Instant OH Flood Insurance at Great Rates.

Save big with our reliable Ohio flood insurance plans—fast quotes, faster coverage.

$2.3M+

Annual Premium Savings

4.9★

Average Ratings

445+

Reviews

5,497+

Happy Clients

OH Flood Insurance | Ohio Flood Insurance

We Get It,

Buying Flood Insurance in Ohio Is Confusing…

You might be asking:

• What coverage do I need?

• How much is flood insurance in Ohio going to cost me?

• How much can I save?

It’s okay, your search for cost-effective OH flood insurance that doesn’t compromise on coverage ends here.

Meet The Flood Nerd™

Your OH Flood Expert, Friend, and Guardian

In 2015, Robert Murphy, inspired to help homeowners and businessowners alike, entered the insurance brokerage market with one goal in mind: To help uncertain Ohio homeowners find affordable, high quality flood insurance that doesn’t compromise on coverage.

We Find You Great Coverage

While Saving You Up To $1,457+ A Year!

What you seek is:

Enhanced security for your Ohio Property.

Significant savings.

Absolute freedom.

Unwavering certainty.

Memorable moments.

Quality family time.

Peaceful travels.

It's As Easy As 1, 2, 3!

1

Fill Out Our Online Form

Complete our easy quote form so we can understand your needs & personalize your rates.

2

Get An Instant Quote

Our team scours insurance companies nationwide to instantly present the best coverage & rate options for your needs.

3

Get Coverage

If you’re happy with the coverage options, you can sign up easily directly from our online portal.

Does my Ohio homeowner insurance cover flooding?

A typical Ohio homeowners’ policy is written through Farmers, State Farm, Allstate, and Progressive, for instance, excludes flooding as something that will be covered under their homeowner’s policy.

In most cases, the only way to get flood coverage is by purchasing a stand-alone flood insurance policy. However, you should ask your homeowners agent if you can add an endorsement to your homeowner’s policy to cover flooding. Yet, don’t be too surprised if the answer is NO.

Do I need flood insurance in Ohio?

Having flood insurance coverage in Ohio is important because our beloved Cowboy State has seen a fair share of flooding, and more is likely coming.

We believe that most homeowners think about Flood insurance in Ohio at some point, maybe before buying a home or during the closing process. However, many of us only think about it when a big storm is looming, or we have heard on the news that there is flooding forecasted or happening too close to our home.

If your home or business is in a flood zone, that is considered a low flood-risk area. Sadly, many homeowners decide to forgo purchasing coverage because they believe they are safe from flooding. Some real estate and insurance agents may even say you don’t need it.

I ask you to consider the facts: 20 percent of all flooding events across our nation come in areas that are considered low risk. After our last few major storms (Hurricane Harvey), we saw flooding in these low-risk areas. Eighty percent of these individuals had water in their homes or buildings and didn’t have flood insurance coverage.

In Harris county, nearly 135,000 homes were damaged. Three-fourths of these properties were considered low to moderate risk.

We often hear that people believe that the government will help, which is true. However, a few things must align for you to get government assistance.

The president of the United States must declare the flooding event a state of emergency. If this doesn’t happen, then there won’t be assistance.

The average amount of assistance homeowners get after a flood when they do not have flood coverage is $5,000. The average cost of damage to one’s property after a flood is $38,000+. That $5K you get from the government? It comes as a loan, and you will need to pay it back. Are you willing to gamble your financial future by forgoing flood insurance coverage?

