Get Flood Insurance Missouri & Save Money Too.

People in Missouri save on average $500 to $1,457+ on their annual flood premiums.

Get flood insurance from a Flood Nerd® at Better Flood Insurance® and save big time.

featured on

Get Cheap Flood Insurance Missouri without Compromising Your Coverage

Flood Insurance Missouri

Floods can happen anywhere, at any time. It can be a painful experience, especially when you have to think about all the damage to your home and all the costs involved in getting your life back together. With unpredictable weather patterns that bring flooding to unexpected places, it’s important to consider flood insurance for your home in Missouri.

There are different levels of protection available depending on where you live. Knowing how much flood insurance in Missouri will cost you is part of protecting what matters most.

Our team of Flood Nerds is experienced in understanding all the options available for your property so that you can confidently make an educated decision. Most of our clients save from $500 – $2,500 on their Missouri flood insurance by moving to one of our many private flood insurance options.

Certain variables need to be considered to determine the cost of flood insurance in Missouri. For an accurate estimate, we’ve created a quick calculator below. But, to obtain a reliable assessment, we recommend requesting a free quote that only takes a few minutes to complete.

Most of our clients buying flood insurance in Missouri pay between $500 and $1,500.

Learn how much flood insurance coverage could cost for your Missouri home with us today.

Finding Cheap Flood Insurance in Missouri, the Flood Nerd™ Way

You’ve probably heard it before – finding cheap flood insurance in Missouri can be daunting. But have no fear; flood nerds are here! If you’re looking for cheap flood insurance in Missouri, then you’ve come to the right place. We shop for the cheapest flood insurance policies that don’t compromise on coverage and have a few exclusive cheap Flood insurance companies in Missouri. Let us show you how we do it.

Step 1: Get us your information by filling out our online form

The first step to getting your cheap flood insurance in Missouri is getting your Flood Nerd your property information using our online form. This will allow us to shop your property and compare it to the NFIP to ensure you get the cheapest flood insurance policy.

Step 2: Shop Around and Compare Rates

Don’t just accept the first quote you get from your local agent – let a flood nerd shop around and compare rates to our pre-flood nerd-approved options to ensure you have found a flood insurance company with your flood nerds’ help getting the better deal. The NFIP has had a monopoly on flood insurance for many years, and now it is time to save money in Missouri.

Step 3: Utilize Exclusive Companies

Since Flood Nerds only work in flood insurance, we have many more options than others, and we have some exclusive relationships with several companies that can offer low-cost policies not available to an agent that isn’t a flood insurance expert in Missouri – giving our customers access to even more savings opportunities than they would find elsewhere. By leveraging our exclusive relationships, customers can save hundreds of dollars on their premiums while still receiving better coverage and peace of mind knowing their property is protected from floods.

Getting quality flood insurance in Missouri doesn’t have to be difficult or expensive. With Flood Nerds on your side, you can feel confident that you’re getting great coverage without compromising on coverage or quality of service. We understand that everyone’s situation is different, so we strive to provide personalized solutions tailored specifically for each customer’s needs and budget constraints – so why wait? Contact us today, and let us help you find cheap flood insurance in Missouri!

Get Cheap Flood Insurance without Compromising Coverage

★★★★★

"Same Coverage at a Better Rate"

-Mohammed K

Flood Nerds will shop the private flood insurance markets and then compare them to the NFIP, guaranteeing you the better option. We will send you the cheapest flood insurance rates within minutes.

★★★★★

"Quick Response, Very Knowledgable"

– Robert W

Paying for low-cost flood insurance is awesome. And letting the Flood Nerds shop your property has other benefits – you can get better coverage while saving money, and you can get it fast.

★★★★★

"Would highly recommend Better Flood for your flood insurance needs."

– Varun K

Better Flood Insurance is an independent flood insurance broker that shops flood insurance ONLY. Flood Nerds are Flood insurance experts. We have 5000+ happy clients and 390+ 5-star reviews.

Does my Missouri homeowner insurance cover flooding?

A typical Missouri homeowners’ policy is written through Farmers, State Farm, Allstate, and Progressive, for instance, excludes flooding as something that will be covered under their homeowner’s policy.

