Get Flood Insurance Georgia & Save Money Too.

People in Georgia save on average $500 to $1,457+ on their annual flood premiums.

In many cases, we save them even more. Get the cheapest flood insurance in Georgia without sacrificing coverage.

Get flood insurance from a Flood Nerd® at Better Flood Insurance® and save big time.

featured on

Get Cheap Flood Insurance GA in 2023 without Compromising Your Coverage.

Get Cheap Flood Insurance without Compromising Coverage

★★★★★

"Same Coverage at a Better Rate"

-Mohammed K

Flood Nerds will shop the private flood insurance markets and then compare them to the NFIP, guaranteeing you the better option. We will send you the cheapest flood insurance rates within minutes.

★★★★★

"Quick Response, Very Knowledgable"

– Robert W

Paying for low-cost flood insurance is awesome. And letting the Flood Nerds shop your property has other benefits – you can get better coverage while saving money, and you can get it fast.

★★★★★

"Would highly recommend Better Flood for your flood insurance needs."

– Varun K

Better Flood Insurance is an independent flood insurance broker that shops flood insurance ONLY. Flood Nerds are Flood insurance experts. We have 5000+ happy clients and 390+ 5-star reviews.

How to Save Money Flood Insurance Georgia

Georgia flood

Does my Georgia homeowner insurance cover flooding?

A typical Georgia homeowners’ policy is written through Farmers, State Farm, Allstate, and Progressive, for instance, excludes flooding as something that will be covered under their homeowner’s policy. Georgia flood zone map

In most cases, the only way to get flood coverage is by purchasing a stand-alone flood insurance policy. However, you should ask your homeowners agent if you can add an endorsement to your homeowner’s policy to cover flooding. Yet, don’t be too surprised if the answer is NO.

How to get Flood insurance in Georgia?

It is important to have flood insurance coverage in Georgia because our beloved Cowboy State has seen a fair share of flooding, and more is likely coming.

We believe that most homeowners think about Flood insurance in Georgia at some point, maybe before buying a home or during the closing process. However, many of us only think about it when a big storm is looming or we have heard on the news that there is flooding forecasted or happening too close to our home.

If your home or business is in a flood zone, that is considered a low flood risk area. Sadly, many homeowners decide to forgo purchasing coverage because they believe they are safe from flooding. Some real estate and insurance agents may even say you don’t need it.I ask you to consider the facts: 20 percent of all flooding events across our nation come in areas that are considered low risk.

After our last few major storms (Hurricane Harvey), we saw flooding in these low-risk areas. 80 percent of these individuals had water in their homes or building and didn’t have flood insurance coverage.In Harris county, nearly 135,000 homes were damaged. Three-fourths of these properties were considered low to moderate risk.

Georgia flood map

Flood Insurance Georgia

We often hear that people believe that the government will help, which is true. However, a few things must align for you to get government assistance.

1 – The president of the United States must declare the flooding event a state of emergency. If this doesn’t happen, then there won’t be assistance.

2 – Homeowners’ average amount of assistance after a flood, when they do not have flood coverage, is $5,000. The average cost of damage to one’s property after a flood is $38,000+. That $5K you get from the government? It comes in the form of a loan and you will need to pay it back. Are you willing to gamble away your financial future by forgoing flood insurance coverage?