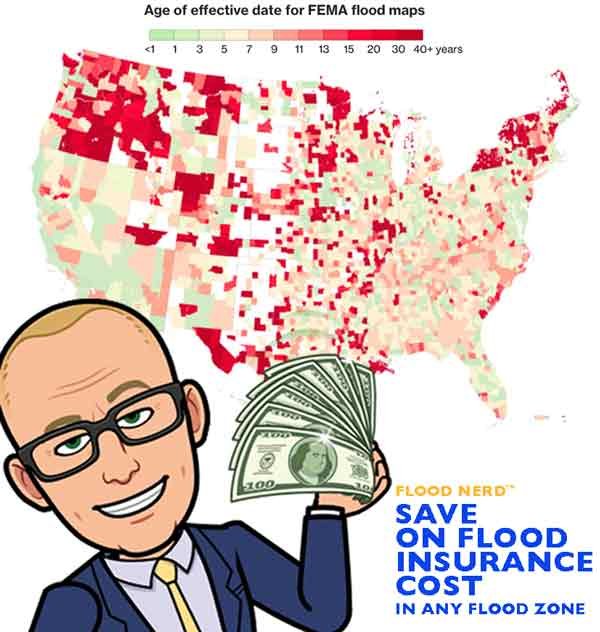

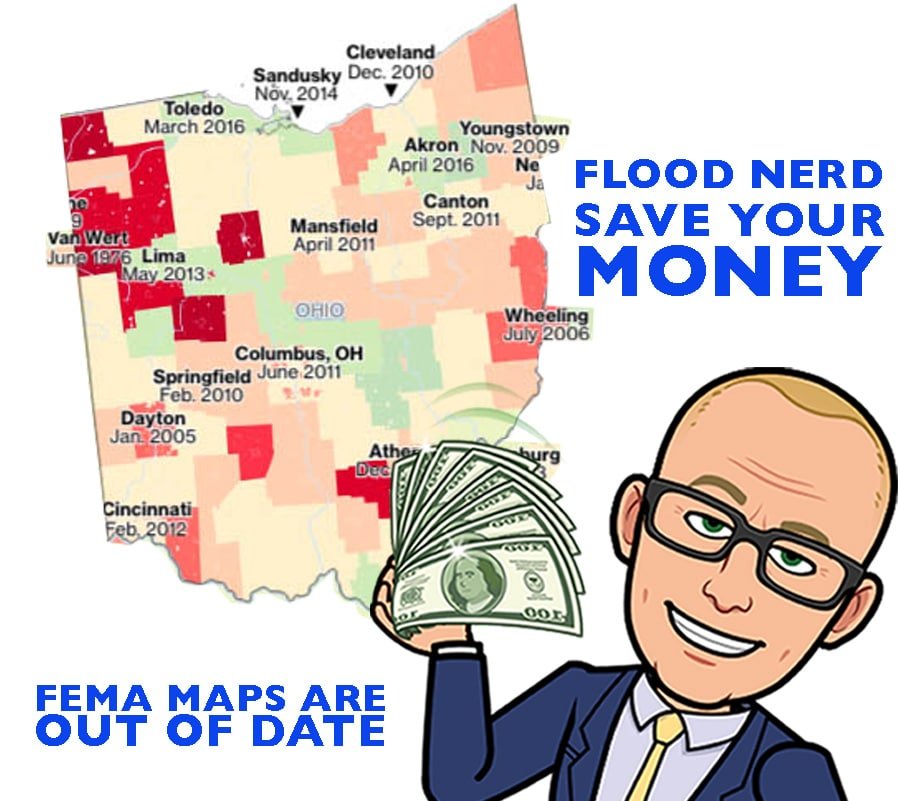

One more note on these low-risk flood zone maps. Many of these maps are over 40 years old. If the area has been developed, there is likely more concrete, creating a barrier for land that previously might have absorbed the massive downpour.

Because of all these factors, it is difficult for property owners to know their true risk of flooding. FEMA admits that their flood maps only give an idea of part of the risk. Our recent storms are facts that it can rain anywhere within Ohio, and you should consider getting flood coverage so you are not uninsured when you need it most.

FEMA flood zone maps often take years to go into effect after the terrain was studied; this gives the impression that the area is “more up to date” than it is.

Cheap flood insurance Ohio « Flood Insurance Cost Ohio

The average cost for Ohio flood insurance in these Low-risk areas is $595 per year.

FEMA’s National Flood Insurance Program (NFIP) and all federally backed lenders rely on these Ohio flood insurance maps to assess risk, set premiums, and determine who is required to purchase flood insurance. Bad information about an area’s flood risk can leave property owners under or uninsured.

Does my homeowners insurance cover flooding?

Many Ohio homeowners mistakenly believe their standard insurance policies include flood coverage. Yet, typical homeowners insurance policies in Ohio do not protect against flood damage. This absence means that any damage from flooding—whether from heavy rain, river overflow, or rapid snowmelt—is not covered under standard policies. Consequently, homeowners in Ohio often need to purchase separate flood insurance to protect their property from such environmental hazards.

Now that you’re equipped with this knowledge, you are better prepared and safer. To meet this essential need, our company provides a convenient online service where Ohio homeowners can initiate their quote process to obtain flood insurance that is customized to their particular requirements. This efficient service ensures homeowners can swiftly and effortlessly obtain the robust protection they need to secure their homes against flood damage. By taking proactive measures, you not only recognize the gaps in typical homeowners’ insurance but also take essential steps to protect your property.