In most cases, the only way to get flood coverage is by purchasing a stand-alone flood insurance policy. However, you should ask your homeowners agent if you can add an endorsement to your homeowner’s policy to cover flooding. Yet, don’t be too surprised if the answer is NO.

Do I need flood insurance in Missouri?

Having flood insurance coverage in Missouri is important because our beloved Cowboy State has seen a fair share of flooding, and more is likely coming.

We believe most homeowners think about Flood insurance in Missouri at some point, maybe before buying a home or during the closing process. However, many of us only think about it when a big storm looms, or we have heard on the news that there is flooding forecasted or happening too close to our home.

If your home or business is in a flood zone, that is considered low flood risk area. Sadly, many homeowners decide to forgo purchasing coverage because they believe they are safe from flooding. Some real estate and insurance agents may even say you don’t need it.

I ask you to consider the facts: 20 percent of all flooding events across our nation come in areas that are considered low risk. After our last few major storms (Hurricane Harvey), we saw flooding in these low-risk areas. In 80 percent of these individuals, had water in their homes or buildings and didn’t have flood insurance coverage.

In Harris County, nearly 135,000 homes were damaged. Three-fourths of these properties were considered low to moderate risk.

We often hear that people believe that the government will help, which is true. However, a few things must align for you to get government assistance.

- The president of the United States must declare the flooding event a state of emergency. If this doesn’t happen, then there won’t be assistance.

- The average amount of assistance homeowners get after a flood when they do not have flood coverage is $5,000. The average cost of damage to one’s property after a flood is $38,000+. That $5K you get from the government? It comes as a loan, and you will need to pay it back. Are you willing to gamble on your financial future by forgoing flood insurance coverage?

