Get Flood Insurance Los Angeles CA & Save Money Too.

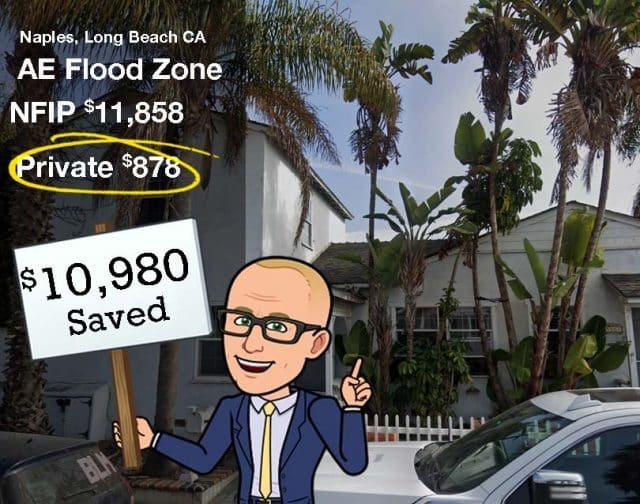

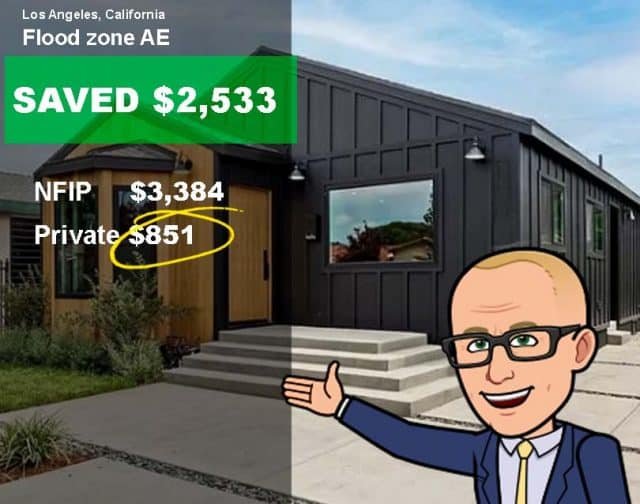

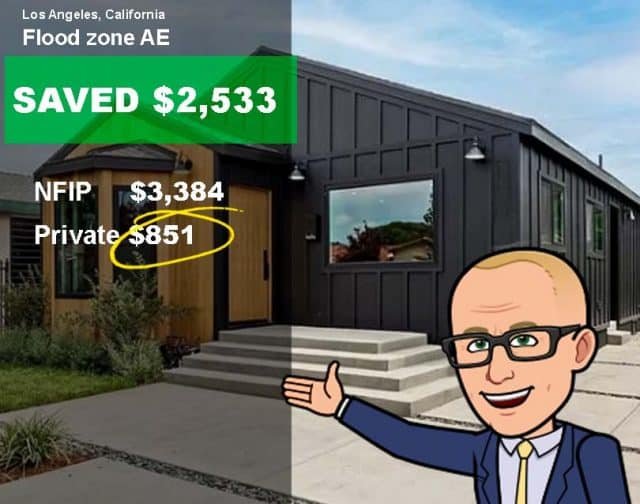

People in Los Angeles CA save on average $500 to $1,457+ on their annual flood premiums.

In many cases, we save them even more. Get the cheapest flood insurance in Los Angeles, CA, without sacrificing coverage.

featured on

Los Angeles Flood Zones: Are You Sitting on a Ticking Time Bomb?

Here’s the 213 & 323 on Los Angeles flood zones from the people who know it well – the Flood Nerds™

What They’re NOT Telling You About Flood Risk in Los Angeles

You might think of earthquakes and wildfires when you hear “Los Angeles,” but did you know floods are one of the most overlooked and devastating natural disasters in the city?

Here’s the cold, hard truth: Thousands of homeowners in Los Angeles flood zones are unknowingly at risk. And when disaster strikes, most find out too late that their insurance won’t cover the damage.

If you own property in LA, ignoring flood zones could cost you everything. But don’t worry—you have the power to protect yourself now.

Los Angeles Flood Zones: Are You in the Danger Zone?

Los Angeles is home to hidden flood risks that many homeowners completely overlook. Why? Because floods don’t just happen from heavy rain.

Here’s what they don’t tell you:

✅ Drought + Fire = Instant Flood Risk. Burned-out land from wildfires can’t absorb water. The next storm? Flooding.

✅ Storm Drains Can Overflow Instantly. LA’s aging infrastructure means streets can turn into rivers within minutes.

✅ Coastal Flooding is on the Rise. High tides, storms, and climate changes are increasing flood risks in places that have NEVER flooded before.

✅ Flash Floods Are Brutal. One minute it’s dry, the next your home is filled with water, mud, and destruction.

Think it won’t happen to you? The last major LA flood caused over $200 million in damages. And FEMA has already mapped new high-risk flood zones that could change your insurance rates overnight.

Will Your Home Insurance Protect You? (Spoiler: Probably Not.)

Most homeowners assume they’re covered for floods. They’re dead wrong.

🔴 Standard homeowners insurance DOES NOT cover flood damage.

🟢 FEMA flood maps are changing, meaning more properties require flood insurance NOW.

🔴 Just ONE inch of floodwater can cause $25,000+ in damage.

FEMA states that over 20% of all flood claims come from properties OUTSIDE high-risk zones. So even if you’re not officially “in a flood zone” today… that could change tomorrow.

Here’s How to Protect Yourself (Before It’s Too Late)

1️⃣ Find Out If You’re in a Los Angeles Flood Zone. Use FEMA’s flood maps or talk to an expert.

2️⃣ Get Flood Insurance—NOW. Don’t wait until after disaster strikes. Prices are cheaper when you act early.

3️⃣ Upgrade Your Home’s Protection. From barriers to proper drainage, there are ways to minimize damage risk.

4️⃣ Stay Ahead of New FEMA Updates. Flood zones are shifting, and new areas are being classified as high-risk every year.

Bottom line? If you wait until after the storm, it’s already too late.

Get a Free Flood Risk Assessment Today

Don’t wait for the next storm to wipe out your home and savings. If you live in Los Angeles, you need to know your flood risk NOW.

👉 Click below to get a FREE flood risk assessment and expert consultation.

Time is running out. Don’t risk your home—act NOW.