What is not covered by the NFIP?

The National Flood Insurance Program (NFIP) has certain exclusions that homeowners in Ohio should be aware of. Notably, the NFIP does not cover the costs of debris removal or additional living expenses if your home becomes uninhabitable due to flooding. It also excludes coverage for items stored in basements and structures not attached to the main property, such as detached garages and sheds, unless a separate policy is secured. For a detailed understanding of coverage limitations, visiting the NFIP website is recommended.

Ohio’s diverse geography, from plains to hills, can expose homeowners to varied flood risks. Understanding the limitations of NFIP coverage is critical, as it may leave significant gaps in your flood protection strategy. Private flood insurance options from companies like the ones that your flood nerd can offer broader coverage, including debris removal and living expenses—areas not typically supported by the NFIP. These policies can be tailored to meet unique requirements, providing higher coverage limits and fewer restrictions.

The issue of basement content coverage is especially pertinent in Ohio, where homes often include basement spaces used for living or storage. Private insurance policies can be adapted to include these areas, ensuring strong protection for your property. This is particularly beneficial for homeowners who store valuable items in their basements or live in regions susceptible to flash floods or snowmelt runoff.

Working with Your Flood Nerd is crucial when exploring the flood insurance options available in Ohio. Your Flood Nerd can help demystify the terms and conditions of both NFIP and private insurance offerings, aiding you in selecting a policy that matches your risk profile and property characteristics. Their expert advice is invaluable for developing a flood insurance strategy that provides strong coverage tailored to the unique needs of Ohio homeowners.

Ohio NFIP flood insurance.

There are many options available in Ohio regarding flood insurance, but they fall into two main categories.

The Government option, also called the NFIP, FEMA, or The Private flood insurance market.

The National Flood Insurance Program (NFIP), also known as FEMA, is the government option for flood insurance. The NFIP has enjoyed a 50-state monopoly on the flood insurance market.

Not “private flood insurance” but NFIP Resellers

Suppose you have Nationwide Flood Insurance, State Farm Flood Insurance, Progressive Flood Insurance, or any of the logos below. In that case, you are buying the NFIP flood policy that is just being resold through a government program. These companies are private companies, but their flood insurance is not. Here is a list of the 70 companies that resell the NFIP policy.

Ohio private flood insurance market

There are alternatives to the NFIP or government insurance. It is called Private flood insurance, most notably Lloyd’s of London Flood insurance. However, there are other options available in Ohio. We shop all the options for your property in your region to ensure you are getting the best premium. Please click here if you are ready to have us do the work for you.

Our shopping includes the NFIP because sometimes we find that you can get a much better premium with government subsidies.

Lloyd’s of London Flood Insurance Ohio Market

Ohio is fortunate to have many Lloyd’s of London flood insurance options. Although many Lloyd’s flood insurance companies will have you assume that there is only one option, nothing could be further from the truth.

Lloyd’s of London has a rich history attributed to having invented the first modern insurance model. Unlike most of its competition, Lloyds of London is not a company but a corporate body. This structure works well since it has been around for over 330 years. Lloyds operates under multiple financial backers pooling their capital to spread the risk.

I have two blog posts that deep dive into Lloyds of London and what they mean to Ohio’s flood insurance market. If you are interested, the links are below.

Flood insurance agents in Ohio

Lloyd’s of London Flood Insurance

FEMA vs Private flood Insurance

Lloyd’s also insures the world with flood insurance, meaning they cover flooding events in India, Australia, and much of Europe. The “game” of insurance is to spread your risk since Lloyds is worldwide.

My joke here is that Lloyds is banking on God’s promise that he won’t flood the entire world again, …..so they won’t have to pay out the whole world’s flood claim.

How much does flood insurance cost in Ohio?

Many factors go into getting the cost of flood insurance for Ohio. If your home is in what is considered a low-to-moderate risk, you can get a heavily subsidized policy through the government.

Flood insurance rate map Ohio

Ohio flood insurance low-to Moderate Risk rate and cost.

This is Flood Zone X, which is not lender required flood zone.

This is usually identified as an X-flood zone. Then we would suggest the government Preferred Risk Policy (PRP) which is a subsidized policy and has set flood insurance coverage limits (see the grid below):

Here is a link if you want to dig into this one. Be ready for an eye chart because every option is a public record and should be standardized accost whoever writes these policies.