Missouri flood plain map

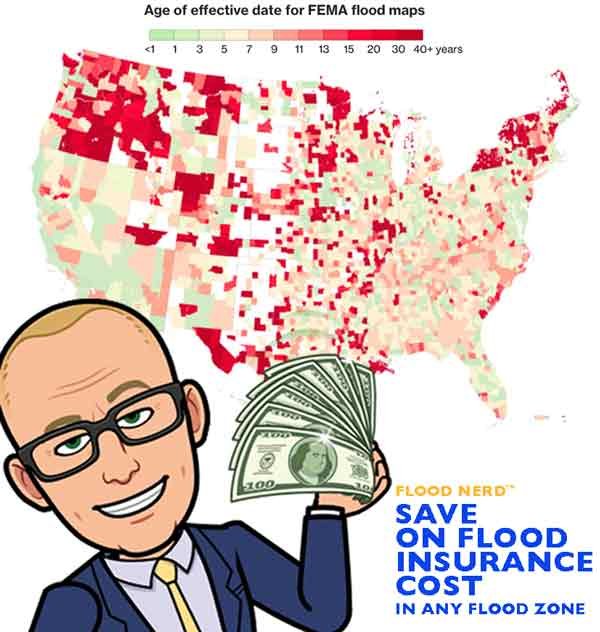

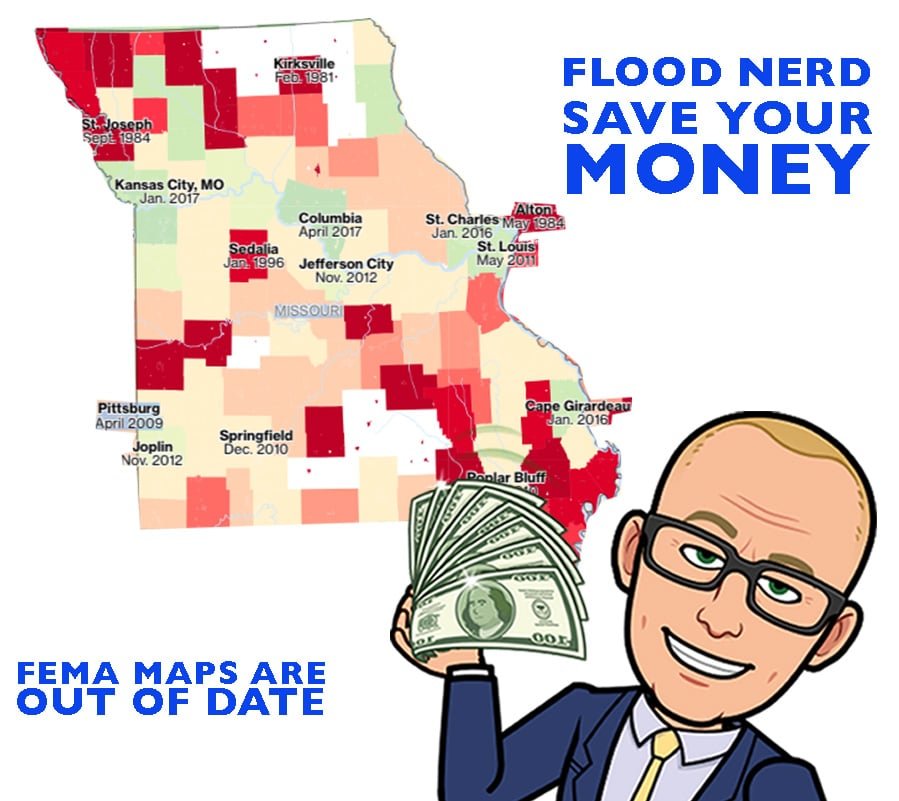

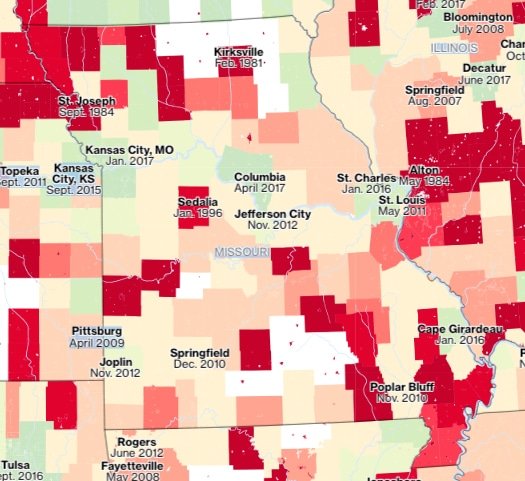

One more note on these low-risk flood zone maps. Many of these maps are over 40 years old. If the area has been developed, there is likely more concrete, creating a barrier for land that previously might have absorbed the massive downpour.

Because of all these factors, it is difficult for property owners to know their true risk of flooding. FEMA admits that their flood maps only give an idea of part of the risk. Our recent storms are facts that it can rain anywhere within Missouri, and you should consider getting flood coverage so you are not uninsured when you need it most.

FEMA flood zone maps often take years to go into effect after the terrain is studied. This gives the impression that the area is “more up to date” than it is.

Missouri flood map

The average cost for Missouri flood insurance in these Low-risk areas is $595 per year.

FEMA’s National Flood Insurance Program (NFIP) and all federally backed lenders rely on these Missouri flood insurance maps to assess risk, set premiums, and determine who is required to purchase flood insurance. Bad information about an area’s flood risk can leave property owners under or uninsured.

How much is flood insurance in Missouri?

Missouri NFIP flood insurance.

There are many options available in Missouri regarding flood insurance, but they fall into two main categories.

The NFIP / FEMA or Government option

The private flood insurance market

The National Flood Insurance Program (NFIP), also known as FEMA, which is the government option for flood insurance. The NFIP has enjoyed a 50-state monopoly on the flood insurance market.

Not “private flood insurance” but NFIP Resellers

If you have Nationwide Flood Insurance, State Farm Flood Insurance, Progressive Flood Insurance, or any of the of logos below, then you are buying the NFIP flood policy that is just being resold through a government program. These companies are private companies, but their flood insurance is not. Here is a list of the 70 companies that resell the NFIP policy.

Missouri private flood insurance market

Lloyd’s of London Flood Insurance Missouri Market

Missouri is fortunate to have many Lloyd’s of London flood insurance options. Although many Lloyd’s flood insurance companies will have you assume that there is only one option, nothing could be further from the truth.