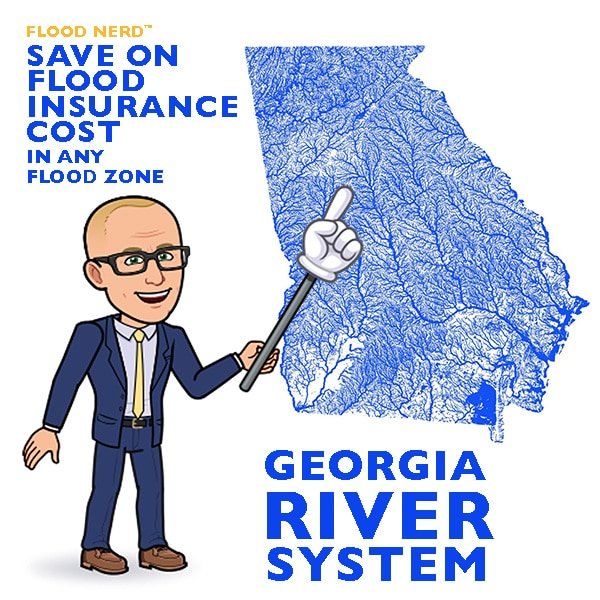

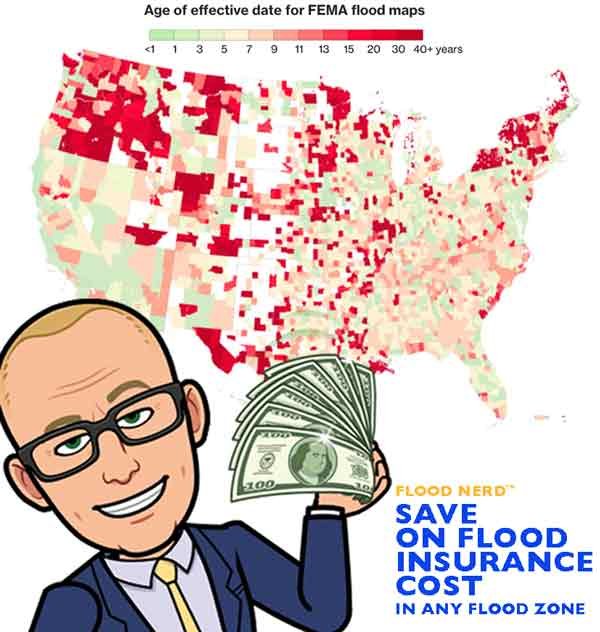

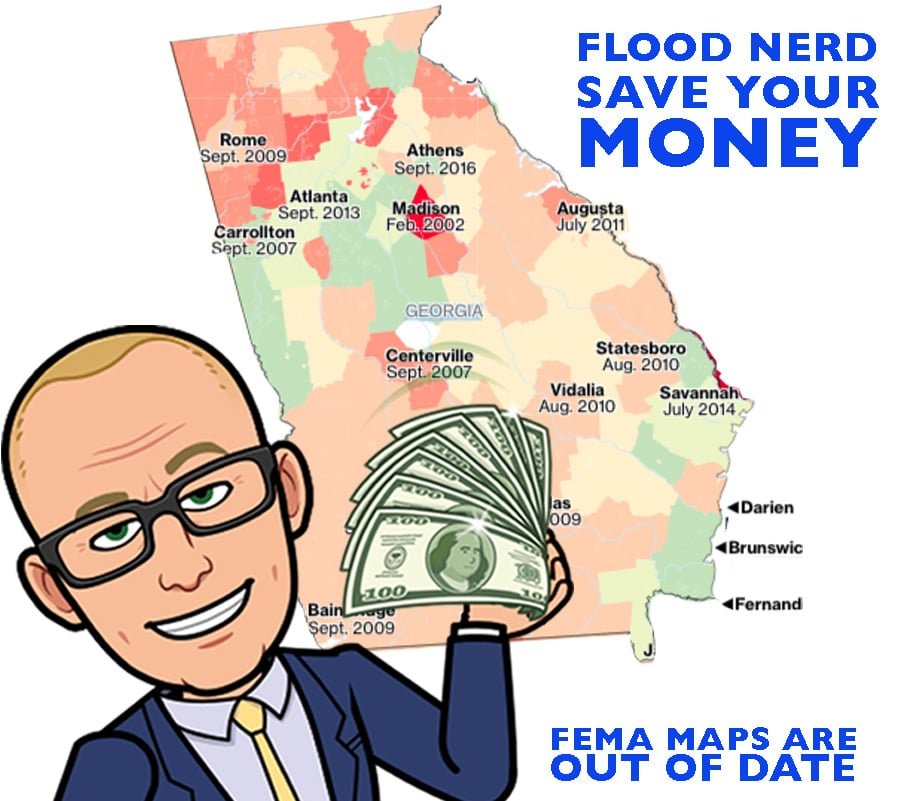

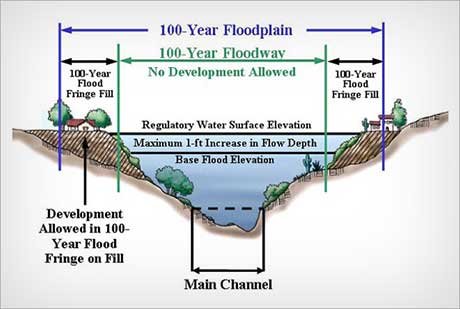

One more note on these low-risk flood zone maps. Many of these maps are over 40-years old. If the area has been developed, then there is likely more concrete, creating a barrier for land that previously, might have absorbed the massive downpour.