How much does flood insurance cost Ohio

The average cost for flood insurance in Ohio with the maximum set limits in these Low-risk flood zone areas is $405 – $700 per year.

Your property is in a higher-risk flood zone, usually identified with a Flood Zone AE. Your lender will require you to have flood insurance. The cost of flood insurance in Ohio depends on many factors unique to the structure. We will try to give you an idea of the most common homes we see in Ohio with a slab-on-grade foundation.

We will look at the Ohio cost of flood insurance for the NFIP maximum of $250,000 for the (building only) with NO CONTENTS and our recommended deductible of $5,000.

We will be rating this example on the NFIP and on a few of our private flood insurance policies, specifically Lloyds flood insurance options in Ohio.

Cost of Flood Insurance in OHIO in high-risk flood zone AE

Our example is in Columbus, but the premiums will be the same if in Butler, Sandusky, Franklin, Cincinnati, Hamilton, and many other Ohio flood ones.

Flood insurance quote Ohio

In our example, the Base Flood Elevation (BFE is 577.4) is a home that is built before 1973

NFIP option in Ohio Flood Zone AE

NFIP – Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

NFIP Annual premium in High-Risk flood zone is $4,254.00

This option is what we see if the property has had a flood loss before and either doesn’t have an Elevation Certificate applied, or the Elevation certificate shows that the lowest floor is 4 feet under the BFE for the area. You can use 10% of your coverage to cover other structures on your property.

Ohio Private flood insurance – Lloyd’s of London Flood Insurance (option 1)

Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

Lloyd’s of London (option 1) Annual premium in High-Risk flood zone is $863.50

This option is great, and we are very happy when we can get this option. They can be a bit choosey about what risk they will accept and will not take anything that has had a flood loss. They offer basements coverage, about $2,000 for loss of use, and $2,000 for other structures, but they can’t increase this coverage. They do not require an Elevation Certificate to rate.

Ohio Private flood insurance – Lloyd’s of London Flood Insurance (option 2)

Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

Lloyd’s of London (option 2) Annual premium in High-Risk flood zone is $1,020.09

This option is great, and we are very happy when we can get this option for our clients. They seem to be writing almost all risks; however, they do not write any property in a designated floodway or have a depth of -4 under the BFE. In our example, with our BFE being 577.4, they will not accept this risk if the lowest floor is 573. They will not take anything that has had a flood loss. They offer limited coverage for basements and do not require an Elevation Certificate to rate as a percentage of coverage for loss of use. If you want coverage for other structures, that will need to be added.

Private Flood insurance option (option 3), Not Lloyd’s

Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

The annual premium in High-Risk flood zone is $3,829.00

This option will take properties that have had one flood loss for more than five years and the payout was under $100,000 on the claim. Their coverage matches the NFIP. They will write practically all risks, don’t need an elevation certificate to rate, and are a bit lower in premium than the NFIP.

Private Flood Insurance – Lloyd’s of London (option 4)

This option must be written on the building’s Replacement Cost Value (RCV). Otherwise, there is a co-insurance penalty that kicks in. So, $250,000 might be a bit low in California, but to keep this going, let’s just use that for this option

Coverage of $250,000 (RCV) building coverage, No Contents, and $5,000 deductible

The annual premium in a High-Risk flood zone is $984.35.

This options rating system is all over the board. Sometimes we get a crazy great price, but other times the premium is way higher than the NFIP will consider taking a property that has had one flood loss before as long as it has been more than ten years and the payout was under $50,000 on the claim. Their preferred coverage is at replacement cost, slightly different from some of our other Lloyd’s flood options. We usually reserve this one if the property doesn’t fit the above options. We can adjust coverages to control premiums. As mentioned before, these underwriters’ rates are all over the board. It is worth shopping through to ensure we are getting you the best premium possible. They don’t need an elevation certificate to rate.

Private Flood Insurance – Lloyd’s of London (option 5)

Coverage of $250,000 (RCV) building coverage, No Contents, and $5,000 deductible.

The annual premium in a High-Risk flood zone is $1,001.59

This option came from the company that used to run the NFIP program, so the coverage matches the NFIP coverage with two differences. They offer living expenses which will cover your cost when you are displaced from your home during repairs (most Lloyds flood policies offer this). They also offer swimming pool clean out, which is kind of unique so if you have a pool ask for this coverage.

Private Flood Insurance – Lloyd’s of London (option 6)

Coverage of $250,000 (RCV) building coverage. No Contents and $5,000 deductible.