Lloyd’s of London has a rich history attributed to having invented the first modern insurance model. Unlike most of its competition, Lloyds of London is not a company but a corporate body. This structure works well since it has been around for over 330 years. Lloyds operates under multiple financial backers pooling their capital to spread the risk.

I have two blog posts that deeply dive into Lloyds of London and what they mean to Missouri’s flood insurance market. If you are interested, the links are below.

Lloyd’s of London flood insurance

NFIP vs private flood insurance market

Lloyd’s also insures the world for flood insurance, meaning they cover flooding events in India, Australia, and much of Europe. The “game” of insurance is to spread your risk since Lloyd’s is worldwide.

My joke here is that Lloyds is banking on God’s promise that he won’t flood the entire world again, …..so they won’t have to pay out the whole worlds flood claim.

How much does flood insurance cost in Missouri?

Many factors go into getting the cost of flood insurance for Missouri. If your home is in what is considered a low-to-moderate risk, you can get a heavily subsidized policy through the government.

Missouri flood insurance low-to Moderate Risk rate and cost.

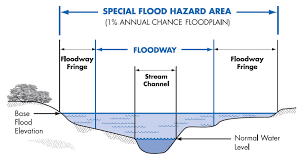

This is Flood Zone X, which is not lender required flood zone.

This is usually identified as an X-flood zone. Then we would suggest the government Preferred Risk Policy (PRP) which is a subsidized policy and has set flood insurance coverage limits (see grid below):

Here is a link if you want to dig into this one. Be ready for an eye chart because every option is public record and should be standardized to accost whoever writes these policies.

The average cost for flood insurance in Missouri with the maximum set limits in these Low-risk flood zone areas is $405 – $700 per year.

Your property is in a higher-risk flood zone, usually identified with a Flood Zone AE. Your lender will require you to have flood insurance. The cost of flood insurance in Missouri depends on many factors unique to the structure. We will try to give you an idea of the most common homes we see in Missouri with a basement foundation.

We will look at the Missouri cost of flood insurance for the NFIP maximum of $250,000 for the (building only) with NO CONTENTS and our recommended deductible of $5,000.

We will be rating this example on the NFIP and on a few of our private flood insurance policies, specifically Lloyds flood insurance options in Missouri.

Cost of Flood Insurance in MISSOURI in high-risk flood zone AE

Our example is Jefferson City, MO, but the premiums will be the same in St. Louis, St. Charles, Butler, Camden, and many other Missouri flood zones.

In our example, the Base Flood Elevation (BFE is 560) and is a home that is built before 1973

NFIP option in Missouri Flood Zone AE

NFIP – Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

NFIP Annual premium in High-Risk flood zone is $5,860.00

This option is what we see if the property has had a flood loss before, and either doesn’t have an Elevation Certificate applied or the Elevation certificate shows that the lowest floor is 4 feet under the BFE for the area. You can use 10% of your coverage to cover other structures on your property.

Missouri Private flood insurance – Lloyd’s of London Flood Insurance (option 1)

Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

Lloyd’s of London (option 2) Annual premium in High-Risk flood zone is $1,267.16

This option is great, and we are very happy when we can get this option for our clients. They seem to be writing almost all risks; however, they do not write any property in a designated floodway or has a depth of -4 under the BFE. In our example, with our BFE being 560, they will not accept this risk if the lowest floor is 556. They will not take anything that has had a flood loss. They offer limited coverage for basements and do not require an Elevation Certificate to rate and as a percentage of coverage for loss of use. If you want coverage for other structures, that will need to be added.

Private Flood insurance option (option 2) Not Lloyd’s

Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

The annual premium in a High-Risk flood zone is $5,274.00

This option will take properties that have had one flood loss for more than five years, and the payout was under $100,000 on the claim. Their coverage matches the NFIP. They will write practically all risks, don’t need an elevation certificate to rate, and are a bit lower in premium than the NFIP.

Private Flood Insurance – Lloyd’s of London (option 3)

This option must be written on the Replacement Cost Value (RCV) of the building. Otherwise, there is a co-insurance penalty that kicks in. So, $250,000 might be a bit low in California, but to keep this going, let’s just use that for this option

Coverage of $250,000 (RCV) building coverage, No Contents, and $5,000 deductible

The annual premium in a High-Risk flood zone is $848.40 (a great price).