Because of all these factors, it is difficult for property owners to know their true risk of flooding. FEMA admits that their flood maps only give an idea for part of the risk. Our recent storms are facts that it can rain anywhere within Georgia, and you should consider getting flood coverage, so you are not uninsured when you need it most.

FEMA flood zone maps often take years to go into effect after the terrain was studied, this gives the impression that the area is “more up to date” then it really is.

The average cost for Georgia flood insurance in these Low-risk areas is $595 per year.

FEMA’s National Flood Insurance Program (NFIP) and all federally backed lenders rely on these Georgia flood insurance maps to assess risk, set premiums, and determine who is required to purchase flood insurance. Bad information about an areas flood risk can leave property owners under or uninsured.

How much is flood insurance in Georgia?

There are many options available in Georgia regarding flood insurance, but they basically fall into two main categories. The Government option also referred to as the NFIP or FEMA. And the Private Flood Insurance Market.

Georgia NFIP flood insurance.

1 – The National Flood Insurance Program (NFIP), also known as FEMA, which is the government option for flood insurance. The NFIP has enjoyed a 50-state monopoly on the flood insurance market.

Not “private flood insurance” but NFIP Resellers

If you have Nationwide Flood Insurance, State Farm Flood Insurance, Progressive Flood Insurance, or any of the of the logos below then you are buying the NFIP flood policy that is just being resold through a government program. These companies are private companies, but their flood insurance is not. Here is a list of the 70 companies that resell the NFIP policy.

Georgia private flood insurance market

There are alternatives to the NFIP or government insurance. It is called Private flood insurance most notably Lloyds of London Flood insurance, however, there are other options available in Georgia . We shop all the options for your property in your region to ensure you are getting the best premium. If you are ready to have us do the work for you, please click here.

Our shopping does include the NFIP because sometimes we find that with government subsidies you can get a much better premium.

Lloyd’s of London Flood Insurance Georgia Market

Georgia is fortunate to have many Lloyd’s of London flood insurance options. Although many Lloyd’s flood insurance companies will have you assume that there is only one option, nothing could be further from the truth.

Cost of flood insurance in Georgia

Lloyd’s of London has a rich history and is attributed to have invented the very first modern insurance model. Unlike most of its competition, Lloyd’s of London is not really a company but rather a corporate body. This structure works quite well since it has been around for over 330 years. Lloyds operates under multiple financial backers that all pool their capital to spread the risk.

I have two blog posts that take a deep dive into Lloyds of London and what they mean to Georgia ’s flood insurance market. If you are interested, the links are below.

Lloyd’s of London Flood Insurance

FEMA vs Private flood Insurance

Lloyd’s also insures the world for flood insurance, meaning they cover flooding events in India, Australia as well as much of Europe. You see the “game” of insurance is to spread your risk since Lloyds is worldwide.

My joke here is that Lloyds is banking on Gods promise that he won’t flood the entire world again, …..so they won’t have to pay out the whole worlds flood claim.

How much does flood insurance cost in Georgia?

There are many factors that go into getting the cost of flood insurance for Georgia. If your home is in what is considered low-to-moderate risk, you can get a heavily subsidized policy though the government.

Georgia flood insurance low-to Moderate Risk rate and cost.

This is Flood Zone X, which is not lender required flood zone.

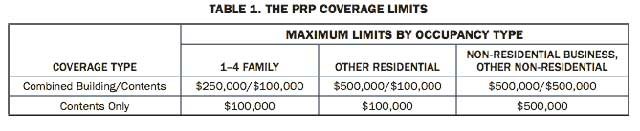

This is usually identified as an X-flood zone. Then we would suggest the government Preferred Risk Policy (PRP) which is a subsidized policy and has set flood insurance coverage limits (see grid below):

Georgia flood zone map

The average cost for flood insurance in Georgia with the maximum set limits in these Low-risk flood zone areas is $405 – $700 per year.