The annual premium in High-Risk flood zone is $1,280.20

This options rating system is also all over the board. Sometimes we get a crazy low price; other times, the premium is way higher than the NFIP. They will consider taking a property that has had one flood loss before as long as it has been more than ten years and the payout was under $25,000 on the claim. They have been rumored to give a low price the first year and then non renew following years, or sometimes they jack the price way up so that we will watch them. They have a slick system, and their underwriting is managed by a 3rd party, which also sometimes seems to be a glitch.

More options are coming online every day, and we are working to be looking into every viable option.

OH flood insurance

Currently, Ohio has 31,711 NFIP policies in force to date, with the total cost of $33,185,859. That would make the average for Ohio $1,047. Of course, some will pay more, and some will pay less.

Click here to have our shop and save you money.

Flood insurance rates Ohio

Hello, Ohio! Thanks for visiting our page for all your flood insurance needs.

Let’s start with Adams and Manchester, Ohio. Adams and Manchester have 102 active flood policies and $89,672 in flood premiums. The average flood rate for these areas is $879.

Now let’s check out Allen, Ohio, where the average flood rate is $896. Allen has 133 flood policies in effect with $119,110 in total premiums.

Delphos, Ohio, is next, with an average flood rate of $849. Delphos has $87,472 in written premiums and 103 active flood policies.

$1,035 is the average flood rate for Ashland and Ashtabula, Ohio. The premiums here total up to $142,887, including 138 flood policies in effect.

Athens, Ohio, flood insurance

Two hundred eighty-three flood policies are active in Athens, Ohio. Athens has $472,493 in premiums which allows the average flood rate to be $1,670. This is a little higher than the state average, so give us a call, Athens! Let’s see if we can help lower your rates!

Let’s check out Nelsonville, Auglaize, and St. Marys, Ohio, where the premiums add up to $240,870. The active policies in these areas total up to 209, allowing the average flood rate to be $1,152.

Belmont, Ohio, is next with an average flood rate of $1,008. Belmont has 175 active flood policies and $176,482 in written premiums.

$776 is the average flood rate for Brown and Ripley, Ohio. Brown and Ripley have $119,574 in flood premiums and 154 total flood policies.

Butler, Ohio, has 575 active flood policies with $499,103 in flood premiums. Butler has an average flood rate of $868.

Cost of flood insurance Butler County Ohio

The average flood rate drops to $803 when we look at Fairfield, Ohio. Fairfield has 286 active flood policies and $229,535 in written premiums.

Looking at New Miami and Sharonville, Ohio, we find 206 active flood policies and $352,708 in total flood premiums. The average flood rate for New Miami and Sharonville is $1,712, which is higher than the state average. Give us a call! We’ll check the rates for you!

Now let’s look at Minerva and Champaign, Ohio, where the average flood rate drops to $776. The total number of flood policies in effect in Minerva and Champaign is 97, with $77,111 in total written premiums.

Clark, Ohio, has an average flood rate of $919. Clark has $271,392 in total flood premiums, which includes 297 active flood policies.

We’ll look at a group of areas now, which include Enon, Clermont, Columbiana, and East Palestine, Ohio, where the total number of active flood policies is 374. The premiums for these areas add up to $343,739, allowing the average flood rate to be $919.

Next, check out another group of areas: Loveland, New Richmond, Coshocton, and Brecksville, Ohio, where the average flood rate is $1,332. The premiums for these areas add up to $520,859, and the total number of flood policies is 391.

Flood Insurance Cleveland Ohio

Hello Cleveland, Ohio! Thanks for stopping by! Your average flood rate is $624. The total number of flood policies in Cleveland is 164. The premiums in Cleveland total $102,257.

$4,197 is the average flood rate for Gates Mills and Independence, Ohio. This is much higher than the state average! Contact us! This includes $470,009 in flood premiums and 112 active flood policies.

One hundred nine flood policies are in effect in North Olmstead, Ohio. North Olmstead has $116,518 in flood premiums which allows the average flood rate to be $1,069.

North Royalton, Shaker Heights, Valley View, and Westlake, Ohio, have an average flood rate of $1,110. The total number of flood policies active in these areas is 343, and the premiums add up to $380,641.

Moving to Solon, Strongsville, and Defiance, Ohio, we find 300 active flood policies and $302,958 in total premiums. These areas’ average flood rate calculates to $1,010.