This options rating system is all over the board. Sometimes we get a crazy great price, but other times the premium is way higher than the NFIP will consider taking a property that has had one flood loss before as long as it has been more than ten years and the payout was under $50,000 on the claim. Their preferred coverage is at replacement cost, slightly different from some of our other Lloyd’s flood options. We usually reserve this one if the property doesn’t fit the above options. We can adjust coverages to control premiums. As mentioned before, these underwriters’ rates are all over the board. It is worth shopping through to ensure we are getting you the best premium possible. They don’t need an elevation certificate to rate.

Private Flood Insurance – Lloyd’s of London (option 4)

Coverage of $250,000 (RCV) building coverage, No Contents, and $5,000 deductible.

The annual premium in a High-Risk flood zone is $1,945.86

This option came from the company that used to run the NFIP program, so the coverage matches the NFIP coverage with two differences. They offer living expenses covering your cost when you are displaced from your home during repairs (most Lloyds flood policies offer this). They also offer a unique swimming pool clean-out, so if you have a pool, ask for this coverage.

Private Flood Insurance – Lloyd’s of London (option 5)

Coverage of $250,000 (RCV) building coverage. No Contents and $5,000 deductible.

The annual premium in a High-Risk flood zone is $606.00

This options rating system is also all over the board. Sometimes we get a crazy low price; other times, the premium is way higher than the NFIP. They will consider taking a property that has had one flood loss before as long as it has been more than ten years and the payout was under $25,000 on the claim. They have been rumored to give a low price the first year and then non-renew following years, or sometimes they jack the price way up so that we will watch them. They have a slick system, and their underwriting is managed by a 3rd party, which also sometimes seems to be a glitch.

More options are coming online every day, and we are working to be looking into every viable option.

Currently, Missouri has 20,386 NFIP policies in force to date, with a total cost of $20,828,499. That would make the average for Missouri $1,071. Of course, some will pay more, and some will pay less.

Click here to have our shop and save you money.

Missouri Flood map | Missouri flooding map | Missouri flood plain map

Hello, Missouri! Thanks for visiting our page for all your flood insurance needs.

Let’s start with Columbia and Buchanan, Missouri. Combined, these two areas have 227 active flood policies with $168,323 in written premiums. The average flood rate for Columbia and Buchanan is $742.

In St. Joseph, Missouri, there are $294,222 in flood premiums. The average flood rate in St. Joseph is $1,231, including 239 flood policies in effect.

When we look at Butler, Missouri, the average flood rate drops down to $726. Butler’s total number of active flood policies is 484, with $351,513 in total premiums.

Two hundred twenty-two flood policies are in effect in Poplar Bluff and Jefferson City, Missouri. The premiums for these two areas total up to $269,037, allowing the average flood rate to be $1,212.

In Camden, Missouri, the average flood rate is $652. The total number of flood policies is 452 with $294,490 in flood premiums.

Let’s check out Cape Girardeau and Carter, Missouri. These areas have 214 active flood policies and $193,523 in premiums. This allows the average flood rate to compute at $904.

When we look at Lee’s Summit, Cass, and Christian, Missouri, we see that the total number of flood policies in effect is 262, with $165,371 in written premiums. The average flood rate for these areas is $631.

There are 210 active flood policies in Independence, Missouri. The average flood rate in Independence is $1,021 with $214,488 in flood premiums.

Hello Kansas City, Missouri! Glad you stopped by! You all have $1,328,764 in flood premiums and 792 active flood policies. Your average flood rate is $1,678.

Looking at North Kansas City, Smithville, and Cole, Missouri, we find the total number of flood policies in effect is 273. Their average flood rate is $1,035, including $282,478 in written premiums.

The average flood rate drops to $479 for Dunklin and Kennett, Missouri. The total premiums in Dunklin and Kennett are $149,992, with 313 active flood policies.

Moving on to Franklin, Pacific, and Greene – they have 441 flood policies and $449,468 in written premiums. The average flood rate for these areas is $1,019.