If your property is in higher-risk flood zone, it is usually identified with a Flood Zone AE. Your lender will require you to have flood insurance. The cost of flood insurance in Georgia depends on many factors that are unique to the structure. We are going to try to give you an idea for the most common homes we see in Georgia with a slab on grade foundation.

We will look at the Georgia cost of flood insurance for the NFIP maximum of $250,000 for the (building only) with NO CONTENTS and our recommended deductible of $5,000.

We will be rating this example on the NFIP, as well as on a few of our private flood insurance policies, specifically Lloyds flood insurance options in Georgia.

Cost of Flood Insurance in GEORGIA in high-risk flood zone AE

Our example is in Chatham, but the premiums will be the same if in Savannah, Tybee Island, Cobb, Glynn, Augusta, and many other Georgia flood ones.

In our example, the Base Flood Elevation (BFE is 13) and is a home that is built before 1973

NFIP option in Georgia Flood Zone AE

NFIP – Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

NFIP Annual premium in High-Risk flood zone is $4,060.00

This option is what we see if the property has had a flood loss before, and either doesn’t have an Elevation Certificate applied or the Elevation certificate showing that the lowest floor is 4 feet under the BFE for the area. You can use 10% of your coverage to cover other structures on your property

Georgia Private flood insurance – Lloyd’s of London Flood Insurance (option 1)

Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

Lloyd’s of London (option 1) Annual premium in High-Risk flood zone is $649.76 (great price).

This option is great, and we are very happy when we can get this option. They can be a bit choosey about what risk they will accept and will not take anything that has had a flood loss. They do offer coverage for basements, about $2,000 for loss of use, $2,000 for other structures, but they can’t increase this coverage. They do not require an Elevation Certificate to rate.

Georgia Private flood insurance – Lloyd’s of London Flood Insurance (option 2)

Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

Lloyd’s of London (option 2) Annual premium in High-Risk flood zone is $465.83

This option is great, and we are very happy when we can get this option for our clients as well. They seem to be writing almost all risks; however, they do not write any property that is in a designated floodway or has the depth of -4 under the BFE. In our example, with our BFE being 5368, if the lowest floor is 5364, then they will not accept this risk. They will not take anything that has had a flood loss. They do offer limited coverage for basements and do not require an Elevation Certificate to rate, and as a percentage of coverage for loss of use. If you want coverage for other structures, then that will need to be added.

Private Flood insurance option (option 3) Not Lloyd’s

Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

Annual premium in High-Risk flood zone is $ 3,539.00

This option will take properties that have had one flood loss as long as it has been more than five years, and the payout was under $100,000 on the claim. Their coverage matches the NFIP. They will write practically all risks, don’t need an elevation certificate to rate, and are a bit lower in premium than the NFIP.

Private Flood insurance – Lloyd’s of London (option 4)

This option must be written on the Replacement Cost Value (RCV) of the building, otherwise there is a co-insurance penalty that kicks in. So, $250,000 might be a bit low in California, but to keep this going, let’s just use that for this option

Coverage of $250,000 (RCV) building coverage, No Contents and $5,000 deductible

Annual premium in High-Risk flood zone is $ 824.72.

This options rating system is all over the board. Sometimes we get a crazy great price, but other times the premium is way higher than the NFIP will consider taking a property that has had one flood loss before as long as it has been more than ten years and the payout was under $50,000 on the claim. Their preferred coverage is at replacement cost, which is a bit different from some of our other Lloyd’s flood options. We usually reserve this one if the property doesn’t fit into any of our options above. We can adjust coverages to control premium. As mentioned before, this underwriters’ rates are all over the board. It is worth shopping through to make sure we are getting you the best premium we can. They don’t need an elevation certificate to rate.

Private Flood insurance – Lloyd’s of London (option 5)

Coverage of $250,000 (RCV) building coverage, No Contents and $5,000 deductible.

Annual premium in High-Risk flood zone is $ 1,138.80

This option came out of the company that used to run the NFIP program, so the coverage almost exactly matches the NFIP coverage with two differences. They offer living expenses which will cover your cost, when you are displaced from your home during repairs (most Lloyds flood policies offer this). They also offer swimming pool clean out, which is kind of unique so if you have a pool ask for this coverage.