Flood insurance Columbus Ohio

Columbus, Ohio! You don’t have the highest number of flood policies in the state, but you are close to 923! The average flood rate for Columbus is $1,179 which includes $1,088,318 in premiums.

$615 is the average flood rate for Delaware, Ohio. Delaware has 259 active flood policies and $159,327 in written flood premiums.

Let’s look at Dublin, Erie, and Huron, Ohio. These areas have an average flood rate of $1,033. The flood policies total 365, with the premiums totaling $$377,133.

One hundred twenty-five active flood policies exist for Westerville and Bellevue, Ohio. Westerville and Bellevue, Ohio, have an average flood rate of $802. The premiums for these areas total $100,261.

Hello Sandusky, Ohio! Home of Cedar Point, where you can ride some of the fastest roller coasters in the United States! Sandusky, your average flood rate is $776. You have 405 active flood policies and $314,406 in flood premiums.

The average flood rate jumps to $1,565 in Vermilion and Buckeye Lake, Ohio. The premiums for these areas total $402,193, including 257 flood policies in effect.

Fairfield, Ohio, has 242 flood policies, with $259,893 in flood premiums. The average flood rate for Fairfield, Ohio, is $1,074.

Looking at Lancaster, Ohio, we see 450 active flood policies and $538,099 in total flood premiums. This allows the average flood rate for Lancaster to be $1,196

Let’s check out Pickerington and Reynoldsburg, Ohio, where the average flood rate is $1,209. The written policies in these areas total 132 with $159,575 in premiums.

Moving on to Franklin, Ohio, where there are 683 active flood policies and $842,775 in flood premiums. The average flood rate in Franklin is $1,234.

Now, we’ll look at a group of areas that include Gahanna, Grandview Heights, Grove City, Gallia, and Gallipolis, Ohio, where the flood premiums total $444,301, with 349 flood policies in effect. These areas have an average flood rate of $1,273.

Upper Arlington and Whitehall, Ohio, have 132 active flood policies. The premiums here total $139,602, allowing the average flood rate to be $1,058.

In Geauga, Ohio, the average flood rate is much lower at $666. The flood policies total 110 with $73,307 in premiums.

$828 is the average flood rate in Beavercreek, Ohio. Beavercreek has 158 flood policies, with $130,875 in flood premiums.

One hundred two policies are active in Bellbrook, Ohio. The premiums in Bellbrook total $104,257, which allows the average flood rate to be $1,022.

The flood premiums in Fairborn, Ohio, total $112,953, with 133 flood policies in effect. The average flood rate in Fairborn is $849.

Greene, Ohio, has 102 flood policies and $112,953 in total premiums. The average flood rate in Greene is $741.

Three hundred one flood policies are active in Kettering, Ohio. Kettering has an average flood rate of $1,120 with $337,178 in total written premium.

Looking at Cambridge and Guernsey, Ohio, we find a higher average flood rate of $1,697. This includes 120 active flood policies and $203,626 in flood premiums.

Flood insurance Cincinnati Ohio

Hello Cincinnati, Ohio! Glad you stopped by! The average flood rate in Cincinnati is $1,689. The active flood policies total 488 with $824,431 in written premiums. Give us a call, Cincinnati!

The average flood rate in Evendale and Fairfax, Ohio, jumps to $3,132. The premiums here total $247,413, with 79 active flood policies. Let’s try to find a lower rate!

Hamilton, Ohio, has 493 active flood policies and $541,651 in written premiums. The average flood rate for Hamilton is $1,099.

The average flood rate drops to $981 in Harrison, Ohio. Harrison has 125 flood policies in effect and $122,661 in total premiums.

$1,388 is the average flood rate for Newtown and Reading, Ohio. Newtown and Reading have 144 flood policies and $199,854 in written flood premiums.

Findlay Ohio flood insurance

Seven hundred thirty-five flood policies are active in Findlay, Ohio! Findlay has an average flood rate of $1,302, including $957,304 in flood premiums.

A group of areas, including Hancock, Hocking, Jackson, and Dillonvale, Ohio, find an average flood rate of $880. The policies in effect in these areas total 360 with $316,696 in premiums.

The rate increases slightly to $1,156 when we look at Logan, Killbuck, Jefferson, and Knox, Ohio. The premiums for these areas total $382,785 with 331 flood policies.

Mount Vernon, Ohio, has 130 active policies and $101,992 in premiums. Mount Vernon’s average flood rate is $785.