$1,158 is the average flood rate in Springfield, Big Lake, and West Plains, Missouri. These areas have 407 active flood policies and $471,376 in premiums.

One hundred seventy-four flood policies are in effect in Jasper and Joplin, Missouri. The average flood rate for Jasper and Joplin is $872, which includes $151,763 in premiums.

The average flood rate jumps up to $1,115 in Arnold and De Soto, Missouri. The total premiums for these areas are $215,253, including 193 active flood policies.

Jefferson City, Missouri, you have the second highest number of active flood policies in the state! With 802 policies, your premiums come in at $909,504, which allows the average flood rate to be $1,134.

Next, let’s look at Canton, Lincoln, Mississippi, and Morgan, Missouri. These areas have combined premiums of $437,757 with 689 active flood policies. The average flood rate here is $635.

With 513 active flood policies in Marion, McDonald, and New Madrid, Missouri, the average flood rate is $707. The total combined flood premiums in these areas is $326,511.

Hello Sikeston, Missouri! Glad you stopped by our page! You all have 420 active flood policies and $221,230 in total flood premiums. Your average flood rate is $527.

Two hundred eighty active flood policies make up Neosho, Seneca, and Caruthersville, Missouri. The premiums in these areas total $219,473, which allows the average flood rate to be $784.

In Permiscot, Missouri, the average flood rate is $353. The total number of policies in effect in Permiscot is 356 with $125,725 in written premiums.

Let’s check out Platte, Ripley, and Miner, Missouri. These areas have a combined total number of flood policies of 318! Their average flood rate is $736 with $233,926 in total premiums.

Scott, Missouri’s average flood rate is $467. Scott has 413 active flood policies and $192,754 in total premiums.

The following areas have $904,311 premiums: O’Fallon, Fenton, Ferguson, and Florissant! We are glad you stopped by our page. You all have an average flood rate of $1,510, including 599 active flood policies. Let us know if we can assist you with anything!

St. Charles, Missouri! You all have quite a few flood policies – 1048, to be exact. Your average flood rate is $1,093 which includes $1,145,604 in written premiums.

Three hundred forty-nine flood policies are in effect in St. Peters and West Alton, Missouri. The written premiums in these areas are $351,015, which allows the average rate to be $1,006.

$1,441 is the average flood rate for Chesterfield, Missouri. The total number of active flood policies in Chesterfield is 343. The premiums here total up to $494,281.

In Hazelwood, Ladue, and Rock Hill, Missouri, there are 403 active flood policies. The total number of premiums is $799,906. The average flood rate for these areas is $1,985. Let us know if we can help you with anything Hazelwood, Ladue, or Rock Hill.

Oh, St. Louis, MO! You have some amazing sites to visit! A boat ride on the Missouri River or a ride up an elevator in the arch, you have something for everyone! Your active flood policies total 1,081. Your average flood rate is $1,505 which includes $1,627,321 in written premiums.

The average flood rate climbs to $1,654 in University City, Missouri. The active policies here total 352 with $582,042 in total premiums.

$1,077 is the average flood rate for Valley Park, Missouri. The total premiums in Valley Park are $227,223 with 211 active flood policies.

Let’s check out Webster Groves, Dexter, Stoddard, Taney, and Wayne, Missouri. These areas have an average flood rate of $976. The premiums in these areas total up to $594,314, including 609 active policies.

Lastly, let’s explore Branson and Stone, Missouri – you all have $296,281 in total premiums and 347 active flood policies. Your average flood rate is $854.

Thanks for checking out all the flood information on Missouri!!

Flood Insurance Costs in Missouri

For decades, the NFIP has over-charged 50 percent of its policyholders and under-charged the other 50 percent, while it has racked up $42 billion in taxpayer-funded losses, equating to more than half of every claim paid by the NFIP since 1978.

About 30 percent of NFIP claims payments go to the same 3 percent of insured “repetitive loss” structures yearly. When you do the math, this means that the other 97 percent of their flood-exposed constituents could have paid in less and still netted larger claims payouts if they had better access to private flood insurance. A recent white paper by Milliman found that 90 percent of homes in would see reduced flood insurance rates through private insurers.