Private Flood insurance – Lloyd’s of London (option 6)

Coverage of $250,000 (RCV) building coverage. No Contents and $5,000 deductible.

Annual premium in High-Risk flood zone is $904.05

This options rating system is also all over the board. Sometimes we get a crazy low price; other times the premium is way higher than the NFIP. They will consider taking a property that has had one flood loss before as long as it has been more than ten years and the payout was under $25,000 on the claim. They have been rumored to give a low price the first year and then non renew following years or sometimes they jack the price way up so we will watch them. They have a slick system, and their underwriting is managed by a 3rd party, which also seems to be a glitch sometimes.

There are more options coming online every day, and we are working to be looking into every viable option.

Georgia Flooding

Currently, Georgia has 87,371 NFIP policies in force to date with the total cost of $57,793,148. That would make the average flood rate for Georgia $684. Of course, some will pay more, and some will pay less.

Click here to have us shop and save you money.

Hello, Georgia! Thanks for visiting our page for all your flood insurance needs.

Let’s start off with a group of areas that include Milledgeville, Bartow, Macon-Bibb, and Macon, Georgia where the average flood rate calculates out to $934. The number of active flood policies add up to 396 with $369,982 in flood premiums.

Next up is Brantley and Pembroke, Georgia where the premiums total $101,732 with 121 active flood policies. The average flood rate for Brantley and Pembroke is $841.

Bryan, Georgia has an average flood rate of $533. Bryan has 2,903 active flood policies and $1,548,481 in flood premiums.

In Richmond Hill, Georgia, there are 2,264 flood policies in effect with $1,237,440 in written premium. Richmond Hill has an average flood rate of $547.

$719 is the average flood rate in Bulloch and Statesboro, Georgia. The premiums for these areas add up to $297,633 with 414 active flood policies.

143 flood policies are active in Butts, Georgia. Butts has an average flood rate of $618 which includes $88,362 in flood premiums.

Camden county Georgia flood map

Let’s look at Camden, Georgia where they have 1,157 flood policies in effect. The premiums total $586,409 which allows the average flood rate to be $507.

Next, we’ll check out Kingsland, Georgia where the average flood rate is $372. The number of active flood policies is 932 with $347,094 in total premiums.

St. Marys, Georgia is up next with 1,744 active flood policies and $899,467 in premiums. The average flood rate for St. Marys is $516.

Now a group of areas that include Carroll, Catoosa, and Fort Oglethorpe, Georgia where the number of active policies total 407 with $374,961 in written premium. The average for these areas is $921.

In Bloomingdale, Georgia, the flood policies number 204. The premiums here total $163,752 which allows the average flood rate to be $803.

Chatham county Georgia flood maps

Let’s look at Camden, Georgia where they have 1,157 flood policies in effect. The premiums total $586,409 which allows the average flood rate to be $507.

Next, we’ll check out Kingsland, Georgia where the average flood rate is $372. The number of active flood policies is 932 with $347,094 in total premiums.

St. Marys, Georgia is up next with 1,744 active flood policies and $899,467 in premiums. The average flood rate for St. Marys is $516.

Now a group of areas that include Carroll, Catoosa, and Fort Oglethorpe, Georgia where the number of active policies total 407 with $374,961 in written premium. The average for these areas is $921.

In Bloomingdale, Georgia, the flood policies number 204. The premiums here total $163,752 which allows the average flood rate to be $803.

Chatham county Georgia flood maps

17,121 is the number of active flood policies in Chatham, Georgia. Chatham has $10,739,542 in flood premiums. The average flood rate here is $627.

$1,098 is the average flood rate for Garden City, Georgia. Garden City has 288 active flood policies with $316,193 in flood premiums.

There are 1,751 flood policies in effect in Pooler, Georgia. Pooler has an average flood rate of $507 with $887,634 in written premium.

Port Wentworth, Georgia has an average flood rate of $539. Port Wentworth has 239 active flood policies with $128,757 in flood premiums.

Hello Savannah, Georgia! You all have 7,116 active flood policies. Savannah has so much charm. The houses are gorgeous. The parks are amazing. There is so much to do! The premiums in Savannah total $4,211,645 which allows the average flood rate to be $592.