The average flood rate goes up to $1,230 when we look at Eastlake, Ohio. Eastlake has 164 active flood policies and $201,791 in written premiums.

There are 196 active flood policies in Lake County and Mentor, Ohio. These two areas have an average flood rate of $536 with $104,978 in flood premiums.

The premiums in Painesville, Willoughby Hills, and Willoughby, Ohio, total $290,397, with 213 flood policies in effect. These areas have an average flood rate of $1,363.

Lawrence, Ohio, has 368 flood policies with $286,181 in flood premiums. The average flood rate for Lawrence is $778.

In Licking, Ohio, there are 111 flood policies in effect. The average flood rate in Licking is $787, including $87,362 in written premiums.

The average flood rate rises to $1,141 in Newark, Ohio. Newark has 234 active flood policies and $266,983 in flood premiums.

$199,656 is the premium total for Logan and Avon, Ohio. These two areas have an average flood rate of $1,040 with 192 flood policies.

Lorain, Ohio, has an average flood rate of $933. Lorain’s active flood policies total 302 with $281,854 in premiums.

$963 is the average flood rate for North Ridgeville, Ohio. The premiums in North Ridgeville total $280,094 with 291 flood policies.

Six hundred seventy-nine flood policies are active in Lucas, Ohio. Lucas has an average flood rate of $1,001. The premiums in Lucas total $679,891.

In Oregon, Ohio, the average flood rate is $777. The premiums in Oregon add up to $187,342 with 241 active policies.

Hello Toledo! Toledo, Ohio, has an average flood rate of $959. The active policies in Toledo total 655 with $627,934 in total premiums.

The average flood rate drops slightly to $710 in Mahoning, Ohio. Mahoning has 123 policies in effect and $87,279 in total premiums.

Looking at La Rue and Marion, Ohio, we find 158 flood policies in effect and an average flood rate of $830. The premiums in these areas total $131,066.

Next, let’s check out Prospect and Brunswick, Ohio. These two areas have 133 flood policies active and $115,713 in flood premiums. The average flood rate is $870.

Medina, Ohio, has an average flood rate of $741. The premiums in Medina add up to $160,895 with 217 policies in effect.

In Rittman and Meigs, Ohio, we find 151 active flood policies and $132,556 in flood premiums. The average flood rate for Rittman and Meigs is $878.

One hundred four policies are active in Middleport, Ohio. Middleport has an average flood rate of $1,012 with $105,256 in premiums.

Let’s look at a group of areas, including Mercer, Miami, Dayton, and Germantown, Ohio. These areas have $390,771 in flood premiums. The average flood rate is $1,034, with 378 flood policies.

Looking at Troy and Carlisle, Ohio, we find an average flood rate of $1,035. These two spots have 200 active flood policies and $207,071 in total flood premiums.

Montgomery, Ohio, has 316 active policies and $322,750 in premiums. The average flood rate in Montgomery is $1,021.

The average flood rate in Moraine, Riverside, and Trotwood, Ohio, is $1,477. The premiums for these areas total $209,778, with 142 flood policies in effect.

$1,199 is the average flood rate for West Carrollton, Ohio. West Carrollton has 221 active flood policies and $264,951 in total premiums.

The average flood rate for Morgan and Muskingum, Ohio, is $801. The number of flood policies totals 202, with $161,718 in flood premiums.

One thousand one hundred ninety-six flood policies are active in Ottawa County, Ohio. Ottawa has an average flood rate of $820 with $980,620 in total premiums.

$189,511 is the premium total for Port Clinton, Ohio. Port Clinton has an average flood rate of $898 with 211 flood policies.

Let’s check out a group of areas: Paulding, New Lexington, Pike, Portage, Putnam, Mansfield, Chillicothe, and Ross, Ohio, where the average flood rate is $1,045. The active flood policies total 657 with $686,597 in total flood premiums.

The next group of areas has the same average flood rate of $1,045. These areas include Perry, Pickaway, Preble, Ottawa, Richland, and Shelby, Ohio. The premiums for these areas total $570,603, with 546 policies in effect.

Hello Sandusky, Ohio! Home of Cedar Point! Cedar Point, OH, is home to some of the fastest roller coasters! Glad to have you here! You have 121 flood policies in effect with $87,882. The average flood rate is $726 in Sandusky.

In Scioto, Ohio, there is an average flood rate of $915. The premiums in Scioto total $284,715, with 311 flood policies in effect.

