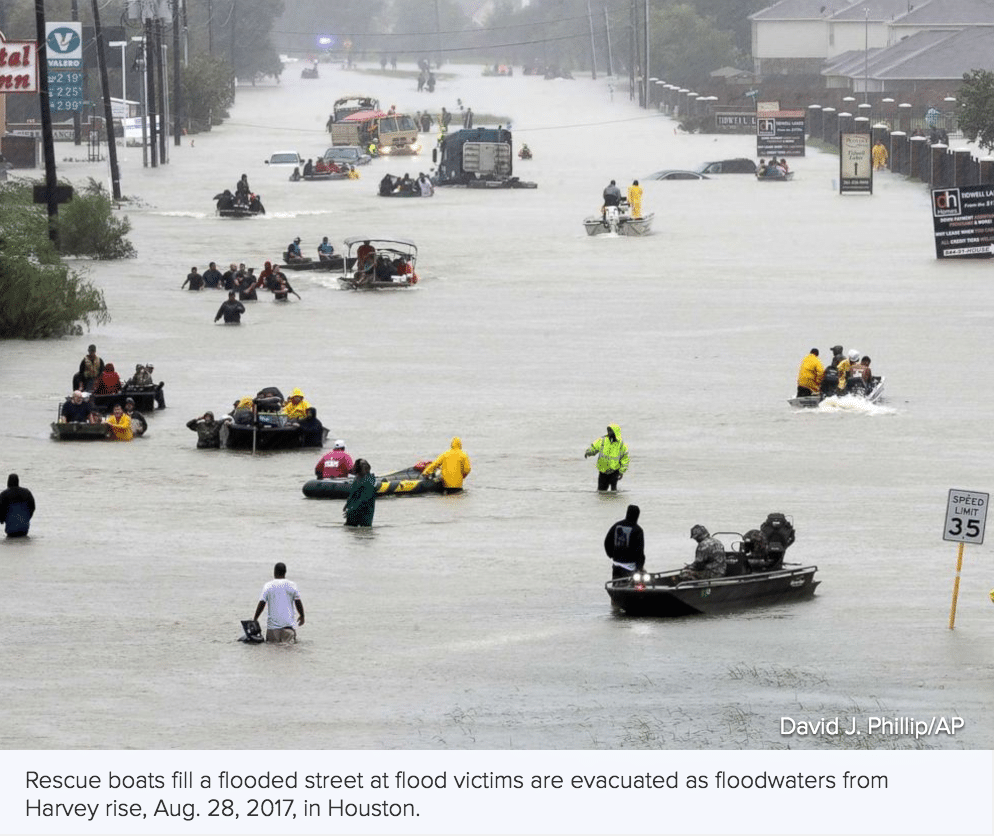

Of the flooding in Houston, the US 4th largest city.

Only a 20% of those who were flooded had flood insurance that means the other 80% could be facing finical ruin.

All those dreams literally washed away.

Modern Insurance was created 1686 by Lloyds of London (who is active in the US flood Insurance market written through private flood options many of whom we will shop for you if you are interested).

They would insure the merchant ships as they made their voyage to the Americas and other countries.

Insurance, All Insurance is meant to transfer your risk to someone else who has the capital to handle the risk should you have to make a claim, there is a fee they charge to do this of course and that is in the form of your insurance premium.

Flood insurance premiums come in various ranges a study by Bankrate says the average annual premium is around $660 and we have seen that to be true if you are in a low-risk area you could get it for around $440 some private flood options are coming in at $220.

You really need to let us do the shopping for you to find the policy that best meets your needs.

FEMA can help but most grant money if you can get it is less than $33,000 and comes in the form of a loan.

Isn’t your property worth more than $33,000?

Floods have caused greater loss of life and property then all other natural hazards combined.

Just one inch of water (according to the NFIP study) can cause damage starting at $20,000 and this is if you have cement floors. How many houses have you been in that only have cement floors?

What would you do if you lost everything?