Next up is Thunderbolt, Georgia where the average flood rate is $847. Thunderbolt has 331 flood policies in effect with $280,464 in written premiums.

Tybee Island, Georgia! Let’s hit the beach, the local ice cream shop, or The Original Crab Shack! Your island is so fun! There are $2,561,490 in flood premiums with 2,638 in active policies. The average flood rate for Tybee Island is $971.

$662 is the average flood rate for Cherokee and Athens-Clarke, Georgia. These areas have premiums that total up to $394,816 with 596 active flood policies.

514 policies are in effect in Clayton and Austell, Georgia. Clayton and Austell have an average flood rate of $555 which includes $285,391 in written premium.

In Cobb, Georgia, there are 2,594 flood policies in effect. Cobb has $1,659,212 in flood premiums with an average flood rate of $640.

Kennesaw, Georgia has an average flood rate of $670. The number of active flood policies is 119 with $79,720 in premiums.

The average flood rate of Marietta and Smyrna, Georgia is $736. The premiums here add up to $306,968 with 417 flood policies in effect.

Let’s check out Columbia, Georgia where there are 812 active flood policies. Columbia has $374,404 in premiums which allows the average flood to be $461.

When we look at Cook, Georgia, we see 68 flood policies in effect with $66,372 in premiums. The average flood rate for Cook, Georgia is $976.

Now let’s check out a group of areas that include Coweta, Crisp, Bainbridge, and Decatur County, Georgia where the premiums total $590,658 with 710 active flood policies. The average flood rate for these areas is $832.

Hello Atlanta, Georgia! Atlanta has 2,053 flood policies in effect. Atlanta has $1,796,644 in written premiums which allows the average flood rate to be $875.

Our next group of areas include Brookhaven, Chamblee, and Decatur, Georgia, where the policies add up to 388 with $341,806 in total premiums. The average flood rate here is $881.

Dekalb County Georgia flood plain map

Looking at Dekalb, Georgia, we find $2,326,902 in flood premiums with 2,539 active flood policies. The average flood rate for Dekalb is $916.

The average flood rate drops to $528 in Dunwoody, Georgia. Dunwoody has 234 flood policies in effect which includes $123,468 in flood premiums.

Moving on to Albany, Georgia where the average flood rate rises to $1,222. Albany has 1,103 in active flood policies with $1,348,030 in written premium.

Dougherty and Douglas, Georgia have an average flood rate of $690. The active policies add up to 547 with $377,225 in flood premiums.

In Douglasville, Georgia, we find 73 flood policies in effect with $42,175 in written premium. The average flood rate for Douglasville is $578.

The average flood rate drops to $464 in Effingham, Georgia. The active flood policies number 803 with $372,356 in flood premiums.

When we look at Rincon, Fannin, and Rome, Georgia, we find 683 policies that are active with $615,468 in total flood premiums. The average flood rate for these areas is $901.

Next up is Fayette, Peachtree City, and Floyd, Georgia where their average flood rate is $617. The premiums total $325,310 with 527 flood policies in effect.

Forsyth, Georgia has an average flood rate of $473. The premiums total $207,900 with 440 active flood policies.

$569 is the average flood rate for East Point and Alpharetta, Georgia. The number of active flood policies in East Point and Alpharetta is 303 with $172,407 in total premiums.

Looking at Fulton, Johns Creek, and Milton, Georgia, we find 652 flood policies in effect with $379,970 in written premium. The average flood rate for these areas is $583.

459 flood policies are active in Roswell, Georgia. The premiums total $227,816 which allows the average flood rate to be $496.

The average flood rate rises to $662 in Sandy Springs, Georgia. The number of policies in Sandy Springs total 520 with $344,131 in flood premiums.

Gilmer, Georgia has an average flood rate of $845. Gilmer has 264 active flood policies with $223,210 in written premium.

1,278 flood policies are active in Brunswick, Georgia. Brunswick has $1,341,338 in flood premiums which causes the average flood rate to be $1,050.

The average flood rate drops to $658 in Glynn, Georgia. Glynn has 12,278 flood policies in effect with $8,080,522 in flood premiums.

The average flood rate drops again to $496 in Jekyll Island, Georgia. Jekyll Island has $413,245 in written premiums and 833 active flood policies.