Seneca and Tiffin, Ohio, has 134 active flood policies with $149,438 in total premiums. The average flood rate for Seneca and Tiffin is $1,115.

$904 is the average flood rate for Shelby and Sidney, Ohio. The premiums for these areas total $176271, with 195 active flood policies.

Three hundred eleven policies are active in Stark, Ohio. Stark has an average flood rate of $872 with $271,079 in written premiums.

Akron and Barberton, Ohio, have $282,437 in flood premiums and 245 flood policies. The average flood rate for Akron and Barberton is $1,153.

$436 is the average flood rate for Cuyahoga Falls and Hudson, Ohio. These areas have 343 policies in effect and $149,478 in total premiums.

In Stow, Ohio, there are 117 flood policies active with $72,832 in premiums. Stow’s average flood rate is $622.

Two hundred thirty-one flood policies are active in Summit, Ohio. The average flood rate for Summit is $595, including $137,431 in total premiums.

Looking at Niles, Trumbull, Tuscarawas, and Uhrichsville, Ohio, we find an average flood rate of $981. These areas have 514 policies, with $504,274 in total flood premiums.

Now, let’s check out Warren, New Philadelphia, Franklin, Morrow, and South Lebanon, Ohio, where there are 437 flood policies active. The premiums for these areas total up to $571,603, allowing the average flood rate to be $1,308.

Warren, Ohio, has an average flood rate of $923. The premiums in Warren total $336,962 with 365 active flood policies.

Flood insurance Belpre Ohio

There are 190 flood policies in effect in Belpre, Ohio. The average flood rate in Belpre is $890, which includes $169,076 in total flood premiums.

Three hundred ninety-eight flood policies are active in Marietta, Ohio. Marietta has $831,953 in written premium, which allows the average flood rate to be $2,090.

The average flood rate drops to $1,311 in Washington, Ohio. Washington has 186 policies in effect with $243,898 in flood premiums.

$747 is the average flood rate for Wayne and Williams, Ohio. The premiums here total $78,430 with 105 active flood policies.

The average flood rate rises to $852 in Wood, Ohio. Wood has $95,473 in total premiums with 112 active flood policies.

Finally, we’ll look at Carey, Ohio, where the average flood rate is $1,164. Carey has 110 policies in effect with $128,079 in total premiums.

Thanks for checking out all the flood information on Ohio!!

Flood Insurance Calculator for Ohio

For decades, the NFIP has over-charged 50 percent of its policyholders and under-charged the other 50 percent while it has racked up $42 billion in taxpayer-funded losses, equating to more than half of every claim paid by the NFIP since 1978.

About 30 percent of NFIP claims payments go to the same 3 percent of insured “repetitive loss” structures yearly. When you do the math, this means that the other 97 percent of their flood-exposed constituents could have paid in less and still netted larger claims payouts if they had better access to private flood insurance. A recent white paper by Milliman found that 90 percent of homes in Sandy-struck New York and New Jersey would see reduced flood insurance rates through private insurers.

Get Cheap Flood Insurance without Compromising Coverage

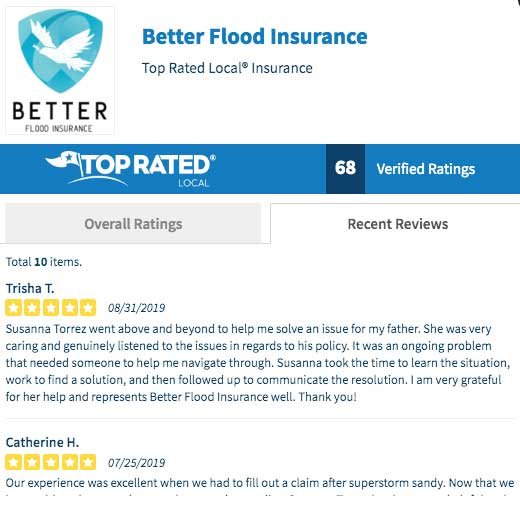

★★★★★

"Same Coverage at a Better Rate"

-Mohammed K

Flood Nerds will shop the private flood insurance markets and then compare them to the NFIP, guaranteeing you the better option. We will send you the cheapest flood insurance rates within minutes.

★★★★★

"Quick Response, Very Knowledgable"

– Robert W

Paying for low-cost flood insurance is awesome. And letting the Flood Nerds shop your property has other benefits – you can get better coverage while saving money, and you can get it fast.

★★★★★

"Would highly recommend Better Flood for your flood insurance needs."

– Varun K