When we look at Gordon and Duluth, Georgia, we find 219 flood policies in effect with $185,441 in total premiums. The average flood rate for these areas is $847.

$617 is the average flood rate in Gwinnett, Georgia. Gwinnett has 1,190 flood policies that are active with $734,083 in written premium.

Let’s look at a group of areas that include Hall, Harris, Henry, Lee, and Flemington, Georgia where the flood premiums add up to $584,939 with 982 active flood policies. The average flood rate for these areas is $596.

Our next group includes McDonough, Houston, and Warner Robins, Georgia where the average flood rate is $593. The policies here number 569 with $337,665 in written premium.

Hinesville, Georgia has 893 active flood policies with $460,392 in flood premiums. Hinesville has an average flood rate of $516.

The average flood rate rises to $800 in Liberty, Georgia. Liberty has 839 flood policies in effect with $671,274 in total premiums.

Looking at Midway, Long, Lowndes, and Valdosta, Georgia, we find the active flood policies number 649 with $440,281 in flood premiums. The average flood rate for these areas is $678.

Next up is Darien, Georgia where the average flood rate is $466. Darien has 74 flood policies in effect with $34,498 in premiums.

In McIntosh, Georgia, there are 771 flood policies active with $585,588 in total flood premiums. The average flood rate for McIntosh is $760.

$814 is the average flood rate for Mitchell and Monroe, Georgia. The premiums here total $161,889 with 199 policies in effect.

855 flood policies are active in Columbus, Georgia. Columbus has an average flood rate of $917 which includes $784,278 in flood premiums.

Let’s check out another group of areas that include Newton, Paulding, Cedartown, and Polk, Georgia where the active flood policies total 471. The average flood rate for these areas is $609 which includes $286,925 in total premiums.

Putnam and Rabun, Georgia have $304,124 in total premiums with 235 active flood policies. The average flood rate for Putnam and Rabun is $1,294.

The average flood rate drops to $764 in Augusta, Georgia. Augusta has 1,032 flood policies in effect with $788,164 in total premium.

Next up, we’ll look at Rockdale, Thomas, Thomasville, Tifton, Waycross, Helen, Dalton, Whitefield, and Worth, Georgia where the premiums add up to $805,496. The flood policies total 932 which allows the average flood rate to be $864.

Finally, our last group includes Seminole, Spalding, Sumter, Union, Rossville, Walker, and Walton, Georgia where the average flood rate is $829. These areas have premiums that total up to $583,016 with 703 active flood policies.

Thanks for checking out all the flood information on Georgia!!

How to save money on Flood Insurance in Georgia VE flood zones

All homes that are ocean facing are custom built so with this special consideration our Lloyds of London VE flood zone and other Private Flood Insurance options for oceanfront properties take this into consideration with variable coverage options as well as significant savings below is a case study for a property we were shopping just last week.

Our example was in the Brunswick, GA area and is in a VE flood zone map.

For the coverage of $250,000 with no contents and a $5,000 deductible the NFIP annual cost for flood insurance in a VE flood zone is $15,859.00. Ouch!

Since we are who we are and experts in Flood Insurance we will look at every property everyway possible to ensure that we are getting the best premium for our clients and WE often Do (smile wink)

We tried this same property on our Private flood options and were able to get the premium to under $2,500 and we have in some cases with similar properties gotten the annual premium to $600 this was a feather in our cap and made our clients very happy. Again all properties are unique in these VE flood zones but if we can find a private flood policy for you we guarantee it will be better then the NFIP option.

Let us help you save money today.

Georgia flood Insurance Cost Calculator

For decades, the NFIP has over-charged 50 percent of its policyholders and under-charged the other 50 percent, while it has racked up $42 billion in taxpayer-funded losses, equating to more than half of every claim paid by the NFIP since 1978.

About 30 percent of NFIP claims payments go to the same 3 percent of insured “repetitive loss” structures year after year. When you do the math, this means that the other 97 percent of their flood-exposed constituents could have paid in less and still netted larger claims payouts if they had better access to private flood insurance. In fact, a recent white paper by Milliman found that 90 percent of homes in Sandy-struck New York and New Jersey would see reduced flood insurance rates through private